Deck 20: Decision Making

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

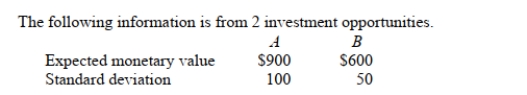

Question

Question

Question

Question

Question

Question

Question

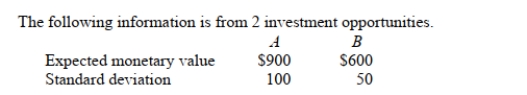

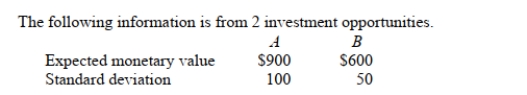

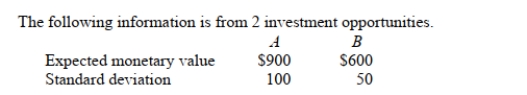

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

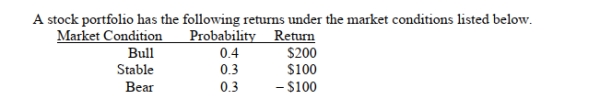

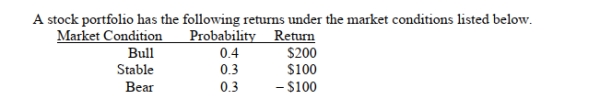

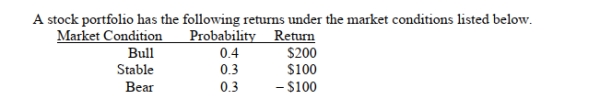

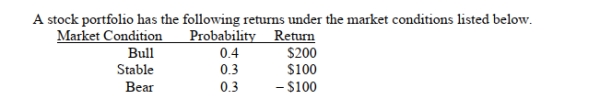

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/121

Play

Full screen (f)

Deck 20: Decision Making

1

SCENARIO 20-1

Referring to Scenario 20-1, the opportunity loss for A2 when S1 occurs is

A) - 2

B) 0

C) 5

D) 14

Referring to Scenario 20-1, the opportunity loss for A2 when S1 occurs is

A) - 2

B) 0

C) 5

D) 14

D

2

A medical doctor is involved in a $1 million malpractice suit.He can either settle out of court for

$250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court

Costs.If he wins in court the plaintiffs pay the court costs.Identify the actions of this decision-making

Problem.

A) Two choices: (1) go to court and (2) settle out of court.

B) Two possibilities: (1) win the case in court and (2) lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

$250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court

Costs.If he wins in court the plaintiffs pay the court costs.Identify the actions of this decision-making

Problem.

A) Two choices: (1) go to court and (2) settle out of court.

B) Two possibilities: (1) win the case in court and (2) lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

A

3

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, what is the optimal alternative using EMV?

A) A1

B) A2

C) A3

D) It cannot be determined.

Referring to Scenario 20-1, if the probability of S1 is 0.5, what is the optimal alternative using EMV?

A) A1

B) A2

C) A3

D) It cannot be determined.

A

4

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.2 and S2 is 0.8, then the expected opportunity

Loss (EOL)for A1 is

A) 0

B) 1.2

C) 4.8

D) 5.6

Referring to Scenario 20-1, if the probability of S1 is 0.2 and S2 is 0.8, then the expected opportunity

Loss (EOL)for A1 is

A) 0

B) 1.2

C) 4.8

D) 5.6

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

5

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )

For A2 is

A) 3

B) 4

C) 6.5

D) 8

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )

For A2 is

A) 3

B) 4

C) 6.5

D) 8

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

6

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected opportunity loss (EOL)

For A1 is

A) 3

B) 4.5

C) 7

D) 8

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected opportunity loss (EOL)

For A1 is

A) 3

B) 4.5

C) 7

D) 8

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

7

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.4, then the probability of S2 is

A) 0.4

B) 0.5

C) 0.6

D) 1.0

Referring to Scenario 20-1, if the probability of S1 is 0.4, then the probability of S2 is

A) 0.4

B) 0.5

C) 0.6

D) 1.0

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

8

The difference between expected payoff under certainty and expected value of the best act without

Certainty is the:

A) expected monetary value.

B) expected net present value.

C) expected value of perfect information.

D) expected rate of return.

Certainty is the:

A) expected monetary value.

B) expected net present value.

C) expected value of perfect information.

D) expected rate of return.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

9

A tabular presentation that shows the outcome for each decision alternative under the various states of

Nature is called:

A) a payback period matrix.

B) a decision matrix.

C) a decision tree.

D) a payoff table.

Nature is called:

A) a payback period matrix.

B) a decision matrix.

C) a decision tree.

D) a payoff table.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

10

A medical doctor is involved in a $1 million malpractice suit.He can either settle out of court for

$250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court

Costs.If he wins in court the plaintiffs pay the court costs.Identify the outcomes of this decision-

Making problem.

A) Two choices: (1) go to court and (2) settle out of court.

B) Two possibilities: (1) win the case in court and (2) lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

$250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court

Costs.If he wins in court the plaintiffs pay the court costs.Identify the outcomes of this decision-

Making problem.

A) Two choices: (1) go to court and (2) settle out of court.

B) Two possibilities: (1) win the case in court and (2) lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

11

A company that manufactures designer jeans is contemplating whether to increase its advertising

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the outcomes in this decision-making

Problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the outcomes in this decision-making

Problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

12

A medical doctor is involved in a $1 million malpractice suit.He can either settle out of court for

$250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court

Costs.If he wins in court the plaintiffs pay the court costs.Identify the states of nature of this

Decision-making problem.

A) Two choices: (1) go to court and (2) settle out of court.

B) Two possibilities: (1) win the case in court and (2) lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

$250,000 or go to court.If he goes to court and loses, he must pay $825,000 plus $175,000 in court

Costs.If he wins in court the plaintiffs pay the court costs.Identify the states of nature of this

Decision-making problem.

A) Two choices: (1) go to court and (2) settle out of court.

B) Two possibilities: (1) win the case in court and (2) lose the case in court.

C) Four consequences resulting from Go/Settle and Win/Lose combinations.

D) The amount of money paid by the doctor.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

13

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )

For A1 is

A) 3

B) 4

C) 6.5

D) 8

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected monetary value (EMV )

For A1 is

A) 3

B) 4

C) 6.5

D) 8

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

14

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.2 and S2 is 0.8, then the expected monetary

Value of A1 is

A) 2.4

B) 5.6

C) 8

D) 16

Referring to Scenario 20-1, if the probability of S1 is 0.2 and S2 is 0.8, then the expected monetary

Value of A1 is

A) 2.4

B) 5.6

C) 8

D) 16

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

15

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.2, what is the optimal alternative using EOL?

A) A1.

B) A2.

C) A3.

D) It cannot be determined.

Referring to Scenario 20-1, if the probability of S1 is 0.2, what is the optimal alternative using EOL?

A) A1.

B) A2.

C) A3.

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

16

A company that manufactures designer jeans is contemplating whether to increase its advertising

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the payoffs in this decision-making problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the payoffs in this decision-making problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

17

A company that manufactures designer jeans is contemplating whether to increase its advertising

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the events in this decision-making problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the events in this decision-making problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

18

A company that manufactures designer jeans is contemplating whether to increase its advertising

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the actions in this decision-making problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Budget by $1 million for next year.If the expanded advertising campaign is successful, the company

Expects sales to increase by $1.6 million next year.If the advertising campaign fails, the company

Expects sales to increase by only $400,000 next year.If the advertising budget is not increased, the

Company expects sales to increase by $200,000.Identify the actions in this decision-making problem.

A) Two choices: (1) increase the budget and (2) do not increase the budget.

B) Two possibilities: (1) campaign is successful and (2) campaign is not successful.

C) Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

D) The increase in sales dollars next year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

19

SCENARIO 20-1

Referring to Scenario 20-1, the opportunity loss for A3 when S2 occurs is

A) 0

B) 4

C) 5

D) 6

Referring to Scenario 20-1, the opportunity loss for A3 when S2 occurs is

A) 0

B) 4

C) 5

D) 6

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

20

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected opportunity loss (EOL)

For A3 is

A) 3

B) 4.5

C) 7

D) 8

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected opportunity loss (EOL)

For A3 is

A) 3

B) 4.5

C) 7

D) 8

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

21

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the EOL for buying 200 dozen roses is

A) $700

B) $900

C) $1,500

D) $1,600

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the EOL for buying 200 dozen roses is

A) $700

B) $900

C) $1,500

D) $1,600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

22

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.If the probability of selling 100 dozen roses is 0.2 and 200 dozen roses is 0.5, then the

Probability of selling 400 dozen roses is

A) 0.7

B) 0.5

C) 0.3

D) 0.2

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.If the probability of selling 100 dozen roses is 0.2 and 200 dozen roses is 0.5, then the

Probability of selling 400 dozen roses is

A) 0.7

B) 0.5

C) 0.3

D) 0.2

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

23

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the coefficient of variation for A2 is

A) 0.231

B) 0.5

C) 1.5

D) 2

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the coefficient of variation for A2 is

A) 0.231

B) 0.5

C) 1.5

D) 2

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

24

SCENARIO 20-1

Referring to Scenario 20-1, what is the best action using the maximin criterion?

A) Action A1

B) Action A2

C) Action A3

D) It cannot be determined.

Referring to Scenario 20-1, what is the best action using the maximin criterion?

A) Action A1

B) Action A2

C) Action A3

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

25

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The number of alternatives for the payoff table is

A) 2

B) 3

C) 4

D) It cannot be determined.

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The number of alternatives for the payoff table is

A) 2

B) 3

C) 4

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

26

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the optimal EMV for buying roses is

A) $700

B) $900

C) $1,700

D) $1,900

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the optimal EMV for buying roses is

A) $700

B) $900

C) $1,700

D) $1,900

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

27

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The opportunity loss for buying 200 dozen roses and selling 100 dozen roses at the full price is

A) $1,000

B) $500

C) - $500

D) - $2,000

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The opportunity loss for buying 200 dozen roses and selling 100 dozen roses at the full price is

A) $1,000

B) $500

C) - $500

D) - $2,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

28

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the return to risk ratio for A1 is

A) 0.667

B) 1.5

C) 2

D) 4.333

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the return to risk ratio for A1 is

A) 0.667

B) 1.5

C) 2

D) 4.333

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

29

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected profit under certainty

(EPUC )is

A) 3

B) 5

C) 8

D) 11

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the expected profit under certainty

(EPUC )is

A) 3

B) 5

C) 8

D) 11

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

30

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the return to risk ratio for A3 is

A) 0.667

B) 1.5

C) 2

D) 4.333

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the return to risk ratio for A3 is

A) 0.667

B) 1.5

C) 2

D) 4.333

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

31

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The payoff for buying 200 dozen roses and selling 100 dozen roses at the full price is

A) $2,000

B) $1,000

C) $500

D) - $500

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The payoff for buying 200 dozen roses and selling 100 dozen roses at the full price is

A) $2,000

B) $1,000

C) $500

D) - $500

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

32

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the optimal EOL for buying roses is

A) $700

B) $900

C) $1,500

D) $1,600

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the optimal EOL for buying roses is

A) $700

B) $900

C) $1,500

D) $1,600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

33

SCENARIO 20-1

Referring to Scenario 20-1, what is the best action using the maximax criterion?

A) Action A1

B) Action A2

C) Action A3

D) It cannot be determined.

Referring to Scenario 20-1, what is the best action using the maximax criterion?

A) Action A1

B) Action A2

C) Action A3

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

34

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The payoff for buying and selling 400 dozen roses at the full price is

A) $12,000

B) $6,000

C) $4,000

D) It cannot be determined.

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The payoff for buying and selling 400 dozen roses at the full price is

A) $12,000

B) $6,000

C) $4,000

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

35

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the EMV for buying 200 dozen roses is

A) $4,500

B) $2,500

C) $1,700

D) $1,000

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the EMV for buying 200 dozen roses is

A) $4,500

B) $2,500

C) $1,700

D) $1,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

36

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the EVPI for the payoff table is

A) - 3

B) 3

C) 8

D) 11

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the EVPI for the payoff table is

A) - 3

B) 3

C) 8

D) 11

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

37

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The opportunity loss for buying 400 dozen roses and selling 200 dozen roses at the full price is

A) - $2,000

B) $1,000

C) $500

D) $0

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The opportunity loss for buying 400 dozen roses and selling 200 dozen roses at the full price is

A) - $2,000

B) $1,000

C) $500

D) $0

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

38

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The number of states of nature for the payoff table is

A) 2

B) 3

C) 4

D) It cannot be determined.

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.The number of states of nature for the payoff table is

A) 2

B) 3

C) 4

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

39

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the optimal alternative using EMV for selling roses is to buy dozen

Roses.

A) 100

B) 200

C) 400

D) 600

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the optimal alternative using EMV for selling roses is to buy dozen

Roses.

A) 100

B) 200

C) 400

D) 600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

40

SCENARIO 20-1

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the coefficient of variation for A1 is

A) 0.231

B) 0.5

C) 1.5

D) 2

Referring to Scenario 20-1, if the probability of S1 is 0.5, then the coefficient of variation for A1 is

A) 0.231

B) 0.5

C) 1.5

D) 2

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

41

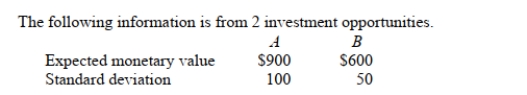

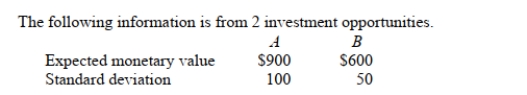

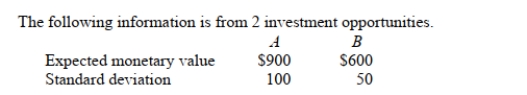

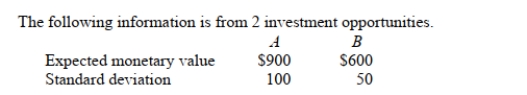

SCENARIO 20-2

Referring to Scenario 20-2, the EVPI is

A) 0

B) 300

C) 400

D) 600

Referring to Scenario 20-2, the EVPI is

A) 0

B) 300

C) 400

D) 600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

42

For a potential investment of $5,000, a portfolio has an EMV of $1,000 and a standard deviation of

$100.The return to risk ratio is

A) 50

B) 20

C) 10

D) 5

$100.The return to risk ratio is

A) 50

B) 20

C) 10

D) 5

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

43

SCENARIO 20-2

Referring to Scenario 20-2, what is the action with the preferable return to risk ratio?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Referring to Scenario 20-2, what is the action with the preferable return to risk ratio?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

44

Blossom's Flowers purchases roses for sale for Valentine's Day.The roses are purchased for $10 a

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the EVPI for buying roses is

A) $700

B) $1,500

C) $1,900

D) $2,600

Dozen and are sold for $20 a dozen.Any roses not sold on Valentine's Day can be sold for $5 per

Dozen.The owner will purchase 1 of 3 amounts of roses for Valentine's Day: 100, 200, or 400 dozen

Roses.Given 0.2, 0.4, and 0.4 are the probabilities for the sale of 100, 200, or 400 dozen roses,

Respectively, then the EVPI for buying roses is

A) $700

B) $1,500

C) $1,900

D) $2,600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

45

For a potential investment of $5,000, a portfolio has an EMV of $1,000 and a standard deviation of

$100.What is the coefficient of variation?

A) 10%

B) 20%

C) 50%

D) 100%

$100.What is the coefficient of variation?

A) 10%

B) 20%

C) 50%

D) 100%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

46

SCENARIO 20-2

Referring to Scenario 20-2, what is the optimal action using the EMV criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Referring to Scenario 20-2, what is the optimal action using the EMV criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

47

The minimum expected opportunity loss is also equal to

A)expected profit under certainty.

B)expected value of perfect information.

C)coefficient of variation.

D)expected value under certainty minus the expected monetary value of the worst

Alternative.

A)expected profit under certainty.

B)expected value of perfect information.

C)coefficient of variation.

D)expected value under certainty minus the expected monetary value of the worst

Alternative.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

48

SCENARIO 20-3

Referring to Scenario 20-3, which investment has the optimal return to risk ratio?

A) Investment A

B) Investment B

C) The investments are equal.

D) It cannot be determined.

Referring to Scenario 20-3, which investment has the optimal return to risk ratio?

A) Investment A

B) Investment B

C) The investments are equal.

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

49

SCENARIO 20-2

Referring to Scenario 20-2, the return to risk ratio for Action B is

A) 0.167

B) 3.0

C) 6.0

D) 9.0

Referring to Scenario 20-2, the return to risk ratio for Action B is

A) 0.167

B) 3.0

C) 6.0

D) 9.0

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

50

SCENARIO 20-2

Referring to Scenario 20-2, what is the action with the preferable coefficient of variation?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Referring to Scenario 20-2, what is the action with the preferable coefficient of variation?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

51

SCENARIO 20-2

Referring to Scenario 20-2, the coefficient of variation for Action A is

A) 12.8%

B) 33.3%

C) 133.33%

D) 333.3%

Referring to Scenario 20-2, the coefficient of variation for Action A is

A) 12.8%

B) 33.3%

C) 133.33%

D) 333.3%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

52

SCENARIO 20-2

Referring to Scenario 20-2, the EOL for Action A is

A) 0

B) 100

C) 200

D) 300

Referring to Scenario 20-2, the EOL for Action A is

A) 0

B) 100

C) 200

D) 300

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

53

SCENARIO 20-2

Referring to Scenario 20-2, what is the best action using the maximax criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Referring to Scenario 20-2, what is the best action using the maximax criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

54

SCENARIO 20-2

Referring to Scenario 20-2, what is the best action using the maximin criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Referring to Scenario 20-2, what is the best action using the maximin criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

55

SCENARIO 20-2

Referring to Scenario 20-2, the EMV for Action A is

A) $300

B) $550

C) $600

D) $700

Referring to Scenario 20-2, the EMV for Action A is

A) $300

B) $550

C) $600

D) $700

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

56

SCENARIO 20-3

Referring to Scenario 20-3, which investment has the optimal coefficient of variation?

A) Investment A

B) Investment B

C) The investments are equal.

D) It cannot be determined.

Referring to Scenario 20-3, which investment has the optimal coefficient of variation?

A) Investment A

B) Investment B

C) The investments are equal.

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

57

For a potential investment of $5,000, a portfolio has an EMV of $1,000 and a standard deviation of

$100.What is the rate of return?

A) 5%

B) 10%

C) 20%

D) 50%

$100.What is the rate of return?

A) 5%

B) 10%

C) 20%

D) 50%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

58

SCENARIO 20-2

Referring to Scenario 20-2, the expected profit under certainty (EPUC )is

A) 0

B) 300

C) 500

D) 600

Referring to Scenario 20-2, the expected profit under certainty (EPUC )is

A) 0

B) 300

C) 500

D) 600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

59

SCENARIO 20-2

Referring to Scenario 20-2, what is the optimal action using the EOL criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Referring to Scenario 20-2, what is the optimal action using the EOL criterion?

A) Action A

B) Action B

C) Either Action A or Action B

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

60

SCENARIO 20-3

Referring to Scenario 20-3, what is the coefficient of variation for investment A?

A) 90.0%

B) 11.1%

C) 8.3%

D) 5.0%

Referring to Scenario 20-3, what is the coefficient of variation for investment A?

A) 90.0%

B) 11.1%

C) 8.3%

D) 5.0%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

61

At Eastern University, 60% of the students are from suburban areas, 30% are from rural areas, and

10% are from urban areas.Of the students from the suburban areas, 60% are nonbusiness majors.Of

The students from the rural areas, 70% are nonbusiness majors.Of the students from the urban areas,

90% are nonbusiness majors.If a randomly selected student is not a business major, the probability

That the student is from the urban area is

A) 0.136

B) 0.214

C) 0.666

D) 0.706

10% are from urban areas.Of the students from the suburban areas, 60% are nonbusiness majors.Of

The students from the rural areas, 70% are nonbusiness majors.Of the students from the urban areas,

90% are nonbusiness majors.If a randomly selected student is not a business major, the probability

That the student is from the urban area is

A) 0.136

B) 0.214

C) 0.666

D) 0.706

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

62

In a local cellular phone area, company A accounts for 60% of the cellular phone market, while

Company B accounts for the remaining 40% of the market.Of the cellular calls made with company

A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B

Will have interference.If a cellular call is selected at random, the probability that it will not have

Interference is

A) 0.014

B) 0.028

C) 0.14

D) 0.986

Company B accounts for the remaining 40% of the market.Of the cellular calls made with company

A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B

Will have interference.If a cellular call is selected at random, the probability that it will not have

Interference is

A) 0.014

B) 0.028

C) 0.14

D) 0.986

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

63

At Eastern University, 60% of the students are from suburban areas, 30% are from rural areas, and

10% are from urban areas.Of the students from the suburban areas, 60% are nonbusiness majors.Of

The students from the rural areas, 70% are nonbusiness majors.Of the students from the urban areas,

90% are nonbusiness majors.The probability that a randomly selected student is a business major is

A) 0.66

B) 0.54

C) 0.44

D) 0.34

10% are from urban areas.Of the students from the suburban areas, 60% are nonbusiness majors.Of

The students from the rural areas, 70% are nonbusiness majors.Of the students from the urban areas,

90% are nonbusiness majors.The probability that a randomly selected student is a business major is

A) 0.66

B) 0.54

C) 0.44

D) 0.34

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

64

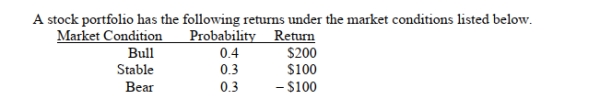

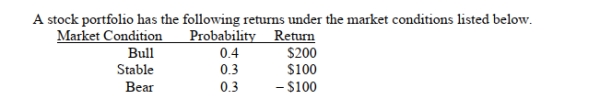

SCENARIO 20-4

Referring to Scenario 20-4, what is the standard deviation?

A) 4,890

B) 4,840

C) 124.9

D) 69.6

Referring to Scenario 20-4, what is the standard deviation?

A) 4,890

B) 4,840

C) 124.9

D) 69.6

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

65

True or False: To calculate expected profit under certainty, you need to have perfect information

about which event will occur.

about which event will occur.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

66

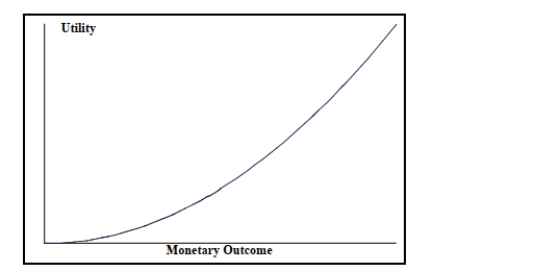

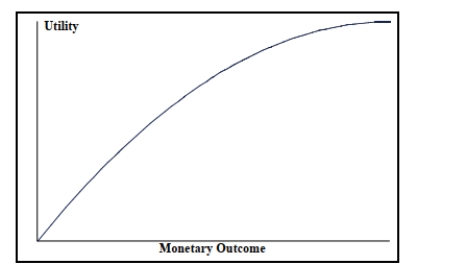

Look at the utility function graphed below and select the type of decision maker that corresponds to

The graph.

A) Risk averter

B) Risk neutral

C) Risk taker

D) Risk player

The graph.

A) Risk averter

B) Risk neutral

C) Risk taker

D) Risk player

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

67

_________ is a procedure for revising probabilities based upon additional information.

A) Utility theory

B) Bernoulli's theorem

C) Beckman's theorem

D) Bayes' theorem

A) Utility theory

B) Bernoulli's theorem

C) Beckman's theorem

D) Bayes' theorem

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

68

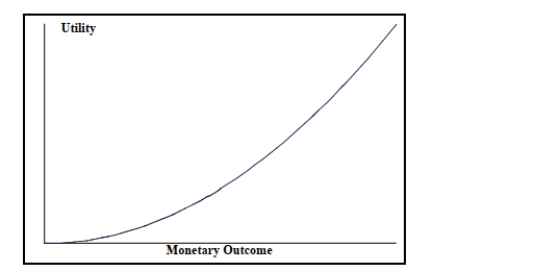

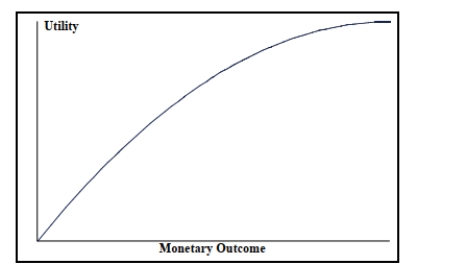

Look at the utility function graphed below and select the type of decision maker that corresponds to

The graph.

A) Risk averter

B) Risk neutral

C) Risk taker

D) Risk player

The graph.

A) Risk averter

B) Risk neutral

C) Risk taker

D) Risk player

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

69

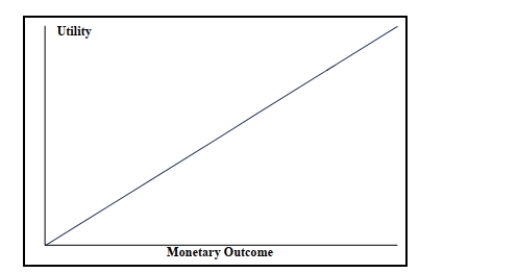

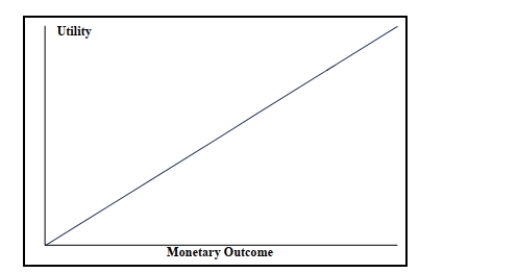

Look at the utility function graphed below and select the type of decision-maker that corresponds to

The graph.

A) Risk averter

B) Risk neutral

C) Risk taker

D) Risk player

The graph.

A) Risk averter

B) Risk neutral

C) Risk taker

D) Risk player

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

70

True or False: Opportunity loss is the difference between the lowest profit for an event and the actual

profit obtained for an action taken.

profit obtained for an action taken.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

71

The curve for the will show a rapid increase in utility for initial amounts of money

Followed by a gradual leveling off for increasing dollar amounts.

A) risk taker

B) risk averter

C) risk neutral

D) profit seeker

Followed by a gradual leveling off for increasing dollar amounts.

A) risk taker

B) risk averter

C) risk neutral

D) profit seeker

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

72

SCENARIO 20-4

Referring to Scenario 20-4, what is the coefficient of variation?

A) 88.8%

B) 90.3%

C) 100%

D) 156.1%

Referring to Scenario 20-4, what is the coefficient of variation?

A) 88.8%

B) 90.3%

C) 100%

D) 156.1%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

73

SCENARIO 20-4

Referring to Scenario 20-4, what is the EMV?

A) $180

B) $130

C) $90

D) $80

Referring to Scenario 20-4, what is the EMV?

A) $180

B) $130

C) $90

D) $80

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

74

SCENARIO 20-3

Referring to Scenario 20-3, what is the return to risk ratio for Investment B?

A) 8

B) 10

C) 12

D) 24

Referring to Scenario 20-3, what is the return to risk ratio for Investment B?

A) 8

B) 10

C) 12

D) 24

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

75

In a local cellular phone area, company A accounts for 60% of the cellular phone market, while

Company B accounts for the remaining 40% of the market.Of the cellular calls made with company

A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B

Will have interference.If a cellular call is selected at random and has interference, what is the

Probability that it was with company A?

A) 0.071

B) 0.429

C) 0.571

D) It cannot be determined.

Company B accounts for the remaining 40% of the market.Of the cellular calls made with company

A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B

Will have interference.If a cellular call is selected at random and has interference, what is the

Probability that it was with company A?

A) 0.071

B) 0.429

C) 0.571

D) It cannot be determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

76

The risk seeker's curve represents the utility of one who enjoys taking risks.Therefore, the slope of

The utility curve becomes for large dollar amounts.

A) smaller

B) stable

C) larger

D) uncertain

The utility curve becomes for large dollar amounts.

A) smaller

B) stable

C) larger

D) uncertain

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

77

SCENARIO 20-4

Referring to Scenario 20-4, what is the return to risk ratio?

A) 0.64

B) 1.08

C) 1.18

D) 2.00

Referring to Scenario 20-4, what is the return to risk ratio?

A) 0.64

B) 1.08

C) 1.18

D) 2.00

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

78

True or False: Removal of uncertainty from a decision-making problem leads to a case referred to as

perfect information.

perfect information.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

79

The curve represents the expected monetary value approach.

A) risk averter's

B) risk taker's

C) risk neutral

D) Bernoulli

A) risk averter's

B) risk taker's

C) risk neutral

D) Bernoulli

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

80

In a local cellular phone area, company A accounts for 60% of the cellular phone market, while

Company B accounts for the remaining 40% of the market.Of the cellular calls made with company

A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B

Will have interference.If a cellular call is selected at random, the probability that it will have

Interference is

A) 0.014

B) 0.028

C) 0.14

D) 0.986

Company B accounts for the remaining 40% of the market.Of the cellular calls made with company

A, 1% of the calls will have some sort of interference, while 2% of the cellular calls with company B

Will have interference.If a cellular call is selected at random, the probability that it will have

Interference is

A) 0.014

B) 0.028

C) 0.14

D) 0.986

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck