Deck 9: Price Takers and the Competitive Process

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 9: Price Takers and the Competitive Process

1

A combination of high crude oil prices and government subsidies for ethanol have led to a sharp increase in the demand for corn in recent years. How will this increase in demand for corn influence (a) the price of corn; (b) the quantity of corn supplied; (c) the cost of producing soybeans and wheat, crops that are often produced on land suitable for production of corn; (d) the price of cereals, tortillas, and other products produced from corn; and (e) the price of beef, chicken, and pork, meats produced from animals that are generally fed large quantities of corn? Explain each of your answers.

According to the given situation, if the demand of corn is increased, then the price of corn will also increase.

After a significant increase in the price of corn, more people will start to produce and so the supply will also increase.

The cost of producing soybeans and wheat will reduce, because more people will start to produce corn, so that the production of soybeans and wheat will reduce, which ultimately reduces the cost of production. This is because as the lands are suitable for the production of corn, growing soybeans and wheat require additional production costs.

If corn is used as a production input in producing cereals, tortillas and other products, then the price of these products will increase. Since the price of corn is already increased, it leads to increase in the cost of production. Hence, the price of these products will increase.

The cost of production of animal meat will increase, as they are fed a large quantity of high priced corn, which ultimately increase the price of meat.

After a significant increase in the price of corn, more people will start to produce and so the supply will also increase.

The cost of producing soybeans and wheat will reduce, because more people will start to produce corn, so that the production of soybeans and wheat will reduce, which ultimately reduces the cost of production. This is because as the lands are suitable for the production of corn, growing soybeans and wheat require additional production costs.

If corn is used as a production input in producing cereals, tortillas and other products, then the price of these products will increase. Since the price of corn is already increased, it leads to increase in the cost of production. Hence, the price of these products will increase.

The cost of production of animal meat will increase, as they are fed a large quantity of high priced corn, which ultimately increase the price of meat.

2

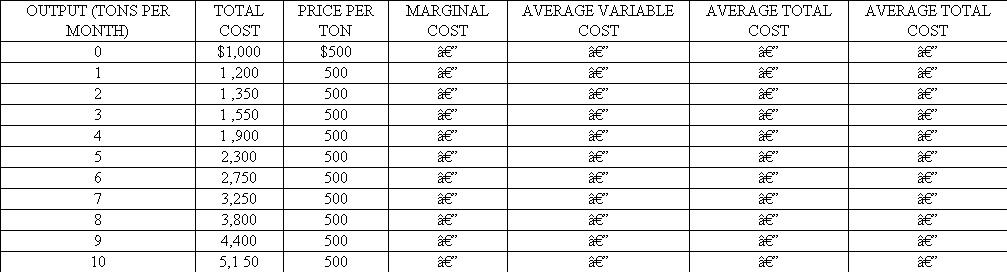

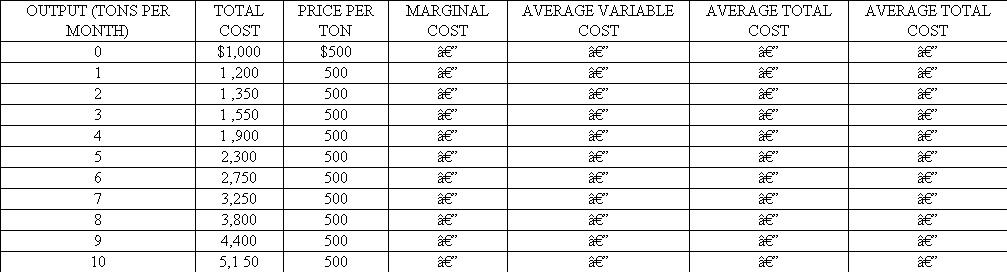

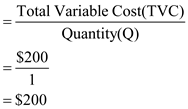

*The accompanying table presents the expected cost and revenue data for the Tucker Tomato Farm. The Tuckers produce tomatoes in a greenhouse and sell them wholesale in a price-taker market.

a. Fill in the firm's marginal cost, average variable cost, average total cost, and profit schedules.

b. If the Tuckers are profit maximizers, how many tomatoes should they produce when the market price is $500 per ton? Indicate their profits.

c. Indicate the firm's output level and maximum profit if the market price of tomatoes increases to $550 per ton.

d. How many units would the Tucker Tomato Farm produce if the price of tomatoes fell to $450 per ton? What would be the firm's profits? Should the firm stay in business? Explain.

Cost and Revenue Schedules for Tucker Tomato Farm, Inc.

a. Fill in the firm's marginal cost, average variable cost, average total cost, and profit schedules.

b. If the Tuckers are profit maximizers, how many tomatoes should they produce when the market price is $500 per ton? Indicate their profits.

c. Indicate the firm's output level and maximum profit if the market price of tomatoes increases to $550 per ton.

d. How many units would the Tucker Tomato Farm produce if the price of tomatoes fell to $450 per ton? What would be the firm's profits? Should the firm stay in business? Explain.

Cost and Revenue Schedules for Tucker Tomato Farm, Inc.

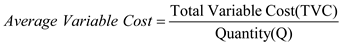

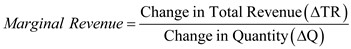

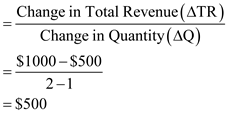

Calculation of cost and revenue of Tucker Tomato Farm:

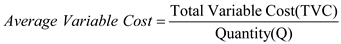

Where,

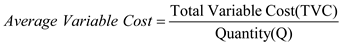

For example, AVC at 1-ton output is

For example, AVC at 1-ton output is

The same procedure is repeated to obtain AVC at different values of output.

The same procedure is repeated to obtain AVC at different values of output.

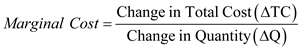

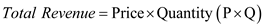

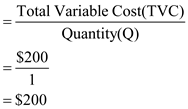

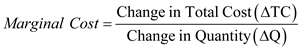

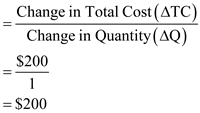

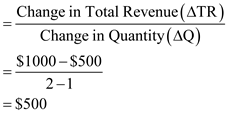

For example, MC at 1-ton output is

For example, MC at 1-ton output is

The same procedure is repeated to obtain MC at different values of output.

The same procedure is repeated to obtain MC at different values of output.

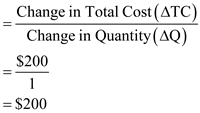

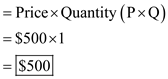

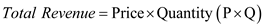

For example total revenue at 1 ton output is

For example total revenue at 1 ton output is

The same procedure is repeated to obtain TR at different values of output

The same procedure is repeated to obtain TR at different values of output

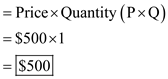

For example total revenue at 1-ton output is

For example total revenue at 1-ton output is

The same procedure is repeated to obtain MR at different values of output.

The same procedure is repeated to obtain MR at different values of output.

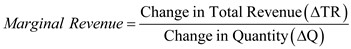

For example total revenue at 1-ton output is

For example total revenue at 1-ton output is

0

0

The same procedure is repeated to obtain profit at different values of output.

Therefore, the following table is obtained on calculations:

1

1

If the Tuckers are earning maximum profit, then 6 or 7 tons of tomatoes should be produced where the profit is equal to $250.

Firm can earn maximum equal to $475 at the output of 8 tons of tomatoes.

Tucker Tomato farm should produce 5 or 6 tons at a price of $450. There will be a loss equal to $50. Yes, it should stay in business, as the reduction in price is temporary.

Where,

For example, AVC at 1-ton output is

For example, AVC at 1-ton output is The same procedure is repeated to obtain AVC at different values of output.

The same procedure is repeated to obtain AVC at different values of output. For example, MC at 1-ton output is

For example, MC at 1-ton output is The same procedure is repeated to obtain MC at different values of output.

The same procedure is repeated to obtain MC at different values of output. For example total revenue at 1 ton output is

For example total revenue at 1 ton output is The same procedure is repeated to obtain TR at different values of output

The same procedure is repeated to obtain TR at different values of output For example total revenue at 1-ton output is

For example total revenue at 1-ton output is The same procedure is repeated to obtain MR at different values of output.

The same procedure is repeated to obtain MR at different values of output. For example total revenue at 1-ton output is

For example total revenue at 1-ton output is 0

0The same procedure is repeated to obtain profit at different values of output.

Therefore, the following table is obtained on calculations:

1

1If the Tuckers are earning maximum profit, then 6 or 7 tons of tomatoes should be produced where the profit is equal to $250.

Firm can earn maximum equal to $475 at the output of 8 tons of tomatoes.

Tucker Tomato farm should produce 5 or 6 tons at a price of $450. There will be a loss equal to $50. Yes, it should stay in business, as the reduction in price is temporary.

3

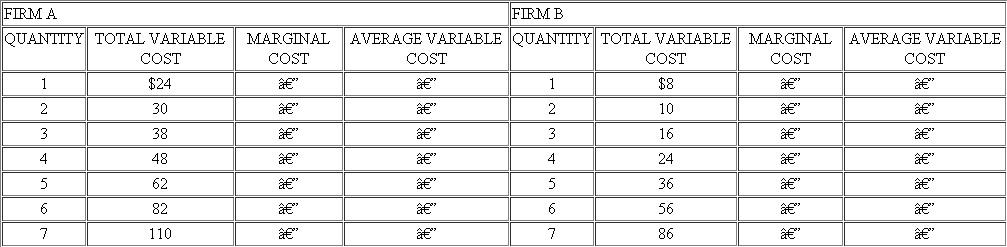

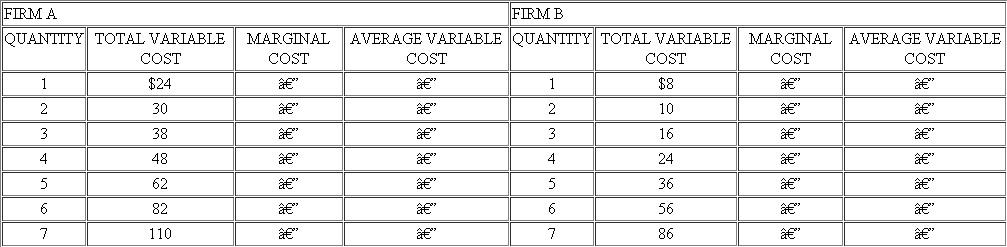

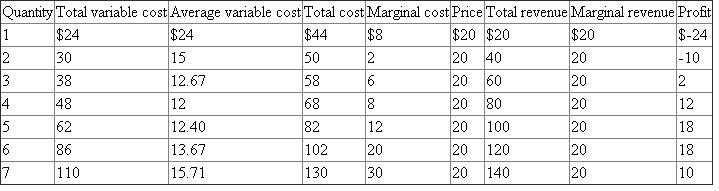

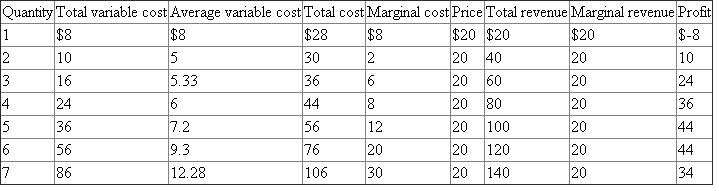

In the accompanying table, you are given information about two firms that compete in a price-taker market. Assume that fixed costs for each firm are $20.

a. Complete the table.

b. What is the lowest price at which firm A will produce?

c. How many units of output will it produce at that price? (Assume that it cannot produce fractional units.)

d. What is the lowest price at which firm B will produce?

e. How many units of output will it produce?

f. How many units will firm A produce if the market price is $20?

g. How many units will firm B produce at the $20 price? (Assume that it cannot produce fractional units.)

h. If each firm's total fixed costs are $20 and the price of output is $20, which firm would earn a higher net profit or incur a smaller loss?

i. How much would that net profit or loss be?

*Asterisk denotes questions for which answers are given in Appendix B.

a. Complete the table.

b. What is the lowest price at which firm A will produce?

c. How many units of output will it produce at that price? (Assume that it cannot produce fractional units.)

d. What is the lowest price at which firm B will produce?

e. How many units of output will it produce?

f. How many units will firm A produce if the market price is $20?

g. How many units will firm B produce at the $20 price? (Assume that it cannot produce fractional units.)

h. If each firm's total fixed costs are $20 and the price of output is $20, which firm would earn a higher net profit or incur a smaller loss?

i. How much would that net profit or loss be?

*Asterisk denotes questions for which answers are given in Appendix B.

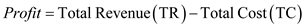

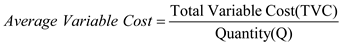

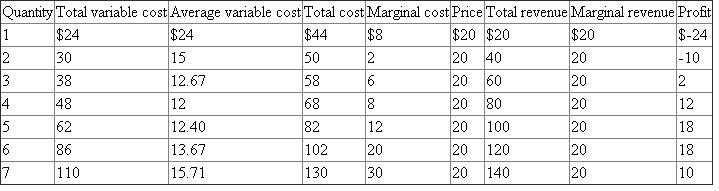

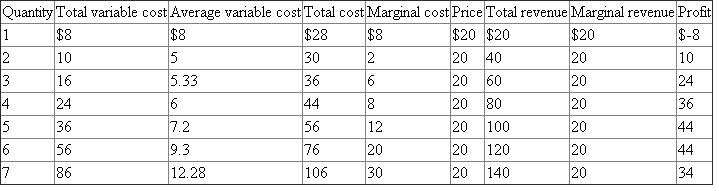

Calculation of firm A and B in price taker market:

Where,

Average Variable Cost = Total Variable Cost/Quantity

Total Cost = Total Variable Cost + Fixed Cost ($20 given)

Marginal Cost = Change in Total Cost/ Change in Quantity

Price is given =$20

Total Revenue = Price × Quantity

Marginal Revenue = Change in Total Revenue/ Change in Quantity

Profit = Total Revenue - Total Cost

Market A

Market B

Market B

As the firm A is price taker in the market and the price is give equal to $20. Hence the price will be $20.

As the firm A is price taker in the market and the price is give equal to $20. Hence the price will be $20.

Firm A will produce 6 units at price of $20, because at this quantity Marginal revenue is equal to the marginal cost.

As the firm B is price taker in the market and the price is give equal to $20. Hence the price will be $20.

Firm B will produce 6 units at price of $20, because at this quantity Marginal revenue is equal to the marginal cost.

If Firm A is price taker then it will produce 6 units at price of $20, because at this quantity Marginal revenue is equal to the marginal cost.

Firm B will produce 6 units at price of $20.

Both the firms are price taker in the market, if the total fixed cost is $20 and price is $20 then firm B will earn more profit equal to $44 as compare to firm A whose profit is equal to $18.

Net profit of firm A will be equal to $18 and for firm B net profit will be equal to $44.

Where,

Average Variable Cost = Total Variable Cost/Quantity

Total Cost = Total Variable Cost + Fixed Cost ($20 given)

Marginal Cost = Change in Total Cost/ Change in Quantity

Price is given =$20

Total Revenue = Price × Quantity

Marginal Revenue = Change in Total Revenue/ Change in Quantity

Profit = Total Revenue - Total Cost

Market A

Market B

Market B As the firm A is price taker in the market and the price is give equal to $20. Hence the price will be $20.

As the firm A is price taker in the market and the price is give equal to $20. Hence the price will be $20.Firm A will produce 6 units at price of $20, because at this quantity Marginal revenue is equal to the marginal cost.

As the firm B is price taker in the market and the price is give equal to $20. Hence the price will be $20.

Firm B will produce 6 units at price of $20, because at this quantity Marginal revenue is equal to the marginal cost.

If Firm A is price taker then it will produce 6 units at price of $20, because at this quantity Marginal revenue is equal to the marginal cost.

Firm B will produce 6 units at price of $20.

Both the firms are price taker in the market, if the total fixed cost is $20 and price is $20 then firm B will earn more profit equal to $44 as compare to firm A whose profit is equal to $18.

Net profit of firm A will be equal to $18 and for firm B net profit will be equal to $44.

4

*Farmers are often heard to complain about the high costs of machinery, labor, and fertilizer, suggesting that these costs drive down their profits. Does it follow that if, for example, the price of fertilizer fell by 10 percent, farming (a highly competitive industry with low barriers to entry) would be more profitable? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

*If the firms in a price-taker market are making short-run profits, what will happen to the market price in the long run? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

"In a price-taker market, if a business operator produces efficiently-that is, if the cost of producing the good is minimized-the operator will be able to make at least a normal profit." True or false? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose the government of a large city levies a 5 percent sales tax on hotel rooms. How will the tax affect (a) prices of hotel rooms, (b) the profits of hotel owners, and (c) gross expenditures (including the tax) on hotel rooms?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

*If coffee suppliers are price takers, how will an unanticipated increase in demand for their product affect each of the following, in a market that was initially in long-run equilibrium?

a. the short-run market price of the product

b. industry output in the short run

c. profitability in the short run

d. the long-run market price in the industry

e. industry output in the long run

f. profitability in the long run

a. the short-run market price of the product

b. industry output in the short run

c. profitability in the short run

d. the long-run market price in the industry

e. industry output in the long run

f. profitability in the long run

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

*Suppose that the development of a new drought-resistant hybrid seed corn leads to a 50 percent increase in the average yield per acre without increasing the cost to the farmers who use the new technology. If the producers in the corn production industry were price takers, what would happen to the following?

a. the price of corn

b. the profitability of corn farmers who quickly adopt the new technology

c. the profitability of corn farmers who are slow to adopt the new technology

d. the price of soybeans, a substitute product for corn

a. the price of corn

b. the profitability of corn farmers who quickly adopt the new technology

c. the profitability of corn farmers who are slow to adopt the new technology

d. the price of soybeans, a substitute product for corn

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

"When the firms in the industry are just able to cover their cost of production, economic profit is zero. Therefore, if demand falls, causing prices to go down even a little bit, all of the firms in the industry will be driven out of business." True or false? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

Why does the short-run market supply curve for a product slope upward to the right? Why does the long-run market supply curve generally slope upward to the right? Why is the long-run market supply curve generally more elastic than the short-run supply curve?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

*How does competition among firms affect the incentive of each firm to (a) operate efficiently (produce at a low per-unit cost) and (b) produce goods that consumers value? What happens to firms that fail to do these two things?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

Will firms in a price-taker market be able to earn profits in the long run? Why or why not? What determines profitability? Discuss.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

*During 2011, drought conditions throughout much of Europe substantially reduced the size of the corn, wheat, and soybean crops, three commodities for which demand is inelastic. Use the price-taker model to determine how the drought affected (a) prices of the three commodities, (b) revenue from the three crops, and (c) the profitability of those farming the three crops.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

Why is competition in a market important? Is there a positive or negative effect on the economy when strong competitive pressures drive various firms out of business? Discuss.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

Do business firms in competitive markets have a strong incentive to serve the interests of consumers? Are they motivated by a strong desire to help consumers? Are "good intentions" necessary if individuals are going to engage in actions that are helpful to others? Discuss.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck