Deck 10: Criticisms of Absorption Cost Systems:incentive to Overproduce

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/23

Play

Full screen (f)

Deck 10: Criticisms of Absorption Cost Systems:incentive to Overproduce

1

Federal Mixing

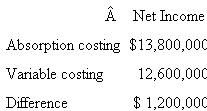

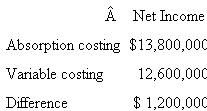

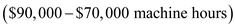

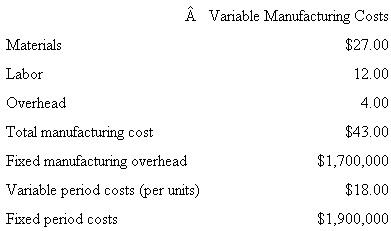

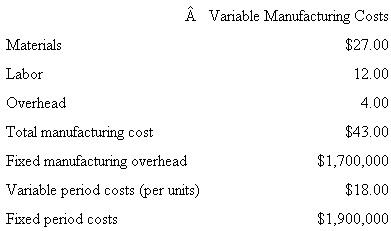

Federal Mixing (FM) is a division of Federal Chemicals, a large diversified chemical company. FM provides mixing services for both outside customers and other Federal divisions. FM buys or receives liquid chemicals and combines and packages them according to the customer's specifications. FM computes its divisional net income on both a fully absorbed and variable costing basis. For the year just ending, it reported Overhead is assigned to products using machine hours.

Overhead is assigned to products using machine hours.

?There is no finished goods inventory at FM, only work-in-process (WIP) inventory. As soon as a product is completed, it is shipped to the customer. The beginning inventory was valued at $6.3 million and contained 70,000 machine hours. The ending WIP inventory was valued at $9.9 million and contained 90,000 machine hours.

Required:

Write a short nontechnical note to senior management explaining why variable costing and absorption costing net income amounts differ.

Federal Mixing (FM) is a division of Federal Chemicals, a large diversified chemical company. FM provides mixing services for both outside customers and other Federal divisions. FM buys or receives liquid chemicals and combines and packages them according to the customer's specifications. FM computes its divisional net income on both a fully absorbed and variable costing basis. For the year just ending, it reported

Overhead is assigned to products using machine hours.

Overhead is assigned to products using machine hours.?There is no finished goods inventory at FM, only work-in-process (WIP) inventory. As soon as a product is completed, it is shipped to the customer. The beginning inventory was valued at $6.3 million and contained 70,000 machine hours. The ending WIP inventory was valued at $9.9 million and contained 90,000 machine hours.

Required:

Write a short nontechnical note to senior management explaining why variable costing and absorption costing net income amounts differ.

Absorption vs. Variable Costing

In the field of bookkeeping, variable costing (direct costing) and ingestion costing (full costing) are two distinct strategies for applying creation expenses to items or administrations. The distinction between the two techniques is in the treatment of settled assembling overhead expenses.

Under the immediate costing technique, settled assembling overhead expenses are expensed amid the period in which they are acquired. Under the full costing technique, settled assembling overhead expenses are expensed when the item is sold.

Variable costing discounts to pay all settled assembling costs acquired amid the year. Ingestion costing customizes the settled overheads between units in stock and units sold in view of machine hours.

Ingestion costing net pay is higher than under factor costing of $1.2 million. This implies inventories under ingestion costing are higher by $1.2 million.

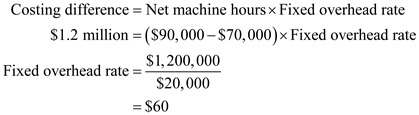

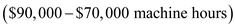

The closing work-in-process stock includes 20,000 more machine hours than the opening stock . From the information given, the settled overhead rate connected to items is $60 per machine hour.

. From the information given, the settled overhead rate connected to items is $60 per machine hour.

Compute the fixed overhead rate with the help of formula shown below: Thus, the overhead rate comes out to be

Thus, the overhead rate comes out to be  .

.

In the field of bookkeeping, variable costing (direct costing) and ingestion costing (full costing) are two distinct strategies for applying creation expenses to items or administrations. The distinction between the two techniques is in the treatment of settled assembling overhead expenses.

Under the immediate costing technique, settled assembling overhead expenses are expensed amid the period in which they are acquired. Under the full costing technique, settled assembling overhead expenses are expensed when the item is sold.

Variable costing discounts to pay all settled assembling costs acquired amid the year. Ingestion costing customizes the settled overheads between units in stock and units sold in view of machine hours.

Ingestion costing net pay is higher than under factor costing of $1.2 million. This implies inventories under ingestion costing are higher by $1.2 million.

The closing work-in-process stock includes 20,000 more machine hours than the opening stock

. From the information given, the settled overhead rate connected to items is $60 per machine hour.

. From the information given, the settled overhead rate connected to items is $60 per machine hour. Compute the fixed overhead rate with the help of formula shown below:

Thus, the overhead rate comes out to be

Thus, the overhead rate comes out to be  .

. 2

Navisky

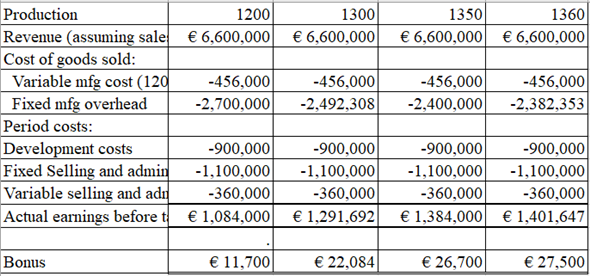

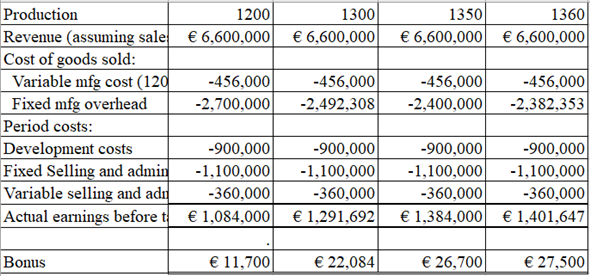

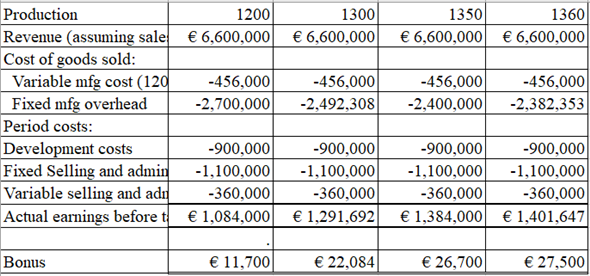

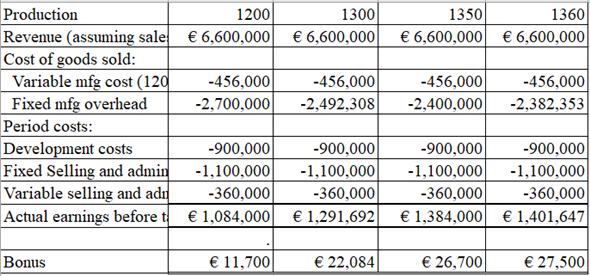

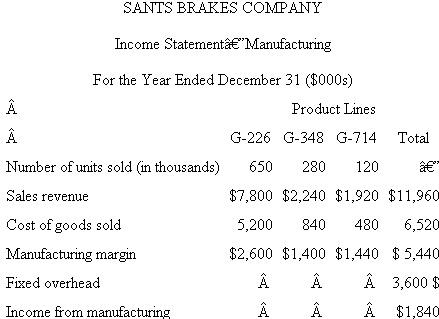

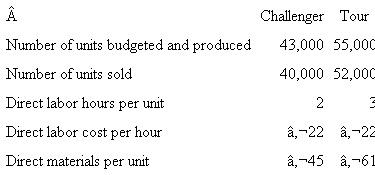

Navisky designs, manufactures, and sells specialized GPS (Global Positioning System) devices for commercial applications. For example, Navisky currently sells a system for environmental studies and is planning systems for private aviation and fleet management. The firm has a design team that identifies potential commercial GPS applications, then designs and develops prototypes. Once a prototype is deemed successful and senior management determines that a market exists for the new application, the new design is put into production and the firm markets the new product through independent salespeople, direct marketing, trade shows, or whatever channel is most appropriate for that market.

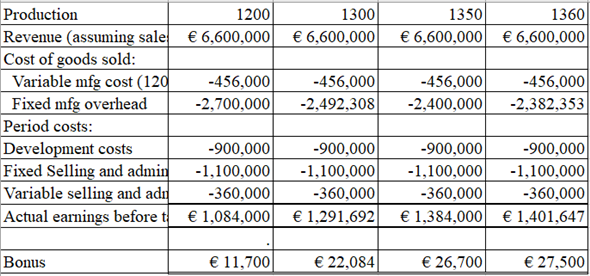

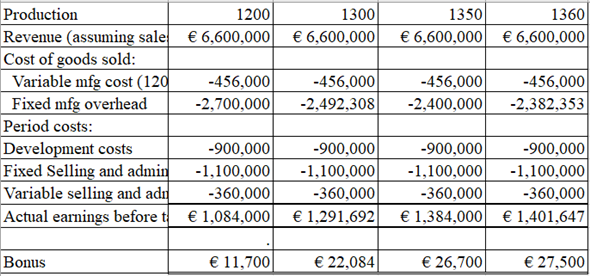

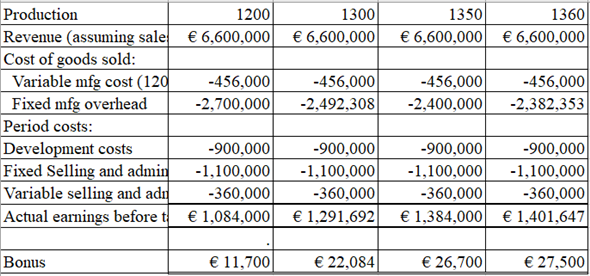

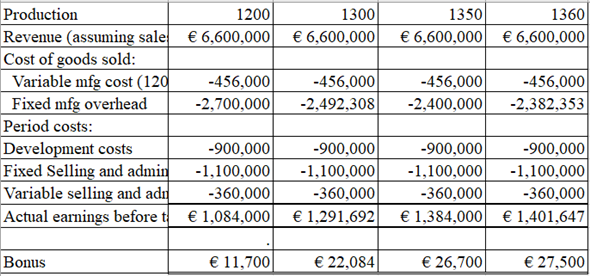

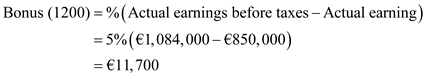

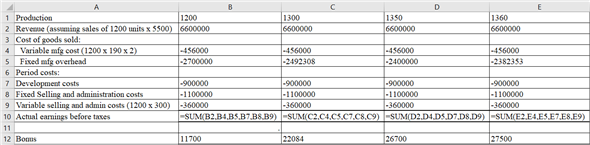

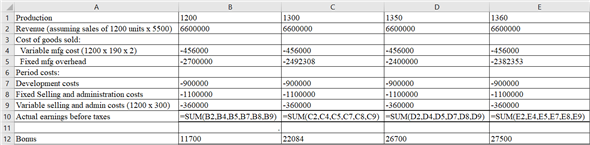

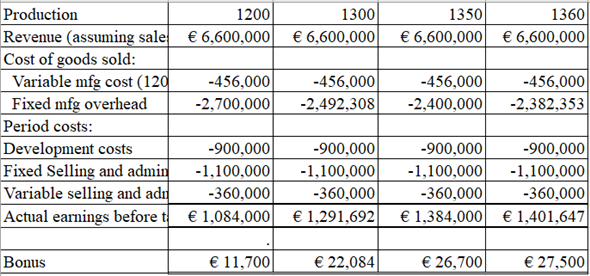

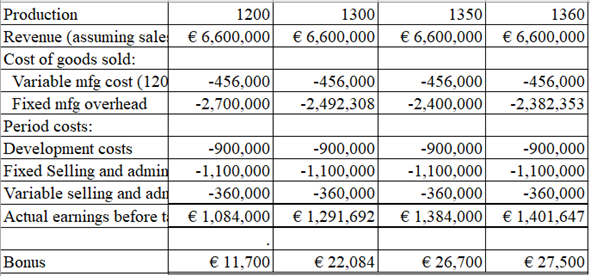

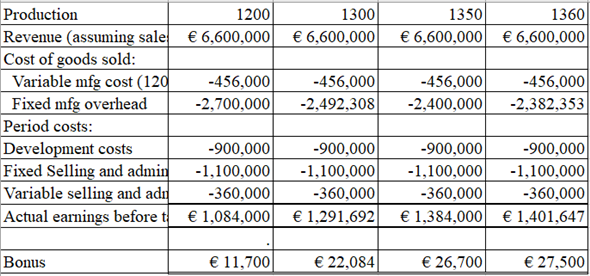

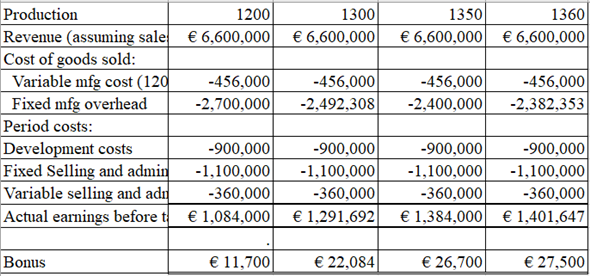

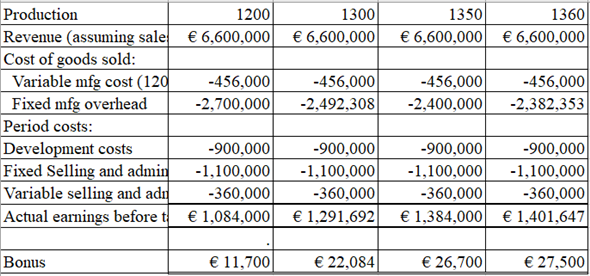

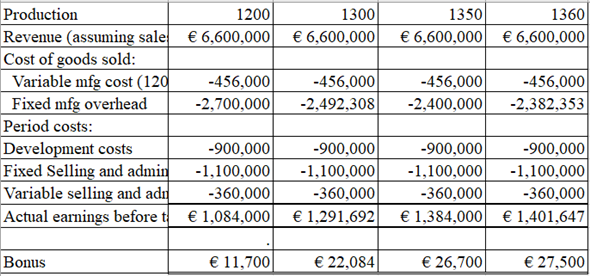

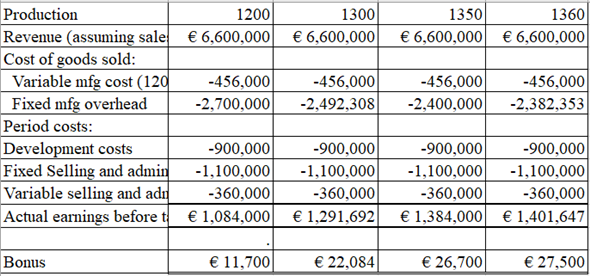

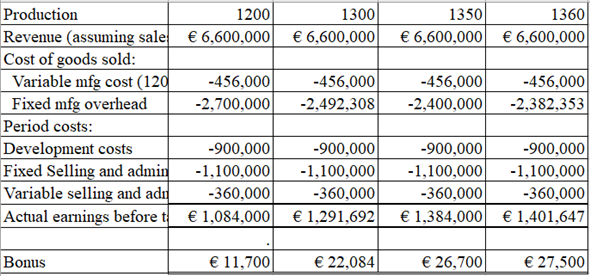

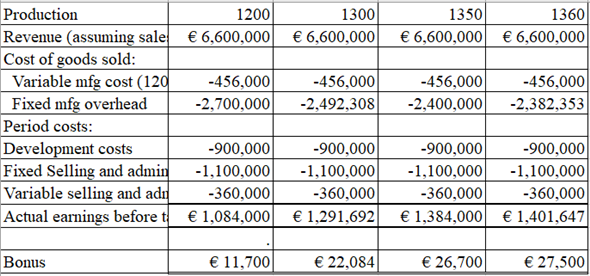

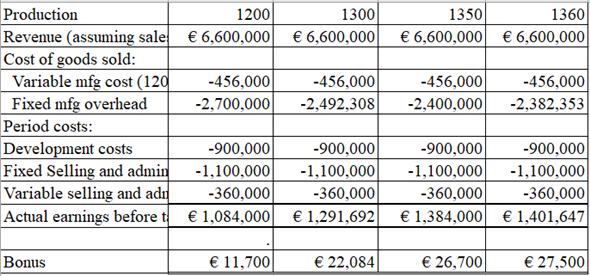

?Currently, Navisky has one very successful system in production (for environmental studies) and several others in development. Navisky, located in Austria, is one of nine wholly owned subsidiaries of a large Swiss conglomerate. Andreas Hoffman, president of Navisky, expects to retire next year. He receives a fixed salary and a bonus based on reported accounting earnings. The bonus is 5 percent of earnings in excess of €850,000 for actual earnings between €850,000 and €1,400,000. If actual earnings exceed €1,400,000, the bonus is capped at €27,500 (5% × [€1,400,000 - €850,000]). (Earnings, both actual and target, are before taxes.)

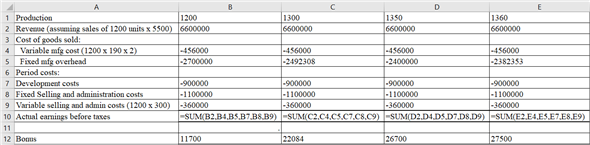

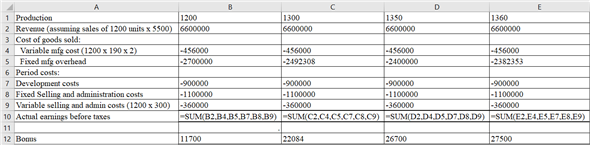

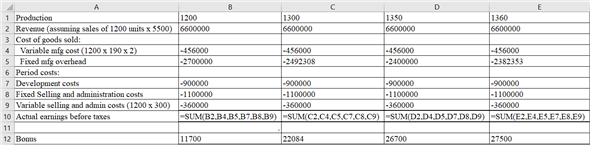

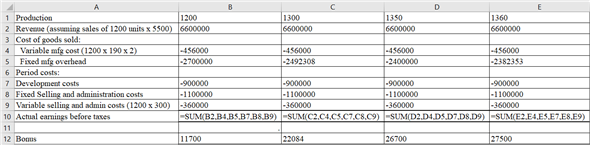

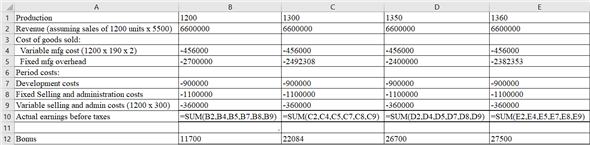

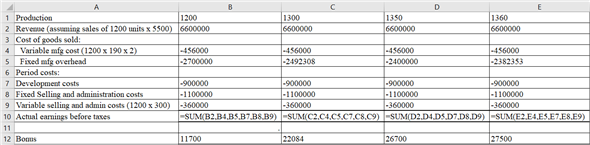

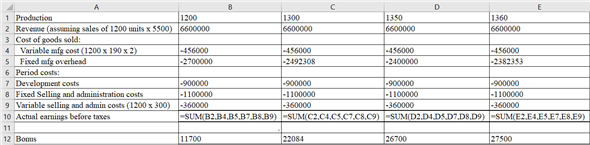

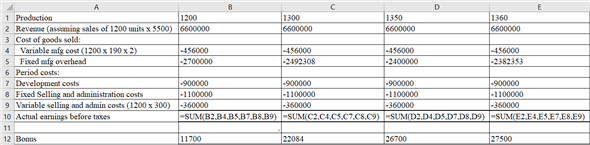

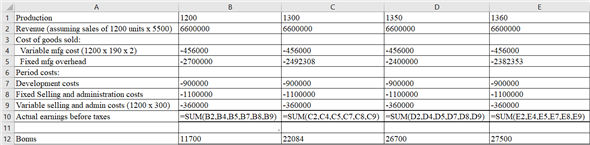

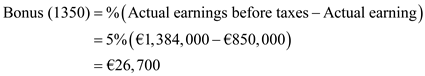

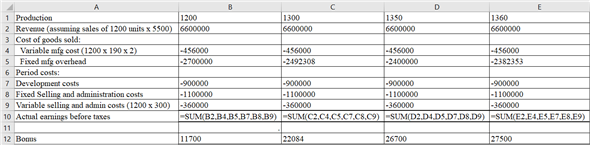

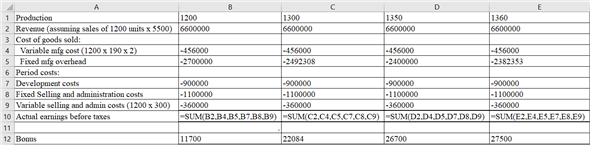

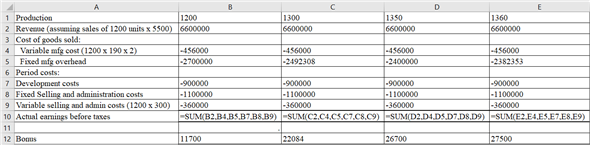

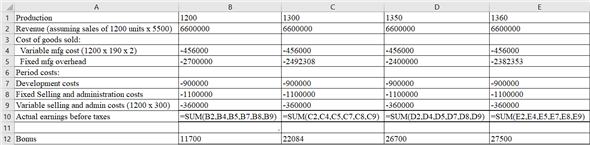

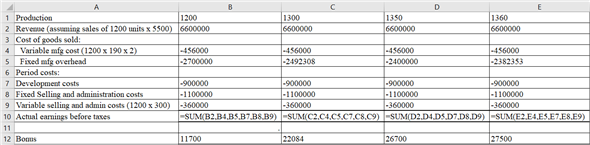

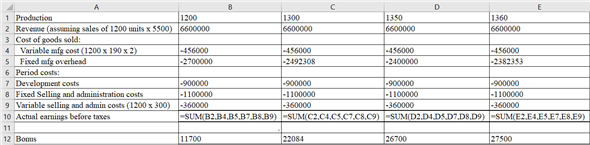

?The following data summarize Navisky's current operations (in euros).![Navisky Navisky designs, manufactures, and sells specialized GPS (Global Positioning System) devices for commercial applications. For example, Navisky currently sells a system for environmental studies and is planning systems for private aviation and fleet management. The firm has a design team that identifies potential commercial GPS applications, then designs and develops prototypes. Once a prototype is deemed successful and senior management determines that a market exists for the new application, the new design is put into production and the firm markets the new product through independent salespeople, direct marketing, trade shows, or whatever channel is most appropriate for that market. ?Currently, Navisky has one very successful system in production (for environmental studies) and several others in development. Navisky, located in Austria, is one of nine wholly owned subsidiaries of a large Swiss conglomerate. Andreas Hoffman, president of Navisky, expects to retire next year. He receives a fixed salary and a bonus based on reported accounting earnings. The bonus is 5 percent of earnings in excess of €850,000 for actual earnings between €850,000 and €1,400,000. If actual earnings exceed €1,400,000, the bonus is capped at €27,500 (5% × [€1,400,000 - €850,000]). (Earnings, both actual and target, are before taxes.) ?The following data summarize Navisky's current operations (in euros). ?Senior management at Navisky, including Mr. Hoffman, expects to sell about 1,200 units of the environmental GPS device this year. However, they have considerable discretion in setting production levels. Their plant has excess capacity and can produce up to 1,500 environmental devices without seeing any increase in the variable manufacturing costs per unit. ?Navisky uses a traditional absorption costing system to absorb manufacturing overhead into product costs for inventory valuation and to calculate earnings for internal compensation purposes as well as external reporting. At the beginning of the current fiscal year, there was no beginning inventory of the environmental GPS devices. Required: a. How many units of the environmental GPS device would Mr. Hoffman like to see Navisky produce if he expects to sell 1,200 devices this year? b. Suppose Mr. Hoffman's bonus calculation was based on net income after including a charge for inventory holding costs at 20 percent of the ending inventory value. In other words, his bonus is 5 percent of net income in excess of €850,000 up to €1,400,000 where net income includes a 20 percent inventory holding cost. How many units of the environmental GPS device would Mr. Hoffman like to see produced if he expects to sell 1,200 devices this year? c. Explain why your answers in parts (b) and (c) differ, if they do. d. How many units of the environmental GPS device would Mr. Hoffman like to see produced assuming he expects to sell 1,200 devices this year if Navisky's net income is calculated using variable costing and net income includes a 20 percent inventory holding cost?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_844b_050c_a8c8_93b54cb27f42_SM1503_00.jpg) ?Senior management at Navisky, including Mr. Hoffman, expects to sell about 1,200 units of the environmental GPS device this year. However, they have considerable discretion in setting production levels. Their plant has excess capacity and can produce up to 1,500 environmental devices without seeing any increase in the variable manufacturing costs per unit.

?Senior management at Navisky, including Mr. Hoffman, expects to sell about 1,200 units of the environmental GPS device this year. However, they have considerable discretion in setting production levels. Their plant has excess capacity and can produce up to 1,500 environmental devices without seeing any increase in the variable manufacturing costs per unit.

?Navisky uses a traditional absorption costing system to absorb manufacturing overhead into product costs for inventory valuation and to calculate earnings for internal compensation purposes as well as external reporting. At the beginning of the current fiscal year, there was no beginning inventory of the environmental GPS devices.

Required:

a. How many units of the environmental GPS device would Mr. Hoffman like to see Navisky produce if he expects to sell 1,200 devices this year?

b. Suppose Mr. Hoffman's bonus calculation was based on net income after including a charge for inventory holding costs at 20 percent of the ending inventory value. In other words, his bonus is 5 percent of net income in excess of €850,000 up to €1,400,000 where net income includes a 20 percent inventory holding cost. How many units of the environmental GPS device would Mr. Hoffman like to see produced if he expects to sell 1,200 devices this year?

c. Explain why your answers in parts (b) and (c) differ, if they do.

d. How many units of the environmental GPS device would Mr. Hoffman like to see produced assuming he expects to sell 1,200 devices this year if Navisky's net income is calculated using variable costing and net income includes a 20 percent inventory holding cost?

Navisky designs, manufactures, and sells specialized GPS (Global Positioning System) devices for commercial applications. For example, Navisky currently sells a system for environmental studies and is planning systems for private aviation and fleet management. The firm has a design team that identifies potential commercial GPS applications, then designs and develops prototypes. Once a prototype is deemed successful and senior management determines that a market exists for the new application, the new design is put into production and the firm markets the new product through independent salespeople, direct marketing, trade shows, or whatever channel is most appropriate for that market.

?Currently, Navisky has one very successful system in production (for environmental studies) and several others in development. Navisky, located in Austria, is one of nine wholly owned subsidiaries of a large Swiss conglomerate. Andreas Hoffman, president of Navisky, expects to retire next year. He receives a fixed salary and a bonus based on reported accounting earnings. The bonus is 5 percent of earnings in excess of €850,000 for actual earnings between €850,000 and €1,400,000. If actual earnings exceed €1,400,000, the bonus is capped at €27,500 (5% × [€1,400,000 - €850,000]). (Earnings, both actual and target, are before taxes.)

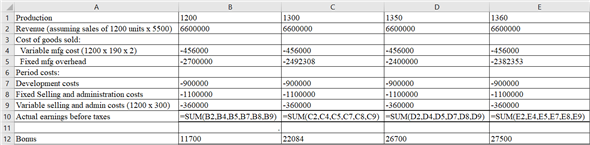

?The following data summarize Navisky's current operations (in euros).

![Navisky Navisky designs, manufactures, and sells specialized GPS (Global Positioning System) devices for commercial applications. For example, Navisky currently sells a system for environmental studies and is planning systems for private aviation and fleet management. The firm has a design team that identifies potential commercial GPS applications, then designs and develops prototypes. Once a prototype is deemed successful and senior management determines that a market exists for the new application, the new design is put into production and the firm markets the new product through independent salespeople, direct marketing, trade shows, or whatever channel is most appropriate for that market. ?Currently, Navisky has one very successful system in production (for environmental studies) and several others in development. Navisky, located in Austria, is one of nine wholly owned subsidiaries of a large Swiss conglomerate. Andreas Hoffman, president of Navisky, expects to retire next year. He receives a fixed salary and a bonus based on reported accounting earnings. The bonus is 5 percent of earnings in excess of €850,000 for actual earnings between €850,000 and €1,400,000. If actual earnings exceed €1,400,000, the bonus is capped at €27,500 (5% × [€1,400,000 - €850,000]). (Earnings, both actual and target, are before taxes.) ?The following data summarize Navisky's current operations (in euros). ?Senior management at Navisky, including Mr. Hoffman, expects to sell about 1,200 units of the environmental GPS device this year. However, they have considerable discretion in setting production levels. Their plant has excess capacity and can produce up to 1,500 environmental devices without seeing any increase in the variable manufacturing costs per unit. ?Navisky uses a traditional absorption costing system to absorb manufacturing overhead into product costs for inventory valuation and to calculate earnings for internal compensation purposes as well as external reporting. At the beginning of the current fiscal year, there was no beginning inventory of the environmental GPS devices. Required: a. How many units of the environmental GPS device would Mr. Hoffman like to see Navisky produce if he expects to sell 1,200 devices this year? b. Suppose Mr. Hoffman's bonus calculation was based on net income after including a charge for inventory holding costs at 20 percent of the ending inventory value. In other words, his bonus is 5 percent of net income in excess of €850,000 up to €1,400,000 where net income includes a 20 percent inventory holding cost. How many units of the environmental GPS device would Mr. Hoffman like to see produced if he expects to sell 1,200 devices this year? c. Explain why your answers in parts (b) and (c) differ, if they do. d. How many units of the environmental GPS device would Mr. Hoffman like to see produced assuming he expects to sell 1,200 devices this year if Navisky's net income is calculated using variable costing and net income includes a 20 percent inventory holding cost?](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_844b_050c_a8c8_93b54cb27f42_SM1503_00.jpg) ?Senior management at Navisky, including Mr. Hoffman, expects to sell about 1,200 units of the environmental GPS device this year. However, they have considerable discretion in setting production levels. Their plant has excess capacity and can produce up to 1,500 environmental devices without seeing any increase in the variable manufacturing costs per unit.

?Senior management at Navisky, including Mr. Hoffman, expects to sell about 1,200 units of the environmental GPS device this year. However, they have considerable discretion in setting production levels. Their plant has excess capacity and can produce up to 1,500 environmental devices without seeing any increase in the variable manufacturing costs per unit.?Navisky uses a traditional absorption costing system to absorb manufacturing overhead into product costs for inventory valuation and to calculate earnings for internal compensation purposes as well as external reporting. At the beginning of the current fiscal year, there was no beginning inventory of the environmental GPS devices.

Required:

a. How many units of the environmental GPS device would Mr. Hoffman like to see Navisky produce if he expects to sell 1,200 devices this year?

b. Suppose Mr. Hoffman's bonus calculation was based on net income after including a charge for inventory holding costs at 20 percent of the ending inventory value. In other words, his bonus is 5 percent of net income in excess of €850,000 up to €1,400,000 where net income includes a 20 percent inventory holding cost. How many units of the environmental GPS device would Mr. Hoffman like to see produced if he expects to sell 1,200 devices this year?

c. Explain why your answers in parts (b) and (c) differ, if they do.

d. How many units of the environmental GPS device would Mr. Hoffman like to see produced assuming he expects to sell 1,200 devices this year if Navisky's net income is calculated using variable costing and net income includes a 20 percent inventory holding cost?

Variable Costing

To take into account lacks in retention costing information, key fund experts will regularly create supplemental information in view of variable costing systems. As its name recommends, just factor generation costs are allotted to stock and cost of products sold. These expenses by and large comprised of direct materials, coordinate work, and variable assembling overhead.

Settled assembling costs are viewed as period costs alongside SG A costs. In some ways, this downplays the genuine cost of creation. The settled assembling overhead will be brought about regardless of what amount is delivered.

Over the long haul, a business must recoup those expenses to survive. In any case, on a case-by-case premise, incorporating settled assembling overhead in an item cost investigation can result in some wrong choices.

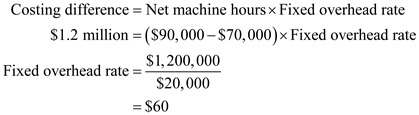

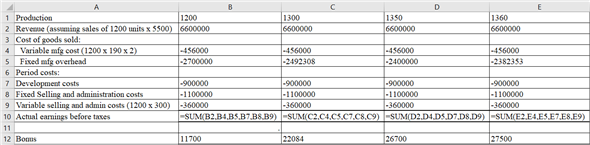

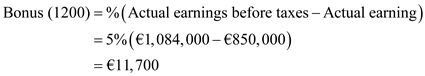

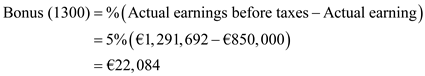

a.Mr. H, since he wants to leave one year from now and hereafter won't have to deal with any plenitude stock, has a propelling power to over convey. The table underneath demonstrates that given offers of 1200 units Mr. H should need to convey around 1,360 units.

At 1,360 units, expected benefit are about €1,401,647, or basically finished the reward best of €1,400,000. So to grow his reward, Mr. H should make 1,360 units or 160 more than he would like to offer. The result of the above MS-Excel has been shown below:

The result of the above MS-Excel has been shown below:  Working Note:

Working Note:

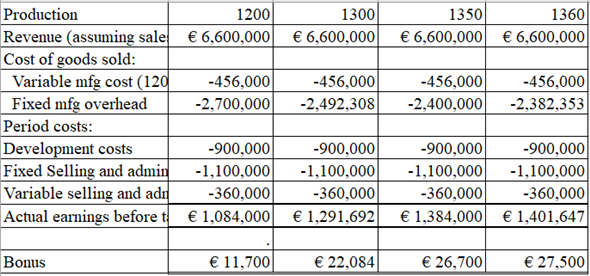

Compute the bonus for 1200 units using the equation as follows: Thus, the bonus for 1200 units to be

Thus, the bonus for 1200 units to be  .

.

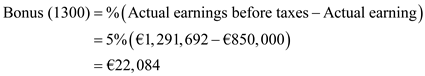

Compute the bonus for 1300 units as follows: Thus, the bonus for 1300 units to be

Thus, the bonus for 1300 units to be  .

.

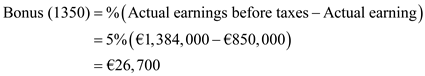

Compute the bonus for 1350 units as follows: Thus, the bonus for 1350 units to be

Thus, the bonus for 1350 units to be  .

.

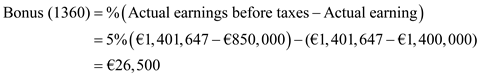

Compute the bonus for 1360 units as follows: Thus, the bonus for 1360 units to be

Thus, the bonus for 1360 units to be  0

0

.

b.With a stock holding cost of 20 percent deducted from profit, Mr. H will want to create 1,420 units on the grounds that at this generation level (and given offers of 1,200 units) Mr. H will achieve the reward top of €27,500. 1

1

The result of the above MS-Excel has been shown below: 2

2

Working Note:

Compute the bonus for 1200 units as follows: 3

3

Thus, the bonus for 1200 units to be 4

4

.

Compute the bonus for 1350 units as follows: 5

5

Thus, the bonus for 1350 units to be 6

6

.

Compute the bonus for 1400 units as follows: 7

7

Thus, the bonus for 1400 units to be 8

8

.

Compute the bonus for 1420 units as follows: 9

9

Thus, the bonus for 1420 units to be 0

0

.

c.Strikingly, charging Mr. H a stock holding expense of 20 percent really makes him over deliver significantly more. Without the 20 percent stock charge Mr. H just needs to deliver around 1,360 units (or 160 more than he hopes to offer) to come to the €1.4 million income top. In any case, with the 20 percent stock charge,

Mr. H needs to deliver around 1,420 (or 220 more than he hopes to offer) to achieve the top. Henceforth, including the stock holding charge has the unreasonable motivator of really causing Mr. H to over to create significantly more. The explanation behind this is the presence of the reward top and the way that the 20 percent charge on the stock is not as much as the decrease in normal settled costs charged to cost of merchandise sold.

d.Under factor costing and a 20 percent stock holding cost, Mr. H won't over deliver. He will deliver precisely what he means to offer, 1,200 gadgets. In the event that he over produces under factor costing, income falls, and consequently, his reward is lower. 1

1

The result of the above MS-Excel has been shown below: 2

2

Working Note:

Compute the bonus for 1200 units as follows: 3

3

Thus, the bonus for 1200 units to be 4

4

.

Compute the bonus for 1350 units as follows: 5

5

Thus, the bonus for 1350 units to be 6

6

.

Compute the bonus for 1390 units as follows: 7

7

Thus, the bonus for 1390 units to be 8

8

.

Compute the bonus for 1400 units as follows: 9

9

Thus, the bonus for 1400 units to be 0

0

.

To take into account lacks in retention costing information, key fund experts will regularly create supplemental information in view of variable costing systems. As its name recommends, just factor generation costs are allotted to stock and cost of products sold. These expenses by and large comprised of direct materials, coordinate work, and variable assembling overhead.

Settled assembling costs are viewed as period costs alongside SG A costs. In some ways, this downplays the genuine cost of creation. The settled assembling overhead will be brought about regardless of what amount is delivered.

Over the long haul, a business must recoup those expenses to survive. In any case, on a case-by-case premise, incorporating settled assembling overhead in an item cost investigation can result in some wrong choices.

a.Mr. H, since he wants to leave one year from now and hereafter won't have to deal with any plenitude stock, has a propelling power to over convey. The table underneath demonstrates that given offers of 1200 units Mr. H should need to convey around 1,360 units.

At 1,360 units, expected benefit are about €1,401,647, or basically finished the reward best of €1,400,000. So to grow his reward, Mr. H should make 1,360 units or 160 more than he would like to offer.

The result of the above MS-Excel has been shown below:

The result of the above MS-Excel has been shown below:  Working Note:

Working Note: Compute the bonus for 1200 units using the equation as follows:

Thus, the bonus for 1200 units to be

Thus, the bonus for 1200 units to be  .

.Compute the bonus for 1300 units as follows:

Thus, the bonus for 1300 units to be

Thus, the bonus for 1300 units to be  .

.Compute the bonus for 1350 units as follows:

Thus, the bonus for 1350 units to be

Thus, the bonus for 1350 units to be  .

.Compute the bonus for 1360 units as follows:

Thus, the bonus for 1360 units to be

Thus, the bonus for 1360 units to be  0

0.

b.With a stock holding cost of 20 percent deducted from profit, Mr. H will want to create 1,420 units on the grounds that at this generation level (and given offers of 1,200 units) Mr. H will achieve the reward top of €27,500.

1

1The result of the above MS-Excel has been shown below:

2

2Working Note:

Compute the bonus for 1200 units as follows:

3

3Thus, the bonus for 1200 units to be

4

4.

Compute the bonus for 1350 units as follows:

5

5Thus, the bonus for 1350 units to be

6

6.

Compute the bonus for 1400 units as follows:

7

7Thus, the bonus for 1400 units to be

8

8.

Compute the bonus for 1420 units as follows:

9

9Thus, the bonus for 1420 units to be

0

0.

c.Strikingly, charging Mr. H a stock holding expense of 20 percent really makes him over deliver significantly more. Without the 20 percent stock charge Mr. H just needs to deliver around 1,360 units (or 160 more than he hopes to offer) to come to the €1.4 million income top. In any case, with the 20 percent stock charge,

Mr. H needs to deliver around 1,420 (or 220 more than he hopes to offer) to achieve the top. Henceforth, including the stock holding charge has the unreasonable motivator of really causing Mr. H to over to create significantly more. The explanation behind this is the presence of the reward top and the way that the 20 percent charge on the stock is not as much as the decrease in normal settled costs charged to cost of merchandise sold.

d.Under factor costing and a 20 percent stock holding cost, Mr. H won't over deliver. He will deliver precisely what he means to offer, 1,200 gadgets. In the event that he over produces under factor costing, income falls, and consequently, his reward is lower.

1

1The result of the above MS-Excel has been shown below:

2

2Working Note:

Compute the bonus for 1200 units as follows:

3

3Thus, the bonus for 1200 units to be

4

4.

Compute the bonus for 1350 units as follows:

5

5Thus, the bonus for 1350 units to be

6

6.

Compute the bonus for 1390 units as follows:

7

7Thus, the bonus for 1390 units to be

8

8.

Compute the bonus for 1400 units as follows:

9

9Thus, the bonus for 1400 units to be

0

0.

3

Joon

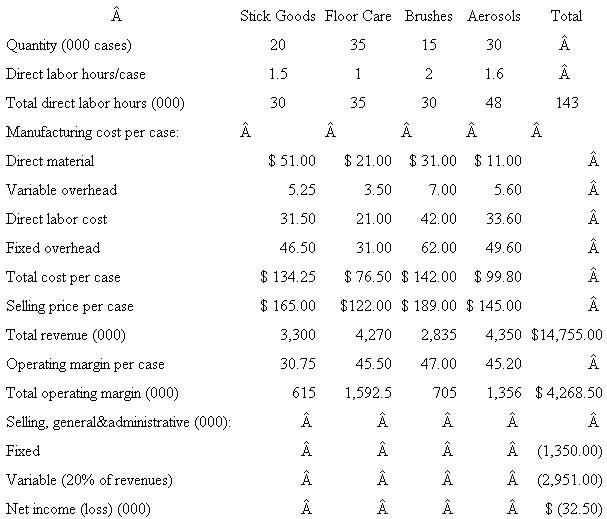

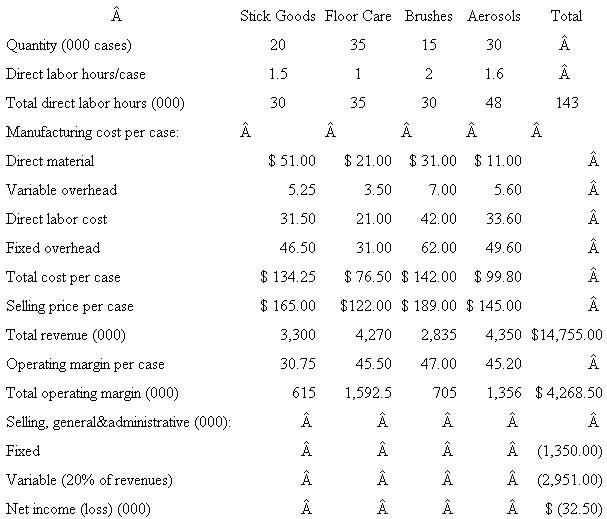

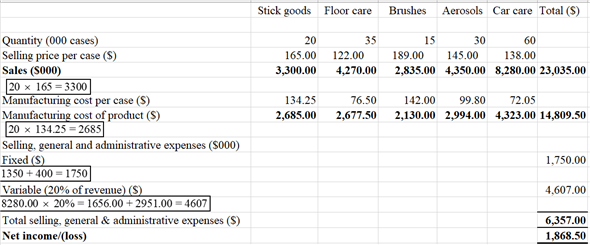

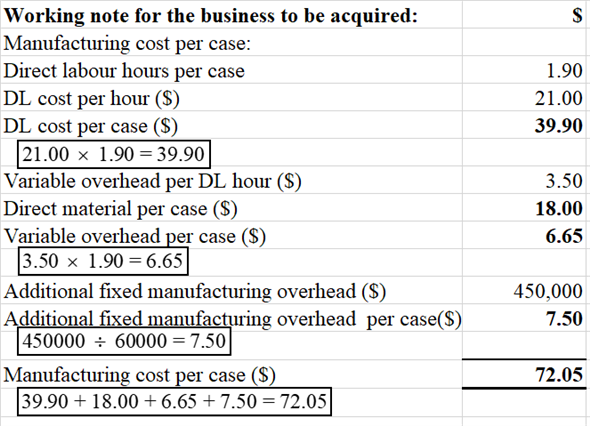

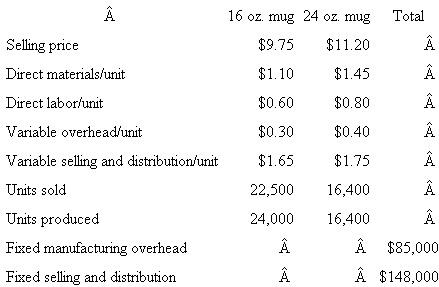

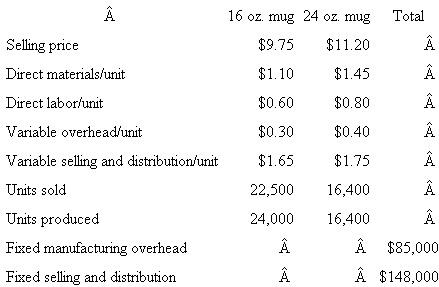

Joon manufactures and sells to retailers a variety of home care and personal care products. Joon has a single plant that produces all four of its product lines: Stick Goods (brooms and mops), Floor Care (strippers, soaps, and waxes), Brushes (hair brushes and shoe brushes), and Aerosols (room deodorizers, bug spray, furniture wax). The following statement summarizes Joon's financial performance for the most recent fiscal year. ?Direct labor costs $21 per hour. Fixed manufacturing overhead of $4.433 million is allocated to products based on direct labor hours. Last year, the fixed manufacturing overhead rate was $31 per direct labor hour ($4.433 million/143,000 direct labor hours). Variable manufacturing overhead is $3.50 per direct labor hour. Selling, general, and administrative (SG A) expenses consist of fixed costs ($1.35 million) and variable costs ($2,951 million). The variable SG A is 20 percent of revenues.

?Direct labor costs $21 per hour. Fixed manufacturing overhead of $4.433 million is allocated to products based on direct labor hours. Last year, the fixed manufacturing overhead rate was $31 per direct labor hour ($4.433 million/143,000 direct labor hours). Variable manufacturing overhead is $3.50 per direct labor hour. Selling, general, and administrative (SG A) expenses consist of fixed costs ($1.35 million) and variable costs ($2,951 million). The variable SG A is 20 percent of revenues.

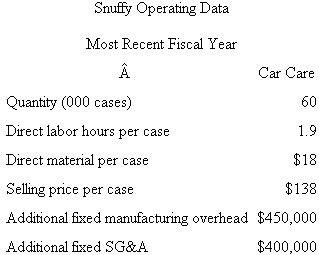

?The Joon plant has considerable excess capacity. Senior management has identified a potential acquisition target, Snuffy, that sells a line of automotive products (car waxes, soaps, brushes, and so forth) that are complementary to Joon's existing products and that can be manufactured in Joon's plant. Snuffy does not have any manufacturing facilities, but rather outsources the production of its products to contract manufacturers. Snuffy can be purchased for $38 million. The following table summarizes Snuffy's current operating data: Senior management argues that the reason Joon is currently losing money is that volumes have fallen in the plant and that the remaining products are having to carry an increasingly larger share of the overhead. This has caused some Joon product managers to raise prices. Senior managers realize that they must drive more volume into the plant if Joon is to return to profitability. Since organic growth (i.e., growth from existing products) is difficult due to a very competitive marketplace, management proposes to the board of directors the purchase of Snuffy as a way to drive additional volume into the plant. With volume of 60,000 cases and 1.9 direct labor hours per case, Snuffy's car care product line will add 114,000 direct labor hours to the plant and increase volume about 80 percent (114,000/143,000). This additional volume will significantly reduce the overhead the existing products must absorb and allow the product managers to lower prices. To incorporate Snuffy's manufacturing and distribution into Joon's current operations, Joon will have to incur additional fixed manufacturing overhead of $450,000 per year for new equipment, and $400,000 per year for additional SG A expenses.

Senior management argues that the reason Joon is currently losing money is that volumes have fallen in the plant and that the remaining products are having to carry an increasingly larger share of the overhead. This has caused some Joon product managers to raise prices. Senior managers realize that they must drive more volume into the plant if Joon is to return to profitability. Since organic growth (i.e., growth from existing products) is difficult due to a very competitive marketplace, management proposes to the board of directors the purchase of Snuffy as a way to drive additional volume into the plant. With volume of 60,000 cases and 1.9 direct labor hours per case, Snuffy's car care product line will add 114,000 direct labor hours to the plant and increase volume about 80 percent (114,000/143,000). This additional volume will significantly reduce the overhead the existing products must absorb and allow the product managers to lower prices. To incorporate Snuffy's manufacturing and distribution into Joon's current operations, Joon will have to incur additional fixed manufacturing overhead of $450,000 per year for new equipment, and $400,000 per year for additional SG A expenses.

Required:

a. Prepare a pro forma financial statement that shows Joon's financial performance (net income) for the most recent fiscal year assuming that Joon has already acquired Snuffy's car care products and has incorporated them into Joon's manufacturing and SG A processes. In preparing your analysis, make the following assumptions:

(i) Snuffy's products have the same fixed and variable cost structure as Joon's exisiting lines (i.e., variable overhead is $3.50 per direct labor hour and variable SG A is 20 percent of revenues).

(ii) The addition of Snuffy products does not change the demand for Joon's existing products.

(iii) There are no positive or negative externalities in manufacturing from having the additional Snuffy volume in the plant.

(iv) There is sufficient excess capacity in the plant and the local labor markets to absorb the additional Snuffy volume without causing labor rates or raw material prices to rise.

b. Based on your financial analysis in part ( a ), should Joon acquire Snuffy?

c. Evaluate management's arguments in favor of acquiring Snuffy.

d. What other advice would you offer Joon's management?

Joon manufactures and sells to retailers a variety of home care and personal care products. Joon has a single plant that produces all four of its product lines: Stick Goods (brooms and mops), Floor Care (strippers, soaps, and waxes), Brushes (hair brushes and shoe brushes), and Aerosols (room deodorizers, bug spray, furniture wax). The following statement summarizes Joon's financial performance for the most recent fiscal year.

?Direct labor costs $21 per hour. Fixed manufacturing overhead of $4.433 million is allocated to products based on direct labor hours. Last year, the fixed manufacturing overhead rate was $31 per direct labor hour ($4.433 million/143,000 direct labor hours). Variable manufacturing overhead is $3.50 per direct labor hour. Selling, general, and administrative (SG A) expenses consist of fixed costs ($1.35 million) and variable costs ($2,951 million). The variable SG A is 20 percent of revenues.

?Direct labor costs $21 per hour. Fixed manufacturing overhead of $4.433 million is allocated to products based on direct labor hours. Last year, the fixed manufacturing overhead rate was $31 per direct labor hour ($4.433 million/143,000 direct labor hours). Variable manufacturing overhead is $3.50 per direct labor hour. Selling, general, and administrative (SG A) expenses consist of fixed costs ($1.35 million) and variable costs ($2,951 million). The variable SG A is 20 percent of revenues.?The Joon plant has considerable excess capacity. Senior management has identified a potential acquisition target, Snuffy, that sells a line of automotive products (car waxes, soaps, brushes, and so forth) that are complementary to Joon's existing products and that can be manufactured in Joon's plant. Snuffy does not have any manufacturing facilities, but rather outsources the production of its products to contract manufacturers. Snuffy can be purchased for $38 million. The following table summarizes Snuffy's current operating data:

Senior management argues that the reason Joon is currently losing money is that volumes have fallen in the plant and that the remaining products are having to carry an increasingly larger share of the overhead. This has caused some Joon product managers to raise prices. Senior managers realize that they must drive more volume into the plant if Joon is to return to profitability. Since organic growth (i.e., growth from existing products) is difficult due to a very competitive marketplace, management proposes to the board of directors the purchase of Snuffy as a way to drive additional volume into the plant. With volume of 60,000 cases and 1.9 direct labor hours per case, Snuffy's car care product line will add 114,000 direct labor hours to the plant and increase volume about 80 percent (114,000/143,000). This additional volume will significantly reduce the overhead the existing products must absorb and allow the product managers to lower prices. To incorporate Snuffy's manufacturing and distribution into Joon's current operations, Joon will have to incur additional fixed manufacturing overhead of $450,000 per year for new equipment, and $400,000 per year for additional SG A expenses.

Senior management argues that the reason Joon is currently losing money is that volumes have fallen in the plant and that the remaining products are having to carry an increasingly larger share of the overhead. This has caused some Joon product managers to raise prices. Senior managers realize that they must drive more volume into the plant if Joon is to return to profitability. Since organic growth (i.e., growth from existing products) is difficult due to a very competitive marketplace, management proposes to the board of directors the purchase of Snuffy as a way to drive additional volume into the plant. With volume of 60,000 cases and 1.9 direct labor hours per case, Snuffy's car care product line will add 114,000 direct labor hours to the plant and increase volume about 80 percent (114,000/143,000). This additional volume will significantly reduce the overhead the existing products must absorb and allow the product managers to lower prices. To incorporate Snuffy's manufacturing and distribution into Joon's current operations, Joon will have to incur additional fixed manufacturing overhead of $450,000 per year for new equipment, and $400,000 per year for additional SG A expenses.Required:

a. Prepare a pro forma financial statement that shows Joon's financial performance (net income) for the most recent fiscal year assuming that Joon has already acquired Snuffy's car care products and has incorporated them into Joon's manufacturing and SG A processes. In preparing your analysis, make the following assumptions:

(i) Snuffy's products have the same fixed and variable cost structure as Joon's exisiting lines (i.e., variable overhead is $3.50 per direct labor hour and variable SG A is 20 percent of revenues).

(ii) The addition of Snuffy products does not change the demand for Joon's existing products.

(iii) There are no positive or negative externalities in manufacturing from having the additional Snuffy volume in the plant.

(iv) There is sufficient excess capacity in the plant and the local labor markets to absorb the additional Snuffy volume without causing labor rates or raw material prices to rise.

b. Based on your financial analysis in part ( a ), should Joon acquire Snuffy?

c. Evaluate management's arguments in favor of acquiring Snuffy.

d. What other advice would you offer Joon's management?

Introduction

Opening statement

Managements of businesses sometimes find themselves in a situation where a decision needs to be made as to whether it is profitable to acquire another business.

Acquisition of a business to increase volume

Sometimes, an unprofitable business needs to take a decision whether to acquire another business when it has excess capacity, but the volume is not adequate to absorb the fixed overheads. In this situation, the incremental financial effect of the acquisition should be computed. If the acquisition results in an incremental income, the acquisition should be implemented. However, the incremental income resulting from the acquisition should be discounted at the cost of capital over the average life of the combined assets of the acquiring and acquired businesses. If the NPV of the acquisition is positive, the acquisition is beneficial. Otherwise, it is not.

Concluding statement

The decision whether to acquire another business or not depends upon whether the two businesses combined would improve profitability and result in a net benefit to the combination of business entities. This is determined by discounted cash flow techniques.

a.

Proforma financial statement for the most recent fiscal year

b.

b.

Based on the financial analysis in (a.), the company should acquire the other business as it would yield an incremental net income of $1,868,500 instead of a net loss of $32,500.

c.

Management's arguments in favour of acquiring the other business are valid as it will add volume to the operations and result in a better absorption of fixed costs.

d.

Other points (advice)

The proposed acquisition of another business entails an additional investment of $38 million. Whether this is profitable depends upon the present value of the incremental income resulting from the acquisition. Hence, discounted cash flow should be used to evaluate the investment of $38 million. The incremental income of 1,901,000 (1,868,500 + 32,500) should be discounted at the cost of the company's capital over the average life of the combined net assets of the company and the other business. The NPV (net present value) of the acquisition would be the ultimate criterion for the decision to acquire the other business.

Opening statement

Managements of businesses sometimes find themselves in a situation where a decision needs to be made as to whether it is profitable to acquire another business.

Acquisition of a business to increase volume

Sometimes, an unprofitable business needs to take a decision whether to acquire another business when it has excess capacity, but the volume is not adequate to absorb the fixed overheads. In this situation, the incremental financial effect of the acquisition should be computed. If the acquisition results in an incremental income, the acquisition should be implemented. However, the incremental income resulting from the acquisition should be discounted at the cost of capital over the average life of the combined assets of the acquiring and acquired businesses. If the NPV of the acquisition is positive, the acquisition is beneficial. Otherwise, it is not.

Concluding statement

The decision whether to acquire another business or not depends upon whether the two businesses combined would improve profitability and result in a net benefit to the combination of business entities. This is determined by discounted cash flow techniques.

a.

Proforma financial statement for the most recent fiscal year

b.

b. Based on the financial analysis in (a.), the company should acquire the other business as it would yield an incremental net income of $1,868,500 instead of a net loss of $32,500.

c.

Management's arguments in favour of acquiring the other business are valid as it will add volume to the operations and result in a better absorption of fixed costs.

d.

Other points (advice)

The proposed acquisition of another business entails an additional investment of $38 million. Whether this is profitable depends upon the present value of the incremental income resulting from the acquisition. Hence, discounted cash flow should be used to evaluate the investment of $38 million. The incremental income of 1,901,000 (1,868,500 + 32,500) should be discounted at the cost of the company's capital over the average life of the combined net assets of the company and the other business. The NPV (net present value) of the acquisition would be the ultimate criterion for the decision to acquire the other business.

4

DIM

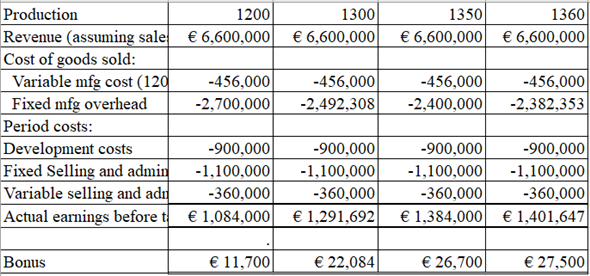

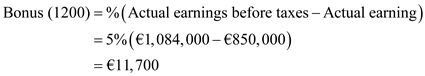

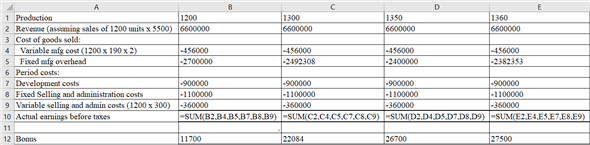

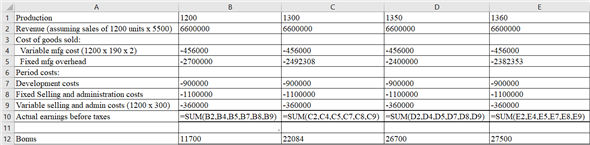

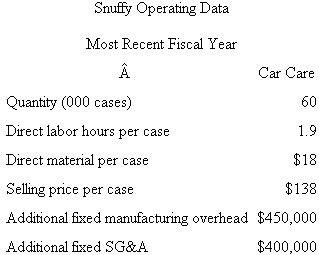

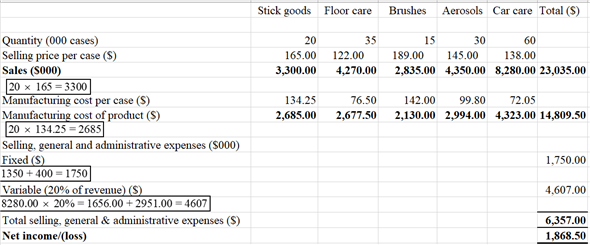

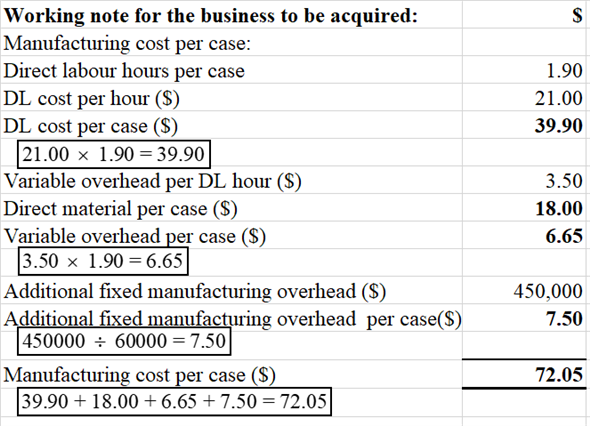

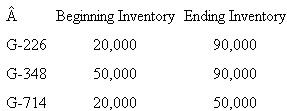

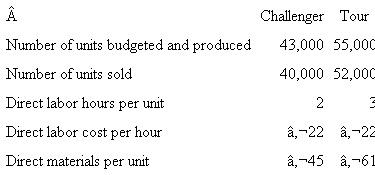

Diagnostic Imaging Medical (DIM) has introduced a revolutionary new magnetic resonance imaging (MRI) device that it sells to hospital radiology departments. Their new device has a much larger chamber that reduces patients' claustrophobic reactions compared to current machines. The following table displays how total cost per year varies with annual production. In other words, if DIM produces nine machines, the nine machines have a total manufacturing cost of $2.93 million.![DIM Diagnostic Imaging Medical (DIM) has introduced a revolutionary new magnetic resonance imaging (MRI) device that it sells to hospital radiology departments. Their new device has a much larger chamber that reduces patients' claustrophobic reactions compared to current machines. The following table displays how total cost per year varies with annual production. In other words, if DIM produces nine machines, the nine machines have a total manufacturing cost of $2.93 million. To simplify the analysis, assume DIM has no period costs, only the product costs in the above table. Management receives a bonus based on reported profits, where profits are calculated using absorption costing. Required: a. At a selling price of $500,000 per MRI, management expects to sell six units next year and plans to produce a few extra machines. The extra units are for training, marketing, and temporary spare parts in case an installed MRI fails and spare parts are needed. Management has financing and production capacity to vary production between 6 and 10 units. How many MRIs do you expect management to produce? Show your analysis that leads to this conclusion. b. Instead of expecting to sell six units at $500,000 each as in part ( a ), management expects to sell 11 units at $400,000 per unit. With expected sales at 11 units and a price of $400,000, DIM has the resources to produce between 11 and 15 MRIs. How many MRIs do you expect management to produce if expected sales are 11 units? Show your analysis that leads to this conclusion. c. Describe the differences and similarities in your answers to parts ( a ) and ( b ). Pay particular attention to the relation between units sold [6 in part ( a ) and 11 in part ( b )] and expected units produced, and how this relation differs or does not differ between parts ( a ) and ( b ). Also, explain what is causing your answers in parts ( a ) and ( b ) to differ or not differ. d. Provide some plausible explanations of why average costs may increase beyond a certain quantity of production.](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_8450_344b_a8c8_f9285f003a4e_SM1503_00.jpg) To simplify the analysis, assume DIM has no period costs, only the product costs in the above table. Management receives a bonus based on reported profits, where profits are calculated using absorption costing.

To simplify the analysis, assume DIM has no period costs, only the product costs in the above table. Management receives a bonus based on reported profits, where profits are calculated using absorption costing.

Required:

a. At a selling price of $500,000 per MRI, management expects to sell six units next year and plans to produce a few extra machines. The extra units are for training, marketing, and temporary spare parts in case an installed MRI fails and spare parts are needed. Management has financing and production capacity to vary production between 6 and 10 units. How many MRIs do you expect management to produce? Show your analysis that leads to this conclusion.

b. Instead of expecting to sell six units at $500,000 each as in part ( a ), management expects to sell 11 units at $400,000 per unit. With expected sales at 11 units and a price of $400,000, DIM has the resources to produce between 11 and 15 MRIs. How many MRIs do you expect management to produce if expected sales are 11 units? Show your analysis that leads to this conclusion.

c. Describe the differences and similarities in your answers to parts ( a ) and ( b ). Pay particular attention to the relation between units sold [6 in part ( a ) and 11 in part ( b )] and expected units produced, and how this relation differs or does not differ between parts ( a ) and ( b ). Also, explain what is causing your answers in parts ( a ) and ( b ) to differ or not differ.

d. Provide some plausible explanations of why average costs may increase beyond a certain quantity of production.

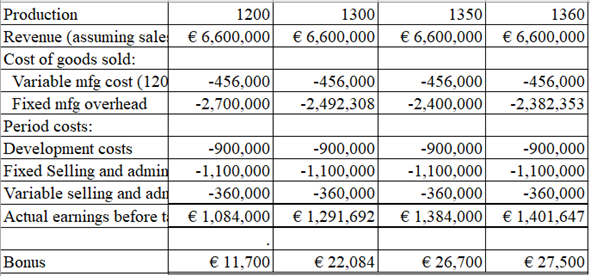

Diagnostic Imaging Medical (DIM) has introduced a revolutionary new magnetic resonance imaging (MRI) device that it sells to hospital radiology departments. Their new device has a much larger chamber that reduces patients' claustrophobic reactions compared to current machines. The following table displays how total cost per year varies with annual production. In other words, if DIM produces nine machines, the nine machines have a total manufacturing cost of $2.93 million.

![DIM Diagnostic Imaging Medical (DIM) has introduced a revolutionary new magnetic resonance imaging (MRI) device that it sells to hospital radiology departments. Their new device has a much larger chamber that reduces patients' claustrophobic reactions compared to current machines. The following table displays how total cost per year varies with annual production. In other words, if DIM produces nine machines, the nine machines have a total manufacturing cost of $2.93 million. To simplify the analysis, assume DIM has no period costs, only the product costs in the above table. Management receives a bonus based on reported profits, where profits are calculated using absorption costing. Required: a. At a selling price of $500,000 per MRI, management expects to sell six units next year and plans to produce a few extra machines. The extra units are for training, marketing, and temporary spare parts in case an installed MRI fails and spare parts are needed. Management has financing and production capacity to vary production between 6 and 10 units. How many MRIs do you expect management to produce? Show your analysis that leads to this conclusion. b. Instead of expecting to sell six units at $500,000 each as in part ( a ), management expects to sell 11 units at $400,000 per unit. With expected sales at 11 units and a price of $400,000, DIM has the resources to produce between 11 and 15 MRIs. How many MRIs do you expect management to produce if expected sales are 11 units? Show your analysis that leads to this conclusion. c. Describe the differences and similarities in your answers to parts ( a ) and ( b ). Pay particular attention to the relation between units sold [6 in part ( a ) and 11 in part ( b )] and expected units produced, and how this relation differs or does not differ between parts ( a ) and ( b ). Also, explain what is causing your answers in parts ( a ) and ( b ) to differ or not differ. d. Provide some plausible explanations of why average costs may increase beyond a certain quantity of production.](https://d2lvgg3v3hfg70.cloudfront.net/SM1503/11eb559c_8450_344b_a8c8_f9285f003a4e_SM1503_00.jpg) To simplify the analysis, assume DIM has no period costs, only the product costs in the above table. Management receives a bonus based on reported profits, where profits are calculated using absorption costing.

To simplify the analysis, assume DIM has no period costs, only the product costs in the above table. Management receives a bonus based on reported profits, where profits are calculated using absorption costing.Required:

a. At a selling price of $500,000 per MRI, management expects to sell six units next year and plans to produce a few extra machines. The extra units are for training, marketing, and temporary spare parts in case an installed MRI fails and spare parts are needed. Management has financing and production capacity to vary production between 6 and 10 units. How many MRIs do you expect management to produce? Show your analysis that leads to this conclusion.

b. Instead of expecting to sell six units at $500,000 each as in part ( a ), management expects to sell 11 units at $400,000 per unit. With expected sales at 11 units and a price of $400,000, DIM has the resources to produce between 11 and 15 MRIs. How many MRIs do you expect management to produce if expected sales are 11 units? Show your analysis that leads to this conclusion.

c. Describe the differences and similarities in your answers to parts ( a ) and ( b ). Pay particular attention to the relation between units sold [6 in part ( a ) and 11 in part ( b )] and expected units produced, and how this relation differs or does not differ between parts ( a ) and ( b ). Also, explain what is causing your answers in parts ( a ) and ( b ) to differ or not differ.

d. Provide some plausible explanations of why average costs may increase beyond a certain quantity of production.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

5

Xerox

An October 25, 1999, article in Business Week by D. Brady, "Why Xerox Is Struggling," reported:

President and Chief Executive G. Richard Thoman is a big-picture guy. For the past two years, he has preached a digital revolution at the copier giant. Get down to the detail, though, and it's clear that the revolution isn't going as planned: In both copiers and printers, Xerox is losing ground. On October 18, the company announced lower than expected earnings and the stock price tumbled more than 13% on that day. Xerox stock is down 60% from its recent high of $60 in July. Xerox blamed the bad news on short-term surprises: sagging productivity in the sales force after a big reorganization as well as weakness in Brazil. But the sheer scope of bad news shocked even Thoman, who told investors in a conference call that he was "disappointed and sad about this quarter."

?Thoman took the top job in April and vowed annual earnings growth in the "mid-to-high teens."

?Beginning November 1, 1999, Xerox factories increased their hours from five eight-hour days a week to six ten-hour days a week through the end of the year. The factory managers were told to build inventories in expectation of higher sales in the fourth quarter of 1999. Fourth-quarter sales were expected to be higher because of anticipation that the new sales force reorganization would increase sales.

Required:

Offer an alternative reason(s) for Xerox's decision to increase output in its factories.

An October 25, 1999, article in Business Week by D. Brady, "Why Xerox Is Struggling," reported:

President and Chief Executive G. Richard Thoman is a big-picture guy. For the past two years, he has preached a digital revolution at the copier giant. Get down to the detail, though, and it's clear that the revolution isn't going as planned: In both copiers and printers, Xerox is losing ground. On October 18, the company announced lower than expected earnings and the stock price tumbled more than 13% on that day. Xerox stock is down 60% from its recent high of $60 in July. Xerox blamed the bad news on short-term surprises: sagging productivity in the sales force after a big reorganization as well as weakness in Brazil. But the sheer scope of bad news shocked even Thoman, who told investors in a conference call that he was "disappointed and sad about this quarter."

?Thoman took the top job in April and vowed annual earnings growth in the "mid-to-high teens."

?Beginning November 1, 1999, Xerox factories increased their hours from five eight-hour days a week to six ten-hour days a week through the end of the year. The factory managers were told to build inventories in expectation of higher sales in the fourth quarter of 1999. Fourth-quarter sales were expected to be higher because of anticipation that the new sales force reorganization would increase sales.

Required:

Offer an alternative reason(s) for Xerox's decision to increase output in its factories.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

6

Easton Plant

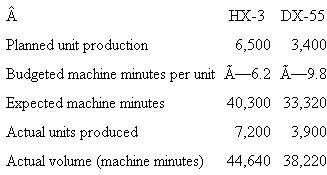

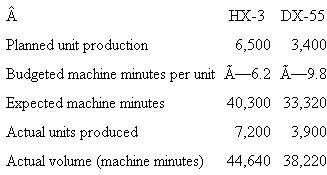

The Easton plant produces sheet metal chassis for television sets. Its customer is General Electric Appliances. The chassis are manufactured on a computerized, numerically controlled (NC) machine that cuts, drills, and bends the metal to form the chassis for the television set. Two different chassis are produced: HX?3 and DX?55.

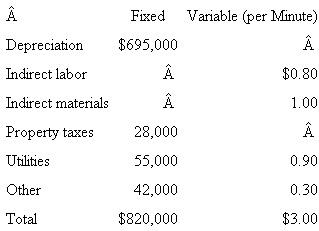

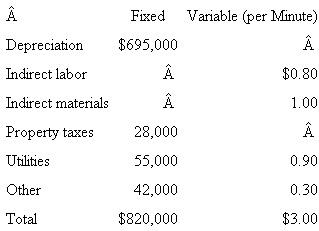

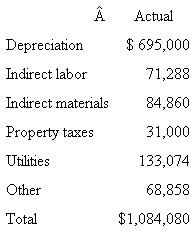

?Easton has a single plant wide overhead account. Actual machine minutes on the NC machine are used to distribute overhead to the two products. There were no beginning inventories of work in process or finished goods. The following table summarizes the planned and actual production data for the year: The following data summarize the flexible overhead budget:

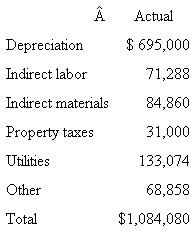

The following data summarize the flexible overhead budget:  At the end of the year, the following overhead amounts had been incurred:

At the end of the year, the following overhead amounts had been incurred:  Any over-or under absorbed overhead is written off to cost of goods sold. The ending finished goods inventory consists of 2,000 units of HX-3 and 1,000 units of DX-55, representing 13,400 minutes and 10,300 minutes of actual machine time, respectively.

Any over-or under absorbed overhead is written off to cost of goods sold. The ending finished goods inventory consists of 2,000 units of HX-3 and 1,000 units of DX-55, representing 13,400 minutes and 10,300 minutes of actual machine time, respectively.

Required: (Round all dollars, including overhead rates, to two decimal places.)

a. Calculate the overhead absorption rate set at the start of the year.

b. Calculate the over-or under absorbed overhead for the year.

c. The firm is considering switching to variable costing. What effect would this decision have on Easton's reported profit for this year? To implement variable costing at the end of the year, variable overhead is calculated as $3.00 per machine minute times the actual number of machine minutes. Fixed overhead is the difference between total actual overhead and variable overhead.

d. Instead of defining fixed overhead as all overhead in excess of variable overhead as in part ( c ) , assume the following: Fixed overhead is budgeted fixed overhead ($820,000), and variable overhead is the difference between total actual overhead and budgeted fixed overhead. What is the difference between absorption net income and variable costing income given these new assumptions?

The Easton plant produces sheet metal chassis for television sets. Its customer is General Electric Appliances. The chassis are manufactured on a computerized, numerically controlled (NC) machine that cuts, drills, and bends the metal to form the chassis for the television set. Two different chassis are produced: HX?3 and DX?55.

?Easton has a single plant wide overhead account. Actual machine minutes on the NC machine are used to distribute overhead to the two products. There were no beginning inventories of work in process or finished goods. The following table summarizes the planned and actual production data for the year:

The following data summarize the flexible overhead budget:

The following data summarize the flexible overhead budget:  At the end of the year, the following overhead amounts had been incurred:

At the end of the year, the following overhead amounts had been incurred:  Any over-or under absorbed overhead is written off to cost of goods sold. The ending finished goods inventory consists of 2,000 units of HX-3 and 1,000 units of DX-55, representing 13,400 minutes and 10,300 minutes of actual machine time, respectively.

Any over-or under absorbed overhead is written off to cost of goods sold. The ending finished goods inventory consists of 2,000 units of HX-3 and 1,000 units of DX-55, representing 13,400 minutes and 10,300 minutes of actual machine time, respectively.Required: (Round all dollars, including overhead rates, to two decimal places.)

a. Calculate the overhead absorption rate set at the start of the year.

b. Calculate the over-or under absorbed overhead for the year.

c. The firm is considering switching to variable costing. What effect would this decision have on Easton's reported profit for this year? To implement variable costing at the end of the year, variable overhead is calculated as $3.00 per machine minute times the actual number of machine minutes. Fixed overhead is the difference between total actual overhead and variable overhead.

d. Instead of defining fixed overhead as all overhead in excess of variable overhead as in part ( c ) , assume the following: Fixed overhead is budgeted fixed overhead ($820,000), and variable overhead is the difference between total actual overhead and budgeted fixed overhead. What is the difference between absorption net income and variable costing income given these new assumptions?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

7

Varilux

Varilux manufactures a single product and sells it for $10 per unit. At the beginning of the year, there were 1,000 units in inventory. Upon further investigation, you discover that units produced last year had $3 of fixed manufacturing costs and $2 of variable manufacturing costs. During the year, Varilux produced 10,000 units of product. Each unit produced generated $3 of variable manufacturing cost. Total fixed manufacturing cost for the current year was $40,000. Selling and administrative costs consisted of $12,000 of variable costs and $18,000 of fixed costs. There were no inventories at the end of the year.

Required:

Prepare two income statements for the current year: one on a variable cost basis and the other on an absorption cost basis. Explain any difference between the two net income numbers and provide calculations supporting your explanation of the difference.

Varilux manufactures a single product and sells it for $10 per unit. At the beginning of the year, there were 1,000 units in inventory. Upon further investigation, you discover that units produced last year had $3 of fixed manufacturing costs and $2 of variable manufacturing costs. During the year, Varilux produced 10,000 units of product. Each unit produced generated $3 of variable manufacturing cost. Total fixed manufacturing cost for the current year was $40,000. Selling and administrative costs consisted of $12,000 of variable costs and $18,000 of fixed costs. There were no inventories at the end of the year.

Required:

Prepare two income statements for the current year: one on a variable cost basis and the other on an absorption cost basis. Explain any difference between the two net income numbers and provide calculations supporting your explanation of the difference.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

8

Weststar Appliances

Weststar manufactures and distributes a complete line of home appliances worldwide. Lynn Tweedie is the U.S. Space Saver Dishwasher product manager for Weststar Appliances. Her responsibilities include pricing, planning, and sales of Weststar's Space Saver dishwasher in the United States. It is the end of the third quarter and Tweedie is deciding how many Space Saver washers to produce in the fourth quarter. Given sales from the first three quarters and orders for the last quarter, she expects total sales for the year to be 73,000 washers at $200 per unit. There are 12,000 washers in inventory at a (LIFO) cost of $90 per washer. The factory produced 58,000 washers in the first three quarters of this year and Tweedie is considering ordering an additional 10,000, 15,000, or 20,000 washers in the fourth quarter. The plant's capacity can easily accommodate any of these volume levels without affecting fixed costs or variable cost per unit. The variable manufacturing cost of the washer is $75 and the plant has fixed annual costs of $1.3 million. Manufacturing overhead is allocated to dishwashers based on units. Tweedie's selling and administrative expenses consist of $15 of variable cost per washer and fixed cost of $2.92 million. The dishwasher division has a 17 percent weighted-average cost of capital and invested capital (not including inventories) of $18 million. Weststar uses full absorption costing.

Required:

a. Prepare a table showing annual accounting earnings prepared under absorption costing for the Space Saver dishwasher for annual production levels of 68,000, 73,000, and 78,000 washers.

b. If Lynn Tweedie's bonus depends on reported accounting earnings from Space Saver dishwashers, what production quantity is she likely to select for the fourth quarter?

c. Prepare a table computing the valuation of the ending inventory (under LIFO) for annual production levels of 68,000, 73,000, and 78,000 washers.

d. If Lynn Tweedie's bonus depends on residual income from Space Saver dishwashers, what production quantity is she likely to select for the fourth quarter?

e. How would your answer change in part ( d ) if Tweedie's bonus was based on return on assets?

Weststar manufactures and distributes a complete line of home appliances worldwide. Lynn Tweedie is the U.S. Space Saver Dishwasher product manager for Weststar Appliances. Her responsibilities include pricing, planning, and sales of Weststar's Space Saver dishwasher in the United States. It is the end of the third quarter and Tweedie is deciding how many Space Saver washers to produce in the fourth quarter. Given sales from the first three quarters and orders for the last quarter, she expects total sales for the year to be 73,000 washers at $200 per unit. There are 12,000 washers in inventory at a (LIFO) cost of $90 per washer. The factory produced 58,000 washers in the first three quarters of this year and Tweedie is considering ordering an additional 10,000, 15,000, or 20,000 washers in the fourth quarter. The plant's capacity can easily accommodate any of these volume levels without affecting fixed costs or variable cost per unit. The variable manufacturing cost of the washer is $75 and the plant has fixed annual costs of $1.3 million. Manufacturing overhead is allocated to dishwashers based on units. Tweedie's selling and administrative expenses consist of $15 of variable cost per washer and fixed cost of $2.92 million. The dishwasher division has a 17 percent weighted-average cost of capital and invested capital (not including inventories) of $18 million. Weststar uses full absorption costing.

Required:

a. Prepare a table showing annual accounting earnings prepared under absorption costing for the Space Saver dishwasher for annual production levels of 68,000, 73,000, and 78,000 washers.

b. If Lynn Tweedie's bonus depends on reported accounting earnings from Space Saver dishwashers, what production quantity is she likely to select for the fourth quarter?

c. Prepare a table computing the valuation of the ending inventory (under LIFO) for annual production levels of 68,000, 73,000, and 78,000 washers.

d. If Lynn Tweedie's bonus depends on residual income from Space Saver dishwashers, what production quantity is she likely to select for the fourth quarter?

e. How would your answer change in part ( d ) if Tweedie's bonus was based on return on assets?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

9

Truini Paints

Using the data from Table 10?6, recast the analysis with one change of assumption: Instead of assuming that an additional $17,000 of overhead was incurred in both years, assume that overhead was lower each year by $10,000. How do incentives change regarding the treatment of the $10,000 savings?

Using the data from Table 10?6, recast the analysis with one change of assumption: Instead of assuming that an additional $17,000 of overhead was incurred in both years, assume that overhead was lower each year by $10,000. How do incentives change regarding the treatment of the $10,000 savings?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

10

Blauvelt Products

Blauvelt Products uses a flexible budget to set the overhead rate at the beginning of the year based on units produced. In year 1 budgeted fixed overhead is $1 million and budgeted variable overhead is $2 per unit. Direct material and direct labor together are $5 per unit. Blauvelt sells the completed product for $30. There is no beginning inventory. Budgeted volume is 80,000 units. Production and sales are 80,000 units. Actual overhead incurred in year 1 is $1,160,000. Any under-or overabsorbed overhead is written off to cost of goods sold.

?In year 2, budgeted volume and production are again both 80,000 units. However, only 60,000 units are sold. Budgeted fixed overhead is $1 million and budgeted variable overhead is $2 per unit. Direct material and direct labor are $5 per unit. Final selling price remains at $30 per unit. Actual overhead incurred in year 2 is $1.35 million.

Required:

a. Calculate net income in year 1 first using absorption costing and then using variable costing. Explain any difference between the two net income numbers.

b. Calculate net income in year 2 using absorption costing, where the overhead rate used to assign overhead to products is based on actual overhead incurred.

c. Calculate net income in year 2 using variable costing, where any difference between budgeted overhead and actual overhead is treated as a fixed cost.

d. Calculate net income in year 2 using variable costing, where any difference between budgeted overhead and actual overhead is treated as a variable cost.

e. Explain why your answers in parts ( b ) , ( c ) , and ( d ) differ.

Blauvelt Products uses a flexible budget to set the overhead rate at the beginning of the year based on units produced. In year 1 budgeted fixed overhead is $1 million and budgeted variable overhead is $2 per unit. Direct material and direct labor together are $5 per unit. Blauvelt sells the completed product for $30. There is no beginning inventory. Budgeted volume is 80,000 units. Production and sales are 80,000 units. Actual overhead incurred in year 1 is $1,160,000. Any under-or overabsorbed overhead is written off to cost of goods sold.

?In year 2, budgeted volume and production are again both 80,000 units. However, only 60,000 units are sold. Budgeted fixed overhead is $1 million and budgeted variable overhead is $2 per unit. Direct material and direct labor are $5 per unit. Final selling price remains at $30 per unit. Actual overhead incurred in year 2 is $1.35 million.

Required:

a. Calculate net income in year 1 first using absorption costing and then using variable costing. Explain any difference between the two net income numbers.

b. Calculate net income in year 2 using absorption costing, where the overhead rate used to assign overhead to products is based on actual overhead incurred.

c. Calculate net income in year 2 using variable costing, where any difference between budgeted overhead and actual overhead is treated as a fixed cost.

d. Calculate net income in year 2 using variable costing, where any difference between budgeted overhead and actual overhead is treated as a variable cost.

e. Explain why your answers in parts ( b ) , ( c ) , and ( d ) differ.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

11

Zipp Cards

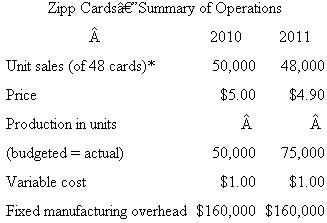

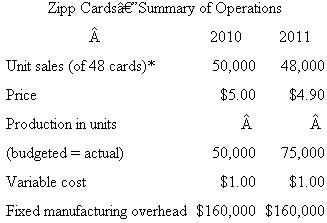

Zipp Cards buys baseball cards in bulk from the companies that produce them. Zipp buys sheets of 48 cards, then cuts the sheets into individual cards, and sorts and packages them, usually by team. Zipp then sells the packages to large discount stores. The accompanying table provides information regarding operations for 2010 and 2011. *One unit equals 48 cards.

*One unit equals 48 cards.

?Volume is measured in terms of 48-card sheets processed. Budgeted production and actual production in 2010 were both 50,000 units. There were no beginning inventories on January 1, 2010. In 2011, budgeted and actual production rose to 75,000 units.

?At the beginning of 2012, the president of Zipp was pleasantly surprised when the accountant showed her the income statement for the year 2011. The president remarked, "I'm surprised we made more money in 2011 than 2010. We had to cut prices and we didn't sell as many units, yet we still made more money. Well, you're the accountant and these numbers don't lie."

Required:

a. Prepare income statements for 2010 and 2011 using absorption costing.

b. Prepare a statement reconciling the change in net income from 2010 to 2011. Explain to the president why the firm made more money in 2011 than in 2010.

Zipp Cards buys baseball cards in bulk from the companies that produce them. Zipp buys sheets of 48 cards, then cuts the sheets into individual cards, and sorts and packages them, usually by team. Zipp then sells the packages to large discount stores. The accompanying table provides information regarding operations for 2010 and 2011.

*One unit equals 48 cards.

*One unit equals 48 cards.?Volume is measured in terms of 48-card sheets processed. Budgeted production and actual production in 2010 were both 50,000 units. There were no beginning inventories on January 1, 2010. In 2011, budgeted and actual production rose to 75,000 units.

?At the beginning of 2012, the president of Zipp was pleasantly surprised when the accountant showed her the income statement for the year 2011. The president remarked, "I'm surprised we made more money in 2011 than 2010. We had to cut prices and we didn't sell as many units, yet we still made more money. Well, you're the accountant and these numbers don't lie."

Required:

a. Prepare income statements for 2010 and 2011 using absorption costing.

b. Prepare a statement reconciling the change in net income from 2010 to 2011. Explain to the president why the firm made more money in 2011 than in 2010.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

12

UniCom

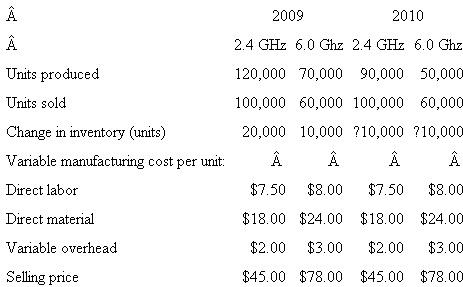

UniCom produces a wide range of consumer electronics. UniCom's Newark, New York, plant produces two types of cordless phones: 2.4 GHz and 6.0 GHz. The following table summarizes operations at the Newark UniCom plant for the years 2009 and 2010. Fixed manufacturing overhead amounted to $4 million in each year. At the start of 2009, there were no beginning inventories of either 2.4-GHz or 6.0-GHz cordless phones. UniCom uses FIFO to value inventories.

Fixed manufacturing overhead amounted to $4 million in each year. At the start of 2009, there were no beginning inventories of either 2.4-GHz or 6.0-GHz cordless phones. UniCom uses FIFO to value inventories.

Required:

a. Prepare variable costing income statements for 2009 and 2010.

b. Prepare absorption costing income statements for 2009 and 2010. At the end of the year, fixed manufacturing overhead is absorbed to the two phone models using direct material as the allocation base.

c. Prepare a table that reconciles any differences in variable costing and absorption costing net incomes for 2009 and 2010.

UniCom produces a wide range of consumer electronics. UniCom's Newark, New York, plant produces two types of cordless phones: 2.4 GHz and 6.0 GHz. The following table summarizes operations at the Newark UniCom plant for the years 2009 and 2010.

Fixed manufacturing overhead amounted to $4 million in each year. At the start of 2009, there were no beginning inventories of either 2.4-GHz or 6.0-GHz cordless phones. UniCom uses FIFO to value inventories.

Fixed manufacturing overhead amounted to $4 million in each year. At the start of 2009, there were no beginning inventories of either 2.4-GHz or 6.0-GHz cordless phones. UniCom uses FIFO to value inventories.Required:

a. Prepare variable costing income statements for 2009 and 2010.

b. Prepare absorption costing income statements for 2009 and 2010. At the end of the year, fixed manufacturing overhead is absorbed to the two phone models using direct material as the allocation base.

c. Prepare a table that reconciles any differences in variable costing and absorption costing net incomes for 2009 and 2010.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

13

Transpacific Bank

You are working as a loan officer at Transpacific Bank and are analyzing a loan request for a client when you come across the following footnote in the client's annual report:

Inventories are priced at the lower of cost or market of materials plus other direct (variable) costs. Fixed overheads of $4.2 million this year and $3.0 million last year are excluded from inventories. Omitting such overhead resulted in a reduction in net income (after taxes) of $720,000 for this year. Our tax rate is 40 percent.

?In preparing to present the loan application to the bank's loan committee, write a brief paragraph in nontechnical terms describing what this footnote means and how it affects the bank's evaluation of the financial condition of the borrower.

You are working as a loan officer at Transpacific Bank and are analyzing a loan request for a client when you come across the following footnote in the client's annual report:

Inventories are priced at the lower of cost or market of materials plus other direct (variable) costs. Fixed overheads of $4.2 million this year and $3.0 million last year are excluded from inventories. Omitting such overhead resulted in a reduction in net income (after taxes) of $720,000 for this year. Our tax rate is 40 percent.

?In preparing to present the loan application to the bank's loan committee, write a brief paragraph in nontechnical terms describing what this footnote means and how it affects the bank's evaluation of the financial condition of the borrower.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

14

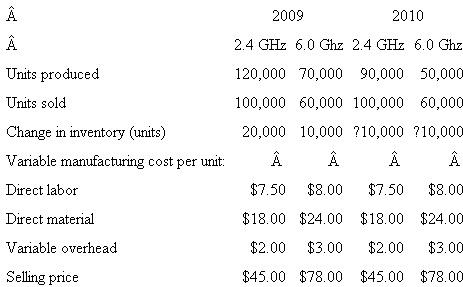

Sants Brakes Co.

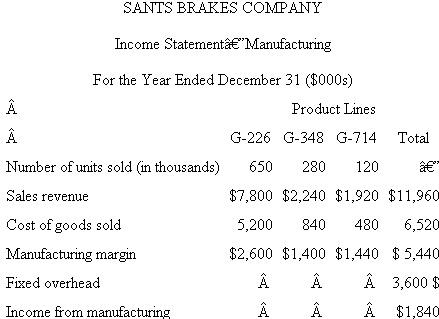

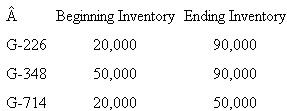

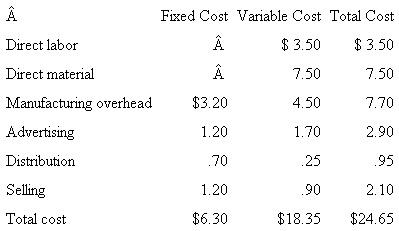

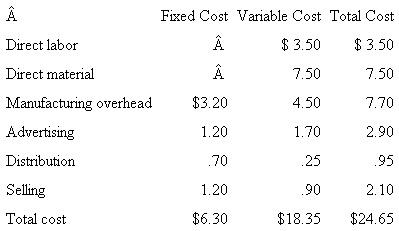

The current year's income statement for Sants Brakes Co. on a variable costing basis appears in the accompanying table. ?Inventories of finished stock were increased during the year in anticipation of increases in sales volume in the current year. Inventories in units of product for the beginning and end of the year follow.

?Inventories of finished stock were increased during the year in anticipation of increases in sales volume in the current year. Inventories in units of product for the beginning and end of the year follow.  ?The budgeted operating level for assigning fixed overhead to production is 1.8 million machine hours. One-half hour is required to produce a unit of G-226, two hours are required for a unit of G-348, and four hours are required for a unit of G-714.

?The budgeted operating level for assigning fixed overhead to production is 1.8 million machine hours. One-half hour is required to produce a unit of G-226, two hours are required for a unit of G-348, and four hours are required for a unit of G-714.

Required:

a. Recast the income statement on an absorption costing basis.

b. Explain why the income from manufacturing on the absorption costing statement differs from the income on the variable costing statement. Show your computations.

The current year's income statement for Sants Brakes Co. on a variable costing basis appears in the accompanying table.

?Inventories of finished stock were increased during the year in anticipation of increases in sales volume in the current year. Inventories in units of product for the beginning and end of the year follow.