Deck 34: Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/33

Play

Full screen (f)

Deck 34: Monetary Policy

1

Over the last five years, Portlandia's average income has risen and caused the supply curve of loanable funds to increase and shift right.

a. Would the domestic interest rate have increased or decreased?

b. Given the change in the interest rate, would General Motors (GM) be more or less likely to open a Camaro plant in the country?

c. If Portlandia hits a recession and interest rates fall, which way must the demand curve for loanable funds have shifted?

a. Would the domestic interest rate have increased or decreased?

b. Given the change in the interest rate, would General Motors (GM) be more or less likely to open a Camaro plant in the country?

c. If Portlandia hits a recession and interest rates fall, which way must the demand curve for loanable funds have shifted?

a. Domestic Interest rate

The supply of loanable funds is raised due to increase in average income of a Country P's citizen. Therefore, Domestic interest rate will decrease.

b. Investment:

The falling domestic interest rate causes fall in the cost of investment. Therefore, Company GM is more likely to invest to open Camaro plant.

c. Shift of the demand for loanable fund:

During a recession, Firms and Households are more likely to avoid spending due to uncertainty. This may likely to cause a decrease in demand of loanable funds. During a recession, there is a decrease in income causes to fall in savings. Thus, loanable fund demand curve shifts leftward.

The supply of loanable funds is raised due to increase in average income of a Country P's citizen. Therefore, Domestic interest rate will decrease.

b. Investment:

The falling domestic interest rate causes fall in the cost of investment. Therefore, Company GM is more likely to invest to open Camaro plant.

c. Shift of the demand for loanable fund:

During a recession, Firms and Households are more likely to avoid spending due to uncertainty. This may likely to cause a decrease in demand of loanable funds. During a recession, there is a decrease in income causes to fall in savings. Thus, loanable fund demand curve shifts leftward.

2

Reevaluate the previous problem assuming the U.S. economy follows a fixed exchange-rate regime.

Exchange rate:

Foreign exchange rate refers to the rate at which currency of a country is exchanged for currency of another country. Foreign exchange rate is determined at foreign exchange market

Fixed exchange rate:

As Federal Reserve cuts the interest rate by increasing the supply of government bonds, causing to increase in the capital outflow and decrease in capital inflow. This causes pressure on exchange rate to depreciate. This can be fixed when Federal Reserve continues to buy government bonds causing increase in interest rate. Thus it returning to the old position and there is no effect on other economic variables.

Foreign exchange rate refers to the rate at which currency of a country is exchanged for currency of another country. Foreign exchange rate is determined at foreign exchange market

Fixed exchange rate:

As Federal Reserve cuts the interest rate by increasing the supply of government bonds, causing to increase in the capital outflow and decrease in capital inflow. This causes pressure on exchange rate to depreciate. This can be fixed when Federal Reserve continues to buy government bonds causing increase in interest rate. Thus it returning to the old position and there is no effect on other economic variables.

3

Critics of the North American Free Trade Agreement argued that opening our borders to free trade with Mexico would result in U.S. firms moving all of their factories to Mexico and the U.S. running large trade deficits with Mexico. Comment on the concerns of these critics using your knowledge of international trade and net capital flows.

International trade:

International trade allows a country to produce a good or service that it can produce more efficiently than others. Hence, international trade made efficient allocation of resources.

Net capital outflow:

Net capital outflow refers to the net flow of funds from the home country invested abroad. Therefore, a positive net capital outflow is that, the country will invest more outside than in the home country.

Critics of North American free trade agreement:

When domestic firms in the United States move all their factories to Mexico, then it will lead to a large trade deficit. And if the direct investment increases, the net capital outflow will start increasing. This means that the net exports should also be increased in order to maintain equilibrium in the economy with trade surpluses. But, if the United States runs large trade deficits, the net capital outflow will start falling in order to maintain the equilibrium. Thus, the firms and individuals in Mexico will be investing in the United States. Therefore, only one of the critics will be possible to happen.

International trade allows a country to produce a good or service that it can produce more efficiently than others. Hence, international trade made efficient allocation of resources.

Net capital outflow:

Net capital outflow refers to the net flow of funds from the home country invested abroad. Therefore, a positive net capital outflow is that, the country will invest more outside than in the home country.

Critics of North American free trade agreement:

When domestic firms in the United States move all their factories to Mexico, then it will lead to a large trade deficit. And if the direct investment increases, the net capital outflow will start increasing. This means that the net exports should also be increased in order to maintain equilibrium in the economy with trade surpluses. But, if the United States runs large trade deficits, the net capital outflow will start falling in order to maintain the equilibrium. Thus, the firms and individuals in Mexico will be investing in the United States. Therefore, only one of the critics will be possible to happen.

4

Discuss what would happen to the real exchange rate between the U.S. and Australia if oil prices fell, which dramatically reduced the cost of transporting goods.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

5

Describe what happens to the supply and/or demand curves for U.S. dollars under the following scenarios.

a. A drought in Russia destroys the wheat crop, resulting in increased purchases of wheat from the United States.

b. Bollywood movies become extremely popular in the U.S., increasing demand for foreign movies.

c. The U.S. government forces all government offices to purchase American-made computer products, instead of importing them.

a. A drought in Russia destroys the wheat crop, resulting in increased purchases of wheat from the United States.

b. Bollywood movies become extremely popular in the U.S., increasing demand for foreign movies.

c. The U.S. government forces all government offices to purchase American-made computer products, instead of importing them.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

6

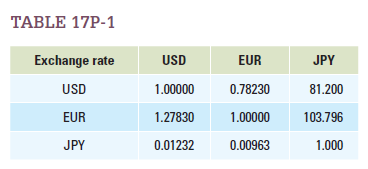

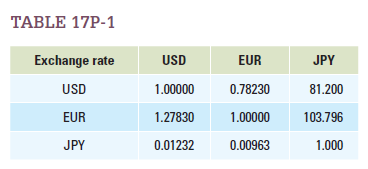

Martha has $10,000 to invest in the foreign-exchange market. She's interested in trading U.S. dollars (USD) for euro (EUR) and Japanese yen (JPY). Using Table 17P-1 , determine the arbitrage profit/loss Martha will make in each of the following scenarios. ( Note: Any value less than $10 should be considered zero.)

a. USD ã EUR ã JPY ã USD.

b. USD ã JPY ã EUR ã USD. c. Now look up the current exchange rates among any three currencies. Show that there are no arbitrage opportunities for the three currencies you chose.

a. USD ã EUR ã JPY ã USD.

b. USD ã JPY ã EUR ã USD. c. Now look up the current exchange rates among any three currencies. Show that there are no arbitrage opportunities for the three currencies you chose.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

7

Rating agencies rate countries on the perceived riskiness of investing in their economies. Standard and Poor's, one of the main rating agencies, downgraded the credit rating for U.S. Treasury bonds in 2011. According to this chapter, what impact should the downgrading have had on net capital outflows and interest rates? Why?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

8

Is it ever possible for a country's nominal exchange rate to be depreciating while its real exchange rate is appreciating? Explain.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose there is major unrest in the labor market in the U.S., making European investors nervous about investing in the U.S.

a. Draw the supply and demand curves for U.S. dollars, and show the appropriate shift(s) in supply and demand for U.S. dollars associated with the labor unrest.

b. Did the value of the U.S. dollar depreciate or appreciate?

a. Draw the supply and demand curves for U.S. dollars, and show the appropriate shift(s) in supply and demand for U.S. dollars associated with the labor unrest.

b. Did the value of the U.S. dollar depreciate or appreciate?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

10

In Windsor, Ontario, a Big Mac from McDonald's costs C$4.16 (Canadian dollars), and across the border in Detroit it costs $3.54 in U.S. dollars.

a. Suppose the nominal U.S. exchange rate with Canada is US$0.80 per Canadian dollar. Does purchasing power parity hold between the two countries?

b. What is the purchasing power parity exchange rate for the U.S.?

a. Suppose the nominal U.S. exchange rate with Canada is US$0.80 per Canadian dollar. Does purchasing power parity hold between the two countries?

b. What is the purchasing power parity exchange rate for the U.S.?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

11

The interest rate on 10-year U.S. Treasury bonds just before Standard and Poor's downgraded the U.S. credit rating was 2.47 percent. One year later, the interest rate on these bonds had fallen to 1.60 percent. How can one explain this result that seems to contradict the findings of this chapter?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

12

Suppose the current U.S.-UK exchange rate is 0.63 pounds (the pound is the UK currency) per dollar, and the aggregate price level is 170 for the U.S. and 140 for the UK. What is the real exchange rate? What does this real exchange rate mean in terms of the relative purchasing power of the dollar and the pound?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose total U.S. exports in the month of June were $122.9 billion and total imports from foreign countries were $192.4 billion. What was the balance of trade?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

14

For each case in problem 7, does the U.S. exchange rate appreciate or depreciate, and what happens to the U.S. balance of trade?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

15

Imagine there are only two trading nations in the world. For each of the following scenarios, determine whether goods in one country will become more attractive relative to goods in the other country given their inflation rates and a shift in the nominal exchange rates. a. Inflation is 8 percent in the UK and 4 percent in Germany, but the UK pound-euro exchange rate remains the same.

B) Inflation is 3 percent in the U.S. and 7 percent in Japan, but the exchange rate for U.S. dollars to Japanese yen increases from 70 to 80 Japanese yen.

C) Inflation is 10 percent in the U.S. and 6 percent in Mexico, and the price of the Mexican peso rises from US$0.08 to US$0.15.

B) Inflation is 3 percent in the U.S. and 7 percent in Japan, but the exchange rate for U.S. dollars to Japanese yen increases from 70 to 80 Japanese yen.

C) Inflation is 10 percent in the U.S. and 6 percent in Mexico, and the price of the Mexican peso rises from US$0.08 to US$0.15.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

16

What happens to the U.S. balance of trade as oil prices rise?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

17

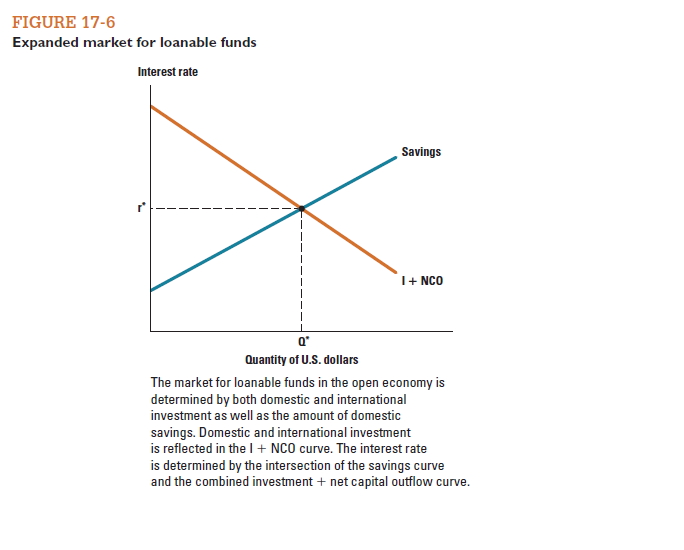

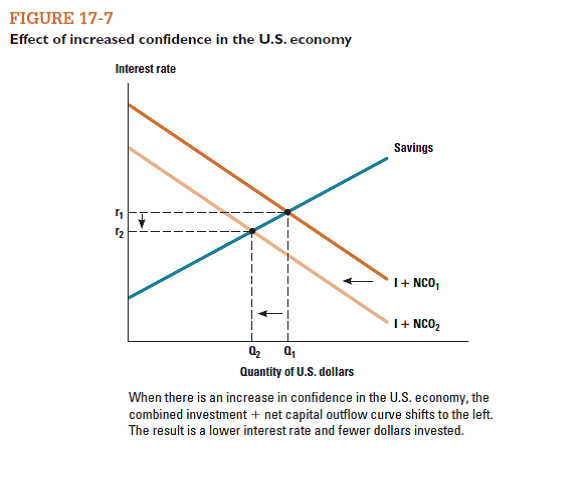

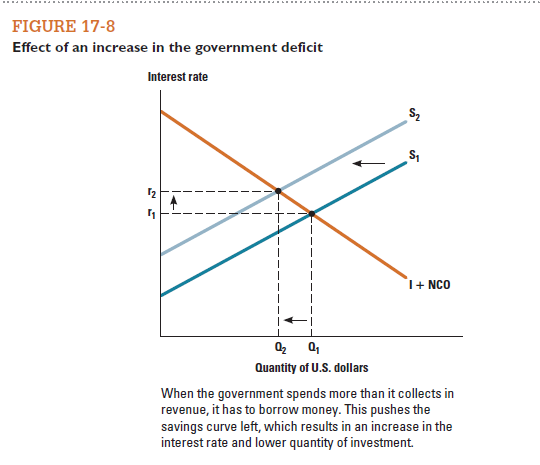

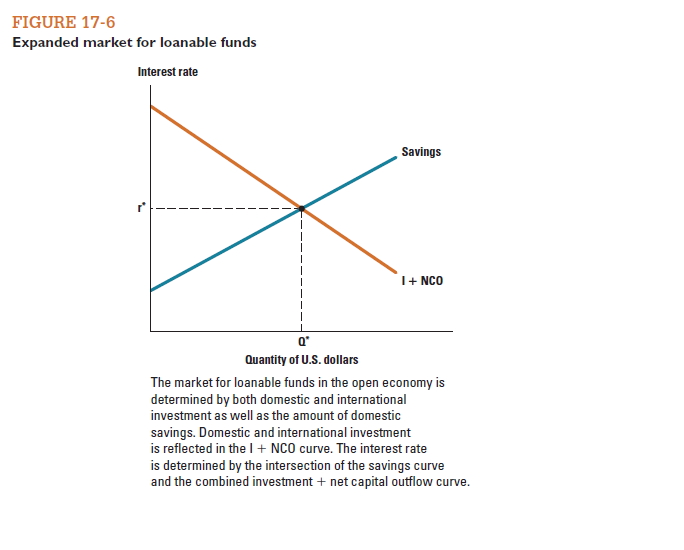

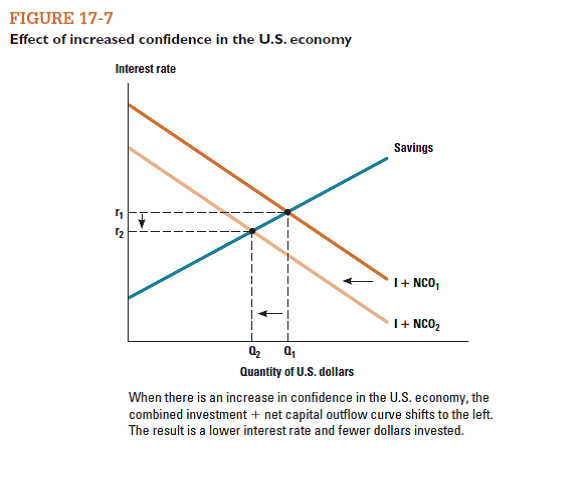

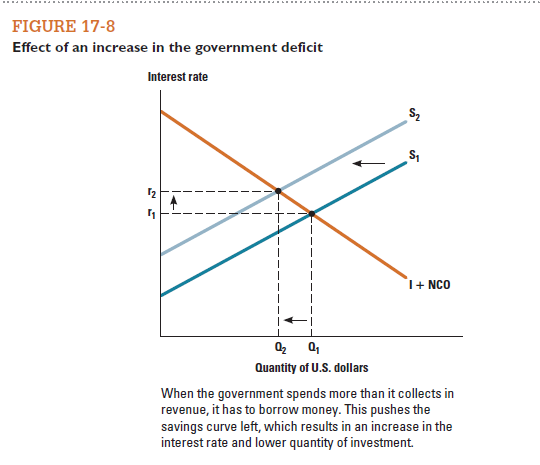

List three policies that a government could engage in that would reduce interest rates. ( Hint: Look back to Figures 17-6 through 17-8.)

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose a country has total GDP (Y) 5 $10 trillion, consumption 5 $7 trillion, government spending 5 $2 trillion, investment 5 $2 trillion, and taxes 5 $1.5 trillion. What is the level of net exports or balance of trade? What is the level of public savings? What is the level of private savings? What is the level of net capital outflow?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose the new CEO for Apple Inc. decides to produce all the company's products in the U.S. instead of China.

a. Which way will the supply for U.S. dollars shift?

b. Which way will the demand for U.S. dollars shift?

c. Does the value of the U.S. dollars depreciate or appreciate?

a. Which way will the supply for U.S. dollars shift?

b. Which way will the demand for U.S. dollars shift?

c. Does the value of the U.S. dollars depreciate or appreciate?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose a presidential candidate criticizes his opponent by saying his opponent's economic policies have made the dollar weaker and cost American factory workers their jobs. What would be your response?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

21

Why might a country's exporters want the country's government to have a balanced budget?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

22

In 2010, U.S. investors purchased $50 billion in foreign assets, and foreigners purchased $100 billion in U.S. assets such as stocks and Treasury bills. In addition, U.S. businesses invested $150 billion in foreign factories and operations, while foreign companies invested $100 billion in U.S. factories and operations. What was the net capital outflow for the United States?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose that in the United States last season's hot holiday gift was the iPad (which is made primarily in China) while this season's big gift is media content for the iPad (which is made in the U.S.). Determine whether there will be an increase, decrease, or no change for each of the following variables compared to last year. a. Supply and demand for dollars.

B) Exchange rate between the U.S. and China.

C) Net exports for the U.S.

D) Net capital outflows for the U.S.

B) Exchange rate between the U.S. and China.

C) Net exports for the U.S.

D) Net capital outflows for the U.S.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

24

Why would a company want to make a direct investment in countries where the company's home currency has higher purchasing power?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

25

Some politicians argue for imposing trade restrictions in the hope that doing so will reduce the trade deficit of the United States. Assuming the United States has a floating exchange rate, give an economic argument against this proposed policy in terms of the supply and demand of money

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

26

Define each of the following as direct or portfolio foreign investment. a. Nike (a U.S. company) builds new factories in Cambodia.

B) A U.S. hedge fund purchases 30 percent of the shares of a Brazilian paper manufacturer.

C) Mercedes-Benz (a German company) builds a new manufacturing plant in Alabama.

D) Intel (a U.S. company) sets up a new call center in India.

E) A British chocolate maker buys a smaller U.S. rival. f. Hilton Hotels (a U.S. company) builds a new resort in Hawaii.

B) A U.S. hedge fund purchases 30 percent of the shares of a Brazilian paper manufacturer.

C) Mercedes-Benz (a German company) builds a new manufacturing plant in Alabama.

D) Intel (a U.S. company) sets up a new call center in India.

E) A British chocolate maker buys a smaller U.S. rival. f. Hilton Hotels (a U.S. company) builds a new resort in Hawaii.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

27

In March 2009 the Canadian dollar was worth $0.78 U.S. dollars. In April 2011 the Canadian dollar was worth $1.06 U.S. dollars. What effect would this increase have on the trade balance between the United States and Canada? Why?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

28

Part of the North American Free Trade Agreement (NAFTA) opened the Mexican stock market to U.S. and Canadian investors for the first time. How would this affect direct and portfolio foreign investment in Mexico?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

29

In response to a severe recession, a politician in a country with a fixed exchange rate proposes to allow the exchange rate to float. What impact would this move have on the economy? Do you think it would be a good response to the recession?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

30

Tom is stuck with his friends on an island that uses coconuts for currency, but they recently discovered Wilson's Island nearby. Tom's Island agrees to make only one transaction with Wilson's Island: It sells a fishing boat to Wilson's for 15 coconuts. Answer the following questions, assuming that yearly consumption on Tom's Island equals 500 coconuts, and domestic investments in huts and farm equipment equals 150 coconuts.

a. What are net exports for Tom's Island?

b. What is the total national savings for Tom's Island?

c. Suppose Tom's Island imports a volleyball net from Wilson's Island for 5 coconuts. What is the total national savings now?

d. Now Tom purchases 1 coconut tree on Wilson Island at a cost of 10 coconuts. What is the balance of payments? ( Hint: A coconut tree produces coconuts like a factory produces goods.)

a. What are net exports for Tom's Island?

b. What is the total national savings for Tom's Island?

c. Suppose Tom's Island imports a volleyball net from Wilson's Island for 5 coconuts. What is the total national savings now?

d. Now Tom purchases 1 coconut tree on Wilson Island at a cost of 10 coconuts. What is the balance of payments? ( Hint: A coconut tree produces coconuts like a factory produces goods.)

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose the U.S. economy slips into a recession. In response, the Federal Reserve cuts the federal funds rate in order to avoid unemployment. Consider what happens to the following under a floating exchange-rate regime. a. Domestic investment.

B) Capital inflow.

C) Capital outflow.

D) Exchange rate.

E) Net exports.

F) Aggregate demand.

B) Capital inflow.

C) Capital outflow.

D) Exchange rate.

E) Net exports.

F) Aggregate demand.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

32

If many factories that once made goods in the United States move to Mexico, what must also happen in order to correct the balance of payments in the United States?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose that in response to a severe recession, a country with an overvalued currency and a fixed exchange rate does, in fact, move to a floating exchange-rate system. Who are the winners and losers in this move?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck