Deck 22: Long-Run Economic Growth: Sources and Policies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/26

Play

Full screen (f)

Deck 22: Long-Run Economic Growth: Sources and Policies

1

Since 1975, total government expenditures as a percentage of GDP in the United States have

A) grown from one third to about 40 percent.

B) remained fairly constant at about one-third.

C) grown from one-fourth to one-half.

D) grown from one quarter to one-third.

A) grown from one third to about 40 percent.

B) remained fairly constant at about one-third.

C) grown from one-fourth to one-half.

D) grown from one quarter to one-third.

As per the chapter analysis, the Government expenditure as a percentage of GDP in 1950 was about one-third. This remained constant until 2008 at which it increased to 35 percent.

Therefore the correct answer is (b) remained fairly constant at about one-third

Therefore the correct answer is (b) remained fairly constant at about one-third

2

Explain why federal, state, and local expenditures account for more than 30 percent of GDP, but total government spending (G in GDP) is only about 20 percent of GDP.

The reason behind this is that the government expenditures include the transfer of payments. Transfer of payments is that they transfer the purchasing power by reallocation of resources. For example, the tax collected in a local or state government is transferred to the central government increasing its purchasing power. This is considered as the local expenditure. This is the reason for the fed, state and local expenditures makeup 30 percent and government spending is 20 percent.

3

Which of the following accounted for the second largest percentage of total federal government expenditures in 2009?

A) Income security

B) National defense

C) Interest on the national debt

D) Education and health

A) Income security

B) National defense

C) Interest on the national debt

D) Education and health

In 2008, the first largest amount of 47% spent on income security which consisted of the social security and Medicare and the second one was national defense which is 21%.

Therefore, the correct answer is (b) national defense

Therefore, the correct answer is (b) national defense

4

Identify the major differences between federal government outlays and spending by state and local governments.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following contributed the largest percentage of total federal government expenditures in 2009?

A) Interest on the national debt

B) Education and health

C) National defense

D) Income security

A) Interest on the national debt

B) Education and health

C) National defense

D) Income security

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

6

What are the primary tax revenue sources at the federal, state, and local levels of government?

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following countries devotes about the same percentage of its GDP to taxes as the United States?

A) Sweden

B) Italy

C) United Kingdom

D) Japan

A) Sweden

B) Italy

C) United Kingdom

D) Japan

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following taxes satisfy the benefits-received principle, and which satisfy the ability-to-pay principle?

A) Gasoline tax

B) Federal income tax

C) Tax on Social Security benefits

A) Gasoline tax

B) Federal income tax

C) Tax on Social Security benefits

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

9

"The poor should not pay income taxes." This statement reflects which of the following principles of taxation?

A) Fairness of contribution

B) Benefits-received

C) Inexpensive-to-collect

D) Ability-to-pay

A) Fairness of contribution

B) Benefits-received

C) Inexpensive-to-collect

D) Ability-to-pay

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

10

What is the difference between the marginal tax rate and the average tax rate?

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

11

Some cities finance their airports with a departure tax: Every person leaving the city by plane is charged a small fixed dollar amount that is used to help pay for building and running the airport. The departure tax follows the

A) benefits-received principle.

B) ability-to-pay principle.

C) flat-rate principle.

D) public-choice principle.

A) benefits-received principle.

B) ability-to-pay principle.

C) flat-rate principle.

D) public-choice principle.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

12

Explain why a 5 percent sales tax on gasoline is regressive.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is true ?

A) The most important source of tax revenue for the federal government is individual income taxes.

B) The taxation burden, measured by taxes as a percentage of GDP, is lighter in the United States than in most other advanced industrial countries.

C) Both (a) and (b) are true.

D) Neither (a) nor (b) are true.

A) The most important source of tax revenue for the federal government is individual income taxes.

B) The taxation burden, measured by taxes as a percentage of GDP, is lighter in the United States than in most other advanced industrial countries.

C) Both (a) and (b) are true.

D) Neither (a) nor (b) are true.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

14

Jones has a taxable income of $30,000, and she must pay $3,000 in taxes. Mr. Smith has a taxable income of $60,000. How much tax must Mr. Smith pay for the tax system to be

A) progressive?

B) regressive?

C) proportional?

A) progressive?

B) regressive?

C) proportional?

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is true ?

A) A sales tax on food is a regressive tax.

B) The largest source of federal government" tax revenue is individual income taxes.

C) The largest source of state and local government tax revenue is sales taxes.

D) All of the above are true.

A) A sales tax on food is a regressive tax.

B) The largest source of federal government" tax revenue is individual income taxes.

C) The largest source of state and local government tax revenue is sales taxes.

D) All of the above are true.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

16

Explain why each of the following taxes is progressive or regressive:

A) A $1 per pack federal excise tax on cigarettes

B) The federal individual income tax

C) The federal payroll tax

A) A $1 per pack federal excise tax on cigarettes

B) The federal individual income tax

C) The federal payroll tax

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

17

A tax that is structured so that people with higher incomes pay a larger percentage of their incomes for the tax than do people with smaller incomes is called a (an)

A) income tax.

B) regressive tax.

C) property tax.

D) progressive tax.

A) income tax.

B) regressive tax.

C) property tax.

D) progressive tax.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

18

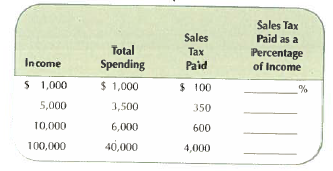

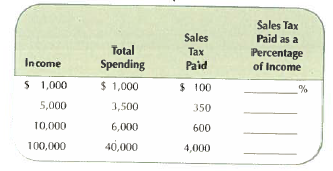

Complete the following table, which describes the sales tax paid by individuals at various income levels. Indicate whether the tax is progressive, proportional, or regressive.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

19

Generally, most economists feel that a __________ type of income tax is a fairer way to raise government revenue than a sales tax.

A) regressive

B) proportional

C) flat-rate

D) progressive

A) regressive

B) proportional

C) flat-rate

D) progressive

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

20

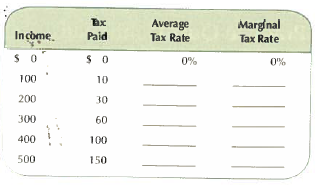

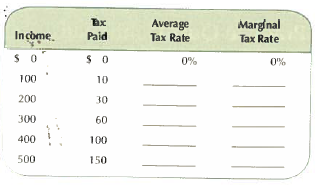

Calculate the average and the marginal tax rates in the following table, and indicate whether the tax is progressive, proportional, or regressive. What observation can you make concerning the relationship between marginal and average tax rates?

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

21

The federal personal income tax is an example of a (an)

A) excise tax.

B) proportional tax.

C) progressive tax.

D) regressive tax.

A) excise tax.

B) proportional tax.

C) progressive tax.

D) regressive tax.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

22

Compare "dollar voting" in private markets with "majority voting" in the political decision-making system.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

23

A 5 percent sales tax on food is an example of a

A) flat tax.

B) progressive tax.

C) proportional tax.

D) regressive tax.

A) flat tax.

B) progressive tax.

C) proportional tax.

D) regressive tax.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

24

Margaret pays a local income tax of 2 percent, regardless of the size of her income. This tax is

A) proportional.

B) regressive.

C) progressive.

D) a mix of (a) and (b).

A) proportional.

B) regressive.

C) progressive.

D) a mix of (a) and (b).

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements relating to public choice is true ?

A) A low voter turnout may result when voters perceive that the marginal cost of voting exceeds its marginal benefit.

B) If the marginal cost of voting exceeds its marginal benefit, the vote is unimportant.

C) Special-interest groups always cause the will of a majority to be imposed on a minority.

D) All of the above are true.

A) A low voter turnout may result when voters perceive that the marginal cost of voting exceeds its marginal benefit.

B) If the marginal cost of voting exceeds its marginal benefit, the vote is unimportant.

C) Special-interest groups always cause the will of a majority to be imposed on a minority.

D) All of the above are true.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

26

According to the shortsightedness effect, politicians tend to favor projects with

A) short-run benefits and short-run costs.

B) short-run benefits and long-run costs.

C) long-run benefits and short-run costs.

D) long-run benefits and long-run costs.

A) short-run benefits and short-run costs.

B) short-run benefits and long-run costs.

C) long-run benefits and short-run costs.

D) long-run benefits and long-run costs.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck