Deck 19: Financial Reporting Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 19: Financial Reporting Issues

1

Reporting entity. The Urban Development Authority (UDA) was created as a separate legal entity by an act of the state legislature and ''activated'' by action of the city council to plan and develop the downtown area of the city and to attract new businesses and residents. The governing board of the authority is appointed by the city council for fixed terms. The UDA has the complete authority to hire management and all other employees. There is no significant continuing relationship between the city and the authority for carrying out day-to-day functions.

The authority is a separate body and levies taxes against the property owners within the designated development district and may hold referendums of its constituents (for bond issues, tax increases, and so forth). The authority's levy and the levies of the city are independent of each other and are related only by the fact that they are levied against a common tax base within the authority's geographic boundaries. Property taxes from the authority's levy are its primary revenue source.

The city council receives the annual budget of the authority for informational purposes, but in the opinion of the city's legal counsel has no option except to ''approve'' the budget. Approval is considered to be a formality. The city is under no obligation to finance operating deficits of the authority and does not have claim to any surpluses. The authority has the power to issue bonds for its lawful purposes. The city has no responsibility for the debt of the authority.

Using the flowchart shown in Illustration 17-2, indicate whether or not the city should incorporate the Urban Development Authority into its own financial statements. If so, how would the city accomplish this?

The authority is a separate body and levies taxes against the property owners within the designated development district and may hold referendums of its constituents (for bond issues, tax increases, and so forth). The authority's levy and the levies of the city are independent of each other and are related only by the fact that they are levied against a common tax base within the authority's geographic boundaries. Property taxes from the authority's levy are its primary revenue source.

The city council receives the annual budget of the authority for informational purposes, but in the opinion of the city's legal counsel has no option except to ''approve'' the budget. Approval is considered to be a formality. The city is under no obligation to finance operating deficits of the authority and does not have claim to any surpluses. The authority has the power to issue bonds for its lawful purposes. The city has no responsibility for the debt of the authority.

Using the flowchart shown in Illustration 17-2, indicate whether or not the city should incorporate the Urban Development Authority into its own financial statements. If so, how would the city accomplish this?

Conditions :

• The governing board of the authority is appointed by the city council for fixed terms.

• The Urban Development Authority (UDA) has the complete authority to hire management and all other employees.

• There is no significant continuing relationship between the city and the authority for carrying out day-to-day functions.

• The authority is a separate body and levies taxes against the property owners within the designated development district.

Authority's levy:

• The authority's levy and the levies of the city are independent of each other and are related only by the fact that they are levied against a common tax base within the authority's geographic boundaries.

• Property taxes from the authority's levy are its primary revenue source.

• The authority has the power to issue bonds for its lawful purposes.

Information of the City :

• The city council receives the annual budget of the authority for informational purposes.

• The city's legal counsel has no option except to "approve" the budget. Approval is considered to be a formality.

• The city is under no obligation to finance operating deficits of the authority and does not have claim for any surpluses.

• The city has no responsibility for the debt of the authority.

Required :

The city should incorporate the Urban Development Authority into its own financial statements.

Suggestions :

• The authority is not a component unit but should be disclosed as a related organization.

• The city appoints the authority to separate the governing board, but it is not financially accountable for the authority.

• The budgetary approval authority is not substantive.

• There are no other indications that the city can impose its will on the Urban Development Authority.

• The city is not entitled to surplus of the authority and is not obligated for its deficits or debts.

• There is no financial benefit or burden relationship.

• The governing board of the authority is appointed by the city council for fixed terms.

• The Urban Development Authority (UDA) has the complete authority to hire management and all other employees.

• There is no significant continuing relationship between the city and the authority for carrying out day-to-day functions.

• The authority is a separate body and levies taxes against the property owners within the designated development district.

Authority's levy:

• The authority's levy and the levies of the city are independent of each other and are related only by the fact that they are levied against a common tax base within the authority's geographic boundaries.

• Property taxes from the authority's levy are its primary revenue source.

• The authority has the power to issue bonds for its lawful purposes.

Information of the City :

• The city council receives the annual budget of the authority for informational purposes.

• The city's legal counsel has no option except to "approve" the budget. Approval is considered to be a formality.

• The city is under no obligation to finance operating deficits of the authority and does not have claim for any surpluses.

• The city has no responsibility for the debt of the authority.

Required :

The city should incorporate the Urban Development Authority into its own financial statements.

Suggestions :

• The authority is not a component unit but should be disclosed as a related organization.

• The city appoints the authority to separate the governing board, but it is not financially accountable for the authority.

• The budgetary approval authority is not substantive.

• There are no other indications that the city can impose its will on the Urban Development Authority.

• The city is not entitled to surplus of the authority and is not obligated for its deficits or debts.

• There is no financial benefit or burden relationship.

2

Measurement focus: comparing statements. Under the reporting model required by GASB Statement No. 34, fund statements are required for governmental, proprietary, and fiduciary funds. Government-wide statements include the statement of net assets and the statement of activities.

1. Explain the measurement focus and basis of accounting for governmental fund statements, proprietary fund statements, fiduciary fund statements, and government-wide statements.

2. Explain some differences between fund financial statements and government-wide statements with regard to component units, fiduciary funds, and location of internal service funds.

3. What should be included in the statement of net assets categories invested in capital assets, net of related debt, restricted, and unrestricted?

1. Explain the measurement focus and basis of accounting for governmental fund statements, proprietary fund statements, fiduciary fund statements, and government-wide statements.

2. Explain some differences between fund financial statements and government-wide statements with regard to component units, fiduciary funds, and location of internal service funds.

3. What should be included in the statement of net assets categories invested in capital assets, net of related debt, restricted, and unrestricted?

Differences between fund financial statements and government-wide statements:

Differences between fund financial statements and government-wide statements with regard to component units, fiduciary funds, and location of internal service funds are as follows:

Component Units: In case of fund financial statements, only blended component units are considered. But, government-wide statement considers both blended and discrete component units.

Fiduciary Funds: Fiduciary statements adopt economic resources and full-accrual basis of accounting. Fiduciary funds statement includes both statement of net assets and statement of changes in net assets. Fiduciary funds are not included in the government-wide statement.

Locations of Internal Service Funds: Internal service funds are proprietary funds that adopt economic resources and full-accrual basis of accounting. In fund financial statements, internal funds are included in the proprietary fund statement. In government-wide statements, internal service funds are included in the governmental activities.

Amounts included in the statement of net asset categories invested in capital assets, net of related debt, restricted and unrestricted are as follows :

Invested in capital (fixed) assets, net of related debt

= Fixed Asset of the Fund - Asset-related debt (Current and Long-term)Restricted = External Restricted Assets - Liabilities Payable from Restricted Assets

Unrestricted = Remaining Assets - Remaining Liabilities

= Reclassifying the assets after government satisfies restriction

Differences between fund financial statements and government-wide statements with regard to component units, fiduciary funds, and location of internal service funds are as follows:

Component Units: In case of fund financial statements, only blended component units are considered. But, government-wide statement considers both blended and discrete component units.

Fiduciary Funds: Fiduciary statements adopt economic resources and full-accrual basis of accounting. Fiduciary funds statement includes both statement of net assets and statement of changes in net assets. Fiduciary funds are not included in the government-wide statement.

Locations of Internal Service Funds: Internal service funds are proprietary funds that adopt economic resources and full-accrual basis of accounting. In fund financial statements, internal funds are included in the proprietary fund statement. In government-wide statements, internal service funds are included in the governmental activities.

Amounts included in the statement of net asset categories invested in capital assets, net of related debt, restricted and unrestricted are as follows :

Invested in capital (fixed) assets, net of related debt

= Fixed Asset of the Fund - Asset-related debt (Current and Long-term)Restricted = External Restricted Assets - Liabilities Payable from Restricted Assets

Unrestricted = Remaining Assets - Remaining Liabilities

= Reclassifying the assets after government satisfies restriction

3

What are major funds? Describe major fund reporting.

Reporting of Major Fund:

According to Governmental Accounting Standards Board (GASB) Statement Number 34:

• Major fund reporting simplifies the presentation of fund information and emphasizes more on the major activities that occur in an organization.

• Major funds are presented individually and all other funds are combined into a single column.

• Major fund reporting is applicable only to governmental and enterprise funds.

According to Governmental Accounting Standards Board (GASB) Statement Number 34:

• Major fund reporting simplifies the presentation of fund information and emphasizes more on the major activities that occur in an organization.

• Major funds are presented individually and all other funds are combined into a single column.

• Major fund reporting is applicable only to governmental and enterprise funds.

4

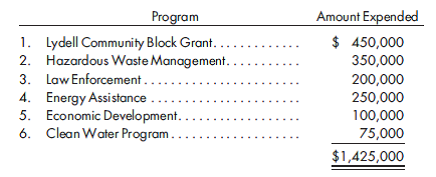

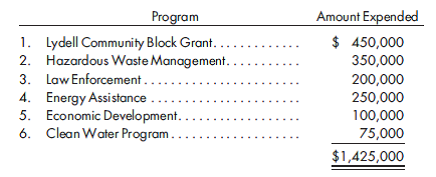

Audit concerns. The city of Lydell expended federal awards from the following programs during 2019.

Assume the auditor has given an unqualified opinion on the financial statements and reports no material weaknesses or reportable conditions in internal control at the financial statement level. Also, assume the auditor has given an unqualified opinion on the schedule of expenditures of federal awards. Programs 2 and 4 are classified as low risk, and Program 6 was not assessed for risk due to its small size.

1. Which programs should the auditor audit as major programs for the purpose of internal control evaluation and compliance testing for the year 2019?

2. How would your answer differ if Program 2 was classified as high risk?

Assume the auditor has given an unqualified opinion on the financial statements and reports no material weaknesses or reportable conditions in internal control at the financial statement level. Also, assume the auditor has given an unqualified opinion on the schedule of expenditures of federal awards. Programs 2 and 4 are classified as low risk, and Program 6 was not assessed for risk due to its small size.

1. Which programs should the auditor audit as major programs for the purpose of internal control evaluation and compliance testing for the year 2019?

2. How would your answer differ if Program 2 was classified as high risk?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

Government-wide financial statements. Select the best answer to the following multiple-choice questions:

1. Which of the following adjustments would likely be made when moving from governmental funds financial statements to government-wide financial statements?

a. Record an additional expense for compensated absences

b. Record an additional expense related to salaries earned at year-end

c. Both of the above

d. Neither of the above

2. Which of the following adjustments is necessary to move from governmental fund financial statements to government-wide financial statements?

a. Eliminate expenditures for debt principal

b. Eliminate expenditures for capital outlay and add depreciation expense

c. Both of the above

d. Neither of the above

3. Which of the following is true regarding government-wide financial statements?

a. Internal service funds are normally included with governmental-type activities.

b. Component units and fiduciary funds are not included.

c. Both of the above

d. Neither of the above

4. Which of the following is true regarding government-wide financial statements?

a. All capital assets, including infrastructure, are required to be reported.

b. Internal service funds are not included.

c. Both of the above

d. Neither of the above

5. Which of the following is true regarding government-wide financial statements?

a. Internal service funds are not included with governmental-type activities.

b. Component units and fiduciary funds are not included.

c. Both of the above

d. Neither of the above

6. Which of the following must exist in order for a government to use the modified approach for recording infrastructure?

a. An up-to-date inventory of eligible infrastructure assets must be maintained.

b. A condition assessment must be performed at least every three years.

c. Both of the above

d. Neither of the above

7. Which of the following would be considered a program revenue in the statement of activities for a governmental unit?

a. A grant from the state restricted for an after-school child care program

b. Hotel taxes restricted for tourist development

c. Both of the above

d. Neither of the above

8. Which of the following is true regarding the incorporation of internal service funds into government-wide financial statements?

a. Internal service funds are not included in the government-wide financial statements.

b. Internal service funds are incorporated into the business-type activities section of the government-wide financial statements.

c. Both of the above

d. Neither of the above

9. Which of the following is true about the reconciliation from governmental fund changes in fund balances to governmental activities changes in net assets?

a. Reconciliation is required to be presented either on the face of the fund financial statement or as a separate statement.

b. The reconciliation converts from modified accrual to full accrual.

c. Both of the above

d. Neither of the above

10. Which of the following is true regarding government-wide financial statements?

a. The government-wide statements include a statement of net assets, a statement of activities, and a statement of cash flows.

b. The government-wide statements include a statement of net assets and a statement of activities, but not a statement of cash flows.

c. The government-wide statements include a balance sheet, an income statement, and a statement of cash flows.

d. None of the above

1. Which of the following adjustments would likely be made when moving from governmental funds financial statements to government-wide financial statements?

a. Record an additional expense for compensated absences

b. Record an additional expense related to salaries earned at year-end

c. Both of the above

d. Neither of the above

2. Which of the following adjustments is necessary to move from governmental fund financial statements to government-wide financial statements?

a. Eliminate expenditures for debt principal

b. Eliminate expenditures for capital outlay and add depreciation expense

c. Both of the above

d. Neither of the above

3. Which of the following is true regarding government-wide financial statements?

a. Internal service funds are normally included with governmental-type activities.

b. Component units and fiduciary funds are not included.

c. Both of the above

d. Neither of the above

4. Which of the following is true regarding government-wide financial statements?

a. All capital assets, including infrastructure, are required to be reported.

b. Internal service funds are not included.

c. Both of the above

d. Neither of the above

5. Which of the following is true regarding government-wide financial statements?

a. Internal service funds are not included with governmental-type activities.

b. Component units and fiduciary funds are not included.

c. Both of the above

d. Neither of the above

6. Which of the following must exist in order for a government to use the modified approach for recording infrastructure?

a. An up-to-date inventory of eligible infrastructure assets must be maintained.

b. A condition assessment must be performed at least every three years.

c. Both of the above

d. Neither of the above

7. Which of the following would be considered a program revenue in the statement of activities for a governmental unit?

a. A grant from the state restricted for an after-school child care program

b. Hotel taxes restricted for tourist development

c. Both of the above

d. Neither of the above

8. Which of the following is true regarding the incorporation of internal service funds into government-wide financial statements?

a. Internal service funds are not included in the government-wide financial statements.

b. Internal service funds are incorporated into the business-type activities section of the government-wide financial statements.

c. Both of the above

d. Neither of the above

9. Which of the following is true about the reconciliation from governmental fund changes in fund balances to governmental activities changes in net assets?

a. Reconciliation is required to be presented either on the face of the fund financial statement or as a separate statement.

b. The reconciliation converts from modified accrual to full accrual.

c. Both of the above

d. Neither of the above

10. Which of the following is true regarding government-wide financial statements?

a. The government-wide statements include a statement of net assets, a statement of activities, and a statement of cash flows.

b. The government-wide statements include a statement of net assets and a statement of activities, but not a statement of cash flows.

c. The government-wide statements include a balance sheet, an income statement, and a statement of cash flows.

d. None of the above

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

Reporting entities. Based on the following very limited information, indicate whether and how the city should report its related entity.

1. Its school district, although not a legally separate government, is managed by a school board elected by city residents. The system is financed with general tax revenues of the city, and its budget is incorporated into that of the city at large (and thereby is subject to the same approval and appropriation process as other city expenditures).

2. Its fixed asset financing authority is a legally separate government that leases equipment to the city. To finance the equipment, the authority issues bonds that are guaranteed by the city and expected to be paid from the rents received from the city. The authority leases equipment exclusively to the city.

3. Its housing authority, which provides loans to low-income families within the city, is governed by a 5-person board appointed by the city's mayor.

4. Its hospital is owned by the city but managed under contract by a private hospital management firm.

5. Its water purification plant is owned in equal shares by the city and two neighboring counties. The city's interest in the plant was acquired with resources from its water utility (enterprise) fund.

6. Its community college, a separate legal entity, is governed by a board of governors elected by city residents and has its own taxing and budgetary authority.

1. Its school district, although not a legally separate government, is managed by a school board elected by city residents. The system is financed with general tax revenues of the city, and its budget is incorporated into that of the city at large (and thereby is subject to the same approval and appropriation process as other city expenditures).

2. Its fixed asset financing authority is a legally separate government that leases equipment to the city. To finance the equipment, the authority issues bonds that are guaranteed by the city and expected to be paid from the rents received from the city. The authority leases equipment exclusively to the city.

3. Its housing authority, which provides loans to low-income families within the city, is governed by a 5-person board appointed by the city's mayor.

4. Its hospital is owned by the city but managed under contract by a private hospital management firm.

5. Its water purification plant is owned in equal shares by the city and two neighboring counties. The city's interest in the plant was acquired with resources from its water utility (enterprise) fund.

6. Its community college, a separate legal entity, is governed by a board of governors elected by city residents and has its own taxing and budgetary authority.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

What benefits are derived from including the management's discussion and analysis in state and local governmental financial reports? What information is required to be included in the MD A?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

Converting to government-wide statements. List some of the major adjustments required when converting from fund financial statements to government wide statements. Why are these adjustments necessary?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

Reporting entity. Define a financial reporting entity. Give an example of a primary government. Define and give an example of a component unit. Explain the two methods of reporting the primary government and component units in the financial reporting entity and when each is required.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

Explain budgetary reporting requirements.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

Select the best answer to the following multiple-choice questions:

1. Which of the following statements is correct concerning a governmental entity's combined statement of cash flows?

a. Cash flows from capital financing activities are reported separately from cash flows from non-capital-related financing activities.

b. The statement format is the same as that of a business enterprise's statement of cash flows.

c. Cash flows from operating activities may be reported using the indirect method.

d. The statement format includes columns for the general, governmental, and proprietary fund types.

2. In a government's comprehensive annual financial report, proprietary fund types are included in which of the following combined financial statements?

3. In a government's comprehensive annual financial report, account groups are included in which of the following combined financial statements?

4. Clover City's comprehensive annual financial report contains both combining and combined financial statements. Total columns are

a. required for both combining and combined financial statements.

b. optional, but commonly shown, for combining financial statements and required for combined financial statements.

c. required for combining financial statements and optional, but commonly shown, for combined financial statements.

d. optional, but commonly shown, for both combining and combined financial statements.

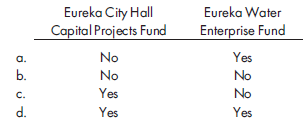

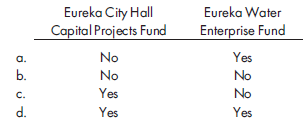

5. Eureka City should issue a statement of cash flows for which of the following funds?

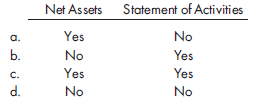

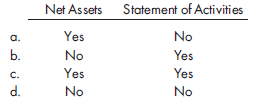

6. On March 2, 2011, Finch City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period from April 1, 2011, to March 31, 2012.

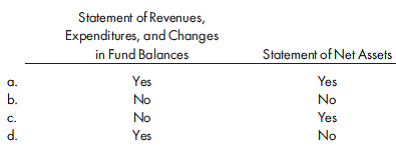

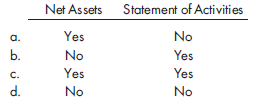

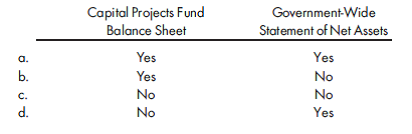

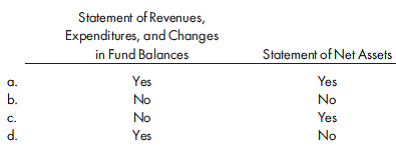

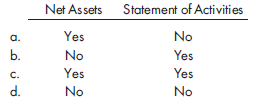

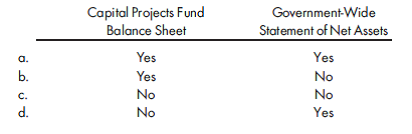

During the fiscal year ended June 30, 2011, no resources had been provided to the debt service fund for the payment of principal and interest. On June 30, 2011, in which statements should Finch report the construction in progress for the civic center?

1. Which of the following statements is correct concerning a governmental entity's combined statement of cash flows?

a. Cash flows from capital financing activities are reported separately from cash flows from non-capital-related financing activities.

b. The statement format is the same as that of a business enterprise's statement of cash flows.

c. Cash flows from operating activities may be reported using the indirect method.

d. The statement format includes columns for the general, governmental, and proprietary fund types.

2. In a government's comprehensive annual financial report, proprietary fund types are included in which of the following combined financial statements?

3. In a government's comprehensive annual financial report, account groups are included in which of the following combined financial statements?

4. Clover City's comprehensive annual financial report contains both combining and combined financial statements. Total columns are

a. required for both combining and combined financial statements.

b. optional, but commonly shown, for combining financial statements and required for combined financial statements.

c. required for combining financial statements and optional, but commonly shown, for combined financial statements.

d. optional, but commonly shown, for both combining and combined financial statements.

5. Eureka City should issue a statement of cash flows for which of the following funds?

6. On March 2, 2011, Finch City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period from April 1, 2011, to March 31, 2012.

During the fiscal year ended June 30, 2011, no resources had been provided to the debt service fund for the payment of principal and interest. On June 30, 2011, in which statements should Finch report the construction in progress for the civic center?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

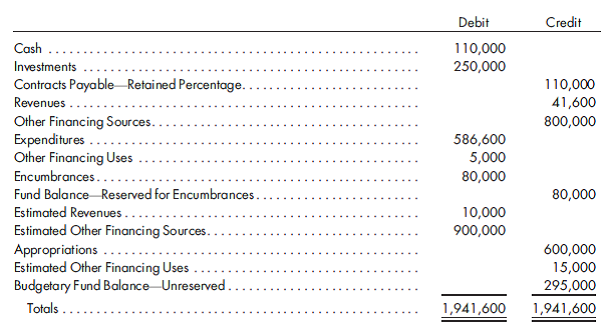

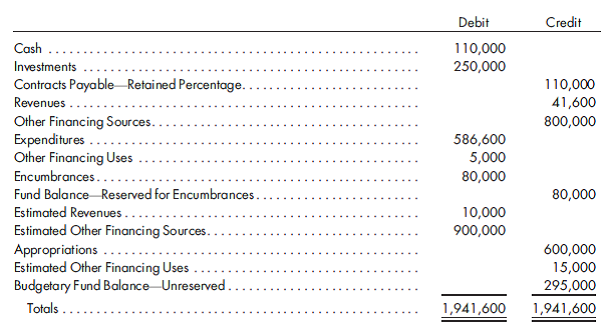

Fund-based statements. The preclosing, year-end trial balance for a capital projects fund of the city of Rochester as of December 31, 2019, follows:

1. Prepare closing entries as of December 31, 2019.

2. Prepare the year-end statement of revenues, expenditures, and changes in fund balances for this project that began on January 2, 2019.

3. Prepare the fund balance sheet as of December 31, 2019.

1. Prepare closing entries as of December 31, 2019.

2. Prepare the year-end statement of revenues, expenditures, and changes in fund balances for this project that began on January 2, 2019.

3. Prepare the fund balance sheet as of December 31, 2019.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

Determining a major fund. Based on the information presented in the 2009 city of Milwaukee, Wisconsin, financial statements, list the major funds disclosed by the city. How were these funds determined? Likewise, what minimum amounts of which statement items were used to determine whether a specific enterprise fund was a major fund?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

How are interfund transactions reported?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

Reporting under GASB Statement No. 34. Select the best answer to the following multiple-choice questions:

1. In the statement of activities,

a. all expenses are subtracted from all revenues to get net income.

b. it is possible to determine the net program expense (revenue) for major functions and programs of the primary government and its component units.

c. some tax revenues are considered program revenues, and others are considered general revenues.

d. extraordinary items are those that are either unusual in nature or infrequent in occurrence.

2. Which of the following is true regarding financial reporting under GASB Statement No. 34?

a. A comparison of budget and actual revenues and expenditures for the general fund is required as part of the basic financial statements.

b. Infrastructure must be recorded and depreciated as part of the statement of activities in the basic financial statements.

c. Public colleges and universities are to report in exactly the same manner as private colleges and universities.

d. Special purpose governments that have only business-type activities are permitted to report only the financial statements required for enterprise funds.

3. Which of the following is true regarding the government-wide financial statements?

a. The government-wide financial statements include the statement of net assets and the statement of activities.

b. The government-wide financial statements are to be prepared using the economic resources measurement focus and the accrual basis of accounting.

c. The government-wide financial statements include information for governmental activities, business-type activities, the total primary government, and its component units.

d. All of the above are true.

4. Which of the following is not part of the basic financial statements?

a. Governmental funds statement of revenues, expenditures, and changes in fund balances

b. Budgetary comparison schedules-general and special revenue funds

c. Government-wide statement of activities

d. Notes to the financial statements

5. Which of the following is not part of the basic financial statements?

a. Government-wide statement of net assets

b. Proprietary funds statement of revenues, expenses, and changes in fund net assets

c. Combining balance sheet-non major governmental funds

d. Notes to the financial statements

6. Which of the following is true regarding the organization of the comprehensive annual financial report?

a. The three major sections are introductory, financial, and statistical.

b. The management's discussion and analysis is considered to be part of the introductory section.

c. The auditor's report is considered to be part of the statistical section.

d. Basic financial statements include the government-wide statements, the budgetary statement, and the notes to the financial statements.

7. Which of the following is true regarding the government-wide financial statements?

a. The government-wide financial statements include the statement of net assets and the statement of activities.

b. The government-wide financial statements are prepared on the financial resources measurement focus for governmental activities and the economic resources measurement focus for business-type activities.

c. Prior-year data must be presented.

d. Works of art, historical treasures, and similar assets must be capitalized.

8. Under GASB Statement No. 34, which of the following is true of infrastructure?

a. Infrastructure must be recorded and depreciated unless a modified approach is used, in which case, depreciation is not required.

b. Infrastructure must be recorded and depreciated in all cases.

c. Infrastructure is not to be recorded and depreciated.

d. The state and local governments have the option, but are not required, to record and depreciate infrastructure.

9. Which statement is true regarding the ''major'' funds?

a. The general fund is always considered major.

b. Other funds are considered major if both of the following conditions exist: (1) total assets, liabilities, revenues, or expenditures/expenses of that individual governmental or enterprise fund constitute 10% of the governmental or enterprise categories, and (2) total assets, liabilities, revenues, or expenditures/expenses are 5% of the total of the governmental and enterprise categories.

c. A government may choose to reflect a fund as major even if it does not meet the criteria for major funds.

d. All of the above are true.

10. Which of the following groups sets standards for audits of federal financial assistance recipients?

a. U.S. General Accounting Office

b. U.S. Office of Management and Budget

c. Governmental Accounting Standards Board

d. Financial Accounting Standards Board

11. OMB Circular A-133 applies

a. only to state and local governmental units.

b. only to not-for-profit organizations.

c. to both state and local governments and not-for-profit organizations.

d. to neither state and local governments nor not-for-profit organizations.

12. The total amount of grant expenditures that must be covered in the audit of major programs is

a. $500,000.

b. 50% of federal expenditures.

c. 25% of federal expenditures.

d. 50% of federal expenditures generally but only 25% if the government is considered to be a low-risk auditee.

1. In the statement of activities,

a. all expenses are subtracted from all revenues to get net income.

b. it is possible to determine the net program expense (revenue) for major functions and programs of the primary government and its component units.

c. some tax revenues are considered program revenues, and others are considered general revenues.

d. extraordinary items are those that are either unusual in nature or infrequent in occurrence.

2. Which of the following is true regarding financial reporting under GASB Statement No. 34?

a. A comparison of budget and actual revenues and expenditures for the general fund is required as part of the basic financial statements.

b. Infrastructure must be recorded and depreciated as part of the statement of activities in the basic financial statements.

c. Public colleges and universities are to report in exactly the same manner as private colleges and universities.

d. Special purpose governments that have only business-type activities are permitted to report only the financial statements required for enterprise funds.

3. Which of the following is true regarding the government-wide financial statements?

a. The government-wide financial statements include the statement of net assets and the statement of activities.

b. The government-wide financial statements are to be prepared using the economic resources measurement focus and the accrual basis of accounting.

c. The government-wide financial statements include information for governmental activities, business-type activities, the total primary government, and its component units.

d. All of the above are true.

4. Which of the following is not part of the basic financial statements?

a. Governmental funds statement of revenues, expenditures, and changes in fund balances

b. Budgetary comparison schedules-general and special revenue funds

c. Government-wide statement of activities

d. Notes to the financial statements

5. Which of the following is not part of the basic financial statements?

a. Government-wide statement of net assets

b. Proprietary funds statement of revenues, expenses, and changes in fund net assets

c. Combining balance sheet-non major governmental funds

d. Notes to the financial statements

6. Which of the following is true regarding the organization of the comprehensive annual financial report?

a. The three major sections are introductory, financial, and statistical.

b. The management's discussion and analysis is considered to be part of the introductory section.

c. The auditor's report is considered to be part of the statistical section.

d. Basic financial statements include the government-wide statements, the budgetary statement, and the notes to the financial statements.

7. Which of the following is true regarding the government-wide financial statements?

a. The government-wide financial statements include the statement of net assets and the statement of activities.

b. The government-wide financial statements are prepared on the financial resources measurement focus for governmental activities and the economic resources measurement focus for business-type activities.

c. Prior-year data must be presented.

d. Works of art, historical treasures, and similar assets must be capitalized.

8. Under GASB Statement No. 34, which of the following is true of infrastructure?

a. Infrastructure must be recorded and depreciated unless a modified approach is used, in which case, depreciation is not required.

b. Infrastructure must be recorded and depreciated in all cases.

c. Infrastructure is not to be recorded and depreciated.

d. The state and local governments have the option, but are not required, to record and depreciate infrastructure.

9. Which statement is true regarding the ''major'' funds?

a. The general fund is always considered major.

b. Other funds are considered major if both of the following conditions exist: (1) total assets, liabilities, revenues, or expenditures/expenses of that individual governmental or enterprise fund constitute 10% of the governmental or enterprise categories, and (2) total assets, liabilities, revenues, or expenditures/expenses are 5% of the total of the governmental and enterprise categories.

c. A government may choose to reflect a fund as major even if it does not meet the criteria for major funds.

d. All of the above are true.

10. Which of the following groups sets standards for audits of federal financial assistance recipients?

a. U.S. General Accounting Office

b. U.S. Office of Management and Budget

c. Governmental Accounting Standards Board

d. Financial Accounting Standards Board

11. OMB Circular A-133 applies

a. only to state and local governmental units.

b. only to not-for-profit organizations.

c. to both state and local governments and not-for-profit organizations.

d. to neither state and local governments nor not-for-profit organizations.

12. The total amount of grant expenditures that must be covered in the audit of major programs is

a. $500,000.

b. 50% of federal expenditures.

c. 25% of federal expenditures.

d. 50% of federal expenditures generally but only 25% if the government is considered to be a low-risk auditee.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

Infrastructure reporting. What are the rules for recording infrastructure under the new GASB reporting model? When are these rules effective? What conditions must exist in order to use one method versus another? What are the advantages and disadvantages of each approach?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

Compare the basis of accounting that is used to report governmental activities versus business-type activities.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

Converting to a government-wide statement of activities. Using the information from Problem 17-6, illustrate and explain the adjustments necessary to convert to a government-wide statement of activities, assuming all expenditures are for capital assets and other finance sources are the result of issuance of general long-term obligations.

REFERENCE:

CAFR. Select the best answer to the following multiple-choice questions:

1. Which of the following statements is correct concerning a governmental entity's combined statement of cash flows?

a. Cash flows from capital financing activities are reported separately from cash flows from non-capital-related financing activities.

b. The statement format is the same as that of a business enterprise's statement of cash flows.

c. Cash flows from operating activities may be reported using the indirect method.

d. The statement format includes columns for the general, governmental, and proprietary fund types.

2. In a government's comprehensive annual financial report, proprietary fund types are included in which of the following combined financial statements?

3. In a government's comprehensive annual financial report, account groups are included in which of the following combined financial statements?

4. Clover City's comprehensive annual financial report contains both combining and combined financial statements. Total columns are

a. required for both combining and combined financial statements.

b. optional, but commonly shown, for combining financial statements and required for combined financial statements.

c. required for combining financial statements and optional, but commonly shown, for combined financial statements.

d. optional, but commonly shown, for both combining and combined financial statements.

5. Eureka City should issue a statement of cash flows for which of the following funds?

6. On March 2, 2011, Finch City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period from April 1, 2011, to March 31, 2012.

During the fiscal year ended June 30, 2011, no resources had been provided to the debt service fund for the payment of principal and interest. On June 30, 2011, in which statements should Finch report the construction in progress for the civic center?

REFERENCE:

CAFR. Select the best answer to the following multiple-choice questions:

1. Which of the following statements is correct concerning a governmental entity's combined statement of cash flows?

a. Cash flows from capital financing activities are reported separately from cash flows from non-capital-related financing activities.

b. The statement format is the same as that of a business enterprise's statement of cash flows.

c. Cash flows from operating activities may be reported using the indirect method.

d. The statement format includes columns for the general, governmental, and proprietary fund types.

2. In a government's comprehensive annual financial report, proprietary fund types are included in which of the following combined financial statements?

3. In a government's comprehensive annual financial report, account groups are included in which of the following combined financial statements?

4. Clover City's comprehensive annual financial report contains both combining and combined financial statements. Total columns are

a. required for both combining and combined financial statements.

b. optional, but commonly shown, for combining financial statements and required for combined financial statements.

c. required for combining financial statements and optional, but commonly shown, for combined financial statements.

d. optional, but commonly shown, for both combining and combined financial statements.

5. Eureka City should issue a statement of cash flows for which of the following funds?

6. On March 2, 2011, Finch City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period from April 1, 2011, to March 31, 2012.

During the fiscal year ended June 30, 2011, no resources had been provided to the debt service fund for the payment of principal and interest. On June 30, 2011, in which statements should Finch report the construction in progress for the civic center?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

New standards. Go to the GASBWeb site, and review the list of current projects and recently released standards. What are the most pressing issues facing the Board? In your opinion, is the Board effectively communicating these issues to the public on itsWeb site?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

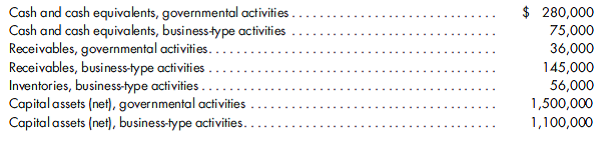

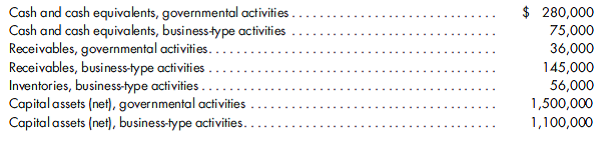

Statement of net assets. From the following information, prepare a statement of net assets for the city of Lucas as of June 30, 2019.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

Describe the purpose of each of the financial statements required under GASB Statement No. 34.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

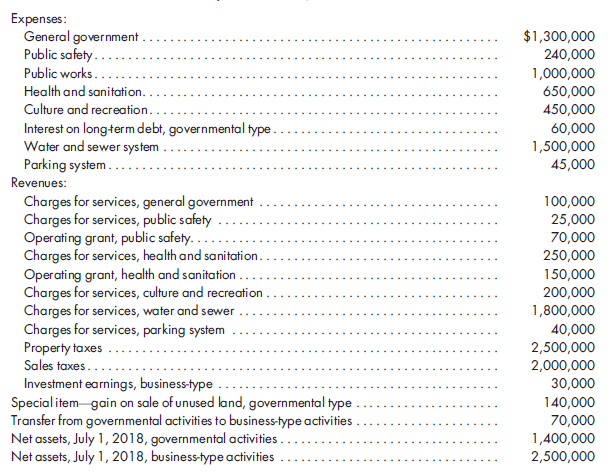

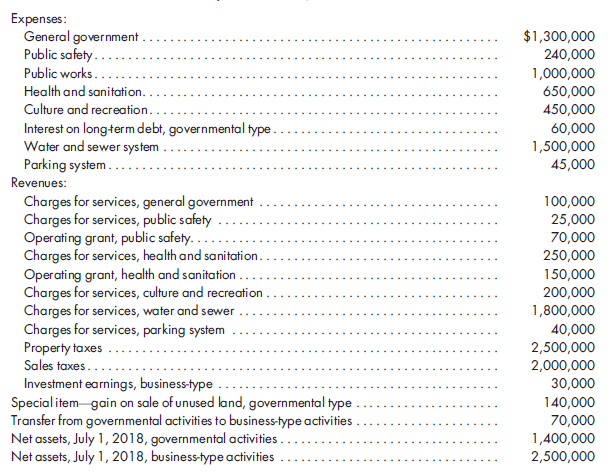

Statement of activities. From the following information, prepare a statement of activities for the city of Rose as of June 30, 2019.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

Reporting major funds. Assume Round Rock City has the following fund structure:

General fund

Special revenue fund (3)

Capital projects fund (2)

Debt service fund (3)

Expendable trust funds (5)

Internal service funds (2)

Enterprise funds (8)

General fixed assets account group

General long-term debt account group

Round Rock City determined that Special Revenue Fund C, capital projects funds, Enterprise Fund D, and Enterprise Fund F are the only major funds.

1. Present the column headings that Round Rock City must use in its governmental fund statement of revenues, expenditures, and changes in fund balances.

2. Present the column headings that Round Rock City must use in its governmental fund statement of revenues, expenses, and changes in net assets.

General fund

Special revenue fund (3)

Capital projects fund (2)

Debt service fund (3)

Expendable trust funds (5)

Internal service funds (2)

Enterprise funds (8)

General fixed assets account group

General long-term debt account group

Round Rock City determined that Special Revenue Fund C, capital projects funds, Enterprise Fund D, and Enterprise Fund F are the only major funds.

1. Present the column headings that Round Rock City must use in its governmental fund statement of revenues, expenditures, and changes in fund balances.

2. Present the column headings that Round Rock City must use in its governmental fund statement of revenues, expenses, and changes in net assets.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

Reporting under GASB Statement No. 34. Go to the Web site featuring the financial statements of Minneapolis, Minnesota, at http://www.ci.minneapolis. mn.us/financial-reports/cafr-home.asp. Provide brief answers to the following:

1. The financial section includes the basic financial statements, notes to the financial statements, required supplementary information, and supplementary information. Describe key features of each of these components of the financial statements. What key information do you see that was not included in the text? Compare the Minneapolis statements with those of the city ofMilwaukee.

2. Compare the information found in the letter of transmittal (in the introductory section) with that found in the newly requiredmanagement's discussion and analysis (in the financial section).

3. Where do you find budgetary comparison information?

4. List the major governmental funds. How does Minneapolis determine major funds? List the nonmajor governmental funds.

5. How isMinneapolis handling the requirements for reporting and depreciating infrastructure assets?

1. The financial section includes the basic financial statements, notes to the financial statements, required supplementary information, and supplementary information. Describe key features of each of these components of the financial statements. What key information do you see that was not included in the text? Compare the Minneapolis statements with those of the city ofMilwaukee.

2. Compare the information found in the letter of transmittal (in the introductory section) with that found in the newly requiredmanagement's discussion and analysis (in the financial section).

3. Where do you find budgetary comparison information?

4. List the major governmental funds. How does Minneapolis determine major funds? List the nonmajor governmental funds.

5. How isMinneapolis handling the requirements for reporting and depreciating infrastructure assets?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck