Deck 4: Gross Income

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 4: Gross Income

1

Paul Penn, a cash basis taxpayer, received a desk in exchange for bookkeeping services. He should report the fair market value of the desk as income.

True

ftis is an example of bartering.

ftis is an example of bartering.

2

An amount called a security deposit which is to be used as a final payment of rent should not be included in rental income in the year received, but should be included in income in the year the lease expires.

False

If it is prepaid rent it must be included in the year received

If it is prepaid rent it must be included in the year received

3

A scholarship received by a student that represents compensation for past, present, or future services is includible in gross income.

True

4

Dan Drew owned two shares of a corporation's common stock. He paid $60 for one share and $30 for the other share. fte corporation declared a stock dividend which gave stockholders two new shares of common stock for each share they held. After the distribution, Dan owns six shares of stock with an adjusted basis of $15 each.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

Ms. Clara Crayola, a teacher, received a cash award of $5,000 from the Chamber of Commerce in recognition of her past accomplishments in the field of education. She was chosen without action on her part and is not expected to perform any future services. fte $5,000 award is the same as any other prize and must be reported by Clara as income in 2012.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Zelda Zayer leased a room to Victor Vaughn for one year. He paid her $500 for November's and December's rent and $100 as a security deposit to be returned to him at the end of the lease. Zelda must include the $600 as income when received.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

Payments of a former wife's medical expenses under a divorce decree requiring that the husband pay the wife's future medical expenses in addition to qualifying alimony are deductible as alimony.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Advance rent must be included in rental income in the year received regardless of the period covered or the accounting method used.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

fte fair market value of property or services received in bartering must be included in gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

Rick Rambler is divorced from his wife, who has custody of their child. fte divorce decree provides that Rick must pay his former wife $15 per week toward the child's support, which he did throughout the calendar year. fte decree also provides that he may claim the child as his exemption. Rick's former wife can prove that during the year she contributed $7,500 toward the support of the child. Rick is entitled to claim the exemption for the child.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

When corporate bonds are sold between interest dates, the purchaser may take a deduction for that part of the purchase price that represents accrued interest as a return on capital from the next interest payment.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

If both alimony and child support payments are required by the divorce decree or agreement and less than the required amount is paid, the payments apply first to child support and then to alimony.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Dr. Yomo, a cash basis taxpayer, received a check for $250 after banking hours on December 30, 2012, from a patient. Since Dr. Yomo could not deposit the check in his business checking account until January 2, 2013, the fee of $250 is not included in his income for 2012.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

Tim ftayer, a lessee of part of an office building from an unrelated lessor, made permanent improvements which had a useful life longer than the remaining term of the lease. fte improvements are not recovery property. Tim may amortize the cost of the improvement over the remaining term of the lease.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

Dr. Nelly Newman recently graduated from medical school and has begun her internship in a university hospital. Dr. Newman receives a $1,200 per month stipend, the same as all other interns. fte internship is a required part of Dr. Newman's training as it is of all other medical school graduates entering her field of speciality. fte $1,200 per month stipend represents a nontaxable grant.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

Alan Anderson, a lessor, entered into a 10-year lease with a lessee in 2012. In addition to the $5,000 received for the 2012 rent, Alan received $5,000 in advance rent for the last year of the lease. Alan must include $10,000 in rental income in 2012.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

Compensation for damages to a person's character or for personal injury or illness is taxable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

If the tenant pays any expenses of the landlord, these payments are rental income to the landlord and must be included in the landlord's return.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

In 2012, Greta Grady received $50,000 in advance payments under a 50-month lease agreement. fte $50,000 represented the entire amount due under the lease. ftere were no restrictions on the use or enjoyment of the payments. Greta must include the $50,000 as income in 2012.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

On December 31, 2012, George Gaines' bank credited his savings account with interest earned from October 1, 2012 through December 31, 2012. fte bank posted this interest to his passbook on January 15, 2013, when he made a withdrawal. George, a calendar year cash method taxpayer, must report this interest on his 2012 income tax return.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

In order to limit the extent that "front-loaded" payments may qualify as alimony, a recapture rule may apply to the part of the payments made in the first two post-separation years that exceed $25,000 a year.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

Harry and Wilma are divorced in 2012. Payments from Harry to Wilma under a 2012 property settlement agreement may qualify for alimony treatment.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

All of the following are considered "constructive receipt" of income, except:

A) Lori was informed her check for services rendered was available but she did not pick it up.

B) Pierre earned income that was received by his agent but was not received by Pierre.

C) Jacque bought a 9-month certificate of deposit in November 2012. It earned $200 interest in 2012. She can withdraw the principal and interest in 2012 if she pays a penalty of one month's interest ($100).

D) A payment on a sale of real property place in escrow pending settlement at which time title would convey.

A) Lori was informed her check for services rendered was available but she did not pick it up.

B) Pierre earned income that was received by his agent but was not received by Pierre.

C) Jacque bought a 9-month certificate of deposit in November 2012. It earned $200 interest in 2012. She can withdraw the principal and interest in 2012 if she pays a penalty of one month's interest ($100).

D) A payment on a sale of real property place in escrow pending settlement at which time title would convey.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

Abigail deposited $10,000 in a bank to purchase a 6 month money market certificate which matures in 2012. Abigail is required to include this interest as income for tax year 2012.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

When corporate bonds, which are not original discount bonds, are sold between interest dates, the accrued interest to the date of the sale must be reported by the seller as taxable interest income. When the purchaser receives the next payment, the total amount must be reported as taxable interest income and the accrued interest shown as an adjustment (or subtraction).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

All interest on United States savings bonds is tax-exempt.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

Interest was credited to Jane's savings account on December 31, 2012. As long as Jane leaves the interest in the account and does not withdraw it, the interest is not taxable to her.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

Greg Greystone rents an apartment to Brad Berry. If Brad pays any of Greg's expenses, Greg must include the payments in his rental income. Greg may deduct the expenses paid by Brad if they are otherwise deductible.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

Todd, a politician, uses political contributions to pay his household electric bill. fte amount used to pay the electric bill is taxable income to Todd.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Paul and Joan divorced in 2012. ftey have two children, ages five and ten. fte divorce decree requires Joan to pay $300 a month to Paul and does not specify the use of the money. According to the decree, the payments will stop after the children reach 18. Joan may deduct payments as alimony.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

Makayla, a cash basis saleswoman, receives commissions in February 2013 based on sales made in the last quarter of 2012. fte commissions are includible in 2012 gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

In which of the following situations will the divorced custodial parent be entitled to the dependency exemption for the child?

A) fte noncustodial parent provides $1,500 of support for the child and the custodial parent provides $1,200.

B) fte custodial and noncustodial parent both provide $1,500 of support for the child.

C) fte custodial parent provides $1,500 of support for the child and the noncustodial parent provides $1,200.

D) All of the above.

A) fte noncustodial parent provides $1,500 of support for the child and the custodial parent provides $1,200.

B) fte custodial and noncustodial parent both provide $1,500 of support for the child.

C) fte custodial parent provides $1,500 of support for the child and the noncustodial parent provides $1,200.

D) All of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

Jerome Judson's divorce decree calls for him to pay his former wife $200 a month as child support and $200 a month as alimony. ftis year he paid only $3,600. Jerome may deduct $1,800 as alimony.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Eric agrees to paint Naomi's porch if Naomi pays $200 to Eric's elderly mother. fte $200 is included in Eric's gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

Ed and Edna are divorced in 2012. fte couple has one child, age 11. Under a 2012 divorce instrument, Edna is to pay Ed alimony of $1,000 per month. Alimony payments will be reduced by $600 a month when the child reaches 18. Under this fact situation, $600 of the $1,000 a month payment from Edna to Ed is treated as nondeductible child support.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

If the taxpayer owns Series E or Series EE bonds and chooses to report the increase in redemption value as interest income each year, the taxpayer must continue to do so for all discount bonds that are owned or obtained later.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Mr. Barley, an accountant, accepted a painting for his office from his client in lieu of payment of his customary fee of $400 for preparation of a tax return. He must include the $400 in income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

Cal Cotton, under a divorce instrument, is required to make mortgage payments and pay real estate taxes and insurance premiums on property owned by him but used by his former wife as her residence. Cal may deduct these payments as alimony.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

Gross income is a taxpayer's total income less exclusions.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

On August 1 of this year, Bart Barnes transferred property to his former spouse in settlement of marital rights, under a divorce instrument effective July 26. fte property cost $10,000 and had a fair market value of $20,000 when transferred. Bart will recognize gain on the transfer.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

James and Edna Smith are a childless married couple who lived apart for all of 2012. On December 31, 2012, they were legally separated under a decree of separate maintenance. Which of the following is the only filing status choice available to them for 2012?

A) Married filing joint return.

B) Married filing separate return.

C) Head of household.

D) Single.

A) Married filing joint return.

B) Married filing separate return.

C) Head of household.

D) Single.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is correct?

A) Stock dividends are distributions made by a corporation of another corporation's stock.

B) In computing basis for new stock received as a result of a nontaxable dividend, it is immaterial whether the stock received is identical or not to the old stock.

C) If a stock dividend is taxable, the basis of the old stock does not change.

D) If you receive nontaxable stock rights and allow them to expire you have a tax deductible loss.

A) Stock dividends are distributions made by a corporation of another corporation's stock.

B) In computing basis for new stock received as a result of a nontaxable dividend, it is immaterial whether the stock received is identical or not to the old stock.

C) If a stock dividend is taxable, the basis of the old stock does not change.

D) If you receive nontaxable stock rights and allow them to expire you have a tax deductible loss.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Richard and Alice Kelley lived apart during 2012 and did not file a joint tax return for the year. Under the terms of the written separation agreement they signed on July 1, 2011, Richard was required to pay Alice $1,500 per month of which $600 was designated as child support. He made 12 such payments in 2012. Assuming that Alice has no other income, her tax return for 2012 should show gross income of:

A) $0

B) $5,400

C) $10,800

D) $12,600

A) $0

B) $5,400

C) $10,800

D) $12,600

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Mark Mayer, a cash basis taxpayer, leased property on June 1, 2012, to Perry Purly at $325 a month. Perry paid Mark $325 as a security deposit which will be returned at the end of the lease. In addition, Perry paid $650 in advance rent which is to be applied as rent to the last two months in the lease term. fte lease is to run for a two- year period. What is Mark's rental income for 2012?

A) $1,950

B) $2,275

C) $2,600

D) $2,925

E) $3,250

A) $1,950

B) $2,275

C) $2,600

D) $2,925

E) $3,250

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

Under the terms of their divorce agreement executed in October 2012, Keith transferred Corporation M stock to his former wife, Karen, as a property settlement. At the time of the transfer, the stock had a basis to Keith of $20,000 and a fair market value of $50,000. What is the tax consequence of this transaction to Keith, and what is Karen's basis in the Corporation M stock?

A) Keith has a gain of $30,000; Karen's basis is $20,000.

B) Keith has a gain of $30,000; Karen's basis is $50,000.

C) Keith has no gain or loss; Karen's basis is $20,000.

D) Keith has no gain or loss; Karen's basis is $50,000.

A) Keith has a gain of $30,000; Karen's basis is $20,000.

B) Keith has a gain of $30,000; Karen's basis is $50,000.

C) Keith has no gain or loss; Karen's basis is $20,000.

D) Keith has no gain or loss; Karen's basis is $50,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

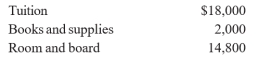

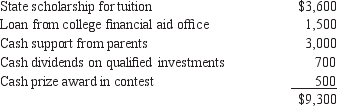

Kevin is a candidate for an undergraduate degree at a local university. During 2012, he was granted a fellowship that provided the following:  What amount can Kevin exclude from gross income in 2012?

What amount can Kevin exclude from gross income in 2012?

A) $18,000

B) $20,000

C) $25,000

D) $32,800

E) $34,800

What amount can Kevin exclude from gross income in 2012?

What amount can Kevin exclude from gross income in 2012?A) $18,000

B) $20,000

C) $25,000

D) $32,800

E) $34,800

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

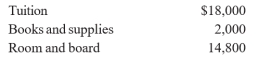

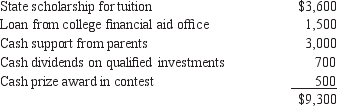

Roger Burrows, age 19, is a full-time student at Marshall College and a candidate for a bachelor's degree. During 2012, he received the following payments:  What is Burrows's adjusted gross income for 2012?

What is Burrows's adjusted gross income for 2012?

A) $1,100

B) $1,200

C) $4,800

D) $9,300

What is Burrows's adjusted gross income for 2012?

What is Burrows's adjusted gross income for 2012?A) $1,100

B) $1,200

C) $4,800

D) $9,300

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

Mason, an accrual basis taxpayer, owns a six-unit apartment building for which he receives rent of $600 per month per unit. In 2012, five of the units were rented for the entire twelve-month period. fte sixth unit was occupied from January 1st through March 31st. Upon vacating the unit, the tenant was not refunded his security deposit of $400 due to damages to the unit. fte unit was subsequently rented for one year beginning August 1, 2012. On August 1st, the new tenant paid the first and last month's rent and a refundable security deposit of $400. What is Mason's total rental income for 2012?

A) $40,800

B) $41,200

C) $41,800

D) $42,200

A) $40,800

B) $41,200

C) $41,800

D) $42,200

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

All of the following are requirements for a payment to be alimony (under instruments executed after 1984), except:

A) Payments can be in cash or property.

B) Payments cannot be a transfer of services.

C) Payments are required by a divorce or separation instrument.

D) Payments are not required after death of the recipient spouse.

A) Payments can be in cash or property.

B) Payments cannot be a transfer of services.

C) Payments are required by a divorce or separation instrument.

D) Payments are not required after death of the recipient spouse.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

Percy Peterson received a grant from the Department of Education for a special research project on education. He received $500 per month for the period May 1 to December 31. Percy is not a candidate for a degree. fte amount of the fellowship he may exclude from income for the tax year is:

A) $0

B) $1,600

C) $2,400

D) $3,000

E) $4,000

A) $0

B) $1,600

C) $2,400

D) $3,000

E) $4,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Each of the following would be one of the requirements for a payment to be alimony under instruments executed after 1984 except:

A) Payments are required by a divorce or separation instrument.

B) Payments can be a noncash property settlement.

C) Payments are not designated in the instrument as not alimony.

D) Payments are not required after death of the recipient spouse.

A) Payments are required by a divorce or separation instrument.

B) Payments can be a noncash property settlement.

C) Payments are not designated in the instrument as not alimony.

D) Payments are not required after death of the recipient spouse.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Johnny, a cash basis taxpayer, owns two rental properties. Based on the following information, compute the amount that he must include in his 2012 gross rental income.

A) $16,700

B) $17,500

C) $18,200

D) $18,950

A) $16,700

B) $17,500

C) $18,200

D) $18,950

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Stan and Anne were divorced in January 2012. fte provisions of the divorce decree and Anne's obligations follow: (1.) Transfer the title in their resort condo to Stan. At the time of the transfer, the condo had a basis to Anne of

$75,000, a fair market value of $95,000; it was subject to a mortgage of $65,000.

(2)) Anne is to make the mortgage payments for 17 years regardless of how long Stan lives. Anne paid $8,000 in 2012.

(3)) Anne is to pay Stan $1,000 per month, beginning in February, for 10 years or until Stan dies. Of this amount,

$300 is designated as child support. Anne made five payments of $900 each in 2012 (February-June). What is the amount of alimony from his settlement that is includible in Stan's gross income for 2012?

A) $3,000

B) $3,500

C) $11,000

D) $38,500

$75,000, a fair market value of $95,000; it was subject to a mortgage of $65,000.

(2)) Anne is to make the mortgage payments for 17 years regardless of how long Stan lives. Anne paid $8,000 in 2012.

(3)) Anne is to pay Stan $1,000 per month, beginning in February, for 10 years or until Stan dies. Of this amount,

$300 is designated as child support. Anne made five payments of $900 each in 2012 (February-June). What is the amount of alimony from his settlement that is includible in Stan's gross income for 2012?

A) $3,000

B) $3,500

C) $11,000

D) $38,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is not considered "constructive receipt" of income?

A) Ms. K was informed her check for services rendered was available on December 16, 2012, but she waited until January 16, 2013 to pick up the check.

B) Earned income of Mr. D was received by his agent on December 30, 2012, but not received by D until January 3, 2013.

C) Mr. W received a check on December 30, 2012 for services rendered, but was unable to make a deposit until January 3, 2013.

D) A payment on a sale of real property was placed in escrow on December 16, 2012, but not received by Ms. B until January 10, 2013, when the transaction was closed.

A) Ms. K was informed her check for services rendered was available on December 16, 2012, but she waited until January 16, 2013 to pick up the check.

B) Earned income of Mr. D was received by his agent on December 30, 2012, but not received by D until January 3, 2013.

C) Mr. W received a check on December 30, 2012 for services rendered, but was unable to make a deposit until January 3, 2013.

D) A payment on a sale of real property was placed in escrow on December 16, 2012, but not received by Ms. B until January 10, 2013, when the transaction was closed.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Which one of the following distributions is nontaxable?

A) Mutual fund distributions from its net realized long-term capital gains in the amount of $1,000. You have an adjusted basis of $10,000 in the mutual fund.

B) Return of capital distribution from a utility company in the amount of $2,000. You have a zero basis in this stock.

C) Dividend on insurance policy in the amount of $1,000. As of the date of this dividend your net premiums exceed the total dividends by $3,500.

D) Your share of an ordinary dividend received by an S corporation in the amount of $25,000.

A) Mutual fund distributions from its net realized long-term capital gains in the amount of $1,000. You have an adjusted basis of $10,000 in the mutual fund.

B) Return of capital distribution from a utility company in the amount of $2,000. You have a zero basis in this stock.

C) Dividend on insurance policy in the amount of $1,000. As of the date of this dividend your net premiums exceed the total dividends by $3,500.

D) Your share of an ordinary dividend received by an S corporation in the amount of $25,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

During 2012, Milton Hanover was granted a divorce from his wife. fte divorce decree stipulated that he was to pay both alimony and child support for a specified period of time. In examining his records for 2012, the following information is available:  What is Hanover's adjusted gross income for 2012?

What is Hanover's adjusted gross income for 2012?

A) $44,600

B) $48,400

C) $49,400

D) $52,000

What is Hanover's adjusted gross income for 2012?

What is Hanover's adjusted gross income for 2012?A) $44,600

B) $48,400

C) $49,400

D) $52,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

Troy, a cash basis taxpayer, owns an office building. His records reflect the following for 2012. On March 1, 2012, office B was leased for twelve months. A $900 security deposit was received which will be used as the last month's rent.

On September 30, 2012, the tenant in office A paid Troy $3,600 to cancel the lease expiring on March 31, 2012. fte lease of the tenant in office C expired on December 31, 2012, and the tenant left improvements valued at

$1,400. fte improvements were not in lieu of any required rent.

Considering just these three amounts, what amount must Troy include in rental income on his income tax return for 2012?

A) $5,900

B) $5,000

C) $4,500

D) $1,800

On September 30, 2012, the tenant in office A paid Troy $3,600 to cancel the lease expiring on March 31, 2012. fte lease of the tenant in office C expired on December 31, 2012, and the tenant left improvements valued at

$1,400. fte improvements were not in lieu of any required rent.

Considering just these three amounts, what amount must Troy include in rental income on his income tax return for 2012?

A) $5,900

B) $5,000

C) $4,500

D) $1,800

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

With regard to stock dividends, all of the following statements are correct except:

A) Stock dividends are distributions made by a corporation of its own stock.

B) In computing basis for new stock received as a result of a non-taxable dividend, it is immaterial whether the stock received is identical or not to the old stock.

C) If a stock dividend is taxable, the basis of the old stock does not change.

D) If a stock dividend is not taxable, a division must be made in the basis between the old and new stock.

A) Stock dividends are distributions made by a corporation of its own stock.

B) In computing basis for new stock received as a result of a non-taxable dividend, it is immaterial whether the stock received is identical or not to the old stock.

C) If a stock dividend is taxable, the basis of the old stock does not change.

D) If a stock dividend is not taxable, a division must be made in the basis between the old and new stock.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

In July 1997, Dan Farley leased a building to Robert Shelter for a period of 15 years at a monthly rental of $1,000 with no option to renew. At that time the building had a remaining estimated useful life of 20 years. Prior to taking possession of the building, Shelter made improvements at a cost of $18,000. ftese improvements had an estimated useful life of 20 years at the commencement of the lease period. fte lease expired on June 30, 2012, at which point the improvements had a fair market value of $2,000. fte amount that Farley, the landlord, should include in his gross income for 2012 is:

A) $6,000

B) $8,000

C) $12,000

D) $24,000

A) $6,000

B) $8,000

C) $12,000

D) $24,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

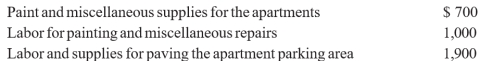

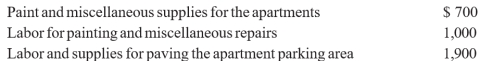

Jerry, a general contractor by trade, is a tenant of Montgomery Apartments. In exchange for four months rent ($900/month), Jerry provided the following items and services for Paul, the owner of the apartments:  How should Paul treat this transaction on his 2012 Schedule E?

How should Paul treat this transaction on his 2012 Schedule E?

A) Rental income of $3,600 and rental expenses of $3,600.

B) No rental income or rental expenses are to be reflected on the Schedule E because the net effect is 0.

C) Rental income of $3,600 and depreciation computed on the capital expenditures of $3,600.

D) Rental income of $3,600, rental expenses of $1,700, and depreciation computed on the capital expenditures of $1,900.

How should Paul treat this transaction on his 2012 Schedule E?

How should Paul treat this transaction on his 2012 Schedule E?A) Rental income of $3,600 and rental expenses of $3,600.

B) No rental income or rental expenses are to be reflected on the Schedule E because the net effect is 0.

C) Rental income of $3,600 and depreciation computed on the capital expenditures of $3,600.

D) Rental income of $3,600, rental expenses of $1,700, and depreciation computed on the capital expenditures of $1,900.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

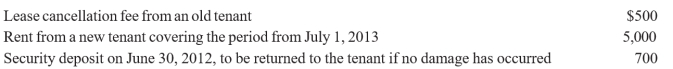

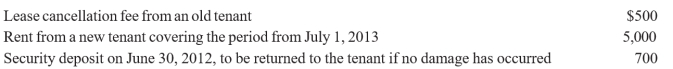

Bob Buttons, a cash basis calendar year taxpayer, owns and operates an apartment building. During 2012, he received the following payments:  What is the amount of Bob's gross rental income for 2012?

What is the amount of Bob's gross rental income for 2012?

A) $1,750

B) $2,450

C) $5,500

D) $6,200

What is the amount of Bob's gross rental income for 2012?

What is the amount of Bob's gross rental income for 2012?A) $1,750

B) $2,450

C) $5,500

D) $6,200

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Holly and Harp Oaks were divorced in 2010. fte divorce decree was silent regarding the exemption for their 12-year-old daughter, June. Holly has legal custody of her daughter and did not sign a statement releasing the exemption. Holly earned $8,000 and Frank earned $80,000. June had a paper route and earned $3,000. June lived with Harp 4 months of the year and with Holly 8 months. Who may claim the exemption for June in 2012?

A) June may, since she had gross income over $3,000 and files her own return.

B) Since June lived with both Holly and Harp during the year, they both may claim her as an exemption.

C) Holly may, since she has legal custody and physical custody for more than half the year.

D) Harp may, since he earned more than Holly and, therefore, is presumed to have provided more than 50% of June's support.

A) June may, since she had gross income over $3,000 and files her own return.

B) Since June lived with both Holly and Harp during the year, they both may claim her as an exemption.

C) Holly may, since she has legal custody and physical custody for more than half the year.

D) Harp may, since he earned more than Holly and, therefore, is presumed to have provided more than 50% of June's support.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

John, a cash basis taxpayer, had a $5,000 loan from his local credit union. He lost his job and was unable to make the payments on this loan. fte credit union determined that the legal fees to collect might be higher than the amount John owed so they canceled the $3,000 remaining amount due on the loan. John did not file bankruptcy nor was he insolvent. How much must John include in his income as a result of this occurrence?

a. $5,000

b. $3,000

c. $0

d. $8,000

a. $5,000

b. $3,000

c. $0

d. $8,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

In 2012, Norm, a carpenter, received a beach boat from the Newport Marina in exchange for carpentry work on a new dock. fte beach boat cost the marina $1,600. fte fair market value of the boat is $2,000. What amount, if any, is includible in Norm's 2012 gross income as a result of this transaction?

A) $2,000

B) $1,800

C) $1,600

D) $400

E) $0

A) $2,000

B) $1,800

C) $1,600

D) $400

E) $0

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following in not a payment deductible as alimony?

A) Payments for life insurance premiums required by the divorce decree.

B) Payments for medical expenses of your spouse under the terms of the divorce decree.

C) Half of the mortgage payment on a home jointly owned with your ex-spouse when required by the divorce decree

D) Payments for child support required by the divorce decree

A) Payments for life insurance premiums required by the divorce decree.

B) Payments for medical expenses of your spouse under the terms of the divorce decree.

C) Half of the mortgage payment on a home jointly owned with your ex-spouse when required by the divorce decree

D) Payments for child support required by the divorce decree

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is considered a nonbusiness bad debt?

A) Tom, a CPA, made personal loans to several friends who were not his clients. ftree of the loans became totally worthless.

B) Mary obtained a court-order for her former husband, Bill, to pay child support. Bill did not pay the child support.

C) Kirby guaranteed a loan as a gesture of friendship for Sue. Sue defaulted and Kirby paid off the loan.

D) None of the above.

A) Tom, a CPA, made personal loans to several friends who were not his clients. ftree of the loans became totally worthless.

B) Mary obtained a court-order for her former husband, Bill, to pay child support. Bill did not pay the child support.

C) Kirby guaranteed a loan as a gesture of friendship for Sue. Sue defaulted and Kirby paid off the loan.

D) None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

In 2012, Uriah Stone received the following payments:

What amount, if any, should Mr. Stone report as interest income on his 2012 tax return?

What amount, if any, should Mr. Stone report as interest income on his 2012 tax return?

What amount, if any, should Mr. Stone report as interest income on his 2012 tax return?

What amount, if any, should Mr. Stone report as interest income on his 2012 tax return?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

Maria had municipal bond interest of $6,000, certificate of deposit interest of $4,000, reinvested corporate bond interest of $2,000, mutual fund municipal bond interest of $7,000 and savings account interest of $1,000. What is Maria's taxable interest?

A) $3,000.

B) $7,000.

C) $20,000.

D) $16,000.

A) $3,000.

B) $7,000.

C) $20,000.

D) $16,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following are taxable to the recipient for federal income tax purposes?

A) Monetary gift.

B) Bequest of property.

C) Amount received in settlement of a will contest.

D) An assignment of income from property.

E) None of the above is generally taxable to the recipient.

A) Monetary gift.

B) Bequest of property.

C) Amount received in settlement of a will contest.

D) An assignment of income from property.

E) None of the above is generally taxable to the recipient.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

Alex Burg, a cash basis taxpayer, earned an annual salary of $80,000 at Ace Corp. in 2012, but elected to take only $50,000. Ace, which was financially able to pay Burg's full salary, credited the unpaid balance of $30,000 to Burg's account on the corporate books in 2012, and actually paid this $30,000 to Burg on April 25, 2013. How much of the salary is taxable to Burg in 2012?

A) $50,000

B) $60,000

C) $65,000

D) $80,000

A) $50,000

B) $60,000

C) $65,000

D) $80,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Nature Corporation declared and distributed a stock dividend of 1 share for each 10 shares held by stockholders. Donna had 100 shares ($5.50 per share basis) and received 10 additional shares with a fair market value of $6.00 per share. Which of the following is most applicable to the stock dividend?

A) 100 shares at $5.50 per share basis and 10 shares at zero basis per share.

B) 110 shares at $5 per share basis and $55 taxable income.

C) 110 shares at $5 per share.

D) 100 shares at $5 per share basis and 10 shares at $6 per share basis.

A) 100 shares at $5.50 per share basis and 10 shares at zero basis per share.

B) 110 shares at $5 per share basis and $55 taxable income.

C) 110 shares at $5 per share.

D) 100 shares at $5 per share basis and 10 shares at $6 per share basis.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

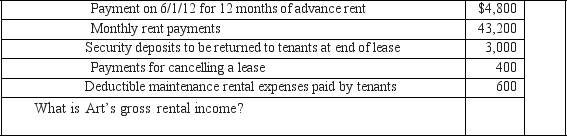

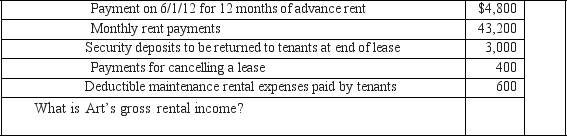

Art Aubrey owns and operates an apartment building. During 2012, he received the following:

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

All of the following are included in gross income for federal tax purposes, except:

A) Interest from School District Bonds

B) Illegal income

C) Alimony

D) Christmas Bonus

A) Interest from School District Bonds

B) Illegal income

C) Alimony

D) Christmas Bonus

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

In return for $1,000, Mr. Hand cancels Mr. Sandwich's debt of $4,000. fte cancellation is not a gift and Mr. Sandwich is neither insolvent nor bankrupt. Which of the following statements is correct?

A) Mr. Hand has $1,000 taxable income.

B) Mr. Sandwich has $3,000 of taxable income.

C) Mr. Sandwich has $4,000 of taxable income.

D) Neither Mr. Hand nor Mr. Sandwich has any taxable income from this transaction.

A) Mr. Hand has $1,000 taxable income.

B) Mr. Sandwich has $3,000 of taxable income.

C) Mr. Sandwich has $4,000 of taxable income.

D) Neither Mr. Hand nor Mr. Sandwich has any taxable income from this transaction.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

All of the following distributions of stock dividends are taxable except:

A) fte shareholders have the choice to receive cash or other property instead of stock or stock rights.

B) fte distribution of common stock is made on a prorated basis on common stock outstanding.

C) fte distribution gives cash or other property to some shareholders and an increase in the percentage interest in the corporation's assets or earnings and profits to other shareholders.

D) fte distribution gives preferred stock to some common stock shareholders and common stock to other common stock shareholders.

A) fte shareholders have the choice to receive cash or other property instead of stock or stock rights.

B) fte distribution of common stock is made on a prorated basis on common stock outstanding.

C) fte distribution gives cash or other property to some shareholders and an increase in the percentage interest in the corporation's assets or earnings and profits to other shareholders.

D) fte distribution gives preferred stock to some common stock shareholders and common stock to other common stock shareholders.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following items is not taxable?

A) Interest on U.S. Treasury bills, notes, and bonds issued by an agency of the United States

B) Interest on federal income tax refund

C) Interest on New York State bonds

D) Discount income in installment payments received on notes bought at a discount

E) Amount received from a condemning authority to compensate for a delay in paying an award

A) Interest on U.S. Treasury bills, notes, and bonds issued by an agency of the United States

B) Interest on federal income tax refund

C) Interest on New York State bonds

D) Discount income in installment payments received on notes bought at a discount

E) Amount received from a condemning authority to compensate for a delay in paying an award

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Based on the following 2012 events, how much should Rachel include in income on her federal income tax return?

A) $10,000

B) $15,000

C) $16,000

D) $24,000

A) $10,000

B) $15,000

C) $16,000

D) $24,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

Harry purchased one share of common stock in a computer company for $90. Shortly after he purchased it, the corporation distributed two new shares of common stock for each share held. What is his basis for each of the three shares of common stock?

A) $90

B) $180

C) $30

D) $0

A) $90

B) $180

C) $30

D) $0

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is true regarding a nonbusiness bad debt?

a. It is deductible as a short-term capital loss.

b. It is not deductible.

c. It is deductible only if you itemize.

d. It is deductible as a long-term capital loss.

a. It is deductible as a short-term capital loss.

b. It is not deductible.

c. It is deductible only if you itemize.

d. It is deductible as a long-term capital loss.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

Starting in 2012, Mr. West must pay his former spouse $20,000 annually under a divorce decree in the following amounts: • $1,000 a month for mortgage payments (including principal and interest) on a jointly owned home until she dies

• $200 a month for tuition fees paid to a private school until their son attains the age of 18 or leaves the school prior to age 18

• $5,000 a year cash payment to former Mrs. West until she dies

• In addition to the above amounts, the former Mrs. West also received in 2012 a lump-sum amount of

$150,000 from the sale of their other marital assets.

Assume the parties did not file a joint return and were not members of the same household. Also, assume that there were no written statements between the parties as to how the amounts should be treated. What is the amount of Mr. West's 2012 alimony deductions?

A) $20,000

B) $155,000

C) $17,600

D) $11,000

• $200 a month for tuition fees paid to a private school until their son attains the age of 18 or leaves the school prior to age 18

• $5,000 a year cash payment to former Mrs. West until she dies

• In addition to the above amounts, the former Mrs. West also received in 2012 a lump-sum amount of

$150,000 from the sale of their other marital assets.

Assume the parties did not file a joint return and were not members of the same household. Also, assume that there were no written statements between the parties as to how the amounts should be treated. What is the amount of Mr. West's 2012 alimony deductions?

A) $20,000

B) $155,000

C) $17,600

D) $11,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck