Deck 8: Investments in Equity Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/113

Play

Full screen (f)

Deck 8: Investments in Equity Securities

1

On November 10, 2011, Clark Inc. purchased shares of Landon Corp. for $100,000 and shares of Norris Incorporated for $50,000. At the end of 2011, the fair market value of the stock of Landon was $80,000 and for Norris Incorporated was $65,000. How should Clark Inc. recognize these changes in market price?

A) As a net unrealized loss of $20,000.

B) As a net unrealized gain of $15,000.

C) As a net unrealized loss of $5,000.

D) No adjustment is required since the total fair value is higher than the total original cost.

A) As a net unrealized loss of $20,000.

B) As a net unrealized gain of $15,000.

C) As a net unrealized loss of $5,000.

D) No adjustment is required since the total fair value is higher than the total original cost.

C

2

Dewey Inc. owns 64% of Felicity Corporation's outstanding voting stock. Dewey should account for its investment in Felicity using the:

A) fair value method.

B) cost method.

C) consolidation procedure.

D) mark-to-market method

A) fair value method.

B) cost method.

C) consolidation procedure.

D) mark-to-market method

C

3

Equity investments are:

A) investments in bonds of a corporation.

B) investments that pay dividends, not interest.

C) classified as long-term liabilities.

D) marketed by the SEC to any investor who wishes to buy bonds of a public company.

A) investments in bonds of a corporation.

B) investments that pay dividends, not interest.

C) classified as long-term liabilities.

D) marketed by the SEC to any investor who wishes to buy bonds of a public company.

B

4

Available-for-sale securities:

A) are reported on the balance sheet at original cost.

B) may have unrealized price increases or decreases, which increase or decrease shareholders' equity.

C) are reported in the shareholders' equity section of the balance sheet at fair value.

D) may have unrealized gains or losses on the income statement associated with price increases or decreases.

A) are reported on the balance sheet at original cost.

B) may have unrealized price increases or decreases, which increase or decrease shareholders' equity.

C) are reported in the shareholders' equity section of the balance sheet at fair value.

D) may have unrealized gains or losses on the income statement associated with price increases or decreases.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following correctly reflects the effects on the financial statements caused by the increase in the market price of long-term available-for-sale securities?

A) Current ratio is unchanged and earnings per share increases.

B) Current ratio and earnings per share increase.

C) Current ratio and earnings per share are unchanged.

D) Current ratio is unchanged and earnings per share decreases.

A) Current ratio is unchanged and earnings per share increases.

B) Current ratio and earnings per share increase.

C) Current ratio and earnings per share are unchanged.

D) Current ratio is unchanged and earnings per share decreases.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

6

During 2010, the market price of trading securities declined. Which one of the following correctly reflects the effects on the financial statements as a result?

A) Current ratio and earnings per share decrease.

B) Current ratio and earnings per share increase.

C) Current ratio is unchanged and earnings per share increases.

D) Current ratio increases and earnings per share are unchanged.

A) Current ratio and earnings per share decrease.

B) Current ratio and earnings per share increase.

C) Current ratio is unchanged and earnings per share increases.

D) Current ratio increases and earnings per share are unchanged.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

7

Trading securities:

A) are recorded on the balance sheet at market value.

B) may have unrealized gains or losses on the balance sheet associated with price increases or decreases.

C) are listed as long-term assets.

D) Both a and b are correct.

A) are recorded on the balance sheet at market value.

B) may have unrealized gains or losses on the balance sheet associated with price increases or decreases.

C) are listed as long-term assets.

D) Both a and b are correct.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

8

Trading securities are:

A) readily marketable investments that management intends to hold for extended periods.

B) always short-term investments.

C) current assets that require the equity method of accounting for investments.

D) actively 'traded' on the open market, but can't be sold until they mature.

A) readily marketable investments that management intends to hold for extended periods.

B) always short-term investments.

C) current assets that require the equity method of accounting for investments.

D) actively 'traded' on the open market, but can't be sold until they mature.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

9

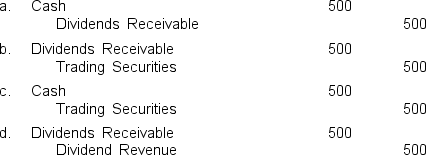

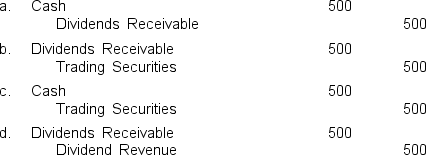

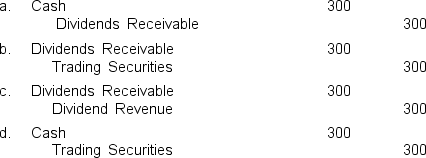

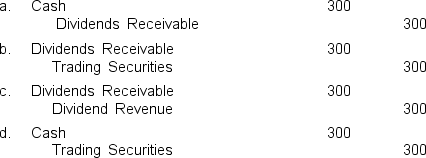

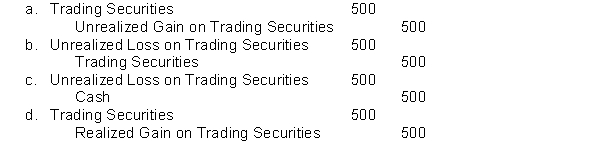

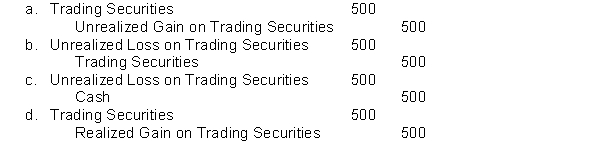

Which one of the following journal entries is appropriate for an investor who owns short-term equity securities when dividends of $500 have been declared on those equity securities?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

10

Which one of the following is true of the equity method?

A) The income recognized by the investor is based on the percentage of stock ownership and the amount of earnings reported by the investee.

B) Market value adjustments are made at yearend.

C) The receipt of dividends increases net income on the investor's financial statements.

D) The percent of ownership must be greater than 50% to apply this method.

A) The income recognized by the investor is based on the percentage of stock ownership and the amount of earnings reported by the investee.

B) Market value adjustments are made at yearend.

C) The receipt of dividends increases net income on the investor's financial statements.

D) The percent of ownership must be greater than 50% to apply this method.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

11

Benson Incorporated owns 32% of Denver Company's outstanding voting stock. Benson Incorporated should account for its investment in Denver using the:

A) fair value method.

B) cost method.

C) consolidation procedure.

D) equity method.

A) fair value method.

B) cost method.

C) consolidation procedure.

D) equity method.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

12

When a company recognizes unrealized losses on trading securities, its earnings per share:

A) decreases.

B) increases.

C) is not affected.

D) may increase or decrease depending on the related market value.

A) decreases.

B) increases.

C) is not affected.

D) may increase or decrease depending on the related market value.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

13

Investments in equity securities are current assets if:

A) they can be sold and converted into cash on demand and a ready market exists.

B) the fair market value can't be determined.

C) management intends to convert them into common stock within one year.

D) management owns less than 50% of the outstanding stock.

A) they can be sold and converted into cash on demand and a ready market exists.

B) the fair market value can't be determined.

C) management intends to convert them into common stock within one year.

D) management owns less than 50% of the outstanding stock.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

14

Income from trading and available-for-sale equity securities is recognized when:

A) dividends are received from the investee due to the uncertainty of payment.

B) dividends are declared by the investee.

C) adjusting entries are made to record fair value adjustments.

D) the investee reports profits for the accounting period.

A) dividends are received from the investee due to the uncertainty of payment.

B) dividends are declared by the investee.

C) adjusting entries are made to record fair value adjustments.

D) the investee reports profits for the accounting period.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

15

Available-for-sale securities are:

A) actively 'traded' on the open market, but can't be sold until they mature.

B) readily marketable investments that management intends to sell for short-term profits.

C) always short-term investments in common stock.

D) adjusted to fair value at yearend.

A) actively 'traded' on the open market, but can't be sold until they mature.

B) readily marketable investments that management intends to sell for short-term profits.

C) always short-term investments in common stock.

D) adjusted to fair value at yearend.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

16

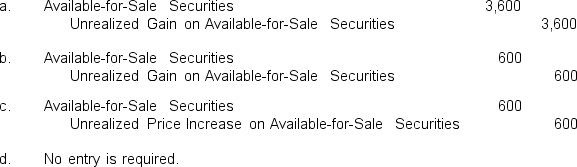

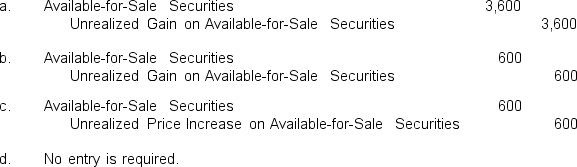

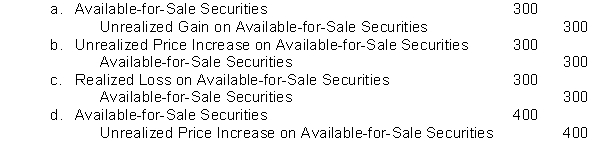

Torborg Corp. purchased available-for-sale securities from Hensley Company on December 23 for $3,000. On December 31, the market value of those securities is $3,600. Which one of the following journal entries is appropriate on December 31?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

17

The recognition of unrealized gains on available-for-sale investments

A) increases the current ratio.

B) decreases the current ratio.

C) does not affect the current ratio.

D) increases the current ratio if the investment is classified as current, otherwise it has no effect.

A) increases the current ratio.

B) decreases the current ratio.

C) does not affect the current ratio.

D) increases the current ratio if the investment is classified as current, otherwise it has no effect.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

18

An investor owns trading equity securities in Noah Company. Noah Company declared dividends of $300 during July. What entry is required in August when the dividends are received?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

19

When a company accounts for an investment under the purchase method of accounting,

A) the book value of the subsidiary's assets is added to the parent company's assets.

B) the book value of the subsidiary's liabilities is added to the parent company's liabilities.

C) the company obviously owns more than 50% of the stock of the investee.

D) a year-end adjustment is made to increase or decrease the carrying value of the investment to fair market value.

A) the book value of the subsidiary's assets is added to the parent company's assets.

B) the book value of the subsidiary's liabilities is added to the parent company's liabilities.

C) the company obviously owns more than 50% of the stock of the investee.

D) a year-end adjustment is made to increase or decrease the carrying value of the investment to fair market value.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

20

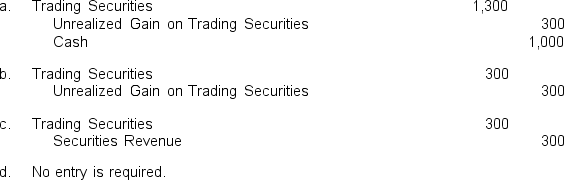

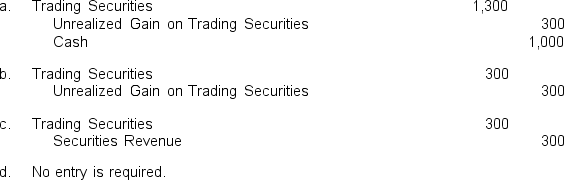

Trading securities of Sanchez Inc. were purchased by Hayden Company on December 14 for $1,000. On December 31, the market value of those securities is $1,300. Which one of the following adjusting journal entries is appropriate at December 31?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

21

Walsh Company purchased 1,000 shares of Pierce Company for $20 per share and classified the investment as trading securities. At the end of the year, the fair market value of the investment was $23 per share. How should Walsh recognize this change?

A) Debit the investment account by $23,000.

B) Credit the investment account by $3,000.

C) Report an unrealized gain on the income statement.

D) Show an unrealized loss on the balance sheet.

A) Debit the investment account by $23,000.

B) Credit the investment account by $3,000.

C) Report an unrealized gain on the income statement.

D) Show an unrealized loss on the balance sheet.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

22

The consolidation procedure of accounting for long-term equity investments is typically used:

A) when less than 20% of the investee company is owned.

B) in situations when over 50% of the investee company is owned.

C) only when 100% of the investee company is owned.

D) when between 20% and 50% of the investee company is owned.

A) when less than 20% of the investee company is owned.

B) in situations when over 50% of the investee company is owned.

C) only when 100% of the investee company is owned.

D) when between 20% and 50% of the investee company is owned.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

23

The cost method of accounting for long-term equity investments is typically used when:

A) between 20% and 50% of the investee company is owned.

B) over 50% of the investee company is owned.

C) at least 20% of the investee company is owned.

D) None of the above is a consideration in choosing the cost method.

A) between 20% and 50% of the investee company is owned.

B) over 50% of the investee company is owned.

C) at least 20% of the investee company is owned.

D) None of the above is a consideration in choosing the cost method.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

24

Which one of the following correctly reflects the effects on the financial statements caused by dividends declared on trading securities owned by a firm?

A) Current ratio decreases.

B) Earnings per share increases.

C) Current ratio is unchanged.

D) Earnings per share is unchanged.

A) Current ratio decreases.

B) Earnings per share increases.

C) Current ratio is unchanged.

D) Earnings per share is unchanged.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

25

Available-for-sale securities were purchased on May 2 for $1,000. On December 31, the market value of those securities is $1,100. Which of the following is part of the adjusting entry necessary on December 31?

A) Debit Unrealized Gain on Available-for-Sale Securities for $1,100

B) Debit Realized Gain on Available-for-Sale Securities for $100

C) Credit Available-for-Sale Securities for $100

D) Credit Unrealized Gain on Available-for-Sale Securities for $100

A) Debit Unrealized Gain on Available-for-Sale Securities for $1,100

B) Debit Realized Gain on Available-for-Sale Securities for $100

C) Credit Available-for-Sale Securities for $100

D) Credit Unrealized Gain on Available-for-Sale Securities for $100

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

26

All of the following statements are true regarding comprehensive income except:

A) Comprehensive income includes all nonowner-related changes in shareholders' equity that do not appear on the income statement and are not reflected in the balance of retained earnings.

B) Comprehensive income includes adjustments to shareholders' equity for holding gains associated with available-for-sale securities.

C) Comprehensive income includes adjustments to shareholders' equity for holding losses associated with available-for-sale securities..

D) Comprehensive income must be reported in a specific format established by the FASB.

A) Comprehensive income includes all nonowner-related changes in shareholders' equity that do not appear on the income statement and are not reflected in the balance of retained earnings.

B) Comprehensive income includes adjustments to shareholders' equity for holding gains associated with available-for-sale securities.

C) Comprehensive income includes adjustments to shareholders' equity for holding losses associated with available-for-sale securities..

D) Comprehensive income must be reported in a specific format established by the FASB.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

27

Which one of the following correctly reflects the effects on the financial statements of the investor caused by dividends declared on trading securities?

A) Current ratio increases

B) Working capital decreases

C) Revenue and assets decrease

D) Assets increase and shareholders' equity decreases

A) Current ratio increases

B) Working capital decreases

C) Revenue and assets decrease

D) Assets increase and shareholders' equity decreases

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

28

Which one of the following must be met prior to classifying an investment as current?

A) It must be an equity security accounted for under the equity method.

B) The percentage of ownership must be greater than 50%.

C) The investment must be readily marketable.

D) Management must intend to hold the investment for an undetermined time period.

A) It must be an equity security accounted for under the equity method.

B) The percentage of ownership must be greater than 50%.

C) The investment must be readily marketable.

D) Management must intend to hold the investment for an undetermined time period.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of the following is an area of subjectivity which opens the incentive of window dressing to management as it relates to investments?

A) The timing of when an investment is sold.

B) The proclamation of the intention to sell an investment within the next year.

C) The determination of the percentage of stock acquired.

D) Whether management has available cash to acquire investments.

A) The timing of when an investment is sold.

B) The proclamation of the intention to sell an investment within the next year.

C) The determination of the percentage of stock acquired.

D) Whether management has available cash to acquire investments.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

30

The recognition of unrealized gains on marketable securities:

A) depends on the classification of the securities.

B) causes net income to increase regardless of the securities' classification.

C) causes earnings per share to increase regardless of the securities' classification.

D) is a primary concern under the equity method.

A) depends on the classification of the securities.

B) causes net income to increase regardless of the securities' classification.

C) causes earnings per share to increase regardless of the securities' classification.

D) is a primary concern under the equity method.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

31

The recognition of realized losses on short-term available-for-sale securities

A) increases the current ratio.

B) decreases working capital.

C) decreases comprehensive income.

D) decreases the debt/equity ratio.

A) increases the current ratio.

B) decreases working capital.

C) decreases comprehensive income.

D) decreases the debt/equity ratio.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

32

The recognition of unrealized losses on trading securities:

A) decreases the quick and current ratios.

B) increases the quick and current ratios.

C) does not affect the quick ratio, but decreases the current ratio.

D) does not affect the current ratio, but decreases the quick ratio.

A) decreases the quick and current ratios.

B) increases the quick and current ratios.

C) does not affect the quick ratio, but decreases the current ratio.

D) does not affect the current ratio, but decreases the quick ratio.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

33

An unrealized holding gain or loss that relates to trading securities represents:

A) an undervalued investment.

B) the profit or loss made when the trading securities were sold.

C) the total dividends received from the investee company during the year.

D) the extent to which an investor's wealth increased or decreased due to holding the investment.

A) an undervalued investment.

B) the profit or loss made when the trading securities were sold.

C) the total dividends received from the investee company during the year.

D) the extent to which an investor's wealth increased or decreased due to holding the investment.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

34

Trading securities were purchased on April 1 for $900. On December 31, the market value of those securities is $700. Which of the following is part of the adjusting entry necessary on December 31?

A) Debit Unrealized Loss on Trading Securities for $700

B) Debit Realized Loss on Trading Securities for $200

C) Credit Trading Securities for $200

D) Credit Unrealized Loss on Trading Securities for $200

A) Debit Unrealized Loss on Trading Securities for $700

B) Debit Realized Loss on Trading Securities for $200

C) Credit Trading Securities for $200

D) Credit Unrealized Loss on Trading Securities for $200

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

35

Trading securities are held primarily for the purpose of:

A) anticipated increases in value over extended time periods.

B) increasing the current ratio.

C) window dressing the balance sheet.

D) generating profits on short-term price increases.

A) anticipated increases in value over extended time periods.

B) increasing the current ratio.

C) window dressing the balance sheet.

D) generating profits on short-term price increases.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following correctly reflects the effects on the financial statements caused by the increase in market price of trading securities?

A) Current ratio and earnings per share decrease.

B) Current ratio and earnings per share increase.

C) Current ratio is unchanged but earnings per share decrease.

D) Current ratio decreases and earnings per share are unchanged.

A) Current ratio and earnings per share decrease.

B) Current ratio and earnings per share increase.

C) Current ratio is unchanged but earnings per share decrease.

D) Current ratio decreases and earnings per share are unchanged.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

37

The equity method of accounting for long-term equity investments is typically used when:

A) less than 20% of the investee company is owned.

B) between 20% and 50% of the investee company is owned.

C) over 50% of the investee company is owned.

D) any amount over 20% is acquired.

A) less than 20% of the investee company is owned.

B) between 20% and 50% of the investee company is owned.

C) over 50% of the investee company is owned.

D) any amount over 20% is acquired.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

38

Which one of the following correctly reflects the effects on the financial statements caused by a decrease in the market price of long-term available-for-sale securities?

A) Current ratio decreases.

B) Earnings per share increases.

C) Current ratio increases.

D) Earnings per share remains unchanged.

A) Current ratio decreases.

B) Earnings per share increases.

C) Current ratio increases.

D) Earnings per share remains unchanged.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

39

Which one of the following is evidence of a ready market?

A) The stock was purchased at a negotiated price from an outside party.

B) The security is actively traded on a public stock exchange.

C) A privately held corporation issued the stock.

D) The stock was purchased from an outside investor.

A) The stock was purchased at a negotiated price from an outside party.

B) The security is actively traded on a public stock exchange.

C) A privately held corporation issued the stock.

D) The stock was purchased from an outside investor.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

40

Camber Corp. owns 10% of Nova Corp's outstanding voting stock. Camber should account for its long-term equity investment in Nova Corp. using the:

A) market value method if the stock is not traded on the market.

B) cost method if the stock is traded on the market.

C) cost method if the stock is not traded on the market.

D) equity method if the stock is traded on the market.

A) market value method if the stock is not traded on the market.

B) cost method if the stock is traded on the market.

C) cost method if the stock is not traded on the market.

D) equity method if the stock is traded on the market.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

41

On January 2, 2010, Pfizer Co. purchased 22% of Wiley Company's voting stock for $150,000. During 2010, Wiley recorded income of $102,000 and paid total dividends of $27,000. Pfizer uses the equity method to account for this investment. What is the December 31, 2010, balance sheet value of its long-term equity investment in Wiley?

A) $178,380

B) $225,000

C) $150,000

D) $166,500

A) $178,380

B) $225,000

C) $150,000

D) $166,500

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

42

On December 31, 2010, available-for-sale securities with an original cost of $15,000 have a carrying value on the balance sheet equal to their market value of $20,000. On January 5, 2011, those securities are sold for $18,000. Which of the following would be part of the appropriate entry to record the sale of the available-for-sale securities?

A) A credit to Realized Gain on Available-for-Sale Securities for $5,000.

B) A debit to Unrealized Price Increase on Available-for Sale Securities for $3,000.

C) A debit to Unrealized Price Increase on Available-for Sale Securities for $5,000.

D) A credit to Available-for Sale Securities for $15,000.

A) A credit to Realized Gain on Available-for-Sale Securities for $5,000.

B) A debit to Unrealized Price Increase on Available-for Sale Securities for $3,000.

C) A debit to Unrealized Price Increase on Available-for Sale Securities for $5,000.

D) A credit to Available-for Sale Securities for $15,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

43

On January 2, 2010, Pfizer Co. purchased 22% of Wiley Company's voting stock for $150,000. During 2010, Wiley recorded income of $102,000 and paid total dividends of $27,000. Pfizer uses the equity method to account for this investment. What is Pfizer's income from the Wiley investment?

A) $27,000

B) $28,380

C) $22,440

D) $33,000

A) $27,000

B) $28,380

C) $22,440

D) $33,000

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

44

James Corporation purchased 100% of the common stock of Rashaad Corporation for $50 million. James must account for this investment as:

A) an available-for-sale security.

B) an acquisition that requires consolidation accounting.

C) a trading security.

D) an equity security investment.

A) an available-for-sale security.

B) an acquisition that requires consolidation accounting.

C) a trading security.

D) an equity security investment.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

45

Which one of the following investments would most likely be held the shortest period of time?

A) Available-for-sale debt securities

B) Available-for-sale equity securities

C) Trading securities

D) An investment as a result of a merger

A) Available-for-sale debt securities

B) Available-for-sale equity securities

C) Trading securities

D) An investment as a result of a merger

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

46

Decuzzi, Inc. paid $10,000 for a stock investment and classified it as available-for-sale. On December 31, 2011, the company appropriately recognized an unrealized increase of $3,000. The stock is reported on Decuzzi's balance sheet at December 31, 2011 at:

A) $10,000.

B) $13,000.

C) $7,000.

D) Not enough information to determine.

A) $10,000.

B) $13,000.

C) $7,000.

D) Not enough information to determine.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

47

Why might chief executives react very positively to current goodwill accounting?

A) Goodwill increases in value.

B) Goodwill is amortized creating expenses that reduce net income, enabling a company to pay less income tax.

C) Its amortization increases earnings per share.

D) Goodwill is no longer amortized so income is greater than prior accounting requirements.

A) Goodwill increases in value.

B) Goodwill is amortized creating expenses that reduce net income, enabling a company to pay less income tax.

C) Its amortization increases earnings per share.

D) Goodwill is no longer amortized so income is greater than prior accounting requirements.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

48

Before adjusting its current investments in equity securities, Caldwell Company has total current assets and current liabilities of $45,000 and $15,000, respectively. During the current year, Caldwell has net income of $243,750 with 75,000 shares of common stock outstanding. This amount excludes the effects of yearend adjustments related to the investments. Included in current assets are trading securities recorded at their original cost of $13,000. However, the current market value of those securities is $4,000 at yearend. If Caldwell properly accounts for trading securities, what is Caldwell's current ratio before and after the investment adjustment?

A) 3.0 and 2.1

B) 3.0 and 3.3

C) 3.0 and 3.6

D) 3.0 and 2.4

A) 3.0 and 2.1

B) 3.0 and 3.3

C) 3.0 and 3.6

D) 3.0 and 2.4

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

49

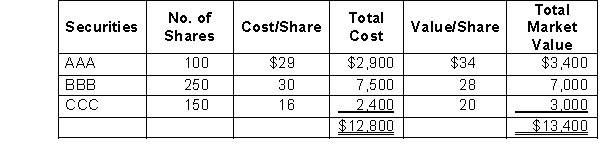

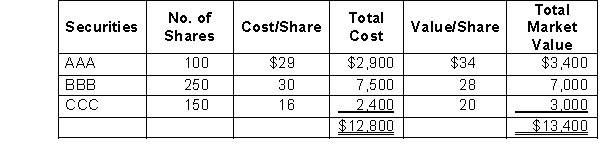

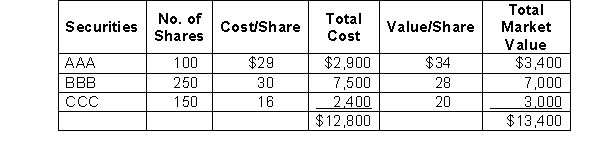

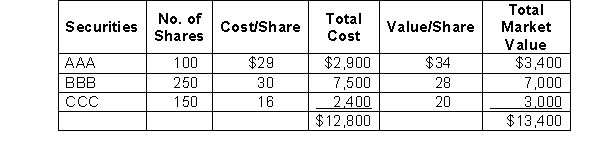

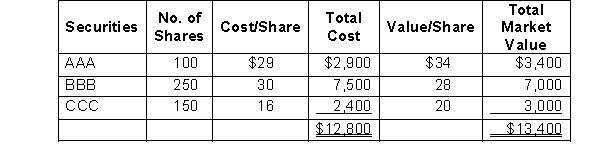

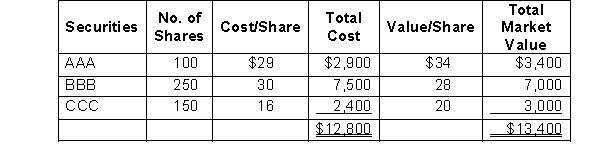

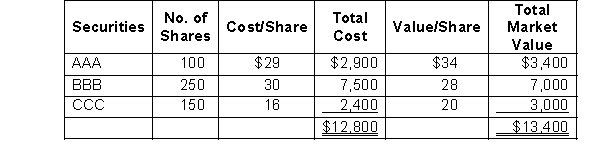

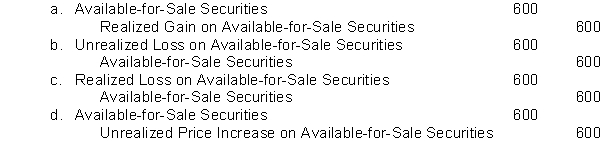

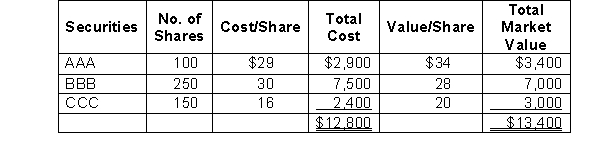

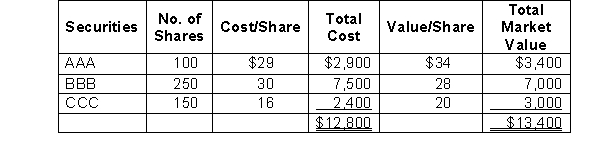

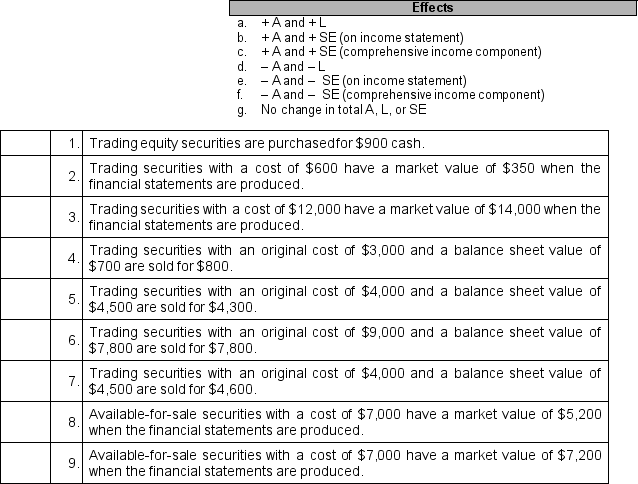

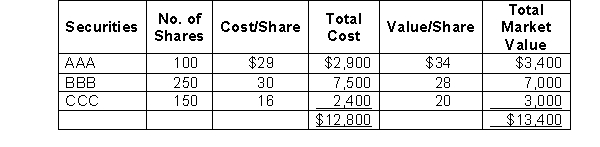

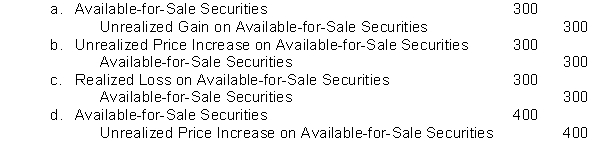

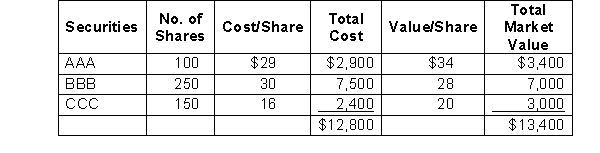

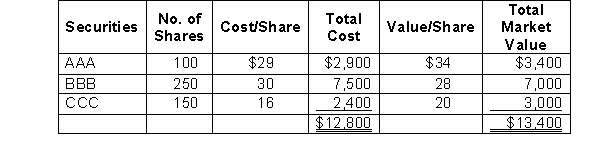

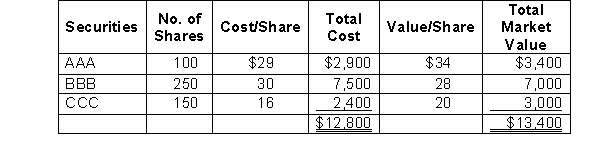

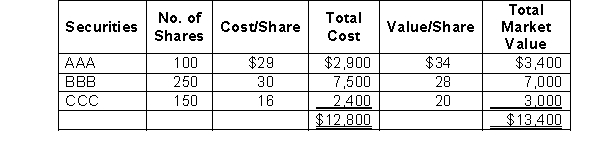

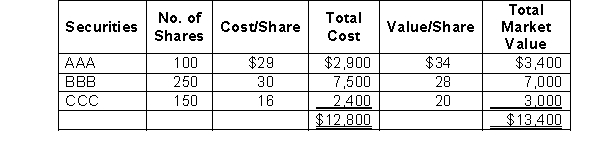

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. The journal entry to record the 50 shares of BBB stock sold in 2010 will include:

Early in 2010, the company sold 50 shares of BBB for $26 per share. The journal entry to record the 50 shares of BBB stock sold in 2010 will include:

A) A credit to Trading Securities for $1,400.

B) A credit to Unrealized Loss on Trading Securities for $100.

C) A credit to Realized Loss on Sale of Trading Securities for $100.

D) A debit to Realized Gain on Sale of Trading Securities for $100.

Early in 2010, the company sold 50 shares of BBB for $26 per share. The journal entry to record the 50 shares of BBB stock sold in 2010 will include:

Early in 2010, the company sold 50 shares of BBB for $26 per share. The journal entry to record the 50 shares of BBB stock sold in 2010 will include:A) A credit to Trading Securities for $1,400.

B) A credit to Unrealized Loss on Trading Securities for $100.

C) A credit to Realized Loss on Sale of Trading Securities for $100.

D) A debit to Realized Gain on Sale of Trading Securities for $100.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

50

Before adjusting its current investments in equity securities, Caldwell Company has total current assets and current liabilities of $45,000 and $15,000, respectively. During the current year, Caldwell has net income of $243,750 with 75,000 shares of common stock outstanding. This amount excludes the effects of yearend adjustments related to the investments. Included in current assets are trading securities recorded at their original cost of $13,000. However, the current market value of those securities is $4,000 at yearend. If Caldwell properly accounts for trading securities, what is Caldwell's earnings per share amount before and after the investment adjustment, respectively?

A) $3.25 and $3.00

B) $3.25 and $3.13

C) $3.25 and $3.37

D) $3.25 and $2.77

A) $3.25 and $3.00

B) $3.25 and $3.13

C) $3.25 and $3.37

D) $3.25 and $2.77

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

51

On January 2, 2010, Dellgate Corp. purchased 27% of Galaxy Corporation's voting stock for $125,000. During 2010, Galaxy recorded income of $214,000 and paid total dividends of $17,000. Dellgate uses the cost method to account for this investment. What is the December 31, 2010, balance sheet value of Dellgate's long-term equity investment in Galaxy?

A) $125,000

B) $178,190

C) $187,370

D) $86,940

A) $125,000

B) $178,190

C) $187,370

D) $86,940

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

52

A controlling interest in another company:

A) exists whenever the relationship between the investor and investee gives the investor significant influence.

B) requires the parent to prepare consolidated financial statements.

C) is evidence that a merger will soon occur.

D) can be as low as 20 percent.

A) exists whenever the relationship between the investor and investee gives the investor significant influence.

B) requires the parent to prepare consolidated financial statements.

C) is evidence that a merger will soon occur.

D) can be as low as 20 percent.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

53

Multinational US companies usually have a number of foreign subsidiaries with financial statements expressed in foreign currency. When the consolidated financial statements are prepared, to combine the financial statements of the US parent and all of its subsidiaries, the consolidation process involves multiple steps. Which of the following statements about the combining process and the resultant consolidated financial statements is always true for multinational US companies?

A) The foreign subsidiaries are separated into three categories, each of which receives different treatment.

B) The foreign entity's financial statements are converted into dollars.

C) Foreign currency translation adjustments have no effect on cash flows.

D) The foreign currency translation adjustments are included in consolidated income.

A) The foreign subsidiaries are separated into three categories, each of which receives different treatment.

B) The foreign entity's financial statements are converted into dollars.

C) Foreign currency translation adjustments have no effect on cash flows.

D) The foreign currency translation adjustments are included in consolidated income.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

54

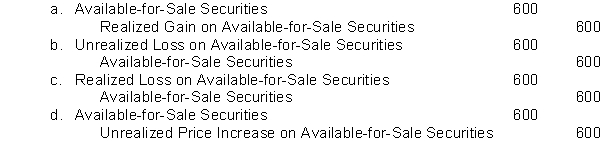

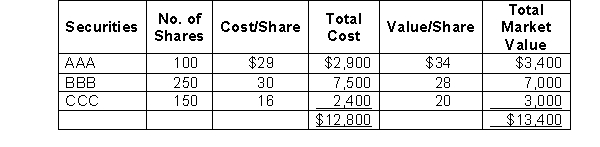

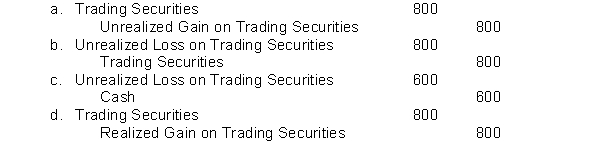

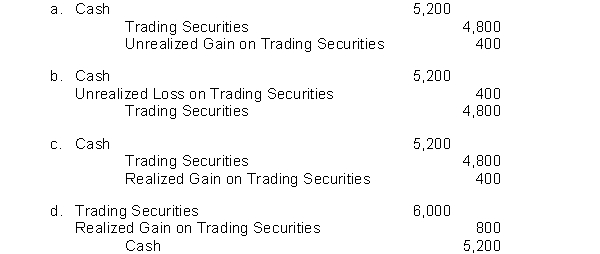

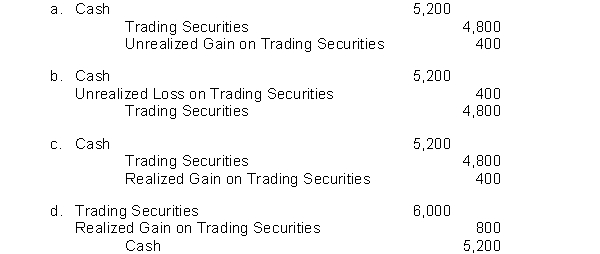

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 2009 revaluation of the AAA securities would be:

Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 2009 revaluation of the AAA securities would be:

Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 2009 revaluation of the AAA securities would be:

Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 2009 revaluation of the AAA securities would be:

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

55

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 100 shares of AAA stock sold in 2010 will include:

Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 100 shares of AAA stock sold in 2010 will include:

A) A debit to Trading Securities for $3,400.

B) A credit to Unrealized Loss on Trading Securities for $200.

C) A credit to Realized Loss on Sale of Trading Securities for $200.

D) A credit to Realized Gain on Sale of Trading Securities for $200.

Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 100 shares of AAA stock sold in 2010 will include:

Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 100 shares of AAA stock sold in 2010 will include:A) A debit to Trading Securities for $3,400.

B) A credit to Unrealized Loss on Trading Securities for $200.

C) A credit to Realized Loss on Sale of Trading Securities for $200.

D) A credit to Realized Gain on Sale of Trading Securities for $200.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

56

Carmen Corporation purchased a 40% interest in Sahara Inc. on January 1, 2010, paying $200,000 for 40% of the outstanding voting stock of Sahara Inc. For its year ended December 31, 2010, Sahara Inc. reported net income of $40,000. On December 31, 2010, Carmen received a dividend payment from Sahara in the amount of $1,000. As a result of its ownership interest in Sahara, the financial statements for Carmen Corporation for the year ended December 31, 2010 will reflect which of the following:

A) An asset in the amount of $200,000.

B) Revenue of $1,000.

C) Cash flows from operations of $1,000.

D) Revenue of $16,000.

A) An asset in the amount of $200,000.

B) Revenue of $1,000.

C) Cash flows from operations of $1,000.

D) Revenue of $16,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

57

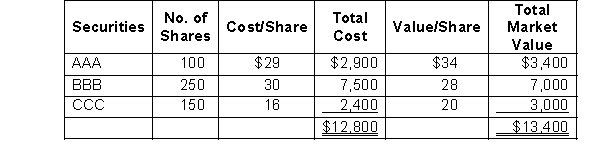

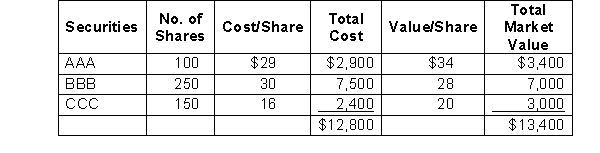

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the 2009 revaluation of the CCC securities would be:

During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the 2009 revaluation of the CCC securities would be:

During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the 2009 revaluation of the CCC securities would be:

During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the 2009 revaluation of the CCC securities would be:

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

58

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010 was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share.

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010 was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share.

The journal entry to record the 2009 revaluation of the BBB securities would be:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010 was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share.

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010 was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share.The journal entry to record the 2009 revaluation of the BBB securities would be:

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

59

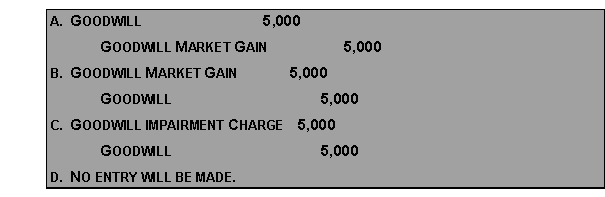

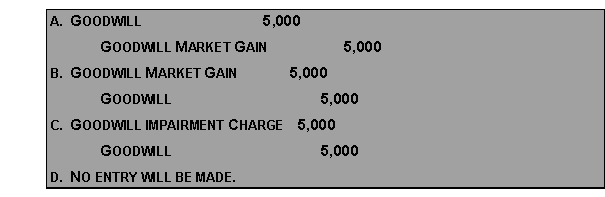

If Howard Company's balance sheet amount of goodwill is $20,000 and the fair market value of the goodwill is estimated to be $25,000, which of the following entries would be recorded in Howard's books?

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements about Special Purpose Entities (SPEs) is not true?

A) SPEs can take on various legal forms, like corporations or partnerships.

B) It can be difficult to determine who actually controls an SPE.

C) Management can structure a transaction using an SPE in such a manner that the accounting treatment fails to reflect the economic substance of the transaction.

D) SPEs have been used to mislead investors.

A) SPEs can take on various legal forms, like corporations or partnerships.

B) It can be difficult to determine who actually controls an SPE.

C) Management can structure a transaction using an SPE in such a manner that the accounting treatment fails to reflect the economic substance of the transaction.

D) SPEs have been used to mislead investors.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

61

On December 31, the cost and market price of trading securities are $5,000 and $9,000, respectively. Give the appropriate adjusting entry on December 31.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

62

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  During 2010, Solo received word that dividends of $$2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the sale of 150 shares of CCC stock in 2011 would include:

During 2010, Solo received word that dividends of $$2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the sale of 150 shares of CCC stock in 2011 would include:

A) A debit to Cash for $2,700.

B) A debit to Unrealized Price Increase on Available-for-Sale Securities for $300.

C) A debit to Unrealized Gain on Available-for-Sale Securities for $900.

D) A debit to Available-for-Sale Securities for $3,300.

During 2010, Solo received word that dividends of $$2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the sale of 150 shares of CCC stock in 2011 would include:

During 2010, Solo received word that dividends of $$2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the sale of 150 shares of CCC stock in 2011 would include:A) A debit to Cash for $2,700.

B) A debit to Unrealized Price Increase on Available-for-Sale Securities for $300.

C) A debit to Unrealized Gain on Available-for-Sale Securities for $900.

D) A debit to Available-for-Sale Securities for $3,300.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

63

Prepare the December 31 journal entry that adjusts available-for-sale securities that were purchased at a cost of $5,000 when current market value is $4,000.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

64

On December 31, the cost and market price of available-for-sale securities are $5,000 and $9,000, respectively. Give the appropriate adjusting entry on December 31.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

65

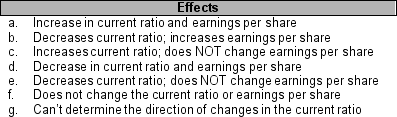

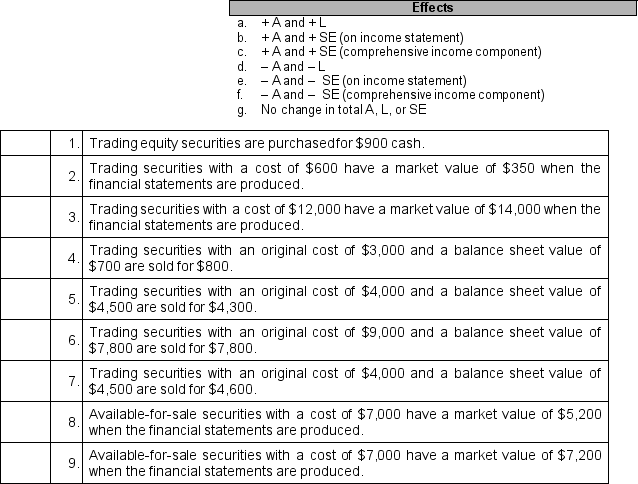

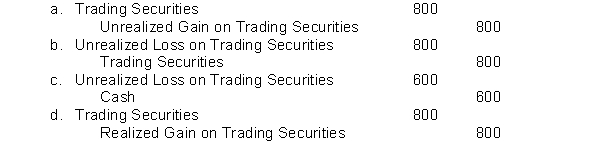

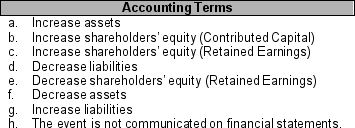

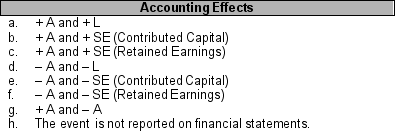

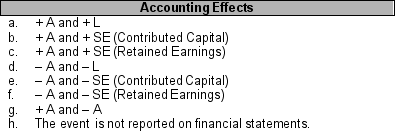

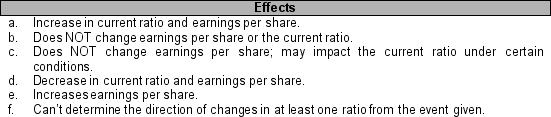

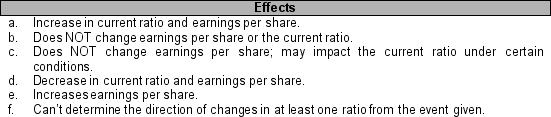

For each transaction numbered 1 through 4 below, identify which effect (a through g) would most likely occur as a result of the transaction. You may use each letter more than once or not at all.

_____ 1. Trading equity securities are purchased for $1,000 cash.

_____ 1. Trading equity securities are purchased for $1,000 cash.

_____ 2. Trading securities that cost $1,000 have a yearend market value of $800.

_____ 3. Trading securities that cost $1,000 have a yearend market value of $1,200.

_____ 4. Trading securities that cost $1,000 that have a current balance sheet value of $800 are sold for $900.

_____ 1. Trading equity securities are purchased for $1,000 cash.

_____ 1. Trading equity securities are purchased for $1,000 cash._____ 2. Trading securities that cost $1,000 have a yearend market value of $800.

_____ 3. Trading securities that cost $1,000 have a yearend market value of $1,200.

_____ 4. Trading securities that cost $1,000 that have a current balance sheet value of $800 are sold for $900.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

66

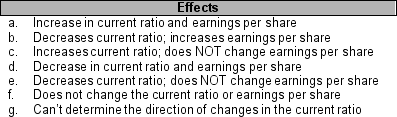

For each transaction numbered 1 through 4 below, identify which effect (a through f) the transaction is most likely to cause. You may use each letter more than once or not at all.

_____ 1. The cost method is used for an investment in long-term equity securities, and the investee company declares a cash dividend.

_____ 1. The cost method is used for an investment in long-term equity securities, and the investee company declares a cash dividend.

_____ 2. The equity method is used for an investment in long-term equity securities and the investee company declares a cash dividend.

_____ 3. The cost method is used for an investment in long-term equity securities and the investee company recognizes net income.

_____ 4. The equity method is used for an investment in long-term equity securities and the investee company recognizes net income.

_____ 1. The cost method is used for an investment in long-term equity securities, and the investee company declares a cash dividend.

_____ 1. The cost method is used for an investment in long-term equity securities, and the investee company declares a cash dividend._____ 2. The equity method is used for an investment in long-term equity securities and the investee company declares a cash dividend.

_____ 3. The cost method is used for an investment in long-term equity securities and the investee company recognizes net income.

_____ 4. The equity method is used for an investment in long-term equity securities and the investee company recognizes net income.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

67

For each transaction listed in 1 through 9, place the letter (a through g) of the best effect in the space provided. You may use each letter more than once or not at all.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

68

On December 31, 2010, available-for-sale securities with an original cost of $10,000 have a carrying value on the balance sheet equal to their market value of $12,000. On January 5, 2011, those securities are sold for $11,000. Give the appropriate entry to record the sale of the available-for-sale securities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

69

On December 31, 2010, trading securities with an original cost of $10,000 have a carrying value on the balance sheet equal to their market value of $12,000. On January 5, 2011, those trading securities are sold for $10,000. Give the appropriate entry to record the sale of the trading securities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

70

On December 31, 2010, available-for-sale securities with an original cost of $14,000 have a carrying value on the balance sheet equal to their market value of $16,000. On January 11, 2011, those securities are sold for $18,000. Give the appropriate entry to record the sale of the available-for-sale securities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

71

On December 31, 2010, trading securities with an original cost of $45,000 have a market value of $47,000. On January 11, 2011, those trading securities are sold for $51,000. Determine the gains or losses in 2009 and 2010 associated with these trading securities. Clearly label whether the gains or losses are realized or unrealized. Name the financial statement on which each is reported.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

72

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the revaluation of BBB shares in 2010 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the revaluation of BBB shares in 2010 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the revaluation of BBB shares in 2010 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the revaluation of BBB shares in 2010 is:

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

73

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the revaluation of CCC shares in 2010 is:

During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the revaluation of CCC shares in 2010 is:

During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the revaluation of CCC shares in 2010 is:

During 2010, Solo received word that dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market value of CCC on December 31, 2010, was $18. During 2011, Solo sold 150 shares of CCC for $22 per share. The journal entry to record the revaluation of CCC shares in 2010 is:

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

74

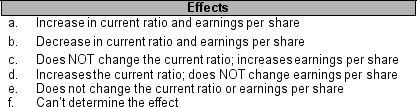

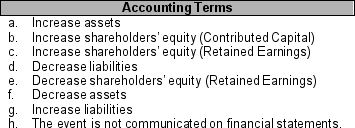

Each transaction listed in 1 through 4 below relates to a long-term investment is equity securities. Select the letters of the accounting effects (a through h) and place them in the space provided. Transactions may have more than one answer.

_____ 1. Using the equity method the market price of the investment increases above its cost.

_____ 1. Using the equity method the market price of the investment increases above its cost.

_____ 2. Using the cost method the market price of the investment increases above its cost.

_____ 3. Using the equity method, the investee company recognizes a net loss for the year.

_____ 4. An investment in a 40%-owned subsidiary is sold for more than its carrying value.

_____ 1. Using the equity method the market price of the investment increases above its cost.

_____ 1. Using the equity method the market price of the investment increases above its cost._____ 2. Using the cost method the market price of the investment increases above its cost.

_____ 3. Using the equity method, the investee company recognizes a net loss for the year.

_____ 4. An investment in a 40%-owned subsidiary is sold for more than its carrying value.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

75

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:

A) A credit to Dividend Revenue for $975.

B) A credit to Dividend Payable for $375.

C) A credit to Cash for $600.

D) A debit to Dividend Expense for $375.

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:A) A credit to Dividend Revenue for $975.

B) A credit to Dividend Payable for $375.

C) A credit to Cash for $600.

D) A debit to Dividend Expense for $375.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

76

On December 31, 2010, trading securities with an original cost of $10,000 have a carrying value on the balance sheet equal to their market value of $12,000. On January 11, 2011, those trading securities are sold for $15,000. Prepare the appropriate entry to record the sale of the trading securities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

77

Each transaction listed in 1 through 4 relates to an investment in a long-term equity security. Place the letter that corresponds to the effect (a through h) the transaction has on the accounting equation in the space provided. You may use each letter more than once or not at all.

____ 1. Under the cost method, the investee company declares a cash dividend.

____ 1. Under the cost method, the investee company declares a cash dividend.

____ 2. Under the equity method, the investee company declares a cash dividend.

____ 3. Under the cost method, the investee company recognizes net income.

____ 4. Under the equity method, the investee company recognizes net income.

____ 1. Under the cost method, the investee company declares a cash dividend.

____ 1. Under the cost method, the investee company declares a cash dividend.____ 2. Under the equity method, the investee company declares a cash dividend.

____ 3. Under the cost method, the investee company recognizes net income.

____ 4. Under the equity method, the investee company recognizes net income.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

78

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010, was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share. The journal entry to record the sale of 200 shares of BBB stock in 2011 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010, was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share. The journal entry to record the sale of 200 shares of BBB stock in 2011 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010, was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share. The journal entry to record the sale of 200 shares of BBB stock in 2011 is:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB. The per-share market value of BBB on December 31, 2010, was $24. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share. The journal entry to record the sale of 200 shares of BBB stock in 2011 is:

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

79

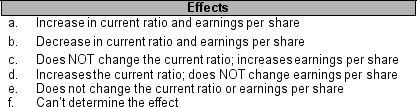

Matching Questions

Each transaction numbered 1 through 5 below involves an equity security originally acquired at a cost of $1,000. Identify the effect each transaction has on the current ratio and earnings per share by selecting from the effects listed in a through f. You may use each letter more than once or not at all.

____ 1. Trading securities with a current balance sheet value of $1,200 are sold for $1,100.

____ 2. Trading securities with a current balance sheet value of $800 are sold for $800.

____ 3. Trading securities with a current balance sheet value of $1,200 are sold for $1,300.

____ 4. Available-for-sale securities have a market value of $800 at yearend.

____ 5. Available-for-sale securities have a market value of $1,200 at yearend.

Each transaction numbered 1 through 5 below involves an equity security originally acquired at a cost of $1,000. Identify the effect each transaction has on the current ratio and earnings per share by selecting from the effects listed in a through f. You may use each letter more than once or not at all.

____ 1. Trading securities with a current balance sheet value of $1,200 are sold for $1,100.

____ 2. Trading securities with a current balance sheet value of $800 are sold for $800.

____ 3. Trading securities with a current balance sheet value of $1,200 are sold for $1,300.

____ 4. Available-for-sale securities have a market value of $800 at yearend.

____ 5. Available-for-sale securities have a market value of $1,200 at yearend.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

80

Trading securities were purchased at a cost of $5,000. Their current market value is $4,000. Prepare the December 31 adjusting journal entry.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck