Deck 29: Financial Distress

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/36

Play

Full screen (f)

Deck 29: Financial Distress

1

Priority of Claims, which of the following has the highest general priority?

A)Tax Claims.

B)Consumer Claims.

C)Wages, salaries and commisions.

D)Preference shareholder claims.

E)Ordinary shareholder claims.

A)Tax Claims.

B)Consumer Claims.

C)Wages, salaries and commisions.

D)Preference shareholder claims.

E)Ordinary shareholder claims.

Wages, salaries and commisions.

2

What is the absolute priority rule of the following claims once a corporation is determined to be bankrupt?

A)Administrative expenses, wages claims, government tax claims, debtholder and then Equityholder claims.

B)Administrative expenses, wages claims, government tax claims, equityholder and then Debtholder claims.

C)Wage claims, administrative expenses, debtholder claims, government tax claims and Equityholder claims.

D)Wage claims, administrative expenses, debtholder claims, equityholder claims and Government tax claims.

E)None of the above.

A)Administrative expenses, wages claims, government tax claims, debtholder and then Equityholder claims.

B)Administrative expenses, wages claims, government tax claims, equityholder and then Debtholder claims.

C)Wage claims, administrative expenses, debtholder claims, government tax claims and Equityholder claims.

D)Wage claims, administrative expenses, debtholder claims, equityholder claims and Government tax claims.

E)None of the above.

Administrative expenses, wages claims, government tax claims, debtholder and then Equityholder claims.

3

Perhaps equally, if not more damaging, are the indirect costs of financial distress.Some examples of indirect costs are:

A)Loss of current customers.

B)Loss of business reputation.

C)Management consumed in survival and not on a strategic direction.

D)A, B and C.

E)Both A and B.

A)Loss of current customers.

B)Loss of business reputation.

C)Management consumed in survival and not on a strategic direction.

D)A, B and C.

E)Both A and B.

A, B and C.

4

The net payoff to creditors in formal bankruptcy may be low in present value terms because:

A)the financial structure may be complicated with several groups and types of creditors.

B)indirect costs of bankruptcy may have been costly in lost revenues and poor maintenance.

C)administrative costs are high and increase with the complexity and length of time in the

Formal bankruptcy process.

D)stopping pre-bankruptcy interest on unsecured debt helps the shareholders but hurts the

Creditors.

E)All of the above.

A)the financial structure may be complicated with several groups and types of creditors.

B)indirect costs of bankruptcy may have been costly in lost revenues and poor maintenance.

C)administrative costs are high and increase with the complexity and length of time in the

Formal bankruptcy process.

D)stopping pre-bankruptcy interest on unsecured debt helps the shareholders but hurts the

Creditors.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

5

A firm that has a series of negative earnings, sales declines and workforce reductions is likely head to:

A)a change in management.

B)a merger.

C)financial distress.

D)new financing.

E)None of the above.

A)a change in management.

B)a merger.

C)financial distress.

D)new financing.

E)None of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

6

A firm in financial distress that reorganizes:

A)continues to run the business as a going concern.

B)must have acceptance of the plan by the creditors.

C)may distribute new securities to creditors and shareholders.

D)may merge with another firm.

E)All of the above.

A)continues to run the business as a going concern.

B)must have acceptance of the plan by the creditors.

C)may distribute new securities to creditors and shareholders.

D)may merge with another firm.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

7

In a prepackaged bankruptcy the firm:

A)and creditors agree to a private reorganization outside formal bankruptcy.

B)must reach agreement privately with most of the creditors.

C)will have difficulty when there are thousands of reluctant trade creditors.

D)an arrangement under which the sale of all or part of a company's business or assets is

Negotiated with a purchaser prior to the appointment of an administrator.

E)All of the above.

A)and creditors agree to a private reorganization outside formal bankruptcy.

B)must reach agreement privately with most of the creditors.

C)will have difficulty when there are thousands of reluctant trade creditors.

D)an arrangement under which the sale of all or part of a company's business or assets is

Negotiated with a purchaser prior to the appointment of an administrator.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

8

Firms deal with financial distress by:

A)selling major assets.

B)merging with another firm.

C)issuing new securities.

D)exchanging debt for equity.

E)All of the above.

A)selling major assets.

B)merging with another firm.

C)issuing new securities.

D)exchanging debt for equity.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

9

Equityholders may prefer a formal bankruptcy filing because:

A)the firm can issue debtor in possession debt.

B)they can delay pre-bankruptcy interest payments.

C)the lack of information about the length and magnitude of the cash flow problem favors

Equityholders.

D)the tax treatment of the cancellation of indebtedness is better.

E)All of the above.

A)the firm can issue debtor in possession debt.

B)they can delay pre-bankruptcy interest payments.

C)the lack of information about the length and magnitude of the cash flow problem favors

Equityholders.

D)the tax treatment of the cancellation of indebtedness is better.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

10

If a firm has a equity based insolvency in both book and market value terms and liquidates:

A)the payoff will not be 100% to all investors.

B)the unsecured creditors are likely to get less than full value.

C)the equityholders typically should receive nothing.

D)the administration expenses are likely to get full value.

E)All of the above.

A)the payoff will not be 100% to all investors.

B)the unsecured creditors are likely to get less than full value.

C)the equityholders typically should receive nothing.

D)the administration expenses are likely to get full value.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

11

Most firms in financial distress do not fail and cease to exist.Many firms can actually benefit from distress by:

A)Forcing a firm to re-evaluate their core operations to retain.

B)Realigning their capital structure to reduce interest costs.

C)Enter Insolvency and liquidate the firm.

D)Both A and B.

E)Both A and C.

A)Forcing a firm to re-evaluate their core operations to retain.

B)Realigning their capital structure to reduce interest costs.

C)Enter Insolvency and liquidate the firm.

D)Both A and B.

E)Both A and C.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

12

Financial restructuring can occur as:

A)A private workout.

B)An employee buy-out.

C)A bankruptcy reorganization.

D)Both A and C.

E)Both B and C.

A)A private workout.

B)An employee buy-out.

C)A bankruptcy reorganization.

D)Both A and C.

E)Both B and C.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

13

The absolute priority rule:

A)is set to ensure senior claims are paid first.

B)is the priority rule in liquidations.

C)distributes proceeds of secured assets sales to the secured creditors first and the

Remainder to the unsecured.

D)is significant when the secured property is liquidated and cash is insufficient to cover the

Amount owed, the remaining liquidated value is divided among secured and unsecured

Creditors.

E)All of the above.

A)is set to ensure senior claims are paid first.

B)is the priority rule in liquidations.

C)distributes proceeds of secured assets sales to the secured creditors first and the

Remainder to the unsecured.

D)is significant when the secured property is liquidated and cash is insufficient to cover the

Amount owed, the remaining liquidated value is divided among secured and unsecured

Creditors.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

14

Many corporations choose Reorganisation bankruptcy proceedings voluntarily because the management can:

A)take up to 120 days to file a reorganization plan.

B)continue to run the business.

C)reorganize if the required fractions of creditors approve of the plan and it is confirmed

Reorganization takes place.

D)have the advantage of not losing the tax carry-forwards.

E)All of the above.

A)take up to 120 days to file a reorganization plan.

B)continue to run the business.

C)reorganize if the required fractions of creditors approve of the plan and it is confirmed

Reorganization takes place.

D)have the advantage of not losing the tax carry-forwards.

E)All of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

15

Flow-based insolvency is:

A)A balance sheet measurement.

B)A negative equity position.

C)When operating cash flow is insufficient to meet current obligations.

D)Inability to pay one's debts.

E)Both C and D.

A)A balance sheet measurement.

B)A negative equity position.

C)When operating cash flow is insufficient to meet current obligations.

D)Inability to pay one's debts.

E)Both C and D.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

16

Prepackaged bankruptcies are:

A)described as a combination of a private workout and a liquidation.

B)the easiest way to transfer wealth to the shareholders.

C)described as a combination of a completed private workout and the formal bankruptcy

filing.

D)the inexpensive way to transfer wealth to the shareholders.

E)None of the above.

A)described as a combination of a private workout and a liquidation.

B)the easiest way to transfer wealth to the shareholders.

C)described as a combination of a completed private workout and the formal bankruptcy

filing.

D)the inexpensive way to transfer wealth to the shareholders.

E)None of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

17

Equity-based insolvency is a:

A)Income statement measurement.

B)Balance sheet measurement.

C)Only a book value measurement.

D)Both A and C.

E)Both B and C.

A)Income statement measurement.

B)Balance sheet measurement.

C)Only a book value measurement.

D)Both A and C.

E)Both B and C.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

18

Financial distress may be more expensive if the:

A)Information about the permanency of shortfall is limited.

B)Firm has many different types of creditors and other investors.

C)Firm has never entered into bankruptcy before.

D)Both A and B.

E)Both B and C.

A)Information about the permanency of shortfall is limited.

B)Firm has many different types of creditors and other investors.

C)Firm has never entered into bankruptcy before.

D)Both A and B.

E)Both B and C.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

19

Credit scoring models are used by lenders to:

A)Determine the borrowers capacity to pay.

B)Aid in the prediction of default or bankruptcy.

C)Determine the optimal debt equity ratio.

D)Both A and B.

E)Both A and C.

A)Determine the borrowers capacity to pay.

B)Aid in the prediction of default or bankruptcy.

C)Determine the optimal debt equity ratio.

D)Both A and B.

E)Both A and C.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

20

Magic Mobile Homes is to be liquidated.All creditors, both secured and unsecured, are owed €2 million.Administrative costs of liquidation and wages payments are expected to be €500,000.A

Sale of assets is expected to bring €1.8 million after all costs and taxes.Secured creditors have a

Mortgage lien for €1,200,000 on the factory which will be liquidated for €900,000 out of the sale

Proceeds.The corporate tax rate is 34%.How much and what percentage of their claim will the

Unsecured creditors receive, in total?

A)€ 100,000; 12.50%

B)€ 290,909; 36.36%

C)€ 300,000; 37.50%.

D)€ 600,000; 75.00%

E)Not enough information to answer.

Sale of assets is expected to bring €1.8 million after all costs and taxes.Secured creditors have a

Mortgage lien for €1,200,000 on the factory which will be liquidated for €900,000 out of the sale

Proceeds.The corporate tax rate is 34%.How much and what percentage of their claim will the

Unsecured creditors receive, in total?

A)€ 100,000; 12.50%

B)€ 290,909; 36.36%

C)€ 300,000; 37.50%.

D)€ 600,000; 75.00%

E)Not enough information to answer.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

21

Consider the following two statements: (i) The absolute priority rule states that senior equity holders are paid in full before other claimants.

(ii) To rule out liquidation, management of a firm can favor a corporate bankruptcy.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

(ii) To rule out liquidation, management of a firm can favor a corporate bankruptcy.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

22

In the Z score model for private firms, the Z score is calculated as Z = 0.717 (Net Working Capital/Total Assets) + 0.847 (Accumulated Retained Earnings/Total Assets) +3.10 (EBIT/Total Assets) + 0.420 (Book Value of Equity/Total Liabilities) +0.998 (Sales/Total Assets).You are part owner of a private firm, which will start to make losses.To help pay the bills, the firm considers taking out an additional loan.What do you expect to happen to the firm's Z score?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

23

At a meeting about a firm that has come under distress, equity and debt holders have gathered. One of the persons present at the meeting urges all to remember that the firm's cash flow problems are just temporary.What is this person most likely to be, an equity or a debt holder, and why?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

24

In the Z score model for private firms, the Z score is calculated as Z = 0.717 (Net Working Capital/Total Assets) + 0.847 (Accumulated Retained Earnings/Total Assets) +3.10 (EBIT/Total Assets) + 0.420 (Book Value of Equity/Total Liabilities) +0.998 (Sales/Total Assets).You are part owner of a private firm.The firm currently has a Z score of 2.60.You and the other owners have taken measures that will double the firm's profitability to 20% in the next year.What will the firm's new Z score say about its survival chances?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

25

In the Z score model for private firms, the Z score is calculated as Z = 0.717 (Net Working Capital/Total Assets) + 0.847 (Accumulated Retained Earnings/Total Assets) +3.10 (EBIT/Total Assets) + 0.420 (Book Value of Equity/Total Liabilities) +0.998 (Sales/Total Assets).You are part owner of a private firm, which currently suffers from major liquidity problems.How and where is this going to affect the firm's Z score?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

26

In the Z score model for private firms, the Z score is calculated as Z = 0.717 (Net Working Capital/Total Assets) + 0.847 (Accumulated Retained Earnings/Total Assets) +3.10 (EBIT/Total Assets) + 0.420 (Book Value of Equity/Total Liabilities) +0.998 (Sales/Total Assets).You are part owner of a private firm.The firm currently has a Z score of 2.60.You find out that you have in fact made a major mistake in the valuation of your assets, which turns out to be 20% higher than you previously had thought.Leverage remains unaffected, however, with equal shares debt and equity.Should you be worried about your firm's survival chances? Why or why not?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

27

The Here Today Corporation has applied to your bank for a loan. You have their financial statements and the revised Z-score model of:

Z = 6.56 (Net Working Capital/Total Assets) + 3.26 (Accumulated Retained Earnings/Total Assets) +6.72 (EBIT/Total Assets) + 1.05 (Book Value of Equity/Total Liabilities) where: Z < 1.23 predicts bankruptcy. A Z score between 1.23 and 2.90 indicates gray area. A Z score greater than 2.90 indicates no bankruptcy. From the financial statements you gathered net working capital of €237,500; accumulated retained earnings of €120,000; book value of equity of €950,000; total assets of €4,750,000; EBIT of €261,250; and total liabilities of €3,800,000. Should the bank lend to Here Today?

Z = 6.56 (Net Working Capital/Total Assets) + 3.26 (Accumulated Retained Earnings/Total Assets) +6.72 (EBIT/Total Assets) + 1.05 (Book Value of Equity/Total Liabilities) where: Z < 1.23 predicts bankruptcy. A Z score between 1.23 and 2.90 indicates gray area. A Z score greater than 2.90 indicates no bankruptcy. From the financial statements you gathered net working capital of €237,500; accumulated retained earnings of €120,000; book value of equity of €950,000; total assets of €4,750,000; EBIT of €261,250; and total liabilities of €3,800,000. Should the bank lend to Here Today?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

28

The management of Magic Mobile Homes has proposed to reorganize the firm.The proposal is based on a going-concern value of €2 million.The proposed financial structure is €750,000 in new

Mortgage debt, €250,000 in subordinated debt and €1,000,000 in new equity.All creditors, both

Secured and unsecured, are owed €2.5 million euros.Secured creditors have a mortgage lien for

€1,500,000 on the factory.The corporate tax rate is 34%.What will the equityholders receive if they

Had 5 million shares with a par value of €0.50 each?

A)€0

B)€35,714

C)€583,333

D)€1,000,000

E)None of the above.

Mortgage debt, €250,000 in subordinated debt and €1,000,000 in new equity.All creditors, both

Secured and unsecured, are owed €2.5 million euros.Secured creditors have a mortgage lien for

€1,500,000 on the factory.The corporate tax rate is 34%.What will the equityholders receive if they

Had 5 million shares with a par value of €0.50 each?

A)€0

B)€35,714

C)€583,333

D)€1,000,000

E)None of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

29

Consider the following two statements: (i) in the UK, the most popular way to resolve financial distress has been asset contraction.

(ii) In the UK, the least popular way to resolve financial distress has been asset expansion.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

(ii) In the UK, the least popular way to resolve financial distress has been asset expansion.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

30

Consider the following two statements: (i) in the U.S., approximately half of the financial restructurings have been done via private workouts.

(ii) in the U.S., approximately 70% of large public firms that have filed for bankruptcy continue to do

Business.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

(ii) in the U.S., approximately 70% of large public firms that have filed for bankruptcy continue to do

Business.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

31

The US legislation on bankruptcy has benefits and drawbacks, when compared to similar legislation in most other countries.Describe the most important benefit and the most important drawback.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

32

The management of Magic Mobile Homes has proposed to reorganize the firm.The proposal is based on a going-concern value of €2 million.The proposed financial structure is €750,000 in new

Mortgage debt, €250,000 in subordinated debt and €1,000,000 in new equity.All creditors, both

Secured and unsecured, are owed €2.5 million euros.Secured creditors have a mortgage lien for

€1,500,000 on the factory.The corporate tax rate is 34%.How much should the secured creditors

Receive?

A)€1,000,000

B)€1,250,000

C)€1,333,333

D)€1,500,000

E)None of the above.

Mortgage debt, €250,000 in subordinated debt and €1,000,000 in new equity.All creditors, both

Secured and unsecured, are owed €2.5 million euros.Secured creditors have a mortgage lien for

€1,500,000 on the factory.The corporate tax rate is 34%.How much should the secured creditors

Receive?

A)€1,000,000

B)€1,250,000

C)€1,333,333

D)€1,500,000

E)None of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

33

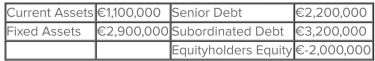

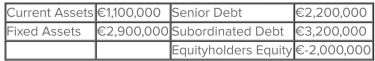

The Steel Pony Company, a maker of all-terrain recreational vehicles, is having financial difficulties due to high interest payments. The estimated "going concern" value if Steel Pony is € 4.0 million. The senior debt claim is on all fixed assets. The balance sheet of the firm is as shown:

If Steel Pony decides to file for formal bankruptcy and expects to sell the firm for the "going concern" value and pay administrative fees which amounts to 5% of the total going concern value, determine the distribution of the proceeds under the rules of absolute priority.

If Steel Pony decides to file for formal bankruptcy and expects to sell the firm for the "going concern" value and pay administrative fees which amounts to 5% of the total going concern value, determine the distribution of the proceeds under the rules of absolute priority.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

34

Consider the following two statements: (i) firms that emerge from private workouts experience share price increases that are much greater

Than those for firms emerging from formal bankruptcies.

(ii) the direct costs of formal bankruptcies are much less than the costs of private workouts.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

Than those for firms emerging from formal bankruptcies.

(ii) the direct costs of formal bankruptcies are much less than the costs of private workouts.

A)(i) is correct and (ii) is incorrect.

B)(ii) is correct and (i) is incorrect.

C)Both (i) and (ii) are correct.

D)Both (i) and (ii) are incorrect.

E)Bankrupt firms cannot continue to do business.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

35

Magic Mobile Homes is to be liquidated.All creditors, both secured and unsecured, are owed €2 million.Administrative costs of liquidation and wages payments are expected to be €500,000.A

Sale of assets is expected to bring €1.8 million after all costs and taxes.Secured creditors have a

Mortgage lien for €1,200,000 on the factory which will be liquidated for €900,000 out of the sale

Proceeds.The corporate tax rate is 34%.How much and what percentage of their claim will the

Secured creditors receive, in total?

A)€ 900,000; 75%

B)€ 981,818; 81.82%

C)€1,009,091; 84.1%

D)€1,200,000; 100%

E)Not enough information to answer.

Sale of assets is expected to bring €1.8 million after all costs and taxes.Secured creditors have a

Mortgage lien for €1,200,000 on the factory which will be liquidated for €900,000 out of the sale

Proceeds.The corporate tax rate is 34%.How much and what percentage of their claim will the

Secured creditors receive, in total?

A)€ 900,000; 75%

B)€ 981,818; 81.82%

C)€1,009,091; 84.1%

D)€1,200,000; 100%

E)Not enough information to answer.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

36

The management of Magic Mobile Homes has proposed to reorganize the firm.The proposal is based on a going-concern value of €2 million.The proposed financial structure is €750,000 in new

Mortgage debt, €250,000 in subordinated debt and €1,000,000 in new equity.All creditors, both

Secured and unsecured, are owed €2.5 million euros.Secured creditors have a mortgage lien for

€1,500,000 on the factory.The corporate tax rate is 34%.How much should the unsecured

Creditors receive?

A)€ 500,000

B)€ 667,000

C)€ 750,000

D)€1,000,000

E)None of the above.

Mortgage debt, €250,000 in subordinated debt and €1,000,000 in new equity.All creditors, both

Secured and unsecured, are owed €2.5 million euros.Secured creditors have a mortgage lien for

€1,500,000 on the factory.The corporate tax rate is 34%.How much should the unsecured

Creditors receive?

A)€ 500,000

B)€ 667,000

C)€ 750,000

D)€1,000,000

E)None of the above.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck