Deck 19: International Trade

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/67

Play

Full screen (f)

Deck 19: International Trade

1

The entire flow of U.S. dollars and foreign currencies into and out of the country constitutes our ____________________________.

What the entire flow of home and foreign currencies into and out of the country constitutes is required to be stated.

The balance of payments is a record of all currencies flows into and out of the country. Therefore, the correct answer is balance of payments.

The balance of payments is a record of all currencies flows into and out of the country. Therefore, the correct answer is balance of payments.

2

We became a debtor nation in ____.

A) 1975

B) 1980

C) 1985

D) 1990

A) 1975

B) 1980

C) 1985

D) 1990

When the import of a country is much higher than their exports there is outflow of currency from domestic country to foreign countries. This imbalance or trade deficit is properly known as trade imbalance.

In the 2 nd half of 19 centaury US borrow lumpsum amount from European nations to finance their infrastructure, plants and equipment. The US quickly shifted from being the largest creditor to the largest debtor of World.

In 1985 US became a net debtor nation.

Hence, option a, b, and d are incorrect.

US become the classic debtor to fulfill their industrial need from 1985.

Hence,

is correct.

is correct.

In the 2 nd half of 19 centaury US borrow lumpsum amount from European nations to finance their infrastructure, plants and equipment. The US quickly shifted from being the largest creditor to the largest debtor of World.

In 1985 US became a net debtor nation.

Hence, option a, b, and d are incorrect.

US become the classic debtor to fulfill their industrial need from 1985.

Hence,

is correct.

is correct. 3

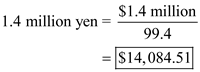

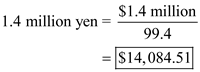

A Toyota Corolla priced at 1.4 million yen.

Using the given exchange rate, it is required to be stated how much it would cost in USD to buy a car priced 1.4 million yen.

As per the given exchange rate, the exchange rate of $1 is 99.4 yen. This means 99.4 yen are equivalent to $1. Therefore,

Therefore, it would cost $14,084.51 to buy a car priced 1.4 million yen.

Therefore, it would cost $14,084.51 to buy a car priced 1.4 million yen.

As per the given exchange rate, the exchange rate of $1 is 99.4 yen. This means 99.4 yen are equivalent to $1. Therefore,

Therefore, it would cost $14,084.51 to buy a car priced 1.4 million yen.

Therefore, it would cost $14,084.51 to buy a car priced 1.4 million yen. 4

What is meant by our balance of payments? Explain what current account and capital account are.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

5

Most all the dollars that foreigners have earned from trading with the United States have been ___________________________ in the form of ___________________________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

6

In 2007 our net foreign debt was over $ ____ trillion.

A) one

B) two

C) three

D) four

E) five

A) one

B) two

C) three

D) four

E) five

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

7

A carton of Canadian paper priced at $9.00 Canadian.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

8

What is the gold standard? How does it work?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

9

The basis for international finance is the exchange of ______________________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

10

Which statement is true?

A) In the 1980s we did not receive many dollars in investment funds from foreigners.

B) In the 1980s foreign investment funds were attracted by our high interest rates.

C) Our military spending has helped reduce our current account deficit.

D) None of these statements is true.

A) In the 1980s we did not receive many dollars in investment funds from foreigners.

B) In the 1980s foreign investment funds were attracted by our high interest rates.

C) Our military spending has helped reduce our current account deficit.

D) None of these statements is true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

11

A British book priced at 12 pounds.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

12

Why does the dollar fluctuate with other currencies?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

13

A nation is on the gold standard when it ____________________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

14

During the 1980s, ____.

A) both American investment abroad and foreign investment in the United States increased

B) both American investment abroad and foreign investment in the United States decreased

C) American investment abroad increased and foreign investment in the United States decreased

D) American investment abroad decreased and foreign investment in the United States increased

A) both American investment abroad and foreign investment in the United States increased

B) both American investment abroad and foreign investment in the United States decreased

C) American investment abroad increased and foreign investment in the United States decreased

D) American investment abroad decreased and foreign investment in the United States increased

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

15

A German camera priced at 250 euros.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

16

How did the United States go from being the world's largest creditor nation to the world's largest debtor?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

17

To be on the gold standard, a nation must maintain a fixed ratio between its gold stock and _____________________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

18

The world's leading debtor nation is ____.

A) Argentina

B) Brazil

C) Mexico

D) the United States

A) Argentina

B) Brazil

C) Mexico

D) the United States

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

19

A DVD priced at $10 is sold in Toronto.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

20

Can there be a deficit on Current Account and a deficit on Capital Account at the same time? Explain.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

21

Under the gold standard, if country J imports more than it exports, it has to ship ___________________ to the trading partners with whom it has trade deficits. This will depress country J's ______________, and its price level will _________________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

22

Which statement is true?

A) Foreigners own most of the assets in the United States.

B) We own more assets in foreign countries than foreigners own in the United States.

C) Foreigners are driving up interest rates in the United States.

D) None of these statements is true.

A) Foreigners own most of the assets in the United States.

B) We own more assets in foreign countries than foreigners own in the United States.

C) Foreigners are driving up interest rates in the United States.

D) None of these statements is true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

23

Windows Vista priced at $100 is sold in China.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

24

For several months before your vacation trip to Germany you find that the exchange rate for the dollar has increased relative to the euro. Are you pleased or saddened? Explain.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

25

Under the gold standard, if country K's price level declines, its imports will ____________________ and its exports will ___________________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

26

Which one of the following statement is the most accurate?

A) As a percentage of GDP, the United States has the highest current account surplus of any nation.

B) As a percentage of GDP, the United States has the highest current account deficit of any nation.

C) As a percentage of GDP, our current account deficit is roughly the same as it was 10 years ago.

D) Our current account deficit is rising at an unsustainable pace.

A) As a percentage of GDP, the United States has the highest current account surplus of any nation.

B) As a percentage of GDP, the United States has the highest current account deficit of any nation.

C) As a percentage of GDP, our current account deficit is roughly the same as it was 10 years ago.

D) Our current account deficit is rising at an unsustainable pace.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

27

A Cadillac priced at $20,000 is sold in London.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

28

If the dollar depreciates relative to the Japanese yen, will the Sony DVD player you wanted become more or less expensive? What effect will this have on the number of Sony DVD players that Americans buy?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

29

Today exchange rates are set by _______________ and _____________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

30

An American importer of Italian shoes would pay in ____.

A) dollars

B) gold

C) euros

D) lira

A) dollars

B) gold

C) euros

D) lira

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

31

A bottle of Viagra priced at $20 is sold in Berlin.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

32

Explain why a currency depreciation leads to an improvement in a nation's balance of trade.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

33

If Tim Matray wanted to buy wine from a French merchant, he would pay her with _____________.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

34

The total of our current and capital accounts ____.

A) will always be zero

B) will always be negative

C) will always be positive

D) may be positive or negative

A) will always be zero

B) will always be negative

C) will always be positive

D) may be positive or negative

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

35

A country had exports of $100 billion, imports of $90 billion, net transfers from abroad of ?$10 billion, and ?$5 billion of net income from foreign investments. What is the country's current account balance?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

36

What is a foreign exchange rate? Provide a few examples.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

37

The main difference between our being a debtor nation in the 19th century and our being a debtor nation since the early 1980s was that in the 19th century we ran up a debt by buying ____________ goods; since the early 1980s we have run up a debt buying ____________ goods.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

38

In recent years we bought ____ from foreigners than they bought from us, and we invested ____ in foreign countries than foreigners invested in the United States.

A) more, more

B) less, less

C) less, more

D) more, less

A) more, more

B) less, less

C) less, more

D) more, less

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

39

Brazil ran a current account deficit of $55 billion. What is its balance on the capital account?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

40

How is the exchange rate determined in a freely floating rate system?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

41

Today international finance is based on ____.

A) the gold standard

B) mainly a relatively free-floating exchange rate system

C) fixed rates of exchange

A) the gold standard

B) mainly a relatively free-floating exchange rate system

C) fixed rates of exchange

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

42

If you could buy a market basket of goods and services in the United States for $1,000 and those same goods and services cost you $1,200 after you converted your dollars into euros, (a) is the euro undervalued or overvalued relative to the dollar? (b) by what percent?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

43

Who demands Japanese yen? Who supplies yen?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

44

The international gold standard worked well until ____.

A) World War I

B) 1940

C) 1968

D) 1975

A) World War I

B) 1940

C) 1968

D) 1975

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

45

If you could buy a market basket of goods and services in the United States for $10,000 and those same goods and services cost you $7,000 in Russia after you converted your dollars into rubles, (a) is the ruble undervalued or overvalued relative to the dollar? (b) by what percent?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

46

Practical Application: Foreigners are buying up hundreds of billions of dollars in American assets. In what ways should this be a matter of concern to Americans?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

47

If we were on an international gold standard, ____.

A) inflations would be eliminated

B) recessions would be eliminated

C) trade deficits and surpluses would be eliminated

D) no nation would ever have to devaluate its currency

A) inflations would be eliminated

B) recessions would be eliminated

C) trade deficits and surpluses would be eliminated

D) no nation would ever have to devaluate its currency

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is false?

A) The gold standard will work only when the gold supply increases as quickly as the world's need for money.

B) The gold standard will work only if all nations agree to devaluate their currencies simultaneously.

C) The gold standard will work only if participating nations are willing to accept periodic inflation.

D) The gold standard will work only if participating nations are willing to accept periodic unemployment.

A) The gold standard will work only when the gold supply increases as quickly as the world's need for money.

B) The gold standard will work only if all nations agree to devaluate their currencies simultaneously.

C) The gold standard will work only if participating nations are willing to accept periodic inflation.

D) The gold standard will work only if participating nations are willing to accept periodic unemployment.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

49

The gold exchange standard was in effect from ____.

A) 1900 to 1944

B) 1944 to 1973

C) 1955 to 1980

D) 1973 to the present

A) 1900 to 1944

B) 1944 to 1973

C) 1955 to 1980

D) 1973 to the present

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

50

The United States began to consistently run current account deficits since ____.

A) 1961

B) 1971

C) 1981

D) 1991

E) 2001

A) 1961

B) 1971

C) 1981

D) 1991

E) 2001

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

51

Today currency exchange rates are set mainly by ____.

A) the International Monetary Fund

B) the U.S. Treasury

C) bilateral agreements between trading nations

D) supply and demand

A) the International Monetary Fund

B) the U.S. Treasury

C) bilateral agreements between trading nations

D) supply and demand

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

52

The most important influence on the exchange rate between two countries is ____.

A) the relative price levels of the two countries

B) the relative growth rates of the two countries

C) the relative level of interest rates in both countries

D) the relative wage rates of both countries

A) the relative price levels of the two countries

B) the relative growth rates of the two countries

C) the relative level of interest rates in both countries

D) the relative wage rates of both countries

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

53

Devaluation would tend to ____.

A) make the devaluating country's goods cheaper

B) make the devaluating country's goods more expensive

C) have no effect on the value of the devaluating country's goods

A) make the devaluating country's goods cheaper

B) make the devaluating country's goods more expensive

C) have no effect on the value of the devaluating country's goods

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

54

Which is the most accurate statement?

A) Since the euro was introduced it has lost almost half its value.

B) The euro has facilitated trade among the members of the euro zone.

C) The euro is now the world's most important reserve currency.

D) The euro circulates as currency in most of the countries of the world.

A) Since the euro was introduced it has lost almost half its value.

B) The euro has facilitated trade among the members of the euro zone.

C) The euro is now the world's most important reserve currency.

D) The euro circulates as currency in most of the countries of the world.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

55

The main reason why we are the world's largest debtor nation is ____.

A) our military spending

B) our trade deficit

C) inflation

D) high taxes

A) our military spending

B) our trade deficit

C) inflation

D) high taxes

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

56

Which is the most accurate statement?

A) Since our current account deficit is matched by our capital account surplus, we have no problem with respect to our international transactions.

B) Foreigners invest all the dollars they receive from our capital account deficit to buy American assets.

C) Our current account deficits are declining and should disappear before the year 2015.

D) A declining dollar makes foreign investment in dollar-denominated assets much less attractive to foreigners.

A) Since our current account deficit is matched by our capital account surplus, we have no problem with respect to our international transactions.

B) Foreigners invest all the dollars they receive from our capital account deficit to buy American assets.

C) Our current account deficits are declining and should disappear before the year 2015.

D) A declining dollar makes foreign investment in dollar-denominated assets much less attractive to foreigners.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

57

Which of these is the most accurate statement?

A) There is no basis for the claim that the United States is living beyond its means.

B) Our current account deficit is not a serious problem.

C) Our trade deficit is a major economic problem.

D) Since 2002 the dollar has been rising against most major currencies.

A) There is no basis for the claim that the United States is living beyond its means.

B) Our current account deficit is not a serious problem.

C) Our trade deficit is a major economic problem.

D) Since 2002 the dollar has been rising against most major currencies.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

58

If you were going to spend time in Italy, France, and Germany, you would be paying for things with ____.

A) lira, francs, and marks

B) dollars

C) euros

D) gold

A) lira, francs, and marks

B) dollars

C) euros

D) gold

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

59

Which is the most accurate statement?

A) Our balance on the current account is negative.

B) Since our balance of payments is always zero, there is little to worry about.

C) The income Americans receive from their foreign investments is much greater than the income foreigners receive for their American investments.

D) Because our imports are much greater than our exports, the federal government is forced to make up the difference.

A) Our balance on the current account is negative.

B) Since our balance of payments is always zero, there is little to worry about.

C) The income Americans receive from their foreign investments is much greater than the income foreigners receive for their American investments.

D) Because our imports are much greater than our exports, the federal government is forced to make up the difference.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose the world was on the gold standard. If Peru ran persistent trade deficits, ____.

A) Peru would be able to continue doing so with no consequences

B) Peru's money stock would decline, its prices would fall, and its trade deficit disappear

C) Peru would soon suffer from inflation

D) Peru would raise tariffs and prohibit the shipment of gold from the country

A) Peru would be able to continue doing so with no consequences

B) Peru's money stock would decline, its prices would fall, and its trade deficit disappear

C) Peru would soon suffer from inflation

D) Peru would raise tariffs and prohibit the shipment of gold from the country

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

61

Suppose that in the year 2012 we run a trade deficit of $900 billion. Our current account deficit would be about billion.

A) $600

B) $800

C) $900

D) $1,000

E) $1,200

A) $600

B) $800

C) $900

D) $1,000

E) $1,200

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

62

The most accurate statement would be:

A) The current account deficit is high, but falling.

B) The current account deficit will bankrupt us by 2015.

C) If our trade deficit begins falling, the current account deficit will fall.

D) Our trade deficit is much higher than our current account deficit.

A) The current account deficit is high, but falling.

B) The current account deficit will bankrupt us by 2015.

C) If our trade deficit begins falling, the current account deficit will fall.

D) Our trade deficit is much higher than our current account deficit.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

63

According to the "Big Mac Index," ____.

A) the U.S. dollar is too highly valued relative to virtually all other currencies

B) the U.S. dollar is valued too low relative to virtually all other currencies

C) you will be able to buy a Big Mac much more cheaply in China or Russia than in the United States

D) you will have to pay much more for a Big Mac in China or Russia than you would in the United States

A) the U.S. dollar is too highly valued relative to virtually all other currencies

B) the U.S. dollar is valued too low relative to virtually all other currencies

C) you will be able to buy a Big Mac much more cheaply in China or Russia than in the United States

D) you will have to pay much more for a Big Mac in China or Russia than you would in the United States

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

64

Which is the most accurate statement? In early 2008 there was strong evidence that the ____.

A) yuan and yen were overvalued against the dollar

B) yuan and yen were undervalued against the dollar

C) yuan was undervalued against the yen

D) yen was undervalued against the yuan

A) yuan and yen were overvalued against the dollar

B) yuan and yen were undervalued against the dollar

C) yuan was undervalued against the yen

D) yen was undervalued against the yuan

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

65

Running mounting current account deficits is analogous to ____.

A) running up debt on a credit card

B) taking money out of one pocket and putting it in another

C) owing money to ourselves

D) borrowing money that never has to be repaid

A) running up debt on a credit card

B) taking money out of one pocket and putting it in another

C) owing money to ourselves

D) borrowing money that never has to be repaid

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

66

If a Japanese DVD player priced at 12,000 yen can be purchased for $60, the exchange rate is

A) 200 yen per dollar.

B) 20 yen per dollar.

C) 20 dollars per yen.

D) 200 dollars per yen.

E) none of the above.

A) 200 yen per dollar.

B) 20 yen per dollar.

C) 20 dollars per yen.

D) 200 dollars per yen.

E) none of the above.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

67

Suppose that last month the U.S. dollar was trading on the foreign-exchange market at 0.85 euros per dollar. Today the U.S. dollar is trading at 0.88 euros per dollar.

A) The dollar has depreciated and the euro has appreciated.

B) The euro has depreciated and the dollar has appreciated.

C) Both the euro and the dollar have appreciated.

D) Neither the euro nor the dollar have depreciated.

A) The dollar has depreciated and the euro has appreciated.

B) The euro has depreciated and the dollar has appreciated.

C) Both the euro and the dollar have appreciated.

D) Neither the euro nor the dollar have depreciated.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck