Deck 22: Real Estate Investment Performance and Portfolio Considerations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/14

Play

Full screen (f)

Deck 22: Real Estate Investment Performance and Portfolio Considerations

1

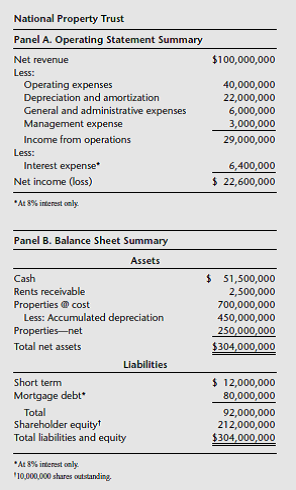

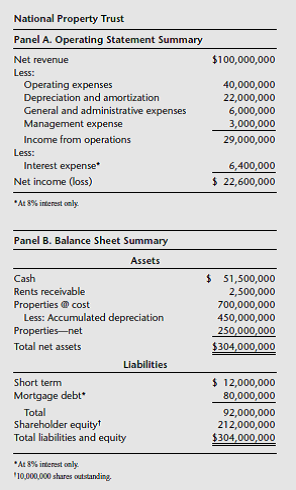

As an investment advisor for MREAF (Momentum Real Estate Advisory Fund), you are about to make a presentation to the portfolio manager of the ET T pension fund. You would like to show what would have happened had ET T made an investment in MREAF during the last 13 quarters. The ET T manager has provided you with historical data on the performance of its portfolio, which is made up entirely of common stock. Historical data for the ET T portfolio and MREAF are as follows:

a. Calculate the quarterly HPR for each investment.

b. Calculate the arithmetic mean HPR , the standard deviation of the HPR s, and the geometric mean for each fund. Which fund contained more risk per unit of return?

c. Was there any correlation between returns on the ET T fund and MREAF?

d. Would a portfolio that contained equal amounts of ET T securities and MREAF have provided any investment diversification? Why?

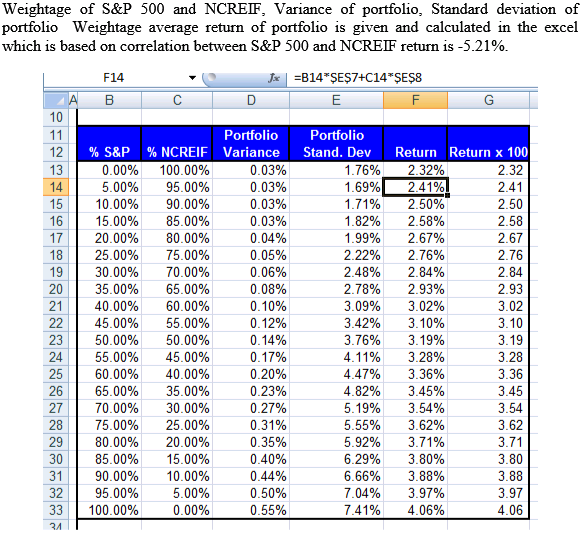

e. Optional. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100 percent)? What combination of securities would have constituted the "efficient frontier" (if any)?

f. If the manager of ET T is considering making an investment in MREAF, of what use is this analysis?

a. Calculate the quarterly HPR for each investment.

b. Calculate the arithmetic mean HPR , the standard deviation of the HPR s, and the geometric mean for each fund. Which fund contained more risk per unit of return?

c. Was there any correlation between returns on the ET T fund and MREAF?

d. Would a portfolio that contained equal amounts of ET T securities and MREAF have provided any investment diversification? Why?

e. Optional. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100 percent)? What combination of securities would have constituted the "efficient frontier" (if any)?

f. If the manager of ET T is considering making an investment in MREAF, of what use is this analysis?

Holding period return (HPR) is the return to the holder for the particular period of the investment of the fund.The following is the formula to calculate the holding period return:

Here,

Here,

The holding period return is HPR.The time period is t.The price at time t is

.The price at time t-1 is

.The price at time t-1 is

The dividend at time t is

The dividend at time t is

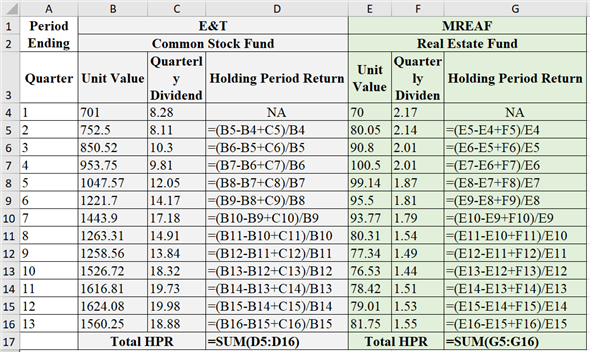

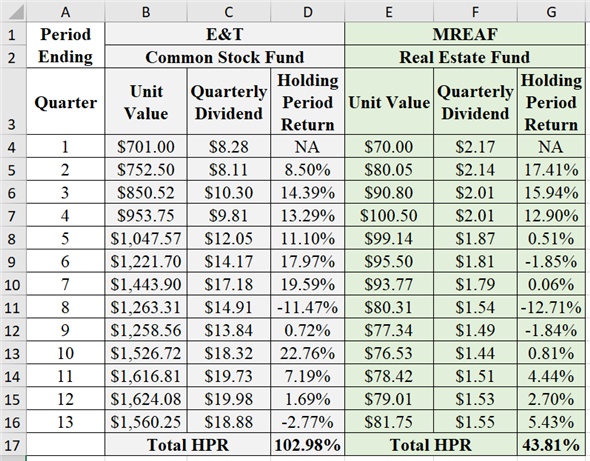

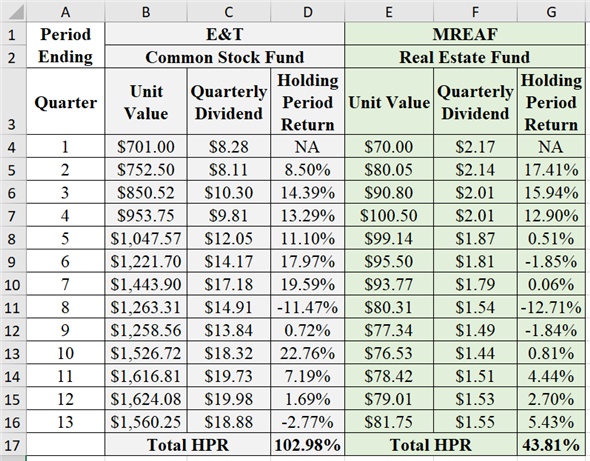

.a. Quarterly holding period return (HPR) for each investment

.a. Quarterly holding period return (HPR) for each investment

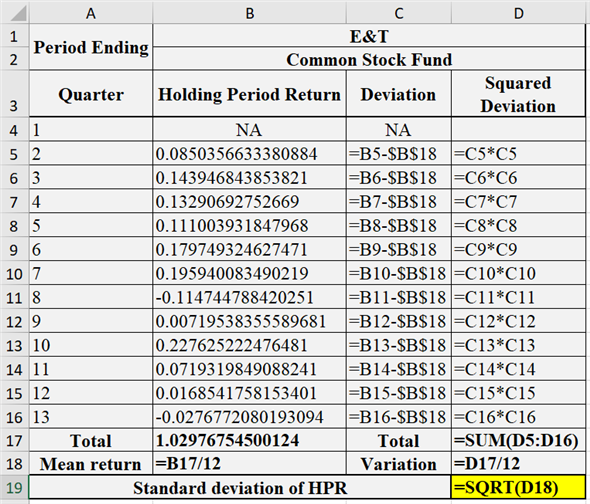

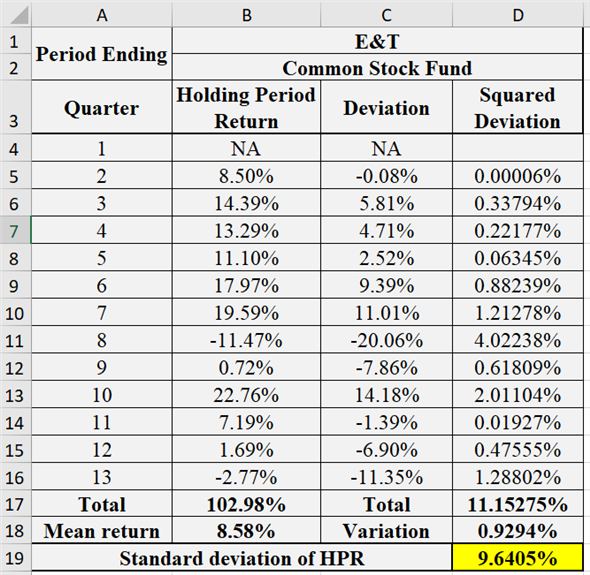

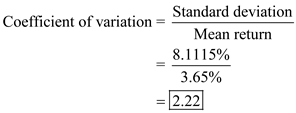

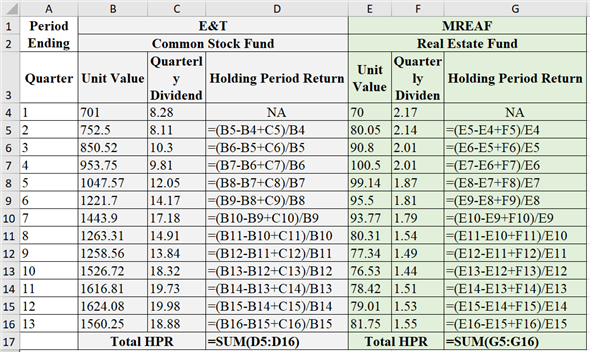

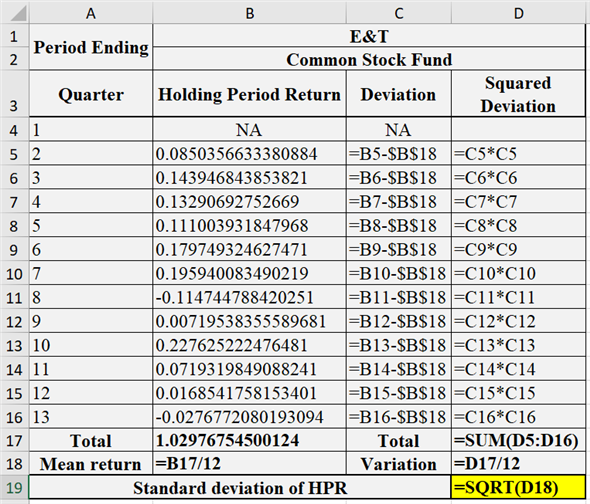

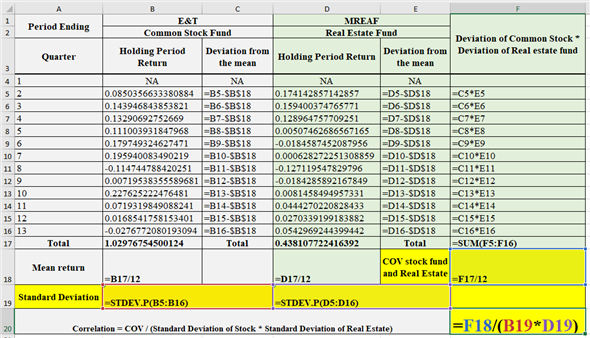

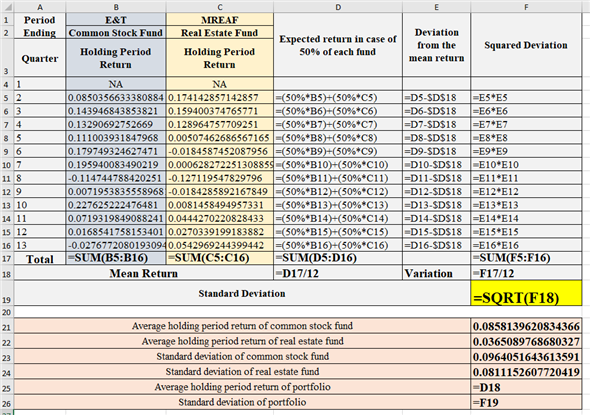

The following are the data inputs in spreadsheet:

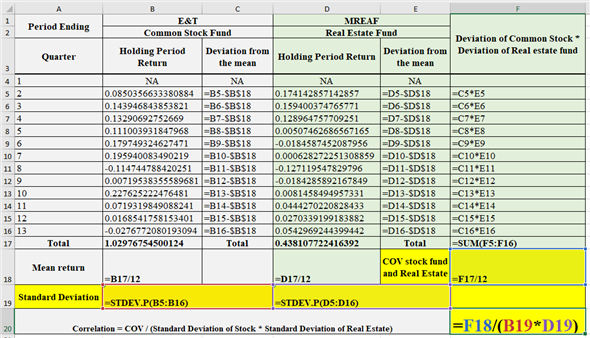

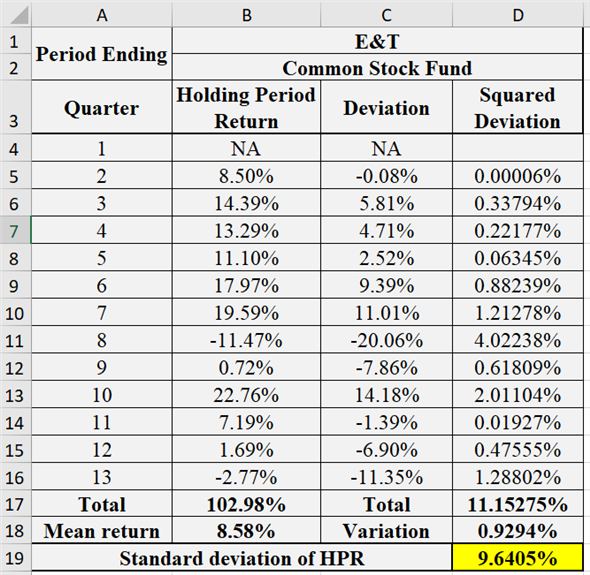

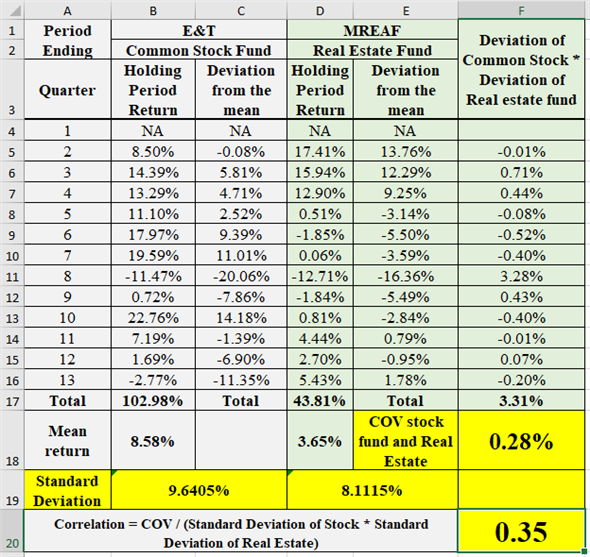

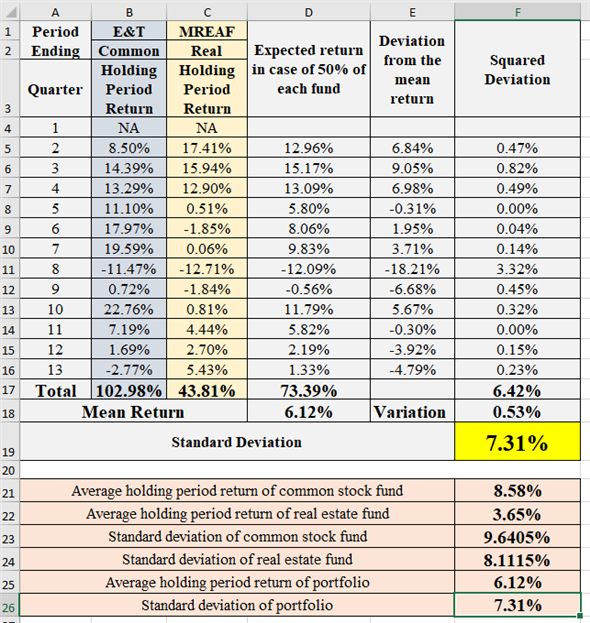

The following are the obtained results in spreadsheet, the holding period return for the given values is provided below:

The following are the obtained results in spreadsheet, the holding period return for the given values is provided below:

b. Arithmetic mean

b. Arithmetic mean

Arithmetic mean is the sum of total values divided by the total number of values.

Calculate the arithmetic mean for common stock fund as follows:

Therefore, the arithmetic mean of commons stock fund is

Therefore, the arithmetic mean of commons stock fund is

.Calculate the arithmetic mean for real estate fund as follows:

.Calculate the arithmetic mean for real estate fund as follows:

Therefore, the arithmetic mean of real estate fund is

Therefore, the arithmetic mean of real estate fund is

.Standard deviation

.Standard deviation

Standard deviation is a measure of dispersion of possible outcomes around the expected value of a random variable.

Standard deviation is calculated as follows:

Where,

Where,

The variance is

.The each value in the set is X.The arithmetic mean is

.The each value in the set is X.The arithmetic mean is

The number of return is N.Standard deviation of common stock funds' HPR:

The number of return is N.Standard deviation of common stock funds' HPR:

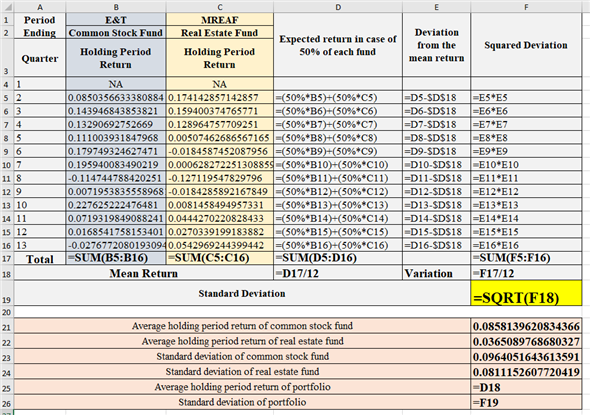

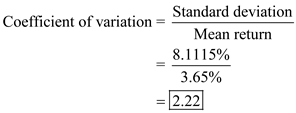

The following are the data inputs in spreadsheet:

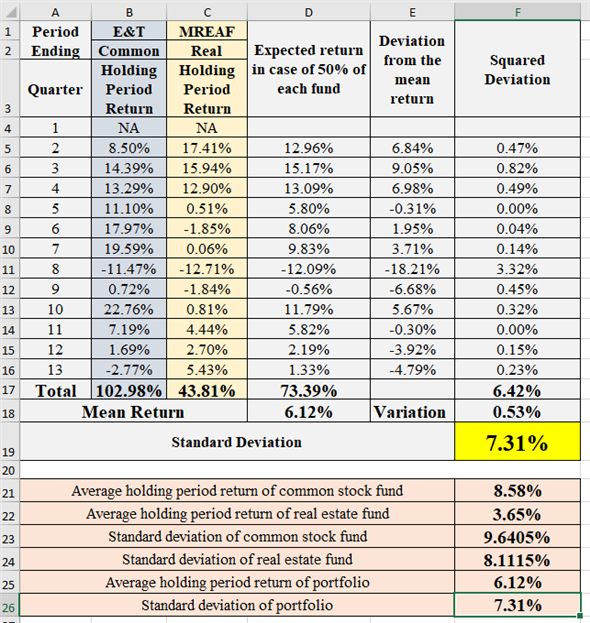

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet:

Therefore, the standard deviation of common stock funds' HPR is

Therefore, the standard deviation of common stock funds' HPR is

.Standard deviation of real estate funds' HPR:

.Standard deviation of real estate funds' HPR:

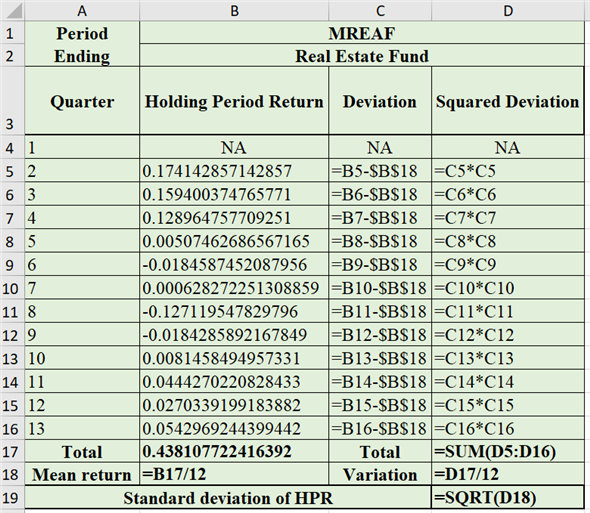

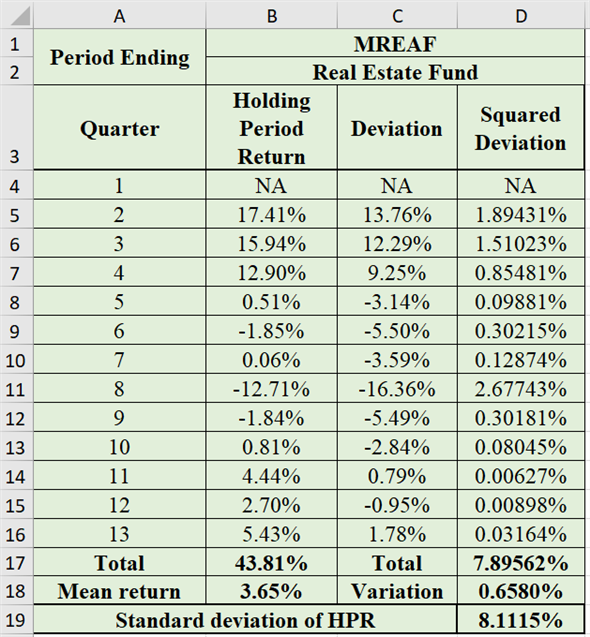

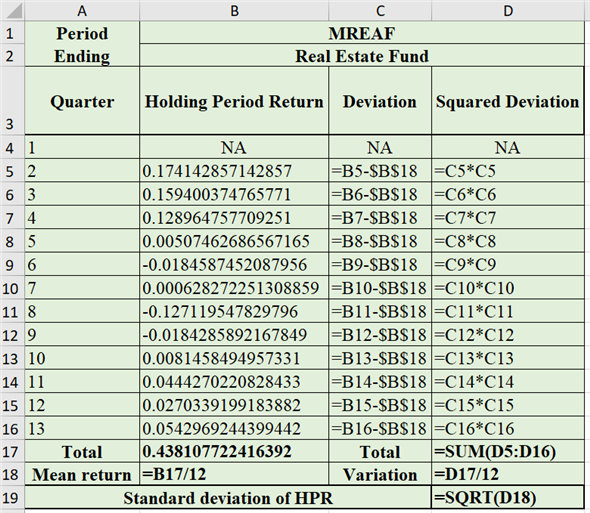

The following are the data inputs in spreadsheet:

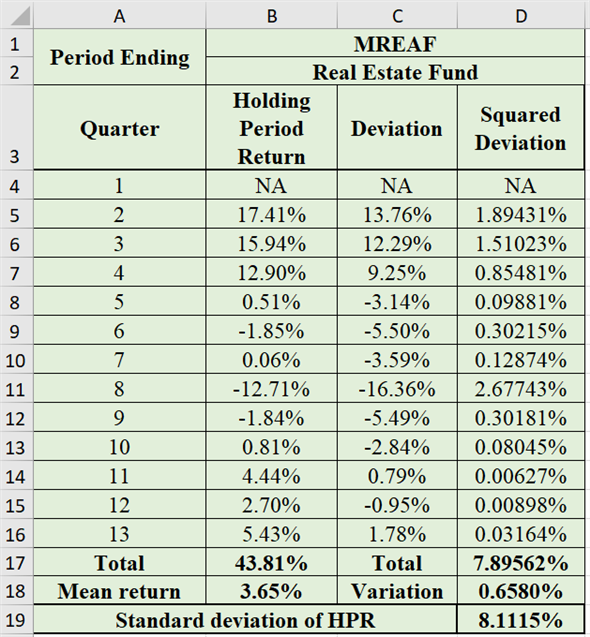

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet:

Therefore, the standard deviation of real estate funds' HPR is

Therefore, the standard deviation of real estate funds' HPR is

.Geometric mean

.Geometric mean

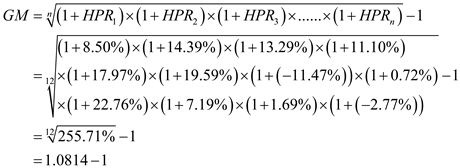

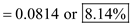

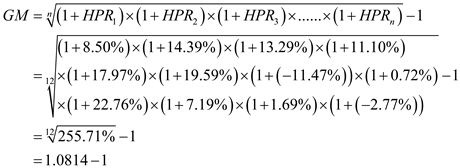

Geometric mean is the measure of compound rate of growth over the period of time. It assumes that all cash flows are reinvested in the asset and those reinvested fund earn the following rates on return.Calculate the geometric mean of common stock as follows:

Therefore, the geometric mean of common stock is

Therefore, the geometric mean of common stock is

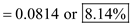

.Calculate the geometric mean of common stock as follows:

.Calculate the geometric mean of common stock as follows:

Therefore, the geometric mean of real estate fund is

Therefore, the geometric mean of real estate fund is

.Risk per unit: Coefficient of variation

.Risk per unit: Coefficient of variation

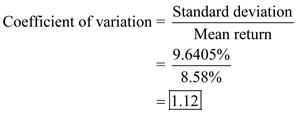

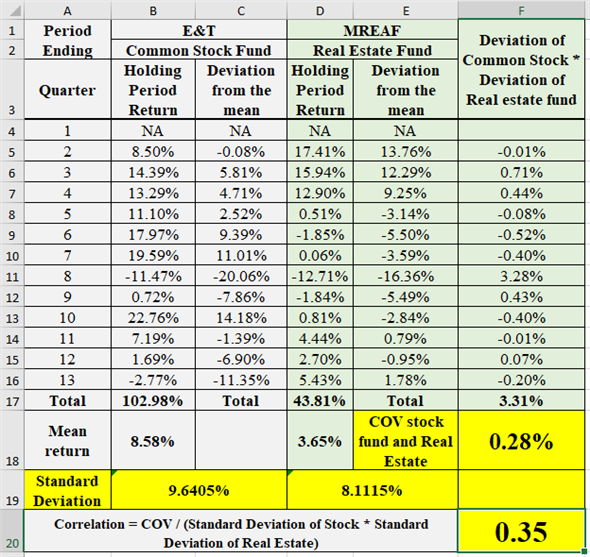

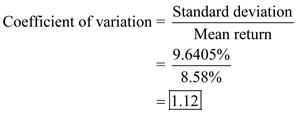

Calculate the coefficient of variation of common stock as follows:

Therefore, the coefficient of variation of common stock fund is

Therefore, the coefficient of variation of common stock fund is

.Calculate the coefficient of variation of real estate fund as follows:

.Calculate the coefficient of variation of real estate fund as follows:

Therefore, the coefficient of variation of real estate fund is

Therefore, the coefficient of variation of real estate fund is

.The real estate fund has more coefficient of variation.Hence, real estate fund contains more risk per unit as compared to the common stock fund.c. Correlation

.The real estate fund has more coefficient of variation.Hence, real estate fund contains more risk per unit as compared to the common stock fund.c. Correlation

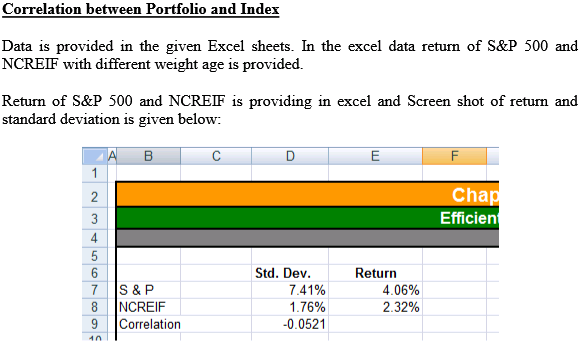

The covariance between the securities of a portfolio measures the relationship between the securities, it may be negative, positive or zero. The positive covariance between the securities increase the risk of the portfolio therefore the negative covariance is always preferable by the investors.The following are the data inputs in spreadsheet:

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet:

Therefore, the correlation between the common stock fund and real estate fund is

Therefore, the correlation between the common stock fund and real estate fund is

.d. 50% of each fund provided any diversification or not

.d. 50% of each fund provided any diversification or not

The following are the data inputs in spreadsheet:

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet:

Therefore, it is clear from the above obtained results that the portfolio of containing 50% of common stock fund and 50% of real estate fund provided diversification and reduced the overall standard deviation (risk) of the investment.e. Optional

Therefore, it is clear from the above obtained results that the portfolio of containing 50% of common stock fund and 50% of real estate fund provided diversification and reduced the overall standard deviation (risk) of the investment.e. Optional

f.

If the manager of ET T is considering for the investment in MREAF then this analysis is very helpful in that as this analysis will show the risk per unit in terms of coefficient of covariation and it will show the risk as standard deviation.If the investment is done in the proportion/weightage then it will show the portfolio's expected return and standard deviation which will be very helpful in making decision and deciding the optimal asset allocation through this analysis only.

Here,

Here,The holding period return is HPR.The time period is t.The price at time t is

.The price at time t-1 is

.The price at time t-1 is  The dividend at time t is

The dividend at time t is  .a. Quarterly holding period return (HPR) for each investment

.a. Quarterly holding period return (HPR) for each investment The following are the data inputs in spreadsheet:

The following are the obtained results in spreadsheet, the holding period return for the given values is provided below:

The following are the obtained results in spreadsheet, the holding period return for the given values is provided below: b. Arithmetic mean

b. Arithmetic mean Arithmetic mean is the sum of total values divided by the total number of values.

Calculate the arithmetic mean for common stock fund as follows:

Therefore, the arithmetic mean of commons stock fund is

Therefore, the arithmetic mean of commons stock fund is  .Calculate the arithmetic mean for real estate fund as follows:

.Calculate the arithmetic mean for real estate fund as follows: Therefore, the arithmetic mean of real estate fund is

Therefore, the arithmetic mean of real estate fund is  .Standard deviation

.Standard deviation Standard deviation is a measure of dispersion of possible outcomes around the expected value of a random variable.

Standard deviation is calculated as follows:

Where,

Where,The variance is

.The each value in the set is X.The arithmetic mean is

.The each value in the set is X.The arithmetic mean is  The number of return is N.Standard deviation of common stock funds' HPR:

The number of return is N.Standard deviation of common stock funds' HPR: The following are the data inputs in spreadsheet:

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet: Therefore, the standard deviation of common stock funds' HPR is

Therefore, the standard deviation of common stock funds' HPR is  .Standard deviation of real estate funds' HPR:

.Standard deviation of real estate funds' HPR: The following are the data inputs in spreadsheet:

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet: Therefore, the standard deviation of real estate funds' HPR is

Therefore, the standard deviation of real estate funds' HPR is  .Geometric mean

.Geometric mean Geometric mean is the measure of compound rate of growth over the period of time. It assumes that all cash flows are reinvested in the asset and those reinvested fund earn the following rates on return.Calculate the geometric mean of common stock as follows:

Therefore, the geometric mean of common stock is

Therefore, the geometric mean of common stock is  .Calculate the geometric mean of common stock as follows:

.Calculate the geometric mean of common stock as follows:

Therefore, the geometric mean of real estate fund is

Therefore, the geometric mean of real estate fund is  .Risk per unit: Coefficient of variation

.Risk per unit: Coefficient of variation Calculate the coefficient of variation of common stock as follows:

Therefore, the coefficient of variation of common stock fund is

Therefore, the coefficient of variation of common stock fund is  .Calculate the coefficient of variation of real estate fund as follows:

.Calculate the coefficient of variation of real estate fund as follows: Therefore, the coefficient of variation of real estate fund is

Therefore, the coefficient of variation of real estate fund is  .The real estate fund has more coefficient of variation.Hence, real estate fund contains more risk per unit as compared to the common stock fund.c. Correlation

.The real estate fund has more coefficient of variation.Hence, real estate fund contains more risk per unit as compared to the common stock fund.c. Correlation The covariance between the securities of a portfolio measures the relationship between the securities, it may be negative, positive or zero. The positive covariance between the securities increase the risk of the portfolio therefore the negative covariance is always preferable by the investors.The following are the data inputs in spreadsheet:

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet: Therefore, the correlation between the common stock fund and real estate fund is

Therefore, the correlation between the common stock fund and real estate fund is  .d. 50% of each fund provided any diversification or not

.d. 50% of each fund provided any diversification or not The following are the data inputs in spreadsheet:

The following are the obtained results in spreadsheet:

The following are the obtained results in spreadsheet: Therefore, it is clear from the above obtained results that the portfolio of containing 50% of common stock fund and 50% of real estate fund provided diversification and reduced the overall standard deviation (risk) of the investment.e. Optional

Therefore, it is clear from the above obtained results that the portfolio of containing 50% of common stock fund and 50% of real estate fund provided diversification and reduced the overall standard deviation (risk) of the investment.e. Optional f.

If the manager of ET T is considering for the investment in MREAF then this analysis is very helpful in that as this analysis will show the risk per unit in terms of coefficient of covariation and it will show the risk as standard deviation.If the investment is done in the proportion/weightage then it will show the portfolio's expected return and standard deviation which will be very helpful in making decision and deciding the optimal asset allocation through this analysis only.

2

What are some of the difficulties of obtaining data to measure real estate investment performance?

Real Estate Investment Data:

This refers to the data related to prices for all investment property transactions whether it is for hotel or for warehouses to apartment units. This includes all investment property in the economy including its detailed description of the land, improvements, and cash flows produced by investing in these properties.The difficulties in obtaining data for measuring real estate investment performance are mentioned below.

Lack of frequency: There is difficulty in obtaining data to evaluate real estate investment performance due to lack of frequency in the selling of properties like in stocks and bonds.Difficult to compare: Even though the properties are sold, the selling price is not publicly available which makes it difficult to compare the investment performance.Geographic location: As there are many geographic areas in which commercial real estate is located due to which it becomes difficult to make the data available.Hence, due to lack of frequency in selling properties, difficulty in comparing, and different geographical locations makes it difficult to obtain data for measuring real estate investment performance.

This refers to the data related to prices for all investment property transactions whether it is for hotel or for warehouses to apartment units. This includes all investment property in the economy including its detailed description of the land, improvements, and cash flows produced by investing in these properties.The difficulties in obtaining data for measuring real estate investment performance are mentioned below.

Lack of frequency: There is difficulty in obtaining data to evaluate real estate investment performance due to lack of frequency in the selling of properties like in stocks and bonds.Difficult to compare: Even though the properties are sold, the selling price is not publicly available which makes it difficult to compare the investment performance.Geographic location: As there are many geographic areas in which commercial real estate is located due to which it becomes difficult to make the data available.Hence, due to lack of frequency in selling properties, difficulty in comparing, and different geographical locations makes it difficult to obtain data for measuring real estate investment performance.

3

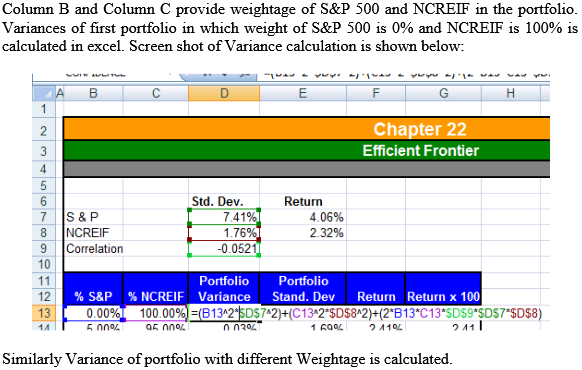

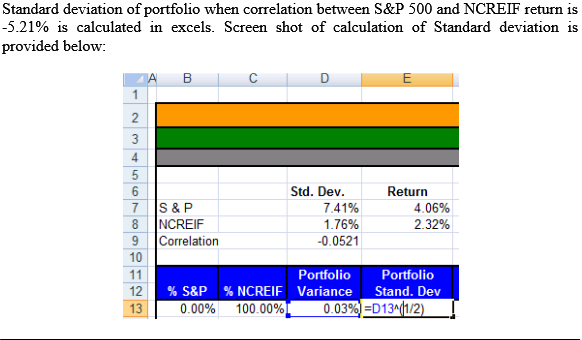

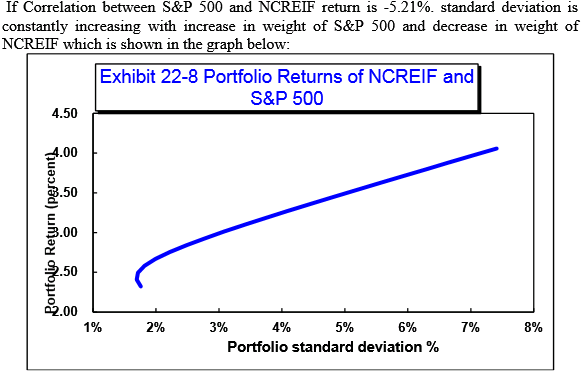

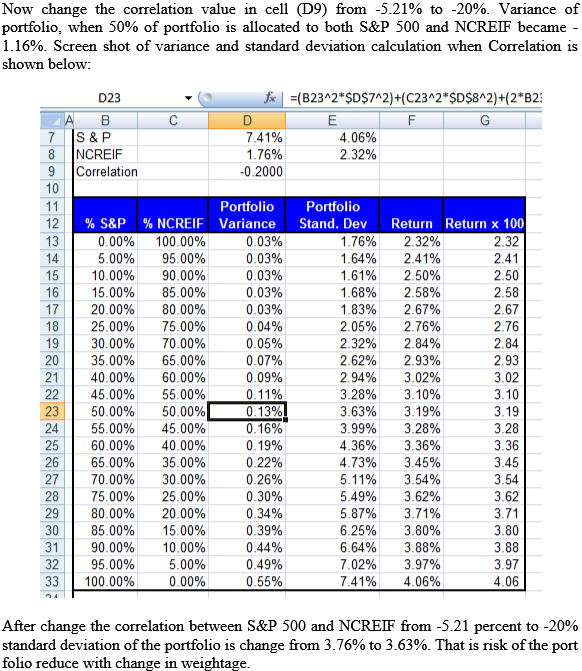

Excel. Refer to the "Ch22_Frontier" tab in the Excel Workbook provided on the Web site. Suppose the correlation between NCREIF and the S P 500 is -20 percent. How does this change the standard deviation of the portfolio when 50 percent of the portfolio is allocated to each investment?

4

What are the distinguishing characteristics between REIT data and the NCREIF Property Index?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

5

What is the d ifference between arithmetic and geometric mean returns?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

6

What statistical concept do many portfolio managers use to represent risk when considering investment performance?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

7

When NCREIF returns and REIT returns are compared, NCREIF returns exhibit a much lower pattern of variation. Why might this be the case?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

8

Mean returns for portfolios are calculated by taking the weighted average of the mean returns for each investment in the portfolio. Why won't this approach work to calculate the standard deviation of portfolio returns?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

9

What is the difference between covariance and correlation? Why are these concepts so important in portfolio analysis?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

10

Results reported in the chapter showed that by including either REITs or the NCREIF Index in a portfolio containing S P 500 securities, corporate bonds, and T bills, diversification benefits resulted. Why was this true? Did those benefits come about for the same reason for each category of real estate investment?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

11

Results presented in the chapter are based on historical data. Of what use are these results to a portfolio manager who may be making an investment decision today? Elaborate.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

12

Why should an investor consider investing globally?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

13

What are the risks of global investment?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

14

How can derivative security be used to hedge portfolio risk?

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck