Deck 12: State and Local Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 12: State and Local Taxes

1

Renée operates Scandinavian Imports a furniture shop in Olney, Maryland. Scandinavian Imports that ships goods to customers in all 50 states. Scandinavian Imports also appraises antique furniture. Recently in-home appraisals have been done in the District of Columbia, Maryland, Pennsylvania, and Virginia. Online appraisals have been done for customers in California, Minnesota, New Mexico, and Texas. Determine where Scandinavian Imports has sales and use tax nexus.

Taxes

Taxes are the most legitimate and important tool for any government to rise funds from the general public in order to finance the various state run financial activities.These are compulsorily to be paid by the citizens and violation of tax laws is punishable under law at all places.Taxes are governed at states as well as federal level.Some of the major sources of taxes are income, sales and property.

Discussion and analysis

States impose taxes mainly upon sales made which is the primary source of their tax collections as well.Nexus can be defined as the minimum connection between the state which is imposing sales tax on business and the business itself.Sales tax is imposed on the sales of property within the state with nexus.Here, both buyer and seller have nexus with state.While in Use Tax, seller of the property does not have nexus with the state in which property is held.In that case, it is the responsibility of the buyer to pay the use tax.

Since Scandinavian Imports do not have physical presence in states of California, Minnesota, New Mexico, and Texas and have done online appraisals which shall attract use tax and not sales tax.While in states with physical presence such as District of Columbia, Maryland, Pennsylvania, and Virginia they would be liable to pay sales tax as they have physical presence and nexus there.

Taxes are the most legitimate and important tool for any government to rise funds from the general public in order to finance the various state run financial activities.These are compulsorily to be paid by the citizens and violation of tax laws is punishable under law at all places.Taxes are governed at states as well as federal level.Some of the major sources of taxes are income, sales and property.

Discussion and analysis

States impose taxes mainly upon sales made which is the primary source of their tax collections as well.Nexus can be defined as the minimum connection between the state which is imposing sales tax on business and the business itself.Sales tax is imposed on the sales of property within the state with nexus.Here, both buyer and seller have nexus with state.While in Use Tax, seller of the property does not have nexus with the state in which property is held.In that case, it is the responsibility of the buyer to pay the use tax.

Since Scandinavian Imports do not have physical presence in states of California, Minnesota, New Mexico, and Texas and have done online appraisals which shall attract use tax and not sales tax.While in states with physical presence such as District of Columbia, Maryland, Pennsylvania, and Virginia they would be liable to pay sales tax as they have physical presence and nexus there.

2

Compare and contrast federal/state tax differences and book/federal tax differences.

Taxes

Taxes are the most legitimate and important tool for any government to rise funds from the general public in order to finance the various state run financial activities.These are compulsorily to be paid by the citizens and violation of tax laws is punishable under law at all places.Taxes are governed at states as well as federal level.Some of the major sources of taxes are income, sales and property.

Discussion and analysis

Difference in calculation of federal/state tax and book/federal tax arises from the basic computation of tax base.In case of federal tax the starting point of calculation is book income.Adjustments are made to the book income in order to derive the federal income and tax on it.Whereas in case of state tax the starting point of calculation is federal income and then adjustments are made to them to arrive at state taxable income.Thus differences are nothing but the adjustments to derive to taxable income as per the laws governing federal and state taxes.

Taxes are the most legitimate and important tool for any government to rise funds from the general public in order to finance the various state run financial activities.These are compulsorily to be paid by the citizens and violation of tax laws is punishable under law at all places.Taxes are governed at states as well as federal level.Some of the major sources of taxes are income, sales and property.

Discussion and analysis

Difference in calculation of federal/state tax and book/federal tax arises from the basic computation of tax base.In case of federal tax the starting point of calculation is book income.Adjustments are made to the book income in order to derive the federal income and tax on it.Whereas in case of state tax the starting point of calculation is federal income and then adjustments are made to them to arrive at state taxable income.Thus differences are nothing but the adjustments to derive to taxable income as per the laws governing federal and state taxes.

3

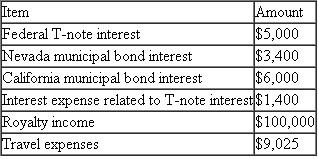

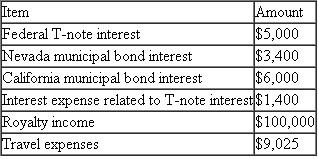

Herger Corporation does business in California, Nevada, and Oregon and has nexus in these states as well. Herger's California state tax base was $921,023 after making the required federal/state adjustments. Herger's state tax base contains the following items:

Determine Herger's business income.

Determine Herger's business income.

Determine Herger's business income.

Determine Herger's business income.Herger's California business income would be $817,623 ($921,023 - $100,000 of royalty income - $3,400 of Nevada municipal bond interest).The royalty income would be considered non-business or allocable income.The Federal T-note interest and related expenses are excluded from the California state income tax base as is the California municipal bond interest.The travel expenses are in the state tax base and are a business expense (no adjustment is necessary).

4

Web Music, located in Gardnerville, Nevada is a new online music service that allows inexpensive legal music downloads. Web Music prides itself in the fact that it has the fastest download times in the industry. Web Music achieved this speed by leasing server space from 10 regional servers dispersed across the country. Discuss where Web Music has sales tax nexus.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

Crazy Eddie, Incorporated manufactures baseball caps and distributes them across the northeastern United States. Crazy Eddie is incorporated and headquartered in New York. It has product sales to customers in Connecticut, Delaware, Massachusetts, New Jersey, New York, Ohio, and Pennsylvania. It has sales personnel only where discussed in the scenarios below. Determine the states in which Crazy Eddie has sales and use tax nexus given the following information:

a) Crazy Eddie is incorporated and headquartered in New York. It also has property, employees, sales personnel, and intangibles in New York.

b) Crazy Eddie has a warehouse in Connecticut.

c) Crazy Eddie has two customers in Delaware. Crazy Eddie receives orders over the phone and ships goods to its customers using FedEx.

d) Crazy Eddie has independent sales representatives in Massachusetts. The representatives distribute baseball related items for over a dozen companies.

e) Crazy Eddie has sales personnel that visit New Jersey. These sales employees follow procedures that comply with Public Law 86-272. The orders are received and sent to New York for acceptance. The goods are shipped by FedEx into New Jersey.

f) Crazy Eddie provides graphic design services to another manufacturer located in Ohio. While the services are performed in New York, Crazy Eddie's designers visit Ohio at least quarterly to deliver the new designs and receive feedback.

g) Crazy Eddie receives online orders from its Pennsylvania client. Because the orders are so large, the goods are delivered weekly on Crazy Eddie's trucks.

a) Crazy Eddie is incorporated and headquartered in New York. It also has property, employees, sales personnel, and intangibles in New York.

b) Crazy Eddie has a warehouse in Connecticut.

c) Crazy Eddie has two customers in Delaware. Crazy Eddie receives orders over the phone and ships goods to its customers using FedEx.

d) Crazy Eddie has independent sales representatives in Massachusetts. The representatives distribute baseball related items for over a dozen companies.

e) Crazy Eddie has sales personnel that visit New Jersey. These sales employees follow procedures that comply with Public Law 86-272. The orders are received and sent to New York for acceptance. The goods are shipped by FedEx into New Jersey.

f) Crazy Eddie provides graphic design services to another manufacturer located in Ohio. While the services are performed in New York, Crazy Eddie's designers visit Ohio at least quarterly to deliver the new designs and receive feedback.

g) Crazy Eddie receives online orders from its Pennsylvania client. Because the orders are so large, the goods are delivered weekly on Crazy Eddie's trucks.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

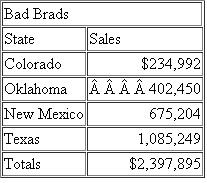

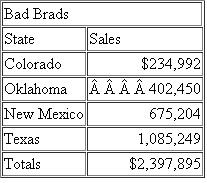

Bad Brad sells used semi trucks and tractor trailers in the Texas panhandle. Bad Brad has sales as follows:

Bad Brad is a Texas Corporation. Answer the questions in each of the following scenarios.

Bad Brad is a Texas Corporation. Answer the questions in each of the following scenarios.

a) Bad Brad has nexus in Colorado, Oklahoma, New Mexico and Texas. What are the Colorado, Oklahoma, New Mexico and Texas sales apportionment factors

b) Bad Brad has nexus in Colorado and Texas. The Oklahoma and New Mexico sales are shipped from Texas (a throwback state). What are the Colorado and Texas sales apportionment factors

c) Bad Brad has nexus in Colorado and Texas. The Oklahoma and New Mexico sales are shipped from Texas (a throwback state); $200,000 of the Oklahoma sales were to the federal government. What are the Colorado and Texas sales apportionment factors

d) Bad Brad has nexus in Colorado and Texas. The Oklahoma and New Mexico sales are shipped from Texas (assume Texas is a non-throwback state). What are the Colorado and Texas sales apportionment factors

Bad Brad is a Texas Corporation. Answer the questions in each of the following scenarios.

Bad Brad is a Texas Corporation. Answer the questions in each of the following scenarios.a) Bad Brad has nexus in Colorado, Oklahoma, New Mexico and Texas. What are the Colorado, Oklahoma, New Mexico and Texas sales apportionment factors

b) Bad Brad has nexus in Colorado and Texas. The Oklahoma and New Mexico sales are shipped from Texas (a throwback state). What are the Colorado and Texas sales apportionment factors

c) Bad Brad has nexus in Colorado and Texas. The Oklahoma and New Mexico sales are shipped from Texas (a throwback state); $200,000 of the Oklahoma sales were to the federal government. What are the Colorado and Texas sales apportionment factors

d) Bad Brad has nexus in Colorado and Texas. The Oklahoma and New Mexico sales are shipped from Texas (assume Texas is a non-throwback state). What are the Colorado and Texas sales apportionment factors

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

Discuss possible reasons for why the Commerce clause was included in the U.S. Constitution.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

Brad Carlton operates Carlton Collectibles a rare coin shop in Washington, D.C. Carlton ships coins to collectors in all 50 states. Carlton also provides appraisal service upon request. During the last several years the appraisal work has been done either in the DC shop or at the homes of private collectors located in Maryland and Virginia. Determine the jurisdictions that Carlton Collectibles has sales and use tax nexus.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

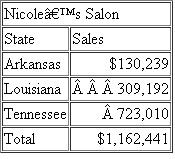

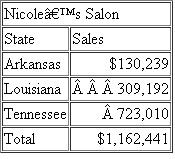

Nicole s Salon, a Louisiana corporation, operates beauty salons in Arkansas, Louisiana, and Tennessee. These salon s sales by state are as follows:

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios

a) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee.

b) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee, but $50,000 of the Arkansas amount is paid to independent contractors.

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios a) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee.

b) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee, but $50,000 of the Arkansas amount is paid to independent contractors.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

Describe the administrative burden that businesses face in collecting sales taxes.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

Melanie operates Mel's Bakery in Foxboro, Massachusetts, with retail stores in Connecticut, Maine, Massachusetts, New Hampshire, and Rhode Island. Mel's also ships specialty breads nationwide upon request. Determine Mel's sales tax collection responsibility and calculate the sales tax liability for Massachusetts, Connecticut, Maine, New Hampshire, Rhode Island, and Texas, using the following information.

a. The Massachusetts stores earn $500,000 in sales. Massachusetts' sales tax rate is 6 percent; assume it exempts food items.

b. The Connecticut retail stores have $400,000 in sales ($300,000 from in-store sales and $100,000 from catering) and $10,000 in delivery charges for catering activities. Connecticut sales tax is 6 percent and excludes food products but taxes prepared meals (catering). Connecticut also imposes sales tax on delivery charges on taxable sales.

c. Mel's Maine retail store has $250,000 of sales ($200,000 for take-out and $50,000 of in-store sales). Maine has a 5 percent sales tax rate and a 7 percent sales tax rate on prepared food; it exempts other food purchases.

d. The New Hampshire retail stores have $250,000 in sales. New Hampshire is one of five states with no sales tax. However, it has a room and meals tax rate of 8 percent. New Hampshire considers any food or beverage served by a restaurant for consumption on or off the premises to be a meal.

e. Mel's Rhode Island stores earn $300,000 in sales. The Rhode Island sales tax rate is 7 percent and its restaurant surtax is 1 percent. Rhode Island considers Mel's a restaurant because its retail store has seating.

f. One of Mel's best customers relocated to Texas, which imposes an 8.25 percent state and local sales tax rate but exempts bakery products. This customer entertains regularly and ordered $5,000 of food items this year.

a. The Massachusetts stores earn $500,000 in sales. Massachusetts' sales tax rate is 6 percent; assume it exempts food items.

b. The Connecticut retail stores have $400,000 in sales ($300,000 from in-store sales and $100,000 from catering) and $10,000 in delivery charges for catering activities. Connecticut sales tax is 6 percent and excludes food products but taxes prepared meals (catering). Connecticut also imposes sales tax on delivery charges on taxable sales.

c. Mel's Maine retail store has $250,000 of sales ($200,000 for take-out and $50,000 of in-store sales). Maine has a 5 percent sales tax rate and a 7 percent sales tax rate on prepared food; it exempts other food purchases.

d. The New Hampshire retail stores have $250,000 in sales. New Hampshire is one of five states with no sales tax. However, it has a room and meals tax rate of 8 percent. New Hampshire considers any food or beverage served by a restaurant for consumption on or off the premises to be a meal.

e. Mel's Rhode Island stores earn $300,000 in sales. The Rhode Island sales tax rate is 7 percent and its restaurant surtax is 1 percent. Rhode Island considers Mel's a restaurant because its retail store has seating.

f. One of Mel's best customers relocated to Texas, which imposes an 8.25 percent state and local sales tax rate but exempts bakery products. This customer entertains regularly and ordered $5,000 of food items this year.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

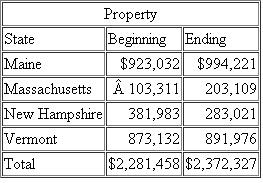

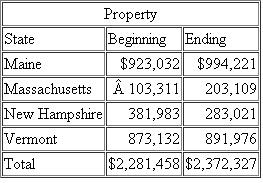

Delicious Dave s Maple Syrup, a Vermont corporation, has property in the following states:

What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont in each of the following alternative scenarios

What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont in each of the following alternative scenarios

a. Delicious has nexus in each of the states.

b. Delicious has nexus in each of the states, but the Maine total includes $400,000 of investment property that Delicious rents out (unrelated to its business).

c. Delicious has nexus in each of the states, but also pays $50,000 to rent property in Massachusetts.

What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont in each of the following alternative scenarios

What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont in each of the following alternative scenarios a. Delicious has nexus in each of the states.

b. Delicious has nexus in each of the states, but the Maine total includes $400,000 of investment property that Delicious rents out (unrelated to its business).

c. Delicious has nexus in each of the states, but also pays $50,000 to rent property in Massachusetts.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

Compare and contrast the rules for where domiciliary and non-domiciliary businesses must file state income tax returns.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

{Research} Cuyahoga County, Ohio has a sales tax rate of 7.75 percent. Determine what the state, local, and transit (a local transportation district) portions of the rate are. You may find resources on the State of Ohio website including the following link: http://www.tax.ohio.gov/divisions/tax_analysis/tax_data_series/sales_and_use/documents/salestaxmapcolor.pdf

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

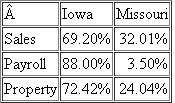

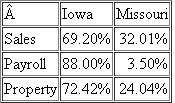

Susie's Sweet Shop has the following sales, payroll and property factors:

What are Susie's Sweet Shop's Iowa and Missouri apportionment factors under each of the following scenarios:

What are Susie's Sweet Shop's Iowa and Missouri apportionment factors under each of the following scenarios:

a) Iowa and Missouri both use a three-factor apportionment formula.

b) Iowa and Missouri both use a four-factor apportionment formula that double- weights sales.

c) Iowa uses a three-factor formula and Missouri uses use single-factor apportionment formula (based solely on sales).

What are Susie's Sweet Shop's Iowa and Missouri apportionment factors under each of the following scenarios:

What are Susie's Sweet Shop's Iowa and Missouri apportionment factors under each of the following scenarios:a) Iowa and Missouri both use a three-factor apportionment formula.

b) Iowa and Missouri both use a four-factor apportionment formula that double- weights sales.

c) Iowa uses a three-factor formula and Missouri uses use single-factor apportionment formula (based solely on sales).

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

Lars operates Keep Flying, Incorporated, a used airplane parts business, in Laramie, Wyoming. Lars employs sales agents that visit mechanics in all 50 states to solicit orders. All orders are sent to Wyoming for approval. All parts are shipped via common carrier. The sales agents are always on the lookout for wrecked, abandoned, or salvage aircraft with rare parts because they receive substantial bonuses for removing these parts and shipping them to Wyoming. Discuss the states where Keep Flying has income tax nexus.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

Kai operates the Surf Shop in Laie, Hawaii. The Surf Shop designs, manufacturers and customizes surf boards. Hawaii has a 4 percent excise tax that is technically paid by the seller. However the state also allows "tax on tax" to be charged, which effectively means a customer is billed 4.166% of the sales price. Determine the sales and use tax liability that the Surf Shop must collect and remit or that the customer must pay for each of the following orders:

a) Bronco, a Utah customer, places an internet order for a $1,000 board that will be shipped to Provo, Utah where the local sales tax rate is 6.25 percent.

b) Norm, a California resident, comes to the retail shop on vacation and has a $2,000 custom board made. Norm uses the board on vacation and then has the Surf Shop ship the board to Los Angeles, California where the sales tax rate is 8.5 percent.

c) Jim, an Ohio resident, places an order for a $2,000 custom board while at the end of his vacation. Upon completion the board will be shipped to Columbus, Ohio where the sales tax rate is 7 percent.

d) Bo, a Nebraska resident, sends his current surf board to the Surf Shop for a custom paint job. The customization services come to $800. The board is shipped to Lincoln, Nebraska where the sales tax rate is 7 percent.

a) Bronco, a Utah customer, places an internet order for a $1,000 board that will be shipped to Provo, Utah where the local sales tax rate is 6.25 percent.

b) Norm, a California resident, comes to the retail shop on vacation and has a $2,000 custom board made. Norm uses the board on vacation and then has the Surf Shop ship the board to Los Angeles, California where the sales tax rate is 8.5 percent.

c) Jim, an Ohio resident, places an order for a $2,000 custom board while at the end of his vacation. Upon completion the board will be shipped to Columbus, Ohio where the sales tax rate is 7 percent.

d) Bo, a Nebraska resident, sends his current surf board to the Surf Shop for a custom paint job. The customization services come to $800. The board is shipped to Lincoln, Nebraska where the sales tax rate is 7 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

Brady Corporation is a Nebraska corporation, but owns business and investment property in surrounding states as well. Determine the state where each item of income is allocated.$15,000 of dividend income. $10,000 of interest income. $15,000 of rental income for South Dakota property. $20,000 of royalty income for an intangible used in South Dakota (where nexus exists). $24,000 of royalty income from Kansas (where nexus does not exist). $15,000 of capital gain from securities held for investment. $30,000 of capital gain on real property located in South Dakota.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

Why do states and local jurisdictions assess taxes

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

Explain changes in the U.S. economy which have caused P.L. 86-272 to become partially obsolete and provide an example of a company that P.L. 86-272 works well for and an example of a company that it does not work well for.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

{Planning} Last year Pete, a Los Angeles, California resident, began selling autographed footballs through Trojan Victory (TV), Incorporated, a California Corporation. TV has never collected sales tax. Last year TV had sales as follows: California ($100,000), Arizona ($10,000), Oregon ($15,000), New York ($50,000), and Wyoming ($1,000). Most sales are made over the internet and shipped by common carrier. How much sales tax should TV have collected in each of the following situations:

a) California treats the autographed football as tangible personal property subject to an 8.25 percent sales tax. Answer for California.

b) California treats the autographed football as part tangible personal property ($50,000) and part services ($50,000) and tangible personal property is subject to an 8.25 percent sales tax. Answer for California.

c) TV has no property or other physical presence in New York or Wyoming. Answer for New York and Wyoming.

d) TV has Pete deliver a few balls to fans in Arizona (5.6 percent) and Oregon (no sales tax) while attending football games there. Answer for Arizona and Oregon.

e) Related to part d, can you make any suggestions that would decrease TV's Arizona sales tax liability

a) California treats the autographed football as tangible personal property subject to an 8.25 percent sales tax. Answer for California.

b) California treats the autographed football as part tangible personal property ($50,000) and part services ($50,000) and tangible personal property is subject to an 8.25 percent sales tax. Answer for California.

c) TV has no property or other physical presence in New York or Wyoming. Answer for New York and Wyoming.

d) TV has Pete deliver a few balls to fans in Arizona (5.6 percent) and Oregon (no sales tax) while attending football games there. Answer for Arizona and Oregon.

e) Related to part d, can you make any suggestions that would decrease TV's Arizona sales tax liability

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

Ashton Corporation is headquartered in Pennsylvania and has a state income tax base there of $500,000. Of this amount, $50,000 was nonbusiness income. Ashton's Pennsylvania apportionment factor is 42.35 percent. The nonbusiness income allocated to Pennsylvania was $32,000. Assuming a Pennsylvania corporate tax rate of 8.25 percent, what is Ashton's Pennsylvania state tax liability

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

Compare and contrast the relative importance of judicial law to state and local and federal tax law.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

Climb Higher is a distributor of high end climbing gear and is located in Paradise, Washington. Climb Higher's sales personnel regularly perform the following activities in an effort to maximize sales:

• Carry swag (free samples) for distribution to climbing shop employees.

• Perform credit checks of new customers to reduce delivery time of first order of merchandise.

• Check customer inventory for proper display and proper quantities.

• Accept returns of defective goods.

Identify which of Climb Higher's sales activities are protected and unprotected from nexus under the Wrigley Supreme Court decision.

• Carry swag (free samples) for distribution to climbing shop employees.

• Perform credit checks of new customers to reduce delivery time of first order of merchandise.

• Check customer inventory for proper display and proper quantities.

• Accept returns of defective goods.

Identify which of Climb Higher's sales activities are protected and unprotected from nexus under the Wrigley Supreme Court decision.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

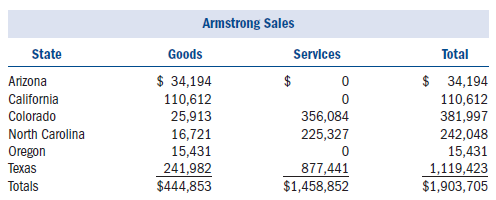

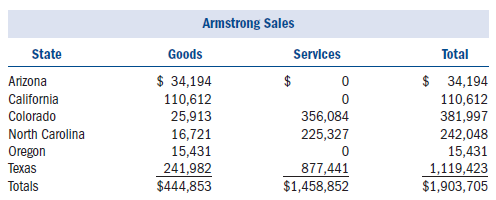

Armstrong Incorporated, a Texas corporation, runs bicycle tours in several states. Armstrong also has a Texas retail store and an Internet store that ships to out-of-state customers. The bicycle tours operate in Colorado, North Carolina, and Texas, where Armstrong has employees and owns and uses tangible personal property. Armstrong has real property only in Texas and logs the following sales:

Assume the following tax rates: Arizona (5.6 percent), California (7.75 percent), Colorado (8 percent), North Carolina (6.75 percent), Oregon (8 percent), and Texas (8.5 percent). How much sales and use tax must Armstrong collect and remit

Assume the following tax rates: Arizona (5.6 percent), California (7.75 percent), Colorado (8 percent), North Carolina (6.75 percent), Oregon (8 percent), and Texas (8.5 percent). How much sales and use tax must Armstrong collect and remit

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

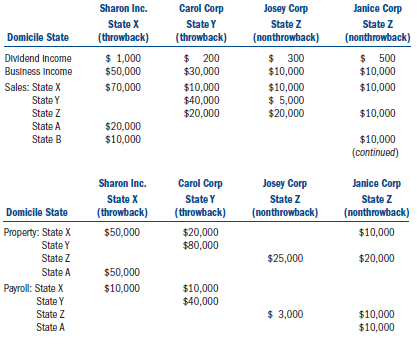

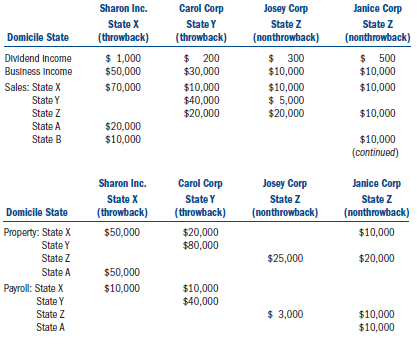

Sharon Inc. is headquartered in State X and owns 100 percent of Carol, Josey, and Janice Corps, which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states:

Compute the income reported, apportionment factors, and tax liability for State X assuming a tax rate of 15 percent.

Compute the income reported, apportionment factors, and tax liability for State X assuming a tax rate of 15 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

Describe briefly the nexus concept and explain its importance to state and local taxation.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

Describe a situation where it would be advantageous for a business to establish income tax nexus in a state.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

Kashi Corporation is the U.S. distributor of fencing (sword fighting) equipment imported from Europe. Kashi is incorporated in Virginia and headquartered in Arlington, Virginia. Kashi ships goods to all 50 states. Kashi's employees attend regional and national fencing competitions where they maintain temporary booths to market their goods. Determine whether Kashi has income tax nexus in the following situations:

a) Kashi is incorporated and headquartered in Virginia. It also has property, employees, sales personnel, and intangibles in Virginia. Determine whether Kashi has nexus in Virginia

b) Kashi has employees that live in Washington, DC and Maryland. All of their employment-related activities are performed in Virginia. Determine whether Kashi has nexus in Washington D.C. and Maryland

c) Kashi has two customers in North Dakota. Kashi receives orders over the phone and ships goods to its customers using FedEx. Determine whether Kashi has nexus in North Dakota

d) Kashi has independent sales representatives in Illinois. The representatives distribute fencing and other sports-related items for many companies. Determine whether Kashi has nexus in Illinois

e) Kashi has sales personnel that visit South Carolina for a regional fencing competition for a total of 3 days during the year. All orders received are sent to Virginia for credit approval and acceptance. The goods are shipped by FedEx into South Carolina. Determine whether Kashi has nexus in South Carolina

f) Kashi has sales personnel that visit California for a national fencing competition and several regional competitions for a total of 17 days during the year. All orders received are sent to Virginia for credit approval and acceptance. The goods are shipped by FedEx into California. Determine whether Kashi has nexus in California

g) Kashi receives orders from its Pennsylvania client over its website. Because the orders are so large, the goods are delivered on Kashi's trucks on a weekly basis. Determine whether Kashi has nexus in Pennsylvania

h) In addition to shipping goods, Kashi provides fencing lessons in Virginia and Maryland locations. Determine whether Kashi has nexus in Virginia and Maryland

i) {Planning} Given that Kashi ships to all 50 states, are there locations that Kashi currently does not have nexus in that would decrease Kashi's overall state income tax burden it nexus were created in these locations

a) Kashi is incorporated and headquartered in Virginia. It also has property, employees, sales personnel, and intangibles in Virginia. Determine whether Kashi has nexus in Virginia

b) Kashi has employees that live in Washington, DC and Maryland. All of their employment-related activities are performed in Virginia. Determine whether Kashi has nexus in Washington D.C. and Maryland

c) Kashi has two customers in North Dakota. Kashi receives orders over the phone and ships goods to its customers using FedEx. Determine whether Kashi has nexus in North Dakota

d) Kashi has independent sales representatives in Illinois. The representatives distribute fencing and other sports-related items for many companies. Determine whether Kashi has nexus in Illinois

e) Kashi has sales personnel that visit South Carolina for a regional fencing competition for a total of 3 days during the year. All orders received are sent to Virginia for credit approval and acceptance. The goods are shipped by FedEx into South Carolina. Determine whether Kashi has nexus in South Carolina

f) Kashi has sales personnel that visit California for a national fencing competition and several regional competitions for a total of 17 days during the year. All orders received are sent to Virginia for credit approval and acceptance. The goods are shipped by FedEx into California. Determine whether Kashi has nexus in California

g) Kashi receives orders from its Pennsylvania client over its website. Because the orders are so large, the goods are delivered on Kashi's trucks on a weekly basis. Determine whether Kashi has nexus in Pennsylvania

h) In addition to shipping goods, Kashi provides fencing lessons in Virginia and Maryland locations. Determine whether Kashi has nexus in Virginia and Maryland

i) {Planning} Given that Kashi ships to all 50 states, are there locations that Kashi currently does not have nexus in that would decrease Kashi's overall state income tax burden it nexus were created in these locations

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

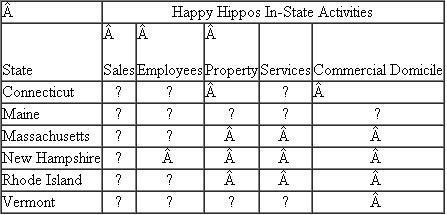

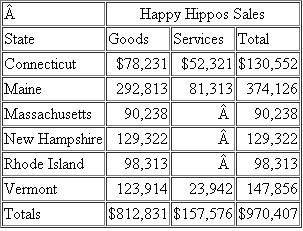

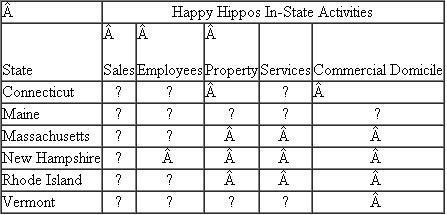

Happy Hippos (HH) is a manufacturer and retailer of New England crafts. HH is headquartered in Camden, Maine. HH has sales, employees, property, provides services, and commercial domicile as follows:

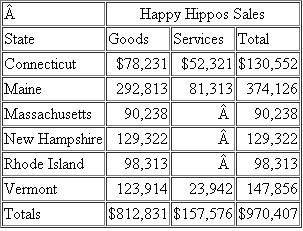

Happy Hippos sales of goods and services by state are as follows:

Happy Hippos sales of goods and services by state are as follows:

HH has federal taxable income of $282,487 for the current year. Included in federal taxable income are the following income and deductions: $12,000 of Vermont rental income; City of Orono, Maine bond interest of $10,000; $10,000 of dividends; $2,498 of state tax refund included in income; $32,084 of state net income tax expense; and $59,234 of federal depreciation. Maine state depreciation for the year was $47,923 and Maine doesn't allow deductions for state net income taxes.

HH has federal taxable income of $282,487 for the current year. Included in federal taxable income are the following income and deductions: $12,000 of Vermont rental income; City of Orono, Maine bond interest of $10,000; $10,000 of dividends; $2,498 of state tax refund included in income; $32,084 of state net income tax expense; and $59,234 of federal depreciation. Maine state depreciation for the year was $47,923 and Maine doesn't allow deductions for state net income taxes.

The employees present in Connecticut, Massachusetts, and Rhode Island are sales personnel and perform only activities protected by Public Law 86-272.Each of the states is a separate-return state.

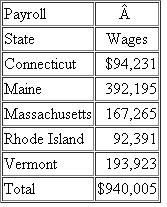

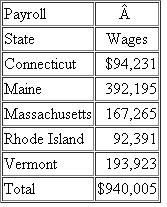

HH's payroll is as follows:

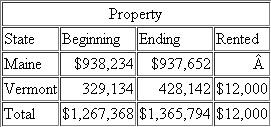

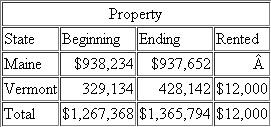

HH's property is as follows:

HH's property is as follows:

a) Determine the states in which HH has sales tax nexus.

a) Determine the states in which HH has sales tax nexus.

b) Calculate the sales tax HH must remit assuming the following sales tax rates: Connecticut (6%), Maine (8%), Massachusetts (7%), New Hampshire (8.5%), Rhode Island (5%), and Vermont (9%).

c) Determine the state in which HH has income tax nexus.

d) Determine HH's state tax base for Maine assuming federal taxable income of $282,487.

e) Calculate business and non-business income.

f) Determine HH's Maine apportionment factors using the three-factor method (assume that Maine is a throwback state).

g) Calculate HH's business income apportioned to Maine.

h) Determine HH's allocation of non-business income to Maine.

i) Determine HH's Maine taxable income.

j) Calculate HH"s Maine net income tax liability assuming a Maine tax rate of 5 percent.

Happy Hippos sales of goods and services by state are as follows:

Happy Hippos sales of goods and services by state are as follows: HH has federal taxable income of $282,487 for the current year. Included in federal taxable income are the following income and deductions: $12,000 of Vermont rental income; City of Orono, Maine bond interest of $10,000; $10,000 of dividends; $2,498 of state tax refund included in income; $32,084 of state net income tax expense; and $59,234 of federal depreciation. Maine state depreciation for the year was $47,923 and Maine doesn't allow deductions for state net income taxes.

HH has federal taxable income of $282,487 for the current year. Included in federal taxable income are the following income and deductions: $12,000 of Vermont rental income; City of Orono, Maine bond interest of $10,000; $10,000 of dividends; $2,498 of state tax refund included in income; $32,084 of state net income tax expense; and $59,234 of federal depreciation. Maine state depreciation for the year was $47,923 and Maine doesn't allow deductions for state net income taxes. The employees present in Connecticut, Massachusetts, and Rhode Island are sales personnel and perform only activities protected by Public Law 86-272.Each of the states is a separate-return state.

HH's payroll is as follows:

HH's property is as follows:

HH's property is as follows: a) Determine the states in which HH has sales tax nexus.

a) Determine the states in which HH has sales tax nexus.b) Calculate the sales tax HH must remit assuming the following sales tax rates: Connecticut (6%), Maine (8%), Massachusetts (7%), New Hampshire (8.5%), Rhode Island (5%), and Vermont (9%).

c) Determine the state in which HH has income tax nexus.

d) Determine HH's state tax base for Maine assuming federal taxable income of $282,487.

e) Calculate business and non-business income.

f) Determine HH's Maine apportionment factors using the three-factor method (assume that Maine is a throwback state).

g) Calculate HH's business income apportioned to Maine.

h) Determine HH's allocation of non-business income to Maine.

i) Determine HH's Maine taxable income.

j) Calculate HH"s Maine net income tax liability assuming a Maine tax rate of 5 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

What is the difference, if any, between the state of a business's commercial domicile and its state of incorporation

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

States are arguing for economic nexus; provide at least one reason for and against the validity of economic nexus.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

Gary Holt LLP provides tax and legal services regarding tax-exempt bond issues of state and local jurisdictions. Gary typically provides the services from his New York offices. However, occasionally, for large issuances Gary and his staff travel to the state to complete the work. Determine whether Gary Holt has income tax nexus in the following situations:

a) Gary Holt is a New York partnership and headquartered in New York. It also has property and employees in New York. Does it have income taxnexus in New York

b. Gary Holt LLP has employees who live in New Jersey and Connecticut and perform all their employment-related activities in New York. Does it have income tax nexus in New Jersey and/or Connecticut

c. Gary Holt LLP has two customers in California. Gary personally travels there to finalize the Alameda County bond issuance. Does it have income tax nexus in California

a) Gary Holt is a New York partnership and headquartered in New York. It also has property and employees in New York. Does it have income taxnexus in New York

b. Gary Holt LLP has employees who live in New Jersey and Connecticut and perform all their employment-related activities in New York. Does it have income tax nexus in New Jersey and/or Connecticut

c. Gary Holt LLP has two customers in California. Gary personally travels there to finalize the Alameda County bond issuance. Does it have income tax nexus in California

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

What types of property sales are subject to a sales tax and why might a state choose to exclude the sales of certain types of property

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

Explain the difference between separate return states and unitary-return states.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

Root Beer Inc. (RBI) is incorporated and headquartered in Seattle, Washington. RBI runs an Internet business, makerootbeer.com, and sells bottling equipment and other supplies for making homemade root beer. It also has an Oregon warehouse from which it ships goods. Determine whether RBI has income tax nexus in the following situations:

a. Root Beer is incorporated and headquartered in Washington and has property and employees in Oregon and Washington. Determine whether RBI has nexus in Oregon and Washington.

b. Root Beer has hundreds of customers in California but no physical presence (no employees or property). Does it have nexus in California

c. Root Beer has 500 New York customers but no physical presence (no employees or property). Remember New York has the new Amazon rule. Determine whether RBI has nexus in New York.

a. Root Beer is incorporated and headquartered in Washington and has property and employees in Oregon and Washington. Determine whether RBI has nexus in Oregon and Washington.

b. Root Beer has hundreds of customers in California but no physical presence (no employees or property). Does it have nexus in California

c. Root Beer has 500 New York customers but no physical presence (no employees or property). Remember New York has the new Amazon rule. Determine whether RBI has nexus in New York.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

In what circumstances would a business be subject to income taxes in more than one state

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

Explain the rationale for the factors (functional integration, centralization of management, and economies of scale) used to determine whether two or more businesses form a unitary group under the Mobil decision.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

Rockville Enterprises manufactures wood working equipment and is incorporated and based in Evansville, Indiana. Rockville's real property is all in Indiana. Rockville employs a large sales force that travels throughout the U.S. Determine whether each of the following is a protected activity in non-domiciliary states under Public Law 86-272:

a) Rockville advertises using television, radio and newspaper.

b) Rockville's employees in Illinois check the credit of a potential customer.

c) Rockville maintains a booth at an industry tradeshow in Arizona for 10 days.

d) Sales representatives check the inventory of a customer to make sure they have enough in stock and that it is properly displayed.e) Rockville holds a management seminar for corporate executives over four days in Florida.f) Sales representatives supervise the repossession of inventory from a customer that is not making payments on time.

g) Rockville provides automobiles to Idaho and Montana sales representatives.

h) An Alabama sales representative accepts a customer deposit on a large order.

i) Sales representatives carry display racks and promotional material that they place in customers retail stores without charge.

a) Rockville advertises using television, radio and newspaper.

b) Rockville's employees in Illinois check the credit of a potential customer.

c) Rockville maintains a booth at an industry tradeshow in Arizona for 10 days.

d) Sales representatives check the inventory of a customer to make sure they have enough in stock and that it is properly displayed.e) Rockville holds a management seminar for corporate executives over four days in Florida.f) Sales representatives supervise the repossession of inventory from a customer that is not making payments on time.

g) Rockville provides automobiles to Idaho and Montana sales representatives.

h) An Alabama sales representative accepts a customer deposit on a large order.

i) Sales representatives carry display racks and promotional material that they place in customers retail stores without charge.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

Describe how the failure to collect sales tax can result in a larger tax liability for a business than failing to pay income taxes.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

Compare and contrast why book/tax and federal/state adjustments are necessary for interest income.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

{Research} Software Incorporated is a sales and use tax software vendor. It provides customers with a license to use its software that is downloaded on customers' machines. The licensing agreement provides that Software actually retains ownership of the software. Software has customers in New Jersey and West Virginia. Does Software have economic nexus in these states because of the following decisions ( Lanco, Inc. v. Director, Division of Taxation , NJ Sup. Ct., Dkt. No.A-89-05; and Tax Commissioner of West Virginia v. MBNA America Bank, N

a., 640 SE 2d 226 (WV 2006))

a., 640 SE 2d 226 (WV 2006))

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

Discuss why restaurant meals, rental cars, and hotel receipts are often taxed at a higher than average sales tax rate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

Compare and contrast the ways a multistate business divides business and nonbusiness income among states.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

Peter, Inc., a Kentucky corporation, owns 100 percent of Suvi, Inc., a Mississippi corporation. Peter and Suvi file a consolidated federal tax return. Peter has income tax nexus in Kentucky and South Carolina; Suvi in Mississippi and South Carolina. Kentucky, Mississippi, and South Carolina are separate-return states. In which states must Pete and Suvi file tax returns Can they file a consolidated return in any states Explain. ( Hint: Use South Carolina Form SC 1120 and the related instructions.)

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

Compare and contrast the difference between general sales tax nexus and the new "Amazon" rule creating nexus in New York.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

Contrast the treatment of government sales and dock sales for the sales apportionment factor.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

{Research} Use California Publication 1061 (2007) to determine the various tests California uses to determine whether two or more entities are part of a unitary group.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

What is the difference between a sales tax and a use tax

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

Most states have increased the weight of the sales factor for the apportionment of business income. What are some possible reasons

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

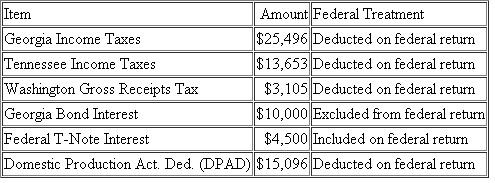

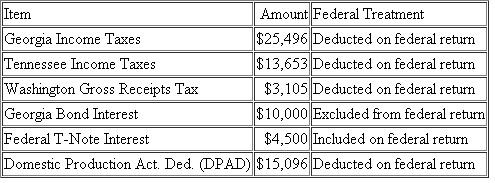

{Research} Bulldog, Incorporated is a Georgia corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck