Deck 12: Price and Output Determination: Oligopoly

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 12: Price and Output Determination: Oligopoly

1

Characterize the product space for mobile phones when Iridium began.

Mobile phones were not accessible to large number of people when the Iridium began. The sizes of phones were somewhat larger and only business persons were able to afford the mobile phones. Competition among the firms was not intense. Mobiles phones were considered as only medium of communication. Only voice analog facility was available in phones.

2

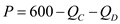

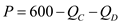

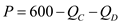

Assume that two companies (C and D) are duopolists that produce identical products. Demand for the products is given by the following linear demand function:

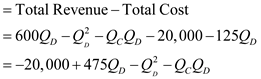

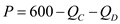

P = 600 -Q C Q D

where QC and QD are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

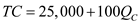

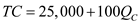

TC C = 25,000 + 100Q C

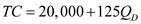

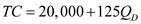

TC D = 20,000 + 125Q D

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine the total profits for each firm at the equilibrium output found in Part (a).

P = 600 -Q C Q D

where QC and QD are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

TC C = 25,000 + 100Q C

TC D = 20,000 + 125Q D

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine the total profits for each firm at the equilibrium output found in Part (a).

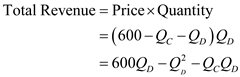

a) Equilibrium output and price

Profit for firm C

…… (1)

…… (1)

Following is the cost function for firm C

Profit function:

Profit function:

Differentiate the total profit function and equating it with zero:

Differentiate the total profit function and equating it with zero:

…… (2)

…… (2)

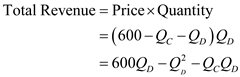

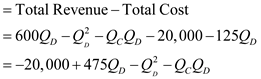

Profit for firm D:

Following is the cost function for firm D:

Following is the cost function for firm D:

Profit Function:-

Profit Function:-

Differentiate the total profit function with respect to the

Differentiate the total profit function with respect to the

and equating it with zero:

and equating it with zero:

…… (3)

…… (3)

Simultaneously solve equations (2) and (3):

Substitute the value of

Substitute the value of

in equation (3):

in equation (3):

Substitute the output values of both firms:

Substitute the output values of both firms:

b) Total profit for each firms

b) Total profit for each firms

Firm C profit

Substitute the values of output of both firms in profit function:

Firm D profit

Firm D profit

Substitute the values of output of both firms in profit function:

Profit for firm C

…… (1)

…… (1)Following is the cost function for firm C

Profit function:

Profit function: Differentiate the total profit function and equating it with zero:

Differentiate the total profit function and equating it with zero:  …… (2)

…… (2)Profit for firm D:

Following is the cost function for firm D:

Following is the cost function for firm D:  Profit Function:-

Profit Function:- Differentiate the total profit function with respect to the

Differentiate the total profit function with respect to the  and equating it with zero:

and equating it with zero:  …… (3)

…… (3)Simultaneously solve equations (2) and (3):

Substitute the value of

Substitute the value of  in equation (3):

in equation (3):  Substitute the output values of both firms:

Substitute the output values of both firms:  b) Total profit for each firms

b) Total profit for each firms Firm C profit

Substitute the values of output of both firms in profit function:

Firm D profit

Firm D profit Substitute the values of output of both firms in profit function:

3

What trends did Nokia pursue as it designed mobile phone products in the late 1990s (Refer to the Managerial Challenge at the beginning of this chapter.)

The cheap and affordable mobiles phones were provided by the Nokia. Nokia posed intense competition to the players in the same field. Nokia was major firm in digital mobile telephony industry. Provision of affordable mobile phones opened up the market for general public in large scale. Other firms also followed the suit.

4

Assume that two companies (A and B) are duopolists who produce identical products. Demand for the products is given by the following linear demand function:

p = 200 Q A Q B

where Q A and Q B are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

TCA = 1,500 + 55Q A +Q 2 A

TCB = 1,200 + 20Q B + 2Q 2 B

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the equilibrium solution found in Part (a).

p = 200 Q A Q B

where Q A and Q B are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

TCA = 1,500 + 55Q A +Q 2 A

TCB = 1,200 + 20Q B + 2Q 2 B

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the equilibrium solution found in Part (a).

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

What might a more proactive Motorola have done differently had it correctly perceived the steps its rival Nokia would take

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

Consider Exercise again. Assume that the firms form a cartel to act as a monopolist and maximize total industry profits (sum of Firm A and Firm B profits).

a. Determine the optimum output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the optimal solution found in Part (a).

c. Show that the marginal costs of the two firms are equal at the optimal solution found in Part (a).

Exercise

Assume that two companies (A and B) are duopolists who produce identical products. Demand for the products is given by the following linear demand function:

p = 200 Q A Q B

where Q A and Q B are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

TCA = 1,500 + 55Q A +Q 2 A

TCB = 1,200 + 20Q B + 2Q 2 B

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the equilibrium solution found in Part (a).

a. Determine the optimum output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the optimal solution found in Part (a).

c. Show that the marginal costs of the two firms are equal at the optimal solution found in Part (a).

Exercise

Assume that two companies (A and B) are duopolists who produce identical products. Demand for the products is given by the following linear demand function:

p = 200 Q A Q B

where Q A and Q B are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

TCA = 1,500 + 55Q A +Q 2 A

TCB = 1,200 + 20Q B + 2Q 2 B

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the equilibrium solution found in Part (a).

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

Smart phones from Apple and RIM today have imposed upon Nokia competitive pressure once associated with Motorola. What would you advise Nokia to do in light of the success of the iPhone with all its thousands of applications from independent software providers

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

Compare the optimal solutions obtained in Exercises 1 and 2 Specifically:

a. How much higher (lower) is the optimal selling price when the two firms form a cartel to maximize industry profits, compared to when they act independently

b. How much higher (lower) is total industry output

c. How much higher (lower) are total industry profits

Exercise 1

Assume that two companies (A and B) are duopolists who produce identical products. Demand for the products is given by the following linear demand function:

p = 200 Q A Q B

where Q A and Q B are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

TCA = 1,500 + 55Q A +Q 2 A

TCB = 1,200 + 20Q B + 2Q 2 B

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the equilibrium solution found in Part (a).

Exercise 2

Consider Exercise 2 again. Assume that the firms form a cartel to act as a monopolist and maximize total industry profits (sum of Firm A and Firm B profits).

a. Determine the optimum output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the optimal solution found in Part (a).

c. Show that the marginal costs of the two firms are equal at the optimal solution found in Part (a).

a. How much higher (lower) is the optimal selling price when the two firms form a cartel to maximize industry profits, compared to when they act independently

b. How much higher (lower) is total industry output

c. How much higher (lower) are total industry profits

Exercise 1

Assume that two companies (A and B) are duopolists who produce identical products. Demand for the products is given by the following linear demand function:

p = 200 Q A Q B

where Q A and Q B are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are

TCA = 1,500 + 55Q A +Q 2 A

TCB = 1,200 + 20Q B + 2Q 2 B

Assume that the firms act independently as in the Cournot model (i.e., each firm assumes that the other firm's output will not change).

a. Determine the long-run equilibrium output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the equilibrium solution found in Part (a).

Exercise 2

Consider Exercise 2 again. Assume that the firms form a cartel to act as a monopolist and maximize total industry profits (sum of Firm A and Firm B profits).

a. Determine the optimum output and selling price for each firm.

b. Determine Firm A, Firm B, and total industry profits at the optimal solution found in Part (a).

c. Show that the marginal costs of the two firms are equal at the optimal solution found in Part (a).

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

Alchem (L) is the price leader in the polyglue market. All 10 other manufacturers (follower [F] firms) sell polyglue at the same price as Alchem. Alchem allows the other firms to sell as much as they wish at the established price and supplies the remainder of the demand itself. Total demand for polyglue is given by the following function (Q T = Q L + Q F ):

P = 20,000 4Q T

Alchem's marginal cost function for manufacturing and selling polyglue is MCL = 5,000 + 5Q L The aggregate marginal cost function for the other manufacturers of polyglue is MCF = 2,000 + 4Q F

a. To maximize profits, how much polyglue should Alchem produce and what price should it charge

b. What is the total market demand for polyglue at the price established by AlchemBN in Part (a) How much of total demand do the follower firms supply

P = 20,000 4Q T

Alchem's marginal cost function for manufacturing and selling polyglue is MCL = 5,000 + 5Q L The aggregate marginal cost function for the other manufacturers of polyglue is MCF = 2,000 + 4Q F

a. To maximize profits, how much polyglue should Alchem produce and what price should it charge

b. What is the total market demand for polyglue at the price established by AlchemBN in Part (a) How much of total demand do the follower firms supply

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

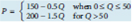

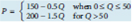

Chillman Motors, Inc., believes it faces the following segmented demand function:

a. Indicate both verbally and graphically why such a segmented demand function is likely to exist. What type of industry structure is indicated by this relationship

b. Calculate the marginal revenue functions facing Chillman. Add these to your graph from Part (a).

c. Chillman's total cost function is TC 1 = 500 + 15 Q +0:5Q 2 Calculate the marginal cost function. What is Chillman's profit-maximizing price and output combination

d. What is Chillman's profit-maximizing price-output combination if total costs increase to TC2 = 500 + 45 Q +0.5Q 2

e. If Chillman's total cost function changes to either TC3 = 500 + 15Q+1.0Q 2 or TC4 = 500 + 5Q+0.25Q 2 what price-output solution do you expect to prevail Would your answer change if you knew that all firms in the industry witnessed similar changes in their cost functions

a. Indicate both verbally and graphically why such a segmented demand function is likely to exist. What type of industry structure is indicated by this relationship

b. Calculate the marginal revenue functions facing Chillman. Add these to your graph from Part (a).

c. Chillman's total cost function is TC 1 = 500 + 15 Q +0:5Q 2 Calculate the marginal cost function. What is Chillman's profit-maximizing price and output combination

d. What is Chillman's profit-maximizing price-output combination if total costs increase to TC2 = 500 + 45 Q +0.5Q 2

e. If Chillman's total cost function changes to either TC3 = 500 + 15Q+1.0Q 2 or TC4 = 500 + 5Q+0.25Q 2 what price-output solution do you expect to prevail Would your answer change if you knew that all firms in the industry witnessed similar changes in their cost functions

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

Library Research Project. It was observed in the chapter that collusion among oligopolists can be facilitated in part by information sharing. As a consequence, the sharing of price information among rival oligopolists can violate U.S. antitrust laws. You can see how the U.S. Supreme Court has interpreted antitrust law as it pertains to sharing price information by reading a summary of the case of U.S. v. U.S. Gypsum Co. et al. (438 U.S. 422), which is available at www.stolaf.edu/eople/becker/antitrust/summaries/438us422.htm. In what manner was price information shared, and why did the court find these actions to be an antitrust violation

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck