Deck 4: Financial Statement Analysis and Forecasting

Question

Question

Question

Question

Question

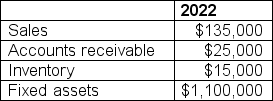

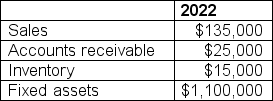

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

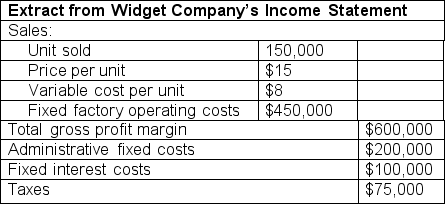

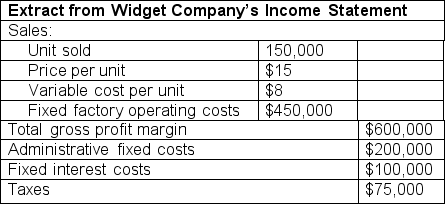

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 4: Financial Statement Analysis and Forecasting

1

What is a pure financial ratio?

A)A financial ratio that does not include non-cash items

B)A financial ratio for the same year

C)A financial ratio that involves items from the same financial statement

D)A financial ratio using the same GAAP

A)A financial ratio that does not include non-cash items

B)A financial ratio for the same year

C)A financial ratio that involves items from the same financial statement

D)A financial ratio using the same GAAP

A financial ratio that involves items from the same financial statement

2

Return on equity (ROE)can be calculated by: Net Income / Average Shareholders' Equity.The reasoning for this method is:

A)net income is earned over the year and shareholder's equity measures invested capital at the end of the year.Average shareholder's equity gives a measure of capital invested throughout the year.

B)net income is measured at the end of the year and shareholder's equity is measured at the beginning of the year.Averaging the shareholder's equity will result in a better match between the timing of the net income measure and the measure of the invested capital (equity).

C)to reduce the number of observations.

D)to increase ROE as average shareholders' equity is usually lower than ending shareholders' equity.

A)net income is earned over the year and shareholder's equity measures invested capital at the end of the year.Average shareholder's equity gives a measure of capital invested throughout the year.

B)net income is measured at the end of the year and shareholder's equity is measured at the beginning of the year.Averaging the shareholder's equity will result in a better match between the timing of the net income measure and the measure of the invested capital (equity).

C)to reduce the number of observations.

D)to increase ROE as average shareholders' equity is usually lower than ending shareholders' equity.

net income is earned over the year and shareholder's equity measures invested capital at the end of the year.Average shareholder's equity gives a measure of capital invested throughout the year.

3

Ratios should not be used to compare two companies in different industries since wide variations across industries can occur.But even within an industry, sometimes comparisons can be problematic.Which of the following is/are a reason(s)for concern?

A)Methods of calculating ROE may differ between analysts

B)Company choice between weighted average and FIFO inventory valuations

C)Companies are based in different countries

D)All of these are reasons for concern.

A)Methods of calculating ROE may differ between analysts

B)Company choice between weighted average and FIFO inventory valuations

C)Companies are based in different countries

D)All of these are reasons for concern.

All of these are reasons for concern.

4

If two firms, GUW and BFG, have the same return on equity (ROE), then:

I.The two companies must have the same operating performance.

II.If GUW has higher leverage than BFG, then GUW must also have higher operating performance.

III.If BFG has lower operating performance than GUW, then BFG must have higher leverage.

A)Only I is true

B)Only III is true

C)Only I and III are true

D)Only II and III are true

I.The two companies must have the same operating performance.

II.If GUW has higher leverage than BFG, then GUW must also have higher operating performance.

III.If BFG has lower operating performance than GUW, then BFG must have higher leverage.

A)Only I is true

B)Only III is true

C)Only I and III are true

D)Only II and III are true

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

What problem arises for comparing Exxon Mobil Corporation (United States)and BP PLC (United Kingdom)financial statements?

A)Different accounting standards between the two countries

B)Different reporting currencies between the two countries

C)Different tax rates between the two countries

D)Exxon Mobil Corporation and BP PLC are each listed on the stock exchange in their respective country

A)Different accounting standards between the two countries

B)Different reporting currencies between the two countries

C)Different tax rates between the two countries

D)Exxon Mobil Corporation and BP PLC are each listed on the stock exchange in their respective country

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

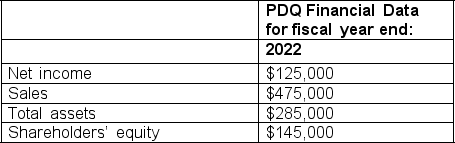

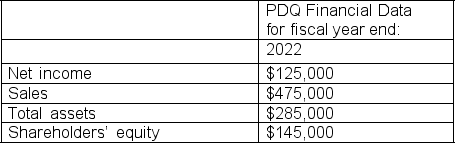

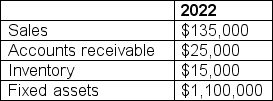

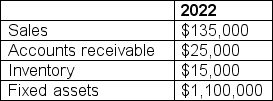

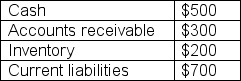

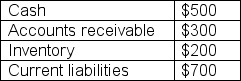

Igor the intern has obtained the following financial data for PDQ Corporation:

The leverage ratio for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

The leverage ratio for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

Why is the DuPont system used by analysts?

A)The DuPont system provides information about the sources of a company's ROE.

B)The DuPont system is easier to calculate than the standard ROE.

C)The DuPont system produces different ROE results than the standard ROE formula.

D)The DuPont system excludes leverage, which can distort the calculation of ROE.

A)The DuPont system provides information about the sources of a company's ROE.

B)The DuPont system is easier to calculate than the standard ROE.

C)The DuPont system produces different ROE results than the standard ROE formula.

D)The DuPont system excludes leverage, which can distort the calculation of ROE.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following people would be likely to calculate financial ratios for a company?

A)Bondholders

B)Equity holders

C)Suppliers

D)All of these would calculate ratios on a company.

A)Bondholders

B)Equity holders

C)Suppliers

D)All of these would calculate ratios on a company.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

Financial ratios are used to perform an analysis of:

A)a company's historical performance

B)a company's performance relative to its peers

C)a company's historical performance and its relative performance to its peers

D)a company using only a single ratio

A)a company's historical performance

B)a company's performance relative to its peers

C)a company's historical performance and its relative performance to its peers

D)a company using only a single ratio

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

Which one of the following is TRUE?

A)Stand-alone ratios provide sufficient information about a firm's performance.

B)Ratios are comparative measures over time and/or across firms.

C)Ratios are forward-looking measures.

D)Analyzing historical ratios is not useful.

A)Stand-alone ratios provide sufficient information about a firm's performance.

B)Ratios are comparative measures over time and/or across firms.

C)Ratios are forward-looking measures.

D)Analyzing historical ratios is not useful.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

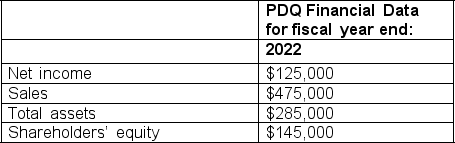

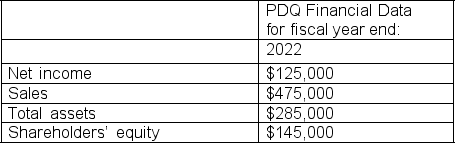

Igor the intern has obtained the following financial data for PDQ Corporation:

The turnover ratio for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

The turnover ratio for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT true?

A)Financial analysis can be fully standardized.

B)Effective analysis requires identification of the most appropriate ratios for the particular objective, as all ratios will not give the same information.

C)The output from financial analysis can often provide only general clues.

D)Some financial ratios will not be appropriate for firms of different sizes.

A)Financial analysis can be fully standardized.

B)Effective analysis requires identification of the most appropriate ratios for the particular objective, as all ratios will not give the same information.

C)The output from financial analysis can often provide only general clues.

D)Some financial ratios will not be appropriate for firms of different sizes.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

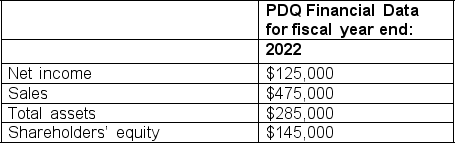

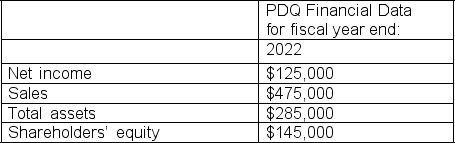

Igor the intern has obtained the following financial data for PDQ Corporation:

The net profit margin for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

The net profit margin for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

What is the risk of comparing financial ratios reported by different companies?

A)Financial ratios have multiple formulations.

B)Financial ratios have only one formulation.

C)Financial ratios all produce the same answer.

D)Financial ratios are disallowed by some companies.

A)Financial ratios have multiple formulations.

B)Financial ratios have only one formulation.

C)Financial ratios all produce the same answer.

D)Financial ratios are disallowed by some companies.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

.Which of the following ratios is also referred to as a "flow ratio"?

A)Debt / equity ratio

B)Times interest earned

C)Leverage ratio

D)None of the above

A)Debt / equity ratio

B)Times interest earned

C)Leverage ratio

D)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following people would be least likely to calculate financial ratios for a company?

A)Bondholders

B)Equity holders

C)Suppliers

D)Customers

A)Bondholders

B)Equity holders

C)Suppliers

D)Customers

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

The International Financial Reporting Standards (IFRS)apply to Canadian public companies.How does that affect comparability of financial statements across countries?

A)It achieves greater comparability in the short term only.

B)It achieves greater comparability in the long term.

C)IFRS is not intended to improve comparability.

D)IFRS coordinates only a few changes in financial reporting standards.

A)It achieves greater comparability in the short term only.

B)It achieves greater comparability in the long term.

C)IFRS is not intended to improve comparability.

D)IFRS coordinates only a few changes in financial reporting standards.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following are NOT components in the DuPont analysis?

A)Leverage ratios

B)Efficiency ratios

C)Liquidity ratios

D)Productivity ratios

A)Leverage ratios

B)Efficiency ratios

C)Liquidity ratios

D)Productivity ratios

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

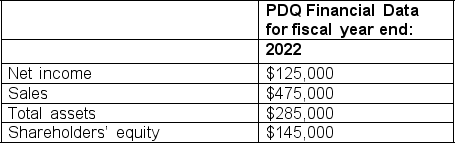

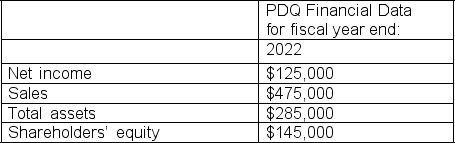

Igor the intern has obtained the following financial data for PDQ Corporation:

The return on equity for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

The return on equity for 2022 is:

A)1.6667

B)1.9655

C)26.32%

D)86.21%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

Toronto Skaters Company earned a net profit margin of 6% in 2022.Their turnover ratio is 5 and their leverage ratio is 3.The return on equity (ROE)earned by Toronto Skaters in 2022 is:

A)0.90%

B)9%

C)10%

D)90%

A)0.90%

B)9%

C)10%

D)90%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

To produce chewing gum, DryFruit Gum Company pays $100,000 per year for rent on a long-term lease and $25 per kilogram for sorbitol and other ingredients.These are the only costs associated with making DryFruit Gum.During the year, the firm sold 30,000 kilograms of chewing gum at $45 per kilogram.Ignoring income taxes, the degree of total leverage (DTL)for DryFruit is:

A)1.20

B).5556

C).4444

D).3704

A)1.20

B).5556

C).4444

D).3704

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

What does the contribution margin measure?

A)The amount that can be contributed to bond repayment

B)The incremental change in revenue from an additional unit sold

C)The amount available to pay fixed costs and contribute to profits

D)The incremental change in revenue from an additional dollar spent on advertising

A)The amount that can be contributed to bond repayment

B)The incremental change in revenue from an additional unit sold

C)The amount available to pay fixed costs and contribute to profits

D)The incremental change in revenue from an additional dollar spent on advertising

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following class(es)of ratios examines the ability of the firm to meet its short-term obligations?

A)Profitability and activity ratios

B)Leverage and coverage ratios

C)Liquidity ratios

D)All of the above

A)Profitability and activity ratios

B)Leverage and coverage ratios

C)Liquidity ratios

D)All of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

Marie invested $3 million in 10-year bonds of Abitibi Mills Company nine years ago.Recent changes in the industry have Marie worried about whether she will receive her principal at the end of next year.Which ratio(s)will most directly address Marie's concern?

I.Debt / asset

II.Debt / equity

III.Times interest earned

A)I only

B)I and II only

C)III only

D)II and III only

I.Debt / asset

II.Debt / equity

III.Times interest earned

A)I only

B)I and II only

C)III only

D)II and III only

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

A firm began the current fiscal year with total assets of $8 million, common shares of $4 million and retained earnings of $2 million.At the end of the current year the firm reported net income of $1 million, all of which was retained by the firm.The debt-to-asset ratio for this reporting period is:

A)0.25

B)0.125

C)0.75

D)0.5

A)0.25

B)0.125

C)0.75

D)0.5

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

A firm began the current fiscal year with total assets of $8 million, common shares of $4 million and retained earnings of $2 million.At the end of the current year the firm reported net income of $1 million, all of which was retained by the firm.The debt-to-equity ratio for this reporting period is:

A)0.17

B)0.14

C)0.25

D)0.33

A)0.17

B)0.14

C)0.25

D)0.33

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

Montreal Brewing Company has an outstanding debt of $20 million.One-tenth of the company debt bears an interest cost of 8.0% and the balance costs 6.0%.If their earnings before taxes are $5.2 million, then their times-interest-earned ratio would be:

A)3.2

B)4.2

C)5.2

D)None of the above

A)3.2

B)4.2

C)5.2

D)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

What does a coverage ratio measure?

A)The company's ability to pay the interest on its debt

B)The company's ability to pay the principal amount of its debt

C)The company's ability to "cover" (pay)its operating expenses

D)The company's ability to "cover" (meet)shareholder return expectations

A)The company's ability to pay the interest on its debt

B)The company's ability to pay the principal amount of its debt

C)The company's ability to "cover" (pay)its operating expenses

D)The company's ability to "cover" (meet)shareholder return expectations

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

Two firms, STM and VPL, have the same contribution margin however VPL's fixed costs (including interest)are greater than STM's.The sales levels and income tax rates of the two firms are the same.We would expect:

A)VPL's income to have the same variability as STM

B)VPL's income to be less variable than STM

C)VPL's income to be more variable than STM

D)Can't determine with the information provided

A)VPL's income to have the same variability as STM

B)VPL's income to be less variable than STM

C)VPL's income to be more variable than STM

D)Can't determine with the information provided

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

Why are leverage ratios important in overall financial analysis of a firm?

A)Low ROA can generate high ROE if the company is highly levered.

B)Use of leverage magnifies losses which increases risk.

C)Leverage ratios measure a firm's ROA.

D)High ROE can only be generated with high leverage.

A)Low ROA can generate high ROE if the company is highly levered.

B)Use of leverage magnifies losses which increases risk.

C)Leverage ratios measure a firm's ROA.

D)High ROE can only be generated with high leverage.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following ratios would be most useful for evaluating a firm's degree of leverage?

A)Earnings-power ratio

B)Debt-to-equity ratio

C)Current ratio

D)Asset turnover ratio

A)Earnings-power ratio

B)Debt-to-equity ratio

C)Current ratio

D)Asset turnover ratio

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following class(es)of ratios examines the relationship of borrowed funds to funds contributed by the equity holders and the ability of the firm to service its existing borrowings?

A)Profitability and activity ratios

B)Leverage and coverage ratios

C)Liquidity ratios

D)All of the above

A)Profitability and activity ratios

B)Leverage and coverage ratios

C)Liquidity ratios

D)All of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following ratios are "stock ratios"?

A)Debt / equity ratio

B)Leverage ratio

C)Debt / asset ratio

D)All of the above

A)Debt / equity ratio

B)Leverage ratio

C)Debt / asset ratio

D)All of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

The only debt a firm has outstanding is a $10 million, 8.0% bond issue.If their earnings before taxes is $5.2 million, then their times-interest-earned ratio would be:

A)5.5

B)6.5

C)7.5

D)None of the above

A)5.5

B)6.5

C)7.5

D)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

On their most recent balance sheet, a company reports total assets of $8 million, common shares of $4 million, and retained earnings of $2 million.The debt-to-asset ratio is:

A)0.25

B)0.50

C)0.75

D)None of the above

A)0.25

B)0.50

C)0.75

D)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

To produce chewing gum, DryFruit Gum Company pays $100,000 per year for rent on a long-term lease and $25 per kilogram for sorbitol and other ingredients.These are the only costs associated with making DryFruit Gum.During the year, the firm sold 30,000 kilograms of chewing gum at $45 per kilogram.Ignoring income taxes, the profit margin for DryFruit is closest to:

A)120.00%

B)55.56%

C)44.44%

D)37.04%

A)120.00%

B)55.56%

C)44.44%

D)37.04%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

On their most recent balance sheet, a company reports total assets of $8 million, common shares of $4 million, and retained earnings of $2 million.The debt-to-equity ratio is:

A)0.33

B)1.00

C)2.00

D)3.00

A)0.33

B)1.00

C)2.00

D)3.00

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following best describes an efficiency ratio?

A)A measure of how well a company converts revenue into earnings

B)A measure of how quickly a company processes accounts receivables

C)A measure of a firm's return on assets (ROA)

D)A measure of the efficiency of a company's logistics

A)A measure of how well a company converts revenue into earnings

B)A measure of how quickly a company processes accounts receivables

C)A measure of a firm's return on assets (ROA)

D)A measure of the efficiency of a company's logistics

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

Which one of the following is FALSE?

A)A high leverage ratio increases ROE.

B)A low leverage ratio decreases the risk of bankruptcy.

C)A leverage ratio is a stock ratio.

D)A low leverage ratio reduces the size of the balance sheet.

A)A high leverage ratio increases ROE.

B)A low leverage ratio decreases the risk of bankruptcy.

C)A leverage ratio is a stock ratio.

D)A low leverage ratio reduces the size of the balance sheet.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

Charles invested $3 million in the bonds of Toys & Tots Company eight years ago.Recent recalls of some toys produced by Toys & Tots has Charles worried about whether he will receive his annual interest cheque from the firm.Which ratio(s)will most directly address Charles' concern?

I.Debt / asset

II.Debt / equity

III.Times interest earned

A)I only

B)I and II only

C)III only

D)II and III only

I.Debt / asset

II.Debt / equity

III.Times interest earned

A)I only

B)I and II only

C)III only

D)II and III only

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

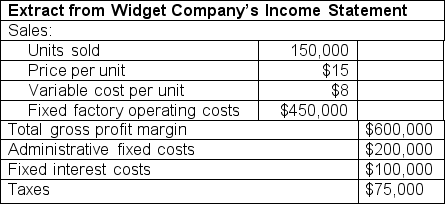

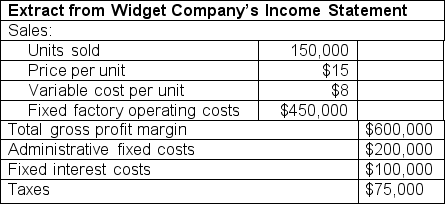

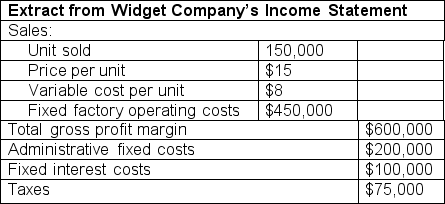

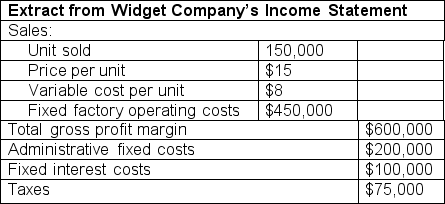

Given the following information extracted from the income statement of Widget Company ( Widget Company has no depreciation expense or opening or closing inventory),

The degree of total leverage (DTL)of Widget Company is closest to:

A)2.80

B)3.25

C)3.50

D)4.00

The degree of total leverage (DTL)of Widget Company is closest to:

A)2.80

B)3.25

C)3.50

D)4.00

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

UUP Inc.is very conservatively managed and nothing ever changes - their sales are constant over time, the collection periods stay the same, and the firm has not invested in any new assets.An investor is puzzled - having found that the fixed asset turnover rate is changing over time.How can the apparent efficiency with which the firm uses its assets be changing if all other items are not changing?

A)This observation is impossible; they must have miscalculated something.

B)This observation is possible; the fixed asset turnover must increase in this case due to depreciation.

C)This observation is possible; the fixed asset turnover must decrease in this case due to depreciation.

D)This observation is possible; they should look at net income and not sales - it is a better measure of the firm's efficiency and productivity.

A)This observation is impossible; they must have miscalculated something.

B)This observation is possible; the fixed asset turnover must increase in this case due to depreciation.

C)This observation is possible; the fixed asset turnover must decrease in this case due to depreciation.

D)This observation is possible; they should look at net income and not sales - it is a better measure of the firm's efficiency and productivity.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following best describes what a turnover ratio measures?

A)how many times the denominator is being used to generate the numerator value in a given period.

B)for each dollar invested in the denominator, how much in the numerator value is generated.

C)how efficiently the management of the firm is managing the denominator value.

D)all of the above.

A)how many times the denominator is being used to generate the numerator value in a given period.

B)for each dollar invested in the denominator, how much in the numerator value is generated.

C)how efficiently the management of the firm is managing the denominator value.

D)all of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

The following information has been obtained on Alberta Drilling Company for 2022:

The receivables turnover and average collection period for Alberta Drilling Company are:

A)Receivables turnover: 67.59; collection period: 5.40 days

B)Receivables turnover: 40.56; collection period: 9.00 days

C)Receivables turnover: 9.00; collection period: 40.56 days

D)Receivables turnover: 5.40; collection period: 67.59 days

The receivables turnover and average collection period for Alberta Drilling Company are:

A)Receivables turnover: 67.59; collection period: 5.40 days

B)Receivables turnover: 40.56; collection period: 9.00 days

C)Receivables turnover: 9.00; collection period: 40.56 days

D)Receivables turnover: 5.40; collection period: 67.59 days

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

At the beginning of the year a company has $140 in inventory and at the end of the year the inventory on the balance sheet is $110.If the firm reports cost of goods sold on the income statement of $400, then the inventory turnover ratio would be:

A)1.60

B)2.86

C)3.20

D)3.64

A)1.60

B)2.86

C)3.20

D)3.64

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

Which one of the following is TRUE?

A)Fixed asset turnover represents the contribution of every dollar of assets to credit sales.

B)The inverse of the inventory turnover times 365 estimates the number of days to liquidate inventory.

C)The collection period of receivables and payables cannot be inferred from their productivity ratios.

D)Productivity ratios estimate the productivity of borrowed amounts.

A)Fixed asset turnover represents the contribution of every dollar of assets to credit sales.

B)The inverse of the inventory turnover times 365 estimates the number of days to liquidate inventory.

C)The collection period of receivables and payables cannot be inferred from their productivity ratios.

D)Productivity ratios estimate the productivity of borrowed amounts.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

Voyage Company is in a very high growth industry while EZgoing Company is in a low growth industry.Comparing their dividend payout ratios we would expect:

A)Voyage's dividend payout ratio to be greater than EZgoing.

B)Voyage's dividend payout ratio to be less than EZgoing

C)The two firms to have the same dividend payout ratio

D)Cannot compare them as they are in different industries.

A)Voyage's dividend payout ratio to be greater than EZgoing.

B)Voyage's dividend payout ratio to be less than EZgoing

C)The two firms to have the same dividend payout ratio

D)Cannot compare them as they are in different industries.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

What is the base, or denominator, of a productivity ratio?

A)Revenue

B)An asset value

C)A liability value

D)A shareholders' equity value

A)Revenue

B)An asset value

C)A liability value

D)A shareholders' equity value

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

Net working capital represents:

A)The amount of money needed to start the company

B)The difference between assets and liabilities

C)The difference between current assets and liabilities

D)The difference between current assets and current liabilities

A)The amount of money needed to start the company

B)The difference between assets and liabilities

C)The difference between current assets and liabilities

D)The difference between current assets and current liabilities

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

The following information has been obtained on Alberta Drilling Company for 2022.

The inventory turnover and average day's sales in inventory for Alberta Drilling Company are:

A)Inventory turnover: 67.59; Average days sales in inventory: 5.40 days

B)Inventory turnover: 40.56; Average days sales in inventory: 9.00 days

C)Inventory turnover: 9.00; Average days sales in inventory: 40.56 days

D)Inventory turnover: 5.40; Average days sales in inventory: 67.59 days

The inventory turnover and average day's sales in inventory for Alberta Drilling Company are:

A)Inventory turnover: 67.59; Average days sales in inventory: 5.40 days

B)Inventory turnover: 40.56; Average days sales in inventory: 9.00 days

C)Inventory turnover: 9.00; Average days sales in inventory: 40.56 days

D)Inventory turnover: 5.40; Average days sales in inventory: 67.59 days

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is a productivity ratio?

A)Times interest earned

B)Leverage

C)Inventory turnover

D)Current ratio

A)Times interest earned

B)Leverage

C)Inventory turnover

D)Current ratio

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

Inventory turnover can be calculated as:

A)Sales/Inventory

B)Accounts receivable/Inventory

C)Inventory/Cost of goods sold

D)Accounts payable/Inventory

A)Sales/Inventory

B)Accounts receivable/Inventory

C)Inventory/Cost of goods sold

D)Accounts payable/Inventory

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is NOT an efficiency ratio?

A)Operating margin

B)Break-even point

C)Times interest earned

D)Degree of total leverage

A)Operating margin

B)Break-even point

C)Times interest earned

D)Degree of total leverage

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

What is the difference between a liquidity ratio and a leverage ratio?

A)Liquidity ratios do not include debt while leverage ratios include debt.

B)Liquidity has a short-term focus while leverage has a long-term focus.

C)Liquidity ratios use balance sheet accounts while leverage ratios use the income statement.

D)There is no difference.

A)Liquidity ratios do not include debt while leverage ratios include debt.

B)Liquidity has a short-term focus while leverage has a long-term focus.

C)Liquidity ratios use balance sheet accounts while leverage ratios use the income statement.

D)There is no difference.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

Given the following information extracted from the income statement of Widget Company (Widget Company has no depreciation expense or opening or closing inventory),

The gross profit margin (GPM)and operating margin (OM)for Widget Company are:

A)GPM = 26.67%; OM = 17.78%

B)GPM = 17.78%; OM = 26.67%

C)GPM = 53.33%; OM = 14.44%

D)GPM = 14.44%; OM = 53.33%

The gross profit margin (GPM)and operating margin (OM)for Widget Company are:

A)GPM = 26.67%; OM = 17.78%

B)GPM = 17.78%; OM = 26.67%

C)GPM = 53.33%; OM = 14.44%

D)GPM = 14.44%; OM = 53.33%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

Why do banks look at the quick ratio in addition to the current ratio?

A)The quick ratio assets are larger than the current ratio assets.

B)The quick ratio is a better measure of how quickly liabilities are coming due.

C)The quick ratio is easier to calculate.

D)The quick ratio uses only the most liquid assets while the current ratio uses all current assets.

A)The quick ratio assets are larger than the current ratio assets.

B)The quick ratio is a better measure of how quickly liabilities are coming due.

C)The quick ratio is easier to calculate.

D)The quick ratio uses only the most liquid assets while the current ratio uses all current assets.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

The following information was extracted from Webb Company's financial statements:

The current ratio and quick ratio for Webb Company are:

A)Current ratio = 1.4286; Quick ratio = 1.1429

B)Current ratio = 1.1429; Quick ratio = 1.4286

C)Current ratio = 0.7143; Quick ratio = 0.4286

D)Current ratio = 0.4286; Quick ratio = 0.7143

The current ratio and quick ratio for Webb Company are:

A)Current ratio = 1.4286; Quick ratio = 1.1429

B)Current ratio = 1.1429; Quick ratio = 1.4286

C)Current ratio = 0.7143; Quick ratio = 0.4286

D)Current ratio = 0.4286; Quick ratio = 0.7143

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

To produce chewing gum, DryFruit Gum Company pays $100,000 per year for rent on a long-term lease and $25 per kilogram for sorbitol and other ingredients.These are the only costs associated with making DryFruit Gum.During the year, the firm sold 30,000 kilograms of chewing gum at $45 per kilogram.Ignoring income taxes, the break-even point for DryFruit is:

A)225,000 kilograms

B)40,000 kilograms

C)5,000 kilograms

D)60,000 kilograms

A)225,000 kilograms

B)40,000 kilograms

C)5,000 kilograms

D)60,000 kilograms

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

In assessing a firm's liquidity, which of the following ratios would be most helpful?

A)Debt/equity ratio

B)Asset turnover ratio

C)Current ratio

D)Times-interest-earned ratio

A)Debt/equity ratio

B)Asset turnover ratio

C)Current ratio

D)Times-interest-earned ratio

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

.Given the following information extracted from the income statement of Widget Company ( Widget Company has no depreciation or expense or opening or closing inventory),

The break-even point for Widget Company is:

A)64,286 units

B)107,135 units

C)117,857 units

D)500,000 units

The break-even point for Widget Company is:

A)64,286 units

B)107,135 units

C)117,857 units

D)500,000 units

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is true when a firm is operating at the sustainable growth rate (SGR)?

A)The firm sells all of its inventory.

B)The firm's net income is zero.

C)The firm neither needs nor generates financing.

D)The firm pays a dividend equal to exactly half of its retained earnings.

A)The firm sells all of its inventory.

B)The firm's net income is zero.

C)The firm neither needs nor generates financing.

D)The firm pays a dividend equal to exactly half of its retained earnings.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

62

In 2022, Voyage Company had earnings per share of $45 and paid a dividend of $15 per share.The dividend yield was 8%.The book value per share is $100.The price-earnings (P/E)ratio was:

A)4.167

B)3.0000

C)0.3333

D)0.1500

A)4.167

B)3.0000

C)0.3333

D)0.1500

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is NOT a step in the financial planning process?

A)Deciding how additional required assets will be financed

B)Estimating various cost categories as per the income statement

C)Preparing projected funds-flow statement

D)Ordering supplies in anticipation of future sales

A)Deciding how additional required assets will be financed

B)Estimating various cost categories as per the income statement

C)Preparing projected funds-flow statement

D)Ordering supplies in anticipation of future sales

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

Alberta High Skies Company has net income of $3 million.It issued 500,000 shares two years ago at an issue price of $20 per share, and the shares are now trading at $35 per share.What is Alberta High Skies' price-earnings ratio?

A)1.75

B)3.33

C)5.83

D)9.17

A)1.75

B)3.33

C)5.83

D)9.17

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

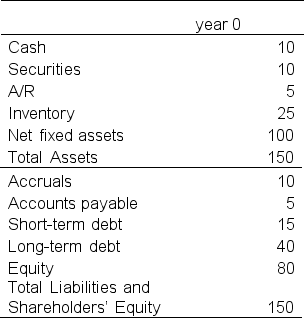

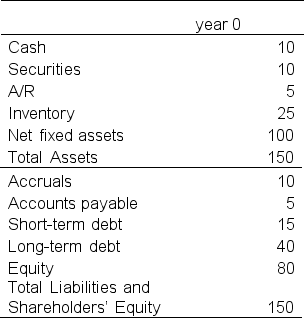

Company A's current sales are $120 and the most current balance sheet is presented below.Suppose the sales growth rate is 10% and that short-term debt, long-term debt, and equity are not expected to change.What is the external financing needed for next year?

A)-$13.5

B)$13.5

C)$165

D)$151.5

A)-$13.5

B)$13.5

C)$165

D)$151.5

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

66

On the projected balance sheet for the next year, total assets are $5,000, total liabilities are $2,000, and shareholder's equity is $1,000.Which of the following is correct?

A)External Funds Required is -$1,000.This firm will have a cash deficit.

B)External Funds Required is $1,000.This firm will have a cash surplus.

C)External Funds Required is -$2,000.This firm will have a cash deficit.

D)External Funds Required is $2,000.This firm will have a cash surplus.

A)External Funds Required is -$1,000.This firm will have a cash deficit.

B)External Funds Required is $1,000.This firm will have a cash surplus.

C)External Funds Required is -$2,000.This firm will have a cash deficit.

D)External Funds Required is $2,000.This firm will have a cash surplus.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

When using a percent of sales method for forecasting, which is the most important variable to estimate?

A)COGS

B)Inventory

C)Revenue

D)Bank debt

A)COGS

B)Inventory

C)Revenue

D)Bank debt

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

What is the difference between the P/E ratio and the forward P/E ratio?

A)The P/E ratio uses the current share price while the forward P/E ratio uses the future share price.

B)The P/E ratio uses the current earnings per share while the forward P/E ratio uses the expected earnings per share.

C)The P/E ratio uses both the current price and earnings, while the forward P/E ratio uses both the future price and earnings.

D)The P/E ratio uses EPS while the forward P/E ratio uses net income.

A)The P/E ratio uses the current share price while the forward P/E ratio uses the future share price.

B)The P/E ratio uses the current earnings per share while the forward P/E ratio uses the expected earnings per share.

C)The P/E ratio uses both the current price and earnings, while the forward P/E ratio uses both the future price and earnings.

D)The P/E ratio uses EPS while the forward P/E ratio uses net income.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

What is the difference between invested capital and spontaneous liabilities?

A)The firm knows who invests capital in the firm, but not the identity of who the firm owes its spontaneous liabilities.

B)Invested capital is randomly determined, so the corresponding liabilities must be spontaneous and therefore also random.

C)Invested capital is the amount of equity invested in the firm, while spontaneous liabilities are the sum of long-term and short-term debt.

D)Invested capital is the result of investor decisions while spontaneous liabilities arise from the firm's business operations.

A)The firm knows who invests capital in the firm, but not the identity of who the firm owes its spontaneous liabilities.

B)Invested capital is randomly determined, so the corresponding liabilities must be spontaneous and therefore also random.

C)Invested capital is the amount of equity invested in the firm, while spontaneous liabilities are the sum of long-term and short-term debt.

D)Invested capital is the result of investor decisions while spontaneous liabilities arise from the firm's business operations.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

In 2022, Voyage Company had earnings per share of $45 and paid a dividend of $15 per share.The dividend yield was 8%.The book value per share is $100.The dividend payout ratio was:

A)4.167

B)3.0000

C)0.3333

D)0.1500

A)4.167

B)3.0000

C)0.3333

D)0.1500

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is NOT true?

A)The relationship between cash and sales can be determined by estimating the past relationship between sales levels and cash balances.

B)Interest expenses can be predicted with a reasonable degree of accuracy, especially when the firm uses variable interest rates on debt.

C)Selling expenses are commonly based on a percentage of sales.

D)A pro forma income statement may also include projected dividend payments based on the firm's established dividend policies.

A)The relationship between cash and sales can be determined by estimating the past relationship between sales levels and cash balances.

B)Interest expenses can be predicted with a reasonable degree of accuracy, especially when the firm uses variable interest rates on debt.

C)Selling expenses are commonly based on a percentage of sales.

D)A pro forma income statement may also include projected dividend payments based on the firm's established dividend policies.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

The external financing requirements (EFR)of a firm are a function of:

A)Sales growth

B)Retention ratio

C)Profit margins

D)All of the above

A)Sales growth

B)Retention ratio

C)Profit margins

D)All of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is TRUE?

A)Interest expenses can be predicted with a reasonable degree of accuracy, especially when the firm uses fixed interest rates on debt.

B)Interest expenses are commonly based on a percentage of sales.

C)Depreciation costs are commonly based on a percentage of sales.

D)Forecasting sales is the last step in financial forecasting.

A)Interest expenses can be predicted with a reasonable degree of accuracy, especially when the firm uses fixed interest rates on debt.

B)Interest expenses are commonly based on a percentage of sales.

C)Depreciation costs are commonly based on a percentage of sales.

D)Forecasting sales is the last step in financial forecasting.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

The current stock price of Bay James Tourism Company is $25.Current earnings per share are $15 and are expected to grow by 20% next year.Bay James Tourism's trailing and forward price-earnings ratios are:

A)Trailing = 1.67; Forward = 1.39

B)Trailing = 1.67; Forward = 1.20

C)Trailing = 1.39; Forward = 1.67

D)Trailing = 1.20; Forward = 1.67

A)Trailing = 1.67; Forward = 1.39

B)Trailing = 1.67; Forward = 1.20

C)Trailing = 1.39; Forward = 1.67

D)Trailing = 1.20; Forward = 1.67

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is TRUE?

A)Interest expenses can be predicted with a reasonable degree of accuracy, especially when the firm uses variable interest rates on debt.

B)Interest expenses are commonly based on a percentage of sales.

C)Depreciation costs are commonly based on a percentage of sales.

D)Forecasting sales is the most important step in financial forecasting.

A)Interest expenses can be predicted with a reasonable degree of accuracy, especially when the firm uses variable interest rates on debt.

B)Interest expenses are commonly based on a percentage of sales.

C)Depreciation costs are commonly based on a percentage of sales.

D)Forecasting sales is the most important step in financial forecasting.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

The dividend payout ratio aids investors by:

A)providing information about the sustainability of the dividend

B)providing information about the company's future revenue growth

C)measuring the company's dividend yield

D)reporting the company's net income margin

A)providing information about the sustainability of the dividend

B)providing information about the company's future revenue growth

C)measuring the company's dividend yield

D)reporting the company's net income margin

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

What does the retention ratio measure?

A)Contribution margin minus fixed costs

B)The percentage of net earnings not paid out in dividends

C)Earnings before tax minus taxes

D)Cash from operations minus cash from investing

A)Contribution margin minus fixed costs

B)The percentage of net earnings not paid out in dividends

C)Earnings before tax minus taxes

D)Cash from operations minus cash from investing

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

GoHabs Firm has assets and liabilities with book values of $65 million and $35 million, respectively.The market value of the assets is $75 million and the market value of the debt is $40 million.If GoHabs's EBITDA is $20 million, what is the EBITDA multiple?

A)0.67

B)1.50

C)1.75

D)3.75

A)0.67

B)1.50

C)1.75

D)3.75

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is NOT true?

A)The process of preparing financial forecasts begins by preparing a projected income statement.

B)In preparing a projected income statement, start with a sales or revenue forecast prepared by marketing personnel.

C)The relationship between sales and some costs may be complex, for example sales and fixed costs.

D)Interest expenses are commonly based on a percentage of sales.

A)The process of preparing financial forecasts begins by preparing a projected income statement.

B)In preparing a projected income statement, start with a sales or revenue forecast prepared by marketing personnel.

C)The relationship between sales and some costs may be complex, for example sales and fixed costs.

D)Interest expenses are commonly based on a percentage of sales.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

If a company has good growth potential, the market to book ratio should be:

A)Higher than 1

B)Lower than 1

C)Less than 0

D)Not relevant

A)Higher than 1

B)Lower than 1

C)Less than 0

D)Not relevant

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck