Deck 4: Nominal and Effective Interest Rates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 4: Nominal and Effective Interest Rates

1

Why is it necessary to consider do-nothing as a viable alternative when evaluating mutually exclusive alternatives or independent projects?

Do-nothing ( DN ) represents the status quo and is understood to always be an option.

If one of the projects absolutely must be selected, the DN alternative is present.It simply, will not be selected when the final selection is made.

If one of the projects absolutely must be selected, the DN alternative is present.It simply, will not be selected when the final selection is made.

2

A biomedical engineer with Johnston Implants just received estimates for replacement equipment to deliver online selected diagnostic results to doctors performing surgery who need immediate information on the patient's condition.The cost is $00,000, the annual maintenance contract costs $000, and the useful life (technologically) is 5 years.

a.What is the alternative if this equipment is not selected? What other information is necessary to perform an economic evaluation of the two?

b.What type of cash flow series will these estimates form?

c.What additional information is needed to convert the cash flow estimates to the other type?

a.What is the alternative if this equipment is not selected? What other information is necessary to perform an economic evaluation of the two?

b.What type of cash flow series will these estimates form?

c.What additional information is needed to convert the cash flow estimates to the other type?

There are several alternatives and choices that business face when they need to go for capital investment.The different alternative has different economic effects and one of the ways to find the best alternative is use of present worth analysis.

(a)Whenever there is an alternative to go for capital investment, then there is always another implied alternative of doing nothing i.e.going for status quo.This option is not there when the investment is mandated by law and it is compulsory for business to invest.Another important information necessary is the rate of return of the market, or the rate expected by the business.

(b)The data given here represents only the cost cash flow estimates as no information about revenues is given.

(c)To convert the cash flow estimates to other type the benefit or revenue information because of capital investment is also needed.

(a)Whenever there is an alternative to go for capital investment, then there is always another implied alternative of doing nothing i.e.going for status quo.This option is not there when the investment is mandated by law and it is compulsory for business to invest.Another important information necessary is the rate of return of the market, or the rate expected by the business.

(b)The data given here represents only the cost cash flow estimates as no information about revenues is given.

(c)To convert the cash flow estimates to other type the benefit or revenue information because of capital investment is also needed.

3

When performing an engineering economy evaluation, only one of several mutually exclusive alternatives is selected, whereas any number of independent projects can be selected.Explain the fundamental difference between mutually exclusive and independent projects that makes these selection rules correct.

Independent projects:

Independent projects are those projects that are not compete with each other.The acceptance or rejection of the projects is made based on the comparison with the MARR.Since projects are not competing with each other, there is a possibility of selecting more than one project.

Mutually exclusive project:

Mutually exclusive projects are those projects that are compete with each other.Since these projects are competing each other, only one project can be selected at a time.

Independent projects are those projects that are not compete with each other.The acceptance or rejection of the projects is made based on the comparison with the MARR.Since projects are not competing with each other, there is a possibility of selecting more than one project.

Mutually exclusive project:

Mutually exclusive projects are those projects that are compete with each other.Since these projects are competing each other, only one project can be selected at a time.

4

The lead engineer at Bell Aerospace has $ million in research funds to commit this year.She is considering five separate R D projects, identified as A through E.Upon examination, she determines that three of these projects (A, B, and C) accomplish exactly the same objective using different techniques.

a.Identify each project as mutually exclusive or independent.

b.If the selected alternative between A, B, and C is labeled X, list all viable options (bundles) for the five projects.

a.Identify each project as mutually exclusive or independent.

b.If the selected alternative between A, B, and C is labeled X, list all viable options (bundles) for the five projects.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

List all possible bundles for the four independent projects 1, 2, 3, and 4.Projects 3 and 4 cannot both be included in the same bundle.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

Johnston Implants is planning new online patient diagnostics for surgeons while they operate.The new system will cost $00,000 to install in an operating room, $000 annually for maintenance, and have an expected life of 5 years.The revenue per system is estimated to be $0,000 in year 1 and to increase by $0,000 per year through year 5.Determine if the project is economically justified using PW analysis and an MARR of 10% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

An engineer and her husband operate a pet sitting service on the side.They want to add a daily service of a photo placed online for pet owners who are traveling.The estimates are: equipment and setup cost $00, and net monthly income over costs $0.For a period of 2 years, will the service make at least 12% per year compounded monthly?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

The CFO of Marta Aaraña Cement Industries knows that many of the diesel-fueled systems in its quarries must be replaced at an estimated cost of $0 million 10 years from now.A fund for these replacements has been established with the commitment of $ million at the end of next year (year 1) with 10% increases through the 10th year.If the fund earns at 5.25% per year, will the company have enough to pay for the replacements?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

Burling Water Cooperative currently contracts the removal of small amounts of hydrogen sulfide from its well water using manganese dioxide filtration prior to the addition of chlorine and fluoride.Contract renewal for 5 years will cost $5,000 annually for the next 3 years and $00,000 in years 4 and 5.Assume payment is made at the end of each contract year.Burling Coop can install the filtration equipment for $50,000 and perform the process for $0,000 per year.At a discount rate of 6% per year, does the contract service still save money?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

Jamal bought a 5% $000 20-year bond for $25.He received a semiannual dividend for 8 years, then sold it immediately after the 16th dividend for $00.Did Jamal make the return of 5% per year compounded semiannually that he wanted?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

Atari needs $.5 million in new investment capital to develop and market downloadable games software for its new GPS2-ZX system.The plan is to sell $0,000 face-value corporate bonds at a discount of $000 now.A bond pays a dividend each 6 months based on a bond interest rate of 5% per year with the $0,000 face value returned after 20 years.Will a purchase make at least 6% per year compounded semiannually?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

Fairchild Industries issued 4% bonds some years ago.Carla's grandfather told her he purchased one at a 5% discount when they were issued, and it has paid him $000 each 3 months for the last 15 years.He told her that he just received the 60th dividend and he plans to sell the bond tomorrow for the face value and give her this money to help with college tuition and expenses.

a.Determine the amount Carla will receive.

b.Use the PW method to determine the number of years to maturity printed on the bond certificate at issue time.

c.Calculate the effective annual rate of return on this investment using a PW relation.

a.Determine the amount Carla will receive.

b.Use the PW method to determine the number of years to maturity printed on the bond certificate at issue time.

c.Calculate the effective annual rate of return on this investment using a PW relation.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

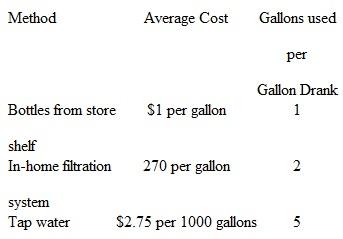

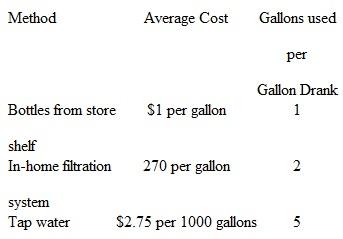

Nicole and Amy share an apartment and work at Pure H 2 O Engineering, and they have decided to drink more water each day.The recommended amount is eight 8-ounce glasses, or 64 ounces, per day.This is a total of one gallon per day for the two of them.Using this 1 gallon (or 3.78 liters equivalent) basis for three possible sources of drinking water, determine the monthly cost and present worth value for one year of use.For each source, the average cost and amount of source water estimated to be used to get a gallon of drinking water is tabulated.Let i = 6% per year compounded monthly and assume 30 days per month.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

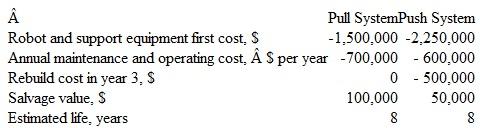

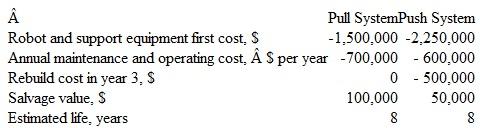

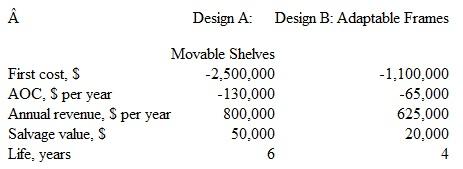

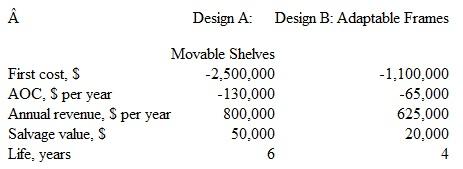

The Briggs and Stratton Commercial Division designs and manufactures small engines for golf turf maintenance equipment.A robotics-based testing system will ensure that their new signature guarantee program entitled "Always Insta-Start" does indeed work for every engine produced.Compare the two systems at MARR = 10% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

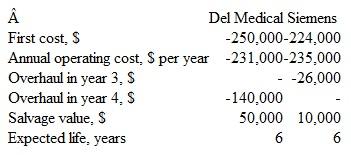

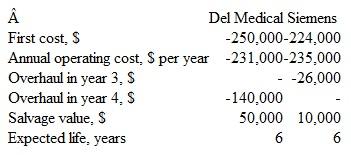

The Bureau of Indian Affairs provides various services to American Indians and Alaskan Natives.The Director of Indian Health Services is working with chief physicians at some of the 230 clinics nationwide to select the better of two medical X-ray system alternatives to be located at secondary-level clinics.At 5% per year, select the more economical system.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

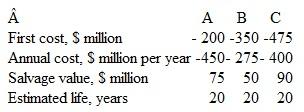

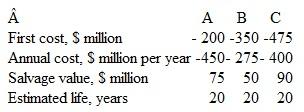

Chevron Corporation has a capital and exploratory budget for oil and gas production of $9.6 billion in one year.The Upstream Division has a project in Angola for which three offshore platform equipment alternatives are identified.Use the present worth method to select the best alternative at 12% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

The TechEdge Corporation offers two forms of 4-year service contracts on its closed-loop water purification system used in the manufacture of semiconductor packages for microwave and high-speed digital devices.The Professional Plan has an initial fee of $2,000 with annual fees starting at $000 in contract year 1 and increasing by $00 each year.Alternatively, the Executive Plan costs $2,000 up front with annual fees starting at $000 in contract year 1 and decreasing by $00 each year.The initial charge is considered a setup cost for which there is no salvage value expected.Evaluate the plans at a MARR of 9% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

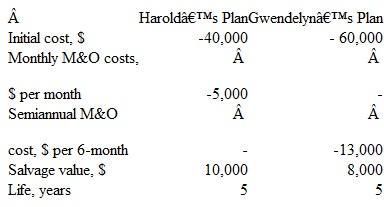

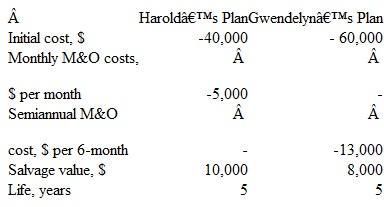

Harold and Gwendelyn are engineers at Raytheon.Each has presented a proposal to track fatigue development in composites materials installed on special-purpose aircraft.Which is the better plan economically if i = 12% per year compounded monthly?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

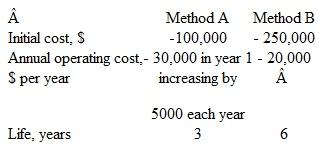

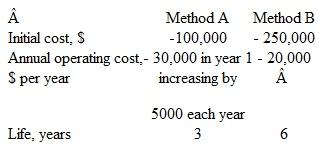

An environmental engineer must recommend one of two methods for monitoring high colony counts of E.coli and other bacteria in watershed area "hot spots." Estimates are tabulated, and the MARR is 10% per year.

a.Use present worth analysis to select the better method.

b.For a study period of 3 years, use PW analysis to select the better method.

a.Use present worth analysis to select the better method.

b.For a study period of 3 years, use PW analysis to select the better method.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

Use the LCM method and PW analysis to solve problem 4.19 a.The engineer has updated the estimates for repurchasing a.The purchase 3 years hence is estimated to cost $50,000, and annual costs will likely increase by $0,000, making them $0,000, $5,000, and $0,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

Allen Auto Group owns corner property that can be a parking lot for customers or sold for retail sales space.The parking lot option can use concrete or asphalt.Concrete will cost $75,000 initially, last for 20 years, and have an estimated annual maintenance cost of $00 starting at the end of the eighth year.Asphalt is cheaper to install at $50,000, but it will last 10 years and cost $500 per year to maintain starting at the end of the second year.If asphalt is replaced after 10 years, the $500 maintenance cost will be expended in its last year.There are no salvage values to be considered.Use i = 8% per year and PW analysis to select the more economic surface, provided the property is ( a ) used as a parking lot for 20 years, and ( b ) sold after 5 years and the parking lot is completely removed.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

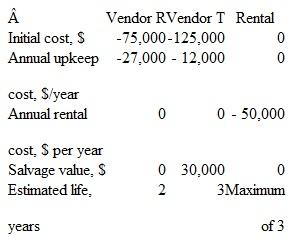

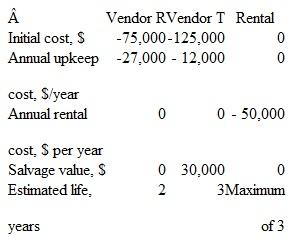

The manager of engineering at the 900- megawatt Hamilton Nuclear Power Plant has three options to supply personal safety equipment to employees.Two are vendors who sell the items, and a third will rent the equipment for $0,000 per year, but for no more than 3 years per contract.These items have relatively short lives due to constant use.The MARR is 10% per year.

a.Select from the two sales vendors using the LCM and PW analysis.

b.Determine which of the three options is cheaper over a study period of 3 years.

a.Select from the two sales vendors using the LCM and PW analysis.

b.Determine which of the three options is cheaper over a study period of 3 years.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

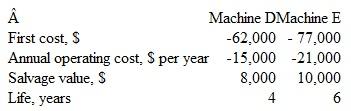

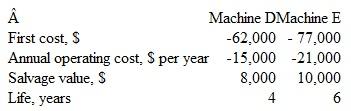

Akash Uni-Safe in Chennai, India, makes Termi- nater fire extinguishers.It needs replacement equipment to form the neck at the top of each extinguisher during production.Select between two metal-constricting systems.Use the corporate MARR of 15% per year with ( a ) present worth analysis, and ( b ) future worth analysis.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

The Engineering Director at Akash Uni-Safe (Problem 4.23) wants to perform the evaluation over a 5-year study period.When asked how he would resolve the dilemma that neither machine has a 5-year life, he provided the following estimates:

Machine D: Rework the machine at an additional cost of $0,000 in year 4, plan for the AOC of $5,000 in year 5, and expect zero salvage when it is discarded.

Machine E: Sell it prematurely for the $0,000 salvage value.

Evaluate the alternatives over 5 years.If you worked problem 4.23, is the selection the same?

Machine D: Rework the machine at an additional cost of $0,000 in year 4, plan for the AOC of $5,000 in year 5, and expect zero salvage when it is discarded.

Machine E: Sell it prematurely for the $0,000 salvage value.

Evaluate the alternatives over 5 years.If you worked problem 4.23, is the selection the same?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

If energy usage guidelines expect future increases in deep freeze efficiency, which one of two energy efficiency improvements is more economical based on future worth at an interest rate of 10% per year? A 20% increase is expected to add $50 to the current price of a freezer, while a 35% increase will add $40 to the price.The estimated cost for energy is $15 per year with the 20% increase in efficiency and $0 per year with the 35% increase.Assume a 15-year life for all freezer models.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

HJ Heinz Corporation is constructing a distribution facility in Italy for products such as Heinz Ketchup, Jack Daniel's Sauces, HP steak sauce, and Lea Perrins Worcestershire sauce.A 15- year life is expected for the structure.The exterior of the building is not yet selected.One alternative is to use the concrete walls as the facade.This will require painting now and every 5 years at a cost of $0,000 each time.Another alternative is an anodized metal exterior attached to the concrete wall.This will cost $00,000 now and require only minimal maintenance of $00 every 3 years.A metal exterior is more attractive and will have a market value of an estimated $5,000 more than concrete 15 years from now.Assume painting (concrete) or maintenance (metal) will be performed in the last year of ownership to promote selling the property.Use future worth analysis and i = 12% per year to select the exterior finish.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

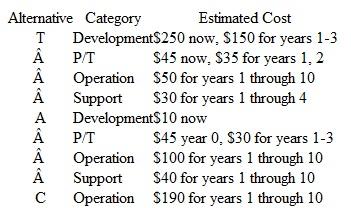

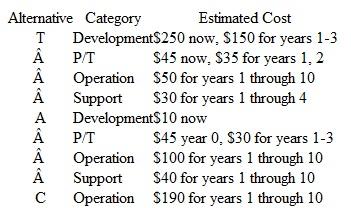

Emerald International Airlines plans to develop and install a new passenger ticketing system.A life-cycle cost approach has been used to categorize costs into four categories: development, programming and testing (P/T), operating, and support.There are three alternatives under consideration, identified as T (tailored system), A (adapted system), and C (current system).Use a life-cycle cost analysis to identify the best alternative at 8% per year.All estimates are in $millions.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

Gatorade Endurance Formula, introduced in 2004, contains more electrolytes (such as calcium and magnesium) than the original sports drink formula, thus causing Endurance to taste saltier to some.It is important that the amount of electrolytes be precisely balanced in the manufacturing process.The currently installed system (called EMOST) can be upgraded to monitor the amount more precisely.It costs $2,000 per year for equipment maintenance and $5,000 per year for labor now, and the upgrade will cost $5,000 now.This can serve for 10 more years, the expected remaining time the product will be financially successful.A new system (UPMOST) will also serve for the 10 years and have the following estimated costs.All costs are per year for the indicated time periods.

Equipment: $50,000; years 0 and 1

Development: $20,000; years 1 and 2

Maintain and phaseout EMOST: $0,000; years 1, 2, and 3

Maintain hardware and software: $0,000; years 3 through 10

Personnel costs: $0,000; years 3 through 10

Scrapped formula: $0,000; years 3 through 10

Sales of Gatorade Endurance are expected to be improved by $50,000 per year beginning in year 3 and increase by $0,000 per year through year 10.Use LCC analysis at an MARR of 20% per year to select the better electrolyte monitoring system.

Equipment: $50,000; years 0 and 1

Development: $20,000; years 1 and 2

Maintain and phaseout EMOST: $0,000; years 1, 2, and 3

Maintain hardware and software: $0,000; years 3 through 10

Personnel costs: $0,000; years 3 through 10

Scrapped formula: $0,000; years 3 through 10

Sales of Gatorade Endurance are expected to be improved by $50,000 per year beginning in year 3 and increase by $0,000 per year through year 10.Use LCC analysis at an MARR of 20% per year to select the better electrolyte monitoring system.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose that at 35 years old you are a well-paid project leader with Electrolux USa.You plan to work for this company for 20 more years and retire from it with a retirement income of $000 per month for the rest of your life.Assume an earning rate of 6% per year compounded monthly on your investments.( a ) How much must you place into your retirement plan monthly starting at the end of next month (month 1) and ending one month prior to the commencement of the retirement benefit? ( b ) Alternatively, assume you decided to deposit the required amount once at the end of each year.Determine the annual retirement savings needed to reach your goal.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

The president of GE Healthcare is considering an external long-term contract offer that will significantly improve the energy efficiency of their imaging systems.The payment schedule has two large payments in the first years with continuing payments thereafter.The proposed schedule is $00,000 now, $00,000 four years from now, $0,000 every 5 years, and an annual amount of $000 beginning 15 years from now.Determine the capitalized cost at 6% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

The Rustin Transportation Planning Board estimates the cost of upgrading a 4-mile section of 4-lane highway from public use to toll road to be $5 million now.Resurfacing and other maintenance will cost $50,000 every 3 years.Annual toll revenue is expected to average $8.5 million for the foreseeable future.If i = 8% per year, what is ( a ) the capitalized cost now, and ( b ) the equivalent value of this capitalized cost? Explain the meaning of the value just calculated.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

A specially built computer system has just been purchased by Progress Greenhouse Products to monitor moisture level and to control drip irrigation in hydroponics beds that grow cluster "tradiro" tomatoes.The system's first cost was $7,000 with an AOC of $0,000 and a salvage value on the international market of $0,000 after 4 years, when Progress expects to sell the system.Determine the capitalized cost at 12% per year and explain its meaning.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

A rich graduate of your university wants to set up a scholarship fund for economically disadvantaged high school seniors who have a mental aptitude to become good engineers.The scholarships will be awarded starting now and continue forever to several individuals for a total of $00,000 per year.If investments earn at 5% per year, how much must the alumnus contribute immediately?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

Tom, a new honors graduate, just received a Visa credit card with a high spending limit and an 18% per year compounded monthly interest rate.He plans to use the card starting next month to reward himself by purchasing things that he has wanted for some time at a rate of $000 per month and pay none of the balance or accrued interest.One month after he stops spending, Tom is willing to then start payments of interest only on the total credit card balance at the rate of $00 per month for the rest of his li fe.Use the capitalized cost method to determine how many months Tom can spend before he must start making the $00 per month payments.Assume the payments can be made for many years, i.e., forever.(Hint: Draw the cash flow diagram first.)

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

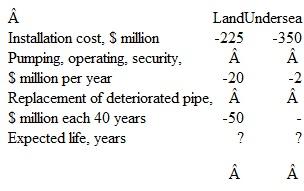

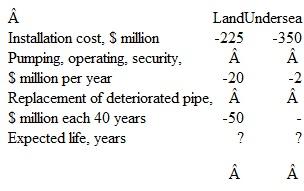

A pipeline engineer working in Kuwait for BP (formerly British Petroleum) wants to perform a capitalized cost analysis on alternative pipeline routings-one predominately by land and the second primarily undersea.The undersea route is more expensive initially due to extra corrosion protection and installation costs, but cheaper security and maintenance reduce annual costs.Select the better routing at 10% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

A Dade County project engineer has received draft cost and revenue estimates for a new exhibit and convention center.She has asked you to perform a capitalized cost analysis at 6% per year.Which plan is more economical?

Plan 1: Initial costs of $0 million with an expansion costing $ million 10 years from now.AOC is $50,000 per year.Net revenue expectation: $90,000 the first year increasing by $0,000 per year for 4 additional years and then leveling off until year 10; $50,000 in year 11 and thereafter.

Plan 2: Initial cost of $2 million with an AOC of $00,000 per year.Net revenue expectation: $60,000 the first year increasing by $0,000 per year for 6 additional years and then leveling off at $40,000 in year 8 and thereafter.

Plan 1: Initial costs of $0 million with an expansion costing $ million 10 years from now.AOC is $50,000 per year.Net revenue expectation: $90,000 the first year increasing by $0,000 per year for 4 additional years and then leveling off until year 10; $50,000 in year 11 and thereafter.

Plan 2: Initial cost of $2 million with an AOC of $00,000 per year.Net revenue expectation: $60,000 the first year increasing by $0,000 per year for 6 additional years and then leveling off at $40,000 in year 8 and thereafter.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

UPS Freight plans to spend $00 million on new long-haul tractor-trailers.Some of these vehicles will include a new shelving design with adjustable shelves to transport irregularly sized freight that requires special handling during loading and unloading.Though the life is relatively short, the director wants a capitalized cost analysis performed on the two final designs.Compare the alternatives at the MARR of 10% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

A water supply cooperative plans to increase its water supply by 8.5 million gallons per day to meet increasing demand.One alternative is to spend $0 million to increase the size of an existing reservoir in an environmentally acceptable way.Added annual upkeep will be $5,000 for this option.A second option is to drill new wells and provide added pipelines for transportation to treatment facilities at an initial cost of $.5 million and annual cost of $20,000.The reservoir is expected to last indefinitely, but the productive well life is 10 years.Compare the alternatives at 5% per year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

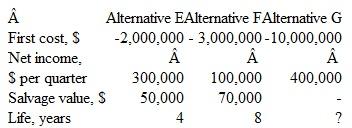

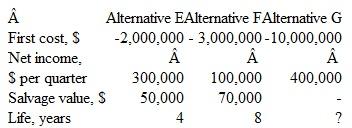

Three alternatives to incorporate improved techniques to manufacture computer drives to play HD DVD optical disc formats have been developed and costed.Compare the alternatives below using capitalized cost and an interest rate of 12% per year compounded quarterly.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

State the primary difference between mutually exclusive alternatives and independent projects for the equal-service requirement when economic evaluation is performed.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

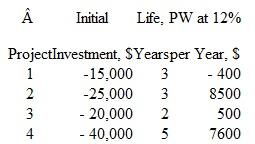

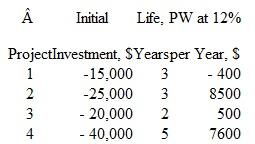

Carlotta, the general manager for Woodsome appliance company Plant #A14 in Mexico City has 4 independent projects she can fund this year to improve surface durability on stainless steel products.The project costs and 12%-per-year PW values are available.What projects are acceptable if the budget limit is ( a ) no limit, and ( b ) $0,000?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

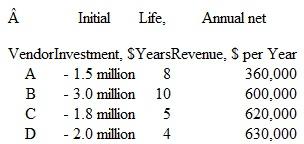

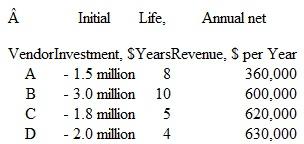

Dwayne has four independent vendor proposals to contract the nationwide oil recycling services for the Ford Corporation manufacturing plants.All combinations are acceptable, except that vendors B and C cannot both be chosen.Revenue sharing of recycled oil sales with Ford is a part of the requirement.Develop all possible mutually exclusive bundles under the additional following restrictions and select the best projects.The corporate MARR is 10% per year.

a.A maximum of $ million can be spent.

b.A larger budget of $.5 million is allowed, but no more than two vendors can be selected.

c.There is no limit on spending.

a.A maximum of $ million can be spent.

b.A larger budget of $.5 million is allowed, but no more than two vendors can be selected.

c.There is no limit on spending.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

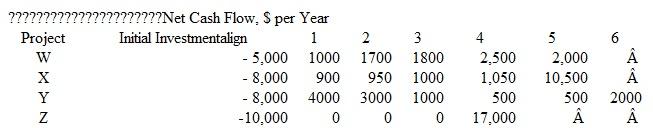

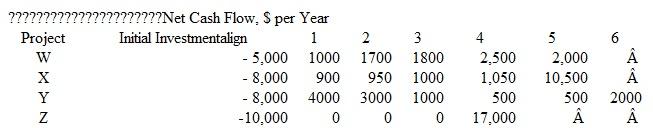

43

Use the PW method at 8% per year to select up to 3 projects from the 4 available ones if no more than $0,000 can be invested.Estimated lives and annual net cash flows vary.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

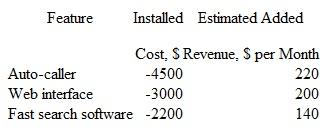

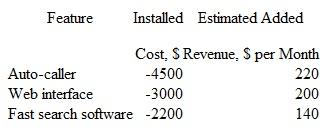

44

Chloe has $,000 to spend on as many as 3 electronic features to enhance revenue from the telemarketing business she operates on weekends.Use the PW method to determine which of these independent investments are financially acceptable at 6% per year compounded monthly.All are expected to last 3 years.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

45

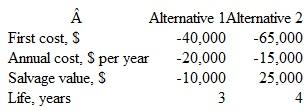

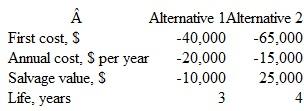

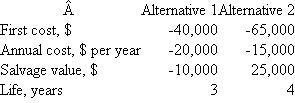

![<strong> The relation that correctly calculates the present worth of alternative 2 over its life is</strong> A)-65,000 -15,000( P / A , 6%, 8) + 25,000( P / F , 6%, 8) B)-65,000 -15,000( P / A , 12%, 4) +25,000( P / F , 12%, 4) C)-65,000 - 15,000( P / A , 12%, 12) +25,000( P / F , 12%, 12) D)-65,000[1 + ( P / F , 12%, 4) + ( P / F ,12%, 8)] -15,000( P / A ,12%, 12) +10,000( P / F , 12%, 4)](https://d2lvgg3v3hfg70.cloudfront.net/SM2038/11eb5d5b_d91e_70ee_b364_6f5ce7d61269_SM2038_00.jpg) The relation that correctly calculates the present worth of alternative 2 over its life is

The relation that correctly calculates the present worth of alternative 2 over its life isA)-65,000 -15,000( P / A , 6%, 8) + 25,000( P / F , 6%, 8)

B)-65,000 -15,000( P / A , 12%, 4) +25,000( P / F , 12%, 4)

C)-65,000 - 15,000( P / A , 12%, 12) +25,000( P / F , 12%, 12)

D)-65,000[1 + ( P / F , 12%, 4) + ( P / F ,12%, 8)] -15,000( P / A ,12%, 12) +10,000( P / F , 12%, 4)

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

46

The number of life cycles for each alternative when performing a present worth evaluation based on equal service is

The number of life cycles for each alternative when performing a present worth evaluation based on equal service isA)2 for each alternative.

B)1 for each alternative.

C)4 for alternative 1; 3 for alternative 2.

D)3 for alternative 1; 4 for alternative 2.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

47

If the evaluation of the two alternatives is performed on a present worth basis, the PW value for alternative 2 is closest to

If the evaluation of the two alternatives is performed on a present worth basis, the PW value for alternative 2 is closest toA)$193,075.

B)$219,060.

C)$189,225.

D)$172,388.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

48

The FW value of alternative 2 when performing a future worth evaluation over a study period of 8 years is closest to

The FW value of alternative 2 when performing a future worth evaluation over a study period of 8 years is closest toA)$383,375.

B)$408,375.

C)$320,433.

D)$603,245.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

49

The correct relation to calculate the capitalized cost of a project with the following estimates at 8% per year is

P = $100,000 A = $24,000 per year n = 6 years

A)[-100,000 - 24,000( P / A , 8%, 6)] × (0.08)

B)-100,000 - [24,000( P / A , 8%, 6)] ÷ (0.08)

C)-100,000 - [24,000( P / A , 8%, 6)] × (0.08)

D)[- 100,000( A / P , 8%, 6) - 24,000] ÷ (0.08)

P = $100,000 A = $24,000 per year n = 6 years

A)[-100,000 - 24,000( P / A , 8%, 6)] × (0.08)

B)-100,000 - [24,000( P / A , 8%, 6)] ÷ (0.08)

C)-100,000 - [24,000( P / A , 8%, 6)] × (0.08)

D)[- 100,000( A / P , 8%, 6) - 24,000] ÷ (0.08)

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

50

Three mutually exclusive cost alternatives (only costs are estimated) are to be evaluated on a PW basis at 15% per year.All have a life of 5 years.An engineer working for you provides the PW values below with a recommendation to select K.The first thing you should do is

PW G = $34,500

PW H = $18,900

PW K = $4,500

A)recommend H as the cheapest alternative.

B)question the positive PW K value since these are cost alternatives.

C)accept the recommendation.

D)question the negative PW G and PW H values since these are cost alternatives.

PW G = $34,500

PW H = $18,900

PW K = $4,500

A)recommend H as the cheapest alternative.

B)question the positive PW K value since these are cost alternatives.

C)accept the recommendation.

D)question the negative PW G and PW H values since these are cost alternatives.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

51

The PW method requires evaluation of two mutually exclusive alternatives over the least common multiple (LCM) of their lives.This is required

A)because the study period is always the LCM of the lives.

B)to maximize the number of calculations to find PW.

C)to ensure that the equal service assumption is not violated.

D)to compare them over a period equal to the life of the longer-lived alternative.

A)because the study period is always the LCM of the lives.

B)to maximize the number of calculations to find PW.

C)to ensure that the equal service assumption is not violated.

D)to compare them over a period equal to the life of the longer-lived alternative.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

52

In a present worth or future worth evaluation over a specified study period that is shorter than the life of an alternative, the alternative's salvage value used in the PW relation is

A)an estimated market value at the end of the study period.

B)the same as the estimated salvage value at the end of the alternative's life.

C)not included in the evaluation.

D)equal to an amount that is a linear interpolation between the first cost and the estimated salvage value.

A)an estimated market value at the end of the study period.

B)the same as the estimated salvage value at the end of the alternative's life.

C)not included in the evaluation.

D)equal to an amount that is a linear interpolation between the first cost and the estimated salvage value.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

53

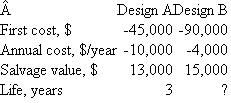

![<strong> The alternative designs are compared using capitalized costs at 10% per year compounded continuously.The relation that correctly determines the capitalized cost of Design A is:</strong> A)45,000 - 10,000( P / A , 10.52%, 6) - 37,000( P / F , 10.52%, 3) + 13,000( P / F , 10.52%, 6) B)-45,000 - 10,000( P / A , 10.52%, 3) + 13,000( P / F , 10.52%, 3) C)[-45,000( A / P , 10%, 3) - 10,000 + 13,000( A / F , 10%, 3)] ÷ 0.10 D)[-45,000( A / P , 10.52%, 3) - 10,000 + 13,000( A / F , 10.52%, 3)] ÷ 0.1052](https://d2lvgg3v3hfg70.cloudfront.net/SM2038/11eb5d5b_d91f_f7a7_b364_1f8744ea7d89_SM2038_00.jpg) The alternative designs are compared using capitalized costs at 10% per year compounded continuously.The relation that correctly determines the capitalized cost of Design A is:

The alternative designs are compared using capitalized costs at 10% per year compounded continuously.The relation that correctly determines the capitalized cost of Design A is:A)45,000 - 10,000( P / A , 10.52%, 6) - 37,000( P / F , 10.52%, 3) + 13,000( P / F , 10.52%, 6)

B)-45,000 - 10,000( P / A , 10.52%, 3) + 13,000( P / F , 10.52%, 3)

C)[-45,000( A / P , 10%, 3) - 10,000 + 13,000( A / F , 10%, 3)] ÷ 0.10

D)[-45,000( A / P , 10.52%, 3) - 10,000 + 13,000( A / F , 10.52%, 3)] ÷ 0.1052

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

54

The PW value for Design B at an interest rate of 8% per year is closest to

The PW value for Design B at an interest rate of 8% per year is closest toA)$128,020.

B)$94,000.

C)$57,200.

D)$140,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

55

A rich graduate of the engineering program at your university wishes to start an endowment that will provide scholarship money of $0,000 per year beginning in year 5 and continuing indefinitely.If the university earns 10% per year on its investments, the single donation required now is closest to

A)$25,470.

B)$48,360.

C)$73,200.

D)$93,820.

A)$25,470.

B)$48,360.

C)$73,200.

D)$93,820.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

56

A $0,000 bond with a coupon rate of 6% per year payable quarterly matures 10 years from now.At an interest rate of 8% per year compounded quarterly, the relation that correctly calculates the present worth of the remaining payments to the owner is

A)750( P / A , 1.5%, 40) + 50,000( P / F , 1.5%, 40)

B)750( P / A , 2%, 40) + 50,000( P / F , 2%, 40)

C)3000( P / A , 8%, 10) + 50,000( P / F , 8%, 10)

D)1500( P / A , 4%, 20) + 50,000( P / F , 4%, 20)

A)750( P / A , 1.5%, 40) + 50,000( P / F , 1.5%, 40)

B)750( P / A , 2%, 40) + 50,000( P / F , 2%, 40)

C)3000( P / A , 8%, 10) + 50,000( P / F , 8%, 10)

D)1500( P / A , 4%, 20) + 50,000( P / F , 4%, 20)

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

57

John purchased a $0,000 20-year bond at a 2% discount.It pays semiannually at a rate of 4% per year.If he wishes to make 6% per year on his investment, the semiannual dividend he will receive is

A)$00.

B)$90.

C)$00.

D)$90.

A)$00.

B)$90.

C)$00.

D)$90.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

58

A 5% $,000 5-year bond is for sale.The dividend is paid quarterly.If you keep the bond to maturity and want to realize a return of 6% per year compounded quarterly, the most you can pay now for the bond is closest to

A)$000.

B)$000.

C)$785.

D)$150.

A)$000.

B)$000.

C)$785.

D)$150.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck