Deck 3: Property Dispositions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 3: Property Dispositions

1

What two factors increase the difference between present and future values

Factors that distinguish present and future value:

The present value is distinguished from the future value by two major factors.They are,

• Rate of return

• Investment period

The present value is distinguished from the future value by two major factors.They are,

• Rate of return

• Investment period

2

"Tax avoidance is discouraged by the courts and Congress." Is this statement true or false Please explain.

Discussion on the statement:

Statement : "Tax avoidance is discouraged by the courts and congress"

The statement is false.The court has time and again made it clear that the taxpayers have no obligation to pay taxes more than required by law.As an example, in " Commissioner vs.Newman, 159 f.2d 848 (2 Cir., 1947)" case where the taxpayer's capability to reallocate income to his children with the help of trusts were considered, the judge included the following statement in his unorthodox opinion."Over and over again courts have said that there is nothing sinister in so arranging one's affairs as to keep taxes as low as possible.Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions.To demand more in the name of morals is mere cant."

Statement : "Tax avoidance is discouraged by the courts and congress"

The statement is false.The court has time and again made it clear that the taxpayers have no obligation to pay taxes more than required by law.As an example, in " Commissioner vs.Newman, 159 f.2d 848 (2 Cir., 1947)" case where the taxpayer's capability to reallocate income to his children with the help of trusts were considered, the judge included the following statement in his unorthodox opinion."Over and over again courts have said that there is nothing sinister in so arranging one's affairs as to keep taxes as low as possible.Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions.To demand more in the name of morals is mere cant."

3

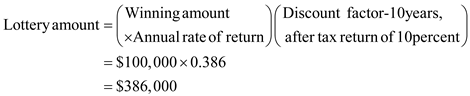

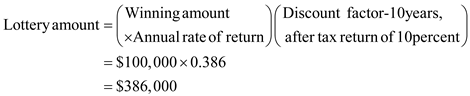

Bob's Lottery, Inc., has decided to offer winners a choice of $100,000 in ten years or some amount currently.Assume that Bob's Lottery, Inc., earns a 10 percent after-tax rate of return.What amount should Bob offer lottery winners currently, in order for him to be indifferent between the two choices

It is given that B.Lottery has decided to offer winners an amount of $100,000 in 10 years or some amount currently.B earns a 10% after tax rate return.Calculate the amount that B.Lottery should offer for him to be indifferent between the two choices as shown below:

Therefore, B.Lottery should offer lottery winners $38,600 today for him to be indifferent between the two choices.

Therefore, B.Lottery should offer lottery winners $38,600 today for him to be indifferent between the two choices.

Therefore, B.Lottery should offer lottery winners $38,600 today for him to be indifferent between the two choices.

Therefore, B.Lottery should offer lottery winners $38,600 today for him to be indifferent between the two choices. 4

What factors have to be present for income shifting to be a viable strategy

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

Yong recently paid his accountant $10,000 for elaborate tax planning strategies that exploit the timing strategy.Assuming this is an election year and there could be a power shift in the White House and Congress, what is a potential risk associated with Yong's strategies

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

Tawana owns and operates a sole proprietorship and has a 40 percent marginal tax rate.She provides her son, Jonathon, $8,000 a year for college expenses.Jonathon works as a pizza delivery person every fall and has a marginal tax rate of 15 percent.What could Tawana do to reduce her family tax burden How much pretax income does it currently take Tawana to generate the $8,000 after-taxes given to Jonathon If Jonathon worked for his mother's sole proprietorship, what salary would she have to pay him to generate $8,000 after taxes (ignoring any Social Security, Medicare, or self-employment tax issues) How much money would this strategy save

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

Name three common types of income shifting.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

Billups, a physician and cash-method taxpayer, is new to the concept of tax planning and recently learned of the timing strategy.To implement the timing strategy, Billups plans to establish a new policy that allows all his clients to wait two years to pay their co-pays.Assume that Billups does not expect his marginal tax rates to change.What is wrong with his strategy

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

Moana is a single taxpayer who operates a sole proprietorship.She expects her taxable income next year to be $250,000, of which $200,000 is attributed to her sole proprietorship.Moana is contemplating incorporating her sole proprietorship.Using the single individual tax brackets and the corporate tax brackets, find out how much current tax this strategy could save Moana (ignore any Social Security, Medicare, or self-employment tax issues).How much income should be left in the corporation

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

What are some ways that a parent could effectively shift income to a child What are some of the disadvantages of these methods

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

Tesha works for a company that pays a year-end bonus in January of each year (instead of December of the preceding year) to allow employees to defer the bonus income.Assume Congress recently passed tax legislation that decreases individual tax rates as of next year.Does this increase or decrease the benefits of the bonus deferral this year What if Congress passed legislation that increased tax rates next year Should Tesha ask the company to change its policy this year What additional information do you need to answer this question

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

Orie and Jane, husband and wife, operate a sole proprietorship.They expect their taxable income next year to be $275,000, of which $125,000 is attributed to the sole proprietorship.Orie and Jane are contemplating incorporating their sole proprietorship.Using the married-joint tax brackets and the corporate tax brackets, find out how much current tax this strategy could save Orie and Jane.How much income should be left in the corporation

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

What is the key factor in shifting income from a business to its owners What are some methods of shifting income in this context

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

Isabel, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship.In late December she received a $20,000 bill from her accountant for consulting services related to her small business.Isabel can pay the $20,000 bill anytime before January 30 of next year without penalty.Assume her marginal tax rate is 40 percent this year and next year, and that she can earn an after-tax rate of return of 12 percent on her investments.When should she pay the $20,000 bill - this year or next

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

Hyundai is considering opening a plant in two neighboring states.One state has a corporate tax rate of 10 percent.If operated in this state, the plant is expected to generate $1,000,000 pretax profit.The other state has a corporate tax rate of 2 percent.If operated in this state, the plant is expected to generate $930,000 of pretax profit.Which state should Hyundai choose Why do you think the plant in the state with a lower tax rate would produce a lower before-tax income

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

"The goal of tax planning is to minimize taxes." Explain why this statement is not true.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

Explain why paying dividends is not an effective way to shift income from a corporation to its owners.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

Using the facts from the previous problem, how would your answer change if Isabel's after-tax rate of return were 8 percent

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

Bendetta, a high-tax-rate taxpayer, owns several rental properties and would like to shift some income to her daughter, Jenine.Bendetta instructs her tenants to send their rent checks to Jenine so Jenine can report the rental income.Will this shift the income from Bendetta to Jenine Why or why not

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

Describe the three parties engaged in every business transaction and how understanding taxes may aid in structuring transactions.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

What are some of the common examples of the conversion strategy

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

Manny, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship.In late December he performed $20,000 of legal services for a client.Manny typically requires his clients to pay his bills immediately upon receipt.Assume Manny's marginal tax rate is 40 percent this year and next year, and that he can earn an after-tax rate of return of 12 percent on his investments.Should Manny send his client the bill in December or January

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

Using the facts in the previous problem, what are some ways that Bendetta could shift some of the rental income to Jenine What are the disadvantages associated with these income-shifting strategies

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

In this chapter we discussed three basic tax planning strategies.What different features of taxation does each of these strategies exploit

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

What is needed to implement the conversion strategy

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

Using the facts from the previous problem, how would your answer change if Manny's after-tax rate of return were 8 percent

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

Dennis is currently considering investing in municipal bonds that earn 6 percent interest, or in taxable bonds issued by the Coca-Cola Company that pay 8 percent.If Dennis' tax rate is 20 percent, which bond should he choose Which bond should he choose if his tax rate is 30 percent At what tax rate would he be indifferent between the bonds What strategy is this decision based upon

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

What are the two basic timing strategies What is the intent of each

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

Explain how implicit taxes may limit the benefits of the conversion strategy.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

Reese, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship.In late December she received a $20,000 bill from her accountant for consulting services related to her small business.Reese can pay the $20,000 bill any time before January 30 of next year without penalty.Assume Reese's marginal tax rate is 30 percent this year and will be 40 percent next year, and that she can earn an after-tax rate of return of 12 percent on her investments.When should she pay the $20,000 bill - this year or next

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

Duff is really interested in decreasing his tax liability, and by his very nature he is somewhat aggressive.A friend of a friend told him that cash transactions are more difficult for the IRS to identify and, thus, tax.Duff is contemplating using this "strategy" of not reporting cash collected in his business to minimize his tax liability.Is this tax planning What are the risks with this strategy

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

Why is the timing strategy particularly effective for cash-method taxpayers

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

Several judicial doctrines limit basic tax planning strategies.What are they Which planning strategies do they limit

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

Using the facts from the previous problem, when should Reese pay the bill if she expects her marginal tax rate to be 33 percent next year 25 percent next year

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

Using the facts from the previous problem, how would your answer change if instead, Duff adopted the cash method of accounting to allow him to better control the timing of his cash receipts and disbursements

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

What are some common examples of the timing strategy

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

What is the constructive receipt doctrine What types of taxpayers does this doctrine generally affect For what tax planning strategy is the constructive receipt doctrine a potential limitation

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

Hank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship.In late December he performed $20,000 of legal services for a client.Hank typically requires his clients to pay his bills immediately upon receipt.Assume his marginal tax rate is 30 percent this year and will be 40 percent next year, and that he can earn an after-tax rate of return of 12 percent on his investments.Should Hank send his client the bill in December or January

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

Using an available tax service or the Internet, identify three basic tax planning ideas or tax tips suggested for year-end tax planning.Which basic tax strategy from this chapter does each planning idea employ

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

What factors increase the benefits of accelerating deductions or deferring income

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

Explain the assignment of income doctrine.In what situations would this doctrine potentially apply

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

Using the facts from the previous problem, when should Hank send the bill if he expect his marginal tax rate to be 33 percent next year 25 percent next year

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

Jayanna, an advertising consultant, is contemplating instructing some of her clients to pay her in cash so that she does not have to report the income on her tax return.Use an available tax service to identify the three basic elements of tax evasion and penalties associated with tax evasion.Write a memo to Jayanna explaining tax evasion and the risks associated with her actions.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

How do changing tax rates affect the timing strategy What information do you need to determine the appropriate timing strategy when tax rates change

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

Relative to arm's-length transactions, why do related-party transactions receive more IRS scrutiny

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

Geraldo recently won a lottery and chose to receive $100,000 today instead of an equivalent amount in ten years, computed using an 8 percent rate of return.Today, he learned that interest rates are expected to increase in the future.Is this good news for Geraldo given his decision

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

Using the IRS Web site (http://www.irs.gov/index.html), how large is the current estimated "tax gap" (i.e., the amount of tax underpaid by taxpayers annually) What group of taxpayers represents the largest "contributors" to the tax gap

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

Describe the ways in which the timing strategy has limitations.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

Describe the business purpose, step-transaction, and substance-over-form doctrines.What types of tax planning strategies may these doctrines inhibit

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Assume Rafael can earn an 8 percent after-tax rate of return.Would he prefer $1,000 today or $1,500 in five years

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

The concept of the time value of money suggests that $1 today is not equal to $1 in the future.Explain why this is true.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

What is the difference between tax avoidance and tax evasion

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

Assume Ellina earns a 10 percent after-tax rate of return, and that she owes a friend $1,200.Would she prefer to pay the friend $1,200 today or $1,750 in four years

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Why is understanding the time value of money important for tax planning

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

What are the rewards of tax avoidance What are the rewards of tax evasion

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

Jonah has the choice of paying Rita $10,000 today or $40,000 in ten years.Assume Jonah can earn a 12 percent after-tax rate of return.Which should he choose

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck