Deck 18: Sources of Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 18: Sources of Capital

1

1 Viscotech Inc. is described in Exercise 17.3. Determine the percentage ownership an angel group may demand for investing the $1 million sought by Viscotech at the start of year 1. If Viscotech is unable to obtain the bank loan of $500,000, it will need an equity investment of $1.5 million. What ownership percentage will the angel group demand for this investment? Assume the annual interest payment on the loan was planned to be 10 percent of the principal.

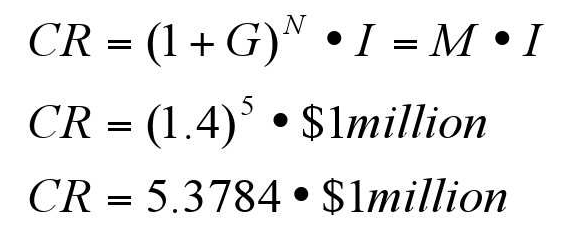

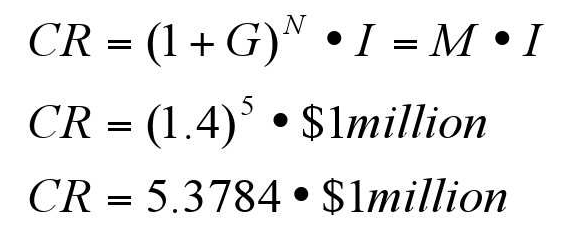

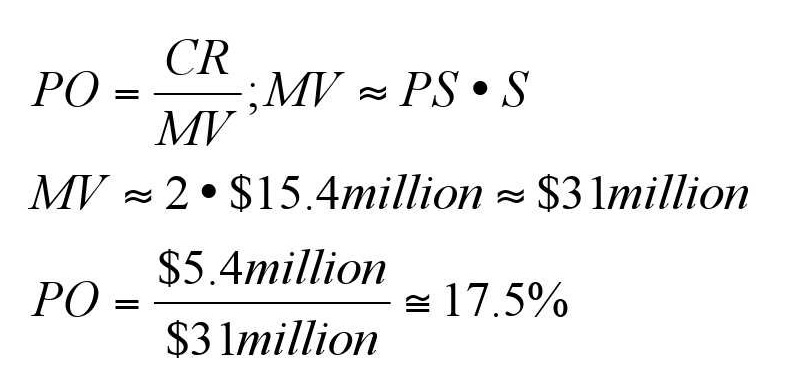

18.1 a) With the loan in place, the angel group's investment will be leveraged; the debt provider only requires a 10% interest payment and by authorizing the loan, the institution essentially shows the investors that the firm is credit worthy. As a result, we can assume the return on capital required by the angels will be at the lower end of the spectrum (40%). From Section 18.8, we apply the formulas as follows: I=$1 million investment, S = $15.4 million rev, G=40%  CR = $5.4 million

CR = $5.4 million

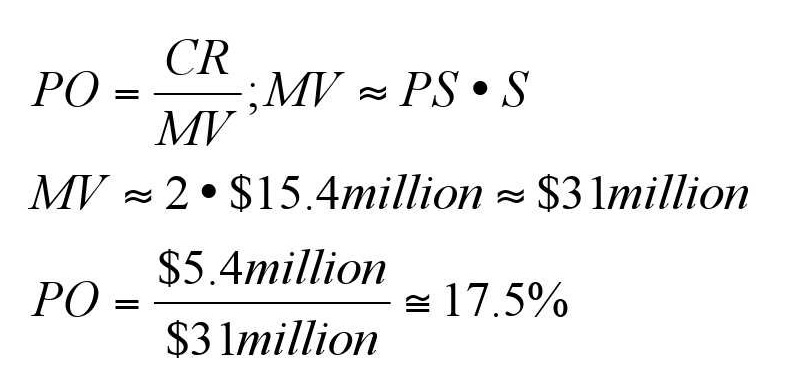

Percent Ownership is based on Market Value that relies on industry comparables. Since no information is available for this particular company, we will assume a Price-to-Sales ratio of 2. (S = $15.4million; PS = 2) b) Without the loan in place, the angel group will be required to invest an additional 1 /2 million dollars. In addition, because the loan is not being granted to the firm, the investors must assume that the project has a higher risk. As a result, we can assume the return on capital required by the angels will be toward the higher end of the spectrum (60%). We apply the same formulas with slightly different variables as follows: I=$1 million investment, S = $15.4 million rev, G=60%

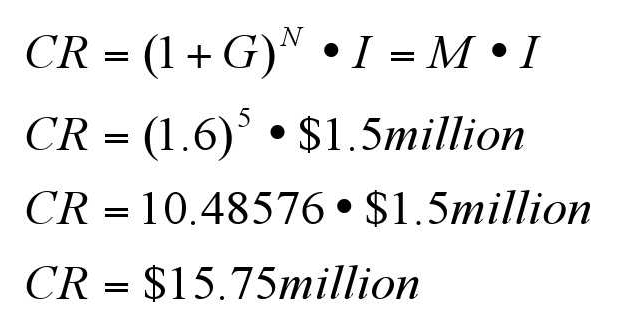

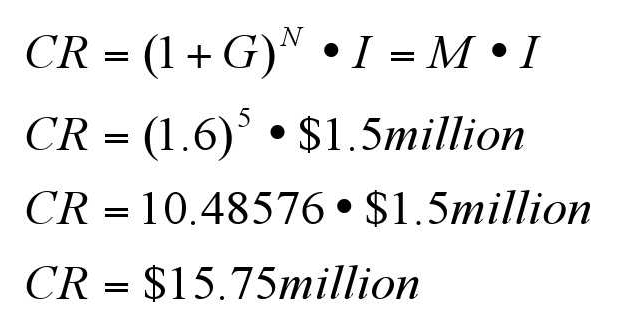

b) Without the loan in place, the angel group will be required to invest an additional 1 /2 million dollars. In addition, because the loan is not being granted to the firm, the investors must assume that the project has a higher risk. As a result, we can assume the return on capital required by the angels will be toward the higher end of the spectrum (60%). We apply the same formulas with slightly different variables as follows: I=$1 million investment, S = $15.4 million rev, G=60%  Below we see the Angel group will demand a higher percent of the company.

Below we see the Angel group will demand a higher percent of the company.

CR = $5.4 million

CR = $5.4 million Percent Ownership is based on Market Value that relies on industry comparables. Since no information is available for this particular company, we will assume a Price-to-Sales ratio of 2. (S = $15.4million; PS = 2)

b) Without the loan in place, the angel group will be required to invest an additional 1 /2 million dollars. In addition, because the loan is not being granted to the firm, the investors must assume that the project has a higher risk. As a result, we can assume the return on capital required by the angels will be toward the higher end of the spectrum (60%). We apply the same formulas with slightly different variables as follows: I=$1 million investment, S = $15.4 million rev, G=60%

b) Without the loan in place, the angel group will be required to invest an additional 1 /2 million dollars. In addition, because the loan is not being granted to the firm, the investors must assume that the project has a higher risk. As a result, we can assume the return on capital required by the angels will be toward the higher end of the spectrum (60%). We apply the same formulas with slightly different variables as follows: I=$1 million investment, S = $15.4 million rev, G=60%  Below we see the Angel group will demand a higher percent of the company.

Below we see the Angel group will demand a higher percent of the company. 2

What sources of capital will you use for your venture?

My organization is a strategy firm in the management consultancy business. Our company advises CEOs of large firms, Heads of governments, international bodies such as the World Bank, IMF, the UN organizations and so on regarding issues which are of top concern to our clients. The areas of service include advising on the future growth direction, performance improvement, competitive strategies, business portfolio analysis, strategy appraisal, organization design and so on.

The organization is a partnership having five partners who each has specialized domain experience and expertise.

• One of the partners is a retired senior bureaucrat who has considerable contacts and goodwill in government departments.

• Another partner is a retired senior banker who has contacts and well wishers in the financial community.

• A third partner is a senior corporate lawyer who is well versed with laws and regulations regarding operating a business enterprise.

• The fourth partner is a renowned economist who is well regarded in the international community.

• The fifth partner is an engineer and business management graduate who has held senior positions in industry, besides having worked with a boutique strategy consulting firm.

Below each of the partners, there are practice heads, engagement managers, consultants and associates.

There is a finance and administration manager, besides a human relations executive.

The billable hours of our consultants are the resources we make available to our clients. These generate our revenues. We plan that the billable hours should be at least 60% of the total of 1,800 hours available in a year per consultant. At least 30% of the 1,800 hours is spent on training, skill development, business development, volunteering and so on.

In addition, we also engage with our clients for performance improvement, where our revenues are a ratio of increased profitability and/or decreased costs which are directly attributable to the recommendations we give to our clients.

We aim to generate average revenues of $300,000 per consultant in a year.

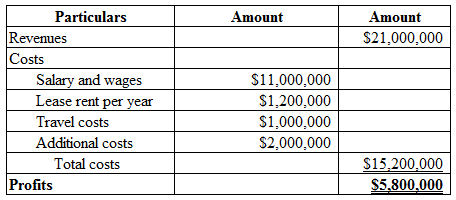

The total consulting team in our organization would be 70, which includes partners, practice heads, engagement managers, consultants and associates. We have an office of 10,000 sq ft for which our monthly lease costs are $10 per sq ft. Our average billings per year would be $300,000 per year per consultant. Our total wage costs, which include both fixed and variable pay would be $11,000,000 per year. Typically, travel related to a particular engagement is borne by our clients. Travel expenses for business development, training, skill development, recruitment, and so on are costs which have to be borne by our organization. These travel related costs are estimated at $1,000,000 per year. Additional costs are incurred such as for utilities, equipment maintenance, purchase of software, fees for external consultants and so on which amounts to $2,000,000.

Therefore, the projected income statement in the fifth year would be as follows: The business may take up to three years for stabilization, since the consultancy business normally grows through referrals, word of mouth, repeat business and so on. Therefore, the consultants' billable time in the initial three years may be less than 50%.

The business may take up to three years for stabilization, since the consultancy business normally grows through referrals, word of mouth, repeat business and so on. Therefore, the consultants' billable time in the initial three years may be less than 50%.

The company may become cash flow positive in three years. The cumulative cash required to sustain the business before it becomes cash positive would be $15,000,000. The various sources of capital will be the personal savings of the partners and relatives, the advance payments received from clients' for engagements, the suppliers' credit from equipment suppliers, bank loans and so on.

The organization is a partnership having five partners who each has specialized domain experience and expertise.

• One of the partners is a retired senior bureaucrat who has considerable contacts and goodwill in government departments.

• Another partner is a retired senior banker who has contacts and well wishers in the financial community.

• A third partner is a senior corporate lawyer who is well versed with laws and regulations regarding operating a business enterprise.

• The fourth partner is a renowned economist who is well regarded in the international community.

• The fifth partner is an engineer and business management graduate who has held senior positions in industry, besides having worked with a boutique strategy consulting firm.

Below each of the partners, there are practice heads, engagement managers, consultants and associates.

There is a finance and administration manager, besides a human relations executive.

The billable hours of our consultants are the resources we make available to our clients. These generate our revenues. We plan that the billable hours should be at least 60% of the total of 1,800 hours available in a year per consultant. At least 30% of the 1,800 hours is spent on training, skill development, business development, volunteering and so on.

In addition, we also engage with our clients for performance improvement, where our revenues are a ratio of increased profitability and/or decreased costs which are directly attributable to the recommendations we give to our clients.

We aim to generate average revenues of $300,000 per consultant in a year.

The total consulting team in our organization would be 70, which includes partners, practice heads, engagement managers, consultants and associates. We have an office of 10,000 sq ft for which our monthly lease costs are $10 per sq ft. Our average billings per year would be $300,000 per year per consultant. Our total wage costs, which include both fixed and variable pay would be $11,000,000 per year. Typically, travel related to a particular engagement is borne by our clients. Travel expenses for business development, training, skill development, recruitment, and so on are costs which have to be borne by our organization. These travel related costs are estimated at $1,000,000 per year. Additional costs are incurred such as for utilities, equipment maintenance, purchase of software, fees for external consultants and so on which amounts to $2,000,000.

Therefore, the projected income statement in the fifth year would be as follows:

The business may take up to three years for stabilization, since the consultancy business normally grows through referrals, word of mouth, repeat business and so on. Therefore, the consultants' billable time in the initial three years may be less than 50%.

The business may take up to three years for stabilization, since the consultancy business normally grows through referrals, word of mouth, repeat business and so on. Therefore, the consultants' billable time in the initial three years may be less than 50%. The company may become cash flow positive in three years. The cumulative cash required to sustain the business before it becomes cash positive would be $15,000,000. The various sources of capital will be the personal savings of the partners and relatives, the advance payments received from clients' for engagements, the suppliers' credit from equipment suppliers, bank loans and so on.

3

Glenn Owens' attractive technology start-up requires $10 million to launch. Projections show earnings of $10 million and sales of $80 million in the fifth year. The venture capital firm expects a return of 50 percent per year for the five-year period prior to an IPO. What valuation would you assign to the new venture? What ownership portion should the venture capitalist expect to receive? Perform a sensitivity analysis on the valuation and rate of return.

Case summary

GO, a technology start-up requires $10 million to launch the company. The forecasts and projections of the company show that the earnings of the company in the fifth year would be $10 million on sales of $80 million.

Calculate the valuation of the company in the fifth year by two methods as shown below.

Using the price to earnings ratio of comparable companies in the industry

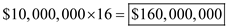

Assume that the price to earnings ratio of comparable companies is 16. This means that on an average in the industry the market capitalization as a proportion to the earnings works out to 16.

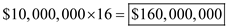

Given that the projected earnings in the fifth year is $10 million, the market capitalization of the company would be .

.

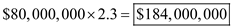

Using the price to turnover ratio of comparable companies in the industry

Assume that the price to turnover ratio of comparable companies is 2.3. This means that on an average in the industry, the market capitalization as a proportion to the turnover works out to 2.3.

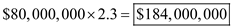

Given that the projected turnover in the fifth year is $80 million, the market capitalization would be Therefore, the market capitalization or valuation of the company would be between $160 million to $184 million at the end of the five year period.

Therefore, the market capitalization or valuation of the company would be between $160 million to $184 million at the end of the five year period.

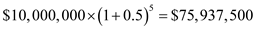

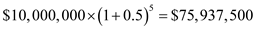

Since the venture capitalist expects a return of 50% per year for the five year period prior to the IPO on his investment of $10 million, he would expect the value of his investment to go up from $10 million to in the five year period.

in the five year period.

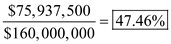

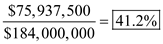

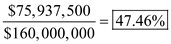

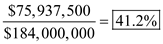

The valuation based on price to earnings ratio is $160,000,000. Therefore, the ownership portion expected by the venture capitalist would be The valuation based on price to turnover ratio is $184,000,000. Therefore, the ownership portion expected by the venture capitalist would be

The valuation based on price to turnover ratio is $184,000,000. Therefore, the ownership portion expected by the venture capitalist would be  The ownership portion for the venture capitalist from the start-up would range between 41.2% to 47.4%.

The ownership portion for the venture capitalist from the start-up would range between 41.2% to 47.4%.

The rate of return expected by the venture capitalist has no relevance to the total valuation of the firm. The total valuation depends on the price to earnings ratio of the industry or the ratio of price to sales revenues of the industry.

The expected rate of return by the venture capitalist will only influence the percentage of ownership in the start-up by the venture capitalist.

Therefore, the valuation of the firm will not be sensitive to changes in the expected rate of return of the venture capitalist.

GO, a technology start-up requires $10 million to launch the company. The forecasts and projections of the company show that the earnings of the company in the fifth year would be $10 million on sales of $80 million.

Calculate the valuation of the company in the fifth year by two methods as shown below.

Using the price to earnings ratio of comparable companies in the industry

Assume that the price to earnings ratio of comparable companies is 16. This means that on an average in the industry the market capitalization as a proportion to the earnings works out to 16.

Given that the projected earnings in the fifth year is $10 million, the market capitalization of the company would be

.

.Using the price to turnover ratio of comparable companies in the industry

Assume that the price to turnover ratio of comparable companies is 2.3. This means that on an average in the industry, the market capitalization as a proportion to the turnover works out to 2.3.

Given that the projected turnover in the fifth year is $80 million, the market capitalization would be

Therefore, the market capitalization or valuation of the company would be between $160 million to $184 million at the end of the five year period.

Therefore, the market capitalization or valuation of the company would be between $160 million to $184 million at the end of the five year period.Since the venture capitalist expects a return of 50% per year for the five year period prior to the IPO on his investment of $10 million, he would expect the value of his investment to go up from $10 million to

in the five year period.

in the five year period.The valuation based on price to earnings ratio is $160,000,000. Therefore, the ownership portion expected by the venture capitalist would be

The valuation based on price to turnover ratio is $184,000,000. Therefore, the ownership portion expected by the venture capitalist would be

The valuation based on price to turnover ratio is $184,000,000. Therefore, the ownership portion expected by the venture capitalist would be  The ownership portion for the venture capitalist from the start-up would range between 41.2% to 47.4%.

The ownership portion for the venture capitalist from the start-up would range between 41.2% to 47.4%.The rate of return expected by the venture capitalist has no relevance to the total valuation of the firm. The total valuation depends on the price to earnings ratio of the industry or the ratio of price to sales revenues of the industry.

The expected rate of return by the venture capitalist will only influence the percentage of ownership in the start-up by the venture capitalist.

Therefore, the valuation of the firm will not be sensitive to changes in the expected rate of return of the venture capitalist.

4

Why did you select these sources?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

3 DGI, a new firm in formation, has developed a set of projections shown in Table 18.21. The expected and pessimistic cases are shown. The harvest of the firm is planned for the fifth year. The firm is seeking an initial investment of $1 million before launching in year 1 as well as a commitment for $1 million at the end of year 2 for expansion. Acting as an adviser to a venture capital firm, prepare an offer of investment to submit to DGI. Assume the PE ratio in DGI's industry is 15.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

How much capital is needed initially and for what purpose?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

The CEO of an early-stage software company is seeking $5 million from venture capitalists. The reasonable projected net income of $5 million in year 5 can be valued at a PE of 20. Furthermore, the sales in year 5 are projected at $25 million. Assuming no dilution from additional financings, what share of the company would the venture capitalists expect if their anticipated rate of return were 50 percent? The company has one million shares outstanding before the venture capitalists purchase shares. What price per share should the venture capitalists pay?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

What percentage of your venture do you plan to offer to outside investors?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

5 Consider a new firm in the nanotechnology field that seeks a second round of financing. This year, it has revenues of $2 million and projects profitability of $200,000 next year on revenues of $3 million. It is raising $1 million from a new set of investors. What share of the company should it offer to the new investors? Assume it can increase profits at a rate of 25 percent per year over the next five years.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

8 Explain the purpose and value of staged financing for investors. For the entrepreneur.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

9 In what circumstances should grants be viewed as an attractive source of capital? When would a grant be less appropriate?

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck