Deck 38: International Trade

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 38: International Trade

1

Quantitatively, how important is international trade to the United States relative to the importance of trade to other nations? What country is the United States' most important trading partner, quantitatively? With what country does the United States have the largest trade deficit?

Quantitatively, the importance of trade to the United States is more than it is to any other countries. The U.S. has the highest combined volume of exports and imports. It also is third in value of exports traded, after China and Germany.

The United States' most important trading partner, in terms of numbers, is Canada. Almost 20 percent of exported goods from the U.S. were to Canada in 2009, and 15 percent of imported goods came from Canada that year as well.

The U.S. has the largest trade deficit with China. A trade deficit occurs when the value of imports exceed the value of exports. In 2009, the U.S. had a $220 billion trade deficit with China.

The United States' most important trading partner, in terms of numbers, is Canada. Almost 20 percent of exported goods from the U.S. were to Canada in 2009, and 15 percent of imported goods came from Canada that year as well.

The U.S. has the largest trade deficit with China. A trade deficit occurs when the value of imports exceed the value of exports. In 2009, the U.S. had a $220 billion trade deficit with China.

2

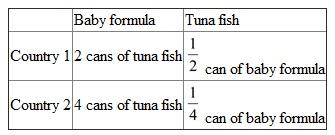

Assume that the comparative-cost ratios of two products-baby formula and tuna fish-are as folin the nations of Canswicki and Tunata

Canswicki: 1 can baby formula ? 2 cans tuna fish

Tunata: 1 can baby formula ?4 cans tuna fish

In what product should each nation specialize? Which of the folterms of trade would be acceptable to both nations: (a) 1 can baby formula ?

cans tuna fish; (b) 1 can baby formula ? 1 can tuna fish; (c) I can liaby formula ? 5 cans tuna fish?

cans tuna fish; (b) 1 can baby formula ? 1 can tuna fish; (c) I can liaby formula ? 5 cans tuna fish?

Canswicki: 1 can baby formula ? 2 cans tuna fish

Tunata: 1 can baby formula ?4 cans tuna fish

In what product should each nation specialize? Which of the folterms of trade would be acceptable to both nations: (a) 1 can baby formula ?

cans tuna fish; (b) 1 can baby formula ? 1 can tuna fish; (c) I can liaby formula ? 5 cans tuna fish?

cans tuna fish; (b) 1 can baby formula ? 1 can tuna fish; (c) I can liaby formula ? 5 cans tuna fish?(a) We are given the folinformation on the opportunity cost of producing baby formula and tuna fish for two countries:

Note that to find the opportunity cost of producing one can of tuna fish, we simply need to ask ourselves "How many can of baby formula must the country give up to produce one can of tuna"

Note that to find the opportunity cost of producing one can of tuna fish, we simply need to ask ourselves "How many can of baby formula must the country give up to produce one can of tuna"

With that said, each country to specialize in the product that they have a opportunity cost in producing. This is what is meant by specialization through comparative advantage. We see that Country 1 has a opportunity cost in producing baby formula, since they only have to give up 2 cans of tuna to make 1 can of baby formula (compared with having to give up 4 cans of tuna for Country 2). Therefore, Country 1 should specialize in baby formula. Country 2, on the other hand, should specialize in tuna fish because they have a opportunity cost of producing one can of tuna fish than Country 1 does.

For a term of trade to be acceptable to both nations, it needs to be between the minimum and maximum price of each good. The minimum price of a good is simply the smaller opportunity cost, and the maximum price of a good is simply the larger opportunity cost. For example, with baby formula, the minimum price is 2 cans of tuna and the maximum price if 4 cans of tuna, and for tuna fish, the minimum price is

cans of tuna and the maximum price is

cans of tuna and the maximum price is

cans of tuna.

cans of tuna.

We see then that if the terms of trade are 1 can of baby formula for 2.5 cans of tuna fish, then that price for a baby formula is within the minimum and maximum price for baby formula, which are 2 and 4 cans of tuna, respectively. Therefore, both countries will be okay with this price.

(b) We see that 1 can of baby formula for 1 can of tuna fish is outside of the 2 to 4 cans of tuna price range for baby formula. Therefore, this will not be a terms of trade that is acceptable. To see why, note that for Country 1, who is specializing in baby formula, is giving up 2 cans of tuna fish in producing one can of baby formula. Therefore, without any trade, the cost of producing one can of baby formula is 2 cans of tuna fish. Note that Country 1 will not want to trade if they can do better without trading. If Country 2 is asking Country 1 to give them one can of baby formula for 1 can of tuna, Country 1 actually does better if they didn't trade, since the cost of producing one can of baby formula is 2 cans of tuna fish, and if they traded, they will only get 1 can of tuna fish for something that they gave up 2 cans of tuna fish for.

(c) We see that 1 can of baby formula for 5 can of tuna fish is outside of the 2 to 4 cans of tuna price range for baby formula. Therefore, this will not be a terms of trade that is acceptable. To see why, note that for Country 2, who is specializing in tuna fish, is then only getting

cans of baby formula for every can of tuna fish they trade. However, it cost Country 2

cans of baby formula for every can of tuna fish they trade. However, it cost Country 2

cans of baby formula to make one can of tuna fish. Therefore, they will not gain in trading, and they will not accept the terms of trade.

cans of baby formula to make one can of tuna fish. Therefore, they will not gain in trading, and they will not accept the terms of trade.

Note that to find the opportunity cost of producing one can of tuna fish, we simply need to ask ourselves "How many can of baby formula must the country give up to produce one can of tuna"

Note that to find the opportunity cost of producing one can of tuna fish, we simply need to ask ourselves "How many can of baby formula must the country give up to produce one can of tuna"With that said, each country to specialize in the product that they have a opportunity cost in producing. This is what is meant by specialization through comparative advantage. We see that Country 1 has a opportunity cost in producing baby formula, since they only have to give up 2 cans of tuna to make 1 can of baby formula (compared with having to give up 4 cans of tuna for Country 2). Therefore, Country 1 should specialize in baby formula. Country 2, on the other hand, should specialize in tuna fish because they have a opportunity cost of producing one can of tuna fish than Country 1 does.

For a term of trade to be acceptable to both nations, it needs to be between the minimum and maximum price of each good. The minimum price of a good is simply the smaller opportunity cost, and the maximum price of a good is simply the larger opportunity cost. For example, with baby formula, the minimum price is 2 cans of tuna and the maximum price if 4 cans of tuna, and for tuna fish, the minimum price is

cans of tuna and the maximum price is

cans of tuna and the maximum price is  cans of tuna.

cans of tuna.We see then that if the terms of trade are 1 can of baby formula for 2.5 cans of tuna fish, then that price for a baby formula is within the minimum and maximum price for baby formula, which are 2 and 4 cans of tuna, respectively. Therefore, both countries will be okay with this price.

(b) We see that 1 can of baby formula for 1 can of tuna fish is outside of the 2 to 4 cans of tuna price range for baby formula. Therefore, this will not be a terms of trade that is acceptable. To see why, note that for Country 1, who is specializing in baby formula, is giving up 2 cans of tuna fish in producing one can of baby formula. Therefore, without any trade, the cost of producing one can of baby formula is 2 cans of tuna fish. Note that Country 1 will not want to trade if they can do better without trading. If Country 2 is asking Country 1 to give them one can of baby formula for 1 can of tuna, Country 1 actually does better if they didn't trade, since the cost of producing one can of baby formula is 2 cans of tuna fish, and if they traded, they will only get 1 can of tuna fish for something that they gave up 2 cans of tuna fish for.

(c) We see that 1 can of baby formula for 5 can of tuna fish is outside of the 2 to 4 cans of tuna price range for baby formula. Therefore, this will not be a terms of trade that is acceptable. To see why, note that for Country 2, who is specializing in tuna fish, is then only getting

cans of baby formula for every can of tuna fish they trade. However, it cost Country 2

cans of baby formula for every can of tuna fish they trade. However, it cost Country 2  cans of baby formula to make one can of tuna fish. Therefore, they will not gain in trading, and they will not accept the terms of trade.

cans of baby formula to make one can of tuna fish. Therefore, they will not gain in trading, and they will not accept the terms of trade. 3

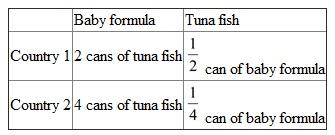

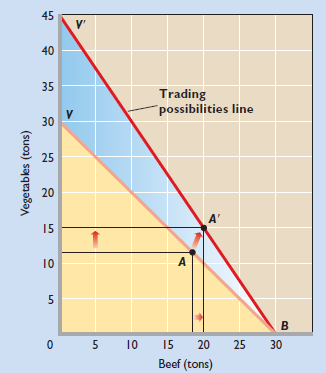

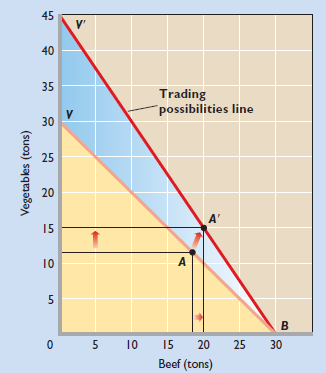

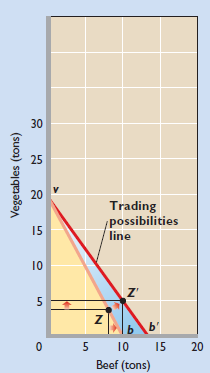

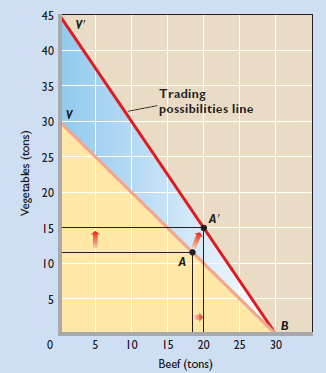

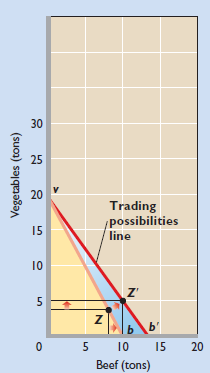

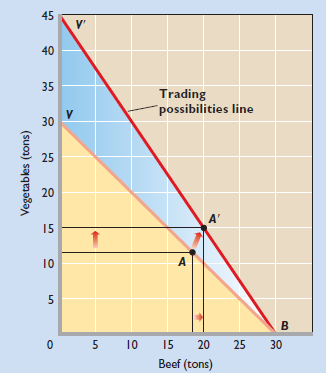

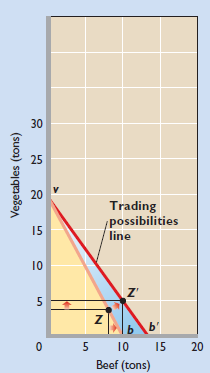

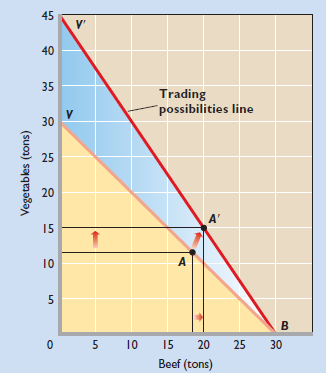

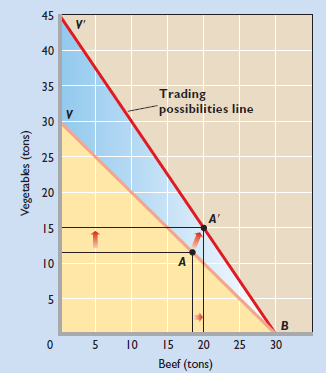

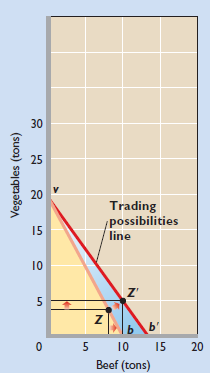

FIGURE 38.2 Trading possibilities lines and the gains from trade. As a result of specialization and trade, both the United States and Mexico can have higher levels of output than the levels attainable on their domestic production possibilities curves. (a) The United States can move from point A on its domestic production possibilities curve to, say, A ? on its trading possibilities line. (b) Mexico can move from Z to Z ?. (a) United States

(b) Mexico

The production possibilities curves in graphs (a) and (b) imply:

A) increasing domestic opportunity costs.

B) decreasing domestic opportunity costs.

C) constant domestic opportunity costs.

D) first decreasing, then increasing, domestic opportunity costs.

(b) Mexico

The production possibilities curves in graphs (a) and (b) imply:

A) increasing domestic opportunity costs.

B) decreasing domestic opportunity costs.

C) constant domestic opportunity costs.

D) first decreasing, then increasing, domestic opportunity costs.

Given information:

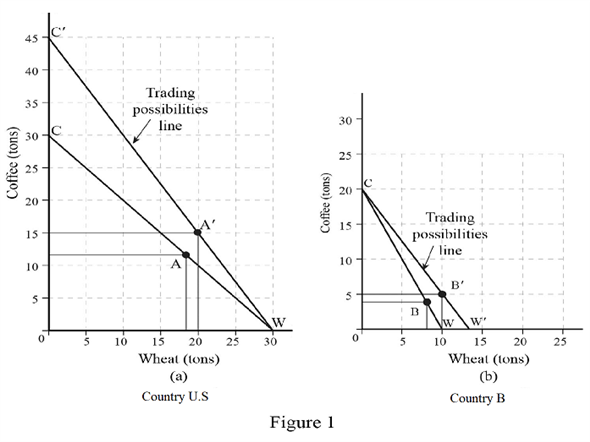

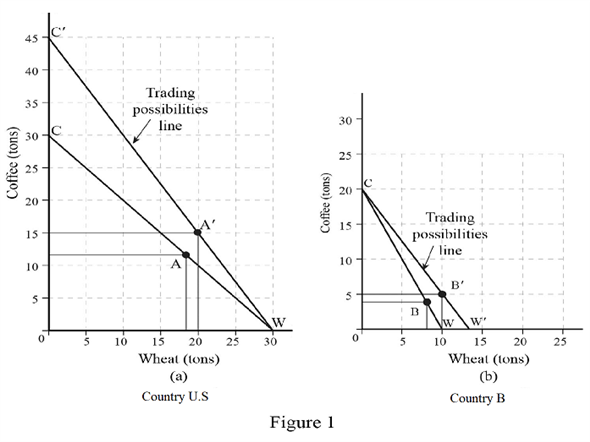

Figure-1 shows the production possibility curve of Country U and Country B:

In Figure-1, the x -axis shows the quantity of wheat, and y -axis shows the quantity of coffee.

In Figure-1, the x -axis shows the quantity of wheat, and y -axis shows the quantity of coffee.

Production possibility curve:

Production possibility curve indicates the points of all possible combinations of the two commodities that the nation can produce efficiently with the available resources at the given period of time.

According to Figure-1, both countries' opportunity cost shows a straight line, which assumes that constant opportunity cost is at a different cost ratio. However, Country U tries to produce more coffee, and Country B tries to produce more wheat, but after the new production combination, the production possibility curve shows again a straight line. Therefore, it assumes that the production possibility curves in Figures (a) and (b) imply a constant domestic opportunity cost.

Therefore, options 'a', 'b', and 'd' are incorrect.

According to the constant opportunity cost assumption, the production possibility curve of the combination of two goods would be a straight line. Therefore, production possibility curves in Figures (a) and (b) meet its assumption; hence, it implies a constant domestic opportunity cost.

Therefore, the correct answer is Option

.

.

Figure-1 shows the production possibility curve of Country U and Country B:

In Figure-1, the x -axis shows the quantity of wheat, and y -axis shows the quantity of coffee.

In Figure-1, the x -axis shows the quantity of wheat, and y -axis shows the quantity of coffee.Production possibility curve:

Production possibility curve indicates the points of all possible combinations of the two commodities that the nation can produce efficiently with the available resources at the given period of time.

According to Figure-1, both countries' opportunity cost shows a straight line, which assumes that constant opportunity cost is at a different cost ratio. However, Country U tries to produce more coffee, and Country B tries to produce more wheat, but after the new production combination, the production possibility curve shows again a straight line. Therefore, it assumes that the production possibility curves in Figures (a) and (b) imply a constant domestic opportunity cost.

Therefore, options 'a', 'b', and 'd' are incorrect.

According to the constant opportunity cost assumption, the production possibility curve of the combination of two goods would be a straight line. Therefore, production possibility curves in Figures (a) and (b) meet its assumption; hence, it implies a constant domestic opportunity cost.

Therefore, the correct answer is Option

.

. 4

In Country A, a worker can make 5 bicycles per hour. In Country B, a worker can make 7 bicycles per hour.

Which country has an absolute advantage in making bicycles?

a. Country A.

b. Country B.

Which country has an absolute advantage in making bicycles?

a. Country A.

b. Country B.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

Distinguish among land-, labor-, and capital-intensive goods, citing an example of each without resorting to book examples. How do these distinctions relate to international trade? How do distinctive products, unrelated to resource intensity, relate to international trade?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

The accompanying hypothetical production possibilities tables are for New Zealand and Spain. Each country can produce apples and plums. Pthe production possibilities data for each of the two countries separately. Referring to your graphs, answer the folWhat is each country's cost ratio of producing plums and apples?

b. Which nation should specialize in which product?

c. Show the trading possibilities lines for each nation if the actual terms of trade are 1 plum for 2 apples. (Pthese lines on your graph.)d. Suppose the optimum product mixes before specialization and trade were alternative B in New Zealand and alternative S in Spain. What would be the gains from specialization and trade?

b. Which nation should specialize in which product?

c. Show the trading possibilities lines for each nation if the actual terms of trade are 1 plum for 2 apples. (Pthese lines on your graph.)d. Suppose the optimum product mixes before specialization and trade were alternative B in New Zealand and alternative S in Spain. What would be the gains from specialization and trade?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

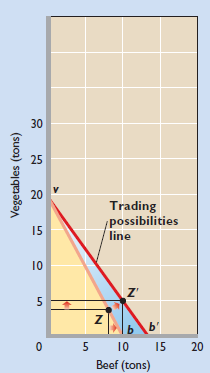

FIGURE 38.2 Trading possibilities lines and the gains from trade. As a result of specialization and trade, both the United States and Mexico can have higher levels of output than the levels attainable on their domestic production possibilities curves. (a) The United States can move from point A on its domestic production possibilities curve to, say, A ? on its trading possibilities line. (b) Mexico can move from Z to Z ?. (a) United States

(b) Mexico

Before specialization, the domestic opportunity cost of producing 1 unit of beef is:

A) 1 unit of vegetables in both the United States and Mexico.

B) 1 unit of vegetables in the United States and 2 units of vegetables in Mexico.

C) 2 units of vegetables in the United States and 1 unit of vegetables in Mexico.

D) 1 unit of vegetables in the United States and

unit of vegetables in Mexico.

unit of vegetables in Mexico.

(b) Mexico

Before specialization, the domestic opportunity cost of producing 1 unit of beef is:

A) 1 unit of vegetables in both the United States and Mexico.

B) 1 unit of vegetables in the United States and 2 units of vegetables in Mexico.

C) 2 units of vegetables in the United States and 1 unit of vegetables in Mexico.

D) 1 unit of vegetables in the United States and

unit of vegetables in Mexico.

unit of vegetables in Mexico.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

In Country A, the production of 1 bicycle requires using resources that could otherwise be used to produce 11 lamps. In Country B, the production of 1 bicycle requires using resources that could otherwise be used to produce 15 lamps. Which country has a comparative advantage in making bicycles?

A) Country A.

B) Country B.

A) Country A.

B) Country B.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

Explain: "The United States can make certain toys with greater productive efficiency than can China. Yet we import those toys from China" Relate your answer to the ideas of Adam Smith and David Ricardo.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

The folhypothetical production possibilities tables are for China and the United States. Assume that before specialization and trade the optimal product mix for China is alternative B and for the United States is alternative U.

a. Are comparative-cost conditions such that the two areas should specialize? If so, what product should each produce?

b. What is the total gain in apparel and chemical output that would result from such specialization?

c. What are the limits of the terms of trade? Suppose that the actual terms of trade are 1 unit of apparel for 1½ units of chemicals and that 4 units of apparel are exchanged for 6 units of chemicals. What are the gains from specialization and trade for each nation?

a. Are comparative-cost conditions such that the two areas should specialize? If so, what product should each produce?

b. What is the total gain in apparel and chemical output that would result from such specialization?

c. What are the limits of the terms of trade? Suppose that the actual terms of trade are 1 unit of apparel for 1½ units of chemicals and that 4 units of apparel are exchanged for 6 units of chemicals. What are the gains from specialization and trade for each nation?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

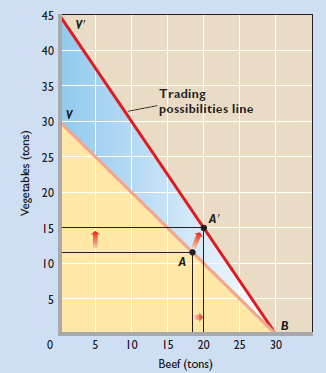

11

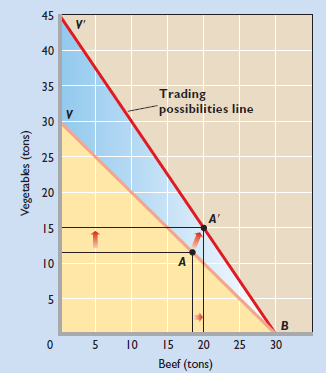

FIGURE 38.2 Trading possibilities lines and the gains from trade. As a result of specialization and trade, both the United States and Mexico can have higher levels of output than the levels attainable on their domestic production possibilities curves. (a) The United States can move from point A on its domestic production possibilities curve to, say, A ? on its trading possibilities line. (b) Mexico can move from Z to Z ?. (a) United States

(b) Mexico

After specialization and international trade, the world output of beef and vegetables is:

A) 20 tons of beef and 20 tons of vegetables.

B) 45 tons of beef and 15 tons of vegetables.

C) 30 tons of beef and 20 tons of vegetables.

D) 10 tons of beef and 30 tons of vegetables.

(b) Mexico

After specialization and international trade, the world output of beef and vegetables is:

A) 20 tons of beef and 20 tons of vegetables.

B) 45 tons of beef and 15 tons of vegetables.

C) 30 tons of beef and 20 tons of vegetables.

D) 10 tons of beef and 30 tons of vegetables.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

True or False: If Country B has an absolute advantage over Country A in producing bicycles, it will also have a comparative advantage over Country A in producing bicycles.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose Big Country can produce 80 units of X by using all its resources to produce X or 60 units of Y by devoting all its resources to Y. Comparable figures for Small Nation are 60units of X and 60 units of Y. Assuming constant costs, in which product should each nation specialize? Explain why. What are the limits of the terms of trade between these two countries? How would rising costs (rather than constant costs) affect the extent of specialization and trade between these two countries?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

Refer to Figure 3.6, page 57. Assume that the graph depicts the U.S. domestic market for corn. How many bushels of corn, if any, will the United States export or import at a world price of $1, $2, $3, $4, and $5? Use this information to construct the U.S. export supply curve and import demand curve for corn. Suppose that the only other corn-producing nation is France, where the domestic price is $4. Which country will export corn; which county will import it?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

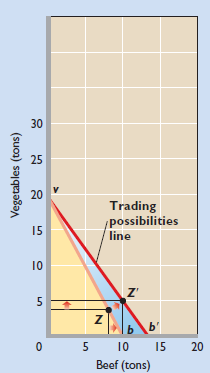

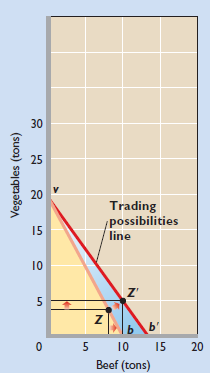

FIGURE 38.2 Trading possibilities lines and the gains from trade. As a result of specialization and trade, both the United States and Mexico can have higher levels of output than the levels attainable on their domestic production possibilities curves. (a) The United States can move from point A on its domestic production possibilities curve to, say, A ? on its trading possibilities line. (b) Mexico can move from Z to Z ?. (a) United States

(b) Mexico

After specialization and international trade:

A) the United States can obtain units of vegetables at less cost than it could before trade.

B) Mexico can obtain more than 20 tons of vegetables, if it so chooses.

C) the United States no has a comparative advantage in producing beef.

D) Mexico can benefit by prohibiting vegetables imports from the United States.

(b) Mexico

After specialization and international trade:

A) the United States can obtain units of vegetables at less cost than it could before trade.

B) Mexico can obtain more than 20 tons of vegetables, if it so chooses.

C) the United States no has a comparative advantage in producing beef.

D) Mexico can benefit by prohibiting vegetables imports from the United States.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose that the opportunity-cost ratio for sugar and almonds is  in California. Which state has the comparative advantage in producing almonds?

in California. Which state has the comparative advantage in producing almonds?

A) Hawaii.

B) California.

C) Neither.

in California. Which state has the comparative advantage in producing almonds?

in California. Which state has the comparative advantage in producing almonds?A) Hawaii.

B) California.

C) Neither.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

What is an export demand curve? What is an import supply curve? How do such curves relate to the determination of the equilibrium world price of a tradable good?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose that the opportunity-cost ratio for fish and lumber is  in Iceland. Then__________should specialize in producing fish while_______ should specialize in producing lumber.

in Iceland. Then__________should specialize in producing fish while_______ should specialize in producing lumber.

A) Canada; Iceland.

B) Iceland; Canada.

in Iceland. Then__________should specialize in producing fish while_______ should specialize in producing lumber.

in Iceland. Then__________should specialize in producing fish while_______ should specialize in producing lumber.A) Canada; Iceland.

B) Iceland; Canada.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

Why is a quota more detrimental to an economy than a tariff that results in the same level of imports as the quota? What is the net outcome of either tariffs or quotas for the world economy?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose that the opportunity-cost ratio for watches and cheese is

in Japan. At which of the folinternational exchange ratios (terms of trade) will Switzerland and Japan be willing to specialize and engage in trade with each other.

in Japan. At which of the folinternational exchange ratios (terms of trade) will Switzerland and Japan be willing to specialize and engage in trade with each other.

Select one or more answers from the choices shown.

in Japan. At which of the folinternational exchange ratios (terms of trade) will Switzerland and Japan be willing to specialize and engage in trade with each other.

in Japan. At which of the folinternational exchange ratios (terms of trade) will Switzerland and Japan be willing to specialize and engage in trade with each other.Select one or more answers from the choices shown.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

"The potentially valid arguments for tariff Protection -military self-sufficiency, infant industry protection, and diversification for stability-are also the most easily abused." Why are these arguments susceptible to abuse?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

We see quite a bit of international trade in the real world. And trade is driven by specialization. So why don't we see full specialization-for instance, all cars in the world being made in South Korea, or all the mobile phones in the world being made in China? Choose the best answer from among the folchoices.

A) High tariffs.

B) Extensive import quotas.

C) Increasing opportunity costs.

D) Increasing returns.

A) High tariffs.

B) Extensive import quotas.

C) Increasing opportunity costs.

D) Increasing returns.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Evaluate the effectiveness of artificial trade barriers, such as tariffs and import quotas, as a way to achieve and maintain full empthroughout the U.S. economy. How might such policies reduce unempin one U.S. industry but increase it in another U.S. industry?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the folare benefits of international trade?

Choose one or more answers from the choices shown.

a. A more efficient alof resources.

b. A higher level of material well-being.

c. Gains from specialization.

d. Promoting competition.

e. Deterring monopoly.

f. Reducing the threat of war.

Choose one or more answers from the choices shown.

a. A more efficient alof resources.

b. A higher level of material well-being.

c. Gains from specialization.

d. Promoting competition.

e. Deterring monopoly.

f. Reducing the threat of war.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

In 2012, manufacturing workers in the United States earned average compensation of $35.67 per hour. That same year, manufacturing workers in Mexico earned average compensation of $6.36 per hour. How can U.S. manufacturers possibly compete? Why isn't all manufacturing done in Mexico and other countries?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

If a country is open to international trade, the domestic price can differ from the international price.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

How might protective tariffs reduce both the imports and the exports of the nation that levies tariffs? In what wav do foreign firms that "dump" their products onto the U.S. rnarker ineffect provide bargains to American consumers? How might the import competition leadto quality improvements and cost reductions by American firms?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose that the current international price of wheat is $6 per bushel and that the United States is currently exporting 30 million bushels per year. If the United States suddenly became a ceconomy with respect to wheat, would the domestic price of wheat in the United States end up higher or than $6?

A) Higher.

B) The same.

A) Higher.

B) The same.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Identify and state the significance of each of the foltrade-related entities: ( a ) the WTO; ( b ) the EU; ( c ) the Euro Zone, and ( d ) NAFTA.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose that if Iceland and Japan were both ceconomies, the domestic price of fish would be $100 per ton in Iceland and $90 per ton in Japan. If the two countries decided to open up to international trade with each other, which of the folcould be the equilibrium international price of fish once they begin trading?

A) $75.

B) $85.

C) $95.

D) $105.

A) $75.

B) $85.

C) $95.

D) $105.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

What form does trade adjustment assistance take in the United States? Howdoes such assistance promote political support for free-trade agreements? Do you think workers who their jobs because of changes in trade laws deserve special treatment relative to workers who their jobs because of other changes in the economy, say, changes in patterns of government spending?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

Draw a domestic supply-and-demand diagram for a product in which the United States does not have a comparative advantage. What impact do foreign imports have on domestic price and quantity? On your diagram show a protective tariff that eliminates approximately one-half of the assumed imports. What are the price-quantity effects of this tariff on ( a ) domestic consumers, ( b ) domestic producers, and ( c ) foreign exporters? How would the effects of a quota that creates the same amount of imports differ?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

what is offshoring of white-collar service jobs and how does that practice relate to international trade?Why has offshoring increased over the past few decades? Give an example (other than that in the textbook) of how offshoring can eliminate some American jobs while creating other American jobs.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

American apparel makers complain to Congress about competition from China. Congress decides to impose either a tariff or a quota on apparel imports from China. Which policy would Chinese apparel manufacturers prefer?

A) Tariff.

B) Quota.

A) Tariff.

B) Quota.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

LASTWORD what was the central point that Bastiat was trying to make in his imaginary petition of the candlemakers?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck