Deck 23: Working Capital Management: General Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 23: Working Capital Management: General Issues

1

Working capital management is the effective management of?

A)current assets and total liabilities

B)total assets and current liabilities

C)current assets and current liabilities

D)total assets and total liabilities

A)current assets and total liabilities

B)total assets and current liabilities

C)current assets and current liabilities

D)total assets and total liabilities

current assets and current liabilities

2

A firm's payment policy is concerned with

A)When the firm pays its bills

B)How the firm pays its bills (e.g.cheques, electronic fund transfer)

C)Which bills the firm pays

D)All of the above

A)When the firm pays its bills

B)How the firm pays its bills (e.g.cheques, electronic fund transfer)

C)Which bills the firm pays

D)All of the above

When the firm pays its bills

3

Winnipeg Golf Club Ltd.collects 25% of its monthly sales immediately and the rest of sales are collected later.Its production costs are 55% of sales.It holds 1 month of inventory, and it pays 60% of its bills immediately and the rest after 30 days.What is this firm's break-even sales growth rate?

A)82.54%

B)71.43%

C)67.23%

D)57.32%

A)82.54%

B)71.43%

C)67.23%

D)57.32%

71.43%

4

The firm's cash budget is its:

A)Cash flow statement for each month

B)Amount of cash available for daily sales

C)Cash amount on its balance sheet

D)Foreign currency on hand for foreign trade

A)Cash flow statement for each month

B)Amount of cash available for daily sales

C)Cash amount on its balance sheet

D)Foreign currency on hand for foreign trade

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following is true?

A)The change in cash position is a linear relationship to production.

B)If the sales are lower than the sales growth break-even point, the firm will run out of working capital.

C)As the level of inventory increases, the required sales growth increases.

D)As the level of inventory increases, the required sales growth decreases.

A)The change in cash position is a linear relationship to production.

B)If the sales are lower than the sales growth break-even point, the firm will run out of working capital.

C)As the level of inventory increases, the required sales growth increases.

D)As the level of inventory increases, the required sales growth decreases.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

Maltese Industries Ltd.is preparing its cash disbursements budget for the coming month.The following information pertains to the cash disbursements:

I.Maltese Industries Ltd.pays for 60% of its direct materials purchases in the month of purchase and the remainder the following month.Last month's direct material purchases were $45,000, while Maltese Industries Ltd.anticipates $50,000 of direct material purchases this coming month.

II.Direct labour for the upcoming month is budgeted to be $42,000 and will be paid at the end of the upcoming month.

III.Overhead is estimated to be 150% of direct labour cost each month and is paid in the month in which it is incurred.This monthly estimate includes $10,000 of depreciation on the plant and equipment.

IV.Monthly operating expenses for next month are expected to be $32,500, which includes $2,500 of depreciation on office equipment.These monthly operating expenses are paid during the month in which they are incurred.

V.Maltese Industries Ltd.will be making an estimated tax payment of $6,000 next month.

VI.Maltese Industries Ltd.will be making their quarterly dividend payment next month in the amount of $20,000

What is the budgeted total cash disbursement for next month?

A)$181,000

B)$193,000

C)$199,000

D)$211,500

I.Maltese Industries Ltd.pays for 60% of its direct materials purchases in the month of purchase and the remainder the following month.Last month's direct material purchases were $45,000, while Maltese Industries Ltd.anticipates $50,000 of direct material purchases this coming month.

II.Direct labour for the upcoming month is budgeted to be $42,000 and will be paid at the end of the upcoming month.

III.Overhead is estimated to be 150% of direct labour cost each month and is paid in the month in which it is incurred.This monthly estimate includes $10,000 of depreciation on the plant and equipment.

IV.Monthly operating expenses for next month are expected to be $32,500, which includes $2,500 of depreciation on office equipment.These monthly operating expenses are paid during the month in which they are incurred.

V.Maltese Industries Ltd.will be making an estimated tax payment of $6,000 next month.

VI.Maltese Industries Ltd.will be making their quarterly dividend payment next month in the amount of $20,000

What is the budgeted total cash disbursement for next month?

A)$181,000

B)$193,000

C)$199,000

D)$211,500

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is a reason why a very profitable company might go bankrupt?

A)Managers are not forecasting sales correctly

B)Profits do not include the real costs of the business

C)Lack of cash to finance activities

D)Profits are inflated using some accounting method

A)Managers are not forecasting sales correctly

B)Profits do not include the real costs of the business

C)Lack of cash to finance activities

D)Profits are inflated using some accounting method

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

On January 1 Joe's Hardware Store Ltd.had $2,300 in cash and had neither accounts receivable nor payable outstanding.During the month of January, the store had received orders from two contractors for building materials for $20,500, each, which would be paid at the end of January.During the month, the store had expenses of $15,500 for salaries, $40,500 for inventory, and $2,200 of utilities.What is the January 31st cash balance for Joe's Hardware Store Ltd.?

A)-$20,400

B)-$14,900

C)-$12,500

D)$2,400

A)-$20,400

B)-$14,900

C)-$12,500

D)$2,400

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

A firm's inventory policy concerns

A)What the firm does with its inventory

B)What kind of inventory the firm buys

C)The amount of inventory to hold

D)Where the firm holds its inventory

A)What the firm does with its inventory

B)What kind of inventory the firm buys

C)The amount of inventory to hold

D)Where the firm holds its inventory

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT a key component of a cash budget?

A)Estimated production schedules

B)Sales forecasts

C)Estimates of the size and timing of other cash inflows and outflows

D)Warranty sales

A)Estimated production schedules

B)Sales forecasts

C)Estimates of the size and timing of other cash inflows and outflows

D)Warranty sales

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is NOT a warning sign indicating potential liquidity problems?

A)build-up of long-term assets

B)sustained decreases in net working capital

C)sustained increases in accounts receivable

D)increase in debt ratios

A)build-up of long-term assets

B)sustained decreases in net working capital

C)sustained increases in accounts receivable

D)increase in debt ratios

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT a part of good working capital management?

A)the maintenance of optimal cash balances

B)the investment of any excess liquid funds in marketable securities that provide the best return possible, considering any liquidity or default-risk constraints

C)the proper management of accounts receivable

D)the extension of long-term debt

A)the maintenance of optimal cash balances

B)the investment of any excess liquid funds in marketable securities that provide the best return possible, considering any liquidity or default-risk constraints

C)the proper management of accounts receivable

D)the extension of long-term debt

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

Why do banks require that business loan applications be accompanied by cash budgets?

A)To determine how much cash to loan

B)To determine whether the loan will be a short-term or long-term loan.

C)To determine whether the business will be profitable

D)To calculate the expected return it earns from the loan

A)To determine how much cash to loan

B)To determine whether the loan will be a short-term or long-term loan.

C)To determine whether the business will be profitable

D)To calculate the expected return it earns from the loan

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

In the event that a business' cash budget forecasts a cash deficit for a short period of time, what should the business then do?

A)Close the business, as it is unprofitable.

B)Arrange for some short-term borrowing around the expected time of the deficit.

C)Try to make the cash forecast positive by decreasing / cutting costs somehow.

D)Change the credit granting policy of the business.

A)Close the business, as it is unprofitable.

B)Arrange for some short-term borrowing around the expected time of the deficit.

C)Try to make the cash forecast positive by decreasing / cutting costs somehow.

D)Change the credit granting policy of the business.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

The break-even sales growth rate is defined as:

A)The sales growth rate at which a firm makes profits

B)The sales growth rate of return on a firm's investment

C)The sales growth rate that makes the monthly cash flow from operations equal zero.

D)The sales growth rate at which investors break even

A)The sales growth rate at which a firm makes profits

B)The sales growth rate of return on a firm's investment

C)The sales growth rate that makes the monthly cash flow from operations equal zero.

D)The sales growth rate at which investors break even

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following two statements is correct?

I.Illiquidity is the inability of a firm to raise funds on reasonable terms.

II.Insolvency is the inability of a firm to meet its financial obligations as they are due

A)Both I and II are correct

B)Both I and II and incorrect

C)Statement I is incorrect and statement II is correct

D)Statement I is correct and statement II is incorrect

I.Illiquidity is the inability of a firm to raise funds on reasonable terms.

II.Insolvency is the inability of a firm to meet its financial obligations as they are due

A)Both I and II are correct

B)Both I and II and incorrect

C)Statement I is incorrect and statement II is correct

D)Statement I is correct and statement II is incorrect

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

Montreal Skaters Corp.(MSC)collects 10% of its monthly sales immediately and the rest a month later.Its production costs are 70% of sales and it holds 1 month of sales in inventory.MSC pays half its bills immediately and half after 30 days.What is this firm's break-even sales growth rate?

A)78.65%

B)71.43%

C)31.58%

D)10.00%

A)78.65%

B)71.43%

C)31.58%

D)10.00%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

The correct measure of the cash generating ability of a firm is:

A)Working capital

B)Cash flow from operations

C)Accounts receivable

D)Net income

A)Working capital

B)Cash flow from operations

C)Accounts receivable

D)Net income

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

On April 1 Montreal Salsa Dance School had $1,750 in cash, and no receivables or payables.It also had 100 students whose classes finished on April 30.Thirty-five of those students paid their tuition of $500 on time (before April 30).During the month the school incurred the following costs associated with its operations: instructor salaries $25,000, rent $4,000, and $1,000 utilities.If the school's policy of paying all bills in cash at the end of each month is respected, how much does the school have to borrow to pay its bills?

A)$30,000

B)$12,500

C)$10,750

D)$0

A)$30,000

B)$12,500

C)$10,750

D)$0

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

A firm can reduce its burn rate through changing different policies, except:

A)Sales policy by increasing its sales volumes through discount pricing

B)Credit policy by collecting its receivables more quickly

C)Payment policy by delaying the paying of bills

D)Inventory policy by decreasing levels of inventory and having higher inventory rates

A)Sales policy by increasing its sales volumes through discount pricing

B)Credit policy by collecting its receivables more quickly

C)Payment policy by delaying the paying of bills

D)Inventory policy by decreasing levels of inventory and having higher inventory rates

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

The operating cycle allows firms to estimate

A)the average time between when a firm pays cash for its inventory purchases and when it receives cash for its sales

B)the average time a firm must keep any borrowed funds

C)the average time required for a firm to acquire inventory, sell it, and collect the proceeds

D)the amount of cash a firm needs to be profitable

A)the average time between when a firm pays cash for its inventory purchases and when it receives cash for its sales

B)the average time a firm must keep any borrowed funds

C)the average time required for a firm to acquire inventory, sell it, and collect the proceeds

D)the amount of cash a firm needs to be profitable

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

Why is sales figure rather than cost of goods sold used when calculating the average days revenues in inventory (ADRI)?

A)The value for COGS is not always comparable across firms due to accounting differences

B)COGS is not the driving variable behind the accumulation of inventory

C)Inventory is accumulated regardless of its COGS

D)There are three types of COGS: raw materials, work in progress, and finished goods.Since all are slightly different, using one or the other would make the calculations inaccurate.

A)The value for COGS is not always comparable across firms due to accounting differences

B)COGS is not the driving variable behind the accumulation of inventory

C)Inventory is accumulated regardless of its COGS

D)There are three types of COGS: raw materials, work in progress, and finished goods.Since all are slightly different, using one or the other would make the calculations inaccurate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

The two components of the operating cycle are:

A)Average days of revenues + average collected payment

B)Average days of revenues in inventory + payables turnover

C)Average days of revenues + average collection period

D)Average days of revenues in inventory + average collection period

A)Average days of revenues + average collected payment

B)Average days of revenues in inventory + payables turnover

C)Average days of revenues + average collection period

D)Average days of revenues in inventory + average collection period

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

The inventory turnover ratio is defined as:

A)The ratio of cost of goods sold to sales

B)A ratio measuring the sales that are generated per dollar of receivables

C)A ratio measuring how fast inventory is paid for

D)A ratio of sales to average inventory

A)The ratio of cost of goods sold to sales

B)A ratio measuring the sales that are generated per dollar of receivables

C)A ratio measuring how fast inventory is paid for

D)A ratio of sales to average inventory

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

The manager of your receivables' department states that the firm's accounts receivable turnover is 25.Which of the following statements is a true interpretation of this value?

A)It takes about 25 days, on average, for customers to pay for their account

B)It takes about 15 days, on average, for customers to pay for their account QUOTE

C)It takes about 2 days, on average, for customers to pay for their account

D)None of the above

A)It takes about 25 days, on average, for customers to pay for their account

B)It takes about 15 days, on average, for customers to pay for their account QUOTE

C)It takes about 2 days, on average, for customers to pay for their account

D)None of the above

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following statements to answer this question:

I.The quick ratio is more conservative than the current ratio because it covers a smaller period of time.

II.The cost of goods sold figure in the inventory turnover ratio is not always reliable because of accounting differences used in measuring it.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.The quick ratio is more conservative than the current ratio because it covers a smaller period of time.

II.The cost of goods sold figure in the inventory turnover ratio is not always reliable because of accounting differences used in measuring it.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

A "good" value for the current ratio is:

A)Varies from industry to industry

B)1.4

C)1.5

D)2.0

A)Varies from industry to industry

B)1.4

C)1.5

D)2.0

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

The average collection period measures

A)How long it takes the average customer to pay bad debts

B)How long the firm waits before asking customers to pay their account

C)How long the firm allows the customers to not pay their account

D)How long it takes the average customer to pay their account

A)How long it takes the average customer to pay bad debts

B)How long the firm waits before asking customers to pay their account

C)How long the firm allows the customers to not pay their account

D)How long it takes the average customer to pay their account

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

What are the two most common measures of liquidity?

A)Cash ratio and inventory turnover ratio

B)Receivables turnover ratio and payables turnover ratio

C)Current ratio and quick ratio

D)Inventory turnover ratio and cash conversion rate

A)Cash ratio and inventory turnover ratio

B)Receivables turnover ratio and payables turnover ratio

C)Current ratio and quick ratio

D)Inventory turnover ratio and cash conversion rate

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is true regarding cash flow from operations?

A)Increases when the collection rate on receivables rises

B)Increases when the bill payments are made quicker.

C)Decreases when the inventory turnover ratio increases.

D)Increases when production costs rise.

A)Increases when the collection rate on receivables rises

B)Increases when the bill payments are made quicker.

C)Decreases when the inventory turnover ratio increases.

D)Increases when production costs rise.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

The quick ratio differs from the current ratio in the following way:

A)The current ratio is a more conservative estimate of liquidity compared to the quick ratio

B)The quick ratio excludes both notes payable and bank loans, while the current ratio excludes only notes payable

C)The quick ratio excludes inventory and prepaid expenses while the current ratio includes all current assets

D)The quick ratio is generally higher than a firm's current ratio

A)The current ratio is a more conservative estimate of liquidity compared to the quick ratio

B)The quick ratio excludes both notes payable and bank loans, while the current ratio excludes only notes payable

C)The quick ratio excludes inventory and prepaid expenses while the current ratio includes all current assets

D)The quick ratio is generally higher than a firm's current ratio

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

The payables turnover ratio indicates:

A)How many times a year a firm is purchasing goods from its suppliers

B)How many times a year a firm's customers are paying their account

C)How long a firm delays payment to its suppliers

D)How many times a year a firm is paying its suppliers

A)How many times a year a firm is purchasing goods from its suppliers

B)How many times a year a firm's customers are paying their account

C)How long a firm delays payment to its suppliers

D)How many times a year a firm is paying its suppliers

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

The operating cycle is defined as:

A)The average time it takes firms to acquire inventory, sell it, and receive payment

B)The average time it takes to convert raw materials into finished goods

C)The average time it takes to generate profit from operations

D)The average time it takes a firm to sell its inventory and receive payment

A)The average time it takes firms to acquire inventory, sell it, and receive payment

B)The average time it takes to convert raw materials into finished goods

C)The average time it takes to generate profit from operations

D)The average time it takes a firm to sell its inventory and receive payment

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

A firm wishes to increase its break-even sales growth rate.Which of the following actions will help to achieve this?

A)Increase inventory levels

B)Slow down the payment of bills to save cash reserves

C)Increase sales levels

D)Decrease the collection period on receivables

A)Increase inventory levels

B)Slow down the payment of bills to save cash reserves

C)Increase sales levels

D)Decrease the collection period on receivables

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following relationships is not true?

A)The break-even sales growth rate is inversely related to the inventory level.

B)The break-even sales growth rate is inversely related to the gross margin.

C)The break-even sales growth rate is inversely related to the payables rate.

D)The break-even sales growth rate is positively related to the collection rate.

A)The break-even sales growth rate is inversely related to the inventory level.

B)The break-even sales growth rate is inversely related to the gross margin.

C)The break-even sales growth rate is inversely related to the payables rate.

D)The break-even sales growth rate is positively related to the collection rate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following statements to answer this question:

I.Delaying payment of payables can create a buffer for the firm to keep its working capital.

II.If the firm cannot change its credit, payment, and inventory policies, it has to slow its growth to survive.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.Delaying payment of payables can create a buffer for the firm to keep its working capital.

II.If the firm cannot change its credit, payment, and inventory policies, it has to slow its growth to survive.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

When interpreting the cash conversion cycle (CCC), which of the following is true?

A)The higher the CCC value the better, because it means the firm is converting its cash quickly

B)The lower the CCC value the better, because it means the firm is recovering its cash quickly

C)The higher the CCC value the better, because it means the firm is paying its debt quickly

D)The higher the CCC value the better, because it means the firm is delaying the payment of its debt

A)The higher the CCC value the better, because it means the firm is converting its cash quickly

B)The lower the CCC value the better, because it means the firm is recovering its cash quickly

C)The higher the CCC value the better, because it means the firm is paying its debt quickly

D)The higher the CCC value the better, because it means the firm is delaying the payment of its debt

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

Montreal Skaters Corp.collects 35% of its monthly sales immediately and the rest a month later.Its production costs are 65% of sales.It holds 1 month of sales in inventory, and it pays half its bills immediately and half after 30 days.What is this firm's break-even sales growth rate?

A)200.0%

B)104.0%

C)56.0%

D)46.8%

A)200.0%

B)104.0%

C)56.0%

D)46.8%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

A firm with a high liquidity ratio is definitely practising effective working capital management.This statement is:

A)True, higher liquidity means that the firm has more cash than it spends.

B)False, higher liquidity means payables are paid much later than receivables and this hurts the firm's reputation

C)True, higher liquidity ratio means receivables are greater than payables.

D)False, the firms' working capital management policy may be too conservative or too lenient

A)True, higher liquidity means that the firm has more cash than it spends.

B)False, higher liquidity means payables are paid much later than receivables and this hurts the firm's reputation

C)True, higher liquidity ratio means receivables are greater than payables.

D)False, the firms' working capital management policy may be too conservative or too lenient

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

A "good" value for the quick ratio is

A)1

B)1.5

C)2

D)Varies from industry to industry

A)1

B)1.5

C)2

D)Varies from industry to industry

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

Firms can decrease their cash conversion cycle by doing all of the following except:

A)Delay paying bills

B)Increase its inventory turnover

C)Reduce collection time

D)Reduce production costs

A)Delay paying bills

B)Increase its inventory turnover

C)Reduce collection time

D)Reduce production costs

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

Montreal Bagel Bakery collects 35% of its monthly sales immediately and the rest a month later.Its production costs are 65% of sales.It holds 1 month of sales in inventory, and pays half its bills immediately and half after 30 days.Calculate the operating cycle (OC)and the cash conversion cycle (CCC)for Montreal Bagel Bakery.

A)OC=49.92 and CCC=34.92

B)OC=49.92 and CCC=15

C)OC=35 and CCC=65

D)OC=0 and CCC=30

A)OC=49.92 and CCC=34.92

B)OC=49.92 and CCC=15

C)OC=35 and CCC=65

D)OC=0 and CCC=30

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

Explain what the break-even sales growth rate means and what impact it has on the development of a firm's operations and credit granting (financial)policy.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

You recently overheard your boss stating that, "Our company's high growth rate is making it difficult for us to keep the business open, and we're frequently forced to rely on bank loans to keep us from going bankrupt." This statement confused you: isn't a high growth rate a good thing to have? Clearly explain why or why not and discuss how firms with a problem such as yours resolve their dilemma.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

Montreal Bagel Bakery collects 70% of its monthly sales immediately and the rest a month later.Its production costs are 65% of sales.It holds 1 month of sales in inventory, and it pays half its bills immediately and half after 30 days.Calculate the cash conversion cycle and the operating cycle for Montreal Bagel Bakery.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

A company has revenue of $2,043,693, accounts receivable of $159,503, average inventory of $71,505, and accounts payable of $157,210.How many days are the operating cycle (OC)and the cash conversion cycle (CCC)?

A)OC=12.77 and CCC=28.49

B)OC=13.18 and CCC=41.26

C)OC=41.26 and CCC=13.18

D)OC=41.26 and CCC=28.08

A)OC=12.77 and CCC=28.49

B)OC=13.18 and CCC=41.26

C)OC=41.26 and CCC=13.18

D)OC=41.26 and CCC=28.08

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

Vancouver Sushi Limited collects 35% of its monthly sales immediately and the rest a month later.Its production costs are 60% of sales.It holds 1 month of sales in inventory, and it pays 60% its bills immediately and 40% after 30 days.Calculate the cash conversion cycle and the operating cycle for Vancouver Sushi Limited.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

The following information concerning Sherwood Ltd.has been made available for the development of cash and other budget information for the months of July, August, and September.

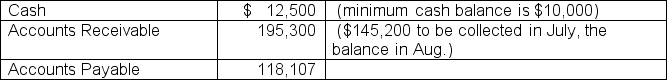

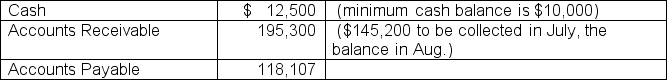

Selected balances at July 1st are expected to be:

The budget is to be based on the following assumptions:

Sixty percent (60.0%)of the billings are collected in the month of the sale; 25% are collected in the month following the sale; 10% are collected in the 2nd month following the sale and 5% are estimated to be uncollectible

Fifty-five percent (55.0%)of all product purchases are paid for in the month purchased, with the remaining 45% paid in the month following the purchase.Each unit of product costs $22.

Selling, general and administrative expenses, of which $2,000 is depreciation, are equal to 25% of the current month's sales dollar.These expenses are paid for in the month incurred.

The Board of Directors of Sherwood Ltd.has declared a cash dividend totaling $75,000 that is to be paid in August.

Sherwood Ltd.has a considerable investment portfolio that provides investment income each month of $12,500.

Sherwood Ltd.is required to pay an installment on their current year's income tax assessment in July.The amount due is $12,000.

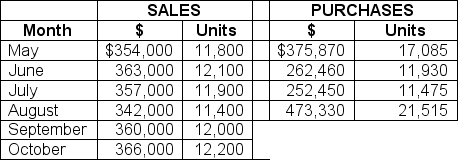

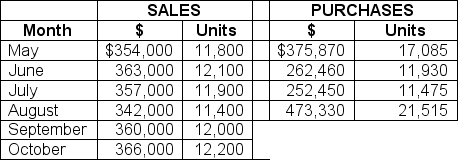

Actual and projected sales and purchases are as follows:

Prepare a cash budget for the months of July and August, including a cash receipts and cash disbursements schedule.

Selected balances at July 1st are expected to be:

The budget is to be based on the following assumptions:

Sixty percent (60.0%)of the billings are collected in the month of the sale; 25% are collected in the month following the sale; 10% are collected in the 2nd month following the sale and 5% are estimated to be uncollectible

Fifty-five percent (55.0%)of all product purchases are paid for in the month purchased, with the remaining 45% paid in the month following the purchase.Each unit of product costs $22.

Selling, general and administrative expenses, of which $2,000 is depreciation, are equal to 25% of the current month's sales dollar.These expenses are paid for in the month incurred.

The Board of Directors of Sherwood Ltd.has declared a cash dividend totaling $75,000 that is to be paid in August.

Sherwood Ltd.has a considerable investment portfolio that provides investment income each month of $12,500.

Sherwood Ltd.is required to pay an installment on their current year's income tax assessment in July.The amount due is $12,000.

Actual and projected sales and purchases are as follows:

Prepare a cash budget for the months of July and August, including a cash receipts and cash disbursements schedule.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

Illustrate and clearly explain how profitable businesses can become bankrupt due to the mismanagement of their working capital.In your explanation, define what working capital is, along with its major components, as well as the difference between cash flow and profits.Finally, describe how businesses can mitigate this problem of going broke while still being technically profitable.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

Explain why preparing a cash budget is important for the sustainability of an organization?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

Montreal Bagel Bakery collects 45% of its monthly sales immediately and the rest a month later.Its production costs are 60% of sales.It holds 1 month of sales in inventory, and it pays half its bills immediately and half after 30 days.Calculate the cash conversion cycle and the operating cycle for Montreal Bagel Bakery.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck