Deck 8: Application: the Costs of Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 8: Application: the Costs of Taxation

1

The market for pizza is characterized by a downward-sloping demand curve and an upward-sloping supply curve.

a. Draw the competitive market equilibrium. Label the price, quantity, consumer surplus, and producer surplus. Is there any deadweight loss? Explain.

b. Suppose that the government forces each pizzeria to pay a $1 tax on each pizza sold. Illustrate the effect of this tax on the pizza market, being sure to label the consumer surplus, producer surplus, government revenue, and deadweight loss. How does each area compare to the pre-tax case?

c. If the tax were removed, pizza eaters and sellers would be better off, but the government would lose tax revenue. Suppose that consumers and producers voluntarily transferred some of their gains to the government. Could all parties (including the government) be better off than they were with a tax? Explain using the labeled areas in your graph.

a. Draw the competitive market equilibrium. Label the price, quantity, consumer surplus, and producer surplus. Is there any deadweight loss? Explain.

b. Suppose that the government forces each pizzeria to pay a $1 tax on each pizza sold. Illustrate the effect of this tax on the pizza market, being sure to label the consumer surplus, producer surplus, government revenue, and deadweight loss. How does each area compare to the pre-tax case?

c. If the tax were removed, pizza eaters and sellers would be better off, but the government would lose tax revenue. Suppose that consumers and producers voluntarily transferred some of their gains to the government. Could all parties (including the government) be better off than they were with a tax? Explain using the labeled areas in your graph.

Price determination under perfect competition: Under perfect competition market, price and quantity is determined by the market forces where demand is equal to supply.

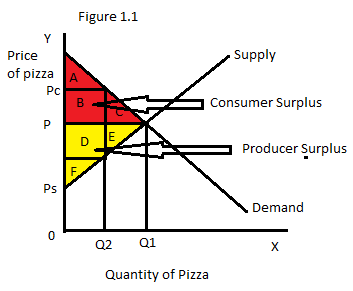

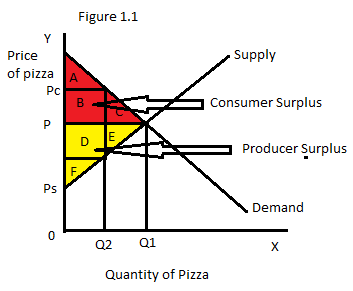

a)Below diagram 1.1 shows the equilibrium price and quantity where demand is equal to supply. In the above diagram, the equilibrium price shown as P and equilibrium quantity is shown as Q1. The area A+B+C is shown as consumer surplus, and the area D+E+F is shown as producer surplus.

In the above diagram, the equilibrium price shown as P and equilibrium quantity is shown as Q1. The area A+B+C is shown as consumer surplus, and the area D+E+F is shown as producer surplus.

Total surplus area is under the area of ( A+B+C+D+E+F ), this means, there is no deadweight loss under the market.

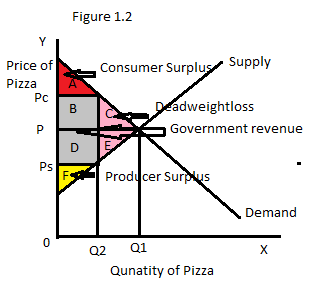

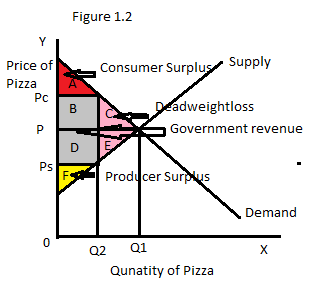

b)Suppose that the government forces each pizzeria to pay a $1 tax on each pizza sold, this will lead to decrease in the consumer surplus, and producer surplus. In the below diagram 1.2, it is shown that as price increases from P to Pc, which means consumers has to pay P C , thus, the area under consumer surplus will decrease.

Whereas producer will receive P S and producer surplus will also decrease, here P C = P S + $1. Now, the consumer surplus is A , and the producer surplus is F. Government revenue area is B+D , and the deadweight loss area is C+E.

Now, the consumer surplus is A , and the producer surplus is F. Government revenue area is B+D , and the deadweight loss area is C+E.

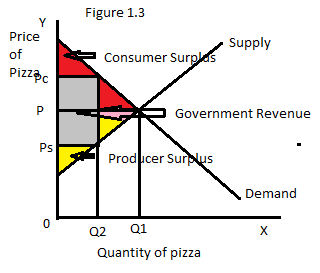

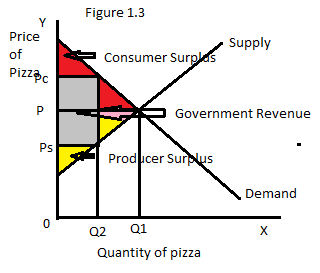

c)If the tax were removed, then the consumers and producers would be better off when some part is voluntarily transferred to the government. The equilibrium price is P and quantity is Q1 , as in the case without tax. Now, the consumer surplus area is A+B+C. Thus, the part B is voluntarily transferred to the government, and producer surplus is D+E+F. Thus, the part D is voluntarily transferred to the government.

In the below graph 1.3, the red shaded area shows the consumer surplus, yellow shaded area shows the producer surplus, and gray shaded area shows government revenue. If consumers and producers transfer a little bit more than B+D , then all the three parties will be better off. This situation is called inefficiency of taxation.

If consumers and producers transfer a little bit more than B+D , then all the three parties will be better off. This situation is called inefficiency of taxation.

a)Below diagram 1.1 shows the equilibrium price and quantity where demand is equal to supply.

In the above diagram, the equilibrium price shown as P and equilibrium quantity is shown as Q1. The area A+B+C is shown as consumer surplus, and the area D+E+F is shown as producer surplus.

In the above diagram, the equilibrium price shown as P and equilibrium quantity is shown as Q1. The area A+B+C is shown as consumer surplus, and the area D+E+F is shown as producer surplus.Total surplus area is under the area of ( A+B+C+D+E+F ), this means, there is no deadweight loss under the market.

b)Suppose that the government forces each pizzeria to pay a $1 tax on each pizza sold, this will lead to decrease in the consumer surplus, and producer surplus. In the below diagram 1.2, it is shown that as price increases from P to Pc, which means consumers has to pay P C , thus, the area under consumer surplus will decrease.

Whereas producer will receive P S and producer surplus will also decrease, here P C = P S + $1.

Now, the consumer surplus is A , and the producer surplus is F. Government revenue area is B+D , and the deadweight loss area is C+E.

Now, the consumer surplus is A , and the producer surplus is F. Government revenue area is B+D , and the deadweight loss area is C+E.c)If the tax were removed, then the consumers and producers would be better off when some part is voluntarily transferred to the government. The equilibrium price is P and quantity is Q1 , as in the case without tax. Now, the consumer surplus area is A+B+C. Thus, the part B is voluntarily transferred to the government, and producer surplus is D+E+F. Thus, the part D is voluntarily transferred to the government.

In the below graph 1.3, the red shaded area shows the consumer surplus, yellow shaded area shows the producer surplus, and gray shaded area shows government revenue.

If consumers and producers transfer a little bit more than B+D , then all the three parties will be better off. This situation is called inefficiency of taxation.

If consumers and producers transfer a little bit more than B+D , then all the three parties will be better off. This situation is called inefficiency of taxation. 2

What happens to consumer and producer surplus when the sale of a good is taxed? How does the change in consumer and producer surplus compare to the tax revenue? Explain.

A tax on a good reduces the welfare of buyers and sellers. Because a tax on a good raises the price buyers pay and lowers the price sellers receive.

So a tax on a good reduces consumer surplus (benefit for buyers) and producer surplus (benefit for sellers)Even though a tax on a good raises the revenue, there are losses to the buyers and sellers because of the tax which can exceed the revenue raised by the Government.

So a tax on a good reduces consumer surplus (benefit for buyers) and producer surplus (benefit for sellers)Even though a tax on a good raises the revenue, there are losses to the buyers and sellers because of the tax which can exceed the revenue raised by the Government.

3

Evaluate the following two statements. Do you agree? Why or why not?

a. "A tax that has no deadweight loss cannot raise any revenue for the government."

b. "A tax that raises no revenue for the government cannot have any deadweight loss."

a. "A tax that has no deadweight loss cannot raise any revenue for the government."

b. "A tax that raises no revenue for the government cannot have any deadweight loss."

a)Do not agree with the statement.

The statement, that says a tax that has no deadweight loss cannot raise any tax revenue for the government is incorrect. This is explained by taking the following example of a perfectly inelastic supply or demand curve; for instance, in the case of perfectly inelastic supply or demand curve , the curves are vertical and the quantity supplied remains constant at any price level; furthermore, the dead weight loss will also be zero as the curves are vertical.

However, there will be positive tax revenue collected as the tax revenue is collected on the number of units sold.

Thus, a tax having zero dead weight loss can collect revenue for the government. Therefore, the statement is incorrect.

(b)Do not agree with the statement.

The statement that says a tax that raises no revenue for the government cannot have any dead weight loss" is incorrect. There can be no revenue for the government in two extreme cases; one is when there are zero taxes and the other one is when there is as high as 100% tax. In the case of 100% tax on the sale of good, the seller will not be able to supply any good as the revenue generated should be entirely deposited as a tax; therefore, there will not be any supply of goods. However, 100% tax has a huge dead weight loss as the quantity of units sold will is reduced to zero.

Thus, at 100% tax there will be no revenue, yet having huge dead weight loss.

The statement, that says a tax that has no deadweight loss cannot raise any tax revenue for the government is incorrect. This is explained by taking the following example of a perfectly inelastic supply or demand curve; for instance, in the case of perfectly inelastic supply or demand curve , the curves are vertical and the quantity supplied remains constant at any price level; furthermore, the dead weight loss will also be zero as the curves are vertical.

However, there will be positive tax revenue collected as the tax revenue is collected on the number of units sold.

Thus, a tax having zero dead weight loss can collect revenue for the government. Therefore, the statement is incorrect.

(b)Do not agree with the statement.

The statement that says a tax that raises no revenue for the government cannot have any dead weight loss" is incorrect. There can be no revenue for the government in two extreme cases; one is when there are zero taxes and the other one is when there is as high as 100% tax. In the case of 100% tax on the sale of good, the seller will not be able to supply any good as the revenue generated should be entirely deposited as a tax; therefore, there will not be any supply of goods. However, 100% tax has a huge dead weight loss as the quantity of units sold will is reduced to zero.

Thus, at 100% tax there will be no revenue, yet having huge dead weight loss.

4

Draw a supply-and-demand diagram with a tax on the sale of the good. Show the deadweight loss. Show the tax revenue.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

Consider the market for rubber bands.

a. If this market has very elastic supply and very inelastic demand, how would the burden of a tax on rubber bands be shared between consumers and producers? Use the tools of consumer surplus and producer surplus in your answer.

b. If this market has very inelastic supply and very elastic demand, how would the burden of a tax on rubber bands be shared between consumers and producers? Contrast your answer with your answer to part (a).

a. If this market has very elastic supply and very inelastic demand, how would the burden of a tax on rubber bands be shared between consumers and producers? Use the tools of consumer surplus and producer surplus in your answer.

b. If this market has very inelastic supply and very elastic demand, how would the burden of a tax on rubber bands be shared between consumers and producers? Contrast your answer with your answer to part (a).

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

How do the elasticities of supply and demand affect the deadweight loss of a tax? Why do they have this effect?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose that the government imposes a tax on heating oil.

a. Would the deadweight loss from this tax likely be greater in the first year after it is imposed or in the fifth year? Explain.

b. Would the revenue collected from this tax likely be greater in the first year after it is imposed or in the fifth year? Explain.

a. Would the deadweight loss from this tax likely be greater in the first year after it is imposed or in the fifth year? Explain.

b. Would the revenue collected from this tax likely be greater in the first year after it is imposed or in the fifth year? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

Why do experts disagree about whether labor taxes have small or large deadweight losses?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

After economics class one day, your friend suggests that taxing food would be a good way to raise revenue because the demand for food is quite inelastic. In what sense is taxing food a "good" way to raise revenue? In what sense is it not a "good" way to raise revenue?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

What happens to the deadweight loss and tax revenue when a tax is increased?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

Daniel Patrick Moynihan, the late senator from New York, once introduced a bill that would levy a 10,000 percent tax on certain hollow-tipped bullets.

a. Do you expect that this tax would raise much revenue? Why or why not?

b. Even if the tax would raise no revenue, why might Senator Moynihan have proposed it?

a. Do you expect that this tax would raise much revenue? Why or why not?

b. Even if the tax would raise no revenue, why might Senator Moynihan have proposed it?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

The government places a tax on the purchase of socks.

a. Illustrate the effect of this tax on equilibrium price and quantity in the sock market. Identify the following areas both before and after the imposition of the tax: total spending by consumers, total revenue for producers, and government tax revenue.

b. Does the price received by producers rise or fall? Can you tell whether total receipts for producers rise or fall? Explain.

c. Does the price paid by consumers rise or fall? Can you tell whether total spending by consumers rises or falls? Explain carefully. (Hint: Think about elasticity.) If total consumer spending falls, does consumer surplus rise? Explain.

a. Illustrate the effect of this tax on equilibrium price and quantity in the sock market. Identify the following areas both before and after the imposition of the tax: total spending by consumers, total revenue for producers, and government tax revenue.

b. Does the price received by producers rise or fall? Can you tell whether total receipts for producers rise or fall? Explain.

c. Does the price paid by consumers rise or fall? Can you tell whether total spending by consumers rises or falls? Explain carefully. (Hint: Think about elasticity.) If total consumer spending falls, does consumer surplus rise? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose the government currently raises $100 million through a 1-cent tax on widgets, and another $100 million through a 10-cent tax on gadgets. If the government doubled the tax rate on widgets and eliminated the tax on gadgets, would it raise more tax revenue than it does today, less tax revenue, or the same amount? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

This chapter analyzed the welfare effects of a tax on a good. Consider now the opposite policy. Suppose that the government subsidizes a good: For each unit of the good sold, the government pays $2 to the buyer. How does the subsidy affect consumer surplus, producer surplus, tax revenue, and total surplus? Does a subsidy lead to a deadweight loss? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

Hotel rooms in Smalltown go for $100, and 1,000 rooms are rented on a typical day.

a. To raise revenue, the mayor decides to charge hotels a tax of $10 per rented room. After the tax is imposed, the going rate for hotel rooms rises to $108, and the number of rooms rented falls to 900. Calculate the amount of revenue this tax raises for Smalltown and the deadweight loss of the tax. (Hint: The area of a triangle is 1?2 3 base 3 height.)

b. The mayor now doubles the tax to $20. The price rises to $116, and the number of rooms rented falls to 800. Calculate tax revenue and deadweight loss with this larger tax. Do they double, more than double, or less than double? Explain.

a. To raise revenue, the mayor decides to charge hotels a tax of $10 per rented room. After the tax is imposed, the going rate for hotel rooms rises to $108, and the number of rooms rented falls to 900. Calculate the amount of revenue this tax raises for Smalltown and the deadweight loss of the tax. (Hint: The area of a triangle is 1?2 3 base 3 height.)

b. The mayor now doubles the tax to $20. The price rises to $116, and the number of rooms rented falls to 800. Calculate tax revenue and deadweight loss with this larger tax. Do they double, more than double, or less than double? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose that a market is described by the following supply and demand equations:

a. Solve for the equilibrium price and the equilibrium quantity.

b. Suppose that a tax of T is placed on buyers, so the new demand equation is

Solve for the new equilibrium. What happens to the price received by sellers, the price paid by buyers, and the quantity sold?

c. Tax revenue is T × Q. Use your answer to part (b) to solve for tax revenue as a function of T. Graph this relationship for T between 0 and 300.

d. The deadweight loss of a tax is the area of the triangle between the supply and demand curves. Recalling that the area of a triangle is ½ × base × height, solve for deadweight loss as a function of T. Graph this relationship for T between 0 and 300. (Hint: Looking sideways, the base of the deadweight loss triangle is T , and the height is the difference between the quantity sold with the tax and the quantity sold without the tax.)

e. The government now levies a tax on this good of $200 per unit. Is this a good policy? Why or why not? Can you propose a better policy?

For further information on topics in this chapter, additional problems, applications, examples, online quizzes, and more, please visit our website at www.cengage.com/economics/mankiw.

a. Solve for the equilibrium price and the equilibrium quantity.

b. Suppose that a tax of T is placed on buyers, so the new demand equation is

Solve for the new equilibrium. What happens to the price received by sellers, the price paid by buyers, and the quantity sold?

c. Tax revenue is T × Q. Use your answer to part (b) to solve for tax revenue as a function of T. Graph this relationship for T between 0 and 300.

d. The deadweight loss of a tax is the area of the triangle between the supply and demand curves. Recalling that the area of a triangle is ½ × base × height, solve for deadweight loss as a function of T. Graph this relationship for T between 0 and 300. (Hint: Looking sideways, the base of the deadweight loss triangle is T , and the height is the difference between the quantity sold with the tax and the quantity sold without the tax.)

e. The government now levies a tax on this good of $200 per unit. Is this a good policy? Why or why not? Can you propose a better policy?

For further information on topics in this chapter, additional problems, applications, examples, online quizzes, and more, please visit our website at www.cengage.com/economics/mankiw.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck