Deck 14: Transfer Taxes and Wealth Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 14: Transfer Taxes and Wealth Planning

1

Explain why the gross estate includes the value of certain property transferred by the decedent at death, such as property held in joint tenancy with the right of survivorship, even though this property is not subject to probate.

Federal transfer taxes means the taxes imposed when someone transfer his property and wealth to legal heir or executor.Property transfer at the death is dictated by last will and testament of the deceased person and such transfers are pronounced by testamentary transfers.After the transfer taxes this system is expanded to include a gift tax which is called intervolves transfers.The gift for inheritance is not included in recipient gross income once there is a tax paid by the decedent on the transfer.

There are some specific inclusions in the gross estate at the time of decedent's death.Besides property in the probate estate the gross state also includes a property transferred automatically at the death of individual, these automatic transfer can occur without the help of probate court because the ownership transfer by the in fraction of law at the time of death.

The reason behind the inclusion of such automatic property in the gross estate is that because Congress deemed that decedent controlled the ultimate disposition of such properties of because the decedent may have effectively determined who would receive the property at the time of his death.A common example is property held in joint tenancy with survivorship which legally transferred to the surviving tenant upon the death of a joint tenant joint bank accounts are commonly owned in joint ownership with the right of survivorship in such cases the alive tenant would hold after the death of other tenant.

To conclude, these automatic transfers can occur without the help of probate court because the ownership transfers by the in fraction of law at the time of death.

There are some specific inclusions in the gross estate at the time of decedent's death.Besides property in the probate estate the gross state also includes a property transferred automatically at the death of individual, these automatic transfer can occur without the help of probate court because the ownership transfer by the in fraction of law at the time of death.

The reason behind the inclusion of such automatic property in the gross estate is that because Congress deemed that decedent controlled the ultimate disposition of such properties of because the decedent may have effectively determined who would receive the property at the time of his death.A common example is property held in joint tenancy with survivorship which legally transferred to the surviving tenant upon the death of a joint tenant joint bank accounts are commonly owned in joint ownership with the right of survivorship in such cases the alive tenant would hold after the death of other tenant.

To conclude, these automatic transfers can occur without the help of probate court because the ownership transfers by the in fraction of law at the time of death.

2

Describe the conditions for using the annual exclusion to offset an otherwise taxable transfer.

The annual exclusion is the amount which is transfer from donor to donee or from one person to another person as a gift without payment of gift tax or affecting the unified credit.It is clear that annual gift exclusion may be in the form of cash or other assets.

Annual exclusion is one of the significant matter of the gift tax, which basically operates to eliminate small gifts from the gift tax base.The amount of exclusion as per 2011 is $13,000, while annual federal gift tax exclusion as per 2019 is $15,000.

In other words we can say that it is the amount which one person transfer to another person without having to pay gift tax.This concept of annual exclusion is applied to every gift.

Example:

If grandparents gives thousands of gift to several grandchildren, then every gift is treated for an annual exclusion separately.The following gift are not taxable:

Gift to spouse

Expenses relates to medical or tuition

Gifts to political organization

Gift which are less than the annual exclusion amount.

Annual exclusion is applicable to only to present interest gift but annual exclusion is not considered to future interest gift

A present interest gift is one in which donee immediate use the gift that is donee have full right to use, possession, and enjoyment of all the property which is gifted.And also any income arises from the gift is on the spot uses by the donee without any delay

But on the other hand gift of future interest is quite opposite from the gift of present interest on the ground that under the future interest donee have no right to use or enjoyment from the gifted property in present but benefit arises on some future date.In other words we can say that donee use, possession or enjoyment of the gifted property on some future date that is, donee is not utilizing this facilities in the present but gain this facilities on some future date is said to be future interest gift.

So it is concerned that annual exclusion gift is not applicable to future interest gift but only applicable to present interest gift.But special annual exclusion for future interest gift is given to minor (below 21 year of age), that is gift in trust for minor are future interest.

Annual exclusion is one of the significant matter of the gift tax, which basically operates to eliminate small gifts from the gift tax base.The amount of exclusion as per 2011 is $13,000, while annual federal gift tax exclusion as per 2019 is $15,000.

In other words we can say that it is the amount which one person transfer to another person without having to pay gift tax.This concept of annual exclusion is applied to every gift.

Example:

If grandparents gives thousands of gift to several grandchildren, then every gift is treated for an annual exclusion separately.The following gift are not taxable:

Gift to spouse

Expenses relates to medical or tuition

Gifts to political organization

Gift which are less than the annual exclusion amount.

Annual exclusion is applicable to only to present interest gift but annual exclusion is not considered to future interest gift

A present interest gift is one in which donee immediate use the gift that is donee have full right to use, possession, and enjoyment of all the property which is gifted.And also any income arises from the gift is on the spot uses by the donee without any delay

But on the other hand gift of future interest is quite opposite from the gift of present interest on the ground that under the future interest donee have no right to use or enjoyment from the gifted property in present but benefit arises on some future date.In other words we can say that donee use, possession or enjoyment of the gifted property on some future date that is, donee is not utilizing this facilities in the present but gain this facilities on some future date is said to be future interest gift.

So it is concerned that annual exclusion gift is not applicable to future interest gift but only applicable to present interest gift.But special annual exclusion for future interest gift is given to minor (below 21 year of age), that is gift in trust for minor are future interest.

3

Terry transferred $500,000 of real estate into an irrevocable trust for her son, Lee. The trustee was directed to retain income until Lee's 21 st birthday and then pay him the corpus of the trust. Terry retained the power to require the trustee to pay income to Lee at any time, and the right to the assets if Lee predeceased her. What amount of the trust, if any, will be included in Terry's estate

The value of the trust assets would be included in Terry's estate because she retains control over the income (the ability to force the trustee to distribute income)and has a contingent right of reversion.

4

For the holidays, Marty gave a watch worth $25,000 to Emily and jewelry worth $40,000 to Natalie. Has Marty made any taxable gifts in 2011 and, if so, in what amounts Does it matter if Marty is married to Wendy and they live in a community property state

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

Identify the factors that determine the proportion of the value of property held in joint tenancy with the right of survivorship that will be included in a decedent's gross estate.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

List the conditions for making an election to split gifts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Last year Robert transferred a life insurance policy worth $45,000 to an irrevocable trust with directions to distribute the corpus of the trust to his grandson, Danny, upon his graduation from college, or to Danny's estate upon his death. Robert paid $15,000 of gift tax on the transfer of the policy. Early this year, Robert died and the insurance company paid $400,000 to the trust. What amount, if any, is included in Robert's gross estate

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

This year Jeff earned $850,000 and used it to purchase land in joint tenancy with a right of survivorship with Mary. Has Jeff made a taxable gift to Mary and, if so, in what amount What is your answer if Jeff and Mary are married

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

Define fair market value for transfer tax purposes.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

Describe the limitations on the deduction of transfers to charity.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

{Research} Willie purchased a whole-life insurance policy on his brother, Benny. Under the policy, the insurance company will pay the named beneficiary $100,000 upon the death of the insured, Benny. Willie names Tess the beneficiary, and upon Benny's death, Tess receives the proceeds of the policy, $100,000. Identify and discuss the transfer tax implications of this arrangement.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

In 2011 Laura transfers $500,000 into trust with the income to be paid annually to her spouse, William, for life (a life estate) and the remainder to Jenny. Calculate the amount of the taxable gifts from the transfers.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

Harold owns a condo in Hawaii that he plans on using for the rest of his life. However, to ensure his sister Maude will own the property after his death, Harold deeded the remainder of the property to her. He signed the deed transferring the remainder in July 2009 when the condo was worth $250,000 and his life estate was worth $75,000. Harold died in January 2011, at which time the condo was worth $300,000. What amount, if any, is included in Harold's gross estate Explain.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

Explain the purpose of adding prior taxable gifts to current taxable gifts and show whether these prior gifts could be taxed multiple times over the years.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Jimmy owns two parcels of real estate, Tara and Sundance. Tara is worth $240,000 and Sundance is worth $360,000. Jimmy plans to bequeath Tara directly to his wife Lois and leave her a life estate in Sundance. What amount of value will be included in Jimmy's gross estate and taxable estate should he die now

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Red transferred $5,000,000 of cash to State University for a new sports complex. Calculate the amount of the taxable gift.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

Paul is a widower with several grown children. He is considering transferring his residence into a trust for his children but retains a life estate in it. Comment on whether this plan will prevent the value of the home from being included in Paul's gross estate when he dies.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Describe a reason why a generation-skipping tax was necessary to augment the estate and gift taxes

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

Roland had a taxable estate of $5.5 million when he died this year. Calculate the amount of estate tax due (if any) under the following alternatives.

a. Roland's prior taxable gifts consist of a taxable gift of $1 million in 2005.b. Roland's prior taxable gifts consist of a taxable gift of $1.5 million in 2005.c. Roland's prior taxable gifts consist of a taxable gift of $2 million made in 2008 (within three years of his death).

a. Roland's prior taxable gifts consist of a taxable gift of $1 million in 2005.b. Roland's prior taxable gifts consist of a taxable gift of $1.5 million in 2005.c. Roland's prior taxable gifts consist of a taxable gift of $2 million made in 2008 (within three years of his death).

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

Casey gave $1 million of stock to both Stephanie and Linda in 2005, 2006, and 2007. Calculate the amount of gift tax due and the marginal gift tax rate on the next $1 of taxable transfers under the following conditions:

a. In 2005, the annual exclusion was $11,000. Casey was not married and has never made any other gifts.

b. In 2006, the annual exclusion was $12,000. Casey was not married and the 2005 gift was the only other gift he has made.

c. In 2007, the annual exclusion was $12,000. Casey was married prior to the date of the gift. He and his spouse, Helen, live in a common-law state and have elected to gift-split. Helen has never made a taxable gift, and Casey's only other taxable gifts were the gifts in 2005 and 2006.

a. In 2005, the annual exclusion was $11,000. Casey was not married and has never made any other gifts.

b. In 2006, the annual exclusion was $12,000. Casey was not married and the 2005 gift was the only other gift he has made.

c. In 2007, the annual exclusion was $12,000. Casey was married prior to the date of the gift. He and his spouse, Helen, live in a common-law state and have elected to gift-split. Helen has never made a taxable gift, and Casey's only other taxable gifts were the gifts in 2005 and 2006.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

Explain how a remainder and an income interest are valued for transfer tax purposes.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

Explain why an effective wealth transfer plan necessitates cooperation between lawyers, accountants, and investment advisors.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

Raquel transferred $100,000 of stock to a trust, with income to be paid to her nephew for 18 years and the remainder to her nephew's children (or their estates). Raquel named a bank as independent trustee but retained the power to determine how much income, if any, will be paid in any particular year. Is this transfer a complete gift Explain.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Jones is seriously ill and has $6 million of property that he wants to leave to his four children. He is considering making a current gift of the property (rather than leaving the property to pass through his will). Assuming any taxable transfer will be subject to the highest transfer tax rate, determine how much gift tax Jones will owe if he makes the transfers now. How much estate tax will Jones save under the 2011 rate schedule and unified credit if he dies after three years, during which time the property appreciates to $6.8 million

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

Explain why the fair market value of a life estate is more difficult to estimate than an income interest.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

Describe how to initiate the construction of a comprehensive and effective wealth plan

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

This year Gerry's friend, Dewey, was disabled. Gerry paid $15,000 to Dewey's doctor for medical expenses and paid $12,500 to State University for college tuition for Dewey's son. Has Gerry made taxable gifts, and if so, in what amounts

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

In 2011 Angelina gave a parcel of realty to Julie valued at $210,000 (Angelina purchased the property five years ago for $88,000). Compute the amount of the taxable gift on the transfer, if any. Suppose several years later Julie sold the property for $215,000. What is the amount of her gain or loss, if any, on the sale

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Describe a reason why transfers of terminable interests should not qualify for the marital deduction

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

List two questions you might pose to a client to find out whether a program of serial gifts would be an advantageous wealth transfer plan.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

This year Dan and Mike purchased realty for $180,000 and took title as equal tenants in common. However, Mike was able to provide only $40,000 of the purchase price and Dan paid the remaining $140,000. Has Dan made a complete gift to Mike, and if so, in what amount

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Several years ago Doug invested $21,000 in stock. In 2011 he gave his daughter Tina the stock on a day it was valued at $20,000. She promptly sold it for $19,500. Determine the amount of the taxable gift, if any, and calculate the amount of taxable income or gain, if any, for Tina. Assume Doug is not married and does not support Tina, who is 28.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

True or false Including taxable gifts when calculating the estate tax subjects these transfers to double taxation. Explain.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

A client in good health wants to support the college education of her teenage grandchildren. The client holds various properties but proposes to make a gift of cash in the amount of the annual exclusion. Explain to the client why a direct gift of cash may not be advisable and what property might serve as a reasonable substitute.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Last year Nate opened a savings account with a deposit of $15,000. The account was in the name of Nate and Derrick, joint tenancy with the right of survivorship. Derrick did not contribute to the account, but this year he withdrew $5,000. Has Nate made a complete gift, and if so, what is the amount of the taxable gift and when was the gift made

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

Roberta is considering making annual gifts of $13,000 of stock each to each of her four children. She expects to live another five years and to leave a taxable estate worth approximately $1,000,000. She requests you justify the gifts by estimating her estate tax savings using the 2011 rate schedule and unified credit from making the gifts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

People sometimes confuse the unified credit with the exemption equivalent. Describe how these terms differ.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

An elderly client has a life insurance policy worth $40,000 that upon her death pays $250,000 to her sole grandchild (or his estate). The client still retains ownership of the policy. Outline for her the costs and benefits of transferring ownership of the policy to a life insurance trust.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Barry transfers $1,000,000 to an irrevocable trust with income to Robin for her life and the remainder to Maurice (or his estate). Calculate the value of the life estate and remainder if Robin's age and the prevailing interest rate result in a Table S discount factor for the remainder of 0.27.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Harold and Maude are married and live in a common law state. Neither have made any taxable gifts and Maude owns (holds title) all their property. She dies with a taxable estate of $10 million and leaves it all to Harold. He dies several years later, leaving the entire $10 million to their three children. Calculate how much estate tax would have been saved using the 2011 rate schedule and unified credit if Maude had used a bypass provision in her will to direct $4 million to her children and the remaining $6 million to Harold. Ignore all credits in this problem except for the unified credit.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Describe the requirements for a complete gift, and contrast a gift of a present interest with a gift of a future interest.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

Describe the conditions in which a married couple would benefit from the use of a bypass provision or a bypass trust.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

This year Jim created an irrevocable trust to provide for Ted, his 32-year-old nephew, and Ted's family. Jim transferred $70,000 to the trust and named a bank as the trustee. The trust was directed to pay income to Ted until he reaches age 35, and at that time the trust is to be terminated and the corpus is to be distributed to Ted's two children (or their estates). Determine the amount, if any, of the current gift and the taxable gift. If necessary, you may assume the relevant interest rate is 6 percent and Jim is unmarried.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Suppose Vince dies this year with a gross estate of $15 million and no adjusted prior gifts. Calculate the amount of estate tax due (if any) under the following alternative conditions using the 2011 rate schedule and unified credit:

a. Vince leaves his entire estate to his spouse, Millie.

b. Vince leaves $10 million to Millie and the remainder to charity.

c. Vince leaves $10 million to Millie and the remainder to his son, Paul.

d. Vince leaves $10 million to Millie and the remainder to a trust whose trustee is required to pay income to Millie for her life and the remainder to Paul.

a. Vince leaves his entire estate to his spouse, Millie.

b. Vince leaves $10 million to Millie and the remainder to charity.

c. Vince leaves $10 million to Millie and the remainder to his son, Paul.

d. Vince leaves $10 million to Millie and the remainder to a trust whose trustee is required to pay income to Millie for her life and the remainder to Paul.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Describe a property transfer or payment that is not, by definition, a transfer for inadequate consideration.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

Under what conditions can an executor or trustee elect to claim a marital deduction for a transfer of a terminable interest to a spouse

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

This year Colleen transferred $100,000 to an irrevocable trust that pays equal shares of income annually to three cousins (or their estates) for the next eight years. At that time, the trust is terminated and the corpus of the trust reverts to Colleen. Determine the amount, if any, of the current gifts and the taxable gifts. If necessary, you may assume the relevant interest rate is 6 percent and Colleen is unmarried. What is your answer if Colleen is married and she elects to gift-split with her spouse

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

Hank possessed a life insurance policy worth $50,000 that will pay his two children a total of $400,000 upon his death. In 2006, Hank transferred the policy and all incidents of ownership to an irrevocable trust that pays income annually to his two children for 15 years and then distributes the corpus to the children in equal shares.

a. Calculate the amount of gift tax due (if any) on the 2006 gift, given Hank has made only one prior taxable gift of $1.5 million in 2005.b. Estimate the amount of estate tax due if Hank were to die more than three years after transferring the insurance policy. At the time of his death, Hank estimates he will have a probate estate of $10 million to be divided in equal shares between his two children.

c. Estimate the amount of estate tax due using the 2011 rate schedule and unified credit if Hank were to die within three years of transferring the insurance policy. At the time of his death, Hank estimates he will have a probate estate of $10 million to be divided in equal shares between his two children.

a. Calculate the amount of gift tax due (if any) on the 2006 gift, given Hank has made only one prior taxable gift of $1.5 million in 2005.b. Estimate the amount of estate tax due if Hank were to die more than three years after transferring the insurance policy. At the time of his death, Hank estimates he will have a probate estate of $10 million to be divided in equal shares between his two children.

c. Estimate the amount of estate tax due using the 2011 rate schedule and unified credit if Hank were to die within three years of transferring the insurance policy. At the time of his death, Hank estimates he will have a probate estate of $10 million to be divided in equal shares between his two children.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

Identify the features common to the gift tax formula and the estate tax formula

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

Describe a situation in which a transfer of cash to a trust might be considered an incomplete gift.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Explain how a transfer of property as a gift may have income tax implications to the donee.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

Sly wants to make annual gifts of cash to each of his four children and six grandchildren. How much can Sly transfer to his children in 2011 if he makes the maximum gifts eligible for the annual exclusion, assuming he is single

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

Jack made his first taxable gift of $1,000,000 in 1997, at which time the unified credit was $192,800. Jack made no further gifts until 2005, at which time he gave $250,000 each to his three children and an additional $100,000 to State University (a charity). The annual exclusion in 2005 was $11,000. Recently Jack has been in poor health and would like you to estimate his estate tax should he die this year. He estimates his taxable estate (after deductions) will be worth $5.4 million at his death. Assume Jack is single, has paid the proper amounts of tax in past years, and use the 2011 rate schedule and unified credit.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

Explain why Congress felt it necessary to enact a gift tax to complement the estate tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

Identify two types of transfers for inadequate consideration that are specifically excluded from imposition of the gift tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Hal and Wendy are married, and they own a parcel of realty, Blackacre, as joint tenants with the right of survivorship. Hal owns an additional parcel of realty, Redacre, in his name alone. Suppose Hal should die when Blackacre is worth $800,000 and Redacre is worth $750,000, what value of realty would be included in Hal's probate estate, and what value would be included in Hal's gross estate

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Jack and Liz live in a community property state and their vacation home is community property. This year they transferred the vacation home to an irrevocable trust that provides their son, Tom, a life estate in the home and the remainder to their daughter, Laura. Under the terms of the trust, Tom has the right to use the vacation home for the duration of his life, and Laura will automatically own the property after Tom's death. At the time of the gift the home was valued at $500,000, Tom was 35 years old, and the §7520 rate was 5.4 percent. What is the amount, if any, of the taxable gifts Would your answer be different if the home were not community property and Jack and Liz elected to gift-split

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

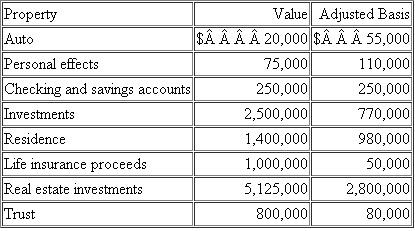

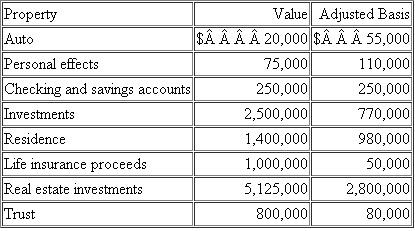

Montgomery has decided to engage in wealth planning and has listed the value of his assets below. The life insurance has a cash surrender value of $120,000 and the proceeds are payable to Montgomery's estate. The trust is an irrevocable trust created by Montgomery's brother 10 years ago and contains assets currently valued at $800,000. The income from the trust is payable to Montgomery's faithful butler, Walen, for his life, and the remainder is payable to Montgomery or his estate. Walen is currently 37 years old and the §7520 interest rate is currently 5.4 percent. Montgomery is unmarried and plans to leave all his assets to his surviving relatives.

a. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and has never made any taxable gifts.

a. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and has never made any taxable gifts.

b. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006. The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax.

c. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006. The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax. Montgomery plans to bequeath his investments to charity and leave his remaining assets to his surviving relatives.

a. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and has never made any taxable gifts.

a. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and has never made any taxable gifts.b. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006. The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax.

c. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006. The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax. Montgomery plans to bequeath his investments to charity and leave his remaining assets to his surviving relatives.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Describe the unified credit and the purpose it serves in the gift and estate tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Under what circumstances will a deposit of cash to a bank account held in joint tenancy be considered a completed gift

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Walter owns a whole-life insurance policy worth $52,000 that directs the insurance company to pay the beneficiary $250,000 on Walter's death. Walter pays the annual premiums and has the power to designate the beneficiary of the policy (it is currently his son, James). What value of the policy, if any, will be included in Walter's estate upon his death

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

David placed $80,000 in trust with income to Steve for his life and the remainder to Lil (or her estate). At the time of the gift, given the prevailing interest rate, Steve's life estate was valued at $65,000 and the remainder at $15,000. What is the amount, if any, of David's taxable gifts

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Fred is retired and living on his pension. He has accumulated almost $1 million of property he would like to leave to his children. However, Fred is afraid much of his wealth will be eliminated by the federal estate tax. Explain whether this fear is well founded.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Explain how a purchase of realty could result in a taxable gift.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Many years ago James and Sergio purchased property for $450,000. Although they are listed as equal co-owners, Sergio was able to provide only $200,000 of the purchase price. James treated the additional $25,000 of his contribution to the purchase price as a gift to Sergio. Suppose the property is worth $900,000 at Sergio's death, what amount would be included in Sergio's estate if the title to the property was tenants in common What if the title were joint tenancy with right of survivorship

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Stephen transferred $15,000 to an irrevocable trust for Graham. The trustee has the discretion to distribute income or corpus for Graham's benefit but is required to distribute all assets to Graham (or his estate) not later than Graham's 21 st birthday. What is the amount, if any, of the taxable gift

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck