Deck 17: Accounting and Reporting for the Federal Government

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/22

Play

Full screen (f)

Deck 17: Accounting and Reporting for the Federal Government

1

Explain the role of the Government Accountability Office (GAO), the Department of the Treasury, and the Office of Management and Budget (OMB) in the financial accounting and reporting of the federal government.

Federal government financial management:

Accounting of federal government must be incorporated with certain standards. As a result, certain agencies are appointed to formulate accounting standards and guideline. This accounting standard ensure accountability and creditability of the financial accounting and reporting of the federal government. Some of the agencies are as follows:

• Government Accountability Office (GAO)

• Department of treasury

• Office of Management and Budget (OMb)These three agencies play a major role in the both financial accounting and reporting of federal agencies.

Following are the roles of Government Accountability Office (GAO) in the financial accounting and reporting of the federal government:

• This office agency performs as self-regulating audit agency for the federal government.

• The main responsibility of Government Accountability Office (GAO) is to audit the federal government.

• The reporting of financial accounting assists to indicate that the agencies have met both legal and Generally Accepted Accounting Principle (GAAP) reporting requirements.

• They even have certain responsibility for fixing accounting standards.

Following are the roles of the Department of treasury in the financial accounting and reporting of the federal government:

• Department of treasury major duty is to collect revenue of the federal government.

• It even offers cash disbursement of the federal government.

• This department maintains standard general ledger for proprietary accounts and budgetary accounts of the federal government.

Following are the roles of the Office of Management and Budget (OMB) in the financial accounting and reporting of the federal government:

• The Office of Management and Budget (OMB) offered financial plans mainly for the federal government.

• Office of Management and Budget (OMB) offers guidance and procedures on reporting and recording transactions to the agencies.

• It offers certain approvals on the standard general ledger.

Accounting of federal government must be incorporated with certain standards. As a result, certain agencies are appointed to formulate accounting standards and guideline. This accounting standard ensure accountability and creditability of the financial accounting and reporting of the federal government. Some of the agencies are as follows:

• Government Accountability Office (GAO)

• Department of treasury

• Office of Management and Budget (OMb)These three agencies play a major role in the both financial accounting and reporting of federal agencies.

Following are the roles of Government Accountability Office (GAO) in the financial accounting and reporting of the federal government:

• This office agency performs as self-regulating audit agency for the federal government.

• The main responsibility of Government Accountability Office (GAO) is to audit the federal government.

• The reporting of financial accounting assists to indicate that the agencies have met both legal and Generally Accepted Accounting Principle (GAAP) reporting requirements.

• They even have certain responsibility for fixing accounting standards.

Following are the roles of the Department of treasury in the financial accounting and reporting of the federal government:

• Department of treasury major duty is to collect revenue of the federal government.

• It even offers cash disbursement of the federal government.

• This department maintains standard general ledger for proprietary accounts and budgetary accounts of the federal government.

Following are the roles of the Office of Management and Budget (OMB) in the financial accounting and reporting of the federal government:

• The Office of Management and Budget (OMB) offered financial plans mainly for the federal government.

• Office of Management and Budget (OMB) offers guidance and procedures on reporting and recording transactions to the agencies.

• It offers certain approvals on the standard general ledger.

2

Compare the GAAP hierarchy for the federal government to that for state and local governments (see Chapter 11).

Federal government financial management:

Accounting of federal government must be incorporated with certain standards. As a result, certain agencies are appointed to formulate accounting standards and guideline. This accounting standard ensure accountability and creditability of the financial accounting and reporting of the federal government.

Following are the comparisons of GAAP (Generally Accepted Accounting Principle) hierarchy for the federal government with the state and local governments:

• Financial Accounting Standard board (FASB) formulates guideline for the federal government whereas Governmental Accounting Standard Board (GASB) provides guideline for the state and local government authoritative.

• Each hierarchy has codified by both accounting standard board.

• Different categories of principles are used for statements and interpretations that are issued by the particular standard-setting bodies. They are four categories of principles.

• Category A principles are expressed in the Financial Accounting Standard board (FASB). Here, this principle is applicable to the state and local governments by the GASB (Governmental Accounting Standard Board).

• Category B principles indicates the Technical Bulletins issued by the particular standard-setting bodies. Moreover, accounting guidelines and A Country institute of certified public accountants (AICPA) are also classified as Category B principles. It is mainly when the federal entities use Financial Accounting Standard board (FASAB) or state and local governments uses the GASB (Governmental Accounting Standard Board).

• Category C principles will be different for both the hierarchies.

• Category D principles comprises of implementation guides. Here, a particular standard-setting bodies issue these implementation guides.

Accounting of federal government must be incorporated with certain standards. As a result, certain agencies are appointed to formulate accounting standards and guideline. This accounting standard ensure accountability and creditability of the financial accounting and reporting of the federal government.

Following are the comparisons of GAAP (Generally Accepted Accounting Principle) hierarchy for the federal government with the state and local governments:

• Financial Accounting Standard board (FASB) formulates guideline for the federal government whereas Governmental Accounting Standard Board (GASB) provides guideline for the state and local government authoritative.

• Each hierarchy has codified by both accounting standard board.

• Different categories of principles are used for statements and interpretations that are issued by the particular standard-setting bodies. They are four categories of principles.

• Category A principles are expressed in the Financial Accounting Standard board (FASB). Here, this principle is applicable to the state and local governments by the GASB (Governmental Accounting Standard Board).

• Category B principles indicates the Technical Bulletins issued by the particular standard-setting bodies. Moreover, accounting guidelines and A Country institute of certified public accountants (AICPA) are also classified as Category B principles. It is mainly when the federal entities use Financial Accounting Standard board (FASAB) or state and local governments uses the GASB (Governmental Accounting Standard Board).

• Category C principles will be different for both the hierarchies.

• Category D principles comprises of implementation guides. Here, a particular standard-setting bodies issue these implementation guides.

3

According to the FASAB conceptual framework, there are four objectives for federal financial reporting. Discuss the four objectives and explain why the focus of the FASAB objectives differs from that of the FASB or the GASB.

Federal government financial management:

Accounting of federal government must be incorporated with certain standards. As a result, certain agencies are appointed to formulate accounting standards and guideline. This accounting standard ensure accountability and creditability of the financial accounting and reporting of the federal government.

Following are the four objectives for federal financial reporting:

• Budgetary integrity: This assists to ensure that the federal government has collected taxes and other funds in accordance of the rules and regulations of the nation. It even can depict the entire expenditures are made accordance with law and regulation.

• Operating performance: This assists to indicate whether the federal agencies have used their resource more effectively, economical, or efficiently. Here, the entire service efforts and accomplishments facts are useful in helping to evaluate operating performance.• Stewardship: It indicates on the accountability of country's general welfare. Here, the stewardship information can be evaluated based on federal governments' operations and investments.

• Adequacy of systems and controls: This ensures to reduce deterrence of fraud, waste, and abuses. It is even necessary to indicate the performance measurement information. Moreover, it is essential to execute every transaction in accordance with budget and laws.

Following are the reasons for Federal Accounting Standards Advisory Board (FASAB) objectives differ from other Accounting Standard board:

• The Federal Accounting Standards Advisory Board (FASAB) indicates both internal and external groups like primary users of federal financial reporting. As a result, its objectives have a broader focus. For instance, the objective on adequacy of systems and controls is the broader focus concept.

• This objective provides more relevance for its standard-setters. It is because the standard-setters have to consider the needs of internal users at the time of promulgating standards.

• Governmental Accounting Standard Board (GASB) recognizes only external groups as the primary users. Here, the internal users are excluded from the consideration in determining the objectives of financial reporting.

Accounting of federal government must be incorporated with certain standards. As a result, certain agencies are appointed to formulate accounting standards and guideline. This accounting standard ensure accountability and creditability of the financial accounting and reporting of the federal government.

Following are the four objectives for federal financial reporting:

• Budgetary integrity: This assists to ensure that the federal government has collected taxes and other funds in accordance of the rules and regulations of the nation. It even can depict the entire expenditures are made accordance with law and regulation.

• Operating performance: This assists to indicate whether the federal agencies have used their resource more effectively, economical, or efficiently. Here, the entire service efforts and accomplishments facts are useful in helping to evaluate operating performance.• Stewardship: It indicates on the accountability of country's general welfare. Here, the stewardship information can be evaluated based on federal governments' operations and investments.

• Adequacy of systems and controls: This ensures to reduce deterrence of fraud, waste, and abuses. It is even necessary to indicate the performance measurement information. Moreover, it is essential to execute every transaction in accordance with budget and laws.

Following are the reasons for Federal Accounting Standards Advisory Board (FASAB) objectives differ from other Accounting Standard board:

• The Federal Accounting Standards Advisory Board (FASAB) indicates both internal and external groups like primary users of federal financial reporting. As a result, its objectives have a broader focus. For instance, the objective on adequacy of systems and controls is the broader focus concept.

• This objective provides more relevance for its standard-setters. It is because the standard-setters have to consider the needs of internal users at the time of promulgating standards.

• Governmental Accounting Standard Board (GASB) recognizes only external groups as the primary users. Here, the internal users are excluded from the consideration in determining the objectives of financial reporting.

4

Explain the differences among these accounts: (1) Estimated Revenues used by state and local governments, (2) Other Appropriations Realized used by federal agencies in their budgetary track, and (3) Fund Balance with Treasury used by federal agencies in their proprietary track.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

5

"Net position for a federal agency is similar to net assets of a state or local government." Do you agree or disagree? Explain.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

6

Defining the reporting entity at the federal level is complicated by different perspectives from which the federal government can be viewed. What are the three perspectives? How are they defined? How do they interrelate?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

7

The federal government uses two groups of funds. Identify the two fund groups, and the funds associated with each group. Compare the funds to those used by state and local governments.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

8

What are stewardship assets? How does the accounting for a stewardship asset differ from that for general property, plant, and equipment?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

9

What are the two tracks in the dual-track accounting system? Explain the purpose of each track. Relate each track to state and local governmental "dualtrack" accounting.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

10

What are the components of the PAR and where would a federal agency go to find out the requirements for preparing a PAR?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

11

Agency PAR and Audit. In 2013, 22 of 24 CFO Act agencies received unqualified (unmodified) audit opinions. The Comptroller General disclaimed an opinion on one agency, and one agency received a qualified opinion. The one agency receiving a qualified opinion was HUD (Housing and Urban Development). Go to the HUD Web site (www.hud.gov) and find its PAR, which can be used to answer the following.

Required

a. Briefly identify the HUD financial situation by answering the following questions.

(1) What portion of HUD's assets is composed of cash (i.e., fund balance with treasury)?

(2) What was the increase or decrease in HUD's net position for the period examined?

b. Who conducted the HUD audit? What audit standards did the auditor apply? In your opinion, what, if any, independence issues would need to be addressed?

c. Why did HUD receive a qualified opinion in FY 2013? Since FY 2013, has HUD received an unqualified (unmodified) opinion or are there ongoing problems?

Required

a. Briefly identify the HUD financial situation by answering the following questions.

(1) What portion of HUD's assets is composed of cash (i.e., fund balance with treasury)?

(2) What was the increase or decrease in HUD's net position for the period examined?

b. Who conducted the HUD audit? What audit standards did the auditor apply? In your opinion, what, if any, independence issues would need to be addressed?

c. Why did HUD receive a qualified opinion in FY 2013? Since FY 2013, has HUD received an unqualified (unmodified) opinion or are there ongoing problems?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

12

Research Case-FASAB. The source of authoritative guidance for federal financial accounting and reporting is the Federal Accounting Standards Advisory Board. To better understand the FASAB, access its Web site at www. fasab.gov to answer the following.

Required

a. What is the mission of the FASAB?

b. What is the composition of the FASAB, and how are the board members selected/appointed?

c. How is the FASAB funded?

d. Discuss whether you believe the FASAB is an independent standard-setting body. Do you believe it is more or less independent than FASB or GASB? Explain your answer.

e. Identify and briefly describe at least three active projects on which the FASAB is currently working. f. The FASB and GASB standards are proprietary in that a user must pay to access the standards. Are the FASAB standards proprietary?

Required

a. What is the mission of the FASAB?

b. What is the composition of the FASAB, and how are the board members selected/appointed?

c. How is the FASAB funded?

d. Discuss whether you believe the FASAB is an independent standard-setting body. Do you believe it is more or less independent than FASB or GASB? Explain your answer.

e. Identify and briefly describe at least three active projects on which the FASAB is currently working. f. The FASB and GASB standards are proprietary in that a user must pay to access the standards. Are the FASAB standards proprietary?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

13

Audit of U.S. Government-wide Annual Report. Obtain the most recent audited annual financial report of the U.S. government. It is available from the Government Accountability Office (GAO).

Required

a. Did the GAO give the federal government an unqualified (unmodified), qualified, adverse, or disclaimer of opinion?

b. What were the material weaknesses cited by the Comptroller General?

c. What CFO Act federal agencies received an unqualified (unmodified) opinion for this fiscal year? ( Hint: Read the Management's Discussion and Analysis.)

d. Did the statements of social insurance receive a clean opinion? If not, why not?

Required

a. Did the GAO give the federal government an unqualified (unmodified), qualified, adverse, or disclaimer of opinion?

b. What were the material weaknesses cited by the Comptroller General?

c. What CFO Act federal agencies received an unqualified (unmodified) opinion for this fiscal year? ( Hint: Read the Management's Discussion and Analysis.)

d. Did the statements of social insurance receive a clean opinion? If not, why not?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

14

Analysis of the U.S. Government Budget Deficit and Net Cost of Operations. Access the most recent Financial Report of the U.S. Government at the U.S. Treasury Department Web site, www.fms.treas.gov/fr , and answer the following questions.

Required

a. What are amounts of the total budget deficit and net operating cost for each of the three most recent fiscal years?

b. How do these two measures of federal government fiscal health differ? (Hint: Refer to the Citizen's Guide that accompanies the report.)

c. What are the main factors that explain the three-year trend in each of these measures?

d. For the most recent fiscal year, identify the five largest components of the net cost of operations of the U.S. government?

Required

a. What are amounts of the total budget deficit and net operating cost for each of the three most recent fiscal years?

b. How do these two measures of federal government fiscal health differ? (Hint: Refer to the Citizen's Guide that accompanies the report.)

c. What are the main factors that explain the three-year trend in each of these measures?

d. For the most recent fiscal year, identify the five largest components of the net cost of operations of the U.S. government?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

15

Multiple Choice. Choose the best answer.

1. Which of the following represents one of the roles of the Government Accountability Office in federal financial accounting and reporting?

a. Providing an independent assessment of the financial reports of the federal government.

b. Providing the chart of accounts for the standard general ledger used by federal agencies.

c. Providing forward-looking financial information, such as estimated future revenues.

d. Providing information to federal agencies on financial reporting requirements.

2. Which of the following is an important aid in assisting federal agencies in preparing their performance and accountability reports?

a. Statement of Federal Financial Accounting Concepts No. 1.

b. Statement of Federal Financial Accounting Concepts No. 6.

c. OMB Circular A-134.

d. OMB Circular A-136.

3. Which of the following is the highest level of GAAP for the federal government?

a. The FASAB's technical bulletins.

b. The FASAB's concepts statements.

c. The FASAB's interpretations.

d. The FASB standards if adopted by FASAB.

4. Objectives that are identified by Statement of Federal Financial Accounting Concepts (SFFAC) No. 1 for federal financial reporting include all of the following except:

a. Budgetary integrity.

b. Adequacy of controls.

c. Stewardship. d. Relevance and reliability of information.

5. Which of the following is a required basic financial statement for federal agencies?

a. Balance sheet.

b. Statement of cash flows.

c. Statement of operations.

d. Statement of budgetary revenues and expenditures.

6. Assuming that an agency's unused appropriations expire at year-end but appropriations continue in effect for obligated amounts (purchase orders, etc.), which of the following budgetary accounts would likely be found in the agency's post-closing trial balance at year-end?

a. Commitments and Other Appropriations Realized.

b. Undelivered Orders and Other Appropriations Realized.

c. Expended Authority and Undelivered Orders.

d. Commitments and Undelivered Orders.

7. Which of the following is a correct mathematical relationship among proprietary account balances?

a. Net Position equals Total Assets minus Total Liabilities.

b. Fund Balance with Treasury equals Unexpended Appropriations.

c. Cumulative Results of Operations equals Revenues and Financing Sources minus Operating/Program Expenses.

d. Disbursements in Transit equals Fund Balance with Treasury minus Accounts Payable and Other Current Liabilities.

8. Which of the following is not a component of a consolidated performance and accountability report (PAR)?

a. MD A.

b. The basic financial statements.

c. Statistical information section.

d. A transmittal letter from the agency head.

9. Fund Balance with the Treasury would be considered equivalent to which of the following accounts?

a. Cash.

b. Other Appropriations Realized.

c. Allotments.

d. Both a and b.

10. Which of the following is not a true statement about the difference between accounting and reporting for federal government agencies versus state and local governments?

a. State and local governments record material amounts of inventory at the fund and government-wide level, as does the federal government at the budgetary and proprietary levels.

b. State and local governments use accrual accounting in the government-wide statements as well as proprietary and fiduciary funds; federal agencies use only the cash basis of accounting.

c. The budget is recorded in the general ledger of a state or local government and a federal agency. d. State and local governments do not account for apportionments and most do not account for allotments.

1. Which of the following represents one of the roles of the Government Accountability Office in federal financial accounting and reporting?

a. Providing an independent assessment of the financial reports of the federal government.

b. Providing the chart of accounts for the standard general ledger used by federal agencies.

c. Providing forward-looking financial information, such as estimated future revenues.

d. Providing information to federal agencies on financial reporting requirements.

2. Which of the following is an important aid in assisting federal agencies in preparing their performance and accountability reports?

a. Statement of Federal Financial Accounting Concepts No. 1.

b. Statement of Federal Financial Accounting Concepts No. 6.

c. OMB Circular A-134.

d. OMB Circular A-136.

3. Which of the following is the highest level of GAAP for the federal government?

a. The FASAB's technical bulletins.

b. The FASAB's concepts statements.

c. The FASAB's interpretations.

d. The FASB standards if adopted by FASAB.

4. Objectives that are identified by Statement of Federal Financial Accounting Concepts (SFFAC) No. 1 for federal financial reporting include all of the following except:

a. Budgetary integrity.

b. Adequacy of controls.

c. Stewardship. d. Relevance and reliability of information.

5. Which of the following is a required basic financial statement for federal agencies?

a. Balance sheet.

b. Statement of cash flows.

c. Statement of operations.

d. Statement of budgetary revenues and expenditures.

6. Assuming that an agency's unused appropriations expire at year-end but appropriations continue in effect for obligated amounts (purchase orders, etc.), which of the following budgetary accounts would likely be found in the agency's post-closing trial balance at year-end?

a. Commitments and Other Appropriations Realized.

b. Undelivered Orders and Other Appropriations Realized.

c. Expended Authority and Undelivered Orders.

d. Commitments and Undelivered Orders.

7. Which of the following is a correct mathematical relationship among proprietary account balances?

a. Net Position equals Total Assets minus Total Liabilities.

b. Fund Balance with Treasury equals Unexpended Appropriations.

c. Cumulative Results of Operations equals Revenues and Financing Sources minus Operating/Program Expenses.

d. Disbursements in Transit equals Fund Balance with Treasury minus Accounts Payable and Other Current Liabilities.

8. Which of the following is not a component of a consolidated performance and accountability report (PAR)?

a. MD A.

b. The basic financial statements.

c. Statistical information section.

d. A transmittal letter from the agency head.

9. Fund Balance with the Treasury would be considered equivalent to which of the following accounts?

a. Cash.

b. Other Appropriations Realized.

c. Allotments.

d. Both a and b.

10. Which of the following is not a true statement about the difference between accounting and reporting for federal government agencies versus state and local governments?

a. State and local governments record material amounts of inventory at the fund and government-wide level, as does the federal government at the budgetary and proprietary levels.

b. State and local governments use accrual accounting in the government-wide statements as well as proprietary and fiduciary funds; federal agencies use only the cash basis of accounting.

c. The budget is recorded in the general ledger of a state or local government and a federal agency. d. State and local governments do not account for apportionments and most do not account for allotments.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

16

Identifying Account Types and Normal Balances. Following is a list of a number of accounts used by federal agencies.

Required

For each of the accounts listed indicate in Column A whether the account is a proprietary account (P) or a budgetary account (B). In Column B indicate whether the account has a normal debit (Dr) or credit (Cr) balance.

Required

For each of the accounts listed indicate in Column A whether the account is a proprietary account (P) or a budgetary account (B). In Column B indicate whether the account has a normal debit (Dr) or credit (Cr) balance.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

17

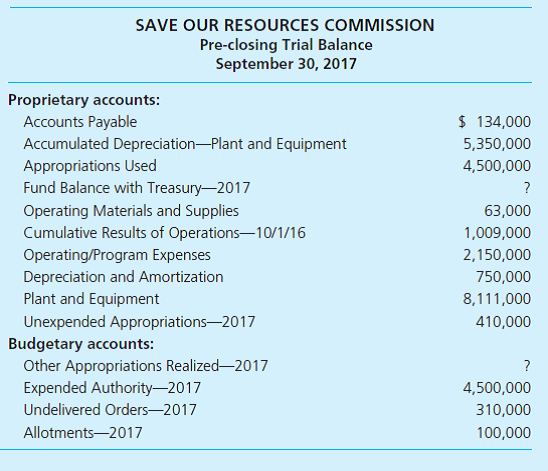

Fund Balance with U.S. Treasury. One amount is missing in the following trial balance of proprietary accounts, and another is missing from the trial balance of budgetary accounts of the Save Our Resources Commission of the federal government. This trial balance was prepared before budgetary accounts were adjusted, such as returning unused appropriations. The debits are not distinguished from the credits.

Required

a. Compute each missing amount in the pre-closing trial balance.

b. Compute the net additions (or reductions) to assets other than Fund Balance with Treasury during fiscal year 2017. Clearly label your computations and show all work in good form.

c. In general journal form, prepare entries to close the budgetary accounts as needed and to close the operating statement proprietary accounts.

Required

a. Compute each missing amount in the pre-closing trial balance.

b. Compute the net additions (or reductions) to assets other than Fund Balance with Treasury during fiscal year 2017. Clearly label your computations and show all work in good form.

c. In general journal form, prepare entries to close the budgetary accounts as needed and to close the operating statement proprietary accounts.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

18

Federal Commission Financial Statements. Use the data from Problem 17-17 for this assignment. In completing the assignment assume that all assets are entity assets, Fund Balance with Treasury is an intragovernmental asset, and all other assets are governmental. Also, assume that Other Appropriations Realized-2016 were zero.

Required

In good form, prepare the following statements for the Save Our Resources Commission for 2017:

a. A statement of budgetary resources using Illustration 17-17 as an example.

b. A statement of changes in net position using Illustration 17-16 as an example.

c. A balance sheet using Illustration 17-15 as an example.

Required

In good form, prepare the following statements for the Save Our Resources Commission for 2017:

a. A statement of budgetary resources using Illustration 17-17 as an example.

b. A statement of changes in net position using Illustration 17-16 as an example.

c. A balance sheet using Illustration 17-15 as an example.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

19

Statement of Net Cost. The Rural Assistance Agency operates three major programs as responsibility centers-the Food Bank, Housing Services, and Credit Counseling. Clients pay a fee for services on a sliding scale based on income. The following information is drawn from the accounting records of the agency for the year ended September 30, 2017. Earned revenue from the three programs was as follows: Food Bank, $2,611,900; Housing Services, $1,237,400; and Credit Counseling, $87,000. Costs for the same period were: Food Bank, $9,632,800; Housing Services, $7,438,500; and Credit Counseling, $2,391,000.

Required

Prepare a statement of net cost for the Rural Assistance Agency for the year ended September 30, 2017.

Required

Prepare a statement of net cost for the Rural Assistance Agency for the year ended September 30, 2017.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

20

Statement of Budgetary Resources. The trial balance of the Federal Antiquities Administration, as of August 31, 2017, follows:

Required

Prepare a statement of budgetary resources for the 11 months ended August 31, 2017, assuming that goods on order at the end of the prior year amounted to $1,210,210.

Required

Prepare a statement of budgetary resources for the 11 months ended August 31, 2017, assuming that goods on order at the end of the prior year amounted to $1,210,210.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

21

Transaction Analysis and Statements. Congress authorized the Flood Control Commission to start operations on October 1, 2017.

Required

a. Record the following transactions in general journal form as they should appear in the accounts of the Flood Control Commission. Record all expenses in the Operating/Program Expenses account.

(1) The Flood Control Commission received official notice that the oneyear appropriation passed by Congress and signed by the President amounted to $7,000,000 for operating expenses.

(2) The Office of Management and Budget notified the Commission of the following schedule of apportionments: first quarter, $2,000,000; second quarter, $2,000,000; third quarter, $1,500,000; and fourth quarter, $1,500,000.

(3) The Flood Control Commissioner allotted $1,000,000 for the first month's operations.

(4) Obligations were recorded for salaries and fringe benefits, $400,000; furniture and equipment, $270,000; materials and supplies, $250,000; and rent and utilities, $50,000. The Commission does not record commitments prior to recording obligations.

(5) Payroll for the first two weeks in the amount of $170,000 was paid.

(6) Invoices approved for payment totaled $395,000; of the total, $180,000 was for furniture and equipment, $175,000 for materials and supplies, and $40,000 for rent.

(7) A liability was recorded for the payroll for the second two weeks, $160,000, and for the employer's share of FICA taxes for the four weeks, $23,000. ( Note: Credit to Accrued Funded Payroll and Benefits.)

(8) Accounts payable totaling $189,000 were paid, and this included liabilities for materials and supplies, $149,000, and rent, $40,000. Accrued Funded Payroll and Benefits in the amount of $183,000 were paid.

(9) Accruals recorded at month-end were salaries, $30,000, and utilities, $10,000. Materials and supplies costing $60,000 were used during the month. Depreciation of $2,500 was recorded on furniture and equipment for the month. ( Note: In practice, this would likely be done in worksheet form for monthly reporting purposes.)

(10) Necessary closing entries were prepared as of October 31, 2017. ( Note: Again, for monthly statements, this would be a worksheet entry only.)

b. Prepare the Balance Sheet of the Flood Control Commission as of October 31, 2017, assuming that all of the Commission's assets are entity assets, Fund Balance with Treasury is intragovernmental, and all other assets are governmental.

c. Prepare the Statement of Changes in Net Position of the Flood Control Commission for the month ended October 31, 2017.

d. Prepare the Statement of Budgetary Resources of the Flood Control Commission for the month ended October 31, 2017.

Required

a. Record the following transactions in general journal form as they should appear in the accounts of the Flood Control Commission. Record all expenses in the Operating/Program Expenses account.

(1) The Flood Control Commission received official notice that the oneyear appropriation passed by Congress and signed by the President amounted to $7,000,000 for operating expenses.

(2) The Office of Management and Budget notified the Commission of the following schedule of apportionments: first quarter, $2,000,000; second quarter, $2,000,000; third quarter, $1,500,000; and fourth quarter, $1,500,000.

(3) The Flood Control Commissioner allotted $1,000,000 for the first month's operations.

(4) Obligations were recorded for salaries and fringe benefits, $400,000; furniture and equipment, $270,000; materials and supplies, $250,000; and rent and utilities, $50,000. The Commission does not record commitments prior to recording obligations.

(5) Payroll for the first two weeks in the amount of $170,000 was paid.

(6) Invoices approved for payment totaled $395,000; of the total, $180,000 was for furniture and equipment, $175,000 for materials and supplies, and $40,000 for rent.

(7) A liability was recorded for the payroll for the second two weeks, $160,000, and for the employer's share of FICA taxes for the four weeks, $23,000. ( Note: Credit to Accrued Funded Payroll and Benefits.)

(8) Accounts payable totaling $189,000 were paid, and this included liabilities for materials and supplies, $149,000, and rent, $40,000. Accrued Funded Payroll and Benefits in the amount of $183,000 were paid.

(9) Accruals recorded at month-end were salaries, $30,000, and utilities, $10,000. Materials and supplies costing $60,000 were used during the month. Depreciation of $2,500 was recorded on furniture and equipment for the month. ( Note: In practice, this would likely be done in worksheet form for monthly reporting purposes.)

(10) Necessary closing entries were prepared as of October 31, 2017. ( Note: Again, for monthly statements, this would be a worksheet entry only.)

b. Prepare the Balance Sheet of the Flood Control Commission as of October 31, 2017, assuming that all of the Commission's assets are entity assets, Fund Balance with Treasury is intragovernmental, and all other assets are governmental.

c. Prepare the Statement of Changes in Net Position of the Flood Control Commission for the month ended October 31, 2017.

d. Prepare the Statement of Budgetary Resources of the Flood Control Commission for the month ended October 31, 2017.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

22

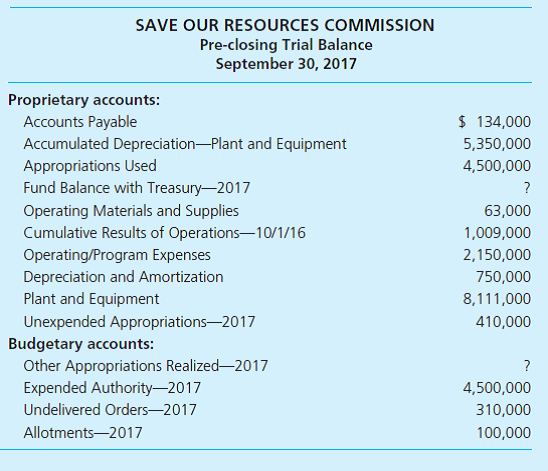

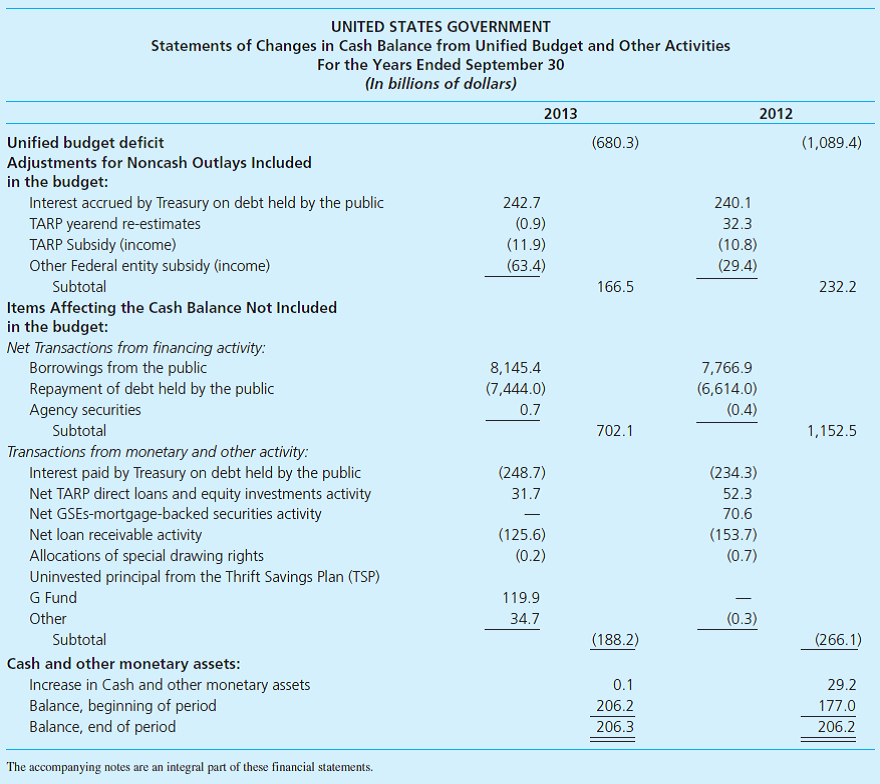

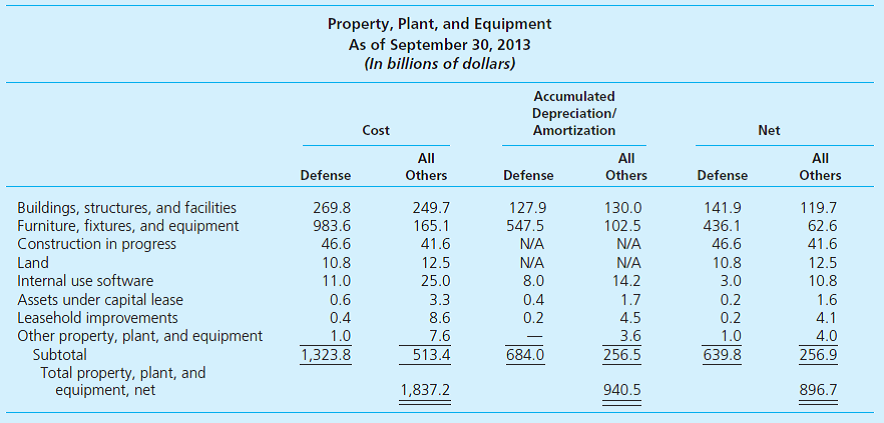

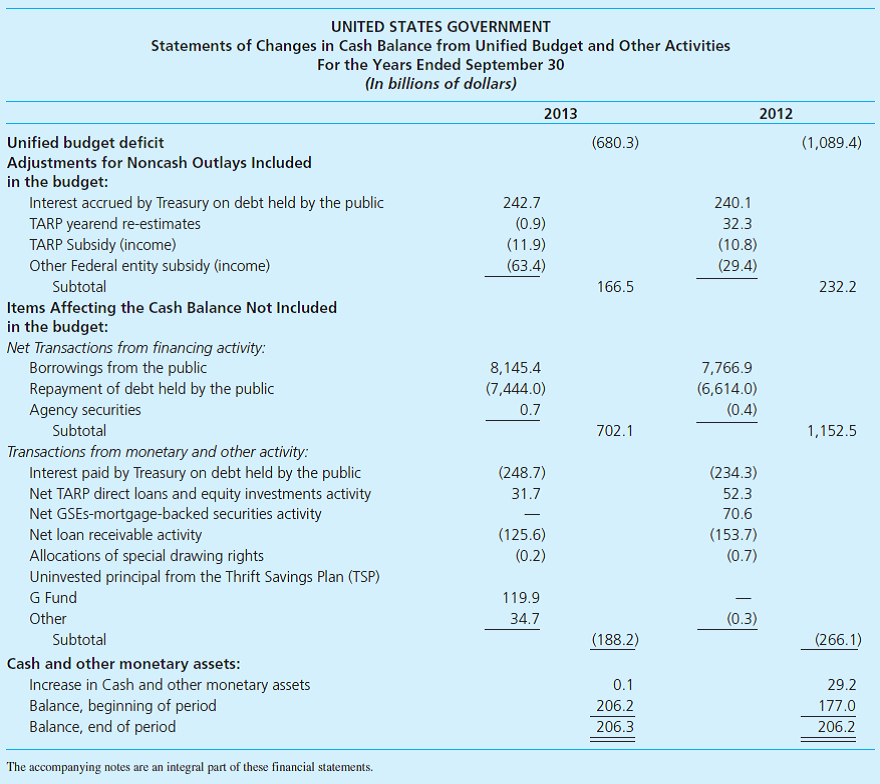

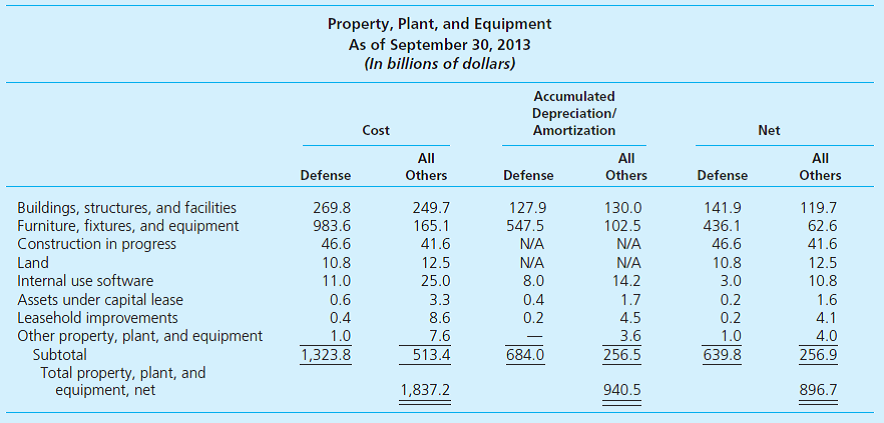

Financial Statement Analysis of the Federal Government. The complexity and uniqueness of the federal government makes it difficult to conduct a meaningful analysis of its financial condition. However, conducting a financial statement analysis does provide a better understanding of the federal government. To assist in the financial statement analysis, use Illustrations 17-2 and 17-3 along with the following excerpts from the 2013 Financial Report of the United States Government. ( Hint: When using revenues or net costs, use the consolidated amounts, which are adjusted for intraentity activity.)

Required

a. To provide an indication of the government's financial capability answer the following:

(1) What percentage of total revenues comes from individual income taxes and withholdings?

(2) What is the debt service as calculated by the ratio of principal and interest payments on debt held by the public to total revenue?

b. To provide an indication of the government's financial performance, answer the following:

(1) What is interperiod equity, as calculated by the ratio of revenue to net costs?

c. To provide an indication of the government's financial position answer the following:

(1) What is the ratio of non-dedicated collections funds to total revenue?

(2) What is the quick ratio (use known current liabilities in the calculation)?

(3) What is the capital asset condition as calculated by the ratio of accumulated depreciation to the cost of depreciable capital assets?

d. Based on the ratios you have calculated, how would you assess the financial condition of the federal government for FY 2013? ( Hint: Chapter 10 may help provide a context/benchmark for the value of some of the ratios you have calculated.)

Required

a. To provide an indication of the government's financial capability answer the following:

(1) What percentage of total revenues comes from individual income taxes and withholdings?

(2) What is the debt service as calculated by the ratio of principal and interest payments on debt held by the public to total revenue?

b. To provide an indication of the government's financial performance, answer the following:

(1) What is interperiod equity, as calculated by the ratio of revenue to net costs?

c. To provide an indication of the government's financial position answer the following:

(1) What is the ratio of non-dedicated collections funds to total revenue?

(2) What is the quick ratio (use known current liabilities in the calculation)?

(3) What is the capital asset condition as calculated by the ratio of accumulated depreciation to the cost of depreciable capital assets?

d. Based on the ratios you have calculated, how would you assess the financial condition of the federal government for FY 2013? ( Hint: Chapter 10 may help provide a context/benchmark for the value of some of the ratios you have calculated.)

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck