Deck 15: Asymmetric Information

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/36

Play

Full screen (f)

Deck 15: Asymmetric Information

1

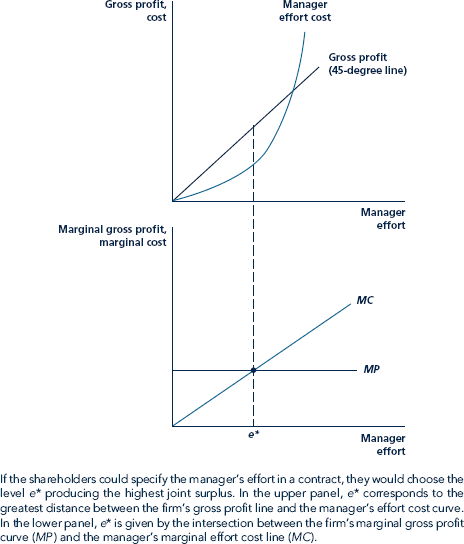

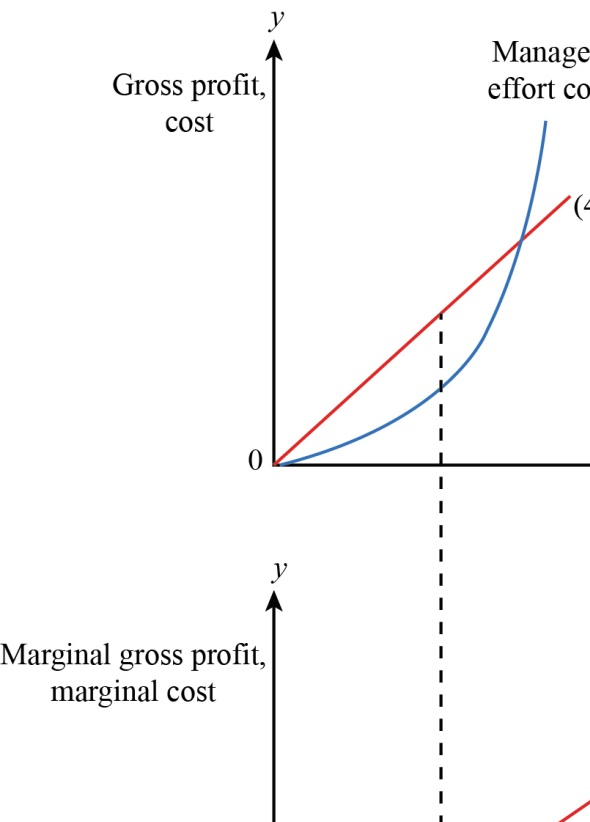

Figure shows why e* is the effort level that is best from the joint perspective of the firm and the manager. Explain why the firm would not want to induce higher effort than e* in the full information equilibrium even though gross profits increasing in e.

Figure Effort Choice under Ful l Information

Figure Effort Choice under Ful l Information

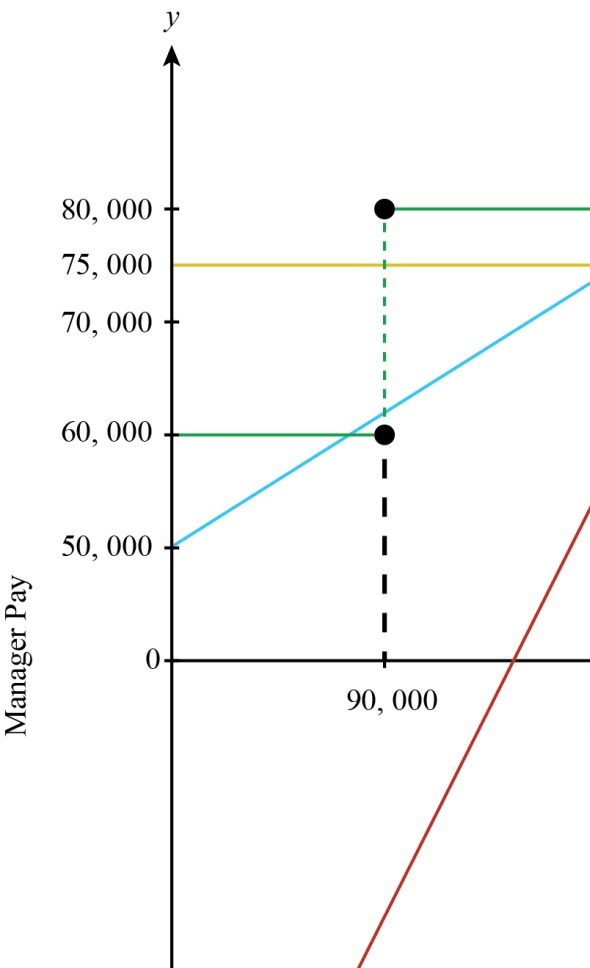

Consider the figures given below showing the choice of effort under full information:

The upper panel of the graph shows the relationship between the effort cost of the manager and gross profit, which can occur to the shareholder. In the graph's upper panel, the x -axis measures the manager's effort and the

The upper panel of the graph shows the relationship between the effort cost of the manager and gross profit, which can occur to the shareholder. In the graph's upper panel, the x -axis measures the manager's effort and the

-axis measures the gross profit and cost. Further, the gross profit curve of the firm is increasing with increase in the manager's effort, whereas the manager's effort cost curve is increasing and convex indicating that manager's effort has a cost that becomes costly at higher levels of effort.

-axis measures the gross profit and cost. Further, the gross profit curve of the firm is increasing with increase in the manager's effort, whereas the manager's effort cost curve is increasing and convex indicating that manager's effort has a cost that becomes costly at higher levels of effort.

On the other hand, a lower panel shows the marginal gross profit of the firm and the marginal effort cost of the manager. On the

-axis is measured the manager's effort and on the

-axis is measured the manager's effort and on the

-axis is measured marginal gross profit and marginal effort cost.

-axis is measured marginal gross profit and marginal effort cost.

Given the assumption of full information, the shareholder could specify the manager's effort in the contract and as a result the joint surplus is maximized at point

. At point

. At point

, the marginal gross profit curve

, the marginal gross profit curve

of the firm is equal to the marginal effort cost

of the firm is equal to the marginal effort cost

curve of the manager. Furthermore, it can be seen in the upper panel, point

curve of the manager. Furthermore, it can be seen in the upper panel, point

corresponds to the greatest difference between the gross profit line of the firm and the effort cost curve of the manager.

corresponds to the greatest difference between the gross profit line of the firm and the effort cost curve of the manager.

The firm would not want to induce higher effort than

(at which the joint surplus is maximized) even though there is increase in the gross profit above

(at which the joint surplus is maximized) even though there is increase in the gross profit above

. This is because in order to induce the manager to work at the firm rather than somewhere else, the firm needs to compensate more as the firm tries to induce the manager to work more. This in essence will only increase the gross profit in

. This is because in order to induce the manager to work at the firm rather than somewhere else, the firm needs to compensate more as the firm tries to induce the manager to work more. This in essence will only increase the gross profit in

above

above

but not the profits (gross profit minus pay of the manager).

but not the profits (gross profit minus pay of the manager).

The upper panel of the graph shows the relationship between the effort cost of the manager and gross profit, which can occur to the shareholder. In the graph's upper panel, the x -axis measures the manager's effort and the

The upper panel of the graph shows the relationship between the effort cost of the manager and gross profit, which can occur to the shareholder. In the graph's upper panel, the x -axis measures the manager's effort and the  -axis measures the gross profit and cost. Further, the gross profit curve of the firm is increasing with increase in the manager's effort, whereas the manager's effort cost curve is increasing and convex indicating that manager's effort has a cost that becomes costly at higher levels of effort.

-axis measures the gross profit and cost. Further, the gross profit curve of the firm is increasing with increase in the manager's effort, whereas the manager's effort cost curve is increasing and convex indicating that manager's effort has a cost that becomes costly at higher levels of effort.On the other hand, a lower panel shows the marginal gross profit of the firm and the marginal effort cost of the manager. On the

-axis is measured the manager's effort and on the

-axis is measured the manager's effort and on the  -axis is measured marginal gross profit and marginal effort cost.

-axis is measured marginal gross profit and marginal effort cost.Given the assumption of full information, the shareholder could specify the manager's effort in the contract and as a result the joint surplus is maximized at point

. At point

. At point  , the marginal gross profit curve

, the marginal gross profit curve  of the firm is equal to the marginal effort cost

of the firm is equal to the marginal effort cost  curve of the manager. Furthermore, it can be seen in the upper panel, point

curve of the manager. Furthermore, it can be seen in the upper panel, point  corresponds to the greatest difference between the gross profit line of the firm and the effort cost curve of the manager.

corresponds to the greatest difference between the gross profit line of the firm and the effort cost curve of the manager.The firm would not want to induce higher effort than

(at which the joint surplus is maximized) even though there is increase in the gross profit above

(at which the joint surplus is maximized) even though there is increase in the gross profit above  . This is because in order to induce the manager to work at the firm rather than somewhere else, the firm needs to compensate more as the firm tries to induce the manager to work more. This in essence will only increase the gross profit in

. This is because in order to induce the manager to work at the firm rather than somewhere else, the firm needs to compensate more as the firm tries to induce the manager to work more. This in essence will only increase the gross profit in  above

above  but not the profits (gross profit minus pay of the manager).

but not the profits (gross profit minus pay of the manager). 2

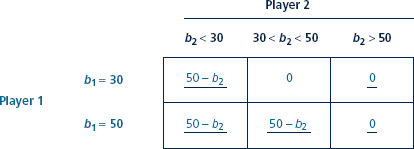

Draw the following incentive contracts on the same graph, with gross profit (revenue minus costs for all inputs, not including payments to the manager)for the firm on the horizontal axis and manager pay on the vertical axis as in Figure. Draw a second graph with the marginal pay implied by each contract.

Figure Bidding Valuation 50 is Player 1?s Dominant Strategy in a Second-Price Auction

a. The manager is paid $50,000 plus a 40% share of gross profit.

b. The manager buys out the firm (so the manager gets all the gross profits) for $100,000.

c. The manager is paid a constant $75,000.

d. The manager is paid $60,000 plus a bonus if the firm's gross profit is more than $90,000.

Figure Bidding Valuation 50 is Player 1?s Dominant Strategy in a Second-Price Auction

a. The manager is paid $50,000 plus a 40% share of gross profit.

b. The manager buys out the firm (so the manager gets all the gross profits) for $100,000.

c. The manager is paid a constant $75,000.

d. The manager is paid $60,000 plus a bonus if the firm's gross profit is more than $90,000.

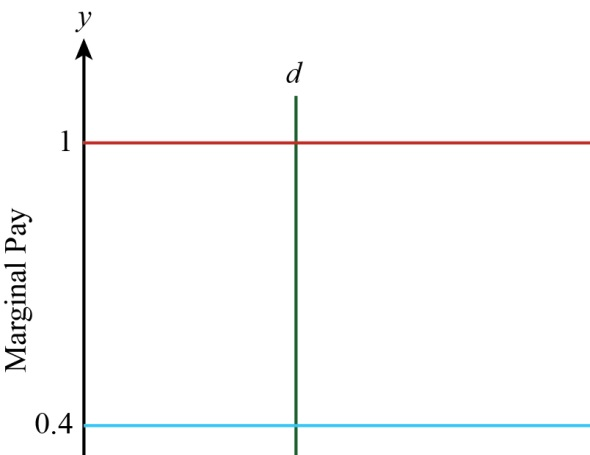

a) Consider the graph given below showing the relationship between manager's pay and gross profit of the firm for different incentive contracts.

In the graph, the x -axis measures the gross profit (gross profit is the difference between total revenue and total cost of the inputs but the pay of the manager is not included as cost) and the y -axis measures the manager's pay.

In the graph, the x -axis measures the gross profit (gross profit is the difference between total revenue and total cost of the inputs but the pay of the manager is not included as cost) and the y -axis measures the manager's pay.

The blue line shows the incentive contract where the manager is paid $50,000 plus a share of 40% of gross profit.

The red line shows the incentive contract where the manager buys out the firm for $100,000. That is all of the gross profit now constitutes the manager's pay.

The yellow line shows the incentive contract where the manager is paid a constant wage of $75,000.

The green line shows the incentive contract where the manager is paid nothing till the target of $90,000 of gross profit is achieved but after that he is paid $60,000 plus a bonus.

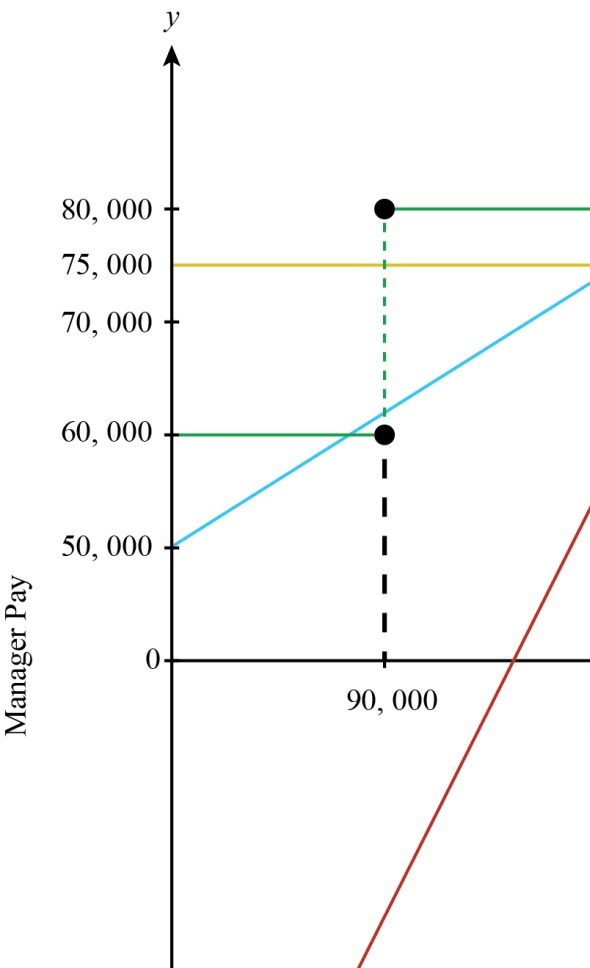

b) Consider the graph given below showing the relationship between marginal pay (increase in pay with additional profit of $1) and the gross profit.

In the graph, the x -axis measures the gross profit and the y -axis measures the marginal pay of the manager.

In the graph, the x -axis measures the gross profit and the y -axis measures the marginal pay of the manager.

The blue line shows the marginal pay for the incentive contract given in (a). It shows that managers pay increases with a constant rate of 0.4

and hence the marginal pay curve is parallel to the x -axis with intercept at 0.4

and hence the marginal pay curve is parallel to the x -axis with intercept at 0.4

The red line shows the marginal pay for the incentive contract (b). Since whole of the gross profit constitutes the managers pay, therefore, the marginal pay graph is a straight line parallel to x -axis with intercept at 1

The yellow line shows the marginal pay curve for incentive contract (c). Since the manager is paid a constant wage so the marginal pay curve is a straight line touching x -axis with intercept 0.

The green line shows the marginal pay curve for incentive contract (d). Since the manager is not paid until the gross profit of $90,000 is achieved and paid thereafter a salary of $60,000 plus a bonus. Therefore the marginal pay curve touches the x -axis up to $90,000 thereafter it is vertical to the x -axis indicating the bonus component.

In the graph, the x -axis measures the gross profit (gross profit is the difference between total revenue and total cost of the inputs but the pay of the manager is not included as cost) and the y -axis measures the manager's pay.

In the graph, the x -axis measures the gross profit (gross profit is the difference between total revenue and total cost of the inputs but the pay of the manager is not included as cost) and the y -axis measures the manager's pay.The blue line shows the incentive contract where the manager is paid $50,000 plus a share of 40% of gross profit.

The red line shows the incentive contract where the manager buys out the firm for $100,000. That is all of the gross profit now constitutes the manager's pay.

The yellow line shows the incentive contract where the manager is paid a constant wage of $75,000.

The green line shows the incentive contract where the manager is paid nothing till the target of $90,000 of gross profit is achieved but after that he is paid $60,000 plus a bonus.

b) Consider the graph given below showing the relationship between marginal pay (increase in pay with additional profit of $1) and the gross profit.

In the graph, the x -axis measures the gross profit and the y -axis measures the marginal pay of the manager.

In the graph, the x -axis measures the gross profit and the y -axis measures the marginal pay of the manager.The blue line shows the marginal pay for the incentive contract given in (a). It shows that managers pay increases with a constant rate of 0.4

and hence the marginal pay curve is parallel to the x -axis with intercept at 0.4

and hence the marginal pay curve is parallel to the x -axis with intercept at 0.4The red line shows the marginal pay for the incentive contract (b). Since whole of the gross profit constitutes the managers pay, therefore, the marginal pay graph is a straight line parallel to x -axis with intercept at 1

The yellow line shows the marginal pay curve for incentive contract (c). Since the manager is paid a constant wage so the marginal pay curve is a straight line touching x -axis with intercept 0.

The green line shows the marginal pay curve for incentive contract (d). Since the manager is not paid until the gross profit of $90,000 is achieved and paid thereafter a salary of $60,000 plus a bonus. Therefore the marginal pay curve touches the x -axis up to $90,000 thereafter it is vertical to the x -axis indicating the bonus component.

3

Consider the moral-hazard problem that arises when a risk-averse manager, whose effort is unobservable, runs a firm on behalf of shareholders. Explain how the trade-off between incentives and risk prevents the firm from obtaining the fully efficient outcome. How can the moral-hazard problem be eliminated if effort is observable? How can the moral-hazard problem be eliminated if effort is unobservable but the manager is risk neutral?

If the effort of the manager was observable, then there would not have been a moral-hazard problem. Since the effort of the manager is not observable, therefore the problem of moral-hazard arises. Moreover, if the manager is risk-averse then the moral hazard problem become further accentuated.

Given the above context and also assuming that there exists a trade-off between risk and incentives, it would be difficult to reach an efficient outcome where the marginal pay of the manager is equal to the marginal cost of manager's effort. This is due to the presence of asymmetric information which links the managers pay to firm's performance (or gross profit) and not his effort. As a result the manger is exposed to risk which is associated with the uncertain gross profits of the firm. This will give rise to two situations: (i) manager will choose less salary for less risk; and (ii) on the other hand, the risk-averse manager will not accept high-powered incentive contract compelling the shareholders to pay a higher fixed salary to the manager to accept the risk.

The moral-hazard problem can be eliminated if the effort of the manager is directly observable by simply linking the manager's effort to the manager's pay. This is because when the effort is observable, the shareholders know that manager's effort is in his control and there is no uncertainty as such.

If the effort is unobservable and the manager is risk-neutral, then the problem of moral-hazard problem can be eliminated by paying incentives for the effort of managers if shareholders gross profit increases.

Given the above context and also assuming that there exists a trade-off between risk and incentives, it would be difficult to reach an efficient outcome where the marginal pay of the manager is equal to the marginal cost of manager's effort. This is due to the presence of asymmetric information which links the managers pay to firm's performance (or gross profit) and not his effort. As a result the manger is exposed to risk which is associated with the uncertain gross profits of the firm. This will give rise to two situations: (i) manager will choose less salary for less risk; and (ii) on the other hand, the risk-averse manager will not accept high-powered incentive contract compelling the shareholders to pay a higher fixed salary to the manager to accept the risk.

The moral-hazard problem can be eliminated if the effort of the manager is directly observable by simply linking the manager's effort to the manager's pay. This is because when the effort is observable, the shareholders know that manager's effort is in his control and there is no uncertainty as such.

If the effort is unobservable and the manager is risk-neutral, then the problem of moral-hazard problem can be eliminated by paying incentives for the effort of managers if shareholders gross profit increases.

4

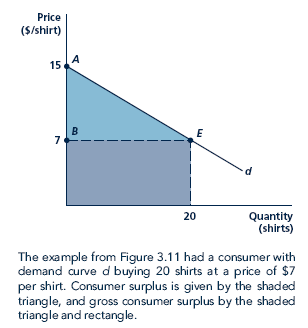

Refer to Figure.

1. Compute consumer surplus.

2. Compute gross consumer surplus.

Figure Comparing Gross and Ordinary Consumer Surplus

1. Compute consumer surplus.

2. Compute gross consumer surplus.

Figure Comparing Gross and Ordinary Consumer Surplus

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

5

Clare manages a piano store. Her utility function is given by Utility ¼ w _ 100where w is the total of all monetary payments to her and 100 represents the cost to her of the effort of running the store. Clare's next best alternative to managing the store provides her with zero utility. The store's gross profit depends on random factors. There is a 50% chance it earns $1,000 (where by earnings we mean gross profits, not including payments to the manager) and a 50% chance it earnsonly$400.

a. If shareholders offered to share half of the

store's gross profit, what would her expected utility be? Would she accept such a contract? What if she were only given a quarter share? What would be the lowest share she would accept to manage the firm?

b. What is the most Clare would pay to buyout the store if shareholders decided to sell it to her?

c. Suppose instead that shareholders decided to offer her a $100 bonus if the store earns$1,000. What fixed salary would Clare need to be paid in addition to get her to accept the contract?

a. If shareholders offered to share half of the

store's gross profit, what would her expected utility be? Would she accept such a contract? What if she were only given a quarter share? What would be the lowest share she would accept to manage the firm?

b. What is the most Clare would pay to buyout the store if shareholders decided to sell it to her?

c. Suppose instead that shareholders decided to offer her a $100 bonus if the store earns$1,000. What fixed salary would Clare need to be paid in addition to get her to accept the contract?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

6

Many contracts between professional athlete sand the teams on which they play involve incentive provisions. Can you provide some examples? Do you think moral hazard is a serious problem for professional athletes? Why or why not? Discuss the problem of using incentive contracts for unproven rookies, whose playing time may depend on the discretion of the coach. How might incentive contracts worsen the problem with performance-enhancing drugs such asteroids?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

7

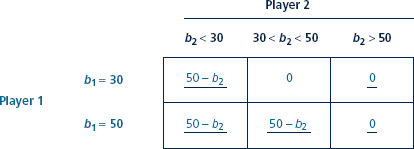

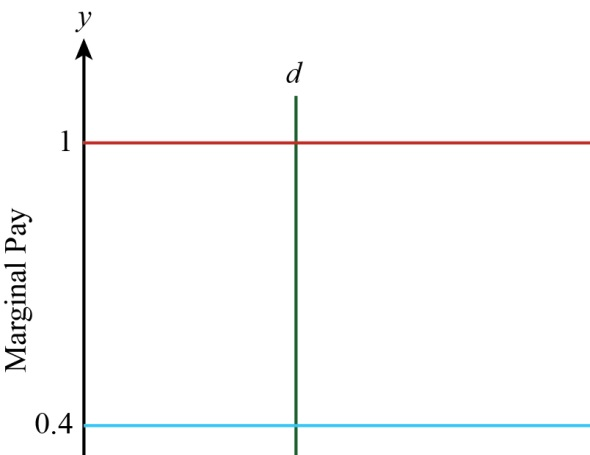

The analysis in Table shows that player 1

prefers to bid 50 (his or her valuation) rather than30 (a lower bid than his or her valuation). Use a similar analysis to show that player 1 would prefer to bid 50 than 70 (a higher bid than his or her valuation).

Table Bidding Valuation 50 is Player 1's Dominant Strategy

in a Second-Price Auction

prefers to bid 50 (his or her valuation) rather than30 (a lower bid than his or her valuation). Use a similar analysis to show that player 1 would prefer to bid 50 than 70 (a higher bid than his or her valuation).

Table Bidding Valuation 50 is Player 1's Dominant Strategy

in a Second-Price Auction

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

8

Return to problem 15.2. Suppose that Clare can still choose to exert effort, as in the previous problem, probationary period during which it observes workers' productivity and fires them or adjusts their wages according to how the workers perform. What affect would this strategy have on the return to education? Can you think of real world markets in which firms use such strategies? but that she can also choose not to exert effort. If she does not exert effort, she has no effort cost, so her utility is just the wage, w; the shop's return is $400for certain.

a. If shareholders offered to share half of the store's gross profit, what effort would Clare

choose? Would she accept such a contract? What if she were only given a quarter share?

What would be the lowest share that would get her to exert effort?

b. Suppose instead that shareholders decided to offer her a $100 bonus if the store earns$1,000. Show that this would not get her to work hard. What is the minimum bonus that she would need to be paid? What fixed salary would she need to be paid in addition to get hereto accept the contract?

a. If shareholders offered to share half of the store's gross profit, what effort would Clare

choose? Would she accept such a contract? What if she were only given a quarter share?

What would be the lowest share that would get her to exert effort?

b. Suppose instead that shareholders decided to offer her a $100 bonus if the store earns$1,000. Show that this would not get her to work hard. What is the minimum bonus that she would need to be paid? What fixed salary would she need to be paid in addition to get hereto accept the contract?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

9

For each of the following types of insurance, explain how the moral-hazard problem might arise. Explain how the adverse selection problem might arise.

a. Life insurance

b. Health insurance

c. Homeowners' insurance

d. Automobile insurance

e. Unemployment insurance

How might an insurance company adjust the insurance contract to mitigate the moral-hazard and adverse-selection problems?

a. Life insurance

b. Health insurance

c. Homeowners' insurance

d. Automobile insurance

e. Unemployment insurance

How might an insurance company adjust the insurance contract to mitigate the moral-hazard and adverse-selection problems?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

10

Consider the market for used cars.

1. What information about the car might an owner know better than a prospective buyer, and so be a source of private information?

2. Whose interest is it in to ''solve'' the lemons problem, the seller, the buyer, or both? What measures can each side take to solve the problem?

1. What information about the car might an owner know better than a prospective buyer, and so be a source of private information?

2. Whose interest is it in to ''solve'' the lemons problem, the seller, the buyer, or both? What measures can each side take to solve the problem?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

11

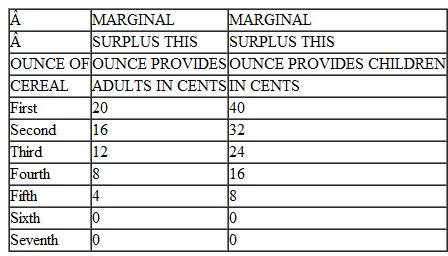

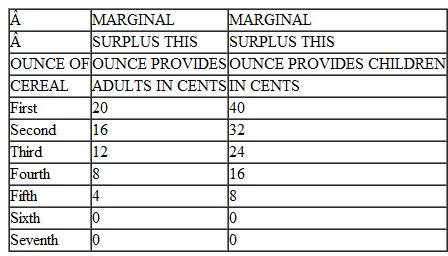

A ready-to-eat cereal manufacturer faces two types of consumers, adults and children, having the following schedule of gross surpluses for each additional unit of cereal consumed.

Cereal costs $0.15 per ounce to produce. The manufacturer has full information about types because adults hate sweet children's cereal and children hate the fiber-filled adult cereal. What is the optimal bundle to offer adults and to children in this full-information setting?

Cereal costs $0.15 per ounce to produce. The manufacturer has full information about types because adults hate sweet children's cereal and children hate the fiber-filled adult cereal. What is the optimal bundle to offer adults and to children in this full-information setting?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

12

A computer manufacturer offers an optional extended warranty on the laptops it sells. What signal does the fact that the manufacturer offers this warranty send to potential consumers about laptop quality? Does this reduce consumers 'incentives to purchase the extended warranty? Suppose consumers are of two types, heavy users who travel with laptops, exposing them to the risk of accidental damage, and light users. Explain how market forces may lead the price of the extended warranty to reflect the heavy users' risk of damage rather than the average consumers'.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose it is more expensive for the high-skill worker to get an education: cL

1. Will there be a separating equilibrium?

2. Can there be pooling equilibria?

1. Will there be a separating equilibrium?

2. Can there be pooling equilibria?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

14

Ahab's Coffee has 150 customers. Fifty of them are small and 100 are big, with appetites for coffee

matching their size. Small people value coffee at$0.10 per ounce for the first 8 ounces and nothing for

more than that. Large people value coffee at $0.15cents per ounce for the first 10 ounces and nothing

for more than that. Coffee costs $0.05 per ounce to produce.

a. What is Ahab's profit-maximizing strategy if it can sell a small cup to small people and large cup to large people and prevent anyone from buying one or more of the other sized cups

(either for their own consumption or to resell to other people). How much profit does Ahab's earn, and how much surplus does each type of consumer obtain?

b. For the rest of the question, suppose it is illegal for Ahab's to charge prices based on people's size. Show that the strategy from part a would not work now by computing the surplus big

customers would get from buying a small cup and showing this is more than their surplus from buying a large cup.

c. What is the most Ahab's can charge for a 10-ounce cup and an 8-ounce cup and still have

some customers buy each sized cup? Calculate the profit Ahab's can earn from such a pricing strategy.

d. Show that Ahab's can do better than in part c by reducing the size of the small cup from 8ounces to6ounces.

e. Show that Ahab's does even better than in part c or part d if it ignores small customers and just sells one size of cup, which big customers end up buying.

matching their size. Small people value coffee at$0.10 per ounce for the first 8 ounces and nothing for

more than that. Large people value coffee at $0.15cents per ounce for the first 10 ounces and nothing

for more than that. Coffee costs $0.05 per ounce to produce.

a. What is Ahab's profit-maximizing strategy if it can sell a small cup to small people and large cup to large people and prevent anyone from buying one or more of the other sized cups

(either for their own consumption or to resell to other people). How much profit does Ahab's earn, and how much surplus does each type of consumer obtain?

b. For the rest of the question, suppose it is illegal for Ahab's to charge prices based on people's size. Show that the strategy from part a would not work now by computing the surplus big

customers would get from buying a small cup and showing this is more than their surplus from buying a large cup.

c. What is the most Ahab's can charge for a 10-ounce cup and an 8-ounce cup and still have

some customers buy each sized cup? Calculate the profit Ahab's can earn from such a pricing strategy.

d. Show that Ahab's can do better than in part c by reducing the size of the small cup from 8ounces to6ounces.

e. Show that Ahab's does even better than in part c or part d if it ignores small customers and just sells one size of cup, which big customers end up buying.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

15

Consider the problem of a monopolist setting a menu of price/quantity bundles when there are two types of consumer and types are unobservable. The source of inefficiency in this setting is that the monopolist distorts the quantity in the low demanders 'bundle. Why does the monopolist do this? Explain with reference to Figure. Why isn't the quantity in the high demanders' bundle also distorted?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

16

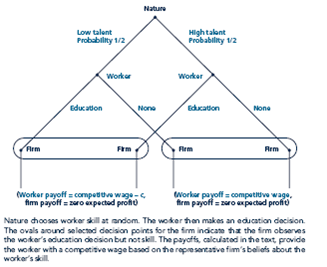

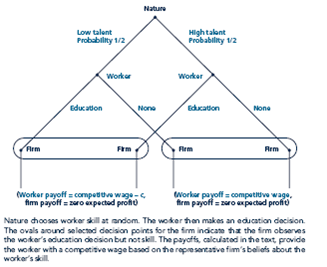

Following the example of Figure, draw the extensive form for the predatory-pricing signaling game outlined in the text, that is, the game in which an incumbent's price may serve as a signal of its costs (high or low) to another firm that is deciding whether to enter the market.

FIGURE Spence Signaling Game in Extensive Form

FIGURE Spence Signaling Game in Extensive Form

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

17

L. Bean, among other stores, has a policy of replacing shoes that wear out with new ones. Suppose there are two types of shoe buyers. Half of them have desk jobs and only have a 20 percent chance of wearing out their shoes. The other half have active jobs (construction nursing) and have a 60 percent chance of wearing out their shoes. A pair of shoes costs $25 to produce.

a. If the store cannot distinguish between the two types, what is the lowest price it can charge for shoes and still break even on average? (This is the price that would prevail in a competitive market.)

b. What would happen to the equilibrium if the desk workers' valuation for shoes was less than the market price in part a? What is a possible source of inefficiency in this new equilibrium?

c. Compute the competitive equilibrium if shoe manufacturers can charge an extra price for shoes with a replacement guarantee, assuming that only the active workers purchase the guarantee.

a. If the store cannot distinguish between the two types, what is the lowest price it can charge for shoes and still break even on average? (This is the price that would prevail in a competitive market.)

b. What would happen to the equilibrium if the desk workers' valuation for shoes was less than the market price in part a? What is a possible source of inefficiency in this new equilibrium?

c. Compute the competitive equilibrium if shoe manufacturers can charge an extra price for shoes with a replacement guarantee, assuming that only the active workers purchase the guarantee.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

18

The famous comedian Groucho Marx once quipped that ''I would never join a club that would have me as a member.'' Modified to apply to market settings, the quote might be rewritten,''Iwould never buy from a seller who was willing to sell to me.'' Under what sort of market conditions would this quote apply? Connect this quote to Akerlof's lemons model. Among other things, use this quote to help identify the source of inefficiency in the lemons model.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

19

Tess and Meg are the only two bidders in an auction for a van Gogh painting. Each can be one of two types with equal probability: a low-value consumer with valuation $1 million or a high-value consumer with valuation $2 million. Each knows her own type but only knows the probabilities of the other's type.

a. Suppose they compete in a sealed-bid, second price auction. What are the equilibrium bidding strategies? Compute the seller's expected revenue.

b. Repeat part a supposing there are three identical bidders. What if there are N bidders?

c. Explain how your answer from parts a and b can be used to compute the seller's expected revenue from a first-price, sealed-bid auction.

a. Suppose they compete in a sealed-bid, second price auction. What are the equilibrium bidding strategies? Compute the seller's expected revenue.

b. Repeat part a supposing there are three identical bidders. What if there are N bidders?

c. Explain how your answer from parts a and b can be used to compute the seller's expected revenue from a first-price, sealed-bid auction.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

20

Why is it a good idea to bid your (known) valuation in a second-price, sealed-bid auction? Why is it a bad idea to bid your (known) valuation in a first-price, sealed-bid auction? Explain, with reference to the ''winner's curse,'' why it is an even worse idea to bid what you think your valuation is when you are not exactly sure of its value.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose 100 cars will be offered on the used-car market, 50 of them good cars, each worth $10,000 to a buyer, and 50 of them lemons, each worth$2,000.

a. Compute a buyer's maximum willingness to pay for a car if he or she cannot observe the car's type.

b. Suppose that there are enough buyers that competition among them leads cars to be sold at their maximum willingness to pay. What would the market equilibrium be if sellers value good cars at $8,000? At $6,000?

a. Compute a buyer's maximum willingness to pay for a car if he or she cannot observe the car's type.

b. Suppose that there are enough buyers that competition among them leads cars to be sold at their maximum willingness to pay. What would the market equilibrium be if sellers value good cars at $8,000? At $6,000?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

22

Consider a signaling model in which the first player may be one of two types. What determines the other player's beliefs about the first player's type before observing the first-player's signal? After observing the first player's signal, what beliefs must the second player have about the first player's type in a separating equilibrium? What beliefs must the second player have in a pooling equilibrium?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

23

A firm earns gross profit (profit not including the wage) of 100 from a low-ability worker and 200 froma high-ability worker. A quarter of the workers are low-ability and the rest are high-ability.

a. If competitive firms have no signals available, what is the equilibrium wage they would pay?

b. Under what conditions on the cost of getting an education for each type, cL and cH, is there a separating equilibrium?

c. Suppose cL ¼ 50 and cH ¼ 0. Outline a pooling equilibrium in which both types get an education. Be sure to specify the firm's out-of equilibrium beliefs if it were to meet an uneducated worker. Similarly, outline a pooling equilibrium in which neither type gets an education.

a. If competitive firms have no signals available, what is the equilibrium wage they would pay?

b. Under what conditions on the cost of getting an education for each type, cL and cH, is there a separating equilibrium?

c. Suppose cL ¼ 50 and cH ¼ 0. Outline a pooling equilibrium in which both types get an education. Be sure to specify the firm's out-of equilibrium beliefs if it were to meet an uneducated worker. Similarly, outline a pooling equilibrium in which neither type gets an education.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

24

In the Spence model of education signaling we studied, what was inefficient about the equilibria? Why did the presence of asymmetric information(the fact that firms do not know the workers 'productivities, but the workers themselves do)lead to this inefficiency? We saw that there were at least three possible equilibria that arose under certain conditions: a pooling equilibrium in which both types (high and low productivity) obtained an education, a pooling equilibrium in which neither type did, and a separating equilibrium in which only the high-productivity worker obtained an education. Are any of these equilibria more efficient than the others? Do workers enjoy having private information, or does your answer depend on the worker's type?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

25

An incumbent firm may be a low-cost type, with constant marginal cost of production 10, or a high-cost type, with marginal cost of production 20, with probabilities t and 1 _ t, respectively. The incumbent's type is private information. The incumbent produces as monopolist in the first period. An entrant who has marginal cost 15 may enter the market between periods. Entry requires at least a small fixed investment. If the entrant comes in the market, it learns what the incumbent's marginal cost is, and firms engage in Bertrand competition in homogeneous products in the second period (see Chapter 14 for a discussion of Bertrand competition). Consumer demand is the same in each period. Suppose there is no discounting between periods, so the incumbent's objective is to maximize the sum of first- plus second-period profit.

a. What is the Nash equilibrium of the second stage game if the entrant enters? Solve the game for each type of incumbent.

b. Argue that the entrant would not enter if it believes the incumbent is certainly low cost

but would enter if it believes the incumbent is certainly high cost.

c. Assume that the low-cost type's monopoly price is greater than 20. Use your answer from part b to argue that 20 is the highestpossible price that the low-cost type of incumbent can charge in a separating equilibrium.

a. What is the Nash equilibrium of the second stage game if the entrant enters? Solve the game for each type of incumbent.

b. Argue that the entrant would not enter if it believes the incumbent is certainly low cost

but would enter if it believes the incumbent is certainly high cost.

c. Assume that the low-cost type's monopoly price is greater than 20. Use your answer from part b to argue that 20 is the highestpossible price that the low-cost type of incumbent can charge in a separating equilibrium.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose you invented a test that can easily measure worker productivity in Spence's signaling model. Who would be interested in paying for the test? Would workers pay to take it? Would firms pay to be able to administer it? One way for the firm to ''test 'workers is to have an initial

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

27

Many states have enacted laws that protect franchisees from their larger parent firms. For example, some states do not allow the establishment of new franchises from the same parent if that would be ''unfair'' to existing firms. How would such restrictions affect the efficiency of franchise contracts?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

28

Why do many medical care consumers hate their HMOs? Do we need an HMO patients' ''Bill of Rights'' to ensure that such consumers are fairly treated?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

29

Michael Eisner, CEO of the Walt Disney Corporation, once received over $500 million in stock options. Do you think he managed the company better than if he had been awarded only $50 million's worth?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

30

If the price of a company's stock declines, stock options may become worthless. What would be the effect of a policy that promised to adjust the purchase price specified in the option contract downward when this happens?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

31

What bailout policies seem to be working to calm financial markets? Now that governments are engaged in bailouts, is the media continuing to report on moral hazard as a significant problem in the financial markets?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

32

In the absence of legally binding contracts, a principal can still mitigate agent moral hazard by maintaining a reputation that it will let the agent suffer for its action seven if this harms the principal in the short run, too. What other areas of life besides bank regulation do we observe principals trying to build such reputations?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

33

How are low-risk individuals made worse off by adverse selection?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

34

Can you think of other types of situations where risk ratings might differ among individuals? How would you decide which risk differences should be reflected in differences in rates and which should not?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

35

Each of these examples suggests that buyers may take steps to address problems raised by asymmetric information. Do sellers have similar incentives to provide information to buyers?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

36

The late 1990s saw a huge number of initial offerings of common stock by Internet start-up companies. How might the lemons model be applied to these initial offerings? Did subsequent events bear out the model?3B. Chezum and D. Wimmer, ''Roses or Lemons: Adverse Selection in the Market for Thoroughbred Yearlings,'' Review of Economics and(August 1997): 521-526.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck