Deck 25: Transfer Taxes and Wealth Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 25: Transfer Taxes and Wealth Planning

1

Explain why the fair market value of a life estate is more difficult to estimate than an income interest.

Fair Market value: Valuation of the property of a gross estate on the date of decedent's death is Fair market value.It is a simple concept but difficult to apply.air market value is evaluated on based of the facts and circumstance for each individual property.Determining the value for the properties is simple when it has an active market.

Income Interest: Once the value of remainder is calculated, income interest is calculated by the difference between the value of the remainder and the value of the property. Estimating the fair market value is difficult than income interest because fair market value is evaluated on based of the facts and circumstance for each individual property, where income interest is calculated by the difference between the value of the remainder and the value of the property.

Estimating the fair market value is difficult than income interest because fair market value is evaluated on based of the facts and circumstance for each individual property, where income interest is calculated by the difference between the value of the remainder and the value of the property.

Income Interest: Once the value of remainder is calculated, income interest is calculated by the difference between the value of the remainder and the value of the property.

Estimating the fair market value is difficult than income interest because fair market value is evaluated on based of the facts and circumstance for each individual property, where income interest is calculated by the difference between the value of the remainder and the value of the property.

Estimating the fair market value is difficult than income interest because fair market value is evaluated on based of the facts and circumstance for each individual property, where income interest is calculated by the difference between the value of the remainder and the value of the property. 2

Describe how to initiate the construction of a comprehensive and effective wealth plan.

Effective Wealth plan

An individual could have various non tax or even personal goals associated with his outlook of wealth.It becomes difficult to determine and prioritize them for planning purpose.An effective wealth plan eliminates this difficulty by identifying and integrating the personal objectives with tax costs.Often, the fundamental non-tax objective of wealth planning is to protect value during the transfer or control of business asset.Wealth planning hence facilitates a safe mechanism to support the older generation while transferring control to the younger generation.rusts are one of the widely used vehicles for tax planning.These are those fiduciaries that can be structured to achieve various tax and non-tax objectives.

An individual could have various non tax or even personal goals associated with his outlook of wealth.It becomes difficult to determine and prioritize them for planning purpose.An effective wealth plan eliminates this difficulty by identifying and integrating the personal objectives with tax costs.Often, the fundamental non-tax objective of wealth planning is to protect value during the transfer or control of business asset.Wealth planning hence facilitates a safe mechanism to support the older generation while transferring control to the younger generation.rusts are one of the widely used vehicles for tax planning.These are those fiduciaries that can be structured to achieve various tax and non-tax objectives.

3

This year Gerry's friend, Dewey, was disabled.Gerry paid $15,000 to Dewey's doctor for medical expenses and paid $12,500 to State University for college tuition for Dewey's son.Has Gerry made taxable gifts, and if so, in what amounts?

Gift tax

It is a tax imposed on the transfer of money or any form of a gift by one person to another.he following are excluded from taxable gifts:

Transfer for inadequate consideration that is specially excluded from the imposition of gift tax is

1.Political contributions

2.Payment of medical expenses and education expenses of other individuals but paid directly to Healthcare or educational institutions. paid medical expenses to his friend's doctor instead and he also paid a tuition fee of his friend's son to the college.Since medical expenses and college fees are not excluded from taxable gifts category, therefore, they shall be considered as taxable.e made a taxable gift and the amount is $27,500 .herefore, G's taxable gifts amount to

.herefore, G's taxable gifts amount to  .

.

It is a tax imposed on the transfer of money or any form of a gift by one person to another.he following are excluded from taxable gifts:

Transfer for inadequate consideration that is specially excluded from the imposition of gift tax is

1.Political contributions

2.Payment of medical expenses and education expenses of other individuals but paid directly to Healthcare or educational institutions. paid medical expenses to his friend's doctor instead and he also paid a tuition fee of his friend's son to the college.Since medical expenses and college fees are not excluded from taxable gifts category, therefore, they shall be considered as taxable.e made a taxable gift and the amount is $27,500

.herefore, G's taxable gifts amount to

.herefore, G's taxable gifts amount to  .

. 4

In 2011 Angelina gave a parcel of realty to Julie valued at $210,000 (Angelina purchased the property five years ago for $88,000).Compute the amount of the taxable gift on the transfer, if any.Suppose several years later Julie sold the property for $215,000.What is the amount of her gain or loss, if any, on the sale?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

Describe a reason why transfers of terminable interests should not qualify for the marital deduction.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

List two questions you might pose to a client to find out whether a program of serial gifts would be an advantageous wealth transfer plan.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

This year Dan and Mike purchased realty for $180,000 and took title as equal tenants in common.However, Mike was able to provide only $40,000 of the purchase price and Dan paid the remaining $140,000.Has Dan made a complete gift to Mike, and if so, in what amount?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Several years ago Doug invested $21,000 in stock.In 2011 he gave his daughter Tina the stock on a day it was valued at $20,000.She promptly sold it for $19,500.Determine the amount of the taxable gift, if any, and calculate the amount of taxable income or gain, if any, for Tina.Assume Doug is not married and does not support Tina, who is 28.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

True or false? Including taxable gifts when calculating the estate tax subjects these transfers to double taxation.Explain.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

A client in good health wants to support the college education of her teenage grandchild.The client holds various properties but proposes to make a gift of cash in the amount of the annual exclusion.Explain to the client why a direct gift of cash may not be advisable and what property might serve as a reasonable substitute.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

Last year Nate opened a savings account with a deposit of $15,000.The account was in the name of Nate and Derrick, joint tenancy with the right of survivorship.Derrick did not contribute to the account, but this year he withdrew $5,000.Has Nate made a complete gift, and if so, what is the amount of the taxable gift and when was the gift made?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

Roberta is considering making annual gifts of $13,000 of stock each to each of her four children.She expects to live another five years and to leave a taxable estate worth approximately $1,000,000.She requests you justify the gifts by estimating her estate tax savings using the 2011 rate schedule and unified credit from making the gifts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

People sometimes confuse the unified credit with the exemption equivalent.Describe how these terms differ.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

An elderly client has a life insurance policy worth $40,000 that upon her death pays $250,000 to her sole grandchild (or his estate).The client still retains ownership of the policy.Outline for her the costs and benefits of transferring ownership of the policy to a life insurance trust.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Barry transfers $1,000,000 to an irrevocable trust with income to Robin for her life and the remainder to Maurice (or his estate).Calculate the value of the life estate and remainder if Robin's age and the prevailing interest rate result in a Table S discount factor for the remainder of 0.7.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Harold and Maude are married and live in a common law state.Neither have made any taxable gifts and Maude owns (holds title) all their property.She dies with a taxable estate of $10 million and leaves it all to Harold.He dies several years later, leaving the entire $10 million to their three children.Calculate how much estate tax would have been saved using the 2011 rate schedule and unified credit if Maude had used a bypass provision in her will to direct $4 million to her children and the remaining $6 million to Harold.Ignore all credits in this problem except for the unified credit.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

Describe the requirements for a complete gift, and contrast a gift of a present interest with a gift of a future interest.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Describe the conditions in which a married couple would benefit from the use of a bypass provision or a bypass trust.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

This year Jim created an irrevocable trust to provide for Ted, his 32-year-old nephew, and Ted's family.Jim transferred $70,000 to the trust and named a bank as the trustee.The trust was directed to pay income to Ted until he reaches age 35, and at that time the trust is to be terminated and the corpus is to be distributed to Ted's two children (or their estates).Determine the amount, if any, of the current gift and the taxable gift.If necessary, you may assume the relevant interest rate is 6 percent and Jim is unmarried.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose Vince dies this year with a gross estate of $15 million and no adjusted prior gifts.Calculate the amount of estate tax due (if any) under the following alternative conditions using the 2011 rate schedule and unified credit:

a.Vince leaves his entire estate to his spouse, Millie.b.Vince leaves $10 million to Millie and the remainder to charity.c.Vince leaves $10 million to Millie and the remainder to his son, Paul.d.Vince leaves $10 million to Millie and the remainder to a trust whose trustee is required to pay income to Millie for her life and the remainder to Paul.

a.Vince leaves his entire estate to his spouse, Millie.b.Vince leaves $10 million to Millie and the remainder to charity.c.Vince leaves $10 million to Millie and the remainder to his son, Paul.d.Vince leaves $10 million to Millie and the remainder to a trust whose trustee is required to pay income to Millie for her life and the remainder to Paul.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

Describe a property transfer or payment that is not, by definition, a transfer for inadequate consideration.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

Under what conditions can an executor or trustee elect to claim a marital deduction for a transfer of a terminable interest to a spouse?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

This year Colleen transferred $100,000 to an irrevocable trust that pays equal shares of income annually to three cousins (or their estates) for the next eight years.At that time, the trust is terminated and the corpus of the trust reverts to Colleen.Determine the amount, if any, of the current gifts and the taxable gifts.If necessary, you may assume the relevant interest rate is 6 percent and Colleen is unmarried.What is your answer if Colleen is married and she elects to gift-split with her spouse?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Hank possessed a life insurance policy worth $50,000 that will pay his two children a total of $400,000 upon his death.In 2006, Hank transferred the policy and all incidents of ownership to an irrevocable trust that pays income annually to his two children for 15 years and then distributes the corpus to the children in equal shares.a.Calculate the amount of gift tax due (if any) on the 2006 gift, given Hank has made only one prior taxable gift of $1. million in 2005.b.Estimate the amount of estate tax due if Hank were to die more than three years after transferring the insurance policy.At the time of his death, Hank estimates he will have a probate estate of $10 million to be divided in equal shares between his two children.c.Estimate the amount of estate tax due using the 2011 rate schedule and unified credit if Hank were to die within three years of transferring the insurance policy.At the time of his death, Hank estimates he will have a probate estate of $10 million to be divided in equal shares between his two children.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

Identify the features common to the gift tax formula and the estate tax formula.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

Describe a situation in which a transfer of cash to a trust might be considered an incomplete gift.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Explain how a transfer of property as a gift may have income tax implications to the donee.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

Sly wants to make annual gifts of cash to each of his four children and six grandchildren.How much can Sly transfer to his children in 2011 if he makes the maximum gifts eligible for the annual exclusion, assuming he is single?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Jack made his first taxable gift of $1,000,000 in 1997, at which time the unified credit was $192,800.Jack made no further gifts until 2005, at which time he gave $250,000 each to his three children and an additional $100,000 to State University (a charity).The annual exclusion in 2005 was $11,000.Recently Jack has been in poor health and would like you to estimate his estate tax should he die this year.He estimates his taxable estate (after deductions) will be worth $5. million at his death.Assume Jack is single, has paid the proper amounts of tax in past years, and use the 2011 rate schedule and unified credit.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

Explain why Congress felt it necessary to enact a gift tax to complement the estate tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

Identify two types of transfers for inadequate consideration that are specifically excluded from imposition of the gift tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Hal and Wendy are married, and they own a parcel of realty, Blackacre, as joint tenants with the right of survivorship.Hal owns an additional parcel of realty, Redacre, in his name alone.Suppose Hal should die when Blackacre is worth $800,000 and Redacre is worth $750,000, what value of realty would be included in Hal's probate estate, and what value would be included in Hal's gross estate?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Jack and Liz live in a community property state and their vacation home is community property.This year they transferred the vacation home to an irrevocable trust that provides their son, Tom, a life estate in the home and the remainder to their daughter, Laura.Under the terms of the trust, Tom has the right to use the vacation home for the duration of his life, and Laura will automatically own the property after Tom's death.At the time of the gift the home was valued at $500,000, Tom was 35 years old, and the §7520 rate was 5. percent.What is the amount, if any, of the taxable gifts? Would your answer be different if the home were not community property and Jack and Liz elected to gift-split?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

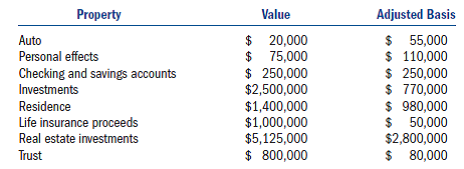

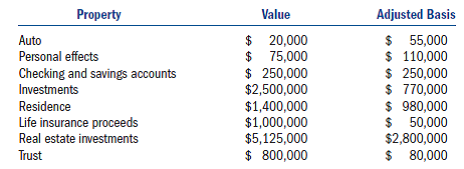

Montgomery has decided to engage in wealth planning and has listed the value of his assets below.The life insurance has a cash surrender value of $120,000, and the proceeds are payable to Montgomery's estate.The trust is an irrevocable trust created by Montgomery's brother 10 years ago and contains assets currently valued at $800,000.The income from the trust is payable to Montgomery's faithful butler, Walen, for his life, and the remainder is payable to Montgomery or his estate.Walen is currently 37 years old, and the §7520 interest rate is currently 5. percent.Montgomery is unmarried and plans to leave all his assets to his surviving relatives.

a.Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and has never made any taxable gifts.b.Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006.The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax.c.Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006.The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax.Montgomery plans to bequeath his investments to charity and leave his remaining assets to his surviving relatives.

a.Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and has never made any taxable gifts.b.Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006.The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax.c.Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in 2006.The taxable gift was $1 million, and Montgomery used his unified credit to avoid paying any gift tax.Montgomery plans to bequeath his investments to charity and leave his remaining assets to his surviving relatives.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Describe the unified credit and the purpose it serves in the gift and estate tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

Under what circumstances will a deposit of cash to a bank account held in joint tenancy be considered a completed gift?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

Walter owns a whole-life insurance policy worth $52,000 that directs the insurance company to pay the beneficiary $250,000 on Walter's death.Walter pays the annual premiums and has the power to designate the beneficiary of the policy (it is currently his son, James).What value of the policy, if any, will be included in Walter's estate upon his death?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

David placed $80,000 in trust with income to Steve for his life and the remainder to Lil (or her estate).At the time of the gift, given the prevailing interest rate, Steve's life estate was valued at $65,000 and the remainder at $15,000.What is the amount, if any, of David's taxable gifts?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Fred is retired and living on his pension.He has accumulated almost $1 million of property he would like to leave to his children.However, Fred is afraid much of his wealth will be eliminated by the federal estate tax.Explain whether this fear is well founded.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Explain how a purchase of realty could result in a taxable gift.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Many years ago James and Sergio purchased property for $450,000.Although they are listed as equal co-owners, Sergio was able to provide only $200,000 of the purchase price.James treated the additional $25,000 of his contribution to the purchase price as a gift to Sergio.Suppose the property is worth $900,000 at Sergio's death, what amount would be included in Sergio's estate if the title to the property was tenants in common? What if the title were joint tenancy with right of survivorship?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

Stephen transferred $15,000 to an irrevocable trust for Graham.The trustee has the discretion to distribute income or corpus for Graham's benefit but is required to distribute all assets to Graham (or his estate) not later than Graham's 21 st birthday.What is the amount, if any, of the taxable gift?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

Explain why the gross estate includes the value of certain property transferred by the decedent at death, such as property held in joint tenancy with the right of survivorship, even though this property is not subject to probate.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Describe the conditions for using the annual exclusion to offset an otherwise taxable transfer.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Terry transferred $500,000 of real estate into an irrevocable trust for her son, Lee.The trustee was directed to retain income until Lee's 21 st birthday and then pay him the corpus of the trust.Terry retained the power to require the trustee to pay income to Lee at any time, and the right to the assets if Lee predeceased her.What amount of the trust, if any, will be included in Terry's estate?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

For the holidays, Marty gave a watch worth $25,000 to Emily and jewelry worth $40,000 to Natalie.Has Marty made any taxable gifts in 2011 and, if so, in what amounts? Does it matter if Marty is married to Wendy and they live in a community property state?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

Identify the factors that determine the proportion of the value of property held in joint tenancy with the right of survivorship that will be included in a decedent's gross estate.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

List the conditions for making an election to split gifts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

Last year Robert transferred a life insurance policy worth $45,000 to an irrevocable trust with directions to distribute the corpus of the trust to his grandson, Danny, upon his graduation from college, or to Danny's estate upon his death.Robert paid $15,000 of gift tax on the transfer of the policy.Early this year, Robert died and the insurance company paid $400,000 to the trust.What amount, if any, is included in Robert's gross estate?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

This year Jeff earned $850,000 and used it to purchase land in joint tenancy with a right of survivorship with Mary.Has Jeff made a taxable gift to Mary and, if so, in what amount? What is your answer if Jeff and Mary are married?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Define fair market value for transfer tax purposes.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

Describe the limitations on the deduction of transfers to charity.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

Willie purchased a whole-life insurance policy on his brother, Benny.Under the policy, the insurance company will pay the named beneficiary $100,000 upon the death of the insured, Benny.Willie names Tess the beneficiary, and upon Benny's death, Tess receives the proceeds of the policy, $100,000.Identify and discuss the transfer tax implications of this arrangement.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

In 2011 Laura transfers $500,000 into trust with the income to be paid annually to her spouse, William, for life (a life estate) and the remainder to Jenny.Calculate the amount of the taxable gifts from the transfers.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

Harold owns a condo in Hawaii that he plans on using for the rest of his life.However, to ensure his sister Maude will own the property after his death, Harold deeded the remainder of the property to her.He signed the deed transferring the remainder in July 2009 when the condo was worth $250,000 and his life estate was worth $75,000.Harold died in January 2011, at which time the condo was worth $300,000.What amount, if any, is included in Harold's gross estate? Explain.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Explain the purpose of adding prior taxable gifts to current taxable gifts and show whether these prior gifts could be taxed multiple times over the years.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Jimmy owns two parcels of real estate, Tara and Sundance.Tara is worth $240,000 and Sundance is worth $360,000.Jimmy plans to bequeath Tara directly to his wife Lois and leave her a life estate in Sundance.What amount of value will be included in Jimmy's gross estate and taxable estate should he die now?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

Red transferred $5,000,000 of cash to State University for a new sports complex.Calculate the amount of the taxable gift.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Paul is a widower with several grown children.He is considering transferring his residence into a trust for his children and retaining a life estate in it.Comment on whether this plan will prevent the value of the home from being included in Paul's gross estate when he dies.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Describe a reason why a generation-skipping tax was necessary to augment the estate and gift taxes?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Roland had a taxable estate of $5. million when he died this year.Calculate the amount of estate tax due (if any) under the following alternatives.a.Roland's prior taxable gifts consist of a taxable gift of $1 million in 2005.b.Roland's prior taxable gifts consist of a taxable gift of $1. million in 2005.c.Roland's prior taxable gifts consist of a taxable gift of $2 million made in 2008 (within three years of his death).

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

Casey gave $1 million of stock to both Stephanie and Linda in 2005, 2006, and 2007.Calculate the amount of gift tax due and the marginal gift tax rate on the next $1 of taxable transfers under the following conditions:

a.In 2005, the annual exclusion was $11,000.Casey was not married and has never made any other gifts.b.In 2006, the annual exclusion was $12,000.Casey was not married and the 2005 gift was the only other gift he has made.c.In 2007, the annual exclusion was $12,000.Casey was married prior to the date of the gift.He and his spouse, Helen, live in a common-law state and have elected to gift-split.Helen has never made a taxable gift, and Casey's only other taxable gifts were the gifts in 2005 and 2006.

a.In 2005, the annual exclusion was $11,000.Casey was not married and has never made any other gifts.b.In 2006, the annual exclusion was $12,000.Casey was not married and the 2005 gift was the only other gift he has made.c.In 2007, the annual exclusion was $12,000.Casey was married prior to the date of the gift.He and his spouse, Helen, live in a common-law state and have elected to gift-split.Helen has never made a taxable gift, and Casey's only other taxable gifts were the gifts in 2005 and 2006.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Explain how a remainder and an income interest are valued for transfer tax purposes.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Explain why an effective wealth transfer plan necessitates cooperation between lawyers, accountants, and investment advisors.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Raquel transferred $100,000 of stock to a trust, with income to be paid to her nephew for 18 years and the remainder to her nephew's children (or their estates).Raquel named a bank as independent trustee but retained the power to determine how much income, if any, will be paid in any particular year.Is this transfer a complete gift? Explain.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Jones is seriously ill and has $6 million of property that he wants to leave to his four children.He is considering making a current gift of the property (rather than leaving the property to pass through his will).Assuming any taxable transfer will be subject to the highest transfer tax rate, determine how much gift tax Jones will owe if he makes the transfers now.How much estate tax will Jones save under the 2011 rate schedule and unified credit if he dies after three years, during which time the property appreciates to $6. million?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck