Deck 17: Exchange Rates and Macroeconomic Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/12

Play

Full screen (f)

Deck 17: Exchange Rates and Macroeconomic Policy

1

Would each of the following events, ceteris paribus, cause the dollar to appreciate against the euro or to depreciate?

a. Health experts discover that red wine, especially French and Italian red wine, lowers cholesterol.

b. GDP in nations across Europe falls.

c. The United States experiences a higher inflation rate than Europe does.

d. The U.S. budget deficit rises. (Hint: What happens to the U.S. interest rate?)

a. Health experts discover that red wine, especially French and Italian red wine, lowers cholesterol.

b. GDP in nations across Europe falls.

c. The United States experiences a higher inflation rate than Europe does.

d. The U.S. budget deficit rises. (Hint: What happens to the U.S. interest rate?)

(a)As a result of discovery, the demand for red wine will increase in the American market, especially for French and Italian wine. The increase in demand would cause demand for Euro to increase so that it can be imported.

Therefore, given the supply of dollar in international market, the increase in demand for Euros will cause US dollar to depreciate and Euro to appreciate.

(b)When GDP shrinks in the European economy, supply of euro along with the demand for import (American) goods will decrease. As a result, given same dollar supply, the decrease in euro will lead to depreciation of dollar and appreciation of euro

(c)The rising inflation erodes the value of currency in foreign market. So, due to higher inflation in the United States, more dollars is needed to command the same value of euro. This would tend to decline in the demand for U.S. dollar in the market. Thus, the U.S. dollar will depreciates against the Euro.

(d)An increase in the budgetary deficit causes a rise in the rate of interest. An increase in the rate of interest negatively affects the investment spending and eventually the growth and development of economy. Thus foreign investors reduce their demand for U.S. dollar and hence, the dollar depreciates against the Euros.

Therefore, given the supply of dollar in international market, the increase in demand for Euros will cause US dollar to depreciate and Euro to appreciate.

(b)When GDP shrinks in the European economy, supply of euro along with the demand for import (American) goods will decrease. As a result, given same dollar supply, the decrease in euro will lead to depreciation of dollar and appreciation of euro

(c)The rising inflation erodes the value of currency in foreign market. So, due to higher inflation in the United States, more dollars is needed to command the same value of euro. This would tend to decline in the demand for U.S. dollar in the market. Thus, the U.S. dollar will depreciates against the Euro.

(d)An increase in the budgetary deficit causes a rise in the rate of interest. An increase in the rate of interest negatively affects the investment spending and eventually the growth and development of economy. Thus foreign investors reduce their demand for U.S. dollar and hence, the dollar depreciates against the Euros.

2

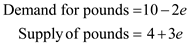

Let the monthly demand for British pounds and the monthly supply of British pounds be described by the following equations:

Demand for pounds =10 - 2 e

Supply of pounds = 4 + 3 e

where the quantities are in millions of pounds, and e is dollars per pound.

a. Find the equilibrium exchange rate.

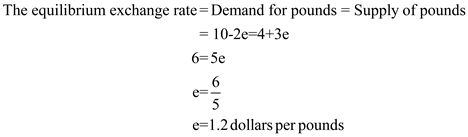

b. Suppose the U.S. government intervenes in the foreign currency market and uses U.S. dollars to buy 2 million pounds each month. What happens to the exchange rate? Why might the U.S. government do this?

Demand for pounds =10 - 2 e

Supply of pounds = 4 + 3 e

where the quantities are in millions of pounds, and e is dollars per pound.

a. Find the equilibrium exchange rate.

b. Suppose the U.S. government intervenes in the foreign currency market and uses U.S. dollars to buy 2 million pounds each month. What happens to the exchange rate? Why might the U.S. government do this?

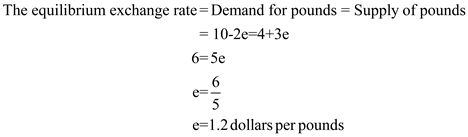

(a)The exchange rate of a currency is determined by the demand and supply of that currency in the international market. If the demand is higher for a currency then the rate of exchange tends to increase. The following is a measurement of equilibrium exchange rate considering the given demand and supply equations.

As given, Substituting the given equations,

Substituting the given equations,  Thus, the exchange rate of pounds is 1.2 dollars per pound. This exchange rate is calculated by considering the given demand and supply equation.

Thus, the exchange rate of pounds is 1.2 dollars per pound. This exchange rate is calculated by considering the given demand and supply equation.

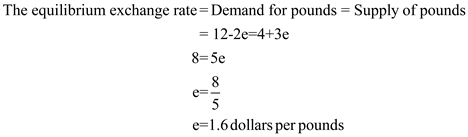

(b)An increase in the demand for pounds leads to a rise in the value of it. If the U.S. dollars are used to buy the pounds then there will decrease in the value of the U.S. dollars. A rise in the demand for pounds causes an appreciation of it. The following is a measurement of equilibrium exchange rate. Thus, the exchange rate of pounds rises to 1.6 dollars per pound. The countries deliberately try to depreciate their respective currencies for export promotion. Exporters are likely to gain when their domestic currency depreciates.

Thus, the exchange rate of pounds rises to 1.6 dollars per pound. The countries deliberately try to depreciate their respective currencies for export promotion. Exporters are likely to gain when their domestic currency depreciates.

As given,

Substituting the given equations,

Substituting the given equations,  Thus, the exchange rate of pounds is 1.2 dollars per pound. This exchange rate is calculated by considering the given demand and supply equation.

Thus, the exchange rate of pounds is 1.2 dollars per pound. This exchange rate is calculated by considering the given demand and supply equation.(b)An increase in the demand for pounds leads to a rise in the value of it. If the U.S. dollars are used to buy the pounds then there will decrease in the value of the U.S. dollars. A rise in the demand for pounds causes an appreciation of it. The following is a measurement of equilibrium exchange rate.

Thus, the exchange rate of pounds rises to 1.6 dollars per pound. The countries deliberately try to depreciate their respective currencies for export promotion. Exporters are likely to gain when their domestic currency depreciates.

Thus, the exchange rate of pounds rises to 1.6 dollars per pound. The countries deliberately try to depreciate their respective currencies for export promotion. Exporters are likely to gain when their domestic currency depreciates. 3

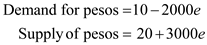

Let the demand and supply of Philippine pesos each month be described by the following equations:

Demand for pounds =100 - 2000 e

Supply of pounds = 20 + 3000 e

where the quantities are millions of pesos, and e is dollars per peso.

a. Find the equilibrium exchange rate.

b. Suppose the Philippine central bank wants to fix the exchange rate at 50 pesos per dollar and keep it there. Should the Philippine central bank buy or sell its own currency? How much per month?

Demand for pounds =100 - 2000 e

Supply of pounds = 20 + 3000 e

where the quantities are millions of pesos, and e is dollars per peso.

a. Find the equilibrium exchange rate.

b. Suppose the Philippine central bank wants to fix the exchange rate at 50 pesos per dollar and keep it there. Should the Philippine central bank buy or sell its own currency? How much per month?

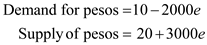

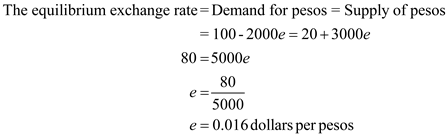

(a)The exchange rate of a currency is determined by the demand and supply of that currency in the international market. If the demand is higher for a currency then the rate of exchange tends to increase. The following is a measurement of equilibrium exchange rate considering the given demand and supply equations.

As given, Substituting the given equations,

Substituting the given equations,  Thus, the exchange rate of pesos is 0.016 dollars per pesos. This exchange rate is calculated by considering the given demand and supply equation.

Thus, the exchange rate of pesos is 0.016 dollars per pesos. This exchange rate is calculated by considering the given demand and supply equation.

(b)The central bank should buy its currency to increase the rate of exchange. Buying of currency leads to a reduction in money supply. This eventually causes an appreciation of the currency. If the central bank sells its currency to buy other currency, then the value of that particular currency depreciates. So, depreciation occurs.

Therefore, the central bank should try to reduce the supply of its currency for increasing the exchange rate.

As given,

Substituting the given equations,

Substituting the given equations,  Thus, the exchange rate of pesos is 0.016 dollars per pesos. This exchange rate is calculated by considering the given demand and supply equation.

Thus, the exchange rate of pesos is 0.016 dollars per pesos. This exchange rate is calculated by considering the given demand and supply equation.(b)The central bank should buy its currency to increase the rate of exchange. Buying of currency leads to a reduction in money supply. This eventually causes an appreciation of the currency. If the central bank sells its currency to buy other currency, then the value of that particular currency depreciates. So, depreciation occurs.

Therefore, the central bank should try to reduce the supply of its currency for increasing the exchange rate.

4

Suppose the United States and Mexico are each other's sole trading partners. The Fed, afraid that the economy is about to overheat, raises the U.S. interest rate.

a. Will the dollar appreciate or depreciate against the Mexican peso? Illustrate with a diagram of the dollar-peso foreign exchange market.

b. What will happen to equilibrium GDP in the United States?

c. How would your analyses in (a) and (b) change if, at the same time that the Fed was increasing the U.S. interest rate, the Mexican central bank increased the Mexican interest rate by an equivalent amount?

a. Will the dollar appreciate or depreciate against the Mexican peso? Illustrate with a diagram of the dollar-peso foreign exchange market.

b. What will happen to equilibrium GDP in the United States?

c. How would your analyses in (a) and (b) change if, at the same time that the Fed was increasing the U.S. interest rate, the Mexican central bank increased the Mexican interest rate by an equivalent amount?

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

5

Jordan fixes its national currency-the dinar-against the dollar. In mid-2011, the fixed rate was 1.41 dollars per dinar.

a. Draw a diagram illustrating the market in which Jordanian dinars are traded for U.S. dollars, assuming that the equilibrium exchange rate is 1.00 dollars per dinar. (In your diagram, put the number of dinars per month on the horizontal axis.)

b. Under the assumption in (a), would Jordan's central bank be buying or selling Jordanian dinars in this market? Indicate the number of dinars per month that the central bank must buy or sell as a distance on your graph.

c. Based on your diagram and your answers so far, could Jordan continue to fix its currency at 1.41 dollars per dinar forever? Why or why not?

d. Suppose that foreign currency traders believe that Jordan will soon allow the dinar to float. How would this affect the current supply and demand curves for dinars? (Draw new curves to indicate the impact.)

e. How would the events in (d) affect the number of dinars that Jordan's central bank must buy or sell?

a. Draw a diagram illustrating the market in which Jordanian dinars are traded for U.S. dollars, assuming that the equilibrium exchange rate is 1.00 dollars per dinar. (In your diagram, put the number of dinars per month on the horizontal axis.)

b. Under the assumption in (a), would Jordan's central bank be buying or selling Jordanian dinars in this market? Indicate the number of dinars per month that the central bank must buy or sell as a distance on your graph.

c. Based on your diagram and your answers so far, could Jordan continue to fix its currency at 1.41 dollars per dinar forever? Why or why not?

d. Suppose that foreign currency traders believe that Jordan will soon allow the dinar to float. How would this affect the current supply and demand curves for dinars? (Draw new curves to indicate the impact.)

e. How would the events in (d) affect the number of dinars that Jordan's central bank must buy or sell?

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

6

As in problem 5, note that Jordan fixes its national currency-the dinar-against the dollar at 1.41 dollars per dinar.

a. Draw a diagram illustrating the market in which Jordanian dinars are traded for U.S. dollars, assuming that the equilibrium exchange rate is 2.00 dollars per dinar. (Put the number of dinars per month on the horizontal axis.)

b. Under the assumption in (a), would Jordan's central bank be buying or selling Jordanian dinars in this market? Indicate the number of dinars per month that the central bank must buy or sell as a distance on your graph.

c. Based on your diagram and your answers so far, could Jordan continue to fix its currency at $1.41 per dinar forever? Why or why not?

d. Suppose that foreign currency traders believe that Jordan will soon allow the dinar to float. How would this affect the current supply and demand curves for dinars? (Draw new curves to indicate the impact.)

e. How would the events in (d) affect the number of dinars that Jordan's central bank must buy or sell?

Reference Problem 5:

5. Jordan fixes its national currency-the dinar-against the dollar. In mid-2011, the fixed rate was 1.41 dollars per dinar.

a. Draw a diagram illustrating the market in which Jordanian dinars are traded for U.S. dollars, assuming that the equilibrium exchange rate is 1.00 dollars per dinar. (In your diagram, put the number of dinars per month on the horizontal axis.)

b. Under the assumption in (a), would Jordan's central bank be buying or selling Jordanian dinars in this market? Indicate the number of dinars per month that the central bank must buy or sell as a distance on your graph.

c. Based on your diagram and your answers so far, could Jordan continue to fix its currency at 1.41 dollars per dinar forever? Why or why not?

d. Suppose that foreign currency traders believe that Jordan will soon allow the dinar to float. How would this affect the current supply and demand curves for dinars? (Draw new curves to indicate the impact.)

e. How would the events in (d) affect the number of dinars that Jordan's central bank must buy or sell?

a. Draw a diagram illustrating the market in which Jordanian dinars are traded for U.S. dollars, assuming that the equilibrium exchange rate is 2.00 dollars per dinar. (Put the number of dinars per month on the horizontal axis.)

b. Under the assumption in (a), would Jordan's central bank be buying or selling Jordanian dinars in this market? Indicate the number of dinars per month that the central bank must buy or sell as a distance on your graph.

c. Based on your diagram and your answers so far, could Jordan continue to fix its currency at $1.41 per dinar forever? Why or why not?

d. Suppose that foreign currency traders believe that Jordan will soon allow the dinar to float. How would this affect the current supply and demand curves for dinars? (Draw new curves to indicate the impact.)

e. How would the events in (d) affect the number of dinars that Jordan's central bank must buy or sell?

Reference Problem 5:

5. Jordan fixes its national currency-the dinar-against the dollar. In mid-2011, the fixed rate was 1.41 dollars per dinar.

a. Draw a diagram illustrating the market in which Jordanian dinars are traded for U.S. dollars, assuming that the equilibrium exchange rate is 1.00 dollars per dinar. (In your diagram, put the number of dinars per month on the horizontal axis.)

b. Under the assumption in (a), would Jordan's central bank be buying or selling Jordanian dinars in this market? Indicate the number of dinars per month that the central bank must buy or sell as a distance on your graph.

c. Based on your diagram and your answers so far, could Jordan continue to fix its currency at 1.41 dollars per dinar forever? Why or why not?

d. Suppose that foreign currency traders believe that Jordan will soon allow the dinar to float. How would this affect the current supply and demand curves for dinars? (Draw new curves to indicate the impact.)

e. How would the events in (d) affect the number of dinars that Jordan's central bank must buy or sell?

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

7

Some nations that fix their exchange rates make their currency more expensive for foreigners (an overvalued currency), while others make their currency artificially cheap to foreigners (an undervalued currency).

a. Why would a country want an overvalued currency? How, specifically, would the country benefit? Would the policy cause harm to anyone in the country? Explain briefly.

b. Why would a country want an undervalued currency? How, specifically, would the country benefit? Would the policy cause harm to anyone in the country? Explain briefly.

a. Why would a country want an overvalued currency? How, specifically, would the country benefit? Would the policy cause harm to anyone in the country? Explain briefly.

b. Why would a country want an undervalued currency? How, specifically, would the country benefit? Would the policy cause harm to anyone in the country? Explain briefly.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

8

If the inflation rate in Country A is 4 percent and the inflation rate in Country B is 6 percent, explain what will happen to the relative value of each country's currency.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

9

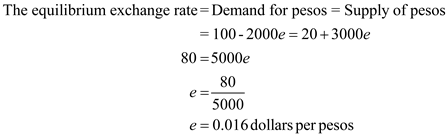

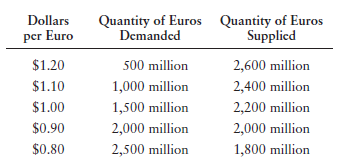

a. Use the information in the following table to find the exchange rate if the euro and the U.S. dollar are allowed to float freely.

b. What will happen to the exchange rate if the demand for euros rises by 700 million at each price if there is no intervention?

c. Assume that the European central bank currently owns 400 million dollars and the Fed currently owns 300 million euros. If the demand for euros rises by 700 million at each price, what would the European central bank have to do to maintain a fixed exchange rate equal to the exchange rate you found in part (a)? Is this possible?

b. What will happen to the exchange rate if the demand for euros rises by 700 million at each price if there is no intervention?

c. Assume that the European central bank currently owns 400 million dollars and the Fed currently owns 300 million euros. If the demand for euros rises by 700 million at each price, what would the European central bank have to do to maintain a fixed exchange rate equal to the exchange rate you found in part (a)? Is this possible?

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

10

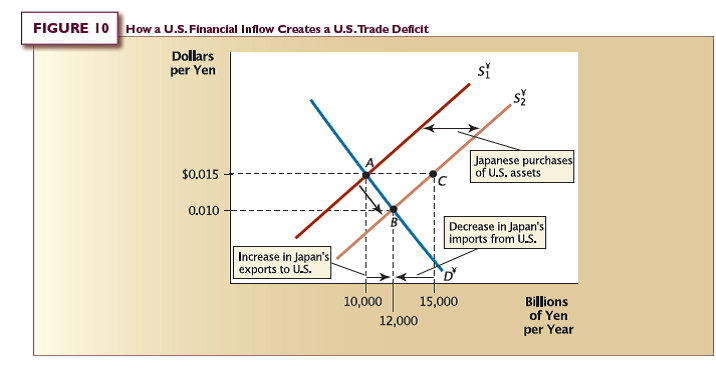

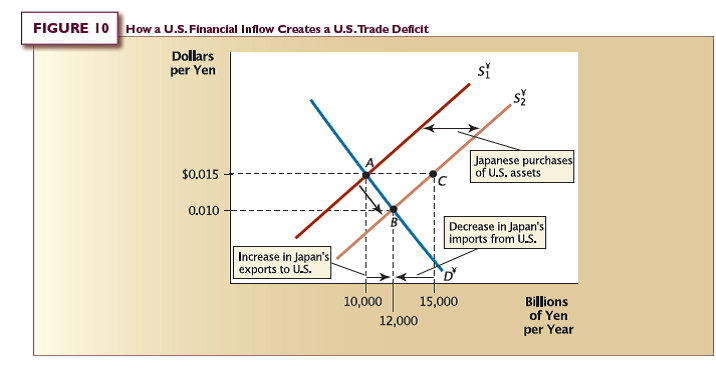

Refer to Figure 10 in the chapter. Remember that there was no trade deficit at point A. What is the U.S. trade deficit with Japan in dollars at point B ?

Reference:

Reference:

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

11

It is often stated that the U.S. trade deficit with Japan results from Japanese trade barriers against U.S. exports to Japan.

a. Suppose that Japan and the United States trade goods but not assets. Show-with a diagram of the dollar-yen market-that a U.S. trade deficit is impossible as long as the exchange rate floats. (Hint: With no trading in assets, the quantity of yen demanded at each exchange rate is equal in value to U.S. imports, and the quantity of yen supplied at each exchange rate is equal in value to U.S. exports.)

b. In the diagram, illustrate the impact of a reduction in Japanese trade barriers enabling an increase in U.S. exports to Japan. Would the dollar appreciate or depreciate against the yen? What would be the impact on U.S. net exports?

c. Now suppose that the United States and Japan also trade assets, but that the Japanese buy more U.S. assets than we buy of theirs. Could the elimination of Japanese trade barriers wipe out the U.S. trade deficit with Japan? Why, or why not? (Hint: What is the relationship between the U.S. trade deficit and U.S. net financial inflow?)

a. Suppose that Japan and the United States trade goods but not assets. Show-with a diagram of the dollar-yen market-that a U.S. trade deficit is impossible as long as the exchange rate floats. (Hint: With no trading in assets, the quantity of yen demanded at each exchange rate is equal in value to U.S. imports, and the quantity of yen supplied at each exchange rate is equal in value to U.S. exports.)

b. In the diagram, illustrate the impact of a reduction in Japanese trade barriers enabling an increase in U.S. exports to Japan. Would the dollar appreciate or depreciate against the yen? What would be the impact on U.S. net exports?

c. Now suppose that the United States and Japan also trade assets, but that the Japanese buy more U.S. assets than we buy of theirs. Could the elimination of Japanese trade barriers wipe out the U.S. trade deficit with Japan? Why, or why not? (Hint: What is the relationship between the U.S. trade deficit and U.S. net financial inflow?)

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

12

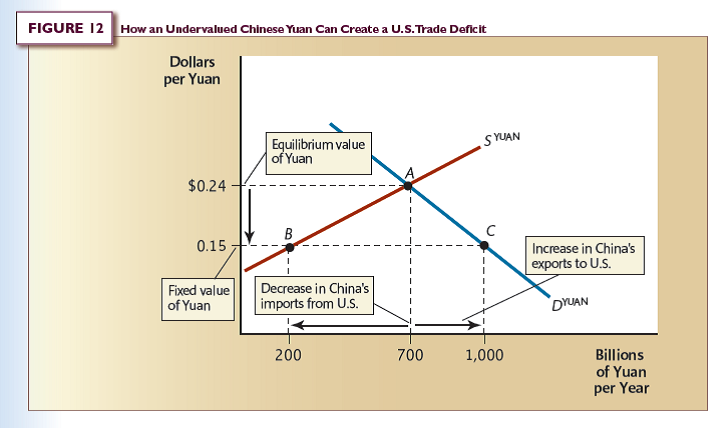

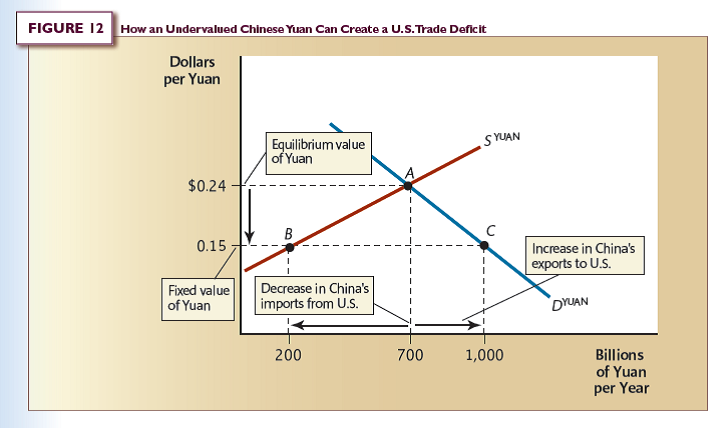

Toward the end of the Using the Theory section, you learned that higher inflation in China than in the U.S. has reduced the yuan's undervaluation in recent years. To see how this works, draw a graph similar to that in Figure 12. To keep the problem simple, suppose the price level in the U.S. does not change and the price level in China rises, while China continues to fix the exchange rate at $0.15 per yuan.

a. What impact does the rise in China's price level have on the supply of yuan curve?

b. What impact does the rise in China's price level have on the demand for yuan curve?

c. What is the combined effect of the changes you found in (a) and (b) above on the equilibrium price of the yuan?

d. After the changes you found above, is the yuan (fixed at $0.15 per yuan) more or less undervalued than initially? Explain briefly.

Reference:

a. What impact does the rise in China's price level have on the supply of yuan curve?

b. What impact does the rise in China's price level have on the demand for yuan curve?

c. What is the combined effect of the changes you found in (a) and (b) above on the equilibrium price of the yuan?

d. After the changes you found above, is the yuan (fixed at $0.15 per yuan) more or less undervalued than initially? Explain briefly.

Reference:

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck