Deck 16: Supply Chain Coordination

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/4

Play

Full screen (f)

Deck 16: Supply Chain Coordination

1

(Buying Tissues) P G, the maker of Puffs tissues, traditionally sells these tissues for $9.40 per case, where a case contains eight boxes. A retailer's average weekly demand is 25 cases of a particular Puffs SKU (color, scent, etc.). P G has decided to change its pricing strategy by offering two different plans. With one plan, the retailer can purchase that SKU for the everyday-low-wholesale price of $9.25 per case. With the other plan, P G charges the regular price of $9.40 per case throughout most of the year, but purchases made for a single delivery at the start of each quarter are given a 5 percent discount. The retailer receives weekly shipments with a one-week lead time between ordering and delivery. Suppose with either plan the retailer manages inventory so that at the end of each week there is on average a one-week supply of inventory. Holding costs are incurred at the rate of 0.4 percent of the value of inventory at the end of each week. Assume 52 weeks per year.

a. Suppose the retailer chose the first plan ($9.25 per case throughout the year). What is the retailer's expected annual purchasing and inventory holding cost?

b. Suppose the retailer chooses the second plan and only buys at the discount price ($9.40 is the regular price and a 5 percent discount for delivery at the start of each quarter). What is the retailer's expected annual purchasing and inventory holding cost?

c. Consider the first plan and propose a new everyday-low wholesale price. Call this the third plan. Design your plan so that both P G and the retailer prefer it relative to the second plan.

a. Suppose the retailer chose the first plan ($9.25 per case throughout the year). What is the retailer's expected annual purchasing and inventory holding cost?

b. Suppose the retailer chooses the second plan and only buys at the discount price ($9.40 is the regular price and a 5 percent discount for delivery at the start of each quarter). What is the retailer's expected annual purchasing and inventory holding cost?

c. Consider the first plan and propose a new everyday-low wholesale price. Call this the third plan. Design your plan so that both P G and the retailer prefer it relative to the second plan.

a) If orders are made every week, then the average order quantity equals one week's worth of demand, which is 25 cases. If at the end of the week there is one week's worth of inventory, then the average inventory is 25/2 + 25 = 37.5. (In this case inventory "saw-toothes" from a high of two week's worth of inventory down to one week, with an average of 1.5 weeks.) On average the inventory value is 37.5 x 9.25 = $346.9. The holding cost per year is 52 x 0.4% = 20.8%. Hence, the inventory holding cost with the first plan is 20.8% x $346.9 = $72. Purchase cost is 52 x 25 x $9.25 = $12,025. Total cost is $12,025 + $72 = $12,097.b) Four orders are made each year, each order on average is for (52/4) x 25 = 325 units. Average inventory is then 325/2 + 25 = 187.5. The price paid per unit is $9.40 x 0.95 = $8.93. The value of that inventory is 187.5 x $8.93 = $1674. Annual holding costs are $1674 x 20.8% = $348. Purchase cost is 52 x 25 x $8.93 = $11,609. Total cost is $348 + $11,609 = $11,957.c) P G prefers our third plan as long as the price is higher than in the second plan, $8.93. But the retailer needs a low enough price so that its total cost with the third plan is not greater than in the second plan, $11,957 (from part b). In part a we determined that the annual holding cost with a weekly ordering plan is approximately $72. If we lower the price, the annual holding cost will be a bit lower, but $72 is a conservative approximation of the holding cost. So the retailer's purchase cost should not exceed $11,957 - $72 = $11,885. Total purchase quantity is 25 x 52 = 1300 units. So if the price is $11,885/1300 = $9.14, then the retailer will be slightly better off (relative to the second plan) and P G is much better off (revenue of $12,012 instead of $11,885).

2

( Returning books ) Dan McClure is trying to decide on how many copies of a book to purchase at the start of the upcoming selling season for his bookstore. The book retails at $28.00. The publisher sells the book to Dan for $20.00. Dan will dispose of all of the unsold copies of the book at 75 percent off the retail price, at the end of the season. Dan estimates that demand for this book during the season is normal with a mean of 100 and a standard deviation of 42.

a. How many books should Dan order to maximize his expected profit?

b. Given the order quantity in part a what is Dan's expected profit?

c. The publisher's variable cost per book is $7.5. Given the order quantity in part a, what is the publisher's expected profit?

The publisher is thinking of offering the following deal to Dan. At the end of the season, the publisher will buy back unsold copies at a predetermined price of $15.00. However, Dan would have to bear the costs of shipping unsold copies back to the publisher at $1.00 per copy.

d. How many books should Dan order to maximize his expected profits given the buyback offer?

e. Given the order quantity in part d, what is Dan's expected profit?

f. Assume the publisher is able on average to earn $6 on each returned book net the publisher's handling costs (some books are destroyed while others are sold at a discount and others are sold at full price). Given the order quantity in part d what is the publisher's expected profit?

g. Suppose the publisher continues to charge $20 per book and Dan still incurs a $1 cost to ship each book back to the publisher. What price should the publisher pay Dan for returned books to maximize the supply chain's profit (the sum of the publisher's profit and Dan's profit)?

a. How many books should Dan order to maximize his expected profit?

b. Given the order quantity in part a what is Dan's expected profit?

c. The publisher's variable cost per book is $7.5. Given the order quantity in part a, what is the publisher's expected profit?

The publisher is thinking of offering the following deal to Dan. At the end of the season, the publisher will buy back unsold copies at a predetermined price of $15.00. However, Dan would have to bear the costs of shipping unsold copies back to the publisher at $1.00 per copy.

d. How many books should Dan order to maximize his expected profits given the buyback offer?

e. Given the order quantity in part d, what is Dan's expected profit?

f. Assume the publisher is able on average to earn $6 on each returned book net the publisher's handling costs (some books are destroyed while others are sold at a discount and others are sold at full price). Given the order quantity in part d what is the publisher's expected profit?

g. Suppose the publisher continues to charge $20 per book and Dan still incurs a $1 cost to ship each book back to the publisher. What price should the publisher pay Dan for returned books to maximize the supply chain's profit (the sum of the publisher's profit and Dan's profit)?

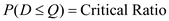

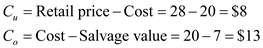

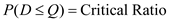

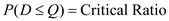

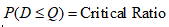

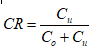

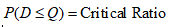

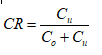

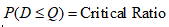

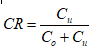

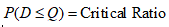

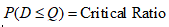

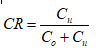

In a single-period inventory model, the order size decision is made by a marginal analysis. In this analysis, the optimal order quantity occurs when the probability of demand, D being less than or equal to the order quantity, Q equals the critical ratio. In other words,

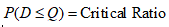

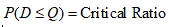

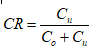

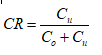

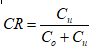

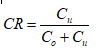

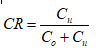

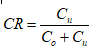

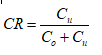

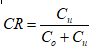

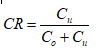

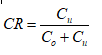

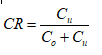

( CR ) where CR can be computed as:

( CR ) where CR can be computed as:

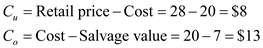

Where

Where

and

and

are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:

are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:

Mean demand,

Standard deviation of demand,

Standard deviation of demand,

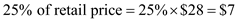

Retail price = $28

Retail price = $28

Purchase cost to the retailer = $20.00

Salvage value =

Publisher's variable cost per book = $7.5

Publisher's variable cost per book = $7.5

a.Compute the optimal number of books to be ordered as follows:

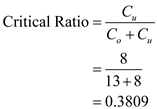

Compute the critical ratio using the following formula:

Compute the critical ratio using the following formula:

The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words,

The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words,

0

0

The nearest value of F ( z ), from the table, is 0.381 and this happens for

1

1

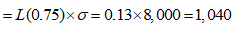

.Compute corresponding order quantity using the formula

2

2

So, the optimal order size, after rounding off, is

3

3

b.Compute the expected profit of the retailer as follows:

The standard normal variable, z , as found in the earlier step is

4

4

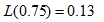

The loss function corresponding to this value,

5

5

Expected lost sales

6

6

So,

7

7

8

8

9

9

So, the expected profit is

0

0

c.

Compute the expected profit of the publisher as follows:

1

1

So, the expected profit of the supplier is

2

2

d.In this case, there is a buy-back price of $15 per unit.Compute the

3

3

and

4

4

for the retailer considering the buyback as follows:

5

5

Compute the critical ratio using the following formula:

6

6

The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words,

7

7

From the table, the nearest value of F ( z ) happens for

8

8

.Compute corresponding order quantity using the formula

9

9

So, the optimal order size, after rounding off, is

0

0

e.Compute the expected profit of the retailer as follows:

The standard normal variable, z , as found in the earlier step is

1

1

The loss function corresponding to this value,

2

2

Expected lost sales

3

3

So,

4

4

5

5

6

6

So, the expected profit is

7

7

f.Compute the expected profit of the publisher as follows:

8

8

So, the expected profit of the supplier is

9

9

g.Compute the optimal buyback price for attaining maximum profit for the supply chain using the following formula:

0

0

So, the optimal buy-back price the publisher should pay the retailer is

1

1

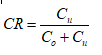

( CR ) where CR can be computed as:

( CR ) where CR can be computed as: Where

Where  and

and  are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:

are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:Mean demand,

Standard deviation of demand,

Standard deviation of demand,  Retail price = $28

Retail price = $28Purchase cost to the retailer = $20.00

Salvage value =

Publisher's variable cost per book = $7.5

Publisher's variable cost per book = $7.5a.Compute the optimal number of books to be ordered as follows:

Compute the critical ratio using the following formula:

Compute the critical ratio using the following formula: The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words,

The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words, 0

0The nearest value of F ( z ), from the table, is 0.381 and this happens for

1

1.Compute corresponding order quantity using the formula

2

2So, the optimal order size, after rounding off, is

3

3b.Compute the expected profit of the retailer as follows:

The standard normal variable, z , as found in the earlier step is

4

4The loss function corresponding to this value,

5

5Expected lost sales

6

6So,

7

7 8

8 9

9So, the expected profit is

0

0c.

Compute the expected profit of the publisher as follows:

1

1So, the expected profit of the supplier is

2

2d.In this case, there is a buy-back price of $15 per unit.Compute the

3

3and

4

4for the retailer considering the buyback as follows:

5

5Compute the critical ratio using the following formula:

6

6The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words,

7

7From the table, the nearest value of F ( z ) happens for

8

8.Compute corresponding order quantity using the formula

9

9So, the optimal order size, after rounding off, is

0

0e.Compute the expected profit of the retailer as follows:

The standard normal variable, z , as found in the earlier step is

1

1The loss function corresponding to this value,

2

2Expected lost sales

3

3So,

4

4 5

5 6

6So, the expected profit is

7

7f.Compute the expected profit of the publisher as follows:

8

8So, the expected profit of the supplier is

9

9g.Compute the optimal buyback price for attaining maximum profit for the supply chain using the following formula:

0

0So, the optimal buy-back price the publisher should pay the retailer is

1

1 3

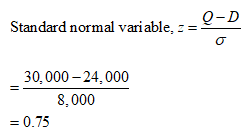

(Component options) Handi Inc., a cell phone manufacturer, procures a standard display from LCD Inc. via an options contract. At the start of quarter 1 (Q1), Handi pays LCD $4.5 per option. At that time, Handi's forecast of demand in Q2 is normally distributed with mean 24,000 and standard deviation 8,000. At the start of Q2, Handi learns exact demand for Q2 and then exercises options at the fee of $3.5 per option, (for every exercised option, LCD delivers one display to Handi). Assume Handi starts Q2 with no display inventory and displays owned at the end of Q2 are worthless. Should Handi's demand in Q2 be larger than the number of options held, Handi purchases additional displays on the spot market for $9 per unit.

For example, suppose Handi purchases 30,000 options at the start of Q1, but at the start of Q2 Handi realizes that demand will be 35,000 units. Then Handi exercises all of its options and purchases 5,000 additional units on the spot market. If, on the other hand, Handi realizes demand is only 27,000 units, then Handi merely exercises 27,000 options.

a. Suppose Handi purchases 30,000 options. What is the expected number of options that Handi will exercise?

b. Suppose Handi purchases 30,000 options. What is the expected number of displays Handi will buy on the spot market?

c. Suppose Handi purchases 30,000 options. What is Handi's expected total procurement cost?

d. How many options should Handi purchase from LCD?

e. What is Handi's expected total procurement cost given the number of purchased options from part d?

For example, suppose Handi purchases 30,000 options at the start of Q1, but at the start of Q2 Handi realizes that demand will be 35,000 units. Then Handi exercises all of its options and purchases 5,000 additional units on the spot market. If, on the other hand, Handi realizes demand is only 27,000 units, then Handi merely exercises 27,000 options.

a. Suppose Handi purchases 30,000 options. What is the expected number of options that Handi will exercise?

b. Suppose Handi purchases 30,000 options. What is the expected number of displays Handi will buy on the spot market?

c. Suppose Handi purchases 30,000 options. What is Handi's expected total procurement cost?

d. How many options should Handi purchase from LCD?

e. What is Handi's expected total procurement cost given the number of purchased options from part d?

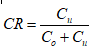

In a single-period inventory model, the order size decision is made by a marginal analysis. In this analysis, the optimal order quantity occurs when the probability of demand, D being less than or equal to the order quantity, Q equals the critical ratio. In other words,

( CR ) where CR can be computed as:

( CR ) where CR can be computed as:

Where

Where

and

and

are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:

are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:

Mean demand,

Standard deviation of demand,

Standard deviation of demand,

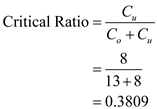

Option price = $4.5

Option price = $4.5

Exercise price = $3.5

Spot market price = $9.0

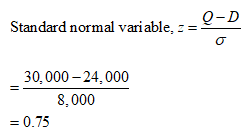

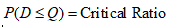

a.Given the total number of options purchased to be Q = 30,000, compute the expected number of options exercised as follows:

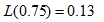

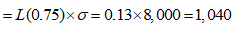

The corresponding loss function,

The corresponding loss function,

Expected lost demand

Expected lost demand

So, the expected exercised options,

So, the expected exercised options,

0

0

So, the expected number of options exercised is

1

1

b.Given the total number of options purchased to be Q = 30,000, compute the expected number of units bought from the spot market as follows:

2

2

The corresponding loss function,

3

3

Expected lost demand

4

4

So, the expected number of units bought from the spot market are

5

5

c.The total procurement cost consists of the cost of the option plus exercise and the cost of buying from the spot market.So,

6

6

So, the total procurement cost is

7

7

d.Compute the optimal number of options purchased as follows:

8

8

Compute the critical ratio using the following formula:

9

9

The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words,

0

0

The corresponding F ( z ) is 0.55 and this happens for

1

1

.Compute corresponding order quantity using the formula

2

2

So, the optimal number of options to be bought is

3

3

e.The total procurement cost consists of the cost of the option plus exercise and the cost of buying from the spot market.For

4

4

, the corresponding loss function,

5

5

Expected lost demand

6

6

So, the expected exercised options,

7

7

So,

8

8

So, the total procurement cost is

9

9

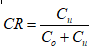

( CR ) where CR can be computed as:

( CR ) where CR can be computed as: Where

Where  and

and  are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:

are the cost per unit of demand underestimated and that of demand overestimated respectively.Note the following information given in the question for computing the optimal order quantity and total cost:Mean demand,

Standard deviation of demand,

Standard deviation of demand,  Option price = $4.5

Option price = $4.5Exercise price = $3.5

Spot market price = $9.0

a.Given the total number of options purchased to be Q = 30,000, compute the expected number of options exercised as follows:

The corresponding loss function,

The corresponding loss function,  Expected lost demand

Expected lost demand  So, the expected exercised options,

So, the expected exercised options,  0

0So, the expected number of options exercised is

1

1b.Given the total number of options purchased to be Q = 30,000, compute the expected number of units bought from the spot market as follows:

2

2The corresponding loss function,

3

3Expected lost demand

4

4So, the expected number of units bought from the spot market are

5

5c.The total procurement cost consists of the cost of the option plus exercise and the cost of buying from the spot market.So,

6

6So, the total procurement cost is

7

7d.Compute the optimal number of options purchased as follows:

8

8Compute the critical ratio using the following formula:

9

9The optimality occurs when the probability of demand, D being less than or equal to the Shillings taken, Q equals the critical ratio. In other words,

0

0The corresponding F ( z ) is 0.55 and this happens for

1

1.Compute corresponding order quantity using the formula

2

2So, the optimal number of options to be bought is

3

3e.The total procurement cost consists of the cost of the option plus exercise and the cost of buying from the spot market.For

4

4, the corresponding loss function,

5

5Expected lost demand

6

6So, the expected exercised options,

7

7So,

8

8So, the total procurement cost is

9

9 4

( Selling Grills ) Smith and Jackson Inc. (SJ) sells an outdoor grill to Cusano's Hardware Store. SJ's wholesale price for the grill is $185. (The wholesale price includes the cost of shipping the grill to Cusano). Cusano sells the grill for $250 and SJ's variable cost per grill is $100. Suppose Cusano's forecast for season sales can be described with a Poisson distribution with mean 8.75. Furthermore, Cusano plans to make only one grill buy for the season. Grills left over at the end of the season are sold at a 75 percent discount.

a. How many grills should Cusano order?

b. What is Cusano's expected profit given Cusano's order in part a?

c. What is SJ's expected profit given Cusano's order in part a?

d. To maximize the supply chain's total profit (SJ's profit plus Cusano's profit), how many grills should be shipped to Cusano's Hardware? Suppose SJ were to accept unsold grills at the end of the season. Cusano would incur a $15 shipping cost per grill returned to SJ. Among the returned grills, 45 percent of them are damaged and SJ cannot resell them the following season, but the remaining 55 percent can be resold to some retailer for the full wholesale price of $185.

e. Given the possibility of returning grills to SJ, how many grills should be sent to Cusano's to maximize the supply chain's total profit?

Suppose SJ gives Cusano a 90 percent credit for each returned grill, that is, SJ pays Cusano $166.5 for each returned grill. Cusano still incurs a $15 cost to ship each grill back to SJ.

f. How many grills should Cusano order to maximize his profit?

g. What is Cusano's expected profit given Cusano's order in part f?

h. What is SJ's expected profit given Cusano's order in part f?

i. To maximize the supply chain's total profit, what should SJ's credit percentage be?

(The current credit is 90 percent.)

Dave Luna, the director of marketing and sales at SJ, suggests yet another arrangement. He suggests that SJ offer an advanced purchase discount. His plan works as follows: there is a 10 percent discount on any grill purchased before the season starts (the prebook order), but then retailers are able to purchase additional grills as needed during the season at the regular wholesale price (at-once orders). With this plan, retailers are responsible for selling any excess grills at the end of the season, that is, SJ will not accept returns. Assume SJ makes enough grills to satisfy Cusano's demand during the season and any leftover grills can be sold the next season at full price.

j. Given this advanced purchase discount plan, how many grills should Cusano prebook to maximize his profit?

k. What is Cusano's expected profit given Cusano's prebook order quantity in part j?

l. What is SJ's expected profit from sales to Cusano this season given Cusano's prebook order quantity in part j?

m. As a thought experiment, which one of these contractual arrangements would you recommend to SJ?

a. How many grills should Cusano order?

b. What is Cusano's expected profit given Cusano's order in part a?

c. What is SJ's expected profit given Cusano's order in part a?

d. To maximize the supply chain's total profit (SJ's profit plus Cusano's profit), how many grills should be shipped to Cusano's Hardware? Suppose SJ were to accept unsold grills at the end of the season. Cusano would incur a $15 shipping cost per grill returned to SJ. Among the returned grills, 45 percent of them are damaged and SJ cannot resell them the following season, but the remaining 55 percent can be resold to some retailer for the full wholesale price of $185.

e. Given the possibility of returning grills to SJ, how many grills should be sent to Cusano's to maximize the supply chain's total profit?

Suppose SJ gives Cusano a 90 percent credit for each returned grill, that is, SJ pays Cusano $166.5 for each returned grill. Cusano still incurs a $15 cost to ship each grill back to SJ.

f. How many grills should Cusano order to maximize his profit?

g. What is Cusano's expected profit given Cusano's order in part f?

h. What is SJ's expected profit given Cusano's order in part f?

i. To maximize the supply chain's total profit, what should SJ's credit percentage be?

(The current credit is 90 percent.)

Dave Luna, the director of marketing and sales at SJ, suggests yet another arrangement. He suggests that SJ offer an advanced purchase discount. His plan works as follows: there is a 10 percent discount on any grill purchased before the season starts (the prebook order), but then retailers are able to purchase additional grills as needed during the season at the regular wholesale price (at-once orders). With this plan, retailers are responsible for selling any excess grills at the end of the season, that is, SJ will not accept returns. Assume SJ makes enough grills to satisfy Cusano's demand during the season and any leftover grills can be sold the next season at full price.

j. Given this advanced purchase discount plan, how many grills should Cusano prebook to maximize his profit?

k. What is Cusano's expected profit given Cusano's prebook order quantity in part j?

l. What is SJ's expected profit from sales to Cusano this season given Cusano's prebook order quantity in part j?

m. As a thought experiment, which one of these contractual arrangements would you recommend to SJ?

Unlock Deck

Unlock for access to all 4 flashcards in this deck.

Unlock Deck

k this deck