Deck 25: Commercial Property Insurance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/18

Play

Full screen (f)

Deck 25: Commercial Property Insurance

1

Vince owns a television repair shop that is insured under a commercial package policy. The policy includes the building and personal property coverage form and the causes-of-loss broad form. The declarations page indicates that coverage applies to both the building and the named insured's business property. Explain whether or not the following losses would be covered under his policy.

a. A fire occurs on the premises, and the building is badly damaged.

b. A burglar steals some money and securities from an unlocked safe.

c. A business computer is damaged by vandals who break into the shop after business hours.

d. A tornado touches down near the store. Several television sets of customers in the shop for repair are damaged in the storm.

a. A fire occurs on the premises, and the building is badly damaged.

b. A burglar steals some money and securities from an unlocked safe.

c. A business computer is damaged by vandals who break into the shop after business hours.

d. A tornado touches down near the store. Several television sets of customers in the shop for repair are damaged in the storm.

Commercial package policy combines two or more coverages in one policy. One of the coverage forms is building and personal property coverage form.

The building and personal property (BPP) coverage covers the buildings, insureds personal property and personal property in care of others, custody or control.

In this case, V owns a TV repair shop and has taken commercial package policy that incudes building and personal property. Both building and personal property are under V's name.

(a)The building is damaged due to a fire.

This loss is covered by the policy.

(b)There is burglary; and money and securities are stolen from unlocked safe.

The personal property inside or on the building is covered under BPP. Thus, the loss shall be covered by the policy.

(c)Computer is damaged by vandals after the business hours.

The personal property inside or on the building is covered under BPP. Thus, the loss shall be covered by the policy.

(d)TV sets of customers is damaged by tornado.

This comes under personal property of others. This is the additional coverage provided by the policy.

Thus, this loss will be covered.

The building and personal property (BPP) coverage covers the buildings, insureds personal property and personal property in care of others, custody or control.

In this case, V owns a TV repair shop and has taken commercial package policy that incudes building and personal property. Both building and personal property are under V's name.

(a)The building is damaged due to a fire.

This loss is covered by the policy.

(b)There is burglary; and money and securities are stolen from unlocked safe.

The personal property inside or on the building is covered under BPP. Thus, the loss shall be covered by the policy.

(c)Computer is damaged by vandals after the business hours.

The personal property inside or on the building is covered under BPP. Thus, the loss shall be covered by the policy.

(d)TV sets of customers is damaged by tornado.

This comes under personal property of others. This is the additional coverage provided by the policy.

Thus, this loss will be covered.

2

What is a package policy?

b. Explain the advantages of a commercial package policy to a business firm as compared to the purchase of separate policies.

b. Explain the advantages of a commercial package policy to a business firm as compared to the purchase of separate policies.

a.Package policy: The policy which covers the features of more than one policy is known as package policy. The various features like property and liability insurance can be combined into single policy and combining known as package policy. The package policy provides the advantages like savings in the premium of the insurer, and it also provides convenience to the insured by holding single policy.

b.The commercial package policy has several advantages over individual policies. The main advantage of commercial package policy is that it is used by offices, hotels, schools, firms, apartment houses, to reduce the gaps in coverage. The package policy provides the advantages like savings in the premium of the insurer, and it also provides convenience to the insured by holding single policy.

b.The commercial package policy has several advantages over individual policies. The main advantage of commercial package policy is that it is used by offices, hotels, schools, firms, apartment houses, to reduce the gaps in coverage. The package policy provides the advantages like savings in the premium of the insurer, and it also provides convenience to the insured by holding single policy.

3

Never-Die Battery manufactures batteries for industrial and consumer use. The company purchased a commercial package policy (CPP) to cover its property exposures. In addition to common policy conditions and declarations, the policy contains a building and personal property coverage form and an equipment breakdown protection coverage form. The policy also contains the causes-of-loss broad form. With respect to each of the following losses, indicate whether or not the loss is covered.

a. An explosion occurred that damaged the building where finished batteries are stored.

b. Because of the explosion, the company incurred expenses for expedited shipping of replacement parts for machines used to manufacture the batteries.

c. The explosion injured several employees who received emergency treatment at a local hospital.

d. An automatic sprinkler system accidentally discharged in the finished goods building. Some recently manufactured batteries were ruined because of water damage and corrosion.

a. An explosion occurred that damaged the building where finished batteries are stored.

b. Because of the explosion, the company incurred expenses for expedited shipping of replacement parts for machines used to manufacture the batteries.

c. The explosion injured several employees who received emergency treatment at a local hospital.

d. An automatic sprinkler system accidentally discharged in the finished goods building. Some recently manufactured batteries were ruined because of water damage and corrosion.

Building and personal property coverage form with equipment breakdown protection coverage form

Building and personal property coverage form covers the direct physical loss to the commercial and business property. It is a commercial property coverage form. The basic coverage under this form is covered property, additional coverage and optional coverage. The causes-of-loss broad form basically covers the damages occurring out of property and main damages covered are fire, smoke, explosion, lightning, windstorm, aircraft, vandalism, riot, volcanic action, sinkhole collapse, sprinkler leakage, water damage, falling objects, weight of snow, ice, etc and collapse of building.

The equipment breakdown insurance covers any physical damage to the equipment covered. The equipment include, steam boiler, refrigeration and conditioning equipment, electrical equipment, pumps, compressors, turbines, machinery and computer equipments, etc.The coverage includes, physical damage, expediting expenses, business and extra income expenses, spoilage damage, utility interruption, newly acquired premises, etc.

a.The batteries company is covered under the business and personal property insurance. As per this policy the building in the name of insured's is covered and as per the causes-of-loss broad form damages through explosion are also covered. Thus, the damages occurred to the company owner through explosion are covered under this policy.

b.The battery company is covered under the equipment breakdown insurance. As per this policy the expediting expenses are covered. Thus, the damages occurred to the shop owner through expediting are covered under this policy.

c.As per business and personal property insurance and equipment breakdown insurance any physical damage to the person or property are covered. Thus, the damages occurred to the employees through explosion are covered under this policy.

d.The battery company is covered under the equipment breakdown insurance. As per this policy the sprinkler expenses are covered. Thus, the damages occurred to the shop owner through this are covered under this policy.

Building and personal property coverage form covers the direct physical loss to the commercial and business property. It is a commercial property coverage form. The basic coverage under this form is covered property, additional coverage and optional coverage. The causes-of-loss broad form basically covers the damages occurring out of property and main damages covered are fire, smoke, explosion, lightning, windstorm, aircraft, vandalism, riot, volcanic action, sinkhole collapse, sprinkler leakage, water damage, falling objects, weight of snow, ice, etc and collapse of building.

The equipment breakdown insurance covers any physical damage to the equipment covered. The equipment include, steam boiler, refrigeration and conditioning equipment, electrical equipment, pumps, compressors, turbines, machinery and computer equipments, etc.The coverage includes, physical damage, expediting expenses, business and extra income expenses, spoilage damage, utility interruption, newly acquired premises, etc.

a.The batteries company is covered under the business and personal property insurance. As per this policy the building in the name of insured's is covered and as per the causes-of-loss broad form damages through explosion are also covered. Thus, the damages occurred to the company owner through explosion are covered under this policy.

b.The battery company is covered under the equipment breakdown insurance. As per this policy the expediting expenses are covered. Thus, the damages occurred to the shop owner through expediting are covered under this policy.

c.As per business and personal property insurance and equipment breakdown insurance any physical damage to the person or property are covered. Thus, the damages occurred to the employees through explosion are covered under this policy.

d.The battery company is covered under the equipment breakdown insurance. As per this policy the sprinkler expenses are covered. Thus, the damages occurred to the shop owner through this are covered under this policy.

4

Identify the causes of loss that are covered under the following forms:

a. Causes-of-loss basic form

b. Causes-of-loss broad form

c. Causes-of-loss special form

a. Causes-of-loss basic form

b. Causes-of-loss broad form

c. Causes-of-loss special form

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

5

Ashley owns a retail shoe store that is insured for $120,000 under the business income (and extra expense) coverage form. Because of a fire, Ashley was forced to close the store for three months. Based on past and projected future earnings, Ashley expected the store to earn a net income of $30,000 during the three-month shutdown period if the loss had not occurred. During the shutdown period, there were no revenues, and Ashley had continuing expenses of $10,000. How much will Ashley recover for the business income loss? Explain your answer.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

6

Explain the following provisions in the building and personal property coverage form:

a. Covered property

b. Additional coverages

c. Optional coverages

a. Covered property

b. Additional coverages

c. Optional coverages

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

7

Janet is the risk manager of Daily News, a daily publication in a highly competitive market. She wants to be certain that the newspaper will continue to be published if the company's printing facilities are damaged or destroyed by a covered cause of loss. What type of insurance can Janet purchase to cover the added cost of continuing to print the paper after a physical damage loss has occurred?

b. Mitchell opened a bookstore in a mall. His store was located between a theater and a department store. Mitchell counts on the theater and department store to generate walk-in business for his store. He knows that if either of the other businesses closes, his store would incur a substantial financial loss. What type of insurance can Mitchell purchase to cover this type of loss exposure?

b. Mitchell opened a bookstore in a mall. His store was located between a theater and a department store. Mitchell counts on the theater and department store to generate walk-in business for his store. He knows that if either of the other businesses closes, his store would incur a substantial financial loss. What type of insurance can Mitchell purchase to cover this type of loss exposure?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

8

The business income (and extra expense) coverage form has a number of policy provisions. Explain the following provisions:

a. Business income loss

b. Coverage of extra expenses

a. Business income loss

b. Coverage of extra expenses

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

9

The Mary Queen, an ocean-going oil tanker, negligently collided with a large freighter. The Mary Queen is insured by an ocean marine hull insurance policy with a running down clause. For each of the following losses, explain whether the ocean marine coverage would apply to the loss.

a. Damage to the Mary Queen

b. Damage to the freighter

c. Death or injury to the crew members on the freighter

a. Damage to the Mary Queen

b. Damage to the freighter

c. Death or injury to the crew members on the freighter

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

10

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

11

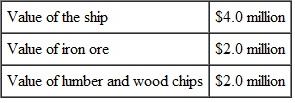

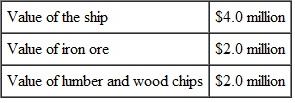

An Ocean Transfer cargo ship was forced to jettison some cargo during a severe storm. The various interests in the voyage at the time the property was jettisoned are the following:

The captain jettisoned iron ore valued at $800,000. What is the amount that Ocean Transfer must pay under a general average loss? Explain your answer.

The captain jettisoned iron ore valued at $800,000. What is the amount that Ocean Transfer must pay under a general average loss? Explain your answer.

The captain jettisoned iron ore valued at $800,000. What is the amount that Ocean Transfer must pay under a general average loss? Explain your answer.

The captain jettisoned iron ore valued at $800,000. What is the amount that Ocean Transfer must pay under a general average loss? Explain your answer.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

12

Explain the following ocean marine insurance coverages:

a. Hull insurance

b. Cargo insurance

c. Protection and indemnity (P I) insurance

d. Freight insurance

a. Hull insurance

b. Cargo insurance

c. Protection and indemnity (P I) insurance

d. Freight insurance

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

13

The value of business personal property at Ruth's business fluctuates periodically, which is due largely to fluctuations in the value of inventory on hand. Ruth's property insurance policy requires the periodic reporting of business personal property. The limit of insurance is $500,000. Ruth believes she can save money by underreporting the value of inventory. Last period, she reported only $200,000 when the actual value was $400,000. Shortly after filing the last report, the value of the inventory increased to $500,000. The inventory was totally destroyed when a fire occurred. Ignoring any deductible, what is the amount that Ruth's insurer will pay? Explain your answer.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

14

What is the difference between a particular average loss and a general average loss in ocean marine insurance?

b. What conditions must be fulfilled to have a general average loss?

b. What conditions must be fulfilled to have a general average loss?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

15

Douglas owns and operates a small furniture store. In addition to Douglas, the firm employs two sales representatives. Douglas's insurance agent advises him that the store can be insured under a businessowners policy (BOP). Identify the various property loss exposures to Douglas's furniture store that can be covered by a businessowners policy.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

16

Identify the major types of commercial property that can be insured under an inland marine insurance policy.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

17

Briefly describe the following inland marine coverages:

a. Accounts receivable coverage form

b. Valuable papers and records coverage form

c. Bailees customer policy

a. Accounts receivable coverage form

b. Valuable papers and records coverage form

c. Bailees customer policy

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

18

A businessowners policy (BOP) contains a number of coverages. Explain the following:

a. Coverage of buildings

b. Coverage of business personal property

c. Covered causes of loss

d. Additional coverages provided by the BOP

a. Coverage of buildings

b. Coverage of business personal property

c. Covered causes of loss

d. Additional coverages provided by the BOP

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck