Deck 9: 7 Redpack Beer Company

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/4

Play

Full screen (f)

Deck 9: 7 Redpack Beer Company

1

In selecting which customer balances to detail test via accounts receivable confirmations, assume that you have decided to direct test only the minimum number of customer accounts required; that is, you will direct test only customer accounts that are greater than tolerable misstatement, and you will use audit sampling to test the remainder of the population. You can find the accounts receivable detail listing at www.pearsonhighered.com/beasley. As noted there, Hooplah has a total of 357 customers, with an accounts receivable balance totaling $12,881,551. Based on the engagement team's knowledge of Hooplah's accounts receivable processes and policies, experience in prior year's audits, and the results of tests of controls and substantive analytical procedures, the assessment of risk of material misstatement for accounts receivable has been set at "moderate." Prepare a schedule that includes the following

[a] List the customer number and related balance for all customers you plan to direct test.

[b] Indicate your computed sample size (using the sample size formula provided on prior page). Provide supporting calculations and justification for your sample size, including justification for the confidence factor and the level of expected misstatement you used to compute your sample size.

[a] List the customer number and related balance for all customers you plan to direct test.

[b] Indicate your computed sample size (using the sample size formula provided on prior page). Provide supporting calculations and justification for your sample size, including justification for the confidence factor and the level of expected misstatement you used to compute your sample size.

Professional Standards and List of Requirements for Client Accounting

The examiner's objective when assessing bookkeeping estimations is to get adequate appropriate evidence to deliver sensible declaration that:

a. All bookkeeping estimations that could be substantial to the monetary reports have been industrialized.b. Those bookkeeping estimations are rational in the situations.

c. The bookkeeping estimations are obtainable in conformism with appropriate bookkeeping ideologies and are correctly revealed.In assessing if organization has recognized all bookkeeping approximations that could be material to the monetary reports, the examiner reflects the situations of the businesses in which the entity functions, its approaches of showing commerce, new bookkeeping assertions, and other exterior factors. The examiner should contemplate executing the following actions:

a. Reflect declarations personified in the monetary reports to control the need for estimations.

b. Assess information attained in execution other processes, such as:

1. Material about variations made or intentional in the object's commerce, counting variations in working policy, and the business in which the entity functions that may designate the need to make a bookkeeping estimation (Auditing Standard No. 12).

2. Variations in the approaches of accumulating information.

3. Information regarding recognized lawsuit, rights, and valuations, information from reading available minutes of meetings of shareholders, directors, and appropriate committees.

4. Material controlled in supervisory or inspection reports, managerial communication, and similar resources from appropriate supervisory activities.

In many circumstances, the examiner measures the sensibleness of bookkeeping approximate by executing processes to test the procedure used by administration to make the estimation. The subsequent are processes the examiner may reflect accomplishing when using this method:

a. Classify if there are controls over the training of bookkeeping estimations and secondary facts that may be valuable in the estimation.

b. Classify the foundations of facts and issues that administration used in forming the prospects, and deliberate if such facts and factors are pertinent, dependable, and adequate for the drive created on material collected in other review exams.

c. Contemplate if there are added key issues or another expectation about the issues.

d. Assess if the expectations are reliable with each other, the secondary facts, relevant past facts, and industry facts.

e. Examine ancient facts used in emerging the expectations to measure if the facts is analogous and reliable with facts of the timeframe under review, and reflect if such facts are adequately dependable for the resolution.

The examiner's objective when assessing bookkeeping estimations is to get adequate appropriate evidence to deliver sensible declaration that:

a. All bookkeeping estimations that could be substantial to the monetary reports have been industrialized.b. Those bookkeeping estimations are rational in the situations.

c. The bookkeeping estimations are obtainable in conformism with appropriate bookkeeping ideologies and are correctly revealed.In assessing if organization has recognized all bookkeeping approximations that could be material to the monetary reports, the examiner reflects the situations of the businesses in which the entity functions, its approaches of showing commerce, new bookkeeping assertions, and other exterior factors. The examiner should contemplate executing the following actions:

a. Reflect declarations personified in the monetary reports to control the need for estimations.

b. Assess information attained in execution other processes, such as:

1. Material about variations made or intentional in the object's commerce, counting variations in working policy, and the business in which the entity functions that may designate the need to make a bookkeeping estimation (Auditing Standard No. 12).

2. Variations in the approaches of accumulating information.

3. Information regarding recognized lawsuit, rights, and valuations, information from reading available minutes of meetings of shareholders, directors, and appropriate committees.

4. Material controlled in supervisory or inspection reports, managerial communication, and similar resources from appropriate supervisory activities.

In many circumstances, the examiner measures the sensibleness of bookkeeping approximate by executing processes to test the procedure used by administration to make the estimation. The subsequent are processes the examiner may reflect accomplishing when using this method:

a. Classify if there are controls over the training of bookkeeping estimations and secondary facts that may be valuable in the estimation.

b. Classify the foundations of facts and issues that administration used in forming the prospects, and deliberate if such facts and factors are pertinent, dependable, and adequate for the drive created on material collected in other review exams.

c. Contemplate if there are added key issues or another expectation about the issues.

d. Assess if the expectations are reliable with each other, the secondary facts, relevant past facts, and industry facts.

e. Examine ancient facts used in emerging the expectations to measure if the facts is analogous and reliable with facts of the timeframe under review, and reflect if such facts are adequately dependable for the resolution.

2

Based on the same background information as was used for question 1, but assuming that in selecting which customer balances to detail test you want to expand directed testing by selecting additional items based on risk and size, reevaluate the mix of directed testing and audit sampling. If you believe it would be efficient and effective to increase your directed testing, prepare a schedule that includes the following:

[a] Identify what characteristic can be used to select riskier items.

[b] List the customer numbers and related balances you would select for directed testing based on risk and provide the characteristics you used.

[c] List the additional customer accounts you would select for directed testing based on size and "coverage."

[d] Determine whether it would be necessary to test the remaining population using audit sampling; if so, compute your sample size for testing the remaining population through audit sampling and justify the inputs you used in the sample size formula.

[a] Identify what characteristic can be used to select riskier items.

[b] List the customer numbers and related balances you would select for directed testing based on risk and provide the characteristics you used.

[c] List the additional customer accounts you would select for directed testing based on size and "coverage."

[d] Determine whether it would be necessary to test the remaining population using audit sampling; if so, compute your sample size for testing the remaining population through audit sampling and justify the inputs you used in the sample size formula.

On the basis of analysis of the information in schedule A-D, assuming that meeting is conducted with R's Credit Manager, the following outcomes are concluded:

a.DB Distributor: creating the reserve against amounts receivable from the same, seems correct step taken by credit manager.

EB Group: creating a reserve for amount receivable from this party is not required. Because, as credit memo has been prepared only for $1,449.4 and also as the stock of beer was spoiled due to sun exposure. So claim supposed to be made against insurance company and not the client.

G Holdings: As it is policy of the company to create a reserve for client having overdue balance since more than 90 days and amount more than $2500. Even, though Clint is sure for collecting the same from the client, but still company must create the reserve for the same. Hence, non-creation of reserve is not valid.b.Based on readings of the transcript discussion the following concerns with other aspects of reporting of revenue and accounts receivable:

• Instead of generating monthly reports of accounts receivable, it should be done on fortnightly basis so that entire process can be more smoothened.• Instead of creating a reserve for dues from 31-90 days of 10%, it should be created for 60-90 days of 10%. Because, after a credit period also, normally we can wait for receipt of payments up to 30 days, then reserve can be created.c.On the basis of information provided to us, the following estimation we can prepare:

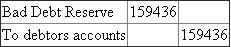

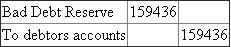

Compared to revenue of $3,299,698 accounts receivables are $197,982 and reserve for bad debt is created for $5,549 which is around 2.8% which seems very less. Normally 5 to 10% reserve should be created.d.Adjusting Entries:

e.Based on reading of professional standards, the frequency of the accounts receivables should be speeded from one month to fortnight to conclude on the adequacy of the allowance for bed debt.

e.Based on reading of professional standards, the frequency of the accounts receivables should be speeded from one month to fortnight to conclude on the adequacy of the allowance for bed debt.

a.DB Distributor: creating the reserve against amounts receivable from the same, seems correct step taken by credit manager.

EB Group: creating a reserve for amount receivable from this party is not required. Because, as credit memo has been prepared only for $1,449.4 and also as the stock of beer was spoiled due to sun exposure. So claim supposed to be made against insurance company and not the client.

G Holdings: As it is policy of the company to create a reserve for client having overdue balance since more than 90 days and amount more than $2500. Even, though Clint is sure for collecting the same from the client, but still company must create the reserve for the same. Hence, non-creation of reserve is not valid.b.Based on readings of the transcript discussion the following concerns with other aspects of reporting of revenue and accounts receivable:

• Instead of generating monthly reports of accounts receivable, it should be done on fortnightly basis so that entire process can be more smoothened.• Instead of creating a reserve for dues from 31-90 days of 10%, it should be created for 60-90 days of 10%. Because, after a credit period also, normally we can wait for receipt of payments up to 30 days, then reserve can be created.c.On the basis of information provided to us, the following estimation we can prepare:

Compared to revenue of $3,299,698 accounts receivables are $197,982 and reserve for bad debt is created for $5,549 which is around 2.8% which seems very less. Normally 5 to 10% reserve should be created.d.Adjusting Entries:

e.Based on reading of professional standards, the frequency of the accounts receivables should be speeded from one month to fortnight to conclude on the adequacy of the allowance for bed debt.

e.Based on reading of professional standards, the frequency of the accounts receivables should be speeded from one month to fortnight to conclude on the adequacy of the allowance for bed debt. 3

Which detail testing approach seems most appropriate in this situation: the minimum level of directed testing together with a larger audit sample, expanded directed testing with no audit sampling, or both expanded directed testing and audit sampling Be sure to consider the effectiveness and efficiency of the approach, as well as the level of assurance needed in view of the evidence already obtained from controls testing, substantive analytical procedures, etc.

Based, on the reading of interview transcript and review of professional judgment introduction, the following modifications can be adopted in the questions:

• At the initial stage, the number of doubtful debtors and creation should be asked.• In case of asking for information about any outstanding balances, the basis of the creation of reserves of same should also be asked.• Justification regarding, their estimations and grounds of calculations should also be asked.• Bifurcation of all reserves created should be asked so that further analysis can be made.• It should be asked that, whether they have received external party confirmations from their clients for outstanding since loan at the time of creating a 100% reserve for amount of more than $2500 or due since more than 90 days.

• At the initial stage, the number of doubtful debtors and creation should be asked.• In case of asking for information about any outstanding balances, the basis of the creation of reserves of same should also be asked.• Justification regarding, their estimations and grounds of calculations should also be asked.• Bifurcation of all reserves created should be asked so that further analysis can be made.• It should be asked that, whether they have received external party confirmations from their clients for outstanding since loan at the time of creating a 100% reserve for amount of more than $2500 or due since more than 90 days.

4

Independent of your responses to prior questions, assume that you direct tested customer balances greater than tolerable misstatement and randomly selected a sample of 40 additional customer balances for confirmation. The total book value of the 40 items sampled is $761,030. No differences were noted in the directed testing, and the sample yielded a combined overstatement in Hooplah's records of $4,215. Brian Thompson, the accounts receivable supervisor agrees that the differences noted are misstatements due to pricing errors. Please answer the following questions:

[a] How much is the known misstatement in the accounts receivable balance

[b] How much is the projected misstatement in the population (i.e., the total accounts receivable account) using ratio projection

[a] How much is the known misstatement in the accounts receivable balance

[b] How much is the projected misstatement in the population (i.e., the total accounts receivable account) using ratio projection

Unlock Deck

Unlock for access to all 4 flashcards in this deck.

Unlock Deck

k this deck