Deck 17: Oligopoly and Business Strategy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/135

Play

Full screen (f)

Deck 17: Oligopoly and Business Strategy

1

If all the oligopolists in a market collude to form a cartel, total profit for the cartel is less than that of a monopolist.

False

2

When oligopolists collude and act like a monopoly, they charge a price above marginal cost. When they act independently, they charge a price equal to marginal cost.

False

3

In a competitive market, strategic interactions among the firms are not important.

True

4

Larger cartels have a greater probability of reaching the monopoly outcome than do smaller cartels.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

5

When an oligopolist decreases production, it is likely that the output effect is less than the price effect.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

6

In the case of oligopoly markets, self-interest prevents cooperation and leads to an inferior outcome for the parties involved.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

7

A collusive agreement over the quantity of output is difficult for firms to maintain because each firm has a profit incentive to break the agreement and increase production.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

8

The game that oligopolists play in trying to reach the monopoly outcome is similar to the game that the two prisoners play in the prisoners' dilemma.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

9

In the prisoner's dilemma game, the dominant strategy is for each player to not confess.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

10

Society will always be better off if the prisoners' dilemma game is repeated numerous times in an oligopoly market.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

11

If both countries agree on a certain level of arms in an arms race game, social welfare will decrease if both countries keep their end of the bargain.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

12

In an oligopoly, the actions of any one market participant can have an impact on the marginal revenue of other participants.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

13

It is individually irrational for players to cooperate in the prisoner's dilemma game because cooperation is not the dominant strategy.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

14

The price-effect of an increase in production refers to the extra profit an oligopolist receives from outputting one extra unit.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

15

The story of the prisoners' dilemma contains a general lesson that applies to any group trying to maintain cooperation among its members.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

16

Total profit for an oligopolist is more than that of a perfectly competitive firm.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

17

Oligopolies can end up looking like competitive firms if the number of firms is large and they do not cooperate.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

18

If the output effect is larger than the price effect, an oligopolist will decrease production.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

19

Game theory is used to study oligopoly, but is not needed in the study of competitive and monopoly markets.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

20

When prisoners' dilemma games are repeated over and over, sometimes the threat of penalty causes both parties to cooperate.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

21

The general term for market structures that fall somewhere in between monopoly and perfect competition is:

A) oligopoly markets

B) monopolistically competitive markets

C) incomplete markets

D) imperfectly competitive markets

A) oligopoly markets

B) monopolistically competitive markets

C) incomplete markets

D) imperfectly competitive markets

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

22

When an oligopoly market is in Nash equilibrium, firms will not act as profit maximisers.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

23

Monopolistically competitive firms are typically characterised by:

A) many firms selling identical products

B) a few firms selling similar or identical products

C) a few firms selling highly different products

D) many firms selling similar, but not identical products

A) many firms selling identical products

B) a few firms selling similar or identical products

C) a few firms selling highly different products

D) many firms selling similar, but not identical products

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

24

An imperfectly market that has only two firms is called:

A) a duopoly

B) a split monopoly

C) a triopoly

D) a binary market

A) a duopoly

B) a split monopoly

C) a triopoly

D) a binary market

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

25

One economic example of prisoner's dilemma is overuse of a common resource like an oil-deposit.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

26

Markets with only a few sellers, each offering a product similar or identical to the others, are typically referred to as:

A) monopolistically competitive markets

B) oligopoly markets

C) monopoly markets

D) competitive markets

A) monopolistically competitive markets

B) oligopoly markets

C) monopoly markets

D) competitive markets

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

27

When an oligopoly market is in Nash equilibrium a firm will choose its best pricing strategy, given the strategies that it observes other firms taking.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

28

If duopolists individually pursue their own self-interest when deciding how much to produce, the price they are able to charge for their product will be equal to the monopoly price.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

29

If duopolists individually pursue their own self-interest when deciding how much to produce, the price they are able to charge for their product will be less than the monopoly price.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following markets is most likely to be an oligopoly?

A) the distribution of electricity across the power grid

B) air travel between two cities on Australia's east coast

C) lunchtime take-away coffee service in Melbourne's CBD

D) pizza restaurants in Sydney's CBD, where each restaurant has its own signature pizza

A) the distribution of electricity across the power grid

B) air travel between two cities on Australia's east coast

C) lunchtime take-away coffee service in Melbourne's CBD

D) pizza restaurants in Sydney's CBD, where each restaurant has its own signature pizza

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

31

Firms in industries that have competitors but, at the same time, do not face so much competition that they are price takers, are operating in either a(n):

A) oligopoly or perfectly competitive market

B) oligopoly or monopolistically competitive market

C) oligopoly or monopoly market

D) monopoly or monopolistically competitive market

A) oligopoly or perfectly competitive market

B) oligopoly or monopolistically competitive market

C) oligopoly or monopoly market

D) monopoly or monopolistically competitive market

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

32

An important characteristic of an oligopoly market structure is that:

A) there are a large number of firms in the industry that produce identical products

B) products typically sell where price is equal to the marginal cost of production

C) the actions of one seller can have a large impact on the profitability of other sellers

D) the actions of one seller can have no impact on the profitability of other sellers because the market is so large

A) there are a large number of firms in the industry that produce identical products

B) products typically sell where price is equal to the marginal cost of production

C) the actions of one seller can have a large impact on the profitability of other sellers

D) the actions of one seller can have no impact on the profitability of other sellers because the market is so large

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

33

In the long run, profits will be higher in a monopolistically competitive market than in an oligopoly.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

34

In the prisoners' dilemma game, each player always has a dominate strategy.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

35

The collective action problem (where everyone is better off if action is coordinated, but free riding on the actions of others is possible) is an example of a prisoners' dilemma game.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose a firm makes a product whose price decreases as the output increases. The firm is in a market with many other firms. It is most likely that the firm:

A) is a monopoly

B) makes a product that is identical to the other firms, hence is in a competitive market

C) makes a similar product to others, hence is in a monopolistically competitive market

D) makes zero economic profit in the long run

A) is a monopoly

B) makes a product that is identical to the other firms, hence is in a competitive market

C) makes a similar product to others, hence is in a monopolistically competitive market

D) makes zero economic profit in the long run

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

37

Insight from the prisoners' dilemma suggests we will exploit common resources, even when it is in the best interests of society to manage them.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

38

One key difference between an oligopoly market and a competitive market is that oligopolistic firms:

A) are interdependent while competitive firms are not

B) sell completely unrelated products while competitive firms do not

C) sell their product at a price equal to marginal cost while competitive firms do not

D) are price takers while competitive firms are not

A) are interdependent while competitive firms are not

B) sell completely unrelated products while competitive firms do not

C) sell their product at a price equal to marginal cost while competitive firms do not

D) are price takers while competitive firms are not

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

39

Oligopoly markets are characterised by:

A) the universal existence of collusive agreements

B) a fall in collective profits if a cartel is organised

C) the pursuit of self-interest by profit-maximising firms always maximising collective profits

D) a conflict between cooperation and self-interest

A) the universal existence of collusive agreements

B) a fall in collective profits if a cartel is organised

C) the pursuit of self-interest by profit-maximising firms always maximising collective profits

D) a conflict between cooperation and self-interest

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

40

If the prisoners' dilemma game is repeated, the co-operative outcome can be supported as an equilibrium.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

41

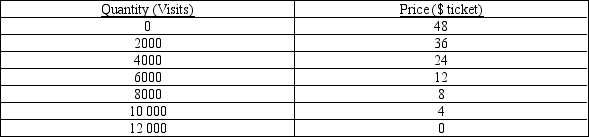

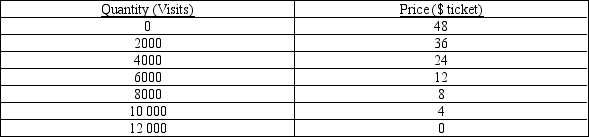

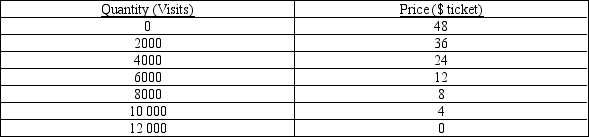

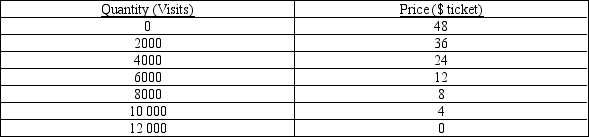

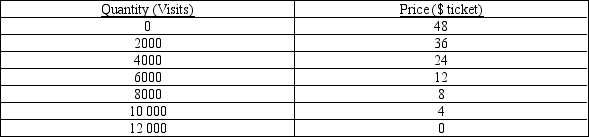

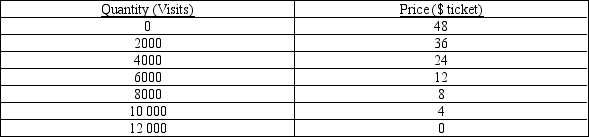

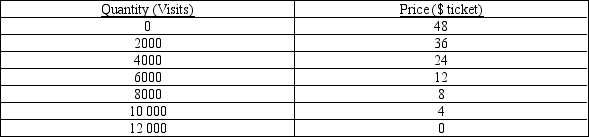

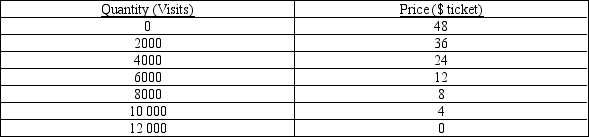

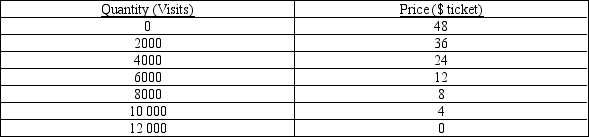

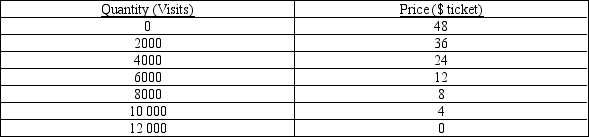

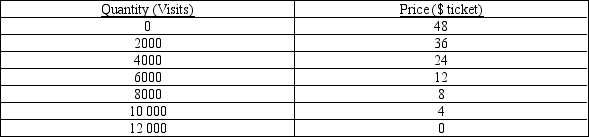

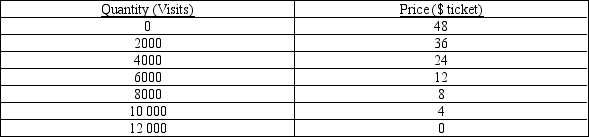

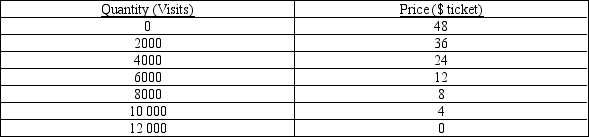

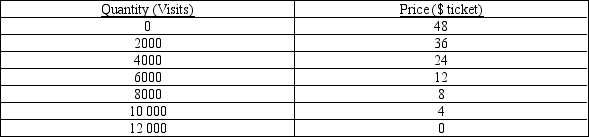

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on price and quantity of the tickets they sell. How many tickets will be sold by each firm when this market reaches a Nash equilibrium?

A) 1000

B) 2000

C) 3000

D) 4000

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on price and quantity of the tickets they sell. How many tickets will be sold by each firm when this market reaches a Nash equilibrium?

A) 1000

B) 2000

C) 3000

D) 4000

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

42

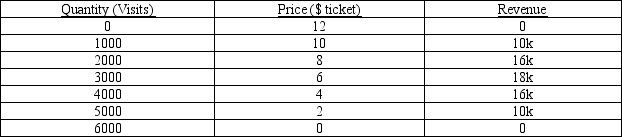

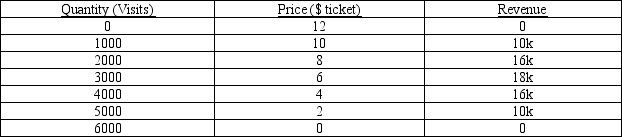

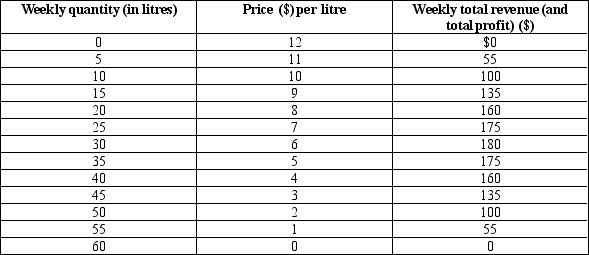

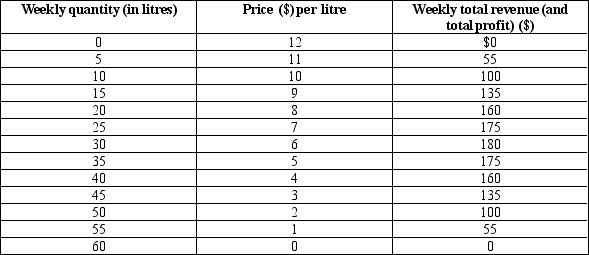

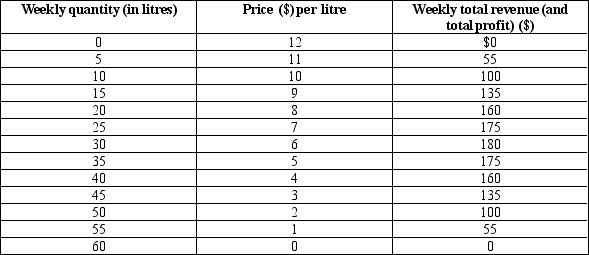

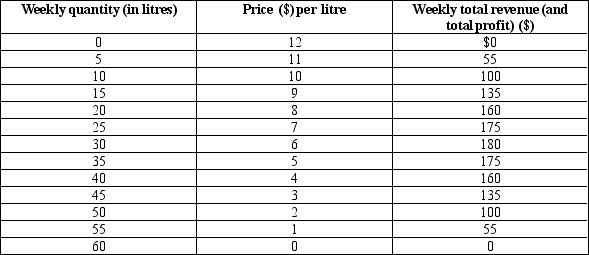

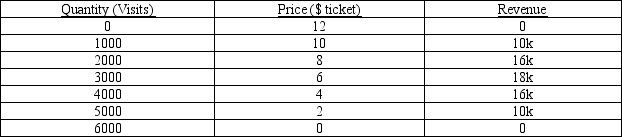

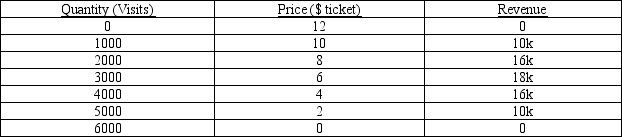

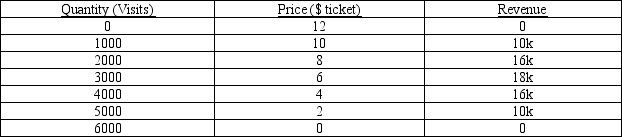

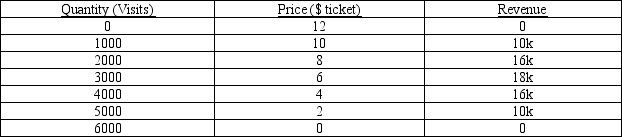

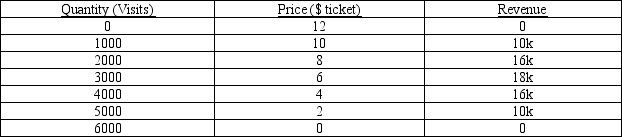

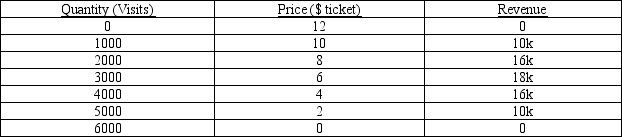

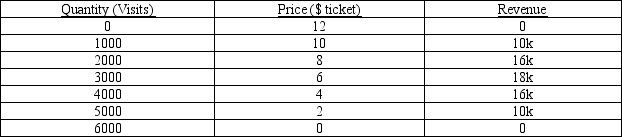

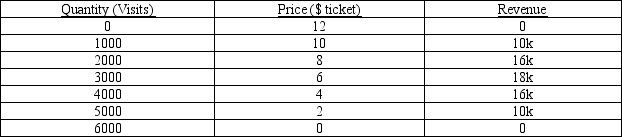

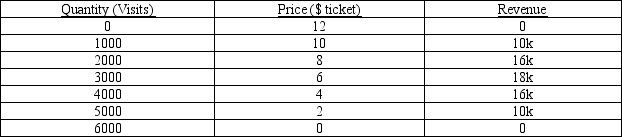

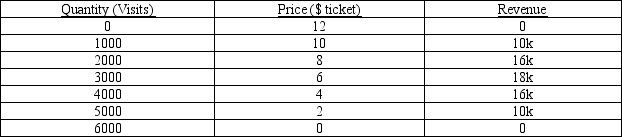

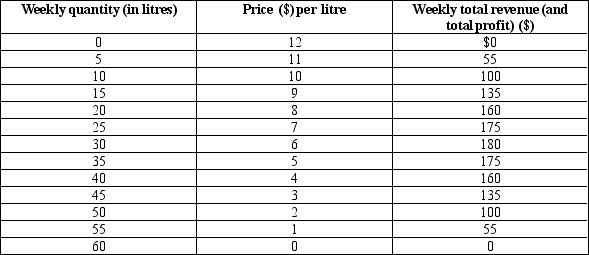

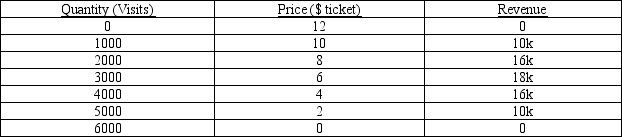

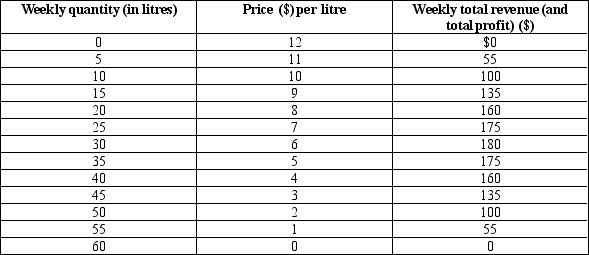

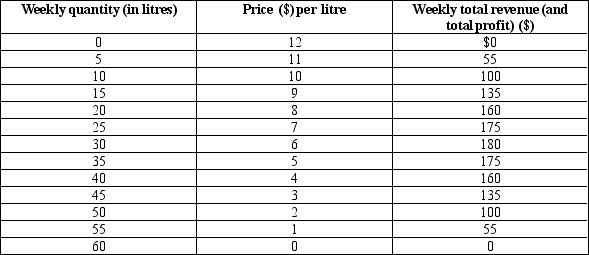

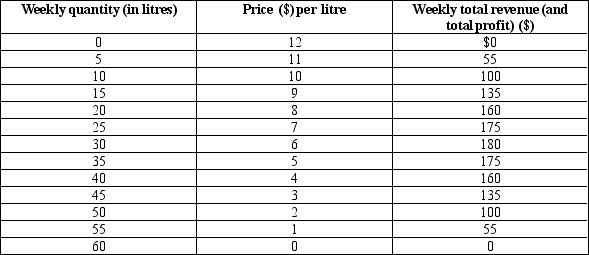

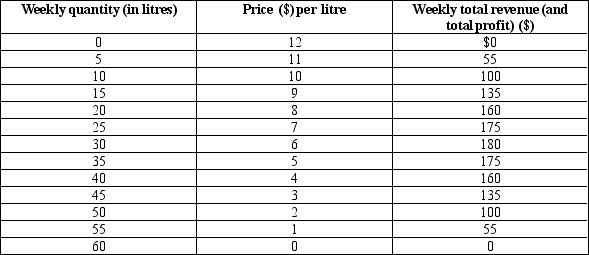

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Suppose the town enacts new anti-trust laws that prohibit Robert and John from operating as a monopolist. What will the new price of water end up being once the Nash equilibrium is reached?

A) $7

B) $6

C) $5

D) $4

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Suppose the town enacts new anti-trust laws that prohibit Robert and John from operating as a monopolist. What will the new price of water end up being once the Nash equilibrium is reached?

A) $7

B) $6

C) $5

D) $4

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

43

If there are many firms participating in a market, the market is either:

A) an oligopoly or perfectly competitive

B) an oligopoly or monopolistically competitive

C) perfectly competitive or monopolistically competitive

D) all of the above are possible

A) an oligopoly or perfectly competitive

B) an oligopoly or monopolistically competitive

C) perfectly competitive or monopolistically competitive

D) all of the above are possible

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

44

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. The socially efficient level of water supplied to the market would be:

A) 15 litres

B) 30 litres

C) 45 litres

D) 60 litres

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. The socially efficient level of water supplied to the market would be:

A) 15 litres

B) 30 litres

C) 45 litres

D) 60 litres

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

45

The best way for oligopolists to increase their profits is to:

A) agree to limit production

B) increase production to increase the size of the market

C) decrease prices to gain larger market share

D) operate according to their own self-interest

A) agree to limit production

B) increase production to increase the size of the market

C) decrease prices to gain larger market share

D) operate according to their own self-interest

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

46

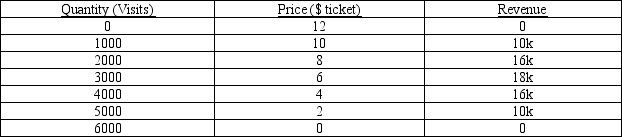

Table 16-2

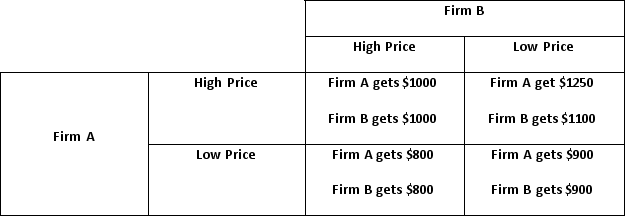

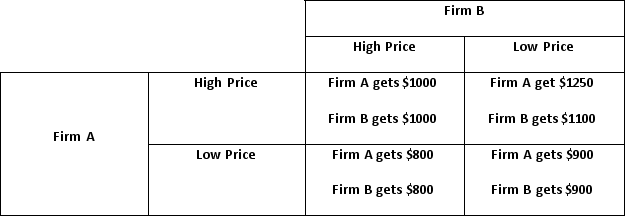

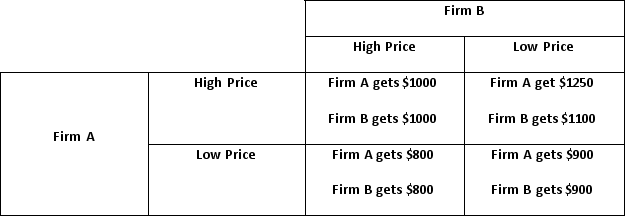

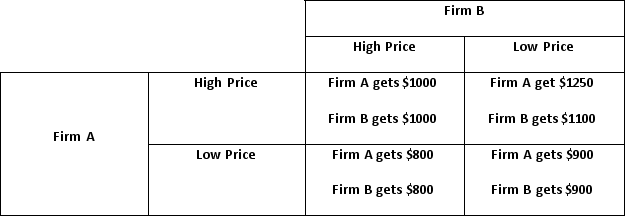

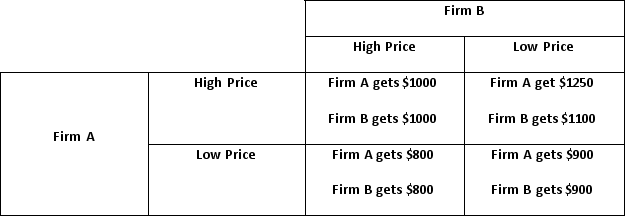

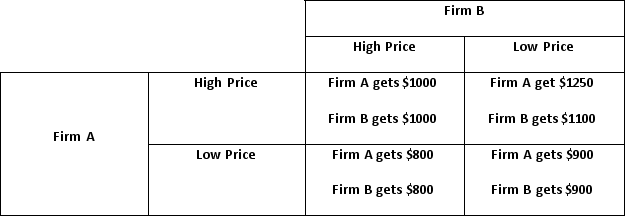

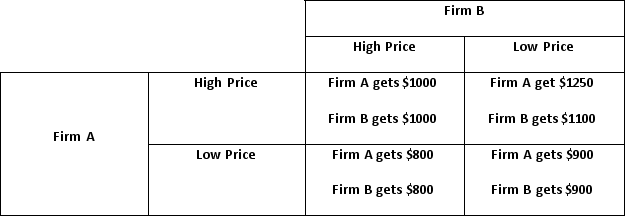

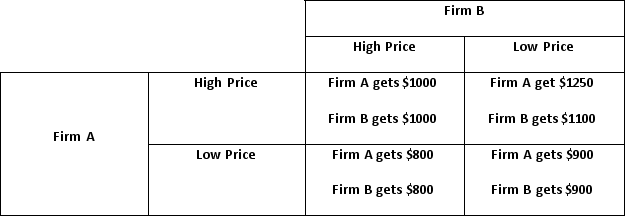

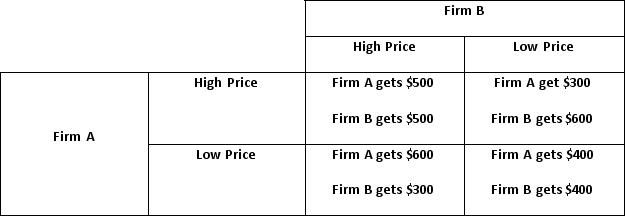

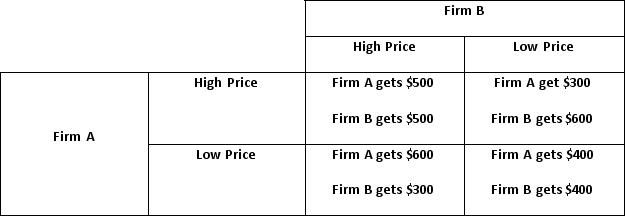

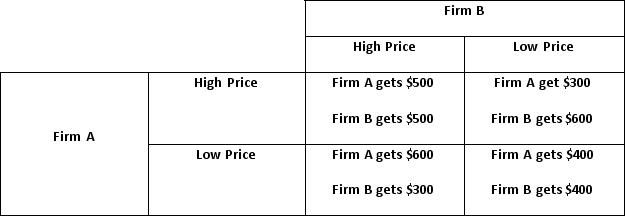

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. If the two firms wanted to achieve the optimal level of profit they would:

A) both sell at a low price

B) both sell at a high price

C) collude to let firm A sell at a low price and firm B to sell at a high price

D) collude to let firm A sell at a high price and firm B to sell at a low price

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. If the two firms wanted to achieve the optimal level of profit they would:

A) both sell at a low price

B) both sell at a high price

C) collude to let firm A sell at a low price and firm B to sell at a high price

D) collude to let firm A sell at a high price and firm B to sell at a low price

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

47

Table 16-2

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm B will earn if it plays its dominant strategy:

A) $1000 if firm A has a high price and $800 if firm A has a low price

B) $1100 if firm A has a high price and $900 if firm A has a low price

C) $800 if firm A has a high price and $900 if firm A has a low price

D) $1250 if firm A has a high price and $1100 if firm A has a low price

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm B will earn if it plays its dominant strategy:

A) $1000 if firm A has a high price and $800 if firm A has a low price

B) $1100 if firm A has a high price and $900 if firm A has a low price

C) $800 if firm A has a high price and $900 if firm A has a low price

D) $1250 if firm A has a high price and $1100 if firm A has a low price

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

48

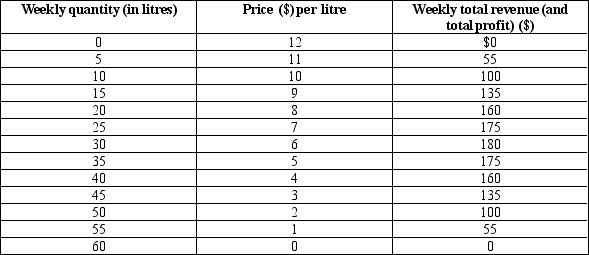

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $0

B) $8000

C) $3000

D) each firm will incur economic losses in a Nash equilibrium

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $0

B) $8000

C) $3000

D) each firm will incur economic losses in a Nash equilibrium

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

49

Illegal cartel agreements are:

A) difficult to maintain because each firm has a profit incentive to break the agreement

B) more likely to occur when there are many firms as the potential profits are higher

C) common in monopolistically competitive markets

D) not detrimental to total welfare as any loss of consumer surplus is offset by higher firm profits

A) difficult to maintain because each firm has a profit incentive to break the agreement

B) more likely to occur when there are many firms as the potential profits are higher

C) common in monopolistically competitive markets

D) not detrimental to total welfare as any loss of consumer surplus is offset by higher firm profits

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

50

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Refer to Table 16-1. Assume that there are two ecotourist companies operating in this market. If they are able to collude on the price of tickets to sell, what price will they charge, and how many tickets will they collectively sell?

A) $2 and 5000 tickets

B) $4 and 4000 tickets

C) $6 and 3000 tickets

D) $8 and 2000 tickets

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)Refer to Table 16-1. Assume that there are two ecotourist companies operating in this market. If they are able to collude on the price of tickets to sell, what price will they charge, and how many tickets will they collectively sell?

A) $2 and 5000 tickets

B) $4 and 4000 tickets

C) $6 and 3000 tickets

D) $8 and 2000 tickets

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

51

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. What price will the tickets be sold at when this market reaches a Nash equilibrium?

A) $0

B) $4

C) $6

D) from the information given in the table, we can't determine price in a Nash equilibrium

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. What price will the tickets be sold at when this market reaches a Nash equilibrium?

A) $0

B) $4

C) $6

D) from the information given in the table, we can't determine price in a Nash equilibrium

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

52

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are able to collude on the price of the tickets they sell. As part of their collusive agreement, they decide to take an equal share of the market. How much profit will each company make?

A) $18 000

B) $16 000

C) $9000

D) $4500

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are able to collude on the price of the tickets they sell. As part of their collusive agreement, they decide to take an equal share of the market. How much profit will each company make?

A) $18 000

B) $16 000

C) $9000

D) $4500

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

53

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Refer to Table 16-1. If there is only one ecotourist company in this market, what ticket price would it charge for its hides to maximise its profit?

A) $2

B) $4

C) $6

D) $8

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)Refer to Table 16-1. If there is only one ecotourist company in this market, what ticket price would it charge for its hides to maximise its profit?

A) $2

B) $4

C) $6

D) $8

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

54

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. If the market for water was perfectly competitive instead of monopolistic, how many litres of water would be produced and sold?

A) 30

B) 35

C) 50

D) 60

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. If the market for water was perfectly competitive instead of monopolistic, how many litres of water would be produced and sold?

A) 30

B) 35

C) 50

D) 60

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

55

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Refer to Table 16-1. Assuming that oligopolists do not have the opportunity to collude, once they have reached the Nash equilibrium, it:

A) is always in their best interest to supply more to the market

B) is always in their best interest to leave supply unchanged

C) is always in their best interest to supply less to the market

D) may be in their best interest to do any of the above, depending on market conditions

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $5000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)

Any firm can change tickets by steps of 500 only. Any 500 step of quantity is assumed to be sold at the midpoint of the two prices (eg. 3500 tickets would be sold for $5)Refer to Table 16-1. Assuming that oligopolists do not have the opportunity to collude, once they have reached the Nash equilibrium, it:

A) is always in their best interest to supply more to the market

B) is always in their best interest to leave supply unchanged

C) is always in their best interest to supply less to the market

D) may be in their best interest to do any of the above, depending on market conditions

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

56

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Since Robert and John operate as a profit-maximising monopoly in the market for water, what price will they charge to sell 45 litres of water?

A) $12

B) $6

C) $3

D) none of the above; the price is arbitrary when dealing with a monopoly market

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Since Robert and John operate as a profit-maximising monopoly in the market for water, what price will they charge to sell 45 litres of water?

A) $12

B) $6

C) $3

D) none of the above; the price is arbitrary when dealing with a monopoly market

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

57

Table 16-2

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. The Nash equilibrium for this game is for:

A) both firms to sell the product at a low price

B) both firms to sell the product at a high price

C) firm A to sell at a low price and for firm B to sell at a high price

D) firm A to sell at a high price and for firm B to sell at a low price

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. The Nash equilibrium for this game is for:

A) both firms to sell the product at a low price

B) both firms to sell the product at a high price

C) firm A to sell at a low price and for firm B to sell at a high price

D) firm A to sell at a high price and for firm B to sell at a low price

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

58

As a group, oligopolists would always be better off if they would act collectively:

A) as a single monopolist

B) as a single competitor

C) as if they were each seeking to maximise their own profit

D) in a manner that would prohibit collusive agreements

A) as a single monopolist

B) as a single competitor

C) as if they were each seeking to maximise their own profit

D) in a manner that would prohibit collusive agreements

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

59

Table 16-2

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm A will earn if it plays its dominant strategy:

A) $1000 if firm B has a high price and $1250 if firm B has a low price

B) $1000 if firm B has a high price and $1100 if firm B has a low price

C) $800 if firm B has a high price and $900 if firm B has a low price

D) $1250 if firm B has a high price and $1100 if firm B has a low price

In the following duopoly game, the two firms can either set the price of their product high or low. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm A will earn if it plays its dominant strategy:

A) $1000 if firm B has a high price and $1250 if firm B has a low price

B) $1000 if firm B has a high price and $1100 if firm B has a low price

C) $800 if firm B has a high price and $900 if firm B has a low price

D) $1250 if firm B has a high price and $1100 if firm B has a low price

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

60

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. As long as Robert and John operate as a profit-maximising monopoly, what will their weekly revenue be?

A) $100

B) $135

C) $175

D) $180

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. As long as Robert and John operate as a profit-maximising monopoly, what will their weekly revenue be?

A) $100

B) $135

C) $175

D) $180

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

61

A situation in which economic actors interacting with one another each choose their best strategy, given the strategies the others have chosen is called a(n):

A) socially optimal solution

B) Nash equilibrium

C) competitive equilibrium

D) open market solution

A) socially optimal solution

B) Nash equilibrium

C) competitive equilibrium

D) open market solution

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

62

Once a cartel is formed, the market is in effect served by:

A) imperfect competition

B) a monopoly

C) monopolistic competition

D) an oligopoly

A) imperfect competition

B) a monopoly

C) monopolistic competition

D) an oligopoly

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

63

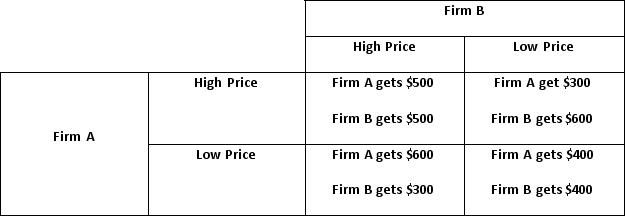

Table 16-4

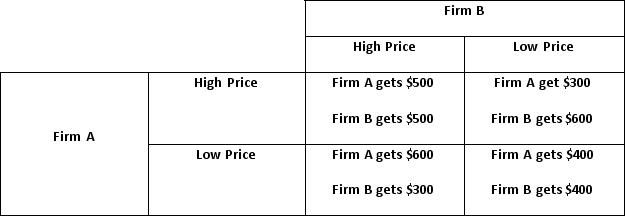

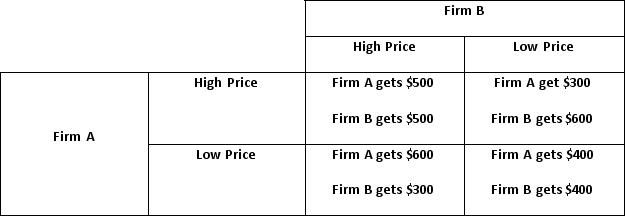

In the following duopoly game, the two firms can either set the price of their product high or low. In this market, customers are very price sensitive: when one firm sets a low price it steals the majority of customers from its competitor. The game is represented in the table below.

Refer to Table 16-4. The Nash-equilibrium in this market is:

A) firm A gets $500, firm B gets $500

B) firm A gets $300, firm B gets $600

C) firm A gets $600, firm B gets $300

D) firm A gets $400, firm B gets $400

In the following duopoly game, the two firms can either set the price of their product high or low. In this market, customers are very price sensitive: when one firm sets a low price it steals the majority of customers from its competitor. The game is represented in the table below.

Refer to Table 16-4. The Nash-equilibrium in this market is:

A) firm A gets $500, firm B gets $500

B) firm A gets $300, firm B gets $600

C) firm A gets $600, firm B gets $300

D) firm A gets $400, firm B gets $400

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

64

To increase their profits further, members of a cartel have an incentive to:

A) collude

B) lower production

C) cheat

D) limit membership

A) collude

B) lower production

C) cheat

D) limit membership

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

65

An oligopolist will increase production if the output effect is:

A) less than the price effect

B) greater than the price effect

C) equal to the price effect

D) greater than or equal to the price effect

A) less than the price effect

B) greater than the price effect

C) equal to the price effect

D) greater than or equal to the price effect

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

66

There are two types of markets in which firms face some competition, yet are still able to have some control over the prices of their products. The names given to these market structures are:

A) oligopoly and duopoly

B) imperfect competition and monopolistic competition

C) duopoly and imperfect competition

D) monopolistic competition and oligopoly

A) oligopoly and duopoly

B) imperfect competition and monopolistic competition

C) duopoly and imperfect competition

D) monopolistic competition and oligopoly

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

67

For the non-colluding oligopolist, there are two factors that affect the decision to raise production. These factors are the:

A) output effect and the cost effect

B) cost effect and the price effect

C) production effect and the output effect

D) output effect and the price effect

A) output effect and the cost effect

B) cost effect and the price effect

C) production effect and the output effect

D) output effect and the price effect

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

68

In what type of market do the actions of any one seller have a significant impact on the profits of all other sellers?

A) a monopoly

B) an oligopoly

C) perfect competition

D) monopolistic competition

A) a monopoly

B) an oligopoly

C) perfect competition

D) monopolistic competition

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

69

OPEC is an example of a:

A) cartel

B) collective

C) international free trade agreement

D) coalition

A) cartel

B) collective

C) international free trade agreement

D) coalition

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

70

If the number of firms in an oligopoly grows smaller, an oligopolistic market looks less and less like:

A) a monopoly

B) a duopoly

C) a competitive market

D) none of the above

A) a monopoly

B) a duopoly

C) a competitive market

D) none of the above

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

71

When an oligopoly grows very large, the:

A) output effect disappears

B) income effect disappears

C) price effect disappears

D) homogeneous product effect disappears

A) output effect disappears

B) income effect disappears

C) price effect disappears

D) homogeneous product effect disappears

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose an opal-mining firm is part of an oligopoly. It will have no profit incentive to increase the output of opals when the output effect is:

A) is equal to the dominant strategy

B) equal to the price effect

C) less than the price effect

D) greater than the price effect

A) is equal to the dominant strategy

B) equal to the price effect

C) less than the price effect

D) greater than the price effect

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

73

Raising production will increase total units sold, which will decrease the per unit price of all units sold. This concept is known as the:

A) cost effect

B) output effect

C) price effect

D) income effect

A) cost effect

B) output effect

C) price effect

D) income effect

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

74

If duopolists individually pursue their own self-interest when deciding how much to produce, the price they are able to charge for their product will be:

A) less than the monopoly price

B) greater than the monopoly price

C) possibly less than or greater than the monopoly price

D) equal to the perfectly competitive market price

A) less than the monopoly price

B) greater than the monopoly price

C) possibly less than or greater than the monopoly price

D) equal to the perfectly competitive market price

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

75

If an oligopolist is part of a cartel that is collectively producing at the monopoly level of output, then the oligopolist, being self-interested, will:

A) lower production and drive up prices

B) increase production and push prices down

C) do nothing, thus allowing the cartel to realise monopoly profits

D) do none of the above

A) lower production and drive up prices

B) increase production and push prices down

C) do nothing, thus allowing the cartel to realise monopoly profits

D) do none of the above

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

76

If duopolists can enforce an agreement, to produce collectively the monopoly output and split the market between the two firms, then the sum of their output will be:

A) be less than the monopoly quantity

B) be greater than the monopoly quantity

C) be equal to the monopoly quantity

D) any of the above are possible

A) be less than the monopoly quantity

B) be greater than the monopoly quantity

C) be equal to the monopoly quantity

D) any of the above are possible

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

77

An agreement among firms over production and price is called:

A) collusion

B) conspiracy

C) multinational corporation

D) trade arrangement

A) collusion

B) conspiracy

C) multinational corporation

D) trade arrangement

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

78

Table 16-4

In the following duopoly game, the two firms can either set the price of their product high or low. In this market, customers are very price sensitive: when one firm sets a low price it steals the majority of customers from its competitor. The game is represented in the table below.

Refer to Table 16-4. The dominant strategy for the firms are:

A) firm A sets low price, firm B sets low price

B) firm A sets low price, firm B sets high price

C) firm A sets high price, firm B sets low price

D) firm A sets high price, firm B sets high price

In the following duopoly game, the two firms can either set the price of their product high or low. In this market, customers are very price sensitive: when one firm sets a low price it steals the majority of customers from its competitor. The game is represented in the table below.

Refer to Table 16-4. The dominant strategy for the firms are:

A) firm A sets low price, firm B sets low price

B) firm A sets low price, firm B sets high price

C) firm A sets high price, firm B sets low price

D) firm A sets high price, firm B sets high price

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

79

Suppose an opal-mining firm notices that the price of opals is above marginal cost. Selling one more unit of opals at the going price also increases profit. This concept is known as the:

A) income effect

B) price effect

C) opal effect

D) output effect

A) income effect

B) price effect

C) opal effect

D) output effect

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

80

Table 16-4

In the following duopoly game, the two firms can either set the price of their product high or low. In this market, customers are very price sensitive: when one firm sets a low price it steals the majority of customers from its competitor. The game is represented in the table below.

Refer to Table 16-4. Profit for each firm would be maximised if:

A) each firm plays their dominant strategy

B) firm A sets a high price and firm B sets a low price

C) firm A sets a low price and firm B sets a high price

D) the two firms could successfully collude

In the following duopoly game, the two firms can either set the price of their product high or low. In this market, customers are very price sensitive: when one firm sets a low price it steals the majority of customers from its competitor. The game is represented in the table below.

Refer to Table 16-4. Profit for each firm would be maximised if:

A) each firm plays their dominant strategy

B) firm A sets a high price and firm B sets a low price

C) firm A sets a low price and firm B sets a high price

D) the two firms could successfully collude

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck