Deck 8: Managing in Competitive, Monopolistic, and Monopolisticolly Competitive Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/21

Play

Full screen (f)

Deck 8: Managing in Competitive, Monopolistic, and Monopolisticolly Competitive Markets

1

The accompanying graph (top of next page) summarizes the demand and costs for a firm that operates in a perfectly competitive market.

a. What level of output should this firm produce in the short run

b. What price should this finn charge in the short run

c. What is the firm's total cost at this level of output

d. What is the firm's total variable cost at this level of output

e. What is the firm's fixed cost at this level of output

f. What is the firm's profit if it produces this level of output

g. What is the firm's profit if it shuts down

h. In the long run, should this firm continue to operate or shut down

a. What level of output should this firm produce in the short run

b. What price should this finn charge in the short run

c. What is the firm's total cost at this level of output

d. What is the firm's total variable cost at this level of output

e. What is the firm's fixed cost at this level of output

f. What is the firm's profit if it produces this level of output

g. What is the firm's profit if it shuts down

h. In the long run, should this firm continue to operate or shut down

a.

The condition for equilibrium level of output is i.e. the marginal cost should be equal to the marginal revenue. The firm should produce at the output level of 7 units since it's here that the marginal revenue and marginal cost curves intersect.

i.e. the marginal cost should be equal to the marginal revenue. The firm should produce at the output level of 7 units since it's here that the marginal revenue and marginal cost curves intersect.

b.

A perfectly competitive firm should always charge the ingoing market price, because in perfect competition, firms are price takers.

A perfectly competitive firm is referred to as a price taker because it is not beneficial for the firm to charge any price other than the market price. The firm loses all revenue by increasing price because no quantity is demanded from the firm if it charges a price higher than the market price. Moreover, since the firm can sell at the market price all that it wants to sell, it makes no economic sense for the firm to sell at a price lower than the market price.

As represented by the marginal revenue curve, the market price is $28 per unit. This is the price that the firm should charge.

c.

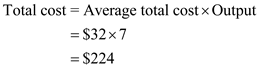

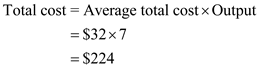

The firm's output level is 7 units. The average total cost (ATC) curve shows that at this level of output, the firm's average total cost is $32. Using this information, calculate the firm's total cost as follows: Therefore, the total cost of the firm is

Therefore, the total cost of the firm is  .

.

d.

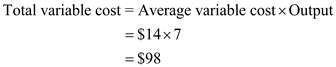

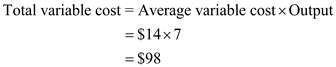

The firm's output level is 7 units. The average variable cost (AVC) curve shows that at this level of output, the firm's average variable cost is $14. Using this information, calculate the firm's total variable cost as follows: Therefore, the total variable cost of the firm is

Therefore, the total variable cost of the firm is  e.

e.

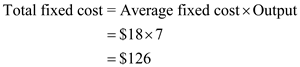

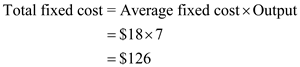

The firm's output level is 7 units. The average fixed cost (AFC) curve shows that at this level of output, the firm's average fixed cost is $18. Using this information, calculate the firm's total fixed cost as follows: Therefore, the total fixed cost of the firm is

Therefore, the total fixed cost of the firm is  (Note: The total fixed cost does not vary with output level. Therefore, $126 is total cost at any level of output.)f.

(Note: The total fixed cost does not vary with output level. Therefore, $126 is total cost at any level of output.)f.

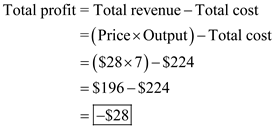

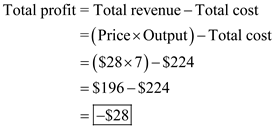

The marker price is $28. The firm's output level is 7 units. From the solution to part c, it is known that the firm's total cost is $224. Calculate the firm's total profit as follows: The firm's profit is a negative of $28. This means the firm is incurring a loss of $28.

The firm's profit is a negative of $28. This means the firm is incurring a loss of $28.

g.

If the firm shuts down its total revenues will be zero and its total variable cost will also be zero. However, in the short run even after shutting down it will keep incurring its fixed cost. Thus, its losses will be equal to the total fixed cost i.e. .

.

h.

The answer is: In the long run, the firm should exit the market. That is, the firm should shut down.

Explanation: All the previous parts were answered in the context of short run. Part f shows that when the firm operates in the short run, it incurs a loss of $28. Part g shows that when the firm shuts down in the short run, it incurs a loss of $126. Since, in the short run, the firm's loss is lower when it operates than when it shuts down, the firm should continue to operate in the short run. However, in the long run, all costs are variable, and therefore by shutting down, the firm will make no losses. Therefore, in the long run, the firm should shut down.

The condition for equilibrium level of output is

i.e. the marginal cost should be equal to the marginal revenue. The firm should produce at the output level of 7 units since it's here that the marginal revenue and marginal cost curves intersect.

i.e. the marginal cost should be equal to the marginal revenue. The firm should produce at the output level of 7 units since it's here that the marginal revenue and marginal cost curves intersect.b.

A perfectly competitive firm should always charge the ingoing market price, because in perfect competition, firms are price takers.

A perfectly competitive firm is referred to as a price taker because it is not beneficial for the firm to charge any price other than the market price. The firm loses all revenue by increasing price because no quantity is demanded from the firm if it charges a price higher than the market price. Moreover, since the firm can sell at the market price all that it wants to sell, it makes no economic sense for the firm to sell at a price lower than the market price.

As represented by the marginal revenue curve, the market price is $28 per unit. This is the price that the firm should charge.

c.

The firm's output level is 7 units. The average total cost (ATC) curve shows that at this level of output, the firm's average total cost is $32. Using this information, calculate the firm's total cost as follows:

Therefore, the total cost of the firm is

Therefore, the total cost of the firm is  .

.d.

The firm's output level is 7 units. The average variable cost (AVC) curve shows that at this level of output, the firm's average variable cost is $14. Using this information, calculate the firm's total variable cost as follows:

Therefore, the total variable cost of the firm is

Therefore, the total variable cost of the firm is  e.

e.The firm's output level is 7 units. The average fixed cost (AFC) curve shows that at this level of output, the firm's average fixed cost is $18. Using this information, calculate the firm's total fixed cost as follows:

Therefore, the total fixed cost of the firm is

Therefore, the total fixed cost of the firm is  (Note: The total fixed cost does not vary with output level. Therefore, $126 is total cost at any level of output.)f.

(Note: The total fixed cost does not vary with output level. Therefore, $126 is total cost at any level of output.)f.The marker price is $28. The firm's output level is 7 units. From the solution to part c, it is known that the firm's total cost is $224. Calculate the firm's total profit as follows:

The firm's profit is a negative of $28. This means the firm is incurring a loss of $28.

The firm's profit is a negative of $28. This means the firm is incurring a loss of $28.g.

If the firm shuts down its total revenues will be zero and its total variable cost will also be zero. However, in the short run even after shutting down it will keep incurring its fixed cost. Thus, its losses will be equal to the total fixed cost i.e.

.

.h.

The answer is: In the long run, the firm should exit the market. That is, the firm should shut down.

Explanation: All the previous parts were answered in the context of short run. Part f shows that when the firm operates in the short run, it incurs a loss of $28. Part g shows that when the firm shuts down in the short run, it incurs a loss of $126. Since, in the short run, the firm's loss is lower when it operates than when it shuts down, the firm should continue to operate in the short run. However, in the long run, all costs are variable, and therefore by shutting down, the firm will make no losses. Therefore, in the long run, the firm should shut down.

2

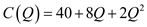

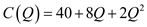

a firni sells its product in a perfectly competitive market where other fimis charge a price of $80 per unit. The firm's total costs are C(Q) = 40 + 8 Q + 2 Q₂.

a. How much output should the firm produce in the short run

b. What price should the finn charge in the short run

c. What are the firm's short-run profits

d. What adjustments should be anticipated in the long run 11eb4f3d_2aeb_11a4_a4ce_136fa9631e96

a. How much output should the firm produce in the short run

b. What price should the finn charge in the short run

c. What are the firm's short-run profits

d. What adjustments should be anticipated in the long run 11eb4f3d_2aeb_11a4_a4ce_136fa9631e96

A perfectly competitive market is the one where there are infinite sellers in the market. Sellers cannot decide the prices of the goods they sell. They cannot even influence their prices. There is free entry and exit in this kind of market stricture.

Marginal cost is the amount of cost added to the total cost as one more unit of output is manufactured. Marginal revenue is the extra revenue earned when an extra visit is made at the clinic, that is, when an extra unit of output is sold. A firm in a perfect competition maximizes profits at a point where the marginal cost and prices are equal. Total revenue is calculated by multiplying price and quantity. Marginal revenue is calculated by subtracting he revenue earned at next level of output from the revenue earned at preceding level of output.

a.

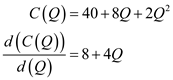

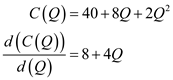

According to the question the price is $80 per unit. The total cost function is .The marginal costs are calculated as follows:

.The marginal costs are calculated as follows:  Now this marginal cost should be equated to 80 to find the output that the firm will produce in the short-run.

Now this marginal cost should be equated to 80 to find the output that the firm will produce in the short-run.  Thus, the output produced in a perfectly competitive market is

Thus, the output produced in a perfectly competitive market is  .

.

b.

The firm should charge the same price as other competitors in the market. This is because if in a perfectly competitive market, the seller sells for a higher price, the demand for his goods is going to fall to 0. If he charges less than what the competitors are charging, he is going to lose. This is why, the seller is going to charge in the short run.

in the short run.

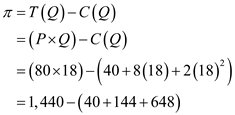

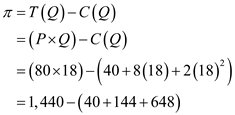

c.

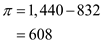

The short-run profits of a perfectly competitive firm are calculated by subtracting total costs from the total revenue. The total cost can be found by substituting the output in place of Q in the total cost function. The calculations have been shown below:

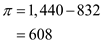

Therefore, the profits in the short-run are

Therefore, the profits in the short-run are  .

.

d.

In the long run, more competitors are going to enter the market. The profit of $608 is abnormal profit. The entrants are going to see this profit as an opportunity. As more and more firms enter the market, they get a share in this above the normal profit. This way profits are driven down to zero.

Therefore, in the long run, profits are driven down to .

.

Marginal cost is the amount of cost added to the total cost as one more unit of output is manufactured. Marginal revenue is the extra revenue earned when an extra visit is made at the clinic, that is, when an extra unit of output is sold. A firm in a perfect competition maximizes profits at a point where the marginal cost and prices are equal. Total revenue is calculated by multiplying price and quantity. Marginal revenue is calculated by subtracting he revenue earned at next level of output from the revenue earned at preceding level of output.

a.

According to the question the price is $80 per unit. The total cost function is

.The marginal costs are calculated as follows:

.The marginal costs are calculated as follows:  Now this marginal cost should be equated to 80 to find the output that the firm will produce in the short-run.

Now this marginal cost should be equated to 80 to find the output that the firm will produce in the short-run.  Thus, the output produced in a perfectly competitive market is

Thus, the output produced in a perfectly competitive market is  .

.b.

The firm should charge the same price as other competitors in the market. This is because if in a perfectly competitive market, the seller sells for a higher price, the demand for his goods is going to fall to 0. If he charges less than what the competitors are charging, he is going to lose. This is why, the seller is going to charge

in the short run.

in the short run.c.

The short-run profits of a perfectly competitive firm are calculated by subtracting total costs from the total revenue. The total cost can be found by substituting the output in place of Q in the total cost function. The calculations have been shown below:

Therefore, the profits in the short-run are

Therefore, the profits in the short-run are  .

.d.

In the long run, more competitors are going to enter the market. The profit of $608 is abnormal profit. The entrants are going to see this profit as an opportunity. As more and more firms enter the market, they get a share in this above the normal profit. This way profits are driven down to zero.

Therefore, in the long run, profits are driven down to

.

. 3

The accompanying graph (bottom of this page) summarizes the demand and costs for a firm that operates in a monopolistically competitive market.

a. What is the firm's optimal output

b. What is the firm's optimal price

c. What arc the firm's maximum profits

d. What adjustments should the manager be anticipating 11eb4f3d_2aeb_d4fe_a4ce_a9f04f738619

a. What is the firm's optimal output

b. What is the firm's optimal price

c. What arc the firm's maximum profits

d. What adjustments should the manager be anticipating 11eb4f3d_2aeb_d4fe_a4ce_a9f04f738619

The equilibrium condition or the optimal output for the firm is that where marginal cost should be equal to marginal cost. i.e.  a)From the graph it is clear that the firm should produce at an output level of 7 since it's here that it's

a)From the graph it is clear that the firm should produce at an output level of 7 since it's here that it's  , not one unit less and not one unit more.

, not one unit less and not one unit more.

Thus, the firm's optimal output is .

.

b.

The demand curve ( D ) is also the average revenue ( AR ) curve and is also the price of the firm. Therefore, at 7 level of output the firm's optimal price will be $130 per unit.

Thus, the firm's optimal price is .

.

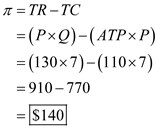

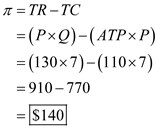

c.

The total profits ( ) are the difference between the total revenue ( TR ) and the total cost ( TC ) at a certain level of output.

Calculate the firms maximum profit as follows: Thus, the firm is thus making a total profit of

Thus, the firm is thus making a total profit of  at 7 level of output.

at 7 level of output.

d.

In monopolistic competition if there are firms making super normal profits in the short run, it will attract new firms into the industry in the long run. The new firms will try to eat into the firm's market share. The increase in supply will reduce the market price and hence the total profits of the firm. New firms will keep entering the industry till all firms make only normal profits in the long run.

a)From the graph it is clear that the firm should produce at an output level of 7 since it's here that it's

a)From the graph it is clear that the firm should produce at an output level of 7 since it's here that it's  , not one unit less and not one unit more.

, not one unit less and not one unit more.Thus, the firm's optimal output is

.

.b.

The demand curve ( D ) is also the average revenue ( AR ) curve and is also the price of the firm. Therefore, at 7 level of output the firm's optimal price will be $130 per unit.

Thus, the firm's optimal price is

.

. c.

The total profits ( ) are the difference between the total revenue ( TR ) and the total cost ( TC ) at a certain level of output.

Calculate the firms maximum profit as follows:

Thus, the firm is thus making a total profit of

Thus, the firm is thus making a total profit of  at 7 level of output.

at 7 level of output.d.

In monopolistic competition if there are firms making super normal profits in the short run, it will attract new firms into the industry in the long run. The new firms will try to eat into the firm's market share. The increase in supply will reduce the market price and hence the total profits of the firm. New firms will keep entering the industry till all firms make only normal profits in the long run.

4

You are the manager of a monopoly, and your demand and cost functions arc given by P= 200 - 2 Q and C(Q) = 2,000 + 3 Q₂ , respectively.

a. What price-quantity combination maximizes your firm's profits

b. Calculate the maximum profits.

c. Is demand elastic, inelastic, or unit elastic at the profit-maximizing price-quantity combination

d. What price-quantity combination maximizes revenue

e. Calculate the maximum revenues.

f. Is demand elastic, inelastic, or unit elastic at the revenue-maximizing price-quantity combination

a. What price-quantity combination maximizes your firm's profits

b. Calculate the maximum profits.

c. Is demand elastic, inelastic, or unit elastic at the profit-maximizing price-quantity combination

d. What price-quantity combination maximizes revenue

e. Calculate the maximum revenues.

f. Is demand elastic, inelastic, or unit elastic at the revenue-maximizing price-quantity combination

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

5

You are the manager of a firm that produces a product according to the cost function 11eb4f3d_2aed_f7fb_a4ce_2123fb1b015a

. Determine the short-run supply function if:

a. You operate a perfectly competitive business.

b. You operate a monopoly.

c. You operate a monopolistically competitive business.

. Determine the short-run supply function if:

a. You operate a perfectly competitive business.

b. You operate a monopoly.

c. You operate a monopolistically competitive business.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

6

The accompanying diagram shows the demand, marginal revenue, and marginal cost of a monopolist.

a. Determine the profit-maximizing output and price.

b. What price and output would prevail if this firm's product was sold by price-taking firms in a perfectly competitive market

c. Calculate the deadweight loss of this monopoly. 11eb4f3d_2aef_097d_a4ce_51e6daa701c5

a. Determine the profit-maximizing output and price.

b. What price and output would prevail if this firm's product was sold by price-taking firms in a perfectly competitive market

c. Calculate the deadweight loss of this monopoly. 11eb4f3d_2aef_097d_a4ce_51e6daa701c5

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

7

You are the manager of a monopolistically competitive firm, and your demand and cost functions are given by 11eb4f3d_2aef_3091_a4ce_9b76d75e9191

a. Find the inverse demand function for your firm's product.

b. Determine the profit-maximizing price and level of production.

c. Calculate your firm's maximum profits.

d. What long-run adjustments should you expect Explain.

a. Find the inverse demand function for your firm's product.

b. Determine the profit-maximizing price and level of production.

c. Calculate your firm's maximum profits.

d. What long-run adjustments should you expect Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

8

The elasticity of demand for a firm's product is -2 and its advertising elasticity of demand is 0.1.

a. Determine the firm's optimal advertising-to-sales ratio.

b. If the firm's revenues arc $50,000, what is its profit-maximizing level of advertising

a. Determine the firm's optimal advertising-to-sales ratio.

b. If the firm's revenues arc $50,000, what is its profit-maximizing level of advertising

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

9

a monopolist's inverse demand function is p = 100 - Q. The company produces output at two facilities; the marginal cost of producing at facility 1 is MC 1 ( Q 1 ) = 4 Q 1 , and the marginal cost of producing at facility 2 is MC 2 ( Q 1 ) = 2 Q₂

a. Provide the equation for the monopolist's marginal revenue function. (Hint: Recall that q 1 + Q₂ = q)

b. Determine Hie profit-maximizing level of output for each facility.

c. Determine the profit-maximizing price.

a. Provide the equation for the monopolist's marginal revenue function. (Hint: Recall that q 1 + Q₂ = q)

b. Determine Hie profit-maximizing level of output for each facility.

c. Determine the profit-maximizing price.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

10

The manager of a local monopoly estimates thai the elasticity of demand for its product is constant and equal to -4. The firm's marginal cost is constant at $10 per unit.

a. Express the firm's marginal revenue as a function of its price.

b. Determine the profit-maximizing price.

a. Express the firm's marginal revenue as a function of its price.

b. Determine the profit-maximizing price.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

11

The CEO of a major automaker overheard one of its division managers make the following statement regarding the firm's production plans: "In order to maximize profits, it is essential that we operate at the minimum point of our average total cost curve." If you were the CEO of the automaker, would you praise or chastise the manager Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

12

You are the manager of a small U.S. finn that sells nails in a competitive U.S. market (the nails you sell are a standardized commodity; stores view your nails as identical to those available from hundreds of other firms). You are concerned about two events you recently learned about through trade publications: (1) the overall market supply of nails will decrease by 2 percent, due to exit by foreign competitors; and (2) due to a growing U.S. economy, the overall market demand for nails will increase by 2 percent. Based on this infonnation, should you plan to increase or decrease your production of nails Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

13

When the first Pizza Hut opened its doors back in 1958, it offered consumers one style of pizza: its Original Thin Crust Pizza. Since its modest beginnings, Pizza Hut has established itself as the leader of the $25 billion pizza industry. Today, Pizza Hut offers five styles of pizza, including the Original Thin. Crust Pizza, Pan Pizza, and its Hand-Tossed Style. Explain why Pizza Hut has expanded its offerings of pizza over the past five decades, and discuss the long-run profitability of such a strategy.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

14

You are the manager of a small pharmaceutical company that received a patent on a new drug three years ago. Despite strong sales ($125 million last year) and a low marginal cost of producing the product ($0.25 per pill), your company has yet to show a profit from selling the drug. This is, in part, due to the fact that the company spent $1.2 billion developing the drug and obtaining FDA approval. An economist has estimated that, at the current price of $I.25 per pill, the own price elasticity of demand for the drug is -2.5. Based on this information, what can you do to boost profits Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

15

The second largest public utility in the nation is the sole provider of electricity in 32 counties of southern Florida. To meet the monthly demand for electricity in these counties, which is given by the inverse demand function P = 1,000 - 5Q, the utility company has set up two electric generating facilities: kilo watts are produced at facility 1, and Q₂ kilowatts are produced at facility 2 (so Q= Q 1 + Q₂ ). The costs of producing electricity at each facility are given by C 1 (Q 1 ) = 10,050 + 5Q1 2 and 11eb4f3d_2af5_245f_a4ce_d5b4ef4c8740

, respectively. Determine the profit-maximizing amounts of electricity to produce at the two facilities, the optimal price, and the utility company's profits.

, respectively. Determine the profit-maximizing amounts of electricity to produce at the two facilities, the optimal price, and the utility company's profits.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

16

You are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the local university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds computers to meet this university's specifications; indeed, it competes with many manufacturers online and through traditional retail outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its "free service after the sale" policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College Computers is given by Q = 1,000 - P, and its weekly cost of producing computers is C(Q) = 2,000 + Q₂. If other firms in the industry sell PCs at $600, what price and quantity of computers should you produce to maximize your finn's profits What long-run adjustments should you anticipate Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

17

In a statement to Gillette's shareholders, Chairman and CEO James Kilts indicated, "Despite several new product launches, Gillette's adveitising-to-sales declined dramatically... to 6.5 percent last year. Gillette's advertising spending, in fact, is one of the lowest in our peer group of consumer product companies." If the elasticity of demand for Gillette's consumer products is similar to other firms in its peer group (which averages -4.5), what is Gillette's advertising elasticity Is Gillette's demand more or less responsive to advertising than other firms in its peer group Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

18

a ccording to the American Metal Markets Magazine, the spot market price of U.S. hot rolled steel recently reached $580 per ton. Less than a year ago this same ton of steel was only $260. A number of factors are cited to explain the

large price increase. The combination of China's increased demand for raw steel-due to expansion of its manufacturing base and infrastructure changes to prepare for the 2008 Beijing Olympics-and the weakening U.S. dollar against the euro and yuan partially explain the upward spiral in raw steel prices. Supply-side changes have also dramatically affected the price of raw steel. In the last 20 years there has been a rapid movement away from large integrated steel mills to minimills. The minimill production process replaces raw iron ore as its primary raw input with scrap steel. Today, minimills account for approximately 52 percent of all U.S. steel production. However, the worldwide movement to the minimill production model has bid up the price of scrap steel. In December, the per-ton price of scrap was around $156 and soared to $302 just two months later. Suppose that, as a result of this increase in the price of scrap, the supply of raw steel changed from C raw = 4,900 + 5Pto Q raw = 100 + 5P. Assuming the market for raw steel is competitive and that the current worldwide demand for steel is Q d = 8,800 - 1 OP. compute the equilibrium price and quantity when the per-ton price of scrap steel was $156, and the equilibrium price-quantity combination when the price of scrap steel reached $302 per ton. Suppose the cost function of a representative minimill producer is C(Q) = 1,000 + 10Q₂. Compare the change in the quantity of raw steel exchanged at the market level with the change in raw steel produced by a representative firm. How do you explain this difference

large price increase. The combination of China's increased demand for raw steel-due to expansion of its manufacturing base and infrastructure changes to prepare for the 2008 Beijing Olympics-and the weakening U.S. dollar against the euro and yuan partially explain the upward spiral in raw steel prices. Supply-side changes have also dramatically affected the price of raw steel. In the last 20 years there has been a rapid movement away from large integrated steel mills to minimills. The minimill production process replaces raw iron ore as its primary raw input with scrap steel. Today, minimills account for approximately 52 percent of all U.S. steel production. However, the worldwide movement to the minimill production model has bid up the price of scrap steel. In December, the per-ton price of scrap was around $156 and soared to $302 just two months later. Suppose that, as a result of this increase in the price of scrap, the supply of raw steel changed from C raw = 4,900 + 5Pto Q raw = 100 + 5P. Assuming the market for raw steel is competitive and that the current worldwide demand for steel is Q d = 8,800 - 1 OP. compute the equilibrium price and quantity when the per-ton price of scrap steel was $156, and the equilibrium price-quantity combination when the price of scrap steel reached $302 per ton. Suppose the cost function of a representative minimill producer is C(Q) = 1,000 + 10Q₂. Compare the change in the quantity of raw steel exchanged at the market level with the change in raw steel produced by a representative firm. How do you explain this difference

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

19

The French government announced plans to convert state-owned power firms EDF and GDF into separate limited companies that operate in geographically distinct markets. BBC News reported that France's CFT union responded by organizing a mass strike, which triggered power outages in some Paris suburbs. Union workers are concerned that privatizing power utilities would lead to large-scale job losses and power outages similar to those experienced in parts of the eastern coast of the United States and parts of Italy in 2003. Suppose that prior to privatization, the price per kilowatt hour of electricity was; €0.105 and that the inverse demand for electricity in each of these two region: of France is P= 1.255 - 0.001 Q (in euros). Furthermore, to supply electricity to its particular region of France, it costs each firm C(Q) = 100.625 + 0.105 Q (in euros). Once privatized, each firm will have incentive to maximize profits. Determine the number of kilowatt hours of electricity each firm will produce and supply to the market, and the per-kilowatt hour price. Compute the price elasticity of demand at the profit maximizing price-quantity combination. Explain why the price elasticity makes sense at the profit-maximizing price-quantity combination. Compare the price-quantity combination before and after privatization. How much more profit will each finn earn as a result of privatization

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

20

The owner of an Italian restaurant has just been notified by her landlord that the monthly lease on the building in which the restaurant operates will increase by 20 percent at the beginning of the year. Her current prices are competitive with nearby restaurants of similar quality. However, she is now c onsidering raising her prices by 20 percent to offset the increase in her monthly rent. Would you recommend that she raise prices Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

21

Last month you assumed the position of manager for a large car dealership. The distinguishing feature of this dealership is its "no hassle" pricing strategy; prices (usually well below the sticker price) arc posted on the windows, and your sales staff has a reputation for not negotiating with customers. Last year, your company spent $ 1 million on advertisements to inform customers about its "no hassle" policy, and had overall sales revenue of $25 million. A recent study from an agency on Madison Avenue indicates that, for each 2 percent increase in TV advertising expenditures, a car dealer can expect to sell 10 percent more cars-but that it would take a 5 percent decrease in price to generate the same 10 percent increase in units sold. Assuming the information from Madison Avenue is correct, should you increase or decrease your firm's level of advertising Explain.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck