Deck 6: International Parity Relationships and Forecasting Foreign Exchange Rates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/23

Play

Full screen (f)

Deck 6: International Parity Relationships and Forecasting Foreign Exchange Rates

1

Give a full definition of arbitrage.

Market for foreign exchange

It is one of the biggest financial market in the world which operates 24 x 7. Turnover of the market increases with increase in transactions by other financial institutions which includes central banks, mutual funds, insurance companies, hedge funds etc. This market covers multiple operations like conversion of purchasing power of one currency into another, trading in foreign currency, foreign trade financing etc.

Arbitrage

It may be defined as an action taken to earn profit by selling and buying the assets or commodities concurrently.

It should be defined in advance because it is very important for subsequent discussions.

Market is in equilibrium when there are no profitable arbitrage opportunities existing. Arbitrage equilibrium conditions are represented by parity relationships like interest rate parity and purchase power parity.

It is one of the biggest financial market in the world which operates 24 x 7. Turnover of the market increases with increase in transactions by other financial institutions which includes central banks, mutual funds, insurance companies, hedge funds etc. This market covers multiple operations like conversion of purchasing power of one currency into another, trading in foreign currency, foreign trade financing etc.

Arbitrage

It may be defined as an action taken to earn profit by selling and buying the assets or commodities concurrently.

It should be defined in advance because it is very important for subsequent discussions.

Market is in equilibrium when there are no profitable arbitrage opportunities existing. Arbitrage equilibrium conditions are represented by parity relationships like interest rate parity and purchase power parity.

2

Derive and explain the monetary approach to exchange rate determination.

Exchange rate:

Different countries have different currencies and the different currencies have different value. Evidently there is rule for currency conversion for global business and investment. The rate of conversion is the exchange rate. In other words, an exchange is the price of one country's expressed in terms of the currency of another country.

Deriving and explaining monetary approach:

According monetary approach, exchange rate is determined by three independent variables.

These are

(a) relative money supplies

(b) relative velocity of monies

(c) relative national output

Monetary approach can be derived in following empirical form: Where:

Where:

s = natural logarithm of the spot exchange rate. = natural logarithm of domestic/foreign money supply.

= natural logarithm of domestic/foreign money supply.  = natural logarithm of domestic/foreign velocity of money.

= natural logarithm of domestic/foreign velocity of money.  = natural logarithm of foreign/domestic output.

= natural logarithm of foreign/domestic output.

u = random error term, with mean zero ,

,  's = model parameters.

's = model parameters.

Different countries have different currencies and the different currencies have different value. Evidently there is rule for currency conversion for global business and investment. The rate of conversion is the exchange rate. In other words, an exchange is the price of one country's expressed in terms of the currency of another country.

Deriving and explaining monetary approach:

According monetary approach, exchange rate is determined by three independent variables.

These are

(a) relative money supplies

(b) relative velocity of monies

(c) relative national output

Monetary approach can be derived in following empirical form:

Where:

Where:s = natural logarithm of the spot exchange rate.

= natural logarithm of domestic/foreign money supply.

= natural logarithm of domestic/foreign money supply.  = natural logarithm of domestic/foreign velocity of money.

= natural logarithm of domestic/foreign velocity of money.  = natural logarithm of foreign/domestic output.

= natural logarithm of foreign/domestic output.u = random error term, with mean zero

,

,  's = model parameters.

's = model parameters. 3

While you were visiting London, you purchased a Jaguar for £35,000, payable in three months. You have enough cash at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.45/£ and the three-month forward exchange rate is $1.40/£. In London, the money market interest rate is 2.0% for a three-month investment. There are two alternative ways of paying for your Jaguar.

(a) Keep the funds at your bank in the U.S. and buy £35,000 forward.

(b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to £35,000.

Evaluate each payment method. Which method would you prefer Why

(a) Keep the funds at your bank in the U.S. and buy £35,000 forward.

(b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to £35,000.

Evaluate each payment method. Which method would you prefer Why

Market for foreign exchange

It is one of the biggest financial market in the world which operates 24 x 7. Turnover of the market increases with increase in transactions by other financial institutions which includes central banks, mutual funds, insurance companies, hedge funds etc. This market covers multiple operations like conversion of purchasing power of one currency into another, trading in foreign currency, foreign trade financing etc.

Arbitrage

It may be defined as an action taken to earn profit by selling and buying the assets or commodities concurrently.

It should be defined in advance because it is very important for subsequent discussions.

Market is in equilibrium when there are no profitable arbitrage opportunities existing. Arbitrage equilibrium conditions are represented by parity relationships like interest rate parity and purchase power parity.

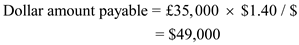

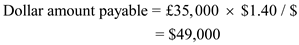

Cost as per alternative a

Calculate the dollar amount payable by multiplying the GBP amount i.e. £35,000 with forward rate i.e. $1.40 / £. Cost as per alternative b

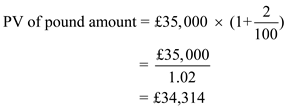

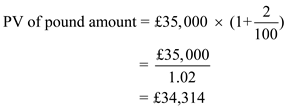

Cost as per alternative b

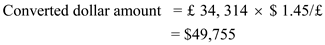

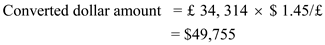

Calculate present value of British pounds by multiplying the interest rate i.e. 1.02 (1 + (US interest rate i.e. 2 /100)) Convert the present value of pound amount into dollar amount using spot rate by multiplying the pound amount with spot rate i.e. $1.45 / £.

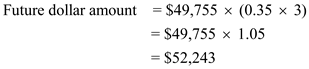

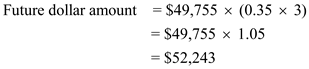

Convert the present value of pound amount into dollar amount using spot rate by multiplying the pound amount with spot rate i.e. $1.45 / £.  Calculate the future value of dollar amount after three months by multiplying the dollar amount i.e. $49,755 with interest rate i.e. 1.05 (0.35 x 3) for 3 months.

Calculate the future value of dollar amount after three months by multiplying the dollar amount i.e. $49,755 with interest rate i.e. 1.05 (0.35 x 3) for 3 months.  Dollar amount payable as per alternative 'b' is higher i.e. $52,243 as compared to alternative a i.e. forward contract.

Dollar amount payable as per alternative 'b' is higher i.e. $52,243 as compared to alternative a i.e. forward contract.

Hence, alternative 'a' should be used because dollar amount payable is less i.e. 49,000.

It is one of the biggest financial market in the world which operates 24 x 7. Turnover of the market increases with increase in transactions by other financial institutions which includes central banks, mutual funds, insurance companies, hedge funds etc. This market covers multiple operations like conversion of purchasing power of one currency into another, trading in foreign currency, foreign trade financing etc.

Arbitrage

It may be defined as an action taken to earn profit by selling and buying the assets or commodities concurrently.

It should be defined in advance because it is very important for subsequent discussions.

Market is in equilibrium when there are no profitable arbitrage opportunities existing. Arbitrage equilibrium conditions are represented by parity relationships like interest rate parity and purchase power parity.

Cost as per alternative a

Calculate the dollar amount payable by multiplying the GBP amount i.e. £35,000 with forward rate i.e. $1.40 / £.

Cost as per alternative b

Cost as per alternative b Calculate present value of British pounds by multiplying the interest rate i.e. 1.02 (1 + (US interest rate i.e. 2 /100))

Convert the present value of pound amount into dollar amount using spot rate by multiplying the pound amount with spot rate i.e. $1.45 / £.

Convert the present value of pound amount into dollar amount using spot rate by multiplying the pound amount with spot rate i.e. $1.45 / £.  Calculate the future value of dollar amount after three months by multiplying the dollar amount i.e. $49,755 with interest rate i.e. 1.05 (0.35 x 3) for 3 months.

Calculate the future value of dollar amount after three months by multiplying the dollar amount i.e. $49,755 with interest rate i.e. 1.05 (0.35 x 3) for 3 months.  Dollar amount payable as per alternative 'b' is higher i.e. $52,243 as compared to alternative a i.e. forward contract.

Dollar amount payable as per alternative 'b' is higher i.e. $52,243 as compared to alternative a i.e. forward contract.Hence, alternative 'a' should be used because dollar amount payable is less i.e. 49,000.

4

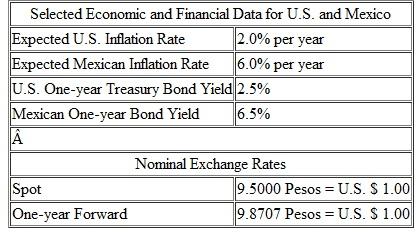

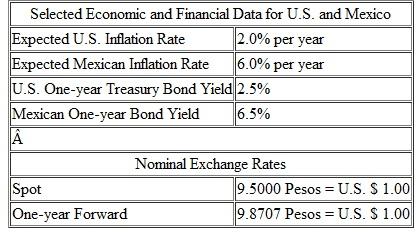

After studying Iris Hamson's credit analysis, George Davies is considering whether he can increase the holding period return on Yucatan Resort's excess cash holdings (which are held in pesos) by investing those cash holdings in the Mexican bond market. Although Davies would be investing in a peso-denominated bond, the investment goal is to achieve the highest holding period return, measured in U.S. dollars, on the investment.

Davies finds the higher yield on the Mexican one-year bond, which is considered to be free of credit risk, to be attractive but he is concerned that depreciation of the peso will reduce the holding period return, measured in U.S. dollars. Hamson has prepared selected economic and financial data, given in Exhibit 3-1, to help Davies make the decision. Hamson recommends buying the Mexican one-year bond and hedging the foreign currency exposure using the one-year forward exchange rate. She concludes: "This transaction will result in a U.S. dollar holding period return that is equal to the holding period return of the U.S. one-year bond."

Hamson recommends buying the Mexican one-year bond and hedging the foreign currency exposure using the one-year forward exchange rate. She concludes: "This transaction will result in a U.S. dollar holding period return that is equal to the holding period return of the U.S. one-year bond."

a. Calculate the U.S. dollar holding period return that would result from the transaction recommended by Hamson. Show your calculations. State whether Hamson's conclusion about the U.S. dollar holding period return resulting from the transaction is correct or incorrect. After conducting his own analysis of the U.S. and Mexican economies, Davies expects that both the U.S. inflation rate and the real exchange rate will remain constant over the coming year. Because of favorable political developments in Mexico, however, he expects that the Mexican inflation rate (in annual terms) will fall from 6.0 percent to 3.0 percent before the end of the year. As a result, Davies decides to invest Yucatan Resorts' cash holdings in the Mexican one-year bond but not to hedge the currency exposure.

b. Calculate the expected exchange rate (pesos per dollar) one year from now. Show your calculations. Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates.

c. Calculate the expected U.S. dollar holding period return on the Mexican one-year bond. Show your calculations. Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates.

Davies finds the higher yield on the Mexican one-year bond, which is considered to be free of credit risk, to be attractive but he is concerned that depreciation of the peso will reduce the holding period return, measured in U.S. dollars. Hamson has prepared selected economic and financial data, given in Exhibit 3-1, to help Davies make the decision.

Hamson recommends buying the Mexican one-year bond and hedging the foreign currency exposure using the one-year forward exchange rate. She concludes: "This transaction will result in a U.S. dollar holding period return that is equal to the holding period return of the U.S. one-year bond."

Hamson recommends buying the Mexican one-year bond and hedging the foreign currency exposure using the one-year forward exchange rate. She concludes: "This transaction will result in a U.S. dollar holding period return that is equal to the holding period return of the U.S. one-year bond."a. Calculate the U.S. dollar holding period return that would result from the transaction recommended by Hamson. Show your calculations. State whether Hamson's conclusion about the U.S. dollar holding period return resulting from the transaction is correct or incorrect. After conducting his own analysis of the U.S. and Mexican economies, Davies expects that both the U.S. inflation rate and the real exchange rate will remain constant over the coming year. Because of favorable political developments in Mexico, however, he expects that the Mexican inflation rate (in annual terms) will fall from 6.0 percent to 3.0 percent before the end of the year. As a result, Davies decides to invest Yucatan Resorts' cash holdings in the Mexican one-year bond but not to hedge the currency exposure.

b. Calculate the expected exchange rate (pesos per dollar) one year from now. Show your calculations. Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates.

c. Calculate the expected U.S. dollar holding period return on the Mexican one-year bond. Show your calculations. Note: Your calculations should assume that Davies is correct in his expectations about the real exchange rate and the Mexican and U.S. inflation rates.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

5

Discuss the implications of the interest rate parity for the exchange rate determination.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

6

Explain the following three concepts of purchasing power parity (PPP):

a. The law of one price.

b. Absolute PPP.

c. Relative PPP.

a. The law of one price.

b. Absolute PPP.

c. Relative PPP.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

7

Currently, the spot exchange rate is $1.50/£ and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000.

a. Determine whether the interest rate parity is currently holding.

b. If the IRP is not holding, how would you carry out covered interest arbitrage Show all the steps and determine the arbitrage profit.

c. Explain how the IRP will be restored as a result of covered arbitrage activities.

a. Determine whether the interest rate parity is currently holding.

b. If the IRP is not holding, how would you carry out covered interest arbitrage Show all the steps and determine the arbitrage profit.

c. Explain how the IRP will be restored as a result of covered arbitrage activities.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

8

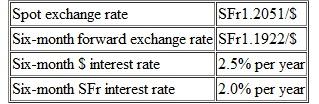

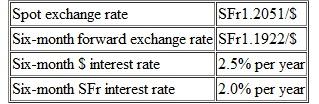

James Clark is a foreign exchange trader with Citibank. He notices the following quotes.  a. Is the interest rate parity holding You may ignore transaction costs.

a. Is the interest rate parity holding You may ignore transaction costs.

b. Is there an arbitrage opportunity If yes, show what steps need to be taken to make arbitrage profit. Assuming that James Clark is authorized to work with $1,000,000, compute the arbitrage profit in dollars.

a. Is the interest rate parity holding You may ignore transaction costs.

a. Is the interest rate parity holding You may ignore transaction costs.b. Is there an arbitrage opportunity If yes, show what steps need to be taken to make arbitrage profit. Assuming that James Clark is authorized to work with $1,000,000, compute the arbitrage profit in dollars.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

9

Explain the conditions under which the forward exchange rate will be an unbiased predictor of the future spot exchange rate.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

10

Evaluate the usefulness of relative PPP in predicting movements in foreign exchange rates on:

a. Short-term basis (for example, three months)

b. Long-term basis (for example, six years)

a. Short-term basis (for example, three months)

b. Long-term basis (for example, six years)

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

11

Suppose that the current spot exchange rate is €0.80/$ and the three-month forward exchange rate is €0.7813/$. The three-month interest rate is 5.60 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €800,000.

a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.

b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros.

a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.

b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

12

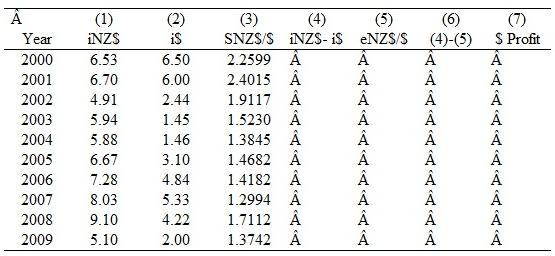

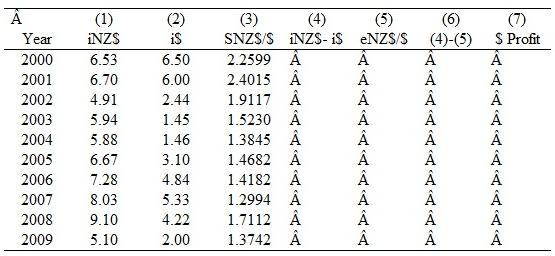

Suppose you conduct currency carry trade by borrowing $1 million at the start of each year and investing in New Zealand dollar for one year. One-year interest rates and the exchange rate between the U.S. dollar ($) and New Zealand dollar (NZ$) are provided below for the period 2000 - 2009. Note that interest rates are one-year interbank rates on January 1 st each year, and that the exchange rate is the amount of New Zealand dollar per U.S. dollar on December 31 each year. The exchange rate was NZ$1.9088/$ on January 1, 2000. Fill out the columns (4) - (7) and compute the total dollar profits from this carry trade over the ten-year period. Also, assess the validity of uncovered interest rate parity based on your solution of this problem. You are encouraged to use Excel program to tackle this problem.  Data source: Datastream.

Data source: Datastream.

Data source: Datastream.

Data source: Datastream.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

13

Explain the purchasing power parity, both the absolute and relative versions. What causes the deviations from the purchasing power parity

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

14

In the issue of October 23, 1999, the Economist reports that the interest rate per annum is 5.93% in the United States and 70.0% in Turkey. Why do you think the interest rate is so high in Turkey Based on the reported interest rates, how would you predict the change of the exchange rate between the U.S. dollar and the Turkish lira

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

15

Discuss the implications of the deviations from the purchasing power parity for countries' competitive positions in the world market.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

16

As of November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.95/$. The consensus forecast for the U.S. and Brazil inflation rates for the next 1-year period is 2.6% and 20.0%, respectively. What would you forecast the exchange rate to be at around November 1, 2000

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

17

Explain and derive the international Fisher effect.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

18

(CFA question) Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:  Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).

Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).

a. The current ZAR spot rate in USD that would have been forecast by PPP.

b. Using the IFE, the expected ZAR spot rate in USD one year from now.

c. Using PPP, the expected ZAR spot rate in USD four years from now.

Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).

Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).a. The current ZAR spot rate in USD that would have been forecast by PPP.

b. Using the IFE, the expected ZAR spot rate in USD one year from now.

c. Using PPP, the expected ZAR spot rate in USD four years from now.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

19

Researchers found that it is very difficult to forecast the future exchange rates more accurately than the forward exchange rate or the current spot exchange rate. How would you interpret this finding

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose that the current spot exchange rate is €1.50/ and the one-year forward exchange rate is €1.60/. The one-year interest rate is 5.4% in euros and 5.2% in pounds. You can borrow at most €1,000,000 or the equivalent pound amount, i.e., 666,667, at the current spot exchange rate.

a. Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are a euro-based investor. Also determine the size of the arbitrage profit.

b. Discuss how the interest rate parity may be restored as a result of the above transactions.

c. Suppose you are a pound-based investor. Show the covered arbitrage process and determine the pound profit amount.

a. Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are a euro-based investor. Also determine the size of the arbitrage profit.

b. Discuss how the interest rate parity may be restored as a result of the above transactions.

c. Suppose you are a pound-based investor. Show the covered arbitrage process and determine the pound profit amount.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

21

Explain the random walk model for exchange rate forecasting. Can it be consistent with the technical analysis

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 8 percent per annum in the United States and 7 percent per annum in Germany. Currently, the spot exchange rate is €1.01 per dollar and the six-month forward exchange rate is €0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

23

Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 2.5%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3.5% in the U.S. and 1.5% in the U.K. for the next three years. The spot exchange rate is currently $1.50/£.

a. Compute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fisher effect holds.

b. What is your expected future spot dollar-pound exchange rate in three years from now

c. Can you infer the forward dollar-pound exchange rate for one-year maturity

a. Compute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fisher effect holds.

b. What is your expected future spot dollar-pound exchange rate in three years from now

c. Can you infer the forward dollar-pound exchange rate for one-year maturity

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck