Deck 13: Accounting for Not-For-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 13: Accounting for Not-For-Profit Organizations

1

What is the value of a statement of functional expenses? What is the FASB and the Financial Reporting Executive Committee's position on who should prepare a statement of functional expenses? Explain why you believe they have taken the positions they have.

Not-for-profit (NFP) entities:

It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities' success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

The following is the value of statement of functional expense:

This statement provides an examination of the costs related with entire program services and its supporting services. This statement allows the ratio of the following:

• Program expenses to total expenses

• Support expenses to total expenses

These ratios are to be calculated and compared with other not-for-profit entities. Further, this statement provides the natural, object of expense such as rent, salary, supplies, and depreciation.

The following is the position of Financial Accounting Standards Board (FASB) and the Financial Reporting Executive Committee:

Presently, the FASB requirement is that the voluntary health and welfare entities should prepare a statement of functional expenses. Based on the FASB and Financial Reporting Executive Committee, those who (not-for-profit entities) receive the supports (at any form) from general public they should prepare a statement of functional expenses.

The purpose of preparing those statements is to verify whether the functional expenses. For example, whether the details provided in the statement is relevant with the way that the resources are allocated based on the objective and goals of the organization.

It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities' success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

The following is the value of statement of functional expense:

This statement provides an examination of the costs related with entire program services and its supporting services. This statement allows the ratio of the following:

• Program expenses to total expenses

• Support expenses to total expenses

These ratios are to be calculated and compared with other not-for-profit entities. Further, this statement provides the natural, object of expense such as rent, salary, supplies, and depreciation.

The following is the position of Financial Accounting Standards Board (FASB) and the Financial Reporting Executive Committee:

Presently, the FASB requirement is that the voluntary health and welfare entities should prepare a statement of functional expenses. Based on the FASB and Financial Reporting Executive Committee, those who (not-for-profit entities) receive the supports (at any form) from general public they should prepare a statement of functional expenses.

The purpose of preparing those statements is to verify whether the functional expenses. For example, whether the details provided in the statement is relevant with the way that the resources are allocated based on the objective and goals of the organization.

2

Recording and Reporting Transactions. INVOLVE was incorporated as a not-for-profit voluntary health and welfare organization on January 1, 2017. During the fiscal year ended December 31, 2017, the following transactions occurred.

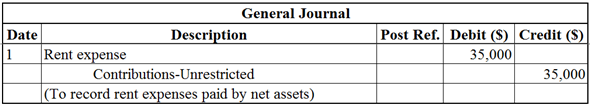

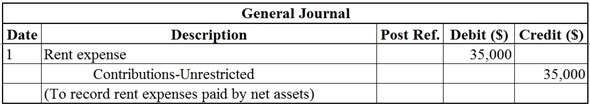

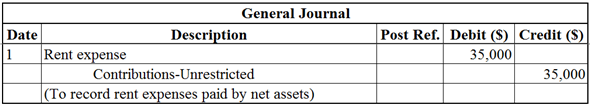

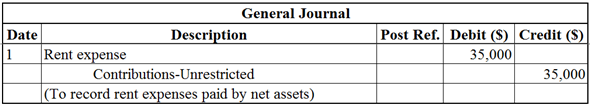

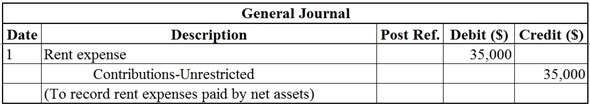

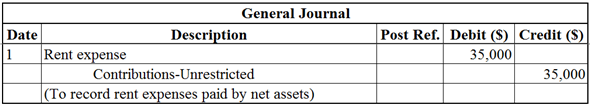

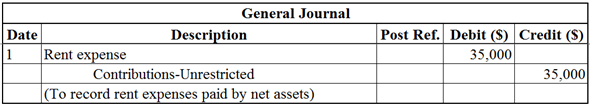

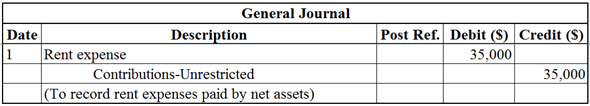

1. A business donated rent-free office space to the organization that would normally rent for $35,000 a year.

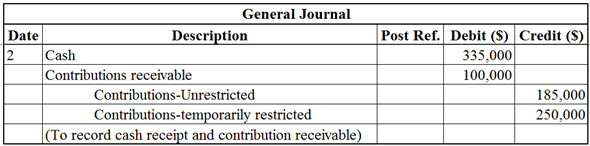

2. A fund drive raised $185,000 in cash and $100,000 in pledges that will be paid within one year. A state government grant of $150,000 was received for program operating costs related to public health education.

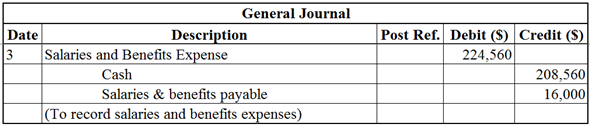

3. Salaries and fringe benefits paid during the year amounted to $208,560. At year-end, an additional $16,000 of salaries and fringe benefits were accrued.

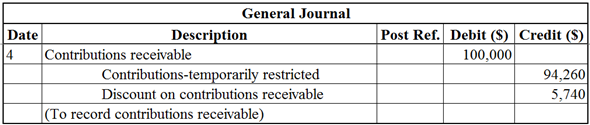

4. A donor pledged $100,000 for construction of a new building, payable over five fiscal years, commencing in 2019. The discounted value of the pledge is expected to be $94,260.

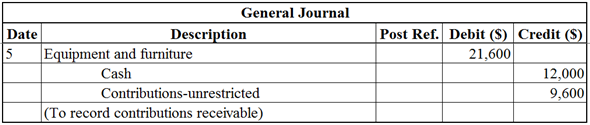

5. Office equipment was purchased for $12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $9,600 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered unrestricted net assets by INVOLVE.

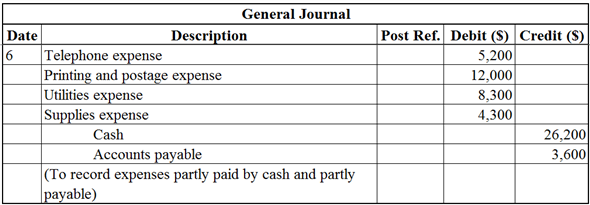

6. Telephone expense for the year was $5,200, printing and postage expense was $12,000 for the year, utilities for the year were $8,300, and supplies expense was $4,300 for the year. At year-end, an immaterial amount of supplies remained on hand and the balance in accounts payable was $3,600.

7. Volunteers contributed $15,000 of time to help with answering the phones, mailing materials, and various other clerical activities.

8. It is estimated that 90 percent of the pledges made for the 2018 year will be collected. Depreciation expense is recorded for the full year on the assets recorded in item 5.

9. Salaries and wages were allocated to program services and support services in the following percentages: public health education, 35 percent; community service, 30 percent; management and general, 20 percent; and fund-raising, 15 percent. All other expenses were allocated in the following percentages: public health education, 35 percent; community service, 20 percent; management and general, 25 percent; and fund-raising, 20 percent.

10. Net assets were released to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes.

11. All nominal accounts were closed to the appropriate net asset accounts.

Required

a. Make all necessary journal entries to record these transactions. Expense transactions should be initially recorded by object classification; in entry 10 expenses will be allocated to functions.

b. Prepare a statement of activities for the year ended December 31, 2017.

c. Prepare a statement of financial position for the year ended December 31, 2017.

d. Prepare a statement of cash flows for the year ended December 31, 2017.

e. Prepare a statement of functional expenses for the year ended December 31, 2017.

1. A business donated rent-free office space to the organization that would normally rent for $35,000 a year.

2. A fund drive raised $185,000 in cash and $100,000 in pledges that will be paid within one year. A state government grant of $150,000 was received for program operating costs related to public health education.

3. Salaries and fringe benefits paid during the year amounted to $208,560. At year-end, an additional $16,000 of salaries and fringe benefits were accrued.

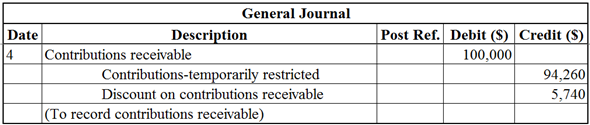

4. A donor pledged $100,000 for construction of a new building, payable over five fiscal years, commencing in 2019. The discounted value of the pledge is expected to be $94,260.

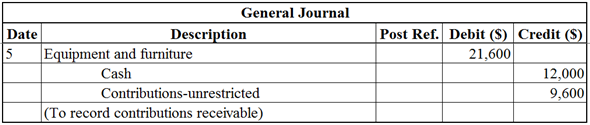

5. Office equipment was purchased for $12,000. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $9,600 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered unrestricted net assets by INVOLVE.

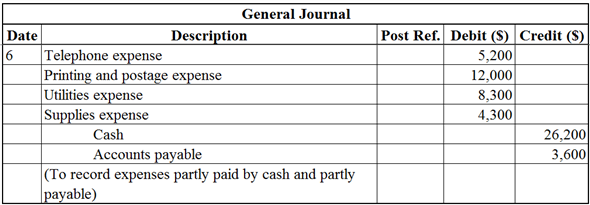

6. Telephone expense for the year was $5,200, printing and postage expense was $12,000 for the year, utilities for the year were $8,300, and supplies expense was $4,300 for the year. At year-end, an immaterial amount of supplies remained on hand and the balance in accounts payable was $3,600.

7. Volunteers contributed $15,000 of time to help with answering the phones, mailing materials, and various other clerical activities.

8. It is estimated that 90 percent of the pledges made for the 2018 year will be collected. Depreciation expense is recorded for the full year on the assets recorded in item 5.

9. Salaries and wages were allocated to program services and support services in the following percentages: public health education, 35 percent; community service, 30 percent; management and general, 20 percent; and fund-raising, 15 percent. All other expenses were allocated in the following percentages: public health education, 35 percent; community service, 20 percent; management and general, 25 percent; and fund-raising, 20 percent.

10. Net assets were released to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes.

11. All nominal accounts were closed to the appropriate net asset accounts.

Required

a. Make all necessary journal entries to record these transactions. Expense transactions should be initially recorded by object classification; in entry 10 expenses will be allocated to functions.

b. Prepare a statement of activities for the year ended December 31, 2017.

c. Prepare a statement of financial position for the year ended December 31, 2017.

d. Prepare a statement of cash flows for the year ended December 31, 2017.

e. Prepare a statement of functional expenses for the year ended December 31, 2017.

Not-for-profit (NFP) entities:

It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities' success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

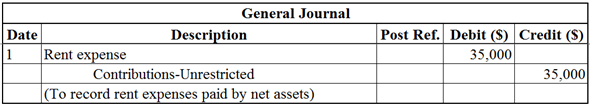

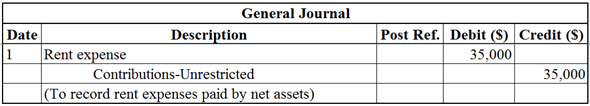

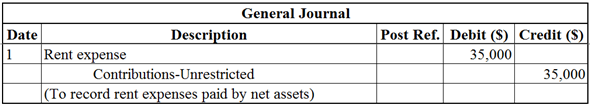

Journal entry:

A journal entry records the organization's accounting related transactions in a chronological order. A general journal is a primary book of original entry that records any type of business transactions or accounting adjustments. It records the date of the transaction, debited account, credited account, ledger folio number, amount for debit and credit, and narration of the transaction.

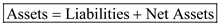

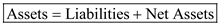

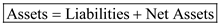

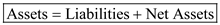

However, the non-profit entities' accounting is little different from the for-profit organization accounting procedure. The equation for the non-profit entities' accounting is given below:

Instead of owners' equity, in the non-profit entities' accounting the net assets are used.

Instead of owners' equity, in the non-profit entities' accounting the net assets are used.

a.Prepare journal entry:

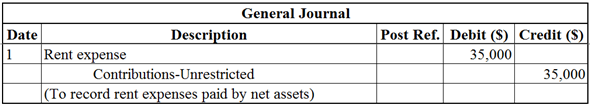

To prepare journal entry to record rent expense, debit rent expense and credit contribution-unrestricted (decrease in net assets).

To prepare journal entry to record rent expense, debit rent expense and credit contribution-unrestricted (decrease in net assets).

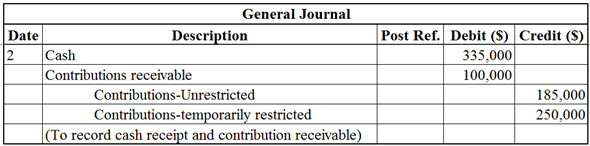

To record journal entry for receipt of contribution partly cash and partly pending to receive, Debit Cash and contribution receivable (increase in assets), credit contribution-unrestricted and contribution-temporarily restricted (increase in net assets).

To record journal entry for receipt of contribution partly cash and partly pending to receive, Debit Cash and contribution receivable (increase in assets), credit contribution-unrestricted and contribution-temporarily restricted (increase in net assets).

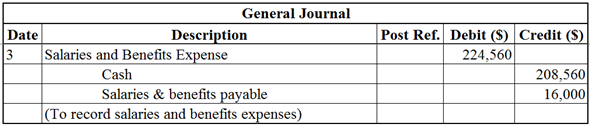

To record journal entry for salaries and benefits expenses partly paid by cash and partly payable, debit salaries and benefits expenses (decrease in net assets) and credit cash (decrease in assets) and salaries and benefits payable (increase in liability).

To record journal entry for salaries and benefits expenses partly paid by cash and partly payable, debit salaries and benefits expenses (decrease in net assets) and credit cash (decrease in assets) and salaries and benefits payable (increase in liability).

To record journal entry for contribution receivable, debit contribution receivable (increase in assets) and credit contribution-temporarily restricted (increase in net assets) and discount on contribution receivable (decrease in assets).

To record journal entry for contribution receivable, debit contribution receivable (increase in assets) and credit contribution-temporarily restricted (increase in net assets) and discount on contribution receivable (decrease in assets).

To record journal entry for purchase of furniture and equipment, debit equipment and furniture (increase in assets). Cash (decrease in assets) and contribution-unrestricted (decrease in net assets) account is credited.

To record journal entry for purchase of furniture and equipment, debit equipment and furniture (increase in assets). Cash (decrease in assets) and contribution-unrestricted (decrease in net assets) account is credited.

To record journal entry for record expenses, debit all expenses (decrease in net assets), credit cash (decrease in assets), and credit accounts payable (increase in liability).

To record journal entry for record expenses, debit all expenses (decrease in net assets), credit cash (decrease in assets), and credit accounts payable (increase in liability).

Journal entry is not required for the transaction 7, because no specialized skill is required.

To record journal entry for allowance for uncollectible pledges-unrestricted, debit provision for uncollectible pledge and credit allowance for uncollectible pledges-unrestricted.

To record journal entry for allowance for uncollectible pledges-unrestricted, debit provision for uncollectible pledge and credit allowance for uncollectible pledges-unrestricted.

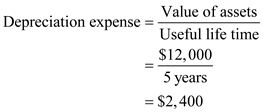

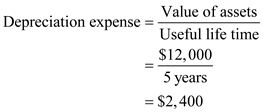

To record journal entry for depreciation expense, depreciation expense is debited and credit allowance for depreciation-equipment and furniture (decrease in assets). Refer below calculations for depreciation amount:

Calculate Depreciation:

Depreciation is calculated under the straight line method. It is calculated by dividing the value of assets divided by number of useful lifetime.

Hence, the depreciation for equipment is

Hence, the depreciation for equipment is

0

0

.

Now, calculate depreciation for furniture:

1

1

Hence, the depreciation for equipment is

2

2

. Therefore, Total depreciation expense is $3,360

3

3

4

4

Note: Refer below resource allocation table for the debit values. To record journal entry for allocation of expenses, debit public health education program, management and general, community service program, and fund raising. Credit all the incurred expenses. The resource allocation is given below based on the available information.

5

5

6

6

To record journal entry for release the release the temporarily restricted net assets, debit net assets released-satisfaction of purpose restriction temporarily restricted. Net assets released-satisfaction of purpose restriction-unrestricted is credited. 7

7

To record journal entry to adjust the contribution-unrestricted and unrestricted net assets, contribution-unrestricted and unrestricted net assets are debited and public health education, community service, management and general, fund-raising are credited.

To record journal entry to adjust contribution-temporarily restricted, contribution - temporarily restricted is debited, temporarily restricted net assets is credited.

To record journal entry to adjust temporarily restricted net assets, temporarily restricted net assets is debited and net assets released-satisfaction of purpose restriction-temporarily restricted is credited.

b.Prepare statement of activity:

It is calculated by deducting the total expenses from the total revenue.

8

8

Hence, the total ending net assets are

9

9

.

c.Prepare statement of financial position:

0

0

Hence, the total assets are equal to total liabilities and nets assets, which is

1

1

.

d.Prepare statement of cash flow:

2

2

Hence, the cash provided by the operating activities is

3

3

.

e.Prepare statement of functional expenses:

4

4

Hence, the total functional expenses is

5

5

.

It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities' success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

Journal entry:

A journal entry records the organization's accounting related transactions in a chronological order. A general journal is a primary book of original entry that records any type of business transactions or accounting adjustments. It records the date of the transaction, debited account, credited account, ledger folio number, amount for debit and credit, and narration of the transaction.

However, the non-profit entities' accounting is little different from the for-profit organization accounting procedure. The equation for the non-profit entities' accounting is given below:

Instead of owners' equity, in the non-profit entities' accounting the net assets are used.

Instead of owners' equity, in the non-profit entities' accounting the net assets are used.a.Prepare journal entry:

To prepare journal entry to record rent expense, debit rent expense and credit contribution-unrestricted (decrease in net assets).

To prepare journal entry to record rent expense, debit rent expense and credit contribution-unrestricted (decrease in net assets). To record journal entry for receipt of contribution partly cash and partly pending to receive, Debit Cash and contribution receivable (increase in assets), credit contribution-unrestricted and contribution-temporarily restricted (increase in net assets).

To record journal entry for receipt of contribution partly cash and partly pending to receive, Debit Cash and contribution receivable (increase in assets), credit contribution-unrestricted and contribution-temporarily restricted (increase in net assets). To record journal entry for salaries and benefits expenses partly paid by cash and partly payable, debit salaries and benefits expenses (decrease in net assets) and credit cash (decrease in assets) and salaries and benefits payable (increase in liability).

To record journal entry for salaries and benefits expenses partly paid by cash and partly payable, debit salaries and benefits expenses (decrease in net assets) and credit cash (decrease in assets) and salaries and benefits payable (increase in liability). To record journal entry for contribution receivable, debit contribution receivable (increase in assets) and credit contribution-temporarily restricted (increase in net assets) and discount on contribution receivable (decrease in assets).

To record journal entry for contribution receivable, debit contribution receivable (increase in assets) and credit contribution-temporarily restricted (increase in net assets) and discount on contribution receivable (decrease in assets). To record journal entry for purchase of furniture and equipment, debit equipment and furniture (increase in assets). Cash (decrease in assets) and contribution-unrestricted (decrease in net assets) account is credited.

To record journal entry for purchase of furniture and equipment, debit equipment and furniture (increase in assets). Cash (decrease in assets) and contribution-unrestricted (decrease in net assets) account is credited. To record journal entry for record expenses, debit all expenses (decrease in net assets), credit cash (decrease in assets), and credit accounts payable (increase in liability).

To record journal entry for record expenses, debit all expenses (decrease in net assets), credit cash (decrease in assets), and credit accounts payable (increase in liability).Journal entry is not required for the transaction 7, because no specialized skill is required.

To record journal entry for allowance for uncollectible pledges-unrestricted, debit provision for uncollectible pledge and credit allowance for uncollectible pledges-unrestricted.

To record journal entry for allowance for uncollectible pledges-unrestricted, debit provision for uncollectible pledge and credit allowance for uncollectible pledges-unrestricted.To record journal entry for depreciation expense, depreciation expense is debited and credit allowance for depreciation-equipment and furniture (decrease in assets). Refer below calculations for depreciation amount:

Calculate Depreciation:

Depreciation is calculated under the straight line method. It is calculated by dividing the value of assets divided by number of useful lifetime.

Hence, the depreciation for equipment is

Hence, the depreciation for equipment is  0

0.

Now, calculate depreciation for furniture:

1

1Hence, the depreciation for equipment is

2

2. Therefore, Total depreciation expense is $3,360

3

3 4

4Note: Refer below resource allocation table for the debit values. To record journal entry for allocation of expenses, debit public health education program, management and general, community service program, and fund raising. Credit all the incurred expenses. The resource allocation is given below based on the available information.

5

5 6

6To record journal entry for release the release the temporarily restricted net assets, debit net assets released-satisfaction of purpose restriction temporarily restricted. Net assets released-satisfaction of purpose restriction-unrestricted is credited.

7

7To record journal entry to adjust the contribution-unrestricted and unrestricted net assets, contribution-unrestricted and unrestricted net assets are debited and public health education, community service, management and general, fund-raising are credited.

To record journal entry to adjust contribution-temporarily restricted, contribution - temporarily restricted is debited, temporarily restricted net assets is credited.

To record journal entry to adjust temporarily restricted net assets, temporarily restricted net assets is debited and net assets released-satisfaction of purpose restriction-temporarily restricted is credited.

b.Prepare statement of activity:

It is calculated by deducting the total expenses from the total revenue.

8

8Hence, the total ending net assets are

9

9.

c.Prepare statement of financial position:

0

0Hence, the total assets are equal to total liabilities and nets assets, which is

1

1.

d.Prepare statement of cash flow:

2

2Hence, the cash provided by the operating activities is

3

3.

e.Prepare statement of functional expenses:

4

4Hence, the total functional expenses is

5

5.

3

What is the difference between an unconditional and a conditional pledge? How are the two pledges reported?

Not-for-profit (NFP) entities:

It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities' success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

The following is the difference between unconditional and conditional pledge:

If a donor commits to pledge an asset without any condition, the not-for-profit organization record the pledge as an accounts receivable and revenue. Unconditional pledge is commonly identified in the same year actually the pledge is made.

A conditional pledge is depends on the occurrence of an uncertain or future event because the conditions imposed for the pledge is unknown whether it will be met. It is not identified at the time the pledge is made, however it will be disclosed. When all the conditions imposed by the donor are met substantially, the conditional pledge will be recognized.

It is an individual or group of people who work together to attain the goals and mission that is something other than making profit for its shareholders or owners. Not-for-profit entities' success is measured by how much the entity serves to the well-being of public or poor people with the available resource of the entity.

The following is the difference between unconditional and conditional pledge:

If a donor commits to pledge an asset without any condition, the not-for-profit organization record the pledge as an accounts receivable and revenue. Unconditional pledge is commonly identified in the same year actually the pledge is made.

A conditional pledge is depends on the occurrence of an uncertain or future event because the conditions imposed for the pledge is unknown whether it will be met. It is not identified at the time the pledge is made, however it will be disclosed. When all the conditions imposed by the donor are met substantially, the conditional pledge will be recognized.

4

Recording and Reporting Transactions. The Art League is a not-for-profit organization dedicated to promoting the arts within the community. There are two programs conducted by the Art League: (1) exhibition and sales of members' art (referred to as Exhibition) and (2) Community Art Education. Activities of the Art League are conducted by a part-time administrator, a part-time secretary-bookkeeper, and several part-time volunteers. The volunteers greet visitors, monitor the security of the exhibit hall, and handle the sales of art to the public. Art on exhibit is considered the property of the member artists, not the Art League.

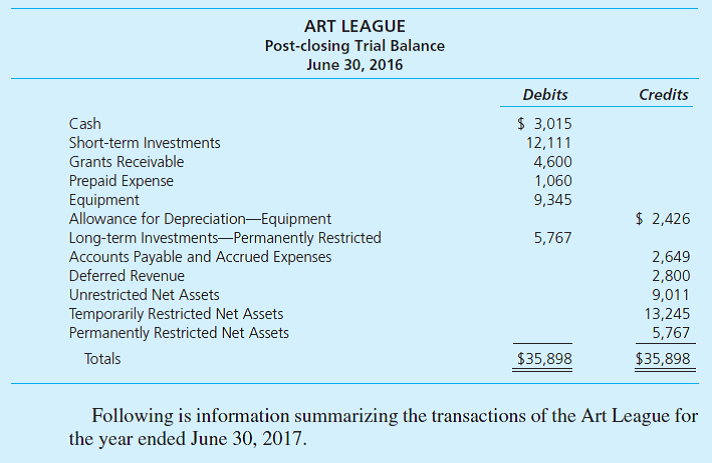

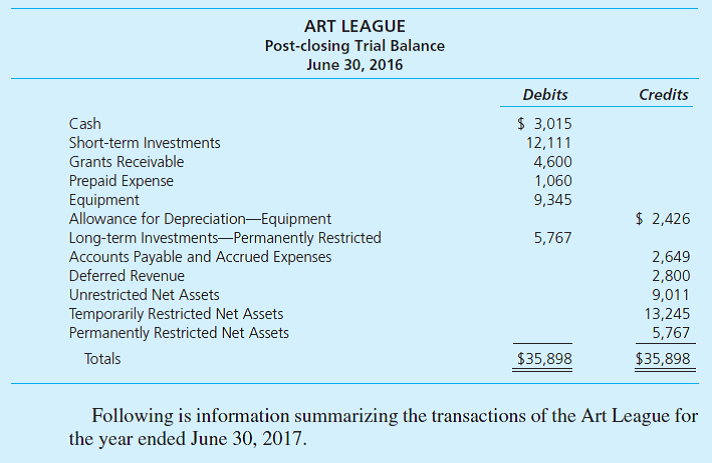

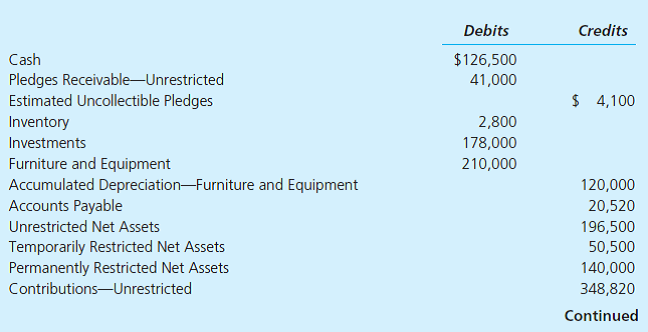

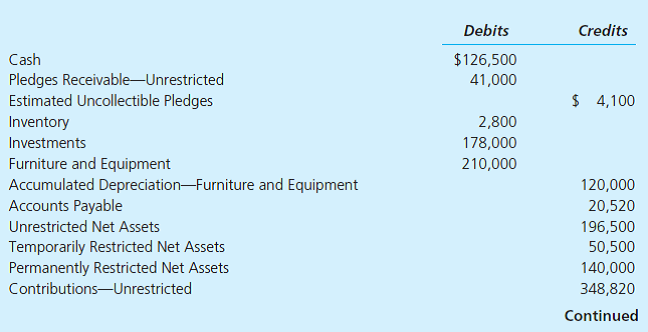

The post-closing trial balance for the Art League as of June 30, 2016, is shown here.

1. During the year, unrestricted cash was received from the following sources: grants, $11,600, of which $4,600 had been reported as receivable on June 30, 2016; annual contributions from fund drives and other unrestricted gifts, $13,861; membership dues, $16,285; tuition and fees for educational workshops, $6,974; and sales of members' art, $12,010, of which 20 percent represents commissions earned by the Art League.

2. Interest earnings were as follows: interest on unrestricted investments totaled $686; interest on temporarily restricted investments totaled $925; interest on permanently restricted investments totaled $344 (these investment earnings are temporarily restricted for program use).

3. Grants receivable as of year-end totaled $5,020, of which $3,120 was earned in the current year (thus unrestricted) and $1,900 was reported as deferred revenue.

4. The Art League receives free rent from the city at an estimated value of $18,000 a year.

5. Expenses incurred during the year were as follows: salaries and fringe benefits, $46,900; utilities $3,080; postage and supplies, $1,310; and miscellaneous, $640. As of year-end, the balances of the following accounts were: Prepaid Expenses, $840; Accounts Payable and Accrued Expenses, $2,746.

6. During the year, $2,900 of short-term investments were sold, with the proceeds used to purchase two computers and printer at a cost of $2,835. The resources used were temporarily restricted for the purchase of equipment. It is the policy of the Art League to record the equipment as temporarily restricted net assets.

7. In accordance with the terms of the Art League endowment, income earned by the endowment for the provision of free art instruction for handicapped children was provided at a cost of $825. This amount was allocated to community art education.

8. Depreciation on equipment in the amount of $1,642 was recorded.

9. Expenses for the year were allocated 30 percent to Exhibition Program, 30 percent to Community Art Education, 25 percent to Management and General Expenses, and 15 percent to Fund-Raising. (Round to the nearest dollar.)

10. Proceeds of art sales, net of commissions charged by the Art League, totaled $9,608. This amount was paid to member artists during the year.

11. All nominal accounts were closed a year-end.

Required

a. On the advice of its independent auditor, the Art League does not record support and expenses related to the value of services donated by the volunteers. Discuss the criteria for recognition of donated services, and comment on the auditor's likely rationale for not recognizing them in this case.

b. Make all necessary journal entries to record these transactions. Expense transactions should be initially recorded by object classification unless otherwise instructed; in entry 9, expenses will be allocated to functions.

c. Prepare a statement of activities for the year ended June 30, 2017.

d. Prepare a statement of financial position for the year ended June 30, 2017.

The post-closing trial balance for the Art League as of June 30, 2016, is shown here.

1. During the year, unrestricted cash was received from the following sources: grants, $11,600, of which $4,600 had been reported as receivable on June 30, 2016; annual contributions from fund drives and other unrestricted gifts, $13,861; membership dues, $16,285; tuition and fees for educational workshops, $6,974; and sales of members' art, $12,010, of which 20 percent represents commissions earned by the Art League.

2. Interest earnings were as follows: interest on unrestricted investments totaled $686; interest on temporarily restricted investments totaled $925; interest on permanently restricted investments totaled $344 (these investment earnings are temporarily restricted for program use).

3. Grants receivable as of year-end totaled $5,020, of which $3,120 was earned in the current year (thus unrestricted) and $1,900 was reported as deferred revenue.

4. The Art League receives free rent from the city at an estimated value of $18,000 a year.

5. Expenses incurred during the year were as follows: salaries and fringe benefits, $46,900; utilities $3,080; postage and supplies, $1,310; and miscellaneous, $640. As of year-end, the balances of the following accounts were: Prepaid Expenses, $840; Accounts Payable and Accrued Expenses, $2,746.

6. During the year, $2,900 of short-term investments were sold, with the proceeds used to purchase two computers and printer at a cost of $2,835. The resources used were temporarily restricted for the purchase of equipment. It is the policy of the Art League to record the equipment as temporarily restricted net assets.

7. In accordance with the terms of the Art League endowment, income earned by the endowment for the provision of free art instruction for handicapped children was provided at a cost of $825. This amount was allocated to community art education.

8. Depreciation on equipment in the amount of $1,642 was recorded.

9. Expenses for the year were allocated 30 percent to Exhibition Program, 30 percent to Community Art Education, 25 percent to Management and General Expenses, and 15 percent to Fund-Raising. (Round to the nearest dollar.)

10. Proceeds of art sales, net of commissions charged by the Art League, totaled $9,608. This amount was paid to member artists during the year.

11. All nominal accounts were closed a year-end.

Required

a. On the advice of its independent auditor, the Art League does not record support and expenses related to the value of services donated by the volunteers. Discuss the criteria for recognition of donated services, and comment on the auditor's likely rationale for not recognizing them in this case.

b. Make all necessary journal entries to record these transactions. Expense transactions should be initially recorded by object classification unless otherwise instructed; in entry 9, expenses will be allocated to functions.

c. Prepare a statement of activities for the year ended June 30, 2017.

d. Prepare a statement of financial position for the year ended June 30, 2017.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

Distinguish between program services expenses and supporting services expenses. Why is it important that NFPs report expenses for program services separately from those for supporting services?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

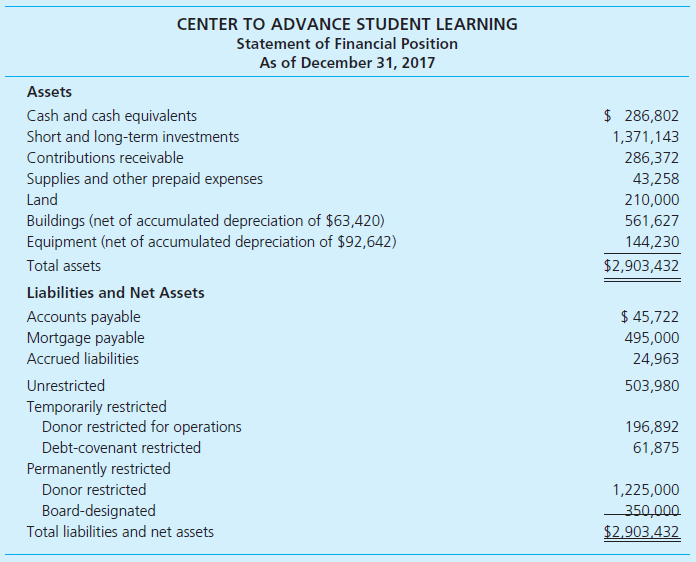

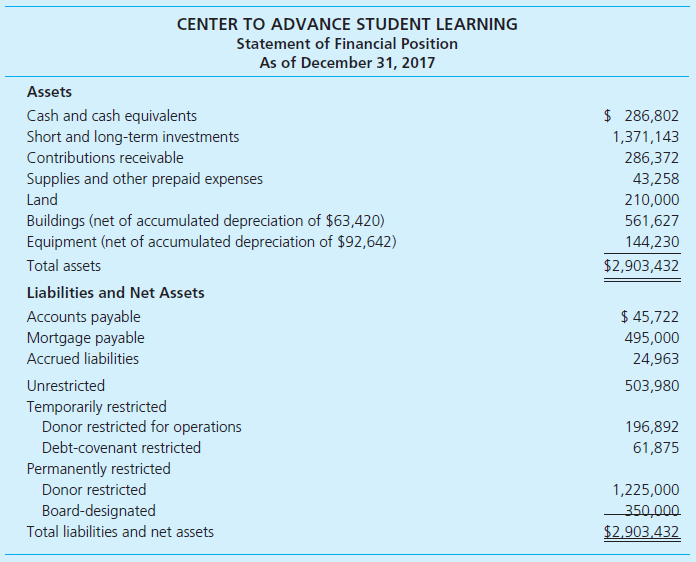

Identify Statement of Financial Position Departures from GAAP. The Center to Advance Student Learning has presented its statement of financial position for the 2017 fiscal year.

Required

Upon reviewing the statement, you realize that it is not presented in compliance with the FASB standards. To help the Center to Advance Student Learning correct the statement, please make a list of the corrections or modifications that should be made to the statement, so it can be presented in the proper format.

Required

Upon reviewing the statement, you realize that it is not presented in compliance with the FASB standards. To help the Center to Advance Student Learning correct the statement, please make a list of the corrections or modifications that should be made to the statement, so it can be presented in the proper format.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

What criteria must be met before a not-for-profit organization can record donated services? If the criteria are met, how should donated services be recorded? Give examples to support your answer.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

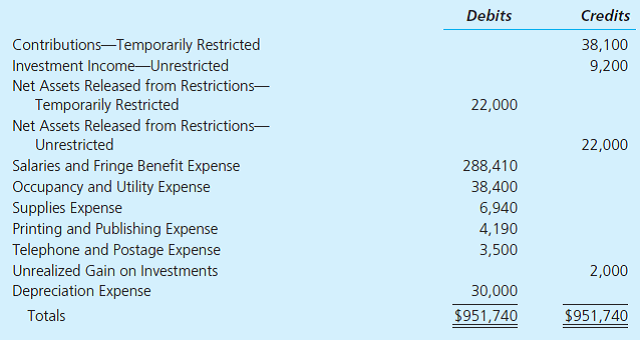

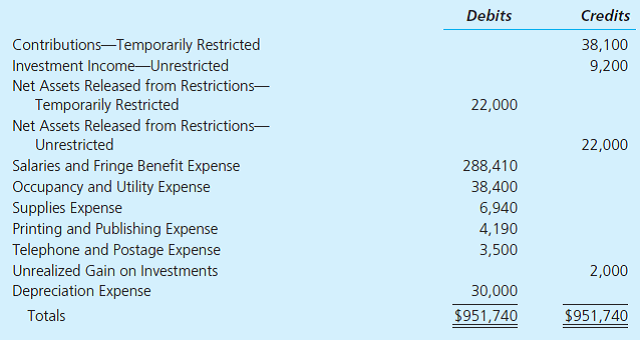

Prepare Financial Statements. The Kare Counseling Center was incorporated as a not-for-profit voluntary health and welfare organization 10 years ago. Its adjusted trial balance as of June 30, 2017, follows.

1. Salaries and fringe benefits were allocated to program services and supporting services in the following percentages: counseling services, 40 percent; professional training, 20 percent; community service, 10 percent; management and general, 20 percent; and fund-raising, 10 percent. Occupancy and utility, supplies, printing and publishing, and telephone and postage expense were allocated to the programs in the same manner as salaries and fringe benefits. Depreciation expense was divided equally among all five functional expense categories.

2. The organization had $165,314 of cash on hand at the beginning of the year. During the year, the center received cash from contributors: $310,800 that was unrestricted and $38,100 that was restricted for the purchase of equipment for the center. It had $9,200 of income earned and received on longterm investments. The center spent cash of $288,410 on salaries and fringe benefits, $22,000 on the purchase of equipment for the center, and $86,504 for operating expenses. Other pertinent information follows: net pledges receivable increased $6,000, inventory increased $1,000, accounts payable decreased $102,594, and there were no salaries payable at the beginning of the year.

Required

a. Prepare a statement of financial position as of June 30, 2017, following the format in Illustration 13-6.

b. Prepare a statement of functional expenses for the year ended June 30, 2017, following the format in Illustration 13-9.

c. Prepare a statement of activities for the year ended June 30, 2017, following the format in Illustration 13-7.

d. Prepare a statement of cash flows for the year ended June 30, 2017, following the format in Illustration 13-8.

1. Salaries and fringe benefits were allocated to program services and supporting services in the following percentages: counseling services, 40 percent; professional training, 20 percent; community service, 10 percent; management and general, 20 percent; and fund-raising, 10 percent. Occupancy and utility, supplies, printing and publishing, and telephone and postage expense were allocated to the programs in the same manner as salaries and fringe benefits. Depreciation expense was divided equally among all five functional expense categories.

2. The organization had $165,314 of cash on hand at the beginning of the year. During the year, the center received cash from contributors: $310,800 that was unrestricted and $38,100 that was restricted for the purchase of equipment for the center. It had $9,200 of income earned and received on longterm investments. The center spent cash of $288,410 on salaries and fringe benefits, $22,000 on the purchase of equipment for the center, and $86,504 for operating expenses. Other pertinent information follows: net pledges receivable increased $6,000, inventory increased $1,000, accounts payable decreased $102,594, and there were no salaries payable at the beginning of the year.

Required

a. Prepare a statement of financial position as of June 30, 2017, following the format in Illustration 13-6.

b. Prepare a statement of functional expenses for the year ended June 30, 2017, following the format in Illustration 13-9.

c. Prepare a statement of activities for the year ended June 30, 2017, following the format in Illustration 13-7.

d. Prepare a statement of cash flows for the year ended June 30, 2017, following the format in Illustration 13-8.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

The new administrator for the art museum was concerned that the museum's collection of rare 17th-century American porcelain was not recognized on the financial statements. Explain to the administrator why the collection might not be recognized on the financial statements.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

What are joint costs and how are joint costs recorded?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

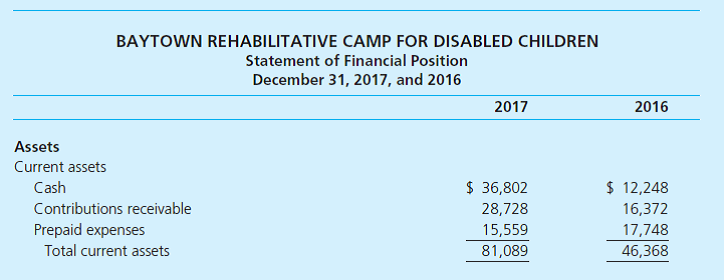

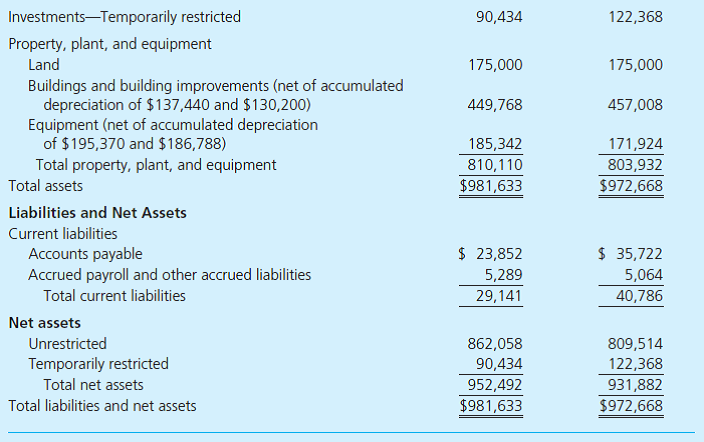

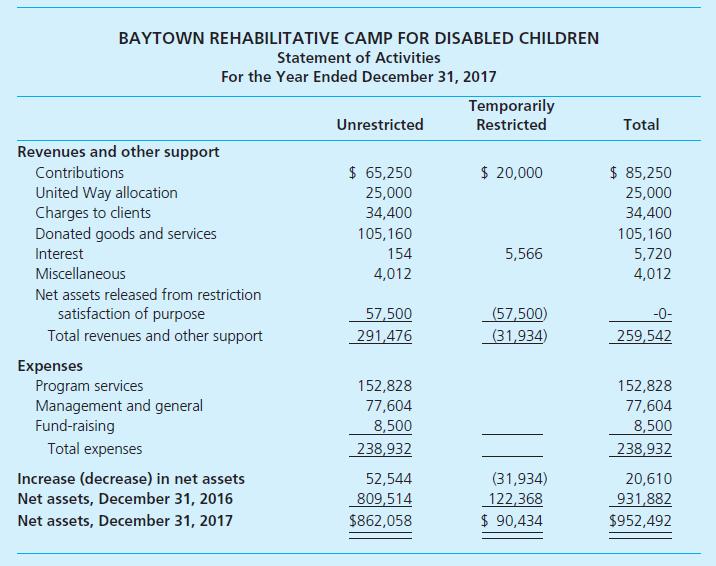

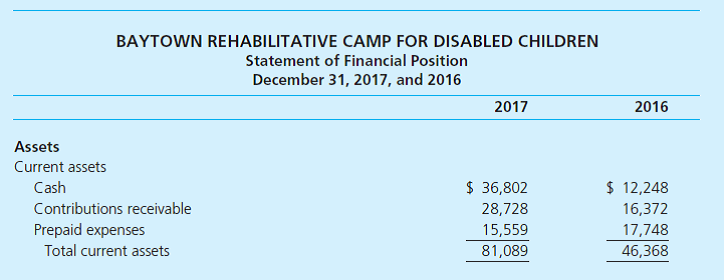

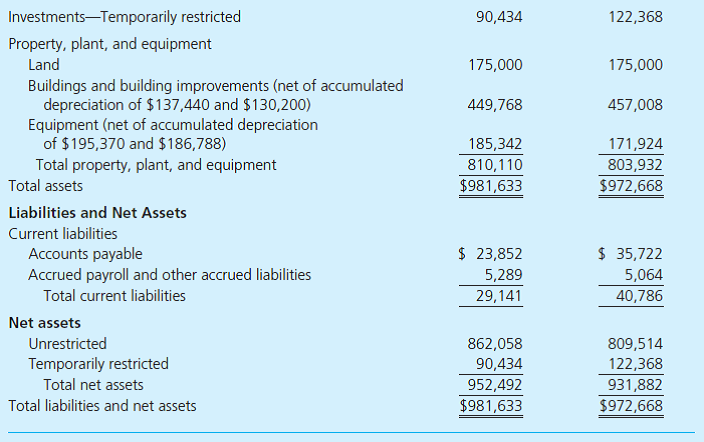

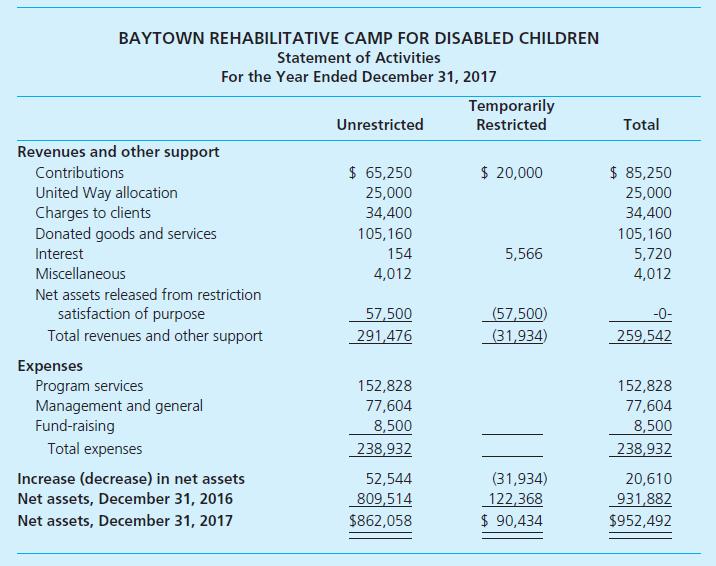

Temporarily Restricted Net Assets. For several years, Baytown Rehabilitative Camp for Disabled Children (hereafter referred to as the camp) has applied for an operating grant from the Baytown Area United Way. As the finance adviser for the local United Way allocation panel, it is your responsibility to evaluate the camp's budget request for the forthcoming year and its audited financial statements. The camp's most recent comparative statement of financial position and statement of activities are presented below.

Additional Information: As reflected in the camp's 2017 statement of activities, the United Way agency allocated $25,000 to the camp for fiscal year 2017. However, the amount allocated was $5,000 less than the camp had requested in its fiscal year 2017 budget, reflecting the allocation panel's concern about the camp's financial reserves (representing about 12 days in 2016) and low ratio of program services expense to total expense (only 57 percent in 2016). As a condition for receiving the $25,000 fiscal year 2017 allocation, Baytown Rehabilitative Camp agreed to take actions to improve its financial reserves and its ratio of program services expense to total expense, including an increase in its fund-raising efforts and a reduction in its support payroll.

Another area of concern to the allocation panel has been the camp's long delay in using a restricted contribution of $100,000 received several years earlier. This gift was restricted by the donor for future expansion of a building used as a dining hall and for rehabilitative activities. This contribution has been invested in CDs and has grown to $122,368 as of December 31, 2016.

The camp is requesting a $35,000 United Way allocation for fiscal year 2018, based on a growing demand for its services and improvement made in its financial condition. As financial adviser for the local United Way allocation panel, however, you note that much of the improvement in unrestricted net assets resulted from $37,500 of temporarily restricted net assets that were released from restriction during fiscal year 2017, with no corresponding increase in the balance of the Buildings and Building Improvements account. ( Note: $20,000 of the $57,500 released from restriction related to $20,000 of temporarily restricted contributions received during 2017.) You immediately contact the camp administrator for an explanation, whereupon she explains that the board of directors voted to use $37,500 of previously restricted investments for operating purposes after the administrator reported to the board that the original agreement with the donor could not be located and the donor was now deceased. She further indicated that the board may continue to use this pool of resources to further improve the camp's financial condition.

Required

a. As financial adviser, evaluate the camp's statement of financial position and statement of activities and prepare a report for the chair of the allocation committee indicating the extent to which the camp's financial situation has improved or worsened. In your analysis, you should look at the camp's unrestricted financial position, both including and excluding the use of the $37,500 of temporarily restricted net assets for operating purposes. As part of your analysis, you should consider liquidity (current and/or quick ratio), days of financial reserves, and effectiveness (program expenses/total expenses). Financial reserves ratio is calculated as working capital (current assets 2 current liabilities) divided by expenses. To calculate the number of days of financial reserves available to cover expenses, multiply the financial reserves ratio by 365 days.

b. What is your reaction to the board of directors' decision to use, for operating purposes, the $100,000 temporarily restricted net assets provided by a donor for building expansion?

c. What amount of United Way funds would you recommend be allocated to the camp for fiscal year 2018? Explain your recommendation.

Additional Information: As reflected in the camp's 2017 statement of activities, the United Way agency allocated $25,000 to the camp for fiscal year 2017. However, the amount allocated was $5,000 less than the camp had requested in its fiscal year 2017 budget, reflecting the allocation panel's concern about the camp's financial reserves (representing about 12 days in 2016) and low ratio of program services expense to total expense (only 57 percent in 2016). As a condition for receiving the $25,000 fiscal year 2017 allocation, Baytown Rehabilitative Camp agreed to take actions to improve its financial reserves and its ratio of program services expense to total expense, including an increase in its fund-raising efforts and a reduction in its support payroll.

Another area of concern to the allocation panel has been the camp's long delay in using a restricted contribution of $100,000 received several years earlier. This gift was restricted by the donor for future expansion of a building used as a dining hall and for rehabilitative activities. This contribution has been invested in CDs and has grown to $122,368 as of December 31, 2016.

The camp is requesting a $35,000 United Way allocation for fiscal year 2018, based on a growing demand for its services and improvement made in its financial condition. As financial adviser for the local United Way allocation panel, however, you note that much of the improvement in unrestricted net assets resulted from $37,500 of temporarily restricted net assets that were released from restriction during fiscal year 2017, with no corresponding increase in the balance of the Buildings and Building Improvements account. ( Note: $20,000 of the $57,500 released from restriction related to $20,000 of temporarily restricted contributions received during 2017.) You immediately contact the camp administrator for an explanation, whereupon she explains that the board of directors voted to use $37,500 of previously restricted investments for operating purposes after the administrator reported to the board that the original agreement with the donor could not be located and the donor was now deceased. She further indicated that the board may continue to use this pool of resources to further improve the camp's financial condition.

Required

a. As financial adviser, evaluate the camp's statement of financial position and statement of activities and prepare a report for the chair of the allocation committee indicating the extent to which the camp's financial situation has improved or worsened. In your analysis, you should look at the camp's unrestricted financial position, both including and excluding the use of the $37,500 of temporarily restricted net assets for operating purposes. As part of your analysis, you should consider liquidity (current and/or quick ratio), days of financial reserves, and effectiveness (program expenses/total expenses). Financial reserves ratio is calculated as working capital (current assets 2 current liabilities) divided by expenses. To calculate the number of days of financial reserves available to cover expenses, multiply the financial reserves ratio by 365 days.

b. What is your reaction to the board of directors' decision to use, for operating purposes, the $100,000 temporarily restricted net assets provided by a donor for building expansion?

c. What amount of United Way funds would you recommend be allocated to the camp for fiscal year 2018? Explain your recommendation.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

Research Case-Not-for-Profit Reporting Model. In November of 2011, the FASB announced two new projects related to financial reporting of not-for-profit organizations. One of the projects was a research project that was subsequently dropped from the agenda; as a result, the standard-setting project was renamed "Financial Statements of Not-For-Profit Entities." As this textbook goes to press, the FASB has tentatively scheduled the release of an exposure draft in the second half of 2014. The board has reached tentative conclusions about several NFP issues, including reporting of net assets. The board proposes that net assets be reported in two net asset categories-net assets with donor-imposed restrictions and net assets without donor-imposed restrictions - instead of the currently required three net asset categories of unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets.

Required

a. Research the current status of the FASB project. ( Hint : the FASB Web site is www.fasb.org. However, you may wish to also search for other current articles about the project.) Write a summary of the current reporting requirement for net assets and compare that with the proposed reporting requirement for net assets.

b. Why is the FASB proposing this change in net asset reporting? In other words, how will the proposed changes improve financial reporting for NFP organizations?

c. In addition to the net asset classification component of the project, there was one other overall objective. Identify the objective and discuss what, if any, proposals are being considered as part of this objective.

d. After having performed this research, what is your opinion? Do you believe the proposed changes will in fact improve financial reporting? Explain the rationale for the position you take.

Required

a. Research the current status of the FASB project. ( Hint : the FASB Web site is www.fasb.org. However, you may wish to also search for other current articles about the project.) Write a summary of the current reporting requirement for net assets and compare that with the proposed reporting requirement for net assets.

b. Why is the FASB proposing this change in net asset reporting? In other words, how will the proposed changes improve financial reporting for NFP organizations?

c. In addition to the net asset classification component of the project, there was one other overall objective. Identify the objective and discuss what, if any, proposals are being considered as part of this objective.

d. After having performed this research, what is your opinion? Do you believe the proposed changes will in fact improve financial reporting? Explain the rationale for the position you take.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

Research Case-Governmental or Not-for-Profit Entity? In partnership with Jefferson County, Mound City recently established a Native American Heritage Center and Museum, organized as a tax-exempt not-for-profit organization. Although the facility does not charge admission, signs at the information desk in the entry lobby encourage gifts of $3.00 for adults and $1.00 for children, 12 and under. Many visitors make the recommended contribution, some contribute larger amounts, and some do not contribute at all. Such contributions comprise 40 percent of the museum's total annual revenues, with net proceeds from fund-raising events and governmental grants comprising the remaining 60 percent. The center operates from a city-owned building for which it pays a nominal $1 per year in rent. Except for a full-time executive director and a part-time assistant, the center is staffed by unpaid volunteers. The center is governed by a six-member board of directors, each appointed for a three-year term. Two of the directors are appointed by the Mound City Council, one by the Jefferson County

Commission, two by the Mound City/Jefferson County Business Council, and one director is a Native American appointed by the local Tribe to represent Tribal interests. Should the center cease to operate, its charter provides that net assets be allocated as follows: all artifacts will revert to the local Tribe; of the remaining net assets, 25 percent will go to the city, 15 percent will go to the county, and the remaining amount will be donated to the State Historical Society.

At the end of its first year of operation, the board of directors decided to engage a local CPA to conduct an audit of the center's financial statements. The board expects to receive an unqualified (clean) audit opinion stating that its financial statements are presented fairly in conformity with generally accepted accounting principles.

Required

Assume you are the CPA who has been engaged to conduct this audit. To which standards-setting body (or bodies) would you look for accounting and financial reporting standards to assist you in determining whether the center's financial statements are in conformity with generally accepted accounting principles? Explain how you arrived at this conclusion.

Commission, two by the Mound City/Jefferson County Business Council, and one director is a Native American appointed by the local Tribe to represent Tribal interests. Should the center cease to operate, its charter provides that net assets be allocated as follows: all artifacts will revert to the local Tribe; of the remaining net assets, 25 percent will go to the city, 15 percent will go to the county, and the remaining amount will be donated to the State Historical Society.

At the end of its first year of operation, the board of directors decided to engage a local CPA to conduct an audit of the center's financial statements. The board expects to receive an unqualified (clean) audit opinion stating that its financial statements are presented fairly in conformity with generally accepted accounting principles.

Required

Assume you are the CPA who has been engaged to conduct this audit. To which standards-setting body (or bodies) would you look for accounting and financial reporting standards to assist you in determining whether the center's financial statements are in conformity with generally accepted accounting principles? Explain how you arrived at this conclusion.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

Multiple Choice. Choose the best answer. 1. Which of the following organizations would be considered a nongovernmental not-for-profit organization?

A) An organization that provides shelter for men who have been victims of domestic violence and has been designated as a not-for-profit organization by the IRS. The board of trustees is composed of county commissioners, but in the case of the dissolution of the organization, any remaining funds would be donated to the United Way. Funding for the organization comes entirely from contributions.

B) An organization that provides services to persons who wish to learn English as their second language. The organization is incorporated and is funded by fees charged to the learners. All profits are reinvested in the organization to provide further services. The organization has applied for not-for-profit status with the IRS.

C) An organization classified by the IRS as a not-for-profit organization that employs individuals with disabilities in a workshop where the workers make custom stationery out of recycled goods. The organization receives cash and in-kind contributions as well as the proceeds from the sale of the stationery. The organization's board is composed of local businessmen and women.

D) An organization that provides fund-raising services for other not-for-profit organizations. The organization is funded by fees for its services and was incorporated by the former chairperson of the local United Way organization. The organization distributes 40 percent of its profits to local charities.

2) According to GAAP, all not-for-profit organizations are required to prepare

A) A statement of activities, a statement of functional expense, and a statement of cash flows using accrual accounting.

B) A statement of activities, a balance sheet, and a statement of cash flows using accrual accounting.

C) A statement of financial position, a statement of activities, a statement of cash flows and a statement of functional expenses using accrual accounting. d. A statement of cash flows, a statement of activities, and a statement of financial position using either cash basis or accrual basis accounting.

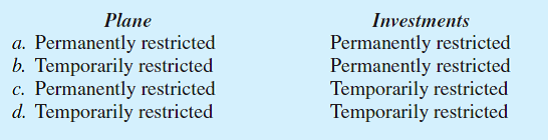

3) Jane's Planes is an organization that provides air transportation for critically ill children. A friend of Jane's Planes, Richard Bucks donated a plane to be used over its remaining life solely for transportation of critically ill children. In addition, he donated a substantial amount of investments that were to be used strictly to generate income to help fund the organization's expenses. These donations would be included in the organization's net assets as:

4) In a local NFP elementary school's statement of cash flows, a contribution restricted for use on a new building project would be reported as:

A) A financing activity.

B) A capital and related financing activity.

C) An investing activity.

D) An operating activity.

5) A wealthy donor promised $1 million to the local art museum to expand the size of its building, contingent on the museum obtaining a grant from the State Endowment for the Arts of at least $500,000. Upon completing a signed agreement with the donor, the museum should:

A) Record a debit to Contributions Receivable-Temporarily Restricted in the amount of $1,000,000.

B) Record a debit to Contributions Receivable-Temporarily Restricted in the amount of $500,000.

C) Not make a journal entry until the conditions of the agreement have been met.

D) Either a or c are permissible, depending on the museum's established policy.

6) Orlando Perez, president of a local information systems company, volunteered his time to help develop software for Best Friends, a local no-kill pet shelter. The software will allow the organization to track intake, placement, and statistics of animals in its three locations. Without Mr. P erez's assistance, Best Friends would have needed to hire someone to develop this software. Best Friends should record the value of Mr. P erez's time as:

A) Program revenue and supporting services expense.

B) Contribution revenue and supporting services expense.

C) Program revenue and program expense.

D) Contribution revenue and a program expense.

7) The Maryville Cultural Center recently conducted a successful talent show in which local talent performed for a nominal prize. The talent show is an ongoing major event and is central to the center's mission. The event raised $4,800 in gross revenue. Expenses related to the event included $1,000 to rent an auditorium, $1,200 to advertise the event, $500 for trophies and other awards for the winner and the runners up, and $100 for printing and mailing tickets. The center believes there was no monetary value received by donors (attendees). To report this event in its statement of activities, the center will report:

A) Special event revenue of $4,800 and special event expense of $1,500.

B) Special event revenue of $4,800 and fund-raising expense of $1,300.

C) Special event revenue of $2,300 and fund-raising expense of $1,300.

D) Both a and b are correct.

8) Many not-for-profit organizations attempt to classify fund-raising expenses as program services expenses by making the activities look educational in nature or advocating for the mission of the organization. For such expenses to be reported as program services expenses, they must meet which of the following three criteria:

A) Purpose, mission-related, and benefit to the public.

B) Purpose, audience, and content.

C) Purpose, expand donor base, and content.

D) Reasonable, improve financial condition, and benefit to the public.

9) Save Our Beaches, a NFP organization, prepared and distributed a tri-fold flyer to individuals and families at White Sands Beach, a popular beach for both residents and tourists. The flyer provided information about beach pollution and invited the public to participate in the organization's semi-annual beach cleanup. In addition, one segment of the flyer solicited contributions to the organization to help fund its activities. The cost of the flyer and its distribution would be considered:

A) A fund-raising cost.

B) A program cost.

C) Both a fund-raising and program cost.

D) A management and general expense.

10) A particular organization functions as an intermediary between donors and other beneficiary organizations. The intermediary organization must report contribution revenue from donors if:

A) The organization has variance power.

B) The organization elects to consistently report such donor gifts as contribution revenue.

C) The beneficiary organization requests a delay in receiving the contribution from the intermediary organization.

D) All of the above are correct.

A) An organization that provides shelter for men who have been victims of domestic violence and has been designated as a not-for-profit organization by the IRS. The board of trustees is composed of county commissioners, but in the case of the dissolution of the organization, any remaining funds would be donated to the United Way. Funding for the organization comes entirely from contributions.

B) An organization that provides services to persons who wish to learn English as their second language. The organization is incorporated and is funded by fees charged to the learners. All profits are reinvested in the organization to provide further services. The organization has applied for not-for-profit status with the IRS.

C) An organization classified by the IRS as a not-for-profit organization that employs individuals with disabilities in a workshop where the workers make custom stationery out of recycled goods. The organization receives cash and in-kind contributions as well as the proceeds from the sale of the stationery. The organization's board is composed of local businessmen and women.

D) An organization that provides fund-raising services for other not-for-profit organizations. The organization is funded by fees for its services and was incorporated by the former chairperson of the local United Way organization. The organization distributes 40 percent of its profits to local charities.

2) According to GAAP, all not-for-profit organizations are required to prepare

A) A statement of activities, a statement of functional expense, and a statement of cash flows using accrual accounting.

B) A statement of activities, a balance sheet, and a statement of cash flows using accrual accounting.

C) A statement of financial position, a statement of activities, a statement of cash flows and a statement of functional expenses using accrual accounting. d. A statement of cash flows, a statement of activities, and a statement of financial position using either cash basis or accrual basis accounting.

3) Jane's Planes is an organization that provides air transportation for critically ill children. A friend of Jane's Planes, Richard Bucks donated a plane to be used over its remaining life solely for transportation of critically ill children. In addition, he donated a substantial amount of investments that were to be used strictly to generate income to help fund the organization's expenses. These donations would be included in the organization's net assets as:

4) In a local NFP elementary school's statement of cash flows, a contribution restricted for use on a new building project would be reported as:

A) A financing activity.

B) A capital and related financing activity.

C) An investing activity.

D) An operating activity.

5) A wealthy donor promised $1 million to the local art museum to expand the size of its building, contingent on the museum obtaining a grant from the State Endowment for the Arts of at least $500,000. Upon completing a signed agreement with the donor, the museum should:

A) Record a debit to Contributions Receivable-Temporarily Restricted in the amount of $1,000,000.

B) Record a debit to Contributions Receivable-Temporarily Restricted in the amount of $500,000.

C) Not make a journal entry until the conditions of the agreement have been met.

D) Either a or c are permissible, depending on the museum's established policy.

6) Orlando Perez, president of a local information systems company, volunteered his time to help develop software for Best Friends, a local no-kill pet shelter. The software will allow the organization to track intake, placement, and statistics of animals in its three locations. Without Mr. P erez's assistance, Best Friends would have needed to hire someone to develop this software. Best Friends should record the value of Mr. P erez's time as:

A) Program revenue and supporting services expense.

B) Contribution revenue and supporting services expense.

C) Program revenue and program expense.

D) Contribution revenue and a program expense.

7) The Maryville Cultural Center recently conducted a successful talent show in which local talent performed for a nominal prize. The talent show is an ongoing major event and is central to the center's mission. The event raised $4,800 in gross revenue. Expenses related to the event included $1,000 to rent an auditorium, $1,200 to advertise the event, $500 for trophies and other awards for the winner and the runners up, and $100 for printing and mailing tickets. The center believes there was no monetary value received by donors (attendees). To report this event in its statement of activities, the center will report:

A) Special event revenue of $4,800 and special event expense of $1,500.

B) Special event revenue of $4,800 and fund-raising expense of $1,300.

C) Special event revenue of $2,300 and fund-raising expense of $1,300.

D) Both a and b are correct.

8) Many not-for-profit organizations attempt to classify fund-raising expenses as program services expenses by making the activities look educational in nature or advocating for the mission of the organization. For such expenses to be reported as program services expenses, they must meet which of the following three criteria:

A) Purpose, mission-related, and benefit to the public.

B) Purpose, audience, and content.

C) Purpose, expand donor base, and content.

D) Reasonable, improve financial condition, and benefit to the public.

9) Save Our Beaches, a NFP organization, prepared and distributed a tri-fold flyer to individuals and families at White Sands Beach, a popular beach for both residents and tourists. The flyer provided information about beach pollution and invited the public to participate in the organization's semi-annual beach cleanup. In addition, one segment of the flyer solicited contributions to the organization to help fund its activities. The cost of the flyer and its distribution would be considered:

A) A fund-raising cost.

B) A program cost.

C) Both a fund-raising and program cost.

D) A management and general expense.

10) A particular organization functions as an intermediary between donors and other beneficiary organizations. The intermediary organization must report contribution revenue from donors if:

A) The organization has variance power.

B) The organization elects to consistently report such donor gifts as contribution revenue.

C) The beneficiary organization requests a delay in receiving the contribution from the intermediary organization.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

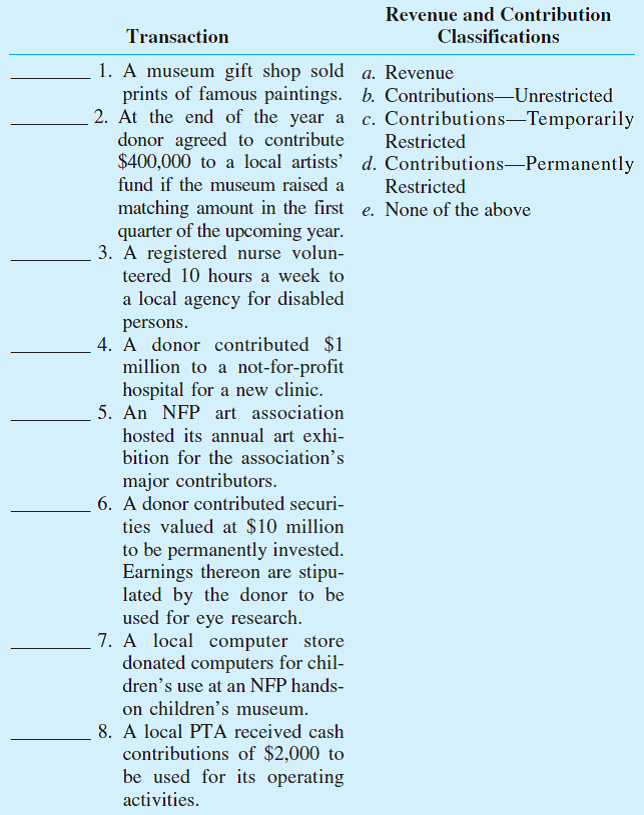

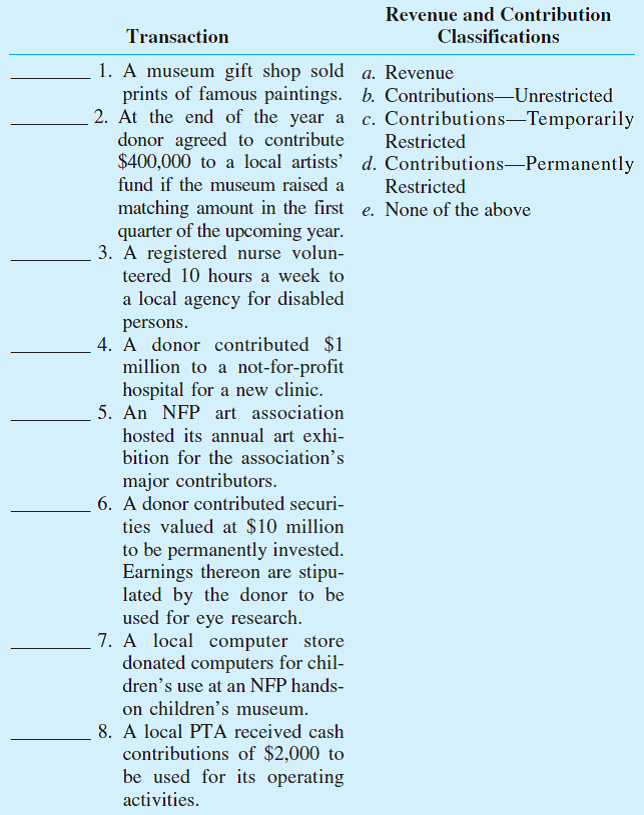

Classification of Revenues and Contributions. For each of the independent transactions listed in the left-hand column below, indicate which of the revenue or contribution classifications apply by choosing one or more of the letters from the listed items in the right-hand column. Choose all that apply.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

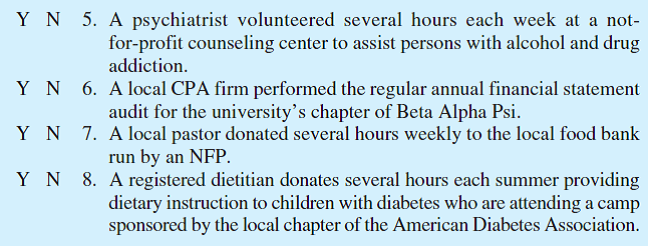

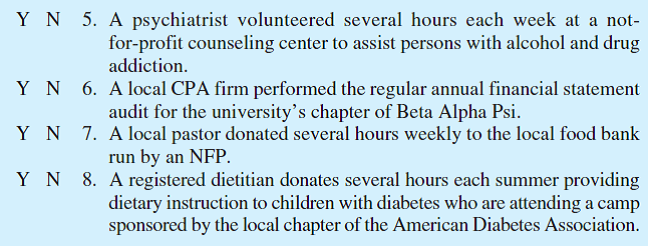

Donated Services. Indicate whether each of the following donated services situations would require a journal entry for contribution revenue and a related expense or asset by circling Y for yes or N for no.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

This chapter divides not-for-profit entities into four categories that align with accounting and auditing standards. What are the four categories and what types of entities are included in each?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

Joint Activities with a Fund-Raising Appeal. Consider the following scenarios relating to activities that include a fund-raising appeal:

1. The Green Group's mission is to protect the environment by increasing the portion of waste recycled by the public. The group conducts a door-to-door canvass of communities that recycle a low portion of their waste. The canvassers share their knowledge about the environmental problems caused by not recycling with households, asking them to change their recycling habits. The canvassers also ask for charitable contributions to continue this work, although these canvassers have not participated in fund-raising activities before.

2. The mission of Kid's Camp is to provide summer camps for economically disadvantaged youths. It conducts a door-to-door solicitation campaign for its camp programs by sending volunteers to homes in upper-class neighborhoods. The volunteers explain the camp's programs and distribute leaflets explaining the organization's mission. Solicitors say, "Although your own children most likely are not eligible to attend this camp, we ask for your financial support, so that children less fortunate can have this summer camp experience."

3. The Save the Ridley Turtles Society is a NFP organization whose mission it is to save the Ridley turtles from extinction and educate the public about the turtles. The society invites the citizens of the coastal areas where the turtles nest to a lecture on the nesting habits of the turtle. It also explains how people can play a role in improving the successful hatching of the turtle eggs in their area. At the conclusion of the lecture, the members of the society request donations to help prevent the extinction of the Ridley turtle.

4. The Citizens for Firefighters is a NFP organization that supports the mission of the city's firefighters. The organization sponsored a telephone campaign in which it called homes in the fire district and provided a list of five simple activities the homeowner could take to help reduce the probability of fires. The caller recommended that these simple steps be taken by the homeowner. Additionally, the caller asked for a donation and said that with the donation the homeowner would receive a pamphlet outlining the five activities along with other suggestions. The Citizens for Firefighters hired a firm to conduct its campaign. The firm conducting the campaign charged a 60 percent fee on the gross contributions received.

Required

Determine for each scenario whether its purpose, audience, and content meet the criteria described in this chapter and FASB ASC 958-720-45, so that the joint costs can be allocated between programs and support expenses. Explain your reasons.

1. The Green Group's mission is to protect the environment by increasing the portion of waste recycled by the public. The group conducts a door-to-door canvass of communities that recycle a low portion of their waste. The canvassers share their knowledge about the environmental problems caused by not recycling with households, asking them to change their recycling habits. The canvassers also ask for charitable contributions to continue this work, although these canvassers have not participated in fund-raising activities before.

2. The mission of Kid's Camp is to provide summer camps for economically disadvantaged youths. It conducts a door-to-door solicitation campaign for its camp programs by sending volunteers to homes in upper-class neighborhoods. The volunteers explain the camp's programs and distribute leaflets explaining the organization's mission. Solicitors say, "Although your own children most likely are not eligible to attend this camp, we ask for your financial support, so that children less fortunate can have this summer camp experience."

3. The Save the Ridley Turtles Society is a NFP organization whose mission it is to save the Ridley turtles from extinction and educate the public about the turtles. The society invites the citizens of the coastal areas where the turtles nest to a lecture on the nesting habits of the turtle. It also explains how people can play a role in improving the successful hatching of the turtle eggs in their area. At the conclusion of the lecture, the members of the society request donations to help prevent the extinction of the Ridley turtle.

4. The Citizens for Firefighters is a NFP organization that supports the mission of the city's firefighters. The organization sponsored a telephone campaign in which it called homes in the fire district and provided a list of five simple activities the homeowner could take to help reduce the probability of fires. The caller recommended that these simple steps be taken by the homeowner. Additionally, the caller asked for a donation and said that with the donation the homeowner would receive a pamphlet outlining the five activities along with other suggestions. The Citizens for Firefighters hired a firm to conduct its campaign. The firm conducting the campaign charged a 60 percent fee on the gross contributions received.

Required

Determine for each scenario whether its purpose, audience, and content meet the criteria described in this chapter and FASB ASC 958-720-45, so that the joint costs can be allocated between programs and support expenses. Explain your reasons.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

Discuss how characteristics of not-for-profit organizations and public sector organizations are similar and how they differ.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

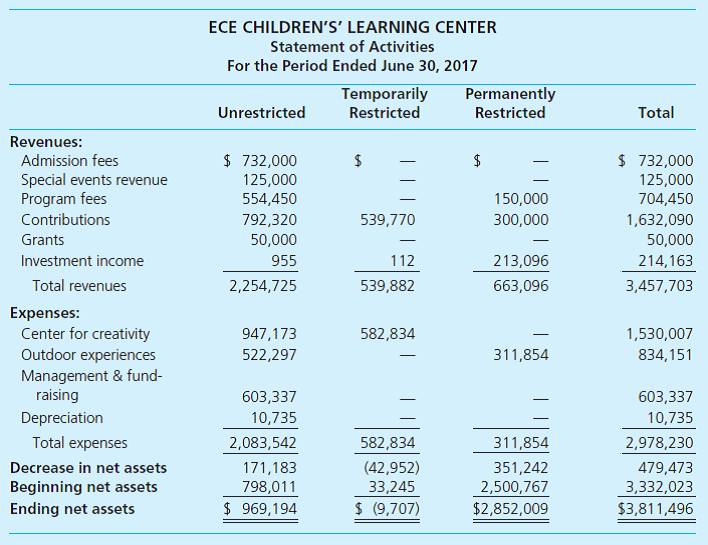

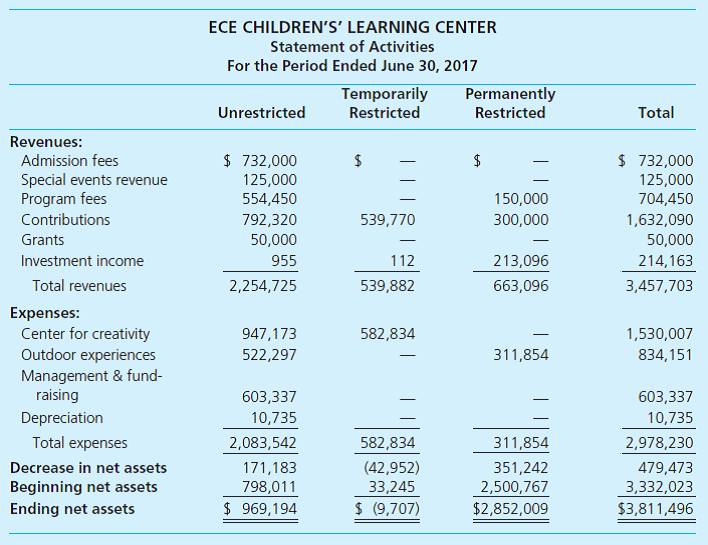

Identify Departures from GAAP. The statement of activities for the ECE Children's Learning Center for fiscal year 2017, prepared by a newly hired budget employee with no NFP experience, is presented on the following page.

Required

a. Because you are taking a not-for-profit course, a friend who sits on the board of the ECE has asked you to review its statement of activities. Your friend has a concern about the statement since it doesn't look quite the same as it did last year. Given that the ECE opted to hire someone without NFP experience, your friend has concerns that the statement may not be properly presented. Make a list of modifications or corrections that you believe should be made to the statement to ensure it is presented in conformance with GAAP.

b. Your friend indicates that the center is facing an upcoming audit. What concern would you have for the ECE regarding its audit, based on the financial statement it has prepared?

Required

a. Because you are taking a not-for-profit course, a friend who sits on the board of the ECE has asked you to review its statement of activities. Your friend has a concern about the statement since it doesn't look quite the same as it did last year. Given that the ECE opted to hire someone without NFP experience, your friend has concerns that the statement may not be properly presented. Make a list of modifications or corrections that you believe should be made to the statement to ensure it is presented in conformance with GAAP.

b. Your friend indicates that the center is facing an upcoming audit. What concern would you have for the ECE regarding its audit, based on the financial statement it has prepared?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

Discuss some of the differences in the preparation and presentation of the operating statements of nongovernmental not-for-profit entities and governmental not-for-profit entities reporting as business-type entities.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

Statement of Activities. The Atkins Museum recently hired a new controller. His experience with managerial accounting and strong communication skills were extremely attractive. The new controller sent each member of the Board of Trustees' Finance Committee a set of the financial statements one week before the monthly meeting for their review. The set included the following statement of activities.

Other information: The management and general expenses are first allocated to the programs to which they directly relate; for example, the executive director's salary is allocated to the Public Exhibit Program according to the percentage of time spent working on the program. Remaining unallocated management and general expenses are allocated to the programs as indirect costs based on the relative amount of salaries and wages to total salaries and wages for the programs.

Required

As a member of The Atkins Museum's Board of Directors Finance Committee, review this statement and answer the following questions:

a. Is the statement in proper form according to FASB standards?

b. What questions do you have for the controller?

c. The Atkins Museum would like to open an Impressionists exhibit. If its operating expenses are expected to be similar to that of the Abstract Exhibit, how much should the organization solicit in contributions or grants to cover the full cost of the program?

d. If you were a potential contributor to the Atkins Museum, do you think you have enough information from this statement on which to base your decision to donate?

Other information: The management and general expenses are first allocated to the programs to which they directly relate; for example, the executive director's salary is allocated to the Public Exhibit Program according to the percentage of time spent working on the program. Remaining unallocated management and general expenses are allocated to the programs as indirect costs based on the relative amount of salaries and wages to total salaries and wages for the programs.

Required

As a member of The Atkins Museum's Board of Directors Finance Committee, review this statement and answer the following questions:

a. Is the statement in proper form according to FASB standards?

b. What questions do you have for the controller?

c. The Atkins Museum would like to open an Impressionists exhibit. If its operating expenses are expected to be similar to that of the Abstract Exhibit, how much should the organization solicit in contributions or grants to cover the full cost of the program?

d. If you were a potential contributor to the Atkins Museum, do you think you have enough information from this statement on which to base your decision to donate?

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

What are the three categories into which NFPs must classify their net assets? Describe which net assets are included in each category. Would board-designated net assets be reported as temporarily restricted net assets? Explain your answer.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24