Deck 13: Breakeven and Payback Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/71

Play

Full screen (f)

Deck 13: Breakeven and Payback Analysis

1

A design-to-cost approach to product pricing involves determining the selling price of the product and then figuring out if it can be made at a cost lower than that. Banner Engineering's QT50R radar-based sensor features frequency-modulated technology to accurately monitor or detect objects up to 15 miles away while resisting rain, wind, humidity, and extreme temperatures. It has a list price of $589, and the variable cost of manufacturing the unit is $340.

a) What could the company's fixed cost per year be in order for Banner to break even with sales of 9000 units per year

b) If Banner's fixed cost is actually $750,000 per year, what is the profit at a sales level of 7000 units per year

a) What could the company's fixed cost per year be in order for Banner to break even with sales of 9000 units per year

b) If Banner's fixed cost is actually $750,000 per year, what is the profit at a sales level of 7000 units per year

The breakeven quantity  is

is  where FC is fixed cost, r is revenue per unit and v is variable cost per unit.

where FC is fixed cost, r is revenue per unit and v is variable cost per unit.

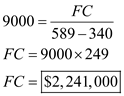

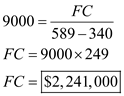

(a)

Here r is $589 and v is $340, breakeven quantity is 9000. The fixed cost will be Thus, the fixed cost is $2,241,000 per year.

Thus, the fixed cost is $2,241,000 per year.

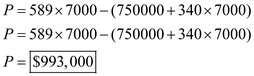

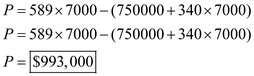

(b)

Here Q is 7000, FC is $750,000, r is $589 and v is $340. The profit will be Thus, the profit is $993,000 per year.

Thus, the profit is $993,000 per year.

is

is  where FC is fixed cost, r is revenue per unit and v is variable cost per unit.

where FC is fixed cost, r is revenue per unit and v is variable cost per unit. (a)

Here r is $589 and v is $340, breakeven quantity is 9000. The fixed cost will be

Thus, the fixed cost is $2,241,000 per year.

Thus, the fixed cost is $2,241,000 per year.(b)

Here Q is 7000, FC is $750,000, r is $589 and v is $340. The profit will be

Thus, the profit is $993,000 per year.

Thus, the profit is $993,000 per year. 2

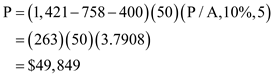

Transporting extremely heavy patients (people who weigh more than 500 pounds) is much more difficult than transporting normal-weight patients. Various cities in Colorado, Nebraska, and Kansas charge $1421 for an extremely obese patient compared to $758 for a typical patient. The extra fees are justified by the ambulance companies on the basis of the specialty equipment required and the extra personnel involved. If it is assumed that 50 extremely obese patients are transported every year, how much could the ambulance companies afford to spend on the specialty equipment now and break even on the initial cost in 5 years just from the extra charges Assume the extra costs are $400 per patient and the company's MARR is 10% per year.

Breakeven point is the point where there is no profit or loss i.e. revenue is equal to the expenses. So, at breakeven quantity, the present worth of cash inflows is equal to present worth of cash outflows. Fixed cost is the cost which does not changes with the change in level of production. Variable cost is the cost which changes with the change in level of production.

Calculate the amount that ambulance company can afford to spend now at breakeven, as follows: Thus, the amount that ambulance company can afford to spend now at breakeven is

Thus, the amount that ambulance company can afford to spend now at breakeven is

Calculate the amount that ambulance company can afford to spend now at breakeven, as follows:

Thus, the amount that ambulance company can afford to spend now at breakeven is

Thus, the amount that ambulance company can afford to spend now at breakeven is

3

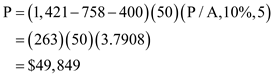

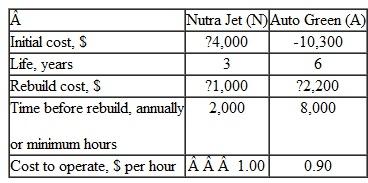

Lorraine can select from two nutrient injection systems for her cottage industry of hydroponic tomato and lettuce greenhouses.

a) Use an AW relation to determine the minimum number of hours per year to operate the pumps that will justify the Auto Green system, if the MARR is 10% per year. b) Which pump is economically better if it operates 7 hours per day, 365 days per year

a) Use an AW relation to determine the minimum number of hours per year to operate the pumps that will justify the Auto Green system, if the MARR is 10% per year. b) Which pump is economically better if it operates 7 hours per day, 365 days per year

Breakeven point is the point where there is no profit or loss i.e. revenue is equal to the expenses. So, at breakeven quantity, the present worth of cash inflows is equal to present worth of cash outflows. Fixed cost is the cost which does not changes with the change in level of production. Variable cost is the cost which changes with the change in level of production.

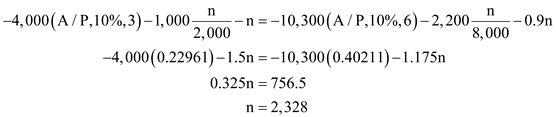

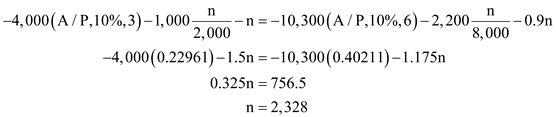

(a)

Calculate the minimum number of hours per year pumping should happen to cover cost of auto green system, as follows: Thus, the minimum number of hours per year pumping should happen to cover cost of auto green system is

Thus, the minimum number of hours per year pumping should happen to cover cost of auto green system is  (b)

(b)

If pumping is happening more than 2,328 hours a year then auto green system is justified. So, if pumping is done for 2,555 hours then one should go for auto green system.

(a)

Calculate the minimum number of hours per year pumping should happen to cover cost of auto green system, as follows:

Thus, the minimum number of hours per year pumping should happen to cover cost of auto green system is

Thus, the minimum number of hours per year pumping should happen to cover cost of auto green system is  (b)

(b)If pumping is happening more than 2,328 hours a year then auto green system is justified. So, if pumping is done for 2,555 hours then one should go for auto green system.

4

Wilson Partners manufactures thermocouples for electronics applications. The current system has a fixed cost of $300,000 per year and a variable cost of $10 per unit. Wilson sells the units for $14 each. A newly proposed process will add onboard features that allow the revenue to increase to $16 per unit, but the fixed cost will now be $500,000 per year. The variable cost of the new system will be based on a $48 per hour rate with 0.2 hour required to produce each unit.

Determine the annual breakeven quantity for

a) the current system and b) the new system.

Determine the annual breakeven quantity for

a) the current system and b) the new system.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

5

An anticorrosive coating for a chemical storage tank will cost $5000 and last 5 years if touched up at the end of 3 years at a cost of $1000. If an oil-base enamel coating could be used that will last 2 years, the amount the enamel coating can cost for the two to breakeven at i = 8% per year is closest to:

a) $2120

b) $2390

c) $2590

d) $2725

a) $2120

b) $2390

c) $2590

d) $2725

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

6

Does a decrease in the efficiency of the aerator motor make the selected alternative of sludge recirculation only more attractive, less attractive, or the same as before

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

7

High-profile vehicles have poor fuel efficiency because of increased wind resistance from their large front area. A number of companies make devices that they claim will significantly increase a vehicle's fuel efficiency. One company claims that by spending $560 on its friction-reducing device, the fuel efficiency of a pickup truck will increase by 25%. Assuming the device works as claimed, for a vehicle that currently gets 20 miles per gallon (mpg), how many miles would the owner have to drive each year to break even in 5 years Assume the cost of gasoline is $3.50 per gallon and the interest rate is 10% per year.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

8

An engineering practitioner can lease a fully equipped computer and color printer system for $800 per month or purchase one for $8500 now and pay a $75 per month maintenance fee. If the nominal interest rate is 15% per year, determine the months of use necessary for the two to break even. Show both

a) hand and b) spreadsheet solutions.

a) hand and b) spreadsheet solutions.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

9

Wilson Partners manufactures thermocouples for electronics applications. The current system has a fixed cost of $300,000 per year and a variable cost of $10 per unit. Wilson sells the units for $14 each. A newly proposed process will add onboard features that allow the revenue to increase to $16 per unit, but the fixed cost will now be $500,000 per year. The variable cost of the new system will be based on a $48 per hour rate with 0.2 hour required to produce each unit.

Plot the two profit relations and estimate graphically the breakeven quantity between the two alternatives.

Plot the two profit relations and estimate graphically the breakeven quantity between the two alternatives.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

10

The price of a car is $50,000 today. Its price is expected to increase by $2400 each year. You now have $25,000 in an investment that is earning 20% per year. The number of years before you have enough money to buy the car, without borrowing any money, is closest to:

a) 3 years

b) 5 years

c) 7 years

d) 9 years

a) 3 years

b) 5 years

c) 7 years

d) 9 years

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

11

Handheld fiber-optic meters with white light polarization interferometry are useful for measuring temperature, pressure, and strain in electrically noisy environments. The fixed costs associated with manufacturing are $800,000 per year. If a base unit sells for $2950 and its variable cost is $2075,

a) how many units must be sold each year for breakeven and b) what will the profit be for sales of 3000 units per year

a) how many units must be sold each year for breakeven and b) what will the profit be for sales of 3000 units per year

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

12

As the price of gasoline goes up, people are willing to drive farther to fill their tank in order to save money. Assume you had been buying gasoline for $2.90 per gallon and that it went up to $2.98 per gallon at the station where you usually go. If you drive an F-150 pickup that gets 18 miles per gallon, what is the round-trip distance you can drive to break even if it will take 20 gallons to fill your tank Use an interest rate of 8% per year.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

13

The office manager of an environmental engineering consulting firm was instructed to make an eco- friendly decision in acquiring an automobile for general office use. He is considering a gasolineelectric hybrid or a gasoline-free, all-electric hatchback. The hybrid under consideration is GM's Volt, which will cost $35,000, will have a salvage value of $15,000 after 5 years, and will have a range of 40 miles on the electric battery, plus several hundred more miles when the gasoline engine kicks in. Nissan's Leaf, on the other hand, is a pure electric that will have a range of only 100 miles, after which its lithium ion battery must be recharged. The Leaf's relatively limited range creates a psychological effect known as range anxiety (RA), which has the company leaning toward purchasing the Volt. The Leaf can be leased for $349 per month after an initial $500 down payment.

The accountant for the consulting firm told the office manager that the Leaf is the better economic option based on an evaluation she performed earlier. If the office manager purchases the Volt anyway (instead of leasing the Leaf), what is the monthly equivalent (AW value) of the extra amount of money the company will be paying to eliminate range anxiety Assume the operating costs will be the same for both vehicles and the MARR is 0.75% per month.

The accountant for the consulting firm told the office manager that the Leaf is the better economic option based on an evaluation she performed earlier. If the office manager purchases the Volt anyway (instead of leasing the Leaf), what is the monthly equivalent (AW value) of the extra amount of money the company will be paying to eliminate range anxiety Assume the operating costs will be the same for both vehicles and the MARR is 0.75% per month.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

14

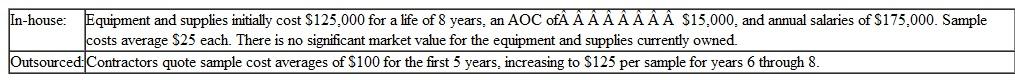

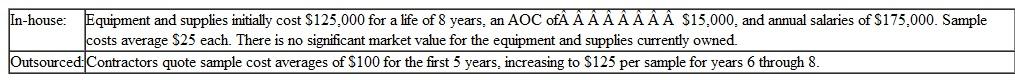

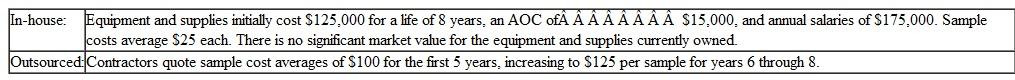

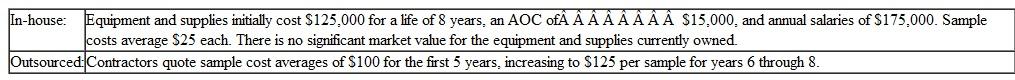

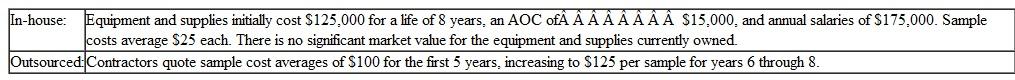

Mid-Valley Industrial Extension Service, a state-sponsored agency, provides water quality sampling services to all business and industrial firms in a 10-county region. Just last month, the service purchased all necessary lab equipment for full in-house testing and analysis. Now an outsourcing agency has offered to take over this function on a per sample basis. Data and quotes for the two options have been collected. The MARR for government projects is 5% per year, and a study period of 8 years is chosen.  Determine the breakeven number of tests between the two options.

Determine the breakeven number of tests between the two options.

Determine the breakeven number of tests between the two options.

Determine the breakeven number of tests between the two options.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

15

Process A has a fixed cost of $16,000 per year and a variable cost of $40 per unit. For process B, 5 units can be produced in 1 day at a cost of $125. If the company's MARR is 10% per year, the fixed cost of process B that will make the two alternatives have the same annual cost at a production rate of 1000 units per year is closest to:

A) Less than $10,000

B) $18,000

C) $27,000

D) Over $30,000

A) Less than $10,000

B) $18,000

C) $27,000

D) Over $30,000

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

16

If the cost of lime were to increase by 50%, would the cost difference between the best alternative and secondbest alternative increase, decrease, or remain the same

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

17

An automobile company is investigating the advisability of converting a plant that manufactures economy cars into one that will make retro sports cars. The initial cost for equipment conversion will be $200 million with a 20% salvage value anytime within a 5-year period. The cost of producing a car will be $21,000, but it is expected to have a selling price of $33,000 to dealers. The production capacity for the first year will be 4000 units. At an interest rate of 12% per year, by what uniform amount will production have to increase each year in order for the company to recover its investment in 3 years

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

18

How long will you have to sell a product that has an income of $5000 per month and expenses of $1500 per month if your initial investment is $28,000 and your MARR is

a) 0% and b) 3% per month Solve by formula. c) Write the spreadsheet functions to display the payback period for both 0% and 3% per month.

a) 0% and b) 3% per month Solve by formula. c) Write the spreadsheet functions to display the payback period for both 0% and 3% per month.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

19

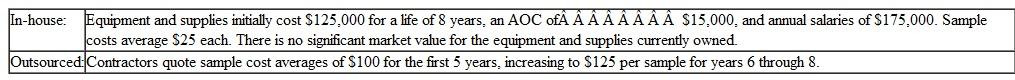

Mid-Valley Industrial Extension Service, a state-sponsored agency, provides water quality sampling services to all business and industrial firms in a 10-county region. Just last month, the service purchased all necessary lab equipment for full in-house testing and analysis. Now an outsourcing agency has offered to take over this function on a per sample basis. Data and quotes for the two options have been collected. The MARR for government projects is 5% per year, and a study period of 8 years is chosen.  Use a spreadsheet to graph the AW curves for both options for test loads between 0 and 4000 per year in increments of 1000 tests. What is the estimated breakeven quantity

Use a spreadsheet to graph the AW curves for both options for test loads between 0 and 4000 per year in increments of 1000 tests. What is the estimated breakeven quantity

Use a spreadsheet to graph the AW curves for both options for test loads between 0 and 4000 per year in increments of 1000 tests. What is the estimated breakeven quantity

Use a spreadsheet to graph the AW curves for both options for test loads between 0 and 4000 per year in increments of 1000 tests. What is the estimated breakeven quantity

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

20

The profit relation for the following estimates at a quantity that is 20% above breakeven is: Fixed cost = $500,000 per year

Variable cost per unit = $200

Revenue per unit = $250

A) Profit = 200(12,000) - 250(12,000) - 500,000

B) Profit = 250(12,000) - 500,000 - 200 (12,000)

C) Profit = 250(12,000) - 200(12,000) + 500,000

D) Profit = 250(10,000) - 200(10,000) - 500,000

Variable cost per unit = $200

Revenue per unit = $250

A) Profit = 200(12,000) - 250(12,000) - 500,000

B) Profit = 250(12,000) - 500,000 - 200 (12,000)

C) Profit = 250(12,000) - 200(12,000) + 500,000

D) Profit = 250(10,000) - 200(10,000) - 500,000

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

21

A metallurgical engineer has estimated that the capital investment cost for recovering valuable metals (nickel, silver, platinum, gold, etc.) from the copper refinery's wastewater stream will be $12 million. The equipment will have a useful life of 15 years with no salvage value. Its operating cost is represented by the relation ($2,600,000)E 19 , where E is the efficiency of the metal recovery operation (in decimal form). The amount of metal currently discharged is 2880 pounds per year prior to recovery operations, and the efficiency of recovery is estimated at 71%. What must the average selling price per pound be for the precious metals that are recovered and sold in order for the company to break even at its MARR of 15% per year

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

22

For the last 2 years, The Health Company has experienced a fixed cost of $850,000 per year and an ( r v ) value of $1.25 per unit for its multivitamin line of products. International competition has become severe enough that some financial changes must be made to keep market share at the current level.

a) Perform a spreadsheet-based graphical analysis to estimate the effect on the breakeven point if the difference between revenue and variable cost per unit increases somewhere between 1% and 15% of its current value.

b) If fixed costs and revenue per unit remain at their current values, what type of change must take place to make the breakeven point go down

a) Perform a spreadsheet-based graphical analysis to estimate the effect on the breakeven point if the difference between revenue and variable cost per unit increases somewhere between 1% and 15% of its current value.

b) If fixed costs and revenue per unit remain at their current values, what type of change must take place to make the breakeven point go down

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

23

Determine the payback period at an interest rate of 8% per year for an asset that initially cost $28,000, has a scrap value of $1500 whenever it is sold, and generates cash flow of $2900 per year.

b) If the asset will be in service for 12 years, should it be purchased

b) If the asset will be in service for 12 years, should it be purchased

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

24

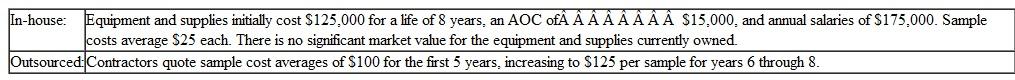

Mid-Valley Industrial Extension Service, a state-sponsored agency, provides water quality sampling services to all business and industrial firms in a 10-county region. Just last month, the service purchased all necessary lab equipment for full in-house testing and analysis. Now an outsourcing agency has offered to take over this function on a per sample basis. Data and quotes for the two options have been collected. The MARR for government projects is 5% per year, and a study period of 8 years is chosen.  The service director has asked the outsource company to reduce the per sample costs by 25% across the board over the 8-year study period. What will this do to the breakeven point ( Hint: Look carefully at your graph from Problem 13.46 before answering.)

The service director has asked the outsource company to reduce the per sample costs by 25% across the board over the 8-year study period. What will this do to the breakeven point ( Hint: Look carefully at your graph from Problem 13.46 before answering.)

The service director has asked the outsource company to reduce the per sample costs by 25% across the board over the 8-year study period. What will this do to the breakeven point ( Hint: Look carefully at your graph from Problem 13.46 before answering.)

The service director has asked the outsource company to reduce the per sample costs by 25% across the board over the 8-year study period. What will this do to the breakeven point ( Hint: Look carefully at your graph from Problem 13.46 before answering.)

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

25

Two methods of weed control in an irrigation canal are under consideration. Method A involves lining at a cost of $4000. The lining will last 20 years. The maintenance cost with this method will be $3 per mile per year. Method B involves spraying a chemical that costs $40 per gallon. One gallon will treat 8 miles, but the treatment must be applied 4 times per year. In determining the number of miles per year that would result in breakeven, the variable cost for method B is closest to:

A) $5 per mile

B) $15 per mile

C) $20 per mile

D) $40 per mile

A) $5 per mile

B) $15 per mile

C) $20 per mile

D) $40 per mile

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

26

If the efficiency of the sludge recirculation pump were reduced from 90% to 70%, would the net savings difference between alternatives 3 and 4 increase, decrease, or stay the same

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

27

(This is an extension of Problem 13.15) Expand the analysis performed in Problem 13.15 by changing the variable cost per unit. The financial manager estimates that fixed costs will fall to $750,000 when the required production rate to break even is at or below 600,000 units. What happens to the breakeven points over the ( r v ) range of 1% to 15% increase as evaluated previously

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

28

ABB purchased fieldbus communication equipment for a project in South Africa for $3.15 million. The net cash flow is estimated at $500,000 per year, and a salvage value of $400,000 is anticipated regardless of when it is sold. Determine the number of years the equipment must be used to obtain payback at MARR values of

a) 0% and 8% per year and b) 15% and 16% per year. c) Use a spreadsheet to plot the payback years for all four return values.

a) 0% and 8% per year and b) 15% and 16% per year. c) Use a spreadsheet to plot the payback years for all four return values.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

29

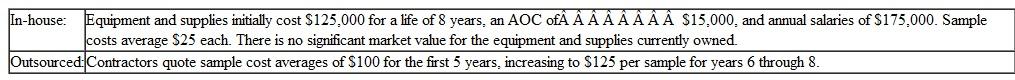

Mid-Valley Industrial Extension Service, a state-sponsored agency, provides water quality sampling services to all business and industrial firms in a 10-county region. Just last month, the service purchased all necessary lab equipment for full in-house testing and analysis. Now an outsourcing agency has offered to take over this function on a per sample basis. Data and quotes for the two options have been collected. The MARR for government projects is 5% per year, and a study period of 8 years is chosen.  Assume the Extension Service can reduce its annual salaries from $175,000 to $100,000 per year and the per sample cost from $25 to $20. What will this do to the breakeven point ( Hint: Again, look carefully at your graph from the previous problem before answering.) What is the new annual breakeven test quantity

Assume the Extension Service can reduce its annual salaries from $175,000 to $100,000 per year and the per sample cost from $25 to $20. What will this do to the breakeven point ( Hint: Again, look carefully at your graph from the previous problem before answering.) What is the new annual breakeven test quantity

Assume the Extension Service can reduce its annual salaries from $175,000 to $100,000 per year and the per sample cost from $25 to $20. What will this do to the breakeven point ( Hint: Again, look carefully at your graph from the previous problem before answering.) What is the new annual breakeven test quantity

Assume the Extension Service can reduce its annual salaries from $175,000 to $100,000 per year and the per sample cost from $25 to $20. What will this do to the breakeven point ( Hint: Again, look carefully at your graph from the previous problem before answering.) What is the new annual breakeven test quantity

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

30

How long will you have to maintain a business that has an income of $5000 per year and expenses of $1500 per year if your initial investment was $28,000 and your MARR is 10% per year

A) Less than 6 years

B) 8 years

C) 12 years

D) 17 years

A) Less than 6 years

B) 8 years

C) 12 years

D) 17 years

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

31

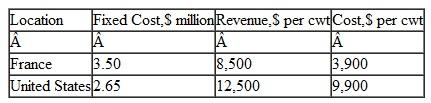

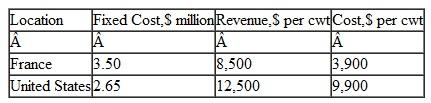

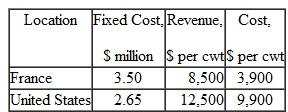

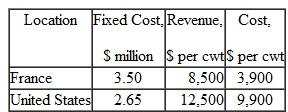

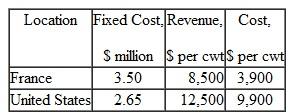

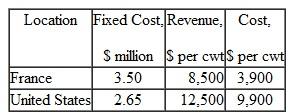

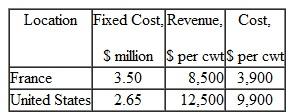

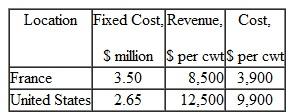

Hambry Enterprises produces a component for recycling uranium used as a nuclear fuel in power plant generators in France and the United States. Use the following cost and revenue figures, quoted in U.S. dollars per hundredweight (cwt), recorded for this year to calculate the answers for each plant.  Determine the breakeven point for each plant.

Determine the breakeven point for each plant.

Determine the breakeven point for each plant.

Determine the breakeven point for each plant.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

32

Providing restrooms at parks, zoos, and other cityowned recreation facilities is a considerable expense for municipal governments. City councils usually opt for permanent restrooms in larger parks and portable restrooms in smaller ones. The cost of renting and servicing a portable restroom is $7500 per year. In one northeastern municipality, the parks director informed the city council that the cost of constructing a permanent restroom is $218,000 and the annual cost of maintaining it is $12,000. He remarked that the rather high cost is due to the necessity to use expensive materials and construction techniques that are tailored to minimize damage from vandalism that often occurs in unattended public facilities. If the useful life of a permanent restroom is assumed to be 20 years, how many portable restrooms could the city afford to rent each year and break even with the cost of one permanent facility Let the interest rate be 6% per year.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

33

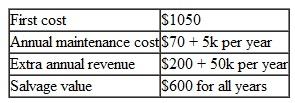

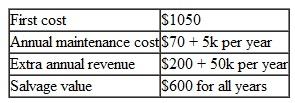

Sundance Detective Agency purchased new surveillance equipment with the following estimates. The year index is k = 1, 2, 3,....

a) Calculate the payback period to make a return of 10% per year.

b) For a preliminary conclusion, should the equipment be purchased if the actual useful life is 7 years

a) Calculate the payback period to make a return of 10% per year.

b) For a preliminary conclusion, should the equipment be purchased if the actual useful life is 7 years

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

34

In linear breakeven analysis, if a company expects to operate at a point above the breakeven point, it should select the alternative:

A) With the lower fixed cost

B) With the higher fixed cost

C) With the lower variable cost

D) With the higher variable cost

A) With the lower fixed cost

B) With the higher fixed cost

C) With the lower variable cost

D) With the higher variable cost

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

35

If hardness removal were to be discontinued at the treatment plant, which alternative would be the most costeffective

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

36

A consulting engineer is considering two methods for lining ponds used for evaporating concentrate generated during reverse osmosis treatment of brackish groundwater for the Clay County Industrial Park. A geosynthetic bentonite clay liner (GCL) will cost $1.8 million to install, and if it is renovated after 4 years at a cost of $375,000, its life can be extended another 2 years. Alternatively, a high-density polyethylene (HDPE) geomembrane can be installed that will have a useful life of 12 years. At an interest rate of 6% per year, how much money can be spent on the HDPE liner for the two methods to break even

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

37

Clarisa, an engineering manager, wants to purchase a resort accommodation to rent to skiers. She is considering the purchase of a three-bedroom lodge in upper Montana that will cost $250,000. The property in the area is rapidly appreciating in value because people anxious to get away from urban developments are bidding up the prices. If Clarisa spends an average of $500 per month for utilities and the investment increases at a rate of 2% per month, how long would it be before she could sell the property for $100,000 more than she has invested in it

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

38

A company is considering two alternatives to automate the pH of process liquids. Alternative A will have fixed costs of $42,000 per year and will require 2 workers at $48 per day each. Together, these workers can generate 100 units of product per day. Alternative B will have fixed costs of $56,000 per year, but with this alternative, 3 workers will generate 200 units of product. If x is the number of units per year, the variable cost (VC) in $ per year for alternative B is represented by:

A) [2(48)/100] x

B) [3(48)/200] x

C) [3(48)/200] x + 56,000

D) [2(48)/100] x + 42,000

A) [2(48)/100] x

B) [3(48)/200] x

C) [3(48)/200] x + 56,000

D) [2(48)/100] x + 42,000

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

39

Hambry Enterprises produces a component for recycling uranium used as a nuclear fuel in power plant generators in France and the United States. Use the following cost and revenue figures, quoted in U.S. dollars per hundredweight (cwt), recorded for this year to calculate the answers for each plant.  Estimate the minimum revenue per hundredweight required for next year if breakeven values and variable costs remain constant, but fixed costs increase by 10%.

Estimate the minimum revenue per hundredweight required for next year if breakeven values and variable costs remain constant, but fixed costs increase by 10%.

Estimate the minimum revenue per hundredweight required for next year if breakeven values and variable costs remain constant, but fixed costs increase by 10%.

Estimate the minimum revenue per hundredweight required for next year if breakeven values and variable costs remain constant, but fixed costs increase by 10%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

40

An irrigation canal contractor wants to determine whether he should purchase a used Caterpillar mini excavator or a Toro powered rotary tiller for servicing irrigation ditches in an agricultural area of California. The initial cost of the excavator is $26,500 with a $9000 salvage value after 10 years. Fixed costs for insurance, license, etc. are expected to be $18,000 per year. The excavator will require one operator at $15 per hour and maintenance at $1 per hour. In 1 hour, 0.15 mile of ditch can be prepared. Alternatively, the contractor can purchase a tiller and hire 2 workers at $11 per hour each. The tiller costs $1200 and has a useful life of 5 years with no salvage value. Its operating cost is expected to be $1.20 per hour, and with the tiller, the two workers can prepare 0.04 mile of ditch in 1 hour. The contractor's MARR is 10% per year. Determine the number of miles of ditch per year the contractor would have to service for the two options to break even.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

41

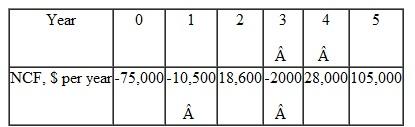

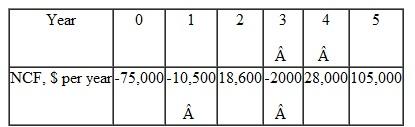

Laura's grandparents helped her purchase a small self-serve laundry business to make extra money during her 5 college years. When she completed her engineering management degree, she sold the business and her grandparents told her to keep the money as a graduation present. For the net cash flows listed below, determine the following:

a) The percentage of the investment recovered during the 5 years

b) The actual rate of return over the 5-year period

c) How long it took to pay back the $75,000 investment in year 0, plus a 7% per year return

a) The percentage of the investment recovered during the 5 years

b) The actual rate of return over the 5-year period

c) How long it took to pay back the $75,000 investment in year 0, plus a 7% per year return

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

42

When the variable cost is reduced for linear total cost and revenue lines, the breakeven point decreases. This is an economic advantage because:

a) The revenue per unit will increase.

b) The two lines will now cross at zero.

c) The profit will increase for the same revenue per unit.

d) The total cost line becomes nonlinear.

a) The revenue per unit will increase.

b) The two lines will now cross at zero.

c) The profit will increase for the same revenue per unit.

d) The total cost line becomes nonlinear.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

43

If the cost of electricity decreased to 8 ¢_kWh, which alternative would be the most cost-effective

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

44

An effective method to recover water used for regeneration of ion exchange resins is to use a reverse osmosis system in a batch treatment mode. Such a system involves recirculation of the partially treated water back into the feed tank, causing the water to heat up. The water can be cooled using one of two systems: a single-pass heat exchanger or a closed-loop heat exchange system. The single-pass system, good for 3 years, requires a small chiller costing $920 plus stainless steel tubing, connectors, valves, etc. costing $360. The cost of water, treatment charges, electricity, etc. will be $3.10 per hour. The closed-loop system will cost $3850 to buy, will have a useful life of 5 years, and will cost $1.28 per hour to operate. What is the minimum number of hours per year that the cooling system must be used in order to justify purchase of the closed-loop system The MARR is 10% per year, and the salvage values are negligible.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

45

Buhler Tractor sold a tractor for $45,000 to Tom Edwards 10 years ago.

a) What is the uniform net cash flow that Tom must make each year to realize payback and a return of 5% per year on his investment over a period of 3 years 5 years 8 years All 10 years b) If the net cash flow was actually $5000 per year, what is the amount Tom should have paid for the tractor to realize payback plus the 5% per year return over these 10 years

a) What is the uniform net cash flow that Tom must make each year to realize payback and a return of 5% per year on his investment over a period of 3 years 5 years 8 years All 10 years b) If the net cash flow was actually $5000 per year, what is the amount Tom should have paid for the tractor to realize payback plus the 5% per year return over these 10 years

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

46

AW 1 = 23,000( A / P ,10%,10)+4000( A / F ,10%,10) 3000 3 x

AW 2 = 8,000( A / P ,10%,4) 2000 6 x

For these two AW relations, the breakeven point x , in miles per year, is closest to:

A) 1130

B) 1224

C) 1590

D) 655

AW 2 = 8,000( A / P ,10%,4) 2000 6 x

For these two AW relations, the breakeven point x , in miles per year, is closest to:

A) 1130

B) 1224

C) 1590

D) 655

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

47

Hambry Enterprises produces a component for recycling uranium used as a nuclear fuel in power plant generators in France and the United States. Use the following cost and revenue figures, quoted in U.S. dollars per hundredweight (cwt), recorded for this year to calculate the answers for each plant.  During this year, the French plant sold 950 units in Europe, and the U.S. plant sold 850 units. Determine the year's profit (loss) for each plant.

During this year, the French plant sold 950 units in Europe, and the U.S. plant sold 850 units. Determine the year's profit (loss) for each plant.

During this year, the French plant sold 950 units in Europe, and the U.S. plant sold 850 units. Determine the year's profit (loss) for each plant.

During this year, the French plant sold 950 units in Europe, and the U.S. plant sold 850 units. Determine the year's profit (loss) for each plant.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

48

Samsung Electronics is trying to reduce supply chain risk by making more responsible make-buy decisions through improved cost estimation. A high-use component (expected usage is 5000 units per year) can be purchased for $25 per unit with delivery promised within a week. Alternatively, Samsung can make the component in-house and have it readily available at a cost of $5 per unit, if equipment costing $150,000 is purchased. Labor and other operating costs are estimated to be $35,000 per year over the study period of 5 years. Salvage is estimated at 10% of first cost and i =12% per year. Neglect the element of availability

a) to determine the breakeven quantity and b) to recommend making or buying at the expected usage level.

a) to determine the breakeven quantity and b) to recommend making or buying at the expected usage level.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

49

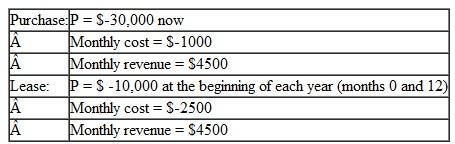

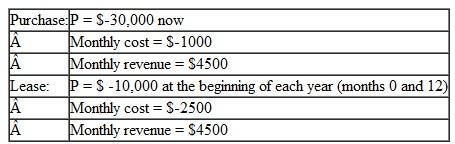

National Parcel Service has historically owned and maintained its own delivery trucks. Leasing is an option being seriously considered because costs for maintenance, fuel, insurance, and some liability issues will be transferred to Pacific Leasing, the truck leasing company. The study period is no more than 24 months for either alternative. The annual lease cost is paid at the beginning of each year and is not refundable for partially used years. Use the first cost and net cash flow estimates to determine the payback in months with a nominal 9% per year return for the

a) purchase option and b) lease option.

a) purchase option and b) lease option.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

50

To make an item in-house, equipment costing $250,000 must be purchased. It will have a life of 4 years, an annual cost of $80,000, and each unit will cost $40 to manufacture. Buying the item externally will cost $100 per unit. At i = 15% per year, it is cheaper to make the item in-house if the number per year needed is:

a) Above 1047 units

b) Above 2793 units

c) Equal to 2793 units

d) Below 2793 units

a) Above 1047 units

b) Above 2793 units

c) Equal to 2793 units

d) Below 2793 units

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

51

At what electricity cost would the following alternatives just break even

a) Alternatives 1 and 2, b) alternatives 1 and 3, c) alternatives 1 and 4.

a) Alternatives 1 and 2, b) alternatives 1 and 3, c) alternatives 1 and 4.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

52

A partner in a medium-size A/E (architectural/engineering) design firm is evaluating two alternatives for improving the exterior appearance of the building they occupy. The building can be completely painted at a cost of $6500. The paint is expected to remain attractive for 4 years, at which time repainting will be necessary. Every time the building is repainted, the cost will be 20% higher than the previous time. Alternatively, the building can be sandblasted now and every 6 years at a cost 40% greater than the previous time. If the company's MARR is 10% per year, what is the maximum amount that could be spent now on the sandblasting alternative that would render the two alternatives indifferent over a study period of 12 years

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

53

Julian Browne, owner of Clear Interior Environments, purchased an air scrubber, HEPA vacuum, and other equipment for mold removal for $15,000 eight months ago. Net cash flows were $2000 for each of the first 2 months, followed by $1000 per month for months 3 and 4. For the last 4 months, a contract generated a net $6000 per month. Julian sold the equipment yesterday for $3000 to a friend. Determine

a) the no-return payback period and b) the nominal 18%-per-year payback period.

a) the no-return payback period and b) the nominal 18%-per-year payback period.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

54

A procedure at Mercy Hospital has fixed costs of $10,000 per year and variable costs of $50 per test. If the procedure is automated, its fixed cost will be $21,500 per year, but its variable cost will be only $10 per test. The number of tests that must be performed each year for the two operations to break even is closest to:

a) 290

b) 455

c) 750

d) Over 800

a) 290

b) 455

c) 750

d) Over 800

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

55

Hambry Enterprises produces a component for recycling uranium used as a nuclear fuel in power plant generators in France and the United States. Use the following cost and revenue figures, quoted in U.S. dollars per hundredweight (cwt), recorded for this year to calculate the answers for each plant.  Hambry's president has a goal of $1 million profit next year at each plant with no revenue or fixed cost increases. Determine the decreases in dollar amounts and percentages in variable cost necessary to meet this goal, if the number of units sold is the same as this year.

Hambry's president has a goal of $1 million profit next year at each plant with no revenue or fixed cost increases. Determine the decreases in dollar amounts and percentages in variable cost necessary to meet this goal, if the number of units sold is the same as this year.

Hambry's president has a goal of $1 million profit next year at each plant with no revenue or fixed cost increases. Determine the decreases in dollar amounts and percentages in variable cost necessary to meet this goal, if the number of units sold is the same as this year.

Hambry's president has a goal of $1 million profit next year at each plant with no revenue or fixed cost increases. Determine the decreases in dollar amounts and percentages in variable cost necessary to meet this goal, if the number of units sold is the same as this year.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

56

A junior mechanical engineering student is cooping this semester at Regency Aircraft, whichcustomizes the interiors of private and corporate jets. Her fi rst assignment is to develop the specifi -cations for a new machine to cut, shape, and sew leather or vinyl covers and trims. The fi rst cost isnot easy to estimate due to many options, but the annual revenue and M O costs should net out at$+15,000 per year over a 10-year life. Salvage is expected to be 20% of the fi rst cost. Determine thebreakeven fi rst cost of the machine to just recover its fi rst cost and a return of 8% per year under twoscenarios:

I: No outside revenue will be developed by the machine.

II: Outside contracting will occur with estimated revenue of $10,000 the fi rst year, increasing by $5000 per year thereafter.

I: No outside revenue will be developed by the machine.

II: Outside contracting will occur with estimated revenue of $10,000 the fi rst year, increasing by $5000 per year thereafter.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

57

Explain why payback analysis may favor an alternative with a shorter payback period when it is not the better choice economically.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

58

An assembly process can be completed using either alternative X or Y. Alternative X has fixed costs of $10,000 per year with a variable cost of $50 per unit. If the process is automated per alternative Y, its fixed cost will be $5000 per year and its variable cost will be only $10 per unit. The number of units that must be produced each year in order for alternative Y to be favored is closest to:

A) Y will be favored for any level of production

B) 125

C) 375

D) X will be favored for any level of production

A) Y will be favored for any level of production

B) 125

C) 375

D) X will be favored for any level of production

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

59

The National Highway Traffic Safety Administration raised the average fuel efficiency standard to 35.5 miles per gallon (mpg) for cars and light trucks by the year 2016. The rules will cost consumers an average of $926 extra per vehicle in the 2016 model year. Assume a person purchases a new car in 2016 that gets 35.5 mpg and keeps it for 5 years. If the person drives an average of 1000 miles per month and gets an extra 10 miles per gallon of gasoline, how much will the gasoline have to cost in order for the buyer to recover the extra investment in 5 years at an interest rate of 0.75% per month

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

60

Ascarate Fishing Club (a nonprofit organization dedicated to teaching kids how to fish) is considering two options for providing a heavily stocked pond for kids who have never caught a fish before. Option 1 is an above-ground swimming pool made of heavy vinyl plastic that will be assembled and disassembled for each quarterly event. The purchase price will be $400. Leaks from hooks piercing the fabric will be repaired with a vinyl repair kit at a cost of $70 per year, but the pool will have to be replaced when too many repairs have been made.

Option 2 is an in-ground pond that will be excavated by club members at no cost and lined with fabric that costs $1 per square foot. The pond will be 15 ft in diameter and 3 ft deep. Assume 300 ft 2 of liner will be purchased. A chain link fence at $10 per lineal foot will be installed around the pond (100 ft of fence). Maintenance inside the fence is expected to cost $20 per year. The park where the pond will be constructed has committed the land for only 10 years. At an interest rate of 6% per year, how long would the above-ground pool have to last to break even

Option 2 is an in-ground pond that will be excavated by club members at no cost and lined with fabric that costs $1 per square foot. The pond will be 15 ft in diameter and 3 ft deep. Assume 300 ft 2 of liner will be purchased. A chain link fence at $10 per lineal foot will be installed around the pond (100 ft of fence). Maintenance inside the fence is expected to cost $20 per year. The park where the pond will be constructed has committed the land for only 10 years. At an interest rate of 6% per year, how long would the above-ground pool have to last to break even

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

61

When comparing two alternatives, why is it best to use no-return payback analysis as a preliminary screening tool prior to conducting a complete PW or AW evaluation

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

62

Two different methods are under consideration for building a bypass road. Material C will cost $100,000 per mile and last for 10 years. Its annual maintenance cost will be $10,000 per year per mile. Material D will cost $30,000 per mile and last for 5 years. At an interest rate of 6% per year, the annual maintenance cost for material D that will make the two methods cost the same is closest to:

A) Less than $14,000

B) $14,270

C) $16,470

D) $19,510

A) Less than $14,000

B) $14,270

C) $16,470

D) $19,510

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

63

A call center in India used by U.S. and U.K. credit card holders has a capacity of 1,400,000 calls annually. The fixed cost of the center is $775,000 with an average variable cost of $1 and revenue of $2.50 per call.

a) Find the percentage of the call capacity that must be placed each year to break even.

b) The center manager expects to dedicate the equivalent of 500,000 of the 1,400,000 capacity to a new product line. This is expected to increase the center's fixed cost to $900,000 of which 50% will be allocated to the new product line. Determine the average revenue per call necessary to make 500,000 calls the breakeven point for only the new product. How does this required revenue compare with the current center revenue of $2.50 per call

a) Find the percentage of the call capacity that must be placed each year to break even.

b) The center manager expects to dedicate the equivalent of 500,000 of the 1,400,000 capacity to a new product line. This is expected to increase the center's fixed cost to $900,000 of which 50% will be allocated to the new product line. Determine the average revenue per call necessary to make 500,000 calls the breakeven point for only the new product. How does this required revenue compare with the current center revenue of $2.50 per call

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

64

A rural subdivision has several miles of access roads that need a new surface treatment. Alternative 1 is a gravel base and pavement with an initial cost of $500,000 that will last for 15 years and has an annual upkeep cost of $100 per mile. Alternative 2 is to enhance the gravel base now at a cost of $50,000 and immediately coat the surface with a durable hot oil mix, which costs $130 per barrel applied. Annual reapplication of the mix is required. A barrel covers 0.05 mile.

a) If the discount rate is 6% per year, determine the number of miles at which the two alternatives break even. b) A drive in a pickup indicates a total of 12.5 miles of road. Which is the more economical alternative

a) If the discount rate is 6% per year, determine the number of miles at which the two alternatives break even. b) A drive in a pickup indicates a total of 12.5 miles of road. Which is the more economical alternative

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

65

Benjamin used regression analysis to fit quadratic relations to monthly revenue and cost data with the following results:

R = -0.007 Q 2 + 32 Q

TC = 0.004 Q 2 + 2.2 Q + 8

a) Plot R and TC. Estimate the quantity Q p at which the maximum profit should occur. Estimate the amount of profit at this quantity.

b) The profit relation P = R - TC and calculus can be used to determine the quantity Q p at which the maximum profit will occur and the amount of the profit. The equations are

Profit = a Q 2 + bQ + c

Maximum profit =

Use these relations to confirm the graphical estimates you made in

a). (Your instructor may ask you to derive the relations above.)

R = -0.007 Q 2 + 32 Q

TC = 0.004 Q 2 + 2.2 Q + 8

a) Plot R and TC. Estimate the quantity Q p at which the maximum profit should occur. Estimate the amount of profit at this quantity.

b) The profit relation P = R - TC and calculus can be used to determine the quantity Q p at which the maximum profit will occur and the amount of the profit. The equations are

Profit = a Q 2 + bQ + c

Maximum profit =

Use these relations to confirm the graphical estimates you made in

a). (Your instructor may ask you to derive the relations above.)

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

66

A construction company can purchase a piece of equipment for $50,000 and spend $100 per day in operating costs. The equipment will have a 5-year life with no salvage value. Alternatively, the company can lease the equipment for $400 per day. The number of days per year the company must require the equipment to justify its purchase at an interest rate of 8% per year is closest to:

A) 10 days

B) 42 days

C) 51 days

D) 68 days

A) 10 days

B) 42 days

C) 51 days

D) 68 days

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

67

What will be the monthly savings in electricity from discontinuation of aeration if the cost of electricity is now 12 ¢_kWh

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

68

The addition of a turbocharger to a small V-6 engine that gets 18 miles per gallon of gasoline can boost its power to that of a V-8 engine and increase fuel efficiency at the same time. If Bill will pay $800 to turbocharge his engine and his fuel efficiency increases by 3 miles per gallon, how many miles will he have to drive each month for 3 years in order to break even Assume the cost of gasoline is $3.25 per gallon and the interest rate is 1% per month.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

69

A waste-holding lagoon situated near the main plant receives sludge daily. When the lagoon is full, it is necessary to remove the sludge to a site located 8.2 kilometers from the main plant. Currently, when the lagoon is full, the sludge is removed by pump into a tank truck and hauled away. This process requires the use of a portable pump that initially costs $800 and has an 8-year life. The company pays a contract individual to operate the pump and oversee environmental and safety factors at a rate of $100 per day, plus the truck and driver must be rented for $200 per day. The company has the option to install a pump and pipeline to the remote site. The pump would have an initial cost of $1600 and a life of 10 years and will cost $3 per day to operate. The company's MARR is 10% per year.

a) If the pipeline will cost $12 per meter to construct and will have a 10-year life, how many days per year must the lagoon require pumping to justify construction of the pipeline

b) If the company expects to pump the lagoon once per week every week of the year, how much money can it afford to spend now on the 10-year life pipeline to just break even

a) If the pipeline will cost $12 per meter to construct and will have a 10-year life, how many days per year must the lagoon require pumping to justify construction of the pipeline

b) If the company expects to pump the lagoon once per week every week of the year, how much money can it afford to spend now on the 10-year life pipeline to just break even

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

70

The National Potato Cooperative purchased a de- skinning machine last year for $150,000. Revenue for the first year was $50,000. Over the total estimated life of 8 years, what must the remaining equivalent annual revenues (years 2 through 8) equal to break even by recovering the investment and a return of 10% per year Costs are expected to be constant at $42,000 per year, and a salvage value of $20,000 is anticipated.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

71

A tractor has a first cost of $40,000, a monthly operating cost of $1500, and a salvage value of $12,000 in 10 years. The MARR is 12% per year. An identical tractor can be rented for $3200 per month (operating cost not included). If n is the minimum number of months per year the tractor must be used in order to justify its purchase, the relation to find n is represented by:

A) 40,000( A / P ,1%,10) 1500 n + 12,000( A / F ,1%,10) = 3200 n

B) 40,000( A/P ,12%, 10) 1500 n + 12,000( A / F ,12%,10) = 3200 n

C) 40,000( A / P ,1%,120) 1500 n + 12,000( A / F ,1%,120) = 3200 n

D) 40,000( A / P ,11.4%,10) 1500 n + 12,000( A / F ,11.4%,10) = 3200 n

A) 40,000( A / P ,1%,10) 1500 n + 12,000( A / F ,1%,10) = 3200 n

B) 40,000( A/P ,12%, 10) 1500 n + 12,000( A / F ,12%,10) = 3200 n

C) 40,000( A / P ,1%,120) 1500 n + 12,000( A / F ,1%,120) = 3200 n

D) 40,000( A / P ,11.4%,10) 1500 n + 12,000( A / F ,11.4%,10) = 3200 n

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck