Deck 10: Individuals: Determination of Taxable Income and Taxes Payable

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 10: Individuals: Determination of Taxable Income and Taxes Payable

1

Which of the following accurately describes a requirement for a business to qualify as a qualified small business corporation (QSBC)?

A)The corporation must be a CCPC that uses at least 50% of the fair market value its assets for active business purposes in Canada at the time the shares are sold.

B)More than fifty percent of the fair market value of the assets of the business must have been used for active business in the past 36 months.

C)The corporation must hire less than 5 full-time employees.

D)The shares must not have been owned by another non-related individual in the past 24 months.

A)The corporation must be a CCPC that uses at least 50% of the fair market value its assets for active business purposes in Canada at the time the shares are sold.

B)More than fifty percent of the fair market value of the assets of the business must have been used for active business in the past 36 months.

C)The corporation must hire less than 5 full-time employees.

D)The shares must not have been owned by another non-related individual in the past 24 months.

D

2

Courtney Adamson received an eligible dividend in the amount of $2,000.Courtney is in a 50% tax bracket for regular income.How much is Courtney's dividend tax credit? (Assume a dividend tax credit rate of 15%.)

A)$300

B)$414

C)$1,000

D)$2,760

A)$300

B)$414

C)$1,000

D)$2,760

B

3

Marble Inc.is a Canadian-controlled private corporation that conducts its business in Canada.The sole shareholder, Latoya Flores, is considering selling the company and would like to know if Marble is a qualified small business corporation.

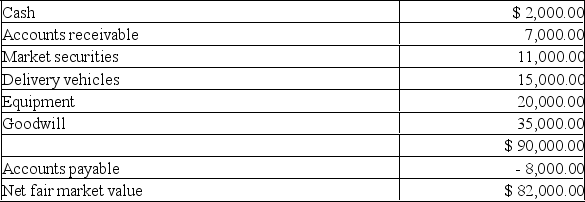

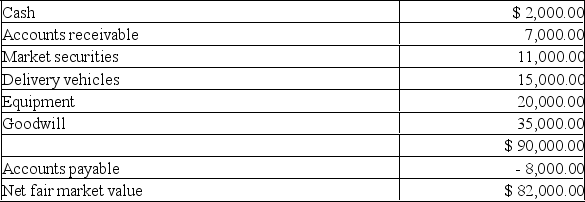

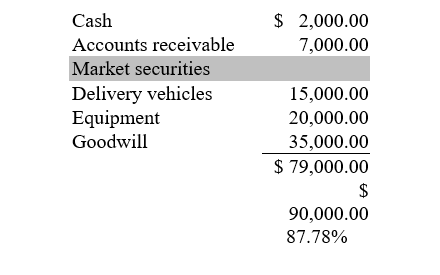

The fair market value of the assets is listed below:

The relevant values of the assets and liabilities have not fluctuated during the past 24 months. During that time, Latoya has been the only shareholder.

Required:

Determine if Marble Inc. is a qualified small business corporation. Show all calculations and briefly explain your conclusion.

The fair market value of the assets is listed below:

The relevant values of the assets and liabilities have not fluctuated during the past 24 months. During that time, Latoya has been the only shareholder.

Required:

Determine if Marble Inc. is a qualified small business corporation. Show all calculations and briefly explain your conclusion.

Marble Inc.is not a QSBC

Although Marble Inc.has met the 50% asset ratio test for the past 24 months and the shares were not owned by an unrelated person, the 90% test at the point of determination has not been met due to the securities, which represent more than 12% of the fair market value of the assets.

4

Diego Garcia is 32 years old.Diego earned $112,000 in 2020 while employed as a financial analyst.The combined CPP and EI deduction during 2020 totaled $3,754.Of this amount, $166 was the CPP enhanced contribution.The following information was also provided pertaining to the 2020 taxation year:

a) Diego enrolled in part-time studies at the local university, paying tuition fees of $1,500.

b) Diego donated $2,000 to a registered charity for tax purposes, and $800 to a federal political party.

c) During the year, a total of $4,500 was spent on eyeglasses, dental care, and prescriptions, and none of this amount was reimbursed.

d) Diego's spouse did not work during 2020 while attending full-time post-secondary classes which cost $8,000 in tuition.The maximum allowed amount was transferred to Diego for 2020 tax purposes.Diego's spouse had no other income during the year.

e) Diego ha a $2,000 non-capital loss from 2019.

f) The couple does not have any children.

Required:

A.Calculate Diego's taxable income for 2020.

B.Calculate Diego's federal tax liability for 2020.

a) Diego enrolled in part-time studies at the local university, paying tuition fees of $1,500.

b) Diego donated $2,000 to a registered charity for tax purposes, and $800 to a federal political party.

c) During the year, a total of $4,500 was spent on eyeglasses, dental care, and prescriptions, and none of this amount was reimbursed.

d) Diego's spouse did not work during 2020 while attending full-time post-secondary classes which cost $8,000 in tuition.The maximum allowed amount was transferred to Diego for 2020 tax purposes.Diego's spouse had no other income during the year.

e) Diego ha a $2,000 non-capital loss from 2019.

f) The couple does not have any children.

Required:

A.Calculate Diego's taxable income for 2020.

B.Calculate Diego's federal tax liability for 2020.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

Modern Ltd.had an unused allowable capital loss of $20,000 during the current fiscal year and an unused business loss of $10,000.Modern Ltd.has a December 31 year-end.Which of the following statements is TRUE?

A)All of the losses will be lost if not used in this fiscal year.

B)The unused allowable capital loss will become a net-capital loss and can be carried back three years and forward indefinitely, and the unused business loss will become a non-capital loss and can be carried back three years and forward twenty years.

C)The unused business loss will become a net-capital loss and can be carried back three years and forward indefinitely, and the unused allowable capital loss will become a non-capital loss and can be carried back three years and forward twenty years.

D)The unused business loss will become a non-capital loss and can be carried back three years and forward indefinitely.

A)All of the losses will be lost if not used in this fiscal year.

B)The unused allowable capital loss will become a net-capital loss and can be carried back three years and forward indefinitely, and the unused business loss will become a non-capital loss and can be carried back three years and forward twenty years.

C)The unused business loss will become a net-capital loss and can be carried back three years and forward indefinitely, and the unused allowable capital loss will become a non-capital loss and can be carried back three years and forward twenty years.

D)The unused business loss will become a non-capital loss and can be carried back three years and forward indefinitely.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

Ivan Melnik passed away unexpectedly at the age of 62.Which of the following of Ivan's income items can be reported on a Rights or Things Return?

A)Dividends declared before the date of death but not paid prior to Ivan's passing.

B)Salary for the pay period ending after the date of death when some of the days were worked prior to passing.

C)Salary for the pay periods paid to Ivan prior to his passing.

D)Interest on Ivan's bank account.

A)Dividends declared before the date of death but not paid prior to Ivan's passing.

B)Salary for the pay period ending after the date of death when some of the days were worked prior to passing.

C)Salary for the pay periods paid to Ivan prior to his passing.

D)Interest on Ivan's bank account.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

Shirin Gilani incurred the following income, disbursements, and losses in 2019 and 2020:

Additional information:

2018 was the first year that Shirin sold a capital asset.

Shirin incurred a business loss of $5,000 from the proprietorship in 2018 (the first year of the business) that was not needed to reduce net income for tax purposes in 2018.

Shirin has never used the lifetime capital gains deduction.

Required:

Calculate Shirin's minimum taxable income for 2019 and 2020, in accordance with Section 3 of the Income Tax Act.(Ignore CPP enhanced contributions in your answers.)

(Marks will only be awarded for answers with work shown.)

Additional information:

2018 was the first year that Shirin sold a capital asset.

Shirin incurred a business loss of $5,000 from the proprietorship in 2018 (the first year of the business) that was not needed to reduce net income for tax purposes in 2018.

Shirin has never used the lifetime capital gains deduction.

Required:

Calculate Shirin's minimum taxable income for 2019 and 2020, in accordance with Section 3 of the Income Tax Act.(Ignore CPP enhanced contributions in your answers.)

(Marks will only be awarded for answers with work shown.)

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not one of the personal federal non-refundable tax credits available to reduce the federal tax liability?

A)Canada employment credit

B)Dividend tax credit

C)Adoption expense credit

D)GST/HST credit

A)Canada employment credit

B)Dividend tax credit

C)Adoption expense credit

D)GST/HST credit

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is FALSE with respect to the final tax returns of deceased taxpayers?

A)Unused net capital losses less any capital gains deductions previously claimed are deductible against any income.

B)Non-refundable tax credits are prorated to the date of death on the final tax return.

C)A Rights or Things return may be filed in addition to the final tax return.

D)Of the tax returns available for a deceased taxpayer, only the final tax return must be filed.

A)Unused net capital losses less any capital gains deductions previously claimed are deductible against any income.

B)Non-refundable tax credits are prorated to the date of death on the final tax return.

C)A Rights or Things return may be filed in addition to the final tax return.

D)Of the tax returns available for a deceased taxpayer, only the final tax return must be filed.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

Harjot earned $85,000 in 2020 as a full-time teacher, and also generated revenues or $8,000 from a part-time farm on the family's acreage.The farm expenses totaled $12,000.

The following information pertaining to Harjot's 2020 tax return has also been provided to you:

1) Net capital losses from 2019 totaled $10,000, and non-capital losses from 2019 totaled $2,000, and neither could be carried back to previous years.

2) Harjot had the following amounts deducted from his pay during the year: CPP and EI of $3,754 (which includes the CPP Enhanced Contribution of $166) and income tax of $19,000.

3) Harjot contributed $5,000 to a TFSA and $15,000 to a guaranteed investment certificate (GIC) which pays 4% annual interest.The first interest receipt for the GIC will be on June 30, 2021.

4) Harjot received a $1,000 non-eligible dividend in 2020.

5) Harjot's spouse works full-time and earns $68,000 a year.

6) Harjot had extensive dental work done in 2020.The total cost was $7,500 and Harjot did not receive any reimbursement for the cost.

Required:

A.Calculate Harjot's net income for tax purposes for 2020 in accordance with Section 3 of the Income Tax Act.

B.Calculate Harjot's taxable income for 2020.

C.Calculate Harjot's minimum federal tax liability for 2020.(Round all amounts to zero decimal places.

D.Identify carry over item(s) and related amount(s).

The following information pertaining to Harjot's 2020 tax return has also been provided to you:

1) Net capital losses from 2019 totaled $10,000, and non-capital losses from 2019 totaled $2,000, and neither could be carried back to previous years.

2) Harjot had the following amounts deducted from his pay during the year: CPP and EI of $3,754 (which includes the CPP Enhanced Contribution of $166) and income tax of $19,000.

3) Harjot contributed $5,000 to a TFSA and $15,000 to a guaranteed investment certificate (GIC) which pays 4% annual interest.The first interest receipt for the GIC will be on June 30, 2021.

4) Harjot received a $1,000 non-eligible dividend in 2020.

5) Harjot's spouse works full-time and earns $68,000 a year.

6) Harjot had extensive dental work done in 2020.The total cost was $7,500 and Harjot did not receive any reimbursement for the cost.

Required:

A.Calculate Harjot's net income for tax purposes for 2020 in accordance with Section 3 of the Income Tax Act.

B.Calculate Harjot's taxable income for 2020.

C.Calculate Harjot's minimum federal tax liability for 2020.(Round all amounts to zero decimal places.

D.Identify carry over item(s) and related amount(s).

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

Tony Pine earned foreign interest income of $7,000 in 2020.15% tax was withheld by the foreign country.Toni's total taxable income for the year was $80,000, and the tax payable was calculated at $10,500.How much is Toni's foreign tax credit? (Rounded)

A)$919

B)$1,007

C)$1,050

D)$1,575

A)$919

B)$1,007

C)$1,050

D)$1,575

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck