Deck 19: GDP: Measuring Total Production and Income

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 19: GDP: Measuring Total Production and Income

1

The net exports line can be

A) positive.

B) negative.

C) zero.

D) any of the above.

A) positive.

B) negative.

C) zero.

D) any of the above.

Imports and exports are autonomous expenditures unaffected by a nation's domestic level of real GDP. Net exports, or exports minus imports (X-M), can be positive, negative, or zero, if both are equal. Net exports can be represented as a horizontal line due to its autonomous relationship with GDP as shown in the figure below:

As stated above, imports can be less than, equal, or exceed exports.

Therefore, the correct answer is D, any of the above.

As stated above, imports can be less than, equal, or exceed exports.

Therefore, the correct answer is D, any of the above.

2

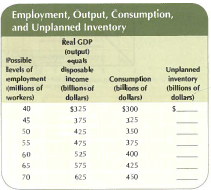

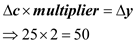

Assume the level of autonomous investment is $100 billion and aggregate expenditures equal consumption and investment. Based on the table below, answer the following questions. Employment, Output, Consumption, and Unplanned Inventory

A) Fill in the unplanned inventory column.

B) Determine the MFC and MPS.

C) If this economy employs a labor force of 40 million, what will happen to this level of employment? Explain and identify the equilibrium level of output.

A) Fill in the unplanned inventory column.

B) Determine the MFC and MPS.

C) If this economy employs a labor force of 40 million, what will happen to this level of employment? Explain and identify the equilibrium level of output.

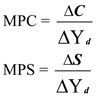

The level of the autonomous investment is $100 billion; Aggregate expenditures is equal to consumption and investment.

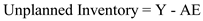

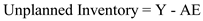

We know that we can calculate unplanned inventory by subtracting aggregate expenditures (AE) from aggregate output (Y). In this problem AE is the same as consumption, which means that we can ignore the other components of AE (government spending, and net exports).

So,

Unplanned Inventory = Y - AE

Essentially, we are subtracting consumption and the $100 billion of autonomous investment from the Real GDP values below. a. The bolded values below are given. We calculate unplanned inventory using the formula above:

a. The bolded values below are given. We calculate unplanned inventory using the formula above:

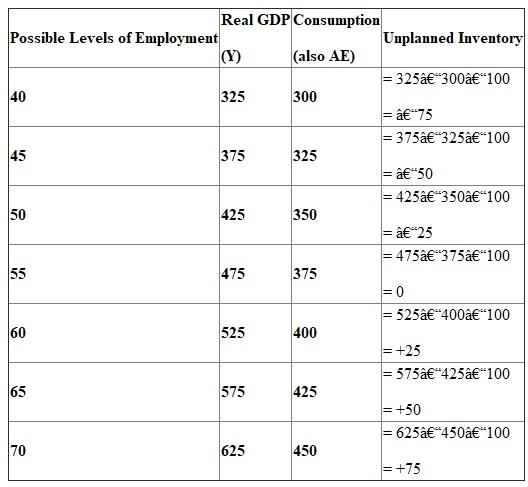

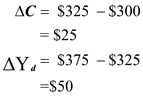

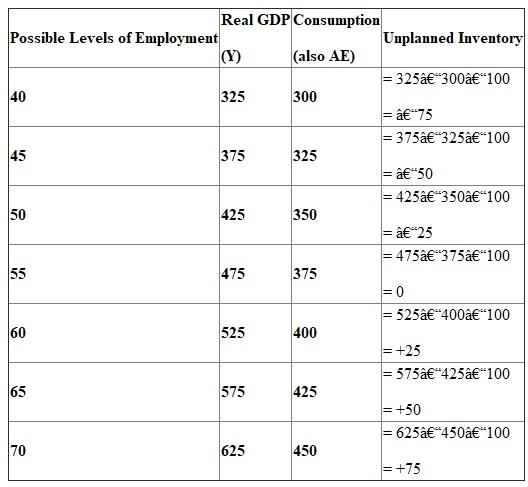

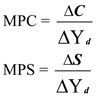

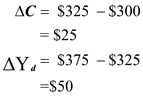

b. Marginal propensity to consume (MPC) is calculated by the formula We can calculate out the necessary values:

We can calculate out the necessary values:

We know that,

We know that,

MPC + MPS = 1

MPS = 1 - 0.5

= 0.5

Therefore, MPS=0.5 as well.

c. At 40 million employees, the unplanned inventory is -75, as seen above. If the economy were at full employment, the unplanned inventory should be zero, as Y would equal AE. Therefore, according to Keynes, this level of employment will not be sustained, as the economy will shift to find equilibrium at full employment. The full employment equilibrium is above 40 million workers, which means there must be an increase in consumption for this balance to be met.

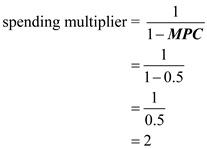

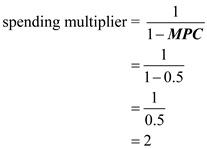

We can find the equilibrium level of output with the help of a few formulas.

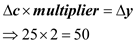

First, let's find out the spending multiplier: We can check our work by plugging in the values above to the following equation:

We can check our work by plugging in the values above to the following equation:  We know that at equilibrium the unplanned inventory should be 0, which occurs when Real GDP equals consumption. We can see above that the unplanned inventory is 0 at 55 million employees. Therefore, the workforce will eventually reach the equilibrium full employment level of 55 million employees.

We know that at equilibrium the unplanned inventory should be 0, which occurs when Real GDP equals consumption. We can see above that the unplanned inventory is 0 at 55 million employees. Therefore, the workforce will eventually reach the equilibrium full employment level of 55 million employees.

We know that we can calculate unplanned inventory by subtracting aggregate expenditures (AE) from aggregate output (Y). In this problem AE is the same as consumption, which means that we can ignore the other components of AE (government spending, and net exports).

So,

Unplanned Inventory = Y - AE

Essentially, we are subtracting consumption and the $100 billion of autonomous investment from the Real GDP values below.

a. The bolded values below are given. We calculate unplanned inventory using the formula above:

a. The bolded values below are given. We calculate unplanned inventory using the formula above:b. Marginal propensity to consume (MPC) is calculated by the formula

We can calculate out the necessary values:

We can calculate out the necessary values:

We know that,

We know that,MPC + MPS = 1

MPS = 1 - 0.5

= 0.5

Therefore, MPS=0.5 as well.

c. At 40 million employees, the unplanned inventory is -75, as seen above. If the economy were at full employment, the unplanned inventory should be zero, as Y would equal AE. Therefore, according to Keynes, this level of employment will not be sustained, as the economy will shift to find equilibrium at full employment. The full employment equilibrium is above 40 million workers, which means there must be an increase in consumption for this balance to be met.

We can find the equilibrium level of output with the help of a few formulas.

First, let's find out the spending multiplier:

We can check our work by plugging in the values above to the following equation:

We can check our work by plugging in the values above to the following equation:  We know that at equilibrium the unplanned inventory should be 0, which occurs when Real GDP equals consumption. We can see above that the unplanned inventory is 0 at 55 million employees. Therefore, the workforce will eventually reach the equilibrium full employment level of 55 million employees.

We know that at equilibrium the unplanned inventory should be 0, which occurs when Real GDP equals consumption. We can see above that the unplanned inventory is 0 at 55 million employees. Therefore, the workforce will eventually reach the equilibrium full employment level of 55 million employees. 3

There will be unplanned inventory investment accumulation when

A) aggregate output (real GDP) equals aggregate expenditures.

B) aggregate output (real GDP) exceeds aggregate expenditures

C) aggregate expenditures exceed aggregate output (real GDP).

D) firms increase output.

A) aggregate output (real GDP) equals aggregate expenditures.

B) aggregate output (real GDP) exceeds aggregate expenditures

C) aggregate expenditures exceed aggregate output (real GDP).

D) firms increase output.

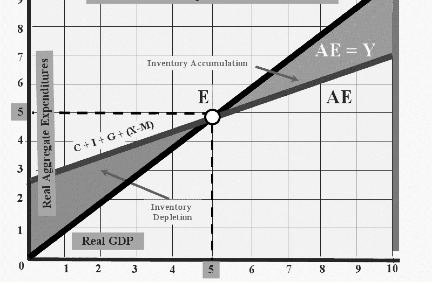

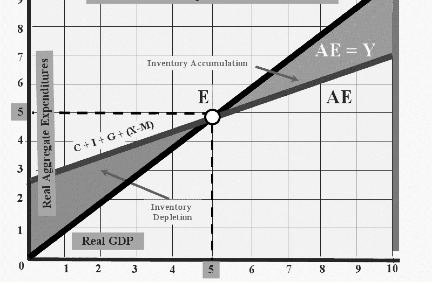

Unplanned inventory investment is defined as the difference between real GDP and aggregate output, or aggregate expenditures.  When aggregate expenditures exceed real GDP, there is an accumulation of unplanned inventory. Likewise, when real GDP exceeds aggregate expenditures, there is a depletion of unplanned inventory.

When aggregate expenditures exceed real GDP, there is an accumulation of unplanned inventory. Likewise, when real GDP exceeds aggregate expenditures, there is a depletion of unplanned inventory.  Accumulation Depletion of Unplanned Inventory

Accumulation Depletion of Unplanned Inventory

For there to be unplanned inventory investment accumulation, aggregate output exceeds aggregate expenditures.

Thus, the answer is B.

When aggregate expenditures exceed real GDP, there is an accumulation of unplanned inventory. Likewise, when real GDP exceeds aggregate expenditures, there is a depletion of unplanned inventory.

When aggregate expenditures exceed real GDP, there is an accumulation of unplanned inventory. Likewise, when real GDP exceeds aggregate expenditures, there is a depletion of unplanned inventory.  Accumulation Depletion of Unplanned Inventory

Accumulation Depletion of Unplanned Inventory For there to be unplanned inventory investment accumulation, aggregate output exceeds aggregate expenditures.

Thus, the answer is B.

4

Using the data given in Question 1, what is the impact of adding net exports? Let imports equal $75 billion, and assume exports equal $50 billion. What is the equilibrium level of employment and output?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

John Maynard Keynes proposed that the multiplier effect can correct an economic depression. Based on this theory, an increase in equilibrium output would be created by an initial

A) increase in investment.

B) increase in government spending.

C) decrease in government spending.

D) both (a) and (b).

E) both (a) and (c).

A) increase in investment.

B) increase in government spending.

C) decrease in government spending.

D) both (a) and (b).

E) both (a) and (c).

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

Explain the determination of equilibrium real GDP by drawing an abstract graph of the aggregate expenditures model. Label the aggregate expenditures line AE and the aggregate output line AO. Explain why the interaction of AE and AO determines the Keynesian equilibrium level of real GDP.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

The spending multiplier is defined as

A) 1/(1 - marginal propensity to consume).

B) l/(marginal propensity to consume).

C) 1/(1 - marginal propensity to save).

D) l/(marginal propensity to consume + marginal propensity to save).

A) 1/(1 - marginal propensity to consume).

B) l/(marginal propensity to consume).

C) 1/(1 - marginal propensity to save).

D) l/(marginal propensity to consume + marginal propensity to save).

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

Use the aggregate expenditures model to demonstrate the multiplier effect.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

If the value of the marginal propensity to consume (MPC) is 0.50, the value of the spending multiplier is

A) 0.50.

B) 1.

C) 2.

D) 5.

A) 0.50.

B) 1.

C) 2.

D) 5.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

How are changes in the MFC, changes in the MPS , and the size of the multiplier related? Answer the following questions:

a. What is the multiplier if the MFC is 0? 0.33? 0.90?

b. Suppose the equilibrium real GDP is $100 billion and the MFC is 4/5. How much will the equilibrium output change if businesses increase their level of investment by $10 billion?

c. Using the data given in question 5(b), what will be the change in equilibrium real GDP if the MFC equals 2/3 ?

a. What is the multiplier if the MFC is 0? 0.33? 0.90?

b. Suppose the equilibrium real GDP is $100 billion and the MFC is 4/5. How much will the equilibrium output change if businesses increase their level of investment by $10 billion?

c. Using the data given in question 5(b), what will be the change in equilibrium real GDP if the MFC equals 2/3 ?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

If the marginal propensity to consume (MPC) is 0.80, the value of the spending multiplier is

A) 2.

B) 5.

C) 8.

D) 10.

A) 2.

B) 5.

C) 8.

D) 10.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

Assume the MFC is 0.90 and autonomous investment increases by $500 billion. What will be the impact on real GDP?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

If the marginal propensity to consume (MPC) is 0.75, a $50 billion decrease in government spending would cause equilibrium output to

A) increase by $50 billion.

B) decrease by $50 billion.

C) increase by $200 billion.

D) decrease by $200 billion.

A) increase by $50 billion.

B) decrease by $50 billion.

C) increase by $200 billion.

D) decrease by $200 billion.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose autonomous investment increases by $100 billion and the MPC is 0.75.

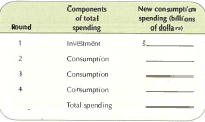

a. Use the following table to compute four rounds of the spending multiplier effect:

b. Use the spending multiplier formula to compute the final cumulative impact on aggregate spending.

a. Use the following table to compute four rounds of the spending multiplier effect:

b. Use the spending multiplier formula to compute the final cumulative impact on aggregate spending.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

If the marginal propensity to consume (MPC) is 0.90, a $100 billion increase in planned investment expenditure, other things being equal, will cause an increase in equilibrium output of

A) $90 billion.

B) $100 billion.

C) $900 billion.

D) $1,000 billion.

A) $90 billion.

B) $100 billion.

C) $900 billion.

D) $1,000 billion.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

First, use the data given in question 1, and assume the level of autonomous investment is , $50 billion. If the full-employment level of output is $525 billion, what is the equilibrium level of output and employment? Does a recessionary gap or an inflationary gap exist? Second, assume the level of autonomous investment is $150 billion. What is the equilibrium level of output and employment? Does a recessionary gap or an inflationary gap exist? Explain the consequences of an inflationary gap using the aggregate expenditures model.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

Keynes's criticism of the classical theory was that the Great Depression would not correct itself. The multiplier effect would restore an economy to full employment if

A) government would follow a "least government is the best government" policy.

B) government taxes were increased.

C) government spending were-increased.

D) government spending were decreased.

A) government would follow a "least government is the best government" policy.

B) government taxes were increased.

C) government spending were-increased.

D) government spending were decreased.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

Assume an economy is in recession with a MPC of 0.75 and there is a GDP gap of $100 billion. How much must government spending increase to eliminate the gap? Instead of increasing government spending by the amount you calculate, what would be the effect of the government cutting taxes by this amount?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

The equilibrium level of real GDP is $1,000 billion, the full-employment level of real GDP is $1,250 billion, and the marginal propensity to consume (MPC) is 0.60. The full-employment target can be reached if government spending is

A) increased by $60 billion.

B) increased by $100 billion.

C) increased by $250 billion.

D) held constant.

A) increased by $60 billion.

B) increased by $100 billion.

C) increased by $250 billion.

D) held constant.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose the government wishes to eliminate an inflationary gap of $100 billion and the MPC is 0.50. How much must the government cut its spending? Instead of decreasing government spending by the amount you calculate, what would be the effect of the government increasing taxes by this amount?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

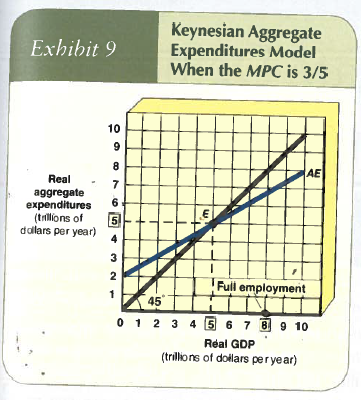

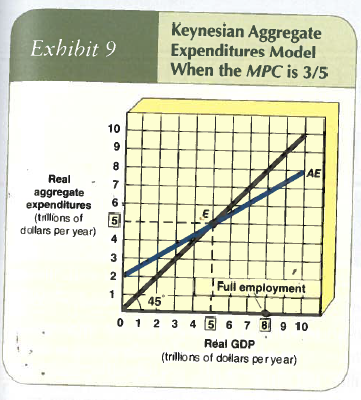

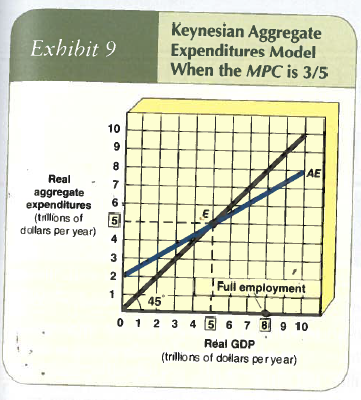

In Exhibit 9, the spending multiplier for this economy is equal to

A) 1 2/3

B) 2 1/2

C) 3

D) 5

A) 1 2/3

B) 2 1/2

C) 3

D) 5

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

To close the recessionary gap and achieve full employment real GDP as shown in Exhibit 9, the government should increase spending by

A) $1 trillion.

B) $1.2 trillion.

C) $2.0 trillion.

D) $2.5 trillion.

A) $1 trillion.

B) $1.2 trillion.

C) $2.0 trillion.

D) $2.5 trillion.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

To close the recessionary gap and achieve full-employment real GDP as shown in Exhibit 9, the goveffiment should cut taxes by

A) $0.60 trillion.

B) $1 trillion.

C) $2 trillion.

D) $3 trillion.

A) $0.60 trillion.

B) $1 trillion.

C) $2 trillion.

D) $3 trillion.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

Using the aggregate expenditures model, assume the aggregate expenditures ( AE ) line is above the 45-degree line at full-employment GDP. This vertical distance is called a tan)

A) inflationary gap.

B) recessionary gap.

C) negative GDP gap.

D) marginal propensity to consume gap.

A) inflationary gap.

B) recessionary gap.

C) negative GDP gap.

D) marginal propensity to consume gap.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

Use the aggregate expenditures model and assume an economy is in equilibrium at $5 trillion, which is $250 billion below full-employment GDP. If the marginal propensity to consume ( MPC ) is 0.60, full employment GDP can be reached if government spending

A) decreases by $60 billion.

B) decreases by $100 billion.

C) decreases by $250 billion.

D) is held constant.

A) decreases by $60 billion.

B) decreases by $100 billion.

C) decreases by $250 billion.

D) is held constant.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck