Deck 4: Accounting for Merchandising Businesses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

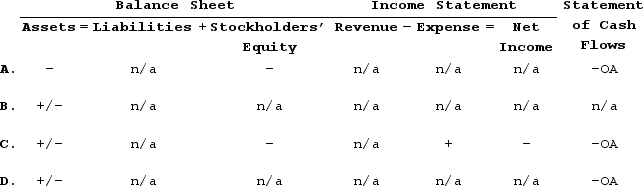

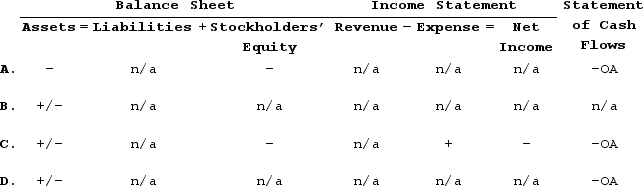

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

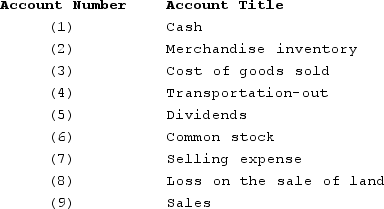

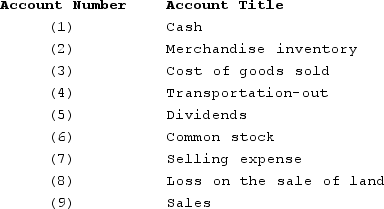

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/187

Play

Full screen (f)

Deck 4: Accounting for Merchandising Businesses

1

With a perpetual inventory system, the cost of merchandise inventory is recognized as an expense at the time of purchase.

False

2

The term FOB shipping point indicates that the seller is responsible forfreight costs.

False

3

A company using a perpetual inventory system treats transportation-out as an operating expense.

True

4

Gains and losses are recorded for increases and decreases in the market value of land.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

5

A multistep income statement separates routine operating results from peripheral or nonoperating items.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

6

Costs charged to the Merchandise Inventory account are product costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

7

Melbourne Company purchased merchandise with a list price of $3,300. The credit terms were 2/10, n/30. Assuming that Melbourne paid for the merchandise during the discount period, the cost of goods sold for this transaction would be $2,970.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

8

A multistep income statement shows sales revenue, cost of goods sold, and gross margin.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

9

Gross margin is equal to the amount of change (increase or decrease)in Merchandise Inventory during a period.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

10

Like product costs, selling and administrative costs cannot be recognized as an expense until inventory has been sold.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

11

Merchandising businesses include retail companies and manufacturing companies.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

12

Net income is not affected by a purchase of merchandise.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

13

Costs of selling inventory are product costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

14

In a perpetual inventory system, a purchase allowance is treated as a decrease in expenses by the company that purchased the goods.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

15

The write-off to record the amount of inventory shrinkage affects both the balance sheet and the income statement.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

16

With a perpetual inventory system, assets and stockholders' equity increase by the amount of the gross margin when inventory is sold. (Consider the effects of both parts of this event.)

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

17

For a company that uses the perpetual inventory system, a physical count of the inventory can reveal the amount of inventory shrinkage the company has experienced.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

18

A company that purchases merchandise treats a cash discount as a reduction to the cost of merchandise inventory.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

19

The beginning inventory plus cost of goods sold equals the cost of goods available for sale during the period.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

20

A perpetual inventory system updates the Merchandise Inventory account for all purchases of inventory, as well as returns of inventory to suppliers.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

21

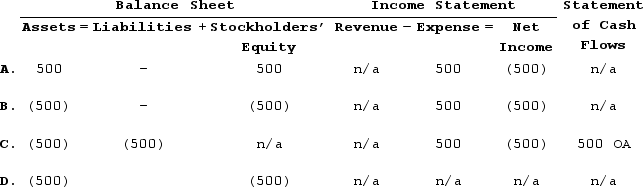

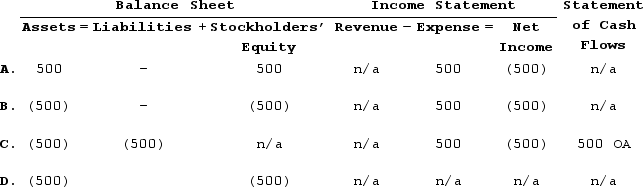

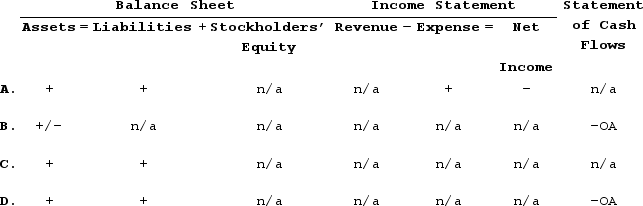

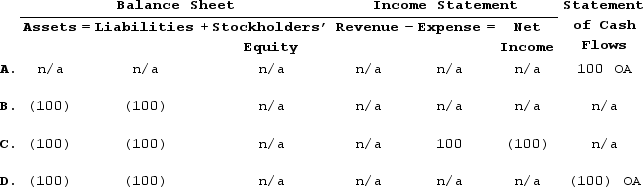

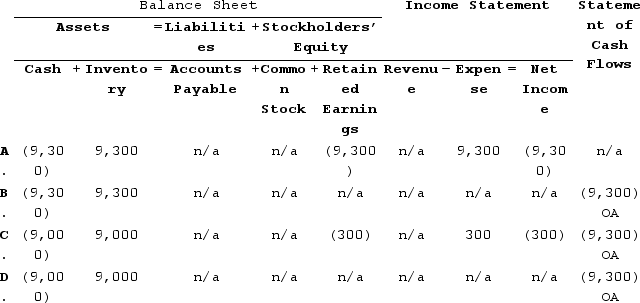

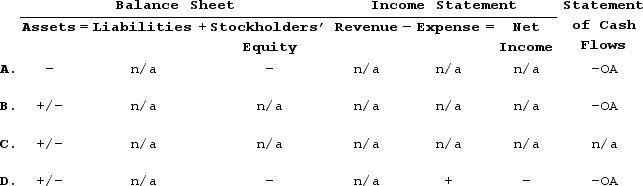

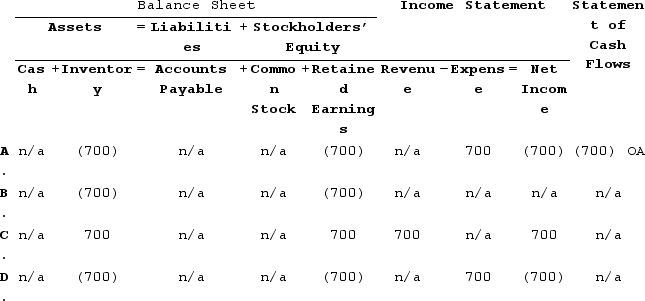

Star Company recognized $500 of cost of goods sold. Note that Star is only recording the cost of goods sold part of the transaction and not the sales revenue. Star uses the perpetual inventory system. Which of the following answers reflects the effect of recognizing the cost of goods sold on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

22

With a periodic inventory system, the cost of goods sold is recorded at the time of a sale of merchandise.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

23

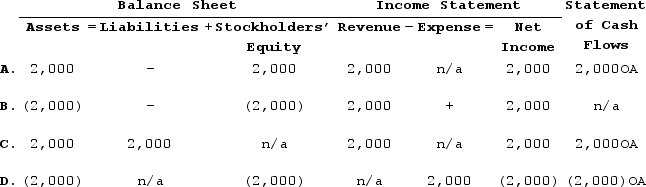

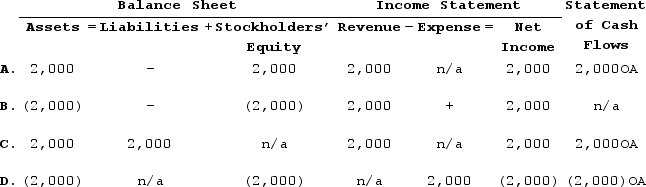

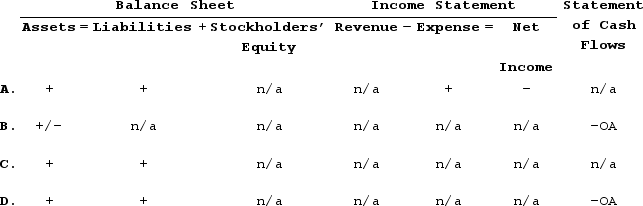

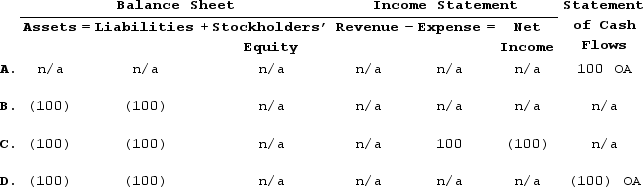

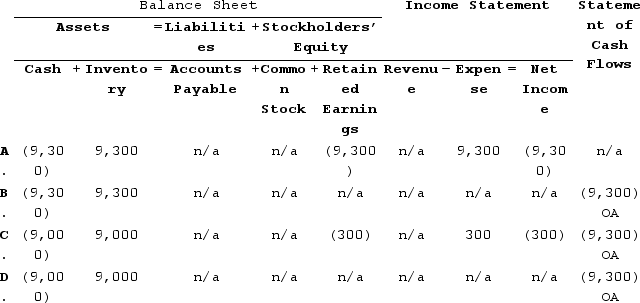

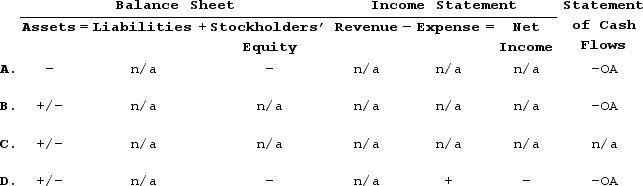

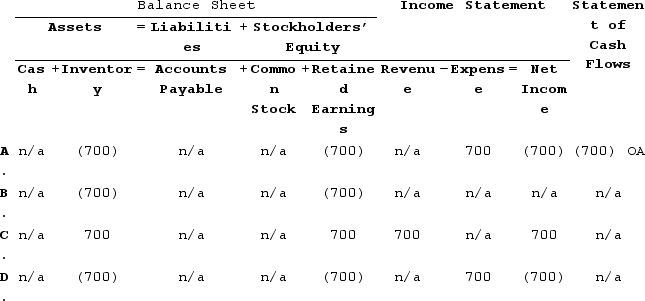

Star Company recognizes sales revenue from selling inventory for $2,000 cash. Note that Star is only recording the sales revenue part of the transaction and not the cost of goods sold. Star uses the perpetual inventory system. Which of the following answers reflects the effect of the sales revenue on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

24

When are product costs matched directly with sales revenue?

A)In the period immediately following the purchase.

B)In the period immediately following the sale.

C)When the merchandise is purchased.

D)When the merchandise is sold.

A)In the period immediately following the purchase.

B)In the period immediately following the sale.

C)When the merchandise is purchased.

D)When the merchandise is sold.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

25

What type of account is the Cost of Goods Sold account?

A)Liability

B)Asset

C)Contra asset

D)Expense

A)Liability

B)Asset

C)Contra asset

D)Expense

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

26

Common size financial statements are prepared by converting dollar amounts to percentages.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following would not be considered as primarily a merchandising business?

A)Abercrombie and Fitch

B)Sam's Clubs

C)Amazon

D)Regal Cinemas

A)Abercrombie and Fitch

B)Sam's Clubs

C)Amazon

D)Regal Cinemas

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

28

When a merchandising company sells inventory, it will

A)recognize only an expense.

B)recognize only revenue.

C)recognize revenue and expense.

D)not recognize revenue or expense.

A)recognize only an expense.

B)recognize only revenue.

C)recognize revenue and expense.

D)not recognize revenue or expense.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

29

A common size income statement is prepared by dividing all amounts on the statement by net income.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following would be considered as primarily a merchandising business?

A)West Consulting

B)Martin's Supermarket

C)Sandridge and Associates Law Offices

D)KPM Accounting and Tax Service

A)West Consulting

B)Martin's Supermarket

C)Sandridge and Associates Law Offices

D)KPM Accounting and Tax Service

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

31

What is the term used to describe a firm that primarily sells merchandise to other businesses?

A)Wholesale firm

B)Service firm

C)Retail firm

D)Consulting firm

A)Wholesale firm

B)Service firm

C)Retail firm

D)Consulting firm

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

32

Net sales is calculated by subtracting cost of goods sold from sales revenue.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

33

Sales discounts affect net sales, but purchase discounts do not.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is considered a period cost?

A)Transportation cost on goods received from suppliers.

B)Advertising expense for the current month.

C)Cost of merchandise purchased.

D)None of these answer choices are considered a period cost.

A)Transportation cost on goods received from suppliers.

B)Advertising expense for the current month.

C)Cost of merchandise purchased.

D)None of these answer choices are considered a period cost.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

35

If a company uses the periodic inventory system, it records inventory purchases in the Purchases account at the time of purchase.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

36

Sales discounts do not affect a company's gross margin percentage.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

37

A company's amount of cost of goods sold reported on the income statement will be the same with a periodic inventory system as it would be with a perpetual system.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

38

When a merchandising company pays cash to purchase inventory

A)the amount of total assets increases.

B)the amount of total assets remains the same.

C)the amount of expenses increases.

D)the amount of total asset decreases.

A)the amount of total assets increases.

B)the amount of total assets remains the same.

C)the amount of expenses increases.

D)the amount of total asset decreases.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is considered a product cost?

A)Utility expense for the current month.

B)Salaries paid to the employees of a merchandiser.

C)Transportation cost on goods received from suppliers.

D)Transportation cost on goods shipped to customers.

A)Utility expense for the current month.

B)Salaries paid to the employees of a merchandiser.

C)Transportation cost on goods received from suppliers.

D)Transportation cost on goods shipped to customers.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

40

The return on sales ratio indicates the amount of each sales dollar that is left over after covering the cost of goods sold.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

41

Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system.1)The company purchased $12,200 of merchandise on account under terms 2/10, n/30.2)The company returned $1,700 of merchandise to the supplier before payment was made.3)The liability was paid within the discount period.4)All of the merchandise purchased was sold for $18,400 cash.What is the net cash flow from operating activities as a result of the four transactions?

A)$8,110

B)$8,144

C)$6,076

D)$6,200

A)$8,110

B)$8,144

C)$6,076

D)$6,200

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

42

A company purchased inventory on account. If the perpetual inventory system is used, which of the following choices accurately reflects how the purchase affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

43

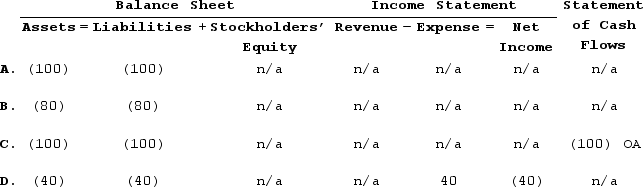

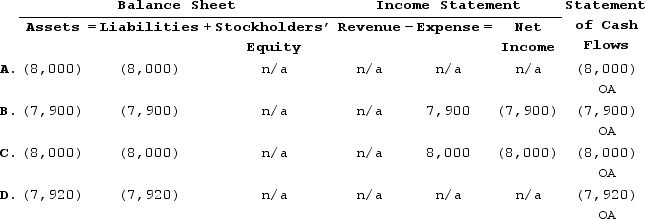

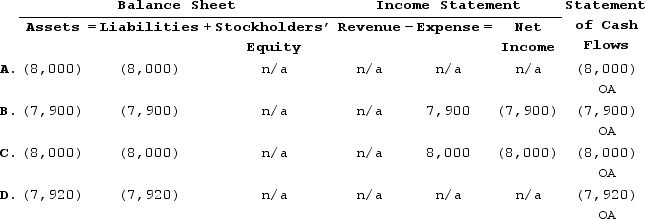

Llewelyn Company paid the balance due on an account payable. Llewelyn uses the perpetual inventory system. Which of the following reflects the effect of the payment on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

44

Galaxy Company sold merchandise costing $1,700 for $2,600 cash. The merchandise was later returned by the customer for a refund. The company uses the perpetual inventory system. What effect will the sales return have on the financial statements?(Consider the effects of both parts of this event.)

A)Total assets and total stockholders' equity decrease by $900.

B)Total assets decrease by $2,600 and total stockholders' equity decreases by $1,700.

C)Total assets and total stockholders' equity decrease by $2,600.

D)Total assets and total stockholders' equity increase by $900.

A)Total assets and total stockholders' equity decrease by $900.

B)Total assets decrease by $2,600 and total stockholders' equity decreases by $1,700.

C)Total assets and total stockholders' equity decrease by $2,600.

D)Total assets and total stockholders' equity increase by $900.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

45

Galaxy Company sold merchandise costing $2,100 for $3,200 cash. The merchandise was later returned by the customer for a refund. The company uses the perpetual inventory system. What effect will the sales return have on the financial statements? (Consider the effects of both parts of this event.)

A)Total assets and total stockholders' equity decrease by $3,200.

B)Total assets and total stockholders' equity increase by $1,100.

C)Total assets and total stockholders' equity decrease by $1,100.

D)Total assets decrease by $3,200 and total stockholders' equity decreases by $2,100.

A)Total assets and total stockholders' equity decrease by $3,200.

B)Total assets and total stockholders' equity increase by $1,100.

C)Total assets and total stockholders' equity decrease by $1,100.

D)Total assets decrease by $3,200 and total stockholders' equity decreases by $2,100.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements about period costs is true?

A)Most period costs are expensed in the period the costs are incurred.

B)Period costs are expensed when the products associated with these costs are sold.

C)Period costs are usually recorded as assets.

D)Period costs do not adhere to the matching concept.

A)Most period costs are expensed in the period the costs are incurred.

B)Period costs are expensed when the products associated with these costs are sold.

C)Period costs are usually recorded as assets.

D)Period costs do not adhere to the matching concept.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

47

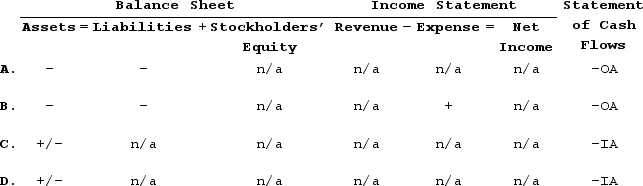

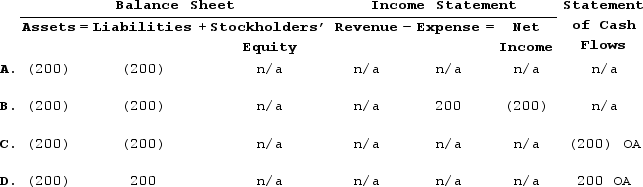

James Company experienced the following events during its first accounting period:(1)Purchased $10,000 of inventory on account.(2)Returned $100 of inventory purchased in Event 1.(3)Sold the inventory for $12,000 cash.Based on this information, which of the following shows how the recognition of the return will affect the Company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

48

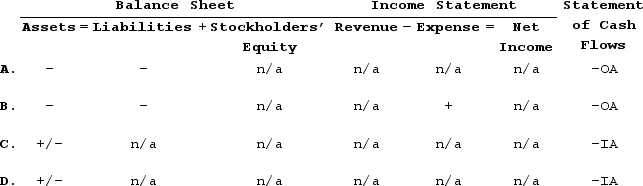

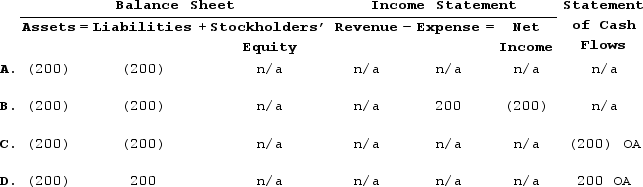

James Company experienced the following events during its first accounting period:(1)Purchased $10,000 of inventory for cash.(2)Returned $200 of the inventory purchased in Event 1. Inventory was returned for cash.Based on this information, which of the following shows how the recognition of the return will affect the Company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

49

Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system.1)The company purchased $12,500 of merchandise on account under terms 2/10, n/30.2)The company returned $1,200 of merchandise to the supplier before payment was made.3)The liability was paid within the discount period.4)All of the merchandise purchased was sold for $18,800 cash.What is the gross margin that results from these four transactions?

A)$5,100

B)$7,726

C)$6,550

D)$11,074

A)$5,100

B)$7,726

C)$6,550

D)$11,074

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

50

Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system. 1)The company purchased $12,400 of merchandise on account under terms 2/10, n/30.2)The company returned $1,900 of merchandise to the supplier before payment was made.3)The liability was paid within the discount period.4)All of the merchandise purchased was sold for $18,800 cash.

What is the gross margin that results from these four transactions?

A)$8,510

B)$8,548

C)$6,400

D)$6,272

What is the gross margin that results from these four transactions?

A)$8,510

B)$8,548

C)$6,400

D)$6,272

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

51

Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system.1)The company purchased $12,500 of merchandise on account under terms 2/10, n/30.2)The company returned $1,200 of merchandise to the supplier before payment was made.3)The liability was paid within the discount period.4)All of the merchandise purchased was sold for $18,800 cash.What is the net cash flow from operating activities as a result of the four transactions?

A)$5,100

B)$7,726

C)$6,550

D)$11,074

A)$5,100

B)$7,726

C)$6,550

D)$11,074

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

52

Edgar Corporation purchased merchandise inventory for $4,000 cash. This transaction is

A)an asset source transaction.

B)an asset exchange transaction.

C)an asset use transaction.

D)a claims exchange transaction.

A)an asset source transaction.

B)an asset exchange transaction.

C)an asset use transaction.

D)a claims exchange transaction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

53

James Company experienced the following events during its accounting period: (1)Purchased $10,000 of inventory on account.(2)Returned $2,000 of inventory purchased in Event 1.(3)Paid the remaining balance in account payable for the inventory purchased in Event 1.(4)Sold inventory purchased in Event 1 for $10,000 to customers on account. At the end of the first accounting period what would be reported on the Income Statement for net income?

A)$2,000

B)$8,000

C)$10,000

D)Zero

A)$2,000

B)$8,000

C)$10,000

D)Zero

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

54

Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system.1)The company purchased $13,300 of merchandise on account under terms 2/10, n/30.2)The company returned $2,800 of merchandise to the supplier before payment was made.3)The liability was paid within the discount period.4)All of the merchandise purchased was sold for $20,600 cash.What effect will the return of merchandise to the supplier in event (2)have on Darlington's financial statements?

A)Assets and stockholders' equity decrease by $2,800.

B)Assets and liabilities decrease by $2,744.

C)Assets and liabilities decrease by $2,800.

D)None. It is an asset exchange transaction.

A)Assets and stockholders' equity decrease by $2,800.

B)Assets and liabilities decrease by $2,744.

C)Assets and liabilities decrease by $2,800.

D)None. It is an asset exchange transaction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

55

James Company experienced the following events during its accounting period: (1)Purchased $10,000 of inventory on account.(2)Returned $2,000 of inventory purchased in Event 1.(3)Paid the remaining balance in account payable for the inventory purchased in Event 1.Immediately after the three events have been recognized, the balance in the Inventory account is

A)$2,000

B)$8,000

C)$10,000

D)Zero

A)$2,000

B)$8,000

C)$10,000

D)Zero

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

56

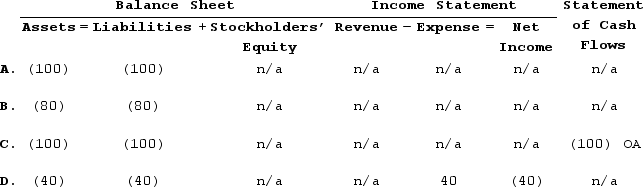

Kenyon Company experienced a transaction that had the following effect on the financial statements:  Which of the following business events would result in this effect on the financial statements?

Which of the following business events would result in this effect on the financial statements?

A)Paid for merchandise that had been purchased on account.

B)A loss on land that was sold for cash.

C)Return by a customer of a sale that was made on account.

D)Return to a supplier of merchandise purchased on account.

Which of the following business events would result in this effect on the financial statements?

Which of the following business events would result in this effect on the financial statements?A)Paid for merchandise that had been purchased on account.

B)A loss on land that was sold for cash.

C)Return by a customer of a sale that was made on account.

D)Return to a supplier of merchandise purchased on account.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

57

James Company experienced the following events during its accounting period:(1)Purchased $10,000 of inventory on account.(2)Returned $2,000 of the inventory purchased in Event 1.(3)Paid the remaining balance in account payable for the inventory purchased in Event 1.(4)Sold inventory purchased in Event 1 for $10,000 to customers on account.At the end of the first accounting period what would be reported for Net Operating Cash Flow on the Statement of Cash Flows?

A)$2,000

B)($8,000)

C)($10,000)

D)Zero

A)$2,000

B)($8,000)

C)($10,000)

D)Zero

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

58

Gross margin is reported on a

A)single step income statement.

B)multistep income statement.

C)single step balance sheet.

D)multistep balance sheet.

A)single step income statement.

B)multistep income statement.

C)single step balance sheet.

D)multistep balance sheet.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

59

A company using the perpetual inventory system paid $250 cash to have goods delivered from one of its suppliers. How would the payment of $250 for transportation-in be classified?

A)An asset source transaction

B)An asset use transaction

C)An asset exchange transaction

D)A claims exchange transaction

A)An asset source transaction

B)An asset use transaction

C)An asset exchange transaction

D)A claims exchange transaction

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

60

Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system.1)The company purchased $12,500 of merchandise on account under terms 2/10, n/30.2)The company returned $1,200 of merchandise to the supplier before payment was made.3)The liability was paid within the discount period.4)All of the merchandise purchased was sold for $18,800 cash.What effect will the return of merchandise to the supplier in event (2)have on Darlington's financial statements?

A)Assets and stockholders' equity decrease by $1,176.

B)Assets and liabilities decrease by $1,176.

C)Assets and liabilities decrease by $1,200.

D)None. It is an asset exchange transaction.

A)Assets and stockholders' equity decrease by $1,176.

B)Assets and liabilities decrease by $1,176.

C)Assets and liabilities decrease by $1,200.

D)None. It is an asset exchange transaction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

61

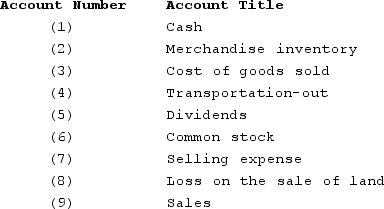

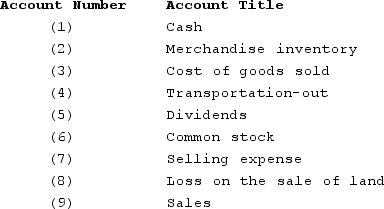

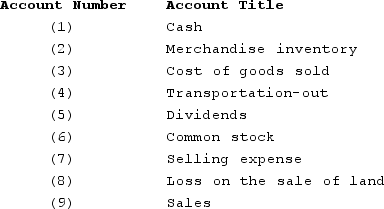

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:  Which accounts would affect gross margin?

Which accounts would affect gross margin?

A)Account numbers 2 and 9

B)Account numbers 3 and 9

C)Account numbers 3, 4, 7, and 9

D)Account numbers 3, 7, 8, and 9

Which accounts would affect gross margin?

Which accounts would affect gross margin?A)Account numbers 2 and 9

B)Account numbers 3 and 9

C)Account numbers 3, 4, 7, and 9

D)Account numbers 3, 7, 8, and 9

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

62

James Company experienced the following events during its first accounting period: (1)Purchased $10,000 of inventory on account under terms 1/10 n/30.(2)Returned $2,000 of the inventory purchased in Event 1(3)Paid the remaining balance in account payable within the discount period for the inventory purchased in Event 1 Immediately after the three events have been recognized, the balance in the inventory account is

A)$7,920

B)$8,000

C)$10,000

D)Zero

A)$7,920

B)$8,000

C)$10,000

D)Zero

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

63

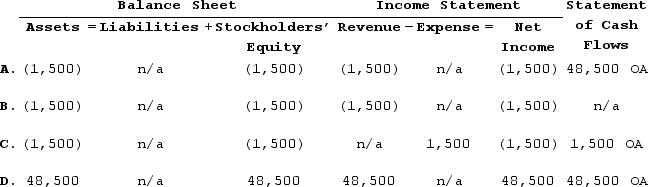

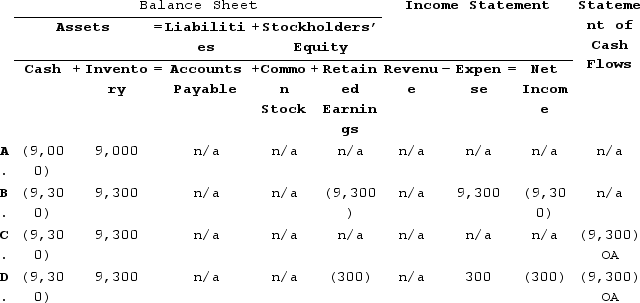

Taha Company purchased $9,000 of inventory under terms FOB destination. Freight cost amounted to $300. The cost of inventory and freight were paid with cash. Which of the following shows how the recognition of this purchase, including freight costs if applicable, will affect Taha's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

64

On April 1, Snell Company sold on account merchandise with a list price of $50,000. Payment terms were 3/10/n30. The receivable was collected from the customer on April 8. Considering only the collection of cash from the receivable, what effect will the transaction have on the company's statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

65

A company using the perpetual inventory system paid cash for freight costs to purchase merchandise. Which of the following reflects the effects of this event on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

66

Faust Company uses the perpetual inventory system. Faust sold goods that cost $5,600 for $9,200. The sale was made on account. What is the net effect of the sale on the company's financial statements?(Consider the effects of both parts of this event.)

A)Increase total assets by $9,200

B)Increase total assets by $3,600

C)Increase total stockholders' equity by $9,200

D)Increase total assets by $5,600

A)Increase total assets by $9,200

B)Increase total assets by $3,600

C)Increase total stockholders' equity by $9,200

D)Increase total assets by $5,600

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

67

Middleton Company uses the perpetual inventory system. The company purchased an item of inventory for $150 and sold the item to a customer for $270. How will the sale affect the company's Inventory account?

A)The inventory account will decrease by $270.

B)The inventory account will decrease by $150.

C)The inventory account will decrease by $120.

D)There is no effect on the inventory account.

A)The inventory account will decrease by $270.

B)The inventory account will decrease by $150.

C)The inventory account will decrease by $120.

D)There is no effect on the inventory account.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

68

James Company experienced the following events during its first accounting period.(1)Purchased $10,000 of inventory on account under terms 1/10 n/30.(2)Returned $2,000 of the inventory purchased in Event 1.(3)Paid the remaining balance in account payable for the inventory purchased in Event 1.If the Company pays the account payable after the discount period has expired, how much cash will be required to settle the liability?

A)$7,920

B)$8,000

C)$10,000

D)Zero

A)$7,920

B)$8,000

C)$10,000

D)Zero

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

69

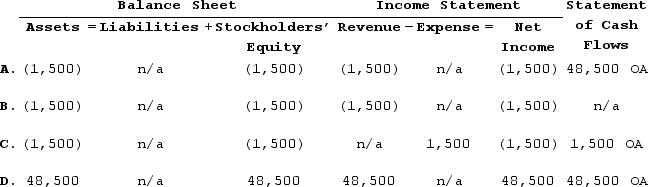

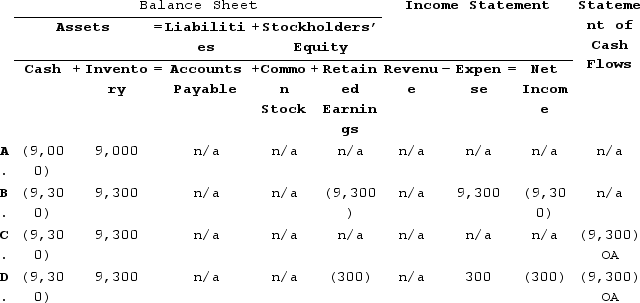

Taylor Company purchased $9,000 of inventory under terms FOB shipping point. Freight cost amounted to $300. The cost of inventory and freight were paid with cash. Which of the following shows how the recognition of this purchase, including freight costs if applicable, will affect Taylor's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

70

Anchor Company sold merchandise with a cost of $560 to a customer for $890 on account. Due to an error, neither part of the related two-part transaction was recorded in the accounting records. What effect will the failure to make the necessary entries have on the company's financial statements?

A)Total assets and total stockholders' equity will be overstated.

B)Total assets will be overstated and total stockholders' equity will be understated.

C)Total assets and total stockholders' equity will be understated.

D)The financial statements will not be affected.

A)Total assets and total stockholders' equity will be overstated.

B)Total assets will be overstated and total stockholders' equity will be understated.

C)Total assets and total stockholders' equity will be understated.

D)The financial statements will not be affected.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

71

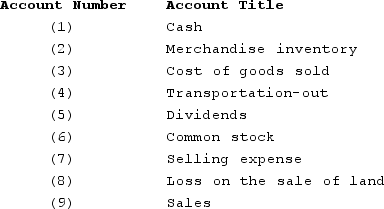

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:  Which accounts would appear on the balance sheet?

Which accounts would appear on the balance sheet?

A)Account numbers 1, 2, 4, and 5

B)Account numbers 1, 3, 7, and 8

C)Account numbers 1, 2, and 6

D)Account numbers 3, 4, 8, and 9

Which accounts would appear on the balance sheet?

Which accounts would appear on the balance sheet?A)Account numbers 1, 2, 4, and 5

B)Account numbers 1, 3, 7, and 8

C)Account numbers 1, 2, and 6

D)Account numbers 3, 4, 8, and 9

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

72

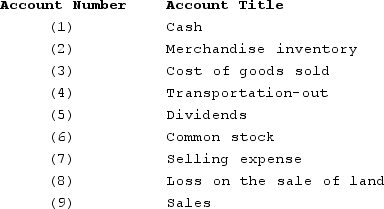

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:  Which accounts would appear on the income statement?

Which accounts would appear on the income statement?

A)Account numbers 3, 4, 7, 8, and 9

B)Account numbers 3, 4, 5, 7, and 9

C)Account numbers 2, 3, 7, 8, and 9

D)Account numbers 3, 5, 7, and 8

Which accounts would appear on the income statement?

Which accounts would appear on the income statement?A)Account numbers 3, 4, 7, 8, and 9

B)Account numbers 3, 4, 5, 7, and 9

C)Account numbers 2, 3, 7, 8, and 9

D)Account numbers 3, 5, 7, and 8

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

73

When using a perpetual inventory system, which of the following events is an asset use transaction?

A)Paid cash to purchase inventory

B)Paid cash for transportation-out costs

C)Purchased inventory on account

D)Paid cash for transportation-in costs

A)Paid cash to purchase inventory

B)Paid cash for transportation-out costs

C)Purchased inventory on account

D)Paid cash for transportation-in costs

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

74

At the end of its Year 1 accounting period, Voss Company had a $35,000 balance in its inventory account. Even so, when the company took a physical count of the inventory, it found only $34,300 of inventory on hand. Which of the following shows how recognizing the inventory shrinkage will affect the Company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

75

James Company experienced the following events during its first accounting period:(1)Purchased $10,000 of inventory on account under terms 1/10 n/30.(2)Returned $2,000 of the inventory purchased in Event 1.(3)Paid the remaining balance in account payable for the inventory purchased in Event 1.Based on this information, which of the following shows how the recognition of the cash discount (Event 1)will affect the Company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

76

What is the effect of recording the purchase of inventory on account under the perpetual inventory system?

A)Total assets increase

B)Total liabilities increase

C)Total assets are unaffected

D)Total assets and total liabilities increase

A)Total assets increase

B)Total liabilities increase

C)Total assets are unaffected

D)Total assets and total liabilities increase

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

77

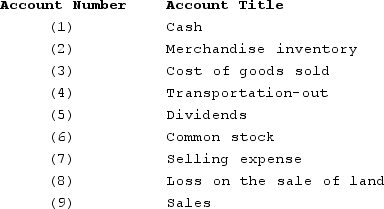

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:  Which accounts would affect operating income?

Which accounts would affect operating income?

A)Account numbers 2, 4, and 9

B)Account numbers 3, 5, 7, and 9

C)Account numbers 3, 4, 7, and 9

D)Account numbers 3, 4, 7, 8, and 9

Which accounts would affect operating income?

Which accounts would affect operating income?A)Account numbers 2, 4, and 9

B)Account numbers 3, 5, 7, and 9

C)Account numbers 3, 4, 7, and 9

D)Account numbers 3, 4, 7, 8, and 9

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

78

Middleton Company uses the perpetual inventory system. The company purchased an item of inventory for $130 and sold the item to a customer for $200. How will the sale affect the company's Inventory account?

A)The inventory account will decrease by $200.

B)The inventory account will decrease by $130.

C)The inventory account will decrease by $70.

D)There is no effect on the inventory account.

A)The inventory account will decrease by $200.

B)The inventory account will decrease by $130.

C)The inventory account will decrease by $70.

D)There is no effect on the inventory account.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

79

A company using the perpetual inventory system paid cash for a transportation-in cost. Which of the following choices reflects the effects of this event on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

80

James Company experienced the following events during its first accounting period:(1)Purchased $10,000 of inventory on account under terms 1/10 n/30.(2)Returned $2,000 of the inventory purchased in Event 1.(3)Paid the remaining balance in account payable for the inventory purchased in Event 1.Based on this information, which of the following shows how paying off the account payable (Event 3)will affect the Company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck