Deck 14: Effects of Inflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

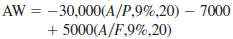

Question

Question

Question

Question

Question

Question

Question

Question

Question

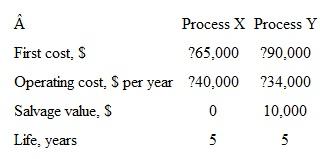

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 14: Effects of Inflation

1

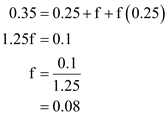

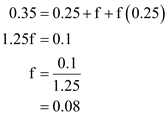

A high tech company whose stock trades on the NASDAQ stock exchange uses a MARR of 35% per year. If the chief financial officer (CFO) said the company expects to make a real rate of return of 25% per year on its investments over the next 3 year period, what is the company expecting the inflation rate per year to be over that time period

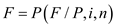

The formula for inflated interest rate as follows:  Here,

Here,

i is interest rate,

f is inflation rate.

Calculate the inflation rate as follows: Thus, the inflation rate is

Thus, the inflation rate is

Here,

Here,i is interest rate,

f is inflation rate.

Calculate the inflation rate as follows:

Thus, the inflation rate is

Thus, the inflation rate is

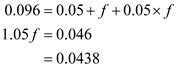

2

The headline on a Chronicle of Higher Education article reads "College Costs Rise Faster than Inflation."The article states that tuition at public colleges and universities increased by 58% over the past 5 years.

a) What was the average annual percentage increase over that period of time (b) If the real increase in tuition (i.e., without inflation) was 5% per year, what was the inflation rate per year

a) What was the average annual percentage increase over that period of time (b) If the real increase in tuition (i.e., without inflation) was 5% per year, what was the inflation rate per year

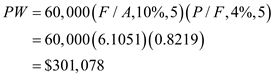

The formula for calculating the future worth is as follows:  Here,

Here,

P is principal amount,

n is number of years, and

i is annual rate of interest.

The standard notation equation is where the value of the factor is seen in the compound interest factor table.

where the value of the factor is seen in the compound interest factor table.

(a)

Calculate the annual average increase in price as follows: Thus, the annual average increase in price is

Thus, the annual average increase in price is  (b)

(b)

Calculate the inflation rate as follows: Thus, the inflation rate is

Thus, the inflation rate is

Here,

Here, P is principal amount,

n is number of years, and

i is annual rate of interest.

The standard notation equation is

where the value of the factor is seen in the compound interest factor table.

where the value of the factor is seen in the compound interest factor table.(a)

Calculate the annual average increase in price as follows:

Thus, the annual average increase in price is

Thus, the annual average increase in price is  (b)

(b)Calculate the inflation rate as follows:

Thus, the inflation rate is

Thus, the inflation rate is

3

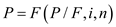

Harmony Corporation plans to set aside $60,000 per year beginning 1 year from now for replacing equipment 5 years from now. What will be the purchasing power (in terms of current-value dollars) of the amount accumulated, if the investment grows by 10% per year, but inflation averages 4% per year

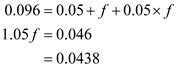

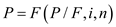

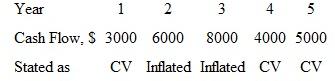

The formula for calculating the present worth is as follows:  Here,

Here,

F is future accumulated amount,

n is number of years, and

i is annual rate of interest.

The standard notation equation is where the value of the factor is seen in the compound interest factor table.

where the value of the factor is seen in the compound interest factor table.

The formula for inflated interest rate as follows: Here,

Here,

i is interest rate,

f is inflation rate.

Calculate the purchasing power in current-value dollar terms as follows: Thus, the purchasing power in current-value dollar terms is

Thus, the purchasing power in current-value dollar terms is

Here,

Here, F is future accumulated amount,

n is number of years, and

i is annual rate of interest.

The standard notation equation is

where the value of the factor is seen in the compound interest factor table.

where the value of the factor is seen in the compound interest factor table.The formula for inflated interest rate as follows:

Here,

Here,i is interest rate,

f is inflation rate.

Calculate the purchasing power in current-value dollar terms as follows:

Thus, the purchasing power in current-value dollar terms is

Thus, the purchasing power in current-value dollar terms is

4

Inflation occurs when:

A) Productivity increases

B) The value of the currency decreases

C) The value of the currency increases

D) The price of gold decreases

A) Productivity increases

B) The value of the currency decreases

C) The value of the currency increases

D) The price of gold decreases

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

Calculate the inflation adjusted interest rate per quarter when the real interest rate is 4% per quarter and the inflation rate is 1% per quarter.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

Stadium Capital Financing Group helps cash strapped sports programs through the marketing of its "sports mortgage."At the University of Kansas, Jayhawks fans can sign up to pay $105,000 over 10 years for the right to buy top seats for football during the next 30 years. In return, the season tickets will stay locked in at current year prices. Season tickets in tier 1 are currently selling for $350. A fan plans to purchase the sports mortgage along with season tickets now and each year for the next 30 years (31 seasons). What is the dollar amount of the savings on the tickets (with no interest considered), if ticket prices rise at a rate of 3% per year for the next 30 years

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

The strategic plan of a solar energy company that manufactures high efficiency solar cells includes an expansion of its physical plant in 4 years. The engineer in charge of planning estimates the expenditure required now to be $8 million, but in 4 years, the cost will be higher by an amount equal to the inflation rate. If the company sets aside $7,000,000 now into an account that earns interest at 7% per year, what will the inflation rate have to be in order for the company to have exactly the right amount of money for the expansion

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

"Then current" (future) dollars can be converted into constant value dollars by:

A) Multiplying them by (1 + f ) n

B) Multiplying them by (1 + f ) n /(1 + i) n

C) Dividing them by (1 + f ) n

D) Dividing them by (1 + i f ) n

A) Multiplying them by (1 + f ) n

B) Multiplying them by (1 + f ) n /(1 + i) n

C) Dividing them by (1 + f ) n

D) Dividing them by (1 + i f ) n

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

Calculate the real interest rate per month if the nominal inflation adjusted interest rate per year, compounded monthly, is 18% and the inflation rate per month is 0.5%.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

There are two ways to account for inflation in present worth calculations. What are they

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

Five years ago, an industrial engineer deposited $10,000 into an account and left it undisturbed until now. The account is now worth $25,000.

a) What was the overall ROR during the 5 years

b) If the inflation over that period was 4% per year, what was the real ROR

c) What is the buying power of the $25,000 now compared to the buying power 5 years ago

a) What was the overall ROR during the 5 years

b) If the inflation over that period was 4% per year, what was the real ROR

c) What is the buying power of the $25,000 now compared to the buying power 5 years ago

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

To calculate how much something will cost if you expect its cost to increase by exactly the inflation rate, you should:

A) Multiply by (1 + f ) n

B) Multiply by [(1 + f ) n /(1 + i) n ]

C) Divide by (1+ f ) n

D) Multiply by (1 + i f ) n

A) Multiply by (1 + f ) n

B) Multiply by [(1 + f ) n /(1 + i) n ]

C) Divide by (1+ f ) n

D) Multiply by (1 + i f ) n

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

A southwestern city has a contract with Firestone Vehicle Fleet Maintenance to provide maintenance services on its fleet of city owned vehicles such as street sweepers, garbage trucks, backhoes, and carpool vehicles. The contract price is fixed at $45,000 per year for 4 years. If you were asked to convert the future amounts into constant value amounts per today's dollars, what would the respective amounts be Assume the current market interest rate of 10% per year and inflation rate of 5% per year are expected to remain the same over the next 4 year period.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

An environmental testing company needs to purchase equipment 2 years from now and expects to pay $50,000 at that time. At a real interest rate of 10% per year and inflation rate of 4% per year, what is the present worth of the cost of the equipment

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

A Toyota Tundra can be purchased today for $32,350. A civil engineering firm is going to need three more trucks in 2 years because of a land development contract it just won. If the price of the truck increases exactly in accordance with an estimated inflation rate of 3.5% per year, determine how much the three trucks will cost in 2 years.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

If the market interest rate is 16% per year when the inflation rate is 9% per year, the real interest rate is closest to:

A) 6.4%

B) 7%

C) 9%

D) 15.6%

A) 6.4%

B) 7%

C) 9%

D) 15.6%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

When the inflation rate is 5% per year, how many inflated dollars will be required 10 years from now to buy the same things that $10,000 buys now

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

Carlsbad Gas and Electric is planning to purchase a degassing tower for removing CO 2 from acidified saltwater. The supplier quoted a price of $125,000 if the unit is purchased within the next 3 years. Your supervisor has asked you to calculate the present worth of the tower when considering inflation. Assuming the tower will not be purchased for 3 years, calculate the present worth at an interest rate of 10% per year and an inflation rate of 4% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

The Nobel Prize is administered by The Nobel Foundation, a private institution that was founded in 1900 based on the will of Alfred Nobel, the inventor of dynamite. In part, his will stated: "The capital shall be invested by my executors in safe securities and shall constitute a fund, the interest on which shall be annually distributed in the form of prizes to those who, during the preceding year, shall have conferred the greatest benefit on mankind." The will further stated that the prizes were to be awarded in physics, chemistry, peace, physiology or medicine, and literature. In addition to a gold medal and a diploma, each recipient receives a substantial sum of money that depends on the Foundation's income that year. The first Nobel Prize was awarded in 1901 in the amount of $150,000. In 1996, the award was $653,000; it was $1.4 million in 2009.

a) If the increase between 1996 and 2009 was strictly due to inflation, what was the average inflation rate per year during that 13 year period

b) If the Foundation expects to invest money with a return of 5% above the inflation rate, how much will a laureate receive in 2020, provided the inflation rate averages 3% per year between 2009 and 2020

a) If the increase between 1996 and 2009 was strictly due to inflation, what was the average inflation rate per year during that 13 year period

b) If the Foundation expects to invest money with a return of 5% above the inflation rate, how much will a laureate receive in 2020, provided the inflation rate averages 3% per year between 2009 and 2020

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

The market interest rate i f is 12% per year, compounded semiannually. For an inflation rate of 2% per 6 months, the effective semiannual interest rate is closest to:

A) 2%

B) 3%

C) 4%

D) 6%

A) 2%

B) 3%

C) 4%

D) 6%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

Assume that you want to retire 30 years from now with an amount of money that will have the same value (same purchasing power) as $1.5 million today. If you estimate the inflation rate will be 4% per year, how many future (then current) dollars will you need

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

How much can the manufacturer of superconducting magnetic energy storage systems afford to spend now on new equipment in lieu of spending $75,000 four years from now The company's real MARR is 12% per year, and the inflation rate is 3% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

Timken Roller Bearing is a manufacturer of seamless tubes for drill bit collars. The company is planning to add larger capacity robotic arms to one of its assembly lines 3 years from now. If it is done now, the cost of the equipment with installation is $2.4 million. If the company's real MARR is 15% per year, determine the equivalent amount the company can spend 3 years from now in then-current dollars if the inflation rate is 2.8% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

Construction equipment has a cost today of $40,000. If its cost has increased only by the inflation rate of 6% per year, when the market interest rate was 10% per year, its cost 10 years ago was closest to:

a) $15,420

b) $22,335

c) $27,405

d) $71,630

a) $15,420

b) $22,335

c) $27,405

d) $71,630

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

What is the overall rate of return after 12 years

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

If the inflation rate is 7% per year, how many years will it take for the cost of something to double when prices increase at exactly the same rate as inflation

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

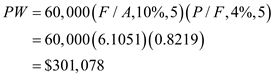

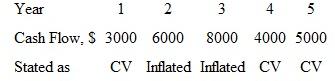

Find the present worth of the cash flows shown. Some are expressed as constant value (CV) dollars, and others are inflated dollars. Assume a real interest rate of 8% per year and an inflation rate of 6% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

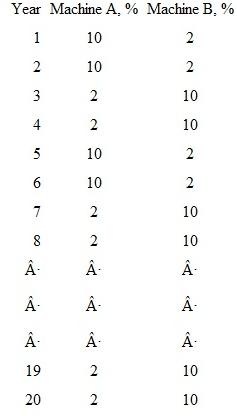

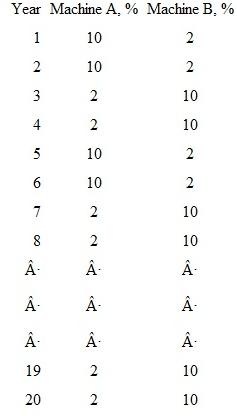

The data below show two patterns of inflation that are exactly the opposite of each other over a 20-year time period.

a) If each machine costs $10,000 in year 0 and they both increase in cost exactly in accordance with the inflation rate, how much will each machine cost at the end of year 20

b) What is the average inflation rate over the time period for machine A (that is, what single inflation rate would result in the same final cost for machine A)

c) In which years will machine A cost more than machine B

a) If each machine costs $10,000 in year 0 and they both increase in cost exactly in accordance with the inflation rate, how much will each machine cost at the end of year 20

b) What is the average inflation rate over the time period for machine A (that is, what single inflation rate would result in the same final cost for machine A)

c) In which years will machine A cost more than machine B

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

The amount of money that would be accumulated now from an investment of $1000 25 years ago at a market rate of 5% per year and an inflation rate averaging 2% per year over that time period is closest to:

A) $1640

B) $3385

C) $5430

D) Over $5500

A) $1640

B) $3385

C) $5430

D) Over $5500

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

What is the difference between today's dollars and constant value dollars

a) when using today as the reference point in time and b) when using 2 years ago as the reference point

a) when using today as the reference point in time and b) when using 2 years ago as the reference point

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

The inflation rate in a Central American country is 6% per year. What real rate of return will an investor make on a $100,000 investment in a copper mine stock that yields an overall internal rate of return of 28% per year

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

A doctor is on contract to a medium sized oil company to provide medical services at remotely located, widely separated refineries. The doctor is considering the purchase of a private plane to reduce the total travel time between refineries. The doctor can buy a used Lear jet now or wait for a new very light jet (VLJ) that will be available 3 years from now. The cost of the VLJ will be $1.9 million, payable when the plane is delivered in 3 years. The doctor has asked you, his friend, to determine the present worth of the VLJ so that he can decide whether to buy the used Lear now or wait for the VLJ. If the MARR is 15% per year and the inflation rate is projected to be 3% per year, what is the present worth of the VLJ with inflation considered

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

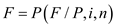

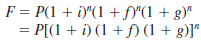

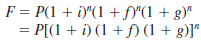

Factors that increase costs and prices especially for materials and manufacturing costs sensitive to market, technology, and labor availability can be considered separately using the real interest rate i, the inflation rate f, and additional increases that grow at a geometric rate g. The future amount is calculated based on a current estimate by using the relation

The product of the first two terms enclosed in parentheses results in the inflated interest rate i f. The geometric rate is the same one used in the geometric series (Chapter 2). It commonly applies to maintenance and repair cost increases as machinery ages. This is over and above the inflation rate. If the current cost to manufacture an electronic subcomponent is $300,000 per year, what is the equivalent cost in 3 years, provided the average annual rates for i, f, and g are 10%, 3%, and 2%, respectively

The product of the first two terms enclosed in parentheses results in the inflated interest rate i f. The geometric rate is the same one used in the geometric series (Chapter 2). It commonly applies to maintenance and repair cost increases as machinery ages. This is over and above the inflation rate. If the current cost to manufacture an electronic subcomponent is $300,000 per year, what is the equivalent cost in 3 years, provided the average annual rates for i, f, and g are 10%, 3%, and 2%, respectively

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

If $1000 is invested now, the number of future dollars required 10 years from now to earn a real interest rate of 6% per year, when the inflation rate is 4% per year, is closest to:

A) $1480

B) $1790

C) $2650

D) Over $2700

A) $1480

B) $1790

C) $2650

D) Over $2700

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

If he decided to sell the stock or bond immediately after the fifth annual dividend, what is his minimum selling price to realize a 7% real return Include an adjustment of 4% per year for inflation.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

During periods of hyperinflation, prices increase rapidly over short periods of time. In 1993, the Consumer Price Index (CPI) in Brazil was 113.6 billion. In 1994, the CPI was 2472.4 billion.

a) What was the inflation rate per year between 1993 and 1994

b) Assuming the inflation rate calculated in part

a) occurred uniformly throughout the year and represented a nominal rate, what were the monthly and daily inflation rates over that time period

a) What was the inflation rate per year between 1993 and 1994

b) Assuming the inflation rate calculated in part

a) occurred uniformly throughout the year and represented a nominal rate, what were the monthly and daily inflation rates over that time period

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

A regional infrastructure building and maintenance contractor is trying to decide whether to buy a new compact horizontal directional drilling (HDD) machine now or wait to buy it 2 years from now (when a large pipeline contract will require the new equipment). The HDD machine will include an innovative pipe loader design and maneuverable undercarriage system. The cost of the system is $68,000 if purchased now or $81,000 if purchased 2 years from now. At a real MARR of 10% per year and an inflation rate of 5% per year, determine if the company should buy now or later

a) without any adjustment for inflation and

b) with inflation considered.

a) without any adjustment for inflation and

b) with inflation considered.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

An electric utility is considering two alternatives for satisfying state regulations regarding pollution control for one of its generating stations. This particular station is located at the outskirts of a major U.S. city and a short distance from a large city in a neighboring country. The station is currently producing excess VOCs and oxides of nitrogen. Two plans have been proposed for satisfying the regulators. Plan A involves replacing the burners and switching from fuel oil to natural gas. The cost of the option will be $300,000 initially and an extra $900,000 per year in fuel costs. Plan B involves going to the foreign city and running gas lines to many of the "backyard" brick making sites that now use wood, tires, and other combustible waste materials for firing the bricks. The idea behind plan B is that by reducing the particulate pollution responsible for smog in the neighboring city, there would be greater benefit to U.S. citizens than would be achieved through plan A. The initial cost of plan B will be $1.2 million for installation of the lines. Additionally, the electric company would subsidize the cost of gas for the brick makers to the extent of $200,000 per year. Extra air monitoring associated with this plan will cost an additional $150,000 per year. For a 10 year project period and no salvage value for either plan, which one should be selected on the basis of an annual worth analysis at a real interest rate of 7% per year and an inflation rate of 4% per year

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

If you expect to receive a gift of $50,000 six years from now, the present worth of the gift at a real interest rate of 4% per year and an inflation rate of 3% per year is closest to:

A) $27,600

B) $29,800

C) $33,100

D) $37,200

A) $27,600

B) $29,800

C) $33,100

D) $37,200

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

State the conditions under which the market interest rate is

a) higher than, b) lower than, and c) the same as the real interest rate.

a) higher than, b) lower than, and c) the same as the real interest rate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

A trust was set up by your grandfather that states you are to receive $250,000 exactly 5 years from today. Determine the buying power of the $250,000 in terms of today's dollars if the market interest rate is 10% per year and the inflation rate is 4% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

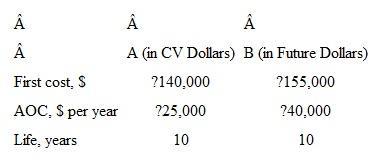

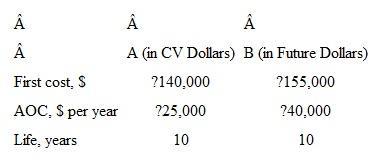

An engineer must recommend one of two rapid prototyping machines for integration into an upgraded manufacturing line. She obtained estimates from salespeople from two companies. Salesman A gave her the estimates in constant value (today's) dollars, while saleswoman B provided the estimates in future (then current) dollars. The company's MARR is equal to the real rate of return of 20% per year, and inflation is estimated at 4% per year. Use PW analysis to determine which machine the engineer should recommend.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

A chemical engineer who is smitten with wanderlust wants to build a reserve fund that will be sufficient to permit her to take time off from work to travel around the world. Her goal is to save enough money over the next 3 years so that when she begins her trip, the amount she has accumulated will have the same buying power as $72,000 today. If she expects to earn a market rate of 12% per year on her investments and inflation averages 5% per year over the 3 years, how much must she save each year to reach her goal

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

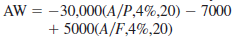

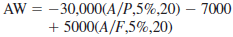

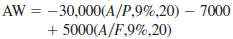

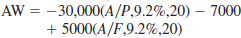

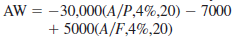

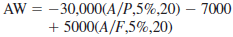

New state mandated emission testing equipment for annual inspection of automobiles at Charlie's Garage has a first cost of $30,000, an annual operating cost of $7000, and a $5000 salvage value after its 20-year life. For a real interest rate of 5% per year and an inflation rate of 4% per year, the annual capital recovery requirement for the equipment (in future dollars) is determined by:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

If Earl needed some money in the future, say, immediately after the fifth dividend payment, what would be the minimum selling price in future dollars, if he were only interested in recovering an amount that maintained the purchasing power of the original price

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

Assume the inflation rate is 4% per year and the market interest rate is 5% above the inflation rate. Determine

a) the number of constant value dollars 5 years in the future that is equivalent to $30,000 now and b) the number of future dollars that will be equivalent to $30,000 now.

a) the number of constant value dollars 5 years in the future that is equivalent to $30,000 now and b) the number of future dollars that will be equivalent to $30,000 now.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

A salesman from Industrial Water Services (IWS), who is trying to get his foot in the door for a large account in Fremont, offered water chlorination equipment for $2.1 million. This is $400,000 more than the price offered by a competing saleswoman from AG Enterprises. However, IWS said the company would not have to pay for the equipment until the warranty runs out. If the equipment has a 2 year warranty, determine which offer is better. The company's real MARR is 12% per year, and the inflation rate is 4% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

An entrepreneur engaged in wildcat oil well drilling is seeking investors who will put up $500,000 for an opportunity to reap high returns if the venture is successful. The prospectus states that a return of at least 22% per year for 5 years is likely. How much will the investors have to receive each year to recover their money if an inflation rate of 5% per year is to be included in the calculation

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

Temporary price deflation may occur in specific sectors of the economy for all of the following reasons except:

A) Improved technology

B) Excessive demand

C) Dumping

D) Increased productivity

A) Improved technology

B) Excessive demand

C) Dumping

D) Increased productivity

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

What annual inflation rate is implied from an inflation adjusted interest rate of 10% per year, when the real interest rate is 4% per year

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

The Pell Grant program of the federal government provides financial aid to needy college students. If the average grant is slated to increase from $4050 to $5400 over the next 5 years "to keep up with inflation," what is the average inflation rate per year expected to be

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

A chemical engineer is considering two sizes of pipes, small (S) and large (L), for moving distillate from a refinery to the tank farm. A small pipeline will cost less to purchase (including valves and other appurtenances) but will have a high head loss and, therefore, a higher pumping cost. In writing the report, the engineer compared the alternatives based on future worth values, but the company president wants the costs expressed as present dollars. Determine present worth values if future worth values are FW S = $2.3 million and FW L = $2.5 million. The company uses a real interest rate of 1% per month and an inflation rate of 0.4% per month. Assume the future worth values were for a 10 year project period.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

Veri Trol, Inc. manufactures in situ calibration verification systems that confirm flow measurement accuracies without removing the meters. The company has decided to modify the main assembly line with one of the enhancement processes shown below. If the company's real MARR is 15% per year, which process has the lower annual cost when inflation of 5% per year is considered

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

As a follow-on to question 3, what happens to the selling price (in future dollars) 5 years after purchase, if Earl is willing to remove (net out) the future purchasing power of each of the dividends in the computation to determine the required selling price 5 years hence

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

Ford Motor Company announced that the price of its F 150 pickup trucks is going to increase by only the inflation rate for the next 3 years. If the current price of a well equipped truck is $28,000 and the inflation rate averages 2.1% per year, what is the expected price of a comparably equipped truck next year 3 years from now

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

As an innovative way to pay for various software packages, a new high tech service company has offered to pay your company, Custom Computer Services (CCS), in one of three ways: (1) pay $480,000 now, (2) pay $1.1 million 5 years from now, or (3) pay an amount of money 5 years from now that will have the same purchasing power as $850,000 now. If you, as president of CCS, want to earn a real interest rate of 10% per year when the inflation rate is 6% per year, which offer should you accept

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

Johnson Thermal Products used austenitic nickel chromium alloys to manufacture resistance heating wire. The company is considering a new annealing drawing process to reduce costs. If the new process will cost $3.7 million now, how much must be saved each year to recover the investment in 5 years if the company's MARR is a real 12% per year and the inflation rate is 3% per year

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

Determine the inflation adjusted interest rate for a growth company that wants to earn a real rate of return of 20% per year when the inflation rate is 5% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

In an effort to reduce pipe breakage, water hammer, and product agitation, a chemical company plans to install several chemically resistant pulsation dampeners. The cost of the dampeners today is $120,000, but the company has to wait until a permit is approved for its bidirectional port to plant product pipeline. The permit approval process will take at least 2 years because of the time required for preparation of an environmental impact statement. Because of intense foreign competition, the manufacturer plans to increase the price only by the inflation rate each year. If the inflation rate is 2.8% per year and the company's MARR is 20% per year, estimate the cost of the dampeners in 2 years in terms of (a) today's dollars and (b) future dollars.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

If the inflation rate is 6% per year and a person wants to earn a true (real) interest rate of 10% per year, determine the number of future dollars she has to receive 10 years from now if the present investment is $10,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

The costs associated with a small X ray inspection system are $40,000 now and $24,000 per year, with a $6000 salvage value after 3 years. Determine the equivalent cost of the system if the real interest rate is 10% per year and the inflation rate is 4% per year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

Earl plans to keep the stocks or bonds for 12 years, that is, until the bond matures. However, he wants to make the 7% per year real return and make up for the expected 4% per year inflation. For what amount must he sell the stocks after 12 years, or buy the bonds now to ensure he realizes this return Do these amounts seem reasonable to you, given your knowledge of the way that stocks and bonds are bought and sold

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

A machine currently under consideration by Holzmann Industries has a cost of $45,000. When the purchasing manager complained that a similar machine the company purchased 5 years ago was much cheaper, the salesman responded that the cost of the machine has increased solely in accordance with the inflation rate, which has averaged 3% per year. When the purchasing manager checked the invoice for the machine he purchased 5 years ago, he saw that the price was $29,000. Was the salesman telling the truth about the increase in the cost of the machine If not, what should the machine cost now, provided the price increased by only the inflation rate

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

How many future dollars would you need 5 years from now just to have the same buying power as $50,000 now, if the deflation rate is 3% per year

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

Maintenance costs for pollution control equipment on a pulverized coal cyclone furnace are expected to be $180,000 now and another $70,000 three years from now. The CFO of Monongahela Power wants to know the equivalent annual cost of the equipment in years 1 through 5. If the company uses a real interest rate of 9% per year and the inflation rate averages 3% per year, what is the equivalent annual cost of the equipment

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

For a high growth company that wants to make a real rate of return of 30% per year, compounded monthly, determine the inflation adjusted nominal interest rate per year. Assume the inflation rate is 1.5% per month.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

A report by the National Center for Public Policy and Higher Education stated that tuition and fees (T F) at public colleges and universities increased by 439% over the last 25 years. During this same time period, the median family income (MFI) rose 147%. When the report was written, T F at a 4 year public university constituted 28% of the MFI of $52,000 (tuition and fees at a private university constituted 76% of MFI).

a) What was the tuition and fee cost per year when the report was written

b) What was the T F cost 25 years ago

c) What percentage was T F of the MFI 25 years ago

a) What was the tuition and fee cost per year when the report was written

b) What was the T F cost 25 years ago

c) What percentage was T F of the MFI 25 years ago

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

If a company deposits $100,000 into an account that earns a market interest rate of 10% per year at a time when the deflation rate is 1% per year, what will be the purchasing power of the accumulated amount (with respect to today's dollars) at the end of 15 years

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

69

MetroKlean LLC, a hazardous waste soil cleaning company, borrowed $2.5 million for 5 years to finance start-up costs for a new project involving site reclamation. The company expects to earn a real rate of return of 20% per year. The average inflation rate is 5% per year.

a) Determine the capital recovery required each year with inflation considered.

b) Determine the capital recovery if the company is satisfied with accumulating $2.5 million at the end of the 5 years with inflation considered.

c) Determine the capital recovery in part b) without considering inflation.

a) Determine the capital recovery required each year with inflation considered.

b) Determine the capital recovery if the company is satisfied with accumulating $2.5 million at the end of the 5 years with inflation considered.

c) Determine the capital recovery in part b) without considering inflation.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck