Deck 52: Decedents Estates and Trusts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 52: Decedents Estates and Trusts

1

In 1984, Alexander Tolin executed a will under which the residue of his estate was to be devised to his friend Adair Creaig. The will was prepared by Steven Fine, Tolin's attorney, and executed in Fine's office. Fine retained the original will, and gave a blue-backed photocopy to Tolin. In 1989, Tolin executed a codicil to the will that changed the residuary beneficiary from Creaig to Broward Art Guild, Inc. Fine prepared the codicil, and retained the original, giving Tolin a blue-backed photocopy of the original executed codicil.

Tolin died in 1990. Six months before his death, he told his neighbor Ed Weinstein, who was a retired attorney, that he made a mistake and wished to revoke the codicil and reinstate Creaig as the residuary beneficiary. Weinstein told Tolin he could do this by tearing up the original codicil. Tolin handed Weinstein a bluebacked document that Tolin said was the original codicil. Weinstein looked at the document; it appeared to him to be the original, and gave it back to Tolin. Tolin then tore up and destroyed the document with the intent and for the purpose of revocation. Some time after Tolin's death, Weinstein spoke with Fine and found out for the first time that Fine had the original will and codicil. Creaig filed a petition to determine if there had been a revocation of the codicil. From a judgment that Tolin's destruction of a copy of the codicil was not an effective revocation of the codicil, Creaig appealed. Who is correct about the revocation and why [In re Estate of Tolin, 622 So2d 988 (Fla)]

Tolin died in 1990. Six months before his death, he told his neighbor Ed Weinstein, who was a retired attorney, that he made a mistake and wished to revoke the codicil and reinstate Creaig as the residuary beneficiary. Weinstein told Tolin he could do this by tearing up the original codicil. Tolin handed Weinstein a bluebacked document that Tolin said was the original codicil. Weinstein looked at the document; it appeared to him to be the original, and gave it back to Tolin. Tolin then tore up and destroyed the document with the intent and for the purpose of revocation. Some time after Tolin's death, Weinstein spoke with Fine and found out for the first time that Fine had the original will and codicil. Creaig filed a petition to determine if there had been a revocation of the codicil. From a judgment that Tolin's destruction of a copy of the codicil was not an effective revocation of the codicil, Creaig appealed. Who is correct about the revocation and why [In re Estate of Tolin, 622 So2d 988 (Fla)]

Refer to the case In re Estate of Tolin to answer question as below:

Facts to this case

• A testate written a will to give part of his assets to a friend.

• The testate later amended the will. But he wanted to revoke the amended will.

• The testate was given the copy of the amended will, but tore it up believing it to be the original amended will.

Case Issue

The issue is whether the amended will was revoked when only a copy of it was destroyed by the testate.

Relevant Terms, Laws, and Cases

Testate - is someone (a male, Testatrix is the female) who have made a will (orders of how to distribute his assets when he dies).

Analysis and Conclusion

The court held that there was no revocation. They argued that:

• In order for there to be revocation, there must be an intent to revoke and physical demonstration of revoking it.

• The testate had the intent to revoke, but failed to physically destroy it because he only destroyed a copy. He needed to destroy the original.

Thus, the will is not revoked.

However, the court granted a constructive trust to place the assets intended for the friend as a judgment of equity. They reasoned that this was to prevent unjust enrichment at the expense of the testator's mistake.

Facts to this case

• A testate written a will to give part of his assets to a friend.

• The testate later amended the will. But he wanted to revoke the amended will.

• The testate was given the copy of the amended will, but tore it up believing it to be the original amended will.

Case Issue

The issue is whether the amended will was revoked when only a copy of it was destroyed by the testate.

Relevant Terms, Laws, and Cases

Testate - is someone (a male, Testatrix is the female) who have made a will (orders of how to distribute his assets when he dies).

Analysis and Conclusion

The court held that there was no revocation. They argued that:

• In order for there to be revocation, there must be an intent to revoke and physical demonstration of revoking it.

• The testate had the intent to revoke, but failed to physically destroy it because he only destroyed a copy. He needed to destroy the original.

Thus, the will is not revoked.

However, the court granted a constructive trust to place the assets intended for the friend as a judgment of equity. They reasoned that this was to prevent unjust enrichment at the expense of the testator's mistake.

2

On July 1, Sutter created a living trust by transferring the legal title to 500 shares of Pine Corporation common stock to Ellis as trustee and named Clay as the sole beneficiary. The trust granted Ellis broad powers to sell and repurchase stock as she saw fit. On June 25, a few days before the trust was created, Pine Corporation distributed cash dividends of $1 per share on its common stock. On July 15, Ellis sold the common stock for $105 per share, which was $5 more than the purchase price that Sutter had paid. Ignoring taxes, how much is in the principal of this trust on July 16

A. $ 2,500

B. $50,000

C. $52,500

D. $53,000

A. $ 2,500

B. $50,000

C. $52,500

D. $53,000

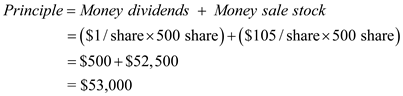

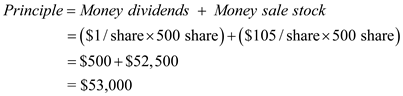

The given events are:

• The trustee has authority to sell 500 shares of stock.

• (I) Dividends of $1 was paid per stock. Note that this was paid before formation of the trust so it would be placed in principle not income.

• (II) Trustee sold all the stocks at $105.

The principle in this trust account is the money the trustee made from selling all the stocks (II) plus the money distributed from dividends of the stock (I):

Thus, there is $53,000 in the principle of the trust. The answer is d.

Thus, there is $53,000 in the principle of the trust. The answer is d.

• The trustee has authority to sell 500 shares of stock.

• (I) Dividends of $1 was paid per stock. Note that this was paid before formation of the trust so it would be placed in principle not income.

• (II) Trustee sold all the stocks at $105.

The principle in this trust account is the money the trustee made from selling all the stocks (II) plus the money distributed from dividends of the stock (I):

Thus, there is $53,000 in the principle of the trust. The answer is d.

Thus, there is $53,000 in the principle of the trust. The answer is d. 3

Valerie and Flora are the beneficiaries of a trust left to them by their mother upon her death. Their mother named Art Casanelli, a family friend, as the trustee. Flora has seen Art driving a new car and has learned that he just purchased a new and rather large home. She is concerned about the trust funds and Art's unfettered access to them. How can she determine whether Art is using trust funds What happens if she finds that he is

A trustee is someone who manages a trust (property transferred to them) to benefit beneficiaries of the trust.

Trust beneficiaries have a right to examine the funds used in the trust by the trustee. The trustee is supposed to keep the funds for the beneficiaries and not inappropriately use it himself.

The beneficiaries can sue the trustee if their funds are used.

Trust beneficiaries have a right to examine the funds used in the trust by the trustee. The trustee is supposed to keep the funds for the beneficiaries and not inappropriately use it himself.

The beneficiaries can sue the trustee if their funds are used.

4

Joseph McKinley Bryan was an elderly, wealthy, and eccentric man. Before his death, he had made provisions for a testamentary trust for his grandchildren and great-grandchildren. Under the terms of the trust, each grandchild who survived him was to receive $500,000, and each greatgrandchild who survived him was to receive $100,000. By the time of Bryan's death on April 26, 1995, there had been at least five versions of the trust's provisions. His will was originally dated June 29, 1990, but the trust agreement was originally made in 1985, with two changes in 1988, one in 1990, and another in 1992. In May 1995, NationsBank Corp., the trustee, notified Bryan's grandchildren by letter that they would be receiving only $100,000. Because the grandchildren had understood that they were to receive $500,000, they asked to see the trust agreements. The trustee refused, contending that there was no duty to share the agreement with the trust beneficiaries. Was the trustee right [Taylor v NationsBank Corp., 481 SE2d 358 (NC App)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Can a murderer inherit property from his victim Why or why not

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Match the letter in list A-D with the appropriate numbered item.

A. Principal includes this.

B. Income includes this.

C. This is payable from principal.

D. This is payable from income.

1. Shares of stock purchased before the trust was formed and placed in the trust.

2. Cash dividends received on the stock up to the formation of the trust.

3. Cash dividends received on the stock after formation of the trust.

4. Stock dividends after the trust is formed.

5. Stock splits after the trust is formed.

6. Rental property placed in the trust.

A. Principal includes this.

B. Income includes this.

C. This is payable from principal.

D. This is payable from income.

1. Shares of stock purchased before the trust was formed and placed in the trust.

2. Cash dividends received on the stock up to the formation of the trust.

3. Cash dividends received on the stock after formation of the trust.

4. Stock dividends after the trust is formed.

5. Stock splits after the trust is formed.

6. Rental property placed in the trust.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

James Horne's will provides that his estate is to be distributed to his heirs per capita. Upon his death, two of his three children are surviving and his deceased child left two children (James's grandchildren). His will provides that all his property is to be distributed per capita to these children and grandchildren. How will the property be distributed How would it be distributed if he had provided for a per stirpes distribution

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Irene Bracewell was married to W. T. Bracewell and they had a son, Charles. Although Irene loved both her husband and her son, it was clear to everyone that her husband and her son did not get along. Often, Irene did not get along with W. T., and she spent a great deal of time living on Charles's ranch. Charles had named a lake on his property Lake Irene and paid considerable attention to his mother when she lived with him. Irene suffered from Parkinson's disease, hypertension, hyperthyroidism, anxiety, and degenerative bone disease. She had a long list of medications including tranquilizers. Irene and W. T. executed wills in 1975 that left their property to each other. In 1989, while living with Charles, Irene was taking so much medication that doctors said she suffered from dementia, delusions, hallucinations, paranoia, and incoherence. Charles took her to have a new will executed that left all of her property to him. When she died in 1995, W. T. wanted the 1975 will probated because he said Irene lacked capacity to make the 1989 will valid. The probate court refused to admit the 1989 will, and Charles appealed. Did she have testamentary capacity What factors should the court consider [Bracewell v Bracewell, 20 SW2d 14 (Tex App)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Craig delivers bonds in the amount of $100,000 to White in trust to hold and to pay over the income in quarterly payments to Craig's niece, Helen, during her minority. Who is the settlor or creator of the trust Who is the trustee Who is the beneficiary

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following expenditures resulting from a trust's ownership of commercial real estate should be allocated to the trust's principal

A) Building management fees.

B) Insurance premiums.

C) Sidewalk assessments.

D) Depreciation.

A) Building management fees.

B) Insurance premiums.

C) Sidewalk assessments.

D) Depreciation.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

Iona wrote her will. The following year, she wrote another will that expressly revoked the earlier will. Later, while cleaning house, she came across the second will. She mistakenly thought that it was the first will and tore it up because the first will had been revoked. Iona died shortly thereafter. The beneficiaries named in the second will claimed that the second will should be probated. The beneficiaries named in the first will claimed that the second will had been revoked when it was torn up. Had the second will been revoked

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

On June 16, 1992, Eble placed 800 shares of Singh Corp.'s common stock in a trust for the benefit of Eble's child. On June 1, 1992, Singh's board of directors had declared a cash dividend of $2 per share on Singh's common stock. Payment was made on July 30, 1993 to shareholders of record on June 30, 1992. What amount of the dividend should be allocated to trust income

a. $0

b. $800

c. $1,200

d. $1,600

a. $0

b. $800

c. $1,200

d. $1,600

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Logsdon, who had three children, disliked one of them without any reason. In his will, he left only a small amount to the child he disliked and gave the bulk of his estate to the remaining two. On his death, the disliked child claimed that the will was void and had been obtained by undue influence. Do you agree [Logsdon v Logsdon, 104 NE2d 622 (Ill)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

Cox transferred assets into a trust under which Smart is entitled to receive the income for life. After Smart's death, the remaining assets are to be given to Mix. In 1998, the trust received rent of $1,000, stock dividends of $6,000, interest on certificates of deposit of $3,000, municipal bond interest of $4,000, and proceeds of $7,000 from the sale of bonds. Both Smart and Mix are still alive. What amount of the 1998 receipts should be allocated to trust principal

A. $ 7,000

B. $ 8,000

C. $13,000

D. $15,000

A. $ 7,000

B. $ 8,000

C. $13,000

D. $15,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

Field executed a will. On her death, the will was found in her safe deposit box, but the part of it containing the fifth bequest had been torn from the will. This torn fragment was also found in the box. There was no evidence that anyone other than Field had ever opened the box. A proceeding was brought to determine whether the will was entitled to be probated. Had the will been revoked Was the will still valid with a portion torn from it [Flora v Hughes, 228 SW2d 27 (Ky)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Miller wrote a will that was 11 pages long and enclosed it in an envelope, which she sealed. She then wrote on the envelope "My last will testament" and signed her name below this statement. This was the only place where she signed her name on any of the papers. Was this signature sufficient to allow this writing to be admitted to probate as her will [Miller's Executor v Shannon, 299 SW2d 103 (Ky)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Lingenfelter's will was offered for probate and was opposed. The testatrix was sick, highly nervous, and extremely jealous, and she committed suicide a week after executing the will. She had, however, seemed to understand the will when she discussed it with an attorney. The will disinherited her husband because she feared he was not faithful to her despite the fact that he was seriously ill when she wrote the will. He died the day after she executed the will, and she grieved his death terribly for one week before committing suicide. Did she have the capacity to make a will Should it be admitted to probate [In re Lingenfelter's Estate, 241 P2d 990 (Cal)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

Copenhaver wrote a will in ink, which was found with her other papers in her bedroom at her death. Pencil lines had been drawn through every provision of the will and the signature. There was no evidence as to the circumstances under which this had been done. Was the will revoked Why or why not [Franklin v Maclean, 66 SE2d 504 (Va)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

George Baxter executed a will that left the bulk of his estate to the Church of Christ in New Boston, Texas. Two members of the church served as the witnesses for the will. Is the will valid [In re Estate of Gordon, 519 SW2d 902 (Tex)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Jeanette Wall worked for D. J. Sharron for many years. Sharron executed a will leaving his entire estate to Jeanette. He reexecuted the same will sometime thereafter with the same provisions. Sharron's children contested the will, offering evidence that Sharron was a very sick man, physically as well as mentally, and that Wall was active in Sharron's business as well as his personal life. They offered no evidence that Wall had any involvement in the procurement of the original or the reexecuted will. Who is entitled to the estate Why [Wall v Hodges, 465 So 2d 359 (Ala App)]

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck