Deck 20: Leading Ventures to Success

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 20: Leading Ventures to Success

1

1 In May 2003, Zipcar of Boston decided it was time to bring in new funding to reach profitability (see www.zipcar.com). However, the willing investors insisted on replacing the CEO and the board of directors. Examine Zipcar's subsequent progress in terms of execution and need at different stages of the life of this company.

Case information:

In the May 2003, Company Z of City B decided to bring a new funding system to attain profitability. However, the investors who were willing to go for this system persisted to replace the board of directors and the Chief Executive Officer of Company Z.

Different stages of the life of a company:

A business will go through many business lifecycles, similar to the life cycle of a plant. Put simply, the life cycle of a business helps business people be prepared to face obstacles in the organization. The various stages in the life cycle of a business are: start-up, take-off, growth, slowing growth, and maturity.

Determine the subsequent progress of Company Z in terms of the execution and requirement at various stages in the life of the company:

Company M has decided to bring a new funding system that helps them to attain profitability. This shows that the company is in the growth stage; the expansion of funds. The investors of the company who are willing to go for this system insist on replacing the board of directors and the Chief Executive Officer of the organization.

In order to bring the new funding system into action, the decision of replacing the board of directors and Chief Executive Officer by the investors is correct if the company faces any of the following issues:

• The current stage of the company is not good

• Neither the Chief Executive Officer nor the board of directors contribute to further growth of the company

• If the investor wishes to change the business model of the company

In the above case, there is no issue with replacing the board of directors or the Chief Executive Officer. Thus, in order for Company Z to achieve its profitable motives and to move the life cycle of the organization along, the investors can talk about this issue to the Chief Executive Officer. The investors can also mention the new requirement of the board of directors and their contribution, based on their funding system.

Conclusion:

Company Z cannot replace the Chief Executive Officer or board of directors immediately, on the request of the investors. The company has to collect the necessary information before replacing its Chief Executive Officer or board of directors. Better communication of the Chief Executive Officer and the board of directors with the investors help them to maintain the life cycle of the company.

In the May 2003, Company Z of City B decided to bring a new funding system to attain profitability. However, the investors who were willing to go for this system persisted to replace the board of directors and the Chief Executive Officer of Company Z.

Different stages of the life of a company:

A business will go through many business lifecycles, similar to the life cycle of a plant. Put simply, the life cycle of a business helps business people be prepared to face obstacles in the organization. The various stages in the life cycle of a business are: start-up, take-off, growth, slowing growth, and maturity.

Determine the subsequent progress of Company Z in terms of the execution and requirement at various stages in the life of the company:

Company M has decided to bring a new funding system that helps them to attain profitability. This shows that the company is in the growth stage; the expansion of funds. The investors of the company who are willing to go for this system insist on replacing the board of directors and the Chief Executive Officer of the organization.

In order to bring the new funding system into action, the decision of replacing the board of directors and Chief Executive Officer by the investors is correct if the company faces any of the following issues:

• The current stage of the company is not good

• Neither the Chief Executive Officer nor the board of directors contribute to further growth of the company

• If the investor wishes to change the business model of the company

In the above case, there is no issue with replacing the board of directors or the Chief Executive Officer. Thus, in order for Company Z to achieve its profitable motives and to move the life cycle of the organization along, the investors can talk about this issue to the Chief Executive Officer. The investors can also mention the new requirement of the board of directors and their contribution, based on their funding system.

Conclusion:

Company Z cannot replace the Chief Executive Officer or board of directors immediately, on the request of the investors. The company has to collect the necessary information before replacing its Chief Executive Officer or board of directors. Better communication of the Chief Executive Officer and the board of directors with the investors help them to maintain the life cycle of the company.

2

Briefly describe your plan for executing your business plan after you receive the resources.

My organization is a strategy firm in the management consultancy business. Our company advises CEOs of large firms, Heads of governments, international bodies such as the World Bank, IMF, the UN organizations and so on regarding issues which are of top concern to our clients. The areas of service include advising on the future growth direction, performance improvement, competitive strategies, business portfolio analysis, strategy appraisal, organization design and so on.

The organization is a partnership having five partners who each has specialized domain experience and expertise.

• One of the partners is a retired senior bureaucrat who has considerable contacts and goodwill in government departments.

• Another partner is a retired senior banker who has contacts and well wishers in the financial community.

• A third partner is a senior corporate lawyer who is well versed with laws and regulations regarding operating a business enterprise.

• The fourth partner is a renowned economist who is well regarded in the international community.

• The fifth partner is an engineer and business management graduate who has held senior positions in industry, besides having worked with a boutique strategy consulting firm.

Below each of the partners, there are practice heads, engagement managers, consultants and associates.

There is a finance and administration manager, besides a human relations executive.

The billable hours of our consultants are the resources we make available to our clients. These generate our revenues. We plan that the billable hours should be at least 60% of the total of 1,800 hours available in a year per consultant. At least 30% of the 1,800 hours is spent on training, skill development, business development, volunteering and so on.

In addition, we also engage with our clients for performance improvement, where our revenues are a ratio of increased profitability and/or decreased costs which are directly attributable to the recommendations we give to our clients.

We aim to generate average revenues of $300,000 per consultant in a year.

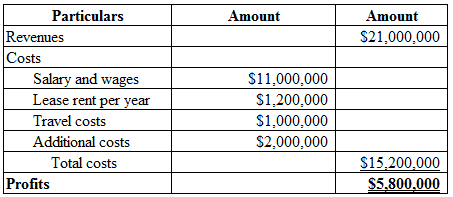

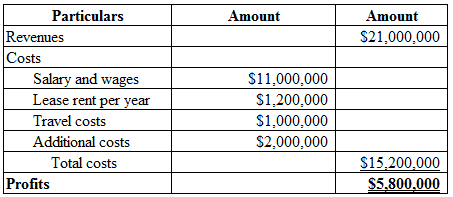

The total consulting team in our organization would be 70, which includes partners, practice heads, engagement managers, consultants and associates. We have an office of 10,000 sq ft for which our monthly lease costs are $10 per sq ft. Our average billings per year would be $300,000 per year per consultant. Our total wage costs, which include both fixed and variable pay would be $11,000,000 per year. Typically, travel related to a particular engagement is borne by our clients. Travel expenses for business development, training, skill development, recruitment, and so on are costs which have to be borne by our organization. These travel related costs are estimated at $1,000,000 per year. Additional costs are incurred such as for utilities, equipment maintenance, purchase of software, fees for external consultants and so on which amounts to $2,000,000.

Therefore the projected income statement will be as follows: The road map for execution of the business plan with milestones for the above venture is described below through a diagram.

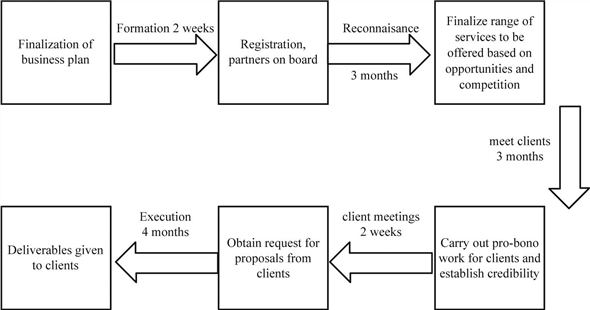

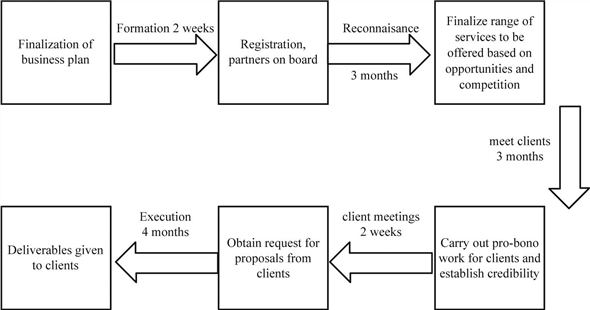

The road map for execution of the business plan with milestones for the above venture is described below through a diagram.

The organization is a partnership having five partners who each has specialized domain experience and expertise.

• One of the partners is a retired senior bureaucrat who has considerable contacts and goodwill in government departments.

• Another partner is a retired senior banker who has contacts and well wishers in the financial community.

• A third partner is a senior corporate lawyer who is well versed with laws and regulations regarding operating a business enterprise.

• The fourth partner is a renowned economist who is well regarded in the international community.

• The fifth partner is an engineer and business management graduate who has held senior positions in industry, besides having worked with a boutique strategy consulting firm.

Below each of the partners, there are practice heads, engagement managers, consultants and associates.

There is a finance and administration manager, besides a human relations executive.

The billable hours of our consultants are the resources we make available to our clients. These generate our revenues. We plan that the billable hours should be at least 60% of the total of 1,800 hours available in a year per consultant. At least 30% of the 1,800 hours is spent on training, skill development, business development, volunteering and so on.

In addition, we also engage with our clients for performance improvement, where our revenues are a ratio of increased profitability and/or decreased costs which are directly attributable to the recommendations we give to our clients.

We aim to generate average revenues of $300,000 per consultant in a year.

The total consulting team in our organization would be 70, which includes partners, practice heads, engagement managers, consultants and associates. We have an office of 10,000 sq ft for which our monthly lease costs are $10 per sq ft. Our average billings per year would be $300,000 per year per consultant. Our total wage costs, which include both fixed and variable pay would be $11,000,000 per year. Typically, travel related to a particular engagement is borne by our clients. Travel expenses for business development, training, skill development, recruitment, and so on are costs which have to be borne by our organization. These travel related costs are estimated at $1,000,000 per year. Additional costs are incurred such as for utilities, equipment maintenance, purchase of software, fees for external consultants and so on which amounts to $2,000,000.

Therefore the projected income statement will be as follows:

The road map for execution of the business plan with milestones for the above venture is described below through a diagram.

The road map for execution of the business plan with milestones for the above venture is described below through a diagram.

3

The global financial crisis in 2007-2010 drastically impacted the spending patterns of many businesses and industries. Select an industry, list specific spending changes that occurred during this period, and describe how a start-up selling into this industry should adapt its strategies to account for the broader market conditions.

The global financial crisis of 2007-2010 significantly impacted the tourism industry. The international tourist arrivals declined by 4% in the year 2009 compared to the previous year. The international tourism receipts reduced by 6%, meaning that tourists were spending less on hotel stay, shopping, eating, local transport and so on. Business travel dropped the maximum during this period. This impacted industries such as airlines, hotels, restaurants, vacation organizers and so on. Airlines, which had ordered and booked for aircrafts with aircraft manufacturers canceled their orders. Large aircraft manufacturers such as Boeing and Airbus laid off thousands of people.

The international aircraft business for passenger aircraft is dominated by two large players - Boeing and Airbus. For a long time, others have tried to break into this market. Companies like Embraer of Brazil and Bombardier of Canada have had some success at the lower end of the passenger aircraft range.

A new entrant or a start-up who entered the passenger aircraft market around the time of the global financial crisis of 2007-2010, would have found the going very difficult as the total market had shrunk. There was heavy competition from the existing players.

A new entrant making aircraft for civilian use should shift its strategy of making aircrafts instead for defense use. Many countries like India, Pakistan, Israel, Afghanistan, Syria, Iraq, Iran and so on have very large budget spending on purchase of aircrafts for defence use. The new start-up should concentrate on selling aircrafts to these countries for defence use. Once the market for civilian aircrafts starts picking up, the strategy can be reviewed and if necessary realigned. The start-up can also offer its services for repairs/refurbishment of Boeing and Airbus aircrafts.

The international aircraft business for passenger aircraft is dominated by two large players - Boeing and Airbus. For a long time, others have tried to break into this market. Companies like Embraer of Brazil and Bombardier of Canada have had some success at the lower end of the passenger aircraft range.

A new entrant or a start-up who entered the passenger aircraft market around the time of the global financial crisis of 2007-2010, would have found the going very difficult as the total market had shrunk. There was heavy competition from the existing players.

A new entrant making aircraft for civilian use should shift its strategy of making aircrafts instead for defense use. Many countries like India, Pakistan, Israel, Afghanistan, Syria, Iraq, Iran and so on have very large budget spending on purchase of aircrafts for defence use. The new start-up should concentrate on selling aircrafts to these countries for defence use. Once the market for civilian aircrafts starts picking up, the strategy can be reviewed and if necessary realigned. The start-up can also offer its services for repairs/refurbishment of Boeing and Airbus aircrafts.

4

Describe your venture 's plans to act as an adaptive organization.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

3 Your emerging new company is selling a high-priced software system to newspapers and magazines. Each sale amounts to $100,000 or more. Your firm is scheduled to deliver a system next week to one of your best customers. However, your chief technical officer has just told you that they have found a major software error that will take two to three weeks to fix. You are counting on the sale within this month so that you can meet payroll and pay all your delinquent bills. Your CFO suggests you ship the system now and send in a team later to fix the error. Your CTO wants to fix it first and then ship. What should you do?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

What mechanisms will you use to instill ethical behavior in your venture?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

4 Southeby's and Christie's are the two largest upscale auction houses. Both enjoyed a growing business in the boom years of the late 1990s. In 2000, both firms were accused of price fixing. The Sherman Antitrust Act was passed in 1890 to control the power of trusts and monopolists. In 1995, both firms announced they would charge a fixed, nonnegotiable sliding-scale commission on the sales price. Is this the age-old tactic of price fixing? What constitutes legal pricing policies versus illegal price fixing?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

5 Your cash-strapped company is bidding for a badly needed contract. As the bid deadline nears, an employee of your nearest competitor pays you a visit. He says he'll provide details of your competitor's bid in return for the promise of a job in six months, after the dust has settled. You know your competitor can survive losing this contract; you can't. Unfortunately, hiring a new employee will mean someone who currently works for you will have to go. Even so, is this an offer you can't refuse?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

6 Your new firm is considering offering one of two health benefit options. One is more complete but also more costly than the other. Should you ask your employees to all accept the lower-cost option? Should you explain the benefits of both plans? If you do, most people will prefer the better plan. What should you do?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

You attend a critical partner meeting with your CEO. After the meeting, your CEO misrepresents the results of the meeting to the broader management team to further a different agenda. How do you handle this situation with your CEO? With your other team members?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

8 Select an example of a white-collar (business) crime such as the Enron case and describe what happened. How could have this crime been avoided?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck