Deck 12: Risk, Cost of Capital and Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

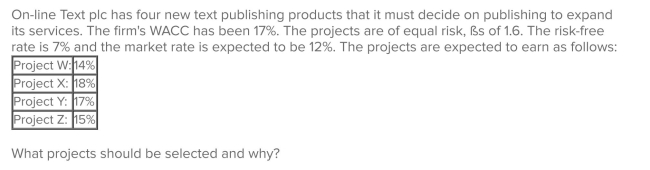

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 12: Risk, Cost of Capital and Capital Budgeting

1

The best fit line of a pairwise plot of the returns of the security against the market index returns is called the:

A)Security Market Line.

B)Capital Market Line.

C)Characteristic line.

D)Risk line.

E)None of the above.

A)Security Market Line.

B)Capital Market Line.

C)Characteristic line.

D)Risk line.

E)None of the above.

Characteristic line.

2

Using the CAPM to calculate the cost of capital for a risky project assumes that:

A)using the firm's beta is the same measure of risk as the project.

B)the firm is all-equity financed.

C)the financial risk is equal to business risk.

D)Both A and B.

E)Both A and C.

A)using the firm's beta is the same measure of risk as the project.

B)the firm is all-equity financed.

C)the financial risk is equal to business risk.

D)Both A and B.

E)Both A and C.

Both A and B.

3

A security's beta represents the:

A)direction of the market variance.

B)overall cycle of the market.

C)variance of the market and asset, but not their co-movement.

D)covariance of the security with the market and how they are correlated.

E)All of the above.

A)direction of the market variance.

B)overall cycle of the market.

C)variance of the market and asset, but not their co-movement.

D)covariance of the security with the market and how they are correlated.

E)All of the above.

covariance of the security with the market and how they are correlated.

4

The problem of using the overall firm's beta in discounting projects of different risk is the:

A)firm would accept too many high-risk projects.

B)firm would reject too many low risk projects.

C)firm would reject too many high-risk projects.

D)firm would accept too many low risk projects.

E)Both A and B.

A)firm would accept too many high-risk projects.

B)firm would reject too many low risk projects.

C)firm would reject too many high-risk projects.

D)firm would accept too many low risk projects.

E)Both A and B.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

The capital cost to a firm is estimated as the:

A)reward to risk ratio for the firm.

B)expected capital gains yield for the equity.

C)expected capital gains yield for the firm.

D)portfolio beta for the firm.

E)weighted average cost of capital (WACC).

A)reward to risk ratio for the firm.

B)expected capital gains yield for the equity.

C)expected capital gains yield for the firm.

D)portfolio beta for the firm.

E)weighted average cost of capital (WACC).

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

The asset beta of a levered firm is generally:

A)equal to the equity beta.

B)different from the equity beta.

C)different from the debt beta.

D)the simple average of the equity beta and debt beta.

E)Both B and C.

A)equal to the equity beta.

B)different from the equity beta.

C)different from the debt beta.

D)the simple average of the equity beta and debt beta.

E)Both B and C.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

Comparing two otherwise equal firms, the beta of the common equity of a levered firm is ____________ than the beta of the common equity of an unlevered firm.

A)equal to

B)significantly less

C)slightly less

D)greater

E)None of the above.

A)equal to

B)significantly less

C)slightly less

D)greater

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

Betas may vary substantially across an industry.The decision to use the industry or firm beta: to estimate the cost of capital depends on

A)how small the estimation errors are of all betas across industries.

B)how similar the firm's operations are to the operations of all other firms in the industry.

C)whether the company is a leader or follower.

D)the size of the company's public float.

E)None of the above.

A)how small the estimation errors are of all betas across industries.

B)how similar the firm's operations are to the operations of all other firms in the industry.

C)whether the company is a leader or follower.

D)the size of the company's public float.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

For a multi-product firm, if a project's beta is different from that of the overall firm, then the:

A)CAPM can no longer be used.

B)project should be discounted using the overall firm's beta.

C)project should be discounted at a rate commensurate with its own beta.

D)project should be discounted at the market rate.

E)project should be discounted at the T-bill rate.

A)CAPM can no longer be used.

B)project should be discounted using the overall firm's beta.

C)project should be discounted at a rate commensurate with its own beta.

D)project should be discounted at the market rate.

E)project should be discounted at the T-bill rate.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

If the risk of an investment project is different than the firm's risk then:

A)you must adjust the discount rate for the project based on the firm's risk.

B)you must adjust the discount rate for the project based on the project risk.

C)you must exercise risk aversion and use the market rate.

D)an average rate across prior projects is acceptable because estimates contain errors.

E)one must have the actual data to determine any differences in the calculations.

A)you must adjust the discount rate for the project based on the firm's risk.

B)you must adjust the discount rate for the project based on the project risk.

C)you must exercise risk aversion and use the market rate.

D)an average rate across prior projects is acceptable because estimates contain errors.

E)one must have the actual data to determine any differences in the calculations.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

The slope of the characteristic line is the estimated:

A)intercept.

B)beta.

C)unsystematic risk.

D)market variance.

E)market risk premium.

A)intercept.

B)beta.

C)unsystematic risk.

D)market variance.

E)market risk premium.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

The weighted average cost of capital (WACC) for a firm is usually used as its corporate discount rate because WACC is the:

A)discount rate which the firm should apply to all of the projects it undertakes.

B)overall rate which the firm must earn on its existing assets to maintain the value of its

Equity.

C)rate the firm should expect to pay on its next bond issue.

D)maximum rate which the firm should require on any projects it undertakes.

E)rate of return that the firm's preference shareholders should expect to earn over the long

Term.

A)discount rate which the firm should apply to all of the projects it undertakes.

B)overall rate which the firm must earn on its existing assets to maintain the value of its

Equity.

C)rate the firm should expect to pay on its next bond issue.

D)maximum rate which the firm should require on any projects it undertakes.

E)rate of return that the firm's preference shareholders should expect to earn over the long

Term.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

Companies that have highly cyclical sales will have a:

A)low beta if sales are highly dependent on the market cycle.

B)high beta if sales are highly dependent on the market cycle.

C)high beta if sales are independent on the market cycle.

D)low beta if sales are independent on the market cycle.

E)None of the above.

A)low beta if sales are highly dependent on the market cycle.

B)high beta if sales are highly dependent on the market cycle.

C)high beta if sales are independent on the market cycle.

D)low beta if sales are independent on the market cycle.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

It is incorrect to use the firm's discount rate when valuing a new project because:

A)you must adjust the discount rate for the project based on the firm's risk.

B)you must adjust the discount rate for the project based on the project risk.

C)you must exercise risk aversion and use the market rate.

D)an average rate across prior projects is acceptable because estimates contain errors.

E)one must have the actual data to determine any differences in the calculations.

A)you must adjust the discount rate for the project based on the firm's risk.

B)you must adjust the discount rate for the project based on the project risk.

C)you must exercise risk aversion and use the market rate.

D)an average rate across prior projects is acceptable because estimates contain errors.

E)one must have the actual data to determine any differences in the calculations.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

The beta of a security provides an:

A)estimate of the market risk premium.

B)estimate of the slope of the Capital Market Line.

C)estimate of the slope of the Security Market Line.

D)estimate of the systematic risk of the security.

E)None of the above.

A)estimate of the market risk premium.

B)estimate of the slope of the Capital Market Line.

C)estimate of the slope of the Security Market Line.

D)estimate of the systematic risk of the security.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

Beta is useful in the calculation of the:

A)company's variance.

B)company's discount rate.

C)company's standard deviation.

D)unsystematic risk.

E)company's market rate.

A)company's variance.

B)company's discount rate.

C)company's standard deviation.

D)unsystematic risk.

E)company's market rate.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

The weighted average cost of capital for a firm is the:

A)discount rate which the firm should apply to all of the projects it undertakes.

B)overall rate which the firm must earn on its existing assets to maintain the value of its

Equity.

C)rate the firm should expect to pay on its next bond issue.

D)maximum rate which the firm should require on any projects it undertakes.

E)rate of return that the firm's preference shareholders should expect to earn over the long

Term.

A)discount rate which the firm should apply to all of the projects it undertakes.

B)overall rate which the firm must earn on its existing assets to maintain the value of its

Equity.

C)rate the firm should expect to pay on its next bond issue.

D)maximum rate which the firm should require on any projects it undertakes.

E)rate of return that the firm's preference shareholders should expect to earn over the long

Term.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

Beta measures depend highly on the:

A)direction of the market variance.

B)overall cycle of the market.

C)variance of the market and asset, but not their co-movement.

D)covariance of the security with the market and how they are correlated.

E)All of the above.

A)direction of the market variance.

B)overall cycle of the market.

C)variance of the market and asset, but not their co-movement.

D)covariance of the security with the market and how they are correlated.

E)All of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

The use of debt is called:

A)operating leverage.

B)production leverage.

C)financial leverage.

D)total asset turnover risk.

E)business risk.

A)operating leverage.

B)production leverage.

C)financial leverage.

D)total asset turnover risk.

E)business risk.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

The weighted average of the firm's costs of equity, preference shares, and after tax debt is the:

A)reward to risk ratio for the firm.

B)expected capital gains yield for the equity.

C)expected capital gains yield for the firm.

D)portfolio beta for the firm.

E)weighted average cost of capital (WACC).

A)reward to risk ratio for the firm.

B)expected capital gains yield for the equity.

C)expected capital gains yield for the firm.

D)portfolio beta for the firm.

E)weighted average cost of capital (WACC).

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

Consolidated Transfer is an all-equity financed firm.The beta is .75, the market risk premium is 8% and the risk-free rate is 4%.What is the expected return of Consolidated?

A)7%

B)8%

C)9%

D)10%

E)13%

A)7%

B)8%

C)9%

D)10%

E)13%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

Slippery Slope Roof Contracting has an equity beta of 1.2, capital structure with 2/3 debt, and a zero tax rate.What is its asset beta?

A)0.40

B)0.72

C)1.20

D)1.80

E)None of the above.

A)0.40

B)0.72

C)1.20

D)1.80

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

Jake's Sound Systems has 210,000 shares of ordinary equity outstanding at a market price of £36 a share.Last month, Jake's paid an annual dividend in the amount of £1.593 per share.The dividend

Growth rate is 4%.Jake's also has 6,000 bonds outstanding with a face value of £1,000 per bond.

The bonds carry a 7 % coupon, pay interest annually, and mature in 4.89 years.The bonds are

Selling at 99% of face value.The company's tax rate is 34%.What is Jake's weighted average cost of

Capital?

A)5.3%

B)5.8%

C)6.3%

D)6.9%

E)7.2%

Growth rate is 4%.Jake's also has 6,000 bonds outstanding with a face value of £1,000 per bond.

The bonds carry a 7 % coupon, pay interest annually, and mature in 4.89 years.The bonds are

Selling at 99% of face value.The company's tax rate is 34%.What is Jake's weighted average cost of

Capital?

A)5.3%

B)5.8%

C)6.3%

D)6.9%

E)7.2%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

A firm with cyclical earnings is characterized by:

A)revenue patterns that vary with the business cycle.

B)high levels of debt in its capital structure.

C)high fixed costs.

D)high price per unit.

E)low contribution margins.

A)revenue patterns that vary with the business cycle.

B)high levels of debt in its capital structure.

C)high fixed costs.

D)high price per unit.

E)low contribution margins.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

If a firm has low fixed costs relative to all other firms in the same industry, a large change in sales volume (either up or down) would have:

A)a smaller change in EBIT for the firm versus the other firms.

B)no effect in any way on the firms as volume does not effect fixed costs.

C)a decreasing effect on the cyclical nature of the business.

D)a larger change in EBIT for the firm versus the other firms.

E)None of the above.

A)a smaller change in EBIT for the firm versus the other firms.

B)no effect in any way on the firms as volume does not effect fixed costs.

C)a decreasing effect on the cyclical nature of the business.

D)a larger change in EBIT for the firm versus the other firms.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

26

Phil's Carvings wants to have a weighted average cost of capital of 9%.The firm has an after-tax cost of debt of 5 %and a cost of equity of 11%.What debt-equity ratio is needed for the firm to

Achieve its targeted weighted average cost of capital?

A).33

B).40

C).50

D).60

E).67

Achieve its targeted weighted average cost of capital?

A).33

B).40

C).50

D).60

E).67

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

Jack's Construction Co.has 80,000 bonds outstanding that are selling at par value of £1,000 per bond.Bonds with similar characteristics are yielding 8.5%.The company also has 4 million shares of

Common equity outstanding.The equity has a beta of 1.1 and sells for £40 a share.Treasury bills are

Yielding 4% and the market risk premium is 8%.Jack's tax rate is 35%.What is Jack's weighted

Average cost of capital?

A)7.10 %

B)7.39 %

C)10.38 %

D)10.65 %

E)11.37 %

Common equity outstanding.The equity has a beta of 1.1 and sells for £40 a share.Treasury bills are

Yielding 4% and the market risk premium is 8%.Jack's tax rate is 35%.What is Jack's weighted

Average cost of capital?

A)7.10 %

B)7.39 %

C)10.38 %

D)10.65 %

E)11.37 %

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose Barges plc's equity has an expected return of 12%.Assume that the risk-free rate is 5%, and the market risk premium is 6%.If no unsystematic influence affected Barges' return, the beta for

Barges is ______ .

A)1.00

B)1.17

C)1.20

D)2.50

E)It is impossible to calculate with the information given

Barges is ______ .

A)1.00

B)1.17

C)1.20

D)2.50

E)It is impossible to calculate with the information given

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

All else equal, a more liquid equity will have a lower ________.

A)beta

B)market premium

C)cost of capital

D)Both A and B.

E)Both A and C.

A)beta

B)market premium

C)cost of capital

D)Both A and B.

E)Both A and C.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

The beta of a firm is determined by which of the following firm characteristics?

A)Cycles in revenues.

B)Operating leverage.

C)Financial leverage.

D)All of the above.

E)None of the above.

A)Cycles in revenues.

B)Operating leverage.

C)Financial leverage.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

Assuming the CAPM or one-factor model holds, what is the cost of equity for a firm if the firm's equity has a beta of 1.2, the risk-free rate of return is 2%, the expected return on the market is 9%,

And the return to the company's debt is 7%?

A)10.4%

B)10.8%

C)12.8%

D)14.4%

E)None of the above.

And the return to the company's debt is 7%?

A)10.4%

B)10.8%

C)12.8%

D)14.4%

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

The beta of a firm is more likely to be high under what two conditions?

A)High cyclical business activity and low operating leverage.

B)High cyclical business activity and high operating leverage.

C)Low cyclical business activity and low financial leverage.

D)Low cyclical business activity and low operating leverage.

E)None of the above.

A)High cyclical business activity and low operating leverage.

B)High cyclical business activity and high operating leverage.

C)Low cyclical business activity and low financial leverage.

D)Low cyclical business activity and low operating leverage.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

For the levered firm the equity beta is __________ the asset beta.

A)greater than

B)less than

C)equal to

D)sometimes greater than and sometimes less than

E)None of the above.

A)greater than

B)less than

C)equal to

D)sometimes greater than and sometimes less than

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

When a specialist is caught in the middle of a trade between an informed and an uniformed traders which effectively eliminates the spread or causes a loss is subject to:

A)market impact costs.

B)adverse selection.

C)broker's quotation bias.

D)increasing the number of uninformed traders.

E)None of the above.

A)market impact costs.

B)adverse selection.

C)broker's quotation bias.

D)increasing the number of uninformed traders.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

The cost of equity for Ryan Corporation is 8.4%.If the expected return on the market is 10% and the risk-free rate is 5%, then the equity beta is ___.

A)0.48

B)0.68

C)1.25

D)1.68

E)Impossible to calculate with information given

A)0.48

B)0.68

C)1.25

D)1.68

E)Impossible to calculate with information given

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

Two equity market based costs of liquidity that affects the cost of capital are the:

A)bid-ask spread and the specialist spread.

B)market impact cost and the brokerage costs.

C)investor opportunity cost and the brokerage costs.

D)bid-ask spread and the market impact costs.

E)None of the above.

A)bid-ask spread and the specialist spread.

B)market impact cost and the brokerage costs.

C)investor opportunity cost and the brokerage costs.

D)bid-ask spread and the market impact costs.

E)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose that Simmons plc's ordinary equity has a beta of 1.6.If the risk-free rate is 5% and the market risk premium is 4%, the expected return on Simmons' equity is:

A)4.0%.

B)5.0%.

C)5.6%.

D)10.6%.

E)11.4%.

A)4.0%.

B)5.0%.

C)5.6%.

D)10.6%.

E)11.4%.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

Peter's Audio Shop has a cost of debt of 7%, a cost of equity of 11%, and a cost of preference shares of 8%.The firm has 104,000 shares of ordinary equity outstanding at a market price of £20 a share.

There are 40,000 preference shares outstanding at a market price of £34 a share.The bond issue

Has a total face value of £500,000 and sells at 102% of face value.The tax rate is 34%.What is the

Weighted average cost of capital for Peter's Audio Shop?

A)6.14%

B)6.54%

C)8.60%

D)9.14%

E)9.45%

There are 40,000 preference shares outstanding at a market price of £34 a share.The bond issue

Has a total face value of £500,000 and sells at 102% of face value.The tax rate is 34%.What is the

Weighted average cost of capital for Peter's Audio Shop?

A)6.14%

B)6.54%

C)8.60%

D)9.14%

E)9.45%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

A firm with high operating leverage is characterized by __________ while one with high financial leverage is characterized by __________.

A)low fixed cost of production; low fixed financial costs

B)high variable cost of production; high variable financial costs

C)high fixed costs of production; high fixed financial costs

D)low costs of production; high fixed financial costs

E)high fixed costs of production; low variable financial costs

A)low fixed cost of production; low fixed financial costs

B)high variable cost of production; high variable financial costs

C)high fixed costs of production; high fixed financial costs

D)low costs of production; high fixed financial costs

E)high fixed costs of production; low variable financial costs

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

A firm with high operating leverage has:

A)low fixed costs in its production process.

B)high variable costs in its production process.

C)high fixed costs in its production process.

D)high price per unit.

E)low price per unit.

A)low fixed costs in its production process.

B)high variable costs in its production process.

C)high fixed costs in its production process.

D)high price per unit.

E)low price per unit.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

Explain the factors that determine beta and how an asset beta can differ from equity betas.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

Neptune plc offers network communications systems to computer users.The company is planning a major investment expansion but is unsure of the correct measure of equity capital as it has no traded equity.Your job is to determine the basis of the equity cost.List and explain the steps you will need to take.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

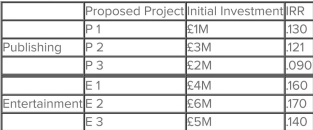

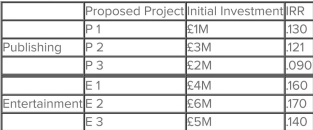

rate for capital budgeting purposes. However, its two divisions - publishing and entertainment - have different degrees of risk given by B P=1.0, BE =2.0, and the beta for the overall firm is 1.3. The firm is considering the following capital expenditures:

Which projects would the firm accept if it uses the opportunity cost of capital for the entire company? Which projects would it accept if it estimates cost of capital separately for each division? Use 6% as the risk-free rate and 12% as the expected return on the market.

Which projects would the firm accept if it uses the opportunity cost of capital for the entire company? Which projects would it accept if it estimates cost of capital separately for each division? Use 6% as the risk-free rate and 12% as the expected return on the market.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

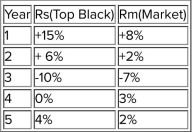

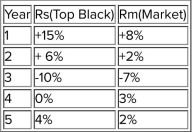

Given the sample of returns of Top Black Tar plc and the FTSE 100 index, calculate Top Black's covariance and beta.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

46

Given the sample of returns of Top Black Tar plc and the FTSE 100 index, calculate Top Black's correlation.What can be said about the relationship of Top Black and the market return behavior?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

NuPress Valet has an improved version of its hotel stand.The investment cost is expected to be £72 million and will return £13.5 million for 5 years in net cash flows.The ratio of debt to equity is 1

To 1.The cost of equity is 13%, the cost of debt is 9%, and the tax rate is 34%.The appropriate

Discount rate, assuming average risk, is:

A)8.65%

B)9%

C)9.47%

D)10.5%

E)13%

To 1.The cost of equity is 13%, the cost of debt is 9%, and the tax rate is 34%.The appropriate

Discount rate, assuming average risk, is:

A)8.65%

B)9%

C)9.47%

D)10.5%

E)13%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

The Template Corporation has an equity beta of 1.2 and a debt beta of .8.The firm's market value debt to equity ratio is .6.Template has a zero tax rate.What is the asset beta?

A)0.70

B)0.72

C)0.96

D)1.04

E)1.05

A)0.70

B)0.72

C)0.96

D)1.04

E)1.05

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck