Deck 13: Loan Amortization: Mortgages

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

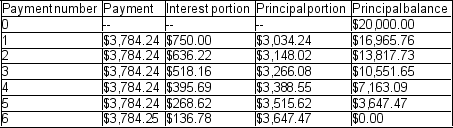

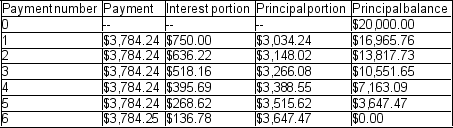

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 13: Loan Amortization: Mortgages

1

A loan of $45,000 at 8% compounded quarterly is to be amortized over four years with equal payments made at the end of every three months. How much interest will be included in the first payment?

A) $2,400

B) $300

C) $450

D) $900

E) $3,600

A) $2,400

B) $300

C) $450

D) $900

E) $3,600

$900

2

A car loan of $18,290 is to be repaid by equal monthly payments for three years. The interest rate is 1.8% compounded monthly. How much interest will be included in the first payment?

A) $329

B) $103

C) $27

D) $76

E) $39

A) $329

B) $103

C) $27

D) $76

E) $39

$27

3

The vendor of a property agrees to take back a $60,000 mortgage at a rate of 8% compounded semi-annually with monthly payments of $500 for a three-year term. Calculate the market value of the mortgage if financial institutions are charging 10% compounded semi-annually on three-year-term mortgages.

A) $41,557.55

B) $57,098.85

C) $60,000.00

D) $53,936.60

E) $59,111.11

A) $41,557.55

B) $57,098.85

C) $60,000.00

D) $53,936.60

E) $59,111.11

$57,098.85

4

How much will the principal be reduced by payments 13 to 24 inclusive?

A) $5,978.87

B) $6,021.13

C) $11,147.84

D) $6,101.66

E) $5,898.34

A) $5,978.87

B) $6,021.13

C) $11,147.84

D) $6,101.66

E) $5,898.34

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

A home improvement loan is to be repaid by equal monthly payments for six years. The interest rate is 5.4% compounded monthly and the amount borrowed is $33,500. How much interest will be included in the first payment?

A) $181

B) $151

C) $161

D) $137

E) $97

A) $181

B) $151

C) $161

D) $137

E) $97

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

How much extra interest did Miss Jones have to pay because of the late payments?

A) $22.47

B) $16.85

C) $179.15

D) $11.25

E) $4.50

A) $22.47

B) $16.85

C) $179.15

D) $11.25

E) $4.50

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

A mortgage loan of $132,000 at 6% compounded semi-annually is to be amortized over 25 years by equal monthly payments. How much interest will be included in the first payment?

A) $652

B) $660

C) $792

D) $487

E) $515

A) $652

B) $660

C) $792

D) $487

E) $515

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

What total amount paid on the scheduled date for the 15th payment will bring the loan up-to-date?

A) $1,068.91

B) $1,123.45

C) $1,134.67

D) $1,116.70

E) $1,079.60

A) $1,068.91

B) $1,123.45

C) $1,134.67

D) $1,116.70

E) $1,079.60

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

What is the outstanding principal just after the fifth payment?

A) $9,293.08

B) $6,136.37

C) $2,706.92

D) $2,374.49

E) $3,001.63

A) $9,293.08

B) $6,136.37

C) $2,706.92

D) $2,374.49

E) $3,001.63

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

How much interest is included in the third payment?

A) $1,258.80

B) $4,421.97

C) $1,827.09

D) $7,164.30

E) $1,680.00

A) $1,258.80

B) $4,421.97

C) $1,827.09

D) $7,164.30

E) $1,680.00

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

How long will it take to pay off this loan?

A) 7 years and 5 months

B) 7 years and 6 months

C) 7 years and 7 months

D) 8 years and 3 months

E) 8 years and 4 months

A) 7 years and 5 months

B) 7 years and 6 months

C) 7 years and 7 months

D) 8 years and 3 months

E) 8 years and 4 months

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

A $3100 item is paid for by end-of-month payments of $350. The interest rate charged is 15% compounded monthly. What is the size of the final payment?

A) $158.46

B) $236.88

C) $154.52

D) $113.12

E) $193.54

A) $158.46

B) $236.88

C) $154.52

D) $113.12

E) $193.54

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

How much will the debtor owe after two years (just after the payment is made at the end of two years)?

A) $7,800.00

B) $8,783.65

C) $8,542.99

D) $8,504.31

E) $8,706.42

A) $7,800.00

B) $8,783.65

C) $8,542.99

D) $8,504.31

E) $8,706.42

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

What is the size of the final payment?

A) $685.83

B) $692.53

C) $1,000.00

D) $307.47

E) $726.98

A) $685.83

B) $692.53

C) $1,000.00

D) $307.47

E) $726.98

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

What will the principal balance be after three years?

A) $77,400.72

B) $65,965.72

C) $78,898.93

D) $76,532.48

E) $79,617.86

A) $77,400.72

B) $65,965.72

C) $78,898.93

D) $76,532.48

E) $79,617.86

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

A loan of $32,000 at 6% compounded annually is to be repaid by equal payments at the end of every month for three years. How much interest will be included in the first payment?

A) $160

B) $192

C) $156

D) $140

E) $123

A) $160

B) $192

C) $156

D) $140

E) $123

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

A $67,800 loan is to be repaid by equal annual payments for 15 years. The interest rate is 8.3% compounded annually. How much interest will be included in the first payment?

A) $2,778

B) $8,490

C) $1,178

D) $3,276

E) $5,627

A) $2,778

B) $8,490

C) $1,178

D) $3,276

E) $5,627

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

A car loan is to be repaid by equal monthly payments for four years. The interest rate is 7.2% compounded monthly and the amount borrowed is $17,355. How much interest will be included in the first payment?

A) $375

B) $1,050

C) $125

D) $104

E) $309

A) $375

B) $1,050

C) $125

D) $104

E) $309

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

How much interest will be paid during the first three years?

A) $3,911.40

B) $25,282.57

C) $20,817.49

D) $16,130.47

E) $$22,293.71

A) $3,911.40

B) $25,282.57

C) $20,817.49

D) $16,130.47

E) $$22,293.71

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

How much interest will the debtor pay in total over the five-year period?

A) $17,178.60

B) $4116.84

C) $4350.80

D) $17,350.80

E) $4178.60

A) $17,178.60

B) $4116.84

C) $4350.80

D) $17,350.80

E) $4178.60

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

How much interest would you pay in total on a 48-month, $20,000 car loan at 13.2% compounded monthly?

A) $3,750

B) $4,759

C) $7,128

D) $5,850

E) $11,537

A) $3,750

B) $4,759

C) $7,128

D) $5,850

E) $11,537

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

A loan of $45,000 at 8% compounded quarterly is to be amortized over four years with equal payments made at the end of every three months. How much interest will be paid over the entire amortization period?

A) $8,028

B) $6,062

C) $5,013

D) $6,692

E) $10,800

A) $8,028

B) $6,062

C) $5,013

D) $6,692

E) $10,800

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

A $33,950 loan at 10.6% compounded semi-annually is to be paid off by a series of $4,000 payments that will be made at the end of every six months. How much of the first payment will be credited towards reduction of the principal?

A) $2,660

B) $1,800

C) $1,290

D) $885

E) $2,201

A) $2,660

B) $1,800

C) $1,290

D) $885

E) $2,201

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

A car loan of $18,290 is to be repaid by equal monthly payments for three years. The interest rate is 1.8% compounded monthly. Calculate the total amount of interest the car buyer will pay?

A) $494

B) $988

C) $672

D) $512

E) $6720

A) $494

B) $988

C) $672

D) $512

E) $6720

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

A mortgage loan of $132,000 at 6% compounded semi-annually is to be amortized over 25 years by equal monthly payments. What will the balance outstanding be after three years?

A) $124,797

B) $124,507

C) $124,200

D) $124,430

E) $124,135

A) $124,797

B) $124,507

C) $124,200

D) $124,430

E) $124,135

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

A loan of $32,000 at 6% compounded annually is to be repaid by equal payments at the end of every month for three years. How much interest will be included in the 19th payment?

A) $272

B) $83

C) $92

D) $81

E) $111

A) $272

B) $83

C) $92

D) $81

E) $111

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

A $33,950 loan at 10.6% compounded semi-annually is to be paid off by a series of $4,000 payments that will be made at the end of every six months. How much of the 10th payment will be credited towards reduction of the principal?

A) 477

B) $497

C) $713

D) $1,005

E) $1,193

A) 477

B) $497

C) $713

D) $1,005

E) $1,193

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

A mortgage loan of $132,000 at 6% compounded semi-annually is to be amortized over 25 years by equal monthly payments. How much interest will be paid during the first three years?

A) $19,528

B) $22,834

C) $23,125

D) $26,119

E) $30,404

A) $19,528

B) $22,834

C) $23,125

D) $26,119

E) $30,404

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

How much principal will be repaid by the 17th monthly payment of $750 on a $22,000 loan at 15% compounded monthly?

A) $319

B) $271

C) $222

D) $205

E) $171

A) $319

B) $271

C) $222

D) $205

E) $171

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

A loan of $49,600 is to be amortized by monthly payments of $1,000. How much interest will be included in the 31st payment if the interest rate is 10.8% compounded monthly?

A) $725

B) $536

C) $276

D) $315

E) $338

A) $725

B) $536

C) $276

D) $315

E) $338

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

A loan of $49,600 is to be amortized by monthly payments of $1,000. How much principal will be repaid by the first payment if the interest rate is 10.8% compounded monthly?

A) $446

B) $776

C) $322

D) $496

E) $554

A) $446

B) $776

C) $322

D) $496

E) $554

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

A $67,800 loan is to be repaid by equal annual payments for 15 years. The interest rate is 8.3% compounded annually. Determine the balance outstanding after 10 years.

A) $28,137

B) $31,955

C) $40,334

D) $53,404

E) $36,954

A) $28,137

B) $31,955

C) $40,334

D) $53,404

E) $36,954

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

A mortgage loan of $100,000 at 6% compounded monthly is amortized by equal monthly payments over 25 years. What is the total amount of interest that would be paid during the first year?

A) $6,168

B) $5,000

C) $5,952

D) $5,902

E) $3,776

A) $6,168

B) $5,000

C) $5,952

D) $5,902

E) $3,776

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

A home improvement loan is to be repaid by equal monthly payments for six years. The interest rate is 5.4% compounded monthly and the amount borrowed is $33,500. How much interest will the borrower pay over the six years?

A) $5,794

B) $3,618

C) $5,427

D) $9,045

E) $7,023

A) $5,794

B) $3,618

C) $5,427

D) $9,045

E) $7,023

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

A mortgage loan of $132,000 at 7% compounded semi-annually is to be amortized over 25 years by equal monthly payments. How much interest will be included in the 48th payment?

A) $814

B) $770

C) $924

D) $719

E) $708

A) $814

B) $770

C) $924

D) $719

E) $708

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

A car loan is to be repaid by equal monthly payments for four years. The interest rate is 7.2% compounded monthly and the amount borrowed is $17,355. In total, how much interest will be paid?

A) $37,380

B) $2,198

C) $2,671

D) $16,445

E) $2,499

A) $37,380

B) $2,198

C) $2,671

D) $16,445

E) $2,499

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

How much principal will be repaid by the first monthly payment of $750 on a $22,000 loan at 15% compounded monthly?

A) $525

B) $475

C) $650

D) $275

E) $500

A) $525

B) $475

C) $650

D) $275

E) $500

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

A home improvement loan is to be repaid by equal monthly payments for six years. The interest rate is 5.4% compounded monthly and the amount borrowed is $33,500. How much will the borrower still owe after four years?

A) $12,389

B) $11,167

C) $31,909

D) $23,675

E) $18,660

A) $12,389

B) $11,167

C) $31,909

D) $23,675

E) $18,660

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

A mortgage loan of $102,542 at 6% compounded monthly is amortized by equal monthly payments over 25 years. What is the total amount of interest that would be paid over the entire amortization period?

A) $44,500

B) $88,297

C) $103,622

D) $198,203

E) $95,662

A) $44,500

B) $88,297

C) $103,622

D) $198,203

E) $95,662

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

How much interest would you pay during the last year of a 48-month, $20,000 car loan? The interest rate is 13.2% compounded monthly?

A) $338

B) $838

C) $264

D) $547

E) $439

A) $338

B) $838

C) $264

D) $547

E) $439

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

Annual payments of $12,000 are to be made on a $70,000 loan at 17% compounded annually. A smaller, final payment will be made at the end of the amortization period. What will be the size of the final payment?

A) $6,150

B) $5,256

C) $4,362

D) $5,914

E) $8,778

A) $6,150

B) $5,256

C) $4,362

D) $5,914

E) $8,778

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

Five years ago, the Alexander family purchased a house for 570,000. They amortized the loan over 25 years, and paid for the mortgage through monthly payments over 5 years at a current interest rate of 5.5% compounded monthly. The mortgage is about to be refinanced, and interest rates have dropped 5.5% to 5.1% compounded monthly. Determine how much the Alexander family will save on each month's payment.

A) Savings of $113.96

B) Savings of $120.96

C) Savings of S127.96

D) Savings of $134.96

E) Savings of S141.96

A) Savings of $113.96

B) Savings of $120.96

C) Savings of S127.96

D) Savings of $134.96

E) Savings of S141.96

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

Ballard is considering purchasing a condo that will have monthly payments of $950 per month. Property taxes along with heating costs will total $375 per month. His monthly credit card bills total $200 per month and car payments are $700 per month. If Sally's gross monthly income is $6,000 per month, determine his Total Debt Service Ratio.

A) 37.08%

B) 38.08%

C) 39.08%

D) 40.08%

E) 41.08%

A) 37.08%

B) 38.08%

C) 39.08%

D) 40.08%

E) 41.08%

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

A $425,000 mortgage with a 3-year term is amortized over 25 years at an interest rate of 8.2% compounded semi-annually. If payments are made at the end of each month, determine the mortgage balance at the end of the 3-year term.

A) $357,093.73

B) $367,093.73

C) $387,093.73

D) $400,053.73

E) $407,053.73

A) $357,093.73

B) $367,093.73

C) $387,093.73

D) $400,053.73

E) $407,053.73

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

A $15,000 personal loan carries a 5.5% interest rate, compounded semi-annually, and is to be repaid quarterly over a 4-year period. Determine the amount of interest paid in the second year.

A) $465.90

B) $501.37

C) $557.13

D) $612.54

E) $686.44

A) $465.90

B) $501.37

C) $557.13

D) $612.54

E) $686.44

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

Grace is analyzing her company's purchase of a new $45,000 machinery. The machinery was purchased through financing at 6.7% compounded quarterly. The company makes quarterly payments over 7 years to pay off this loan. Determine the amount of the principal that had been paid off at the end of year 3 through the quarterly payments.

A) $18,762.29

B) $16,762.29

C) $14,762.29

D) $12,762.29

E) $10,762.29

A) $18,762.29

B) $16,762.29

C) $14,762.29

D) $12,762.29

E) $10,762.29

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

Armando purchased a $380,000 condo with a 25-year mortgage. The interest on the mortgage is 5.6% compounded monthly and he makes semi-monthly payments towards the mortgage. Determine how much total interest was paid up to the end of year 5.

A) $40,256.86

B) $40,556.86

C) $40,996.86

D) $41,256.86

E) $41,556.86

A) $40,256.86

B) $40,556.86

C) $40,996.86

D) $41,256.86

E) $41,556.86

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

Gurpreet plans to purchase a condo valued at $385,000. He is considering putting in a $45,000 down payment on the property and obtaining a mortgage for the remainder. Determine the Loan to Value Ratio.

A) 85.31%

B) 86.31%

C) 87.31%

D) 88.31%

E) 89.31%

A) 85.31%

B) 86.31%

C) 87.31%

D) 88.31%

E) 89.31%

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

A $120,000 mortgage is amortized over 25 years. Interest is 7.5% compounded semi-annually for a 5-year term with monthly payments. At the end of the fifth year, the mortgage is renewed for a four-year term at a rate of 7.0% compounded semi-annually. Determine the monthly payments throughout the renewal four year term.

A) $898.65

B) $863.24

C) $845.66

D) $822.44

E) $808.10

A) $898.65

B) $863.24

C) $845.66

D) $822.44

E) $808.10

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

A mortgage balance of $17,321.50 is renewed for a 3-year period at 8% compounded semiannually. Determine the amount of interest paid in the 3rd year.

A) $268.85

B) $298.85

C) $328.85

D) $348.85

E) $368.85

A) $268.85

B) $298.85

C) $328.85

D) $348.85

E) $368.85

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

Sally is considering purchasing a condo that will have monthly payments of $800 per month. Property taxes along with heating costs will total $225 per month. Her monthly credit card bills total $150 per month and her car payments are $600 per month. If Sally's gross monthly income is $3,500 per month, determine her Gross Debt Service Ratio.

A) 26.29%

B) 27.29%

C) 28.29%

D) 29.29%

E) 30.29%

A) 26.29%

B) 27.29%

C) 28.29%

D) 29.29%

E) 30.29%

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

The Davidson's have a lump sum amount of $60,000 saved up and have the budget to pay $2,500 at the start of each month for mortgage payments over 25 years. Determine the price of the home they can afford given interest rates are at 5.95% compounded monthly.

A) $391,798

B) $451,798

C) $491,798

D) $551,798

E) $591,798

A) $391,798

B) $451,798

C) $491,798

D) $551,798

E) $591,798

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

The Robinson family is considering purchasing a house in the Ottawa area for $650,000. They wish to amortize the loan over 25 years, and pay for the mortgage through monthly payments over 3 years at a current interest rate of 5.8% compounded monthly. They family is calculating the change in interest rates if at the end of the third year interest rates change from 5.8% to 6.1% compounded monthly. Determine the value of the current payment and the new payment after year 3.

A) Current payment = $4,113.55; new payment = $4,367.36

B) Current payment = $4,108.85; new payment = $4,217.13

C) Current payment = $4,202.15; new payment = $4,423.27

D) Current payment = $4,333.45; new payment = $4,673.23

E) Current payment = $4,123,67; new payment = $4,523.87

A) Current payment = $4,113.55; new payment = $4,367.36

B) Current payment = $4,108.85; new payment = $4,217.13

C) Current payment = $4,202.15; new payment = $4,423.27

D) Current payment = $4,333.45; new payment = $4,673.23

E) Current payment = $4,123,67; new payment = $4,523.87

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

Gloria purchased a $45,000 vehicle by financing it through a 3.8% rate of interest compounded monthly over 5 years. At the end of the 3rd year, Nancy received an inheritance that allowed her to pay off the balance. Determine the balance of the vehicle at the end of year 3.

A) $19,030.11

B) $20,030.11

C) $21,030.11

D) $22,030.11

E) $23,030.11

A) $19,030.11

B) $20,030.11

C) $21,030.11

D) $22,030.11

E) $23,030.11

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

The Globerman family purchased a $580,000 home 5 years ago. The mortgage was based on 25-year amortization and the term of the mortgage was for 5 years at 7.5% interest compounded monthly. At the start of year 6, the Globerman family have refinanced their mortgage at 7.3% compounded monthly, and have decided to increase their payments by 5% of the original payment amount. Determine how much faster the family will be able to pay off the mortgage by increasing payments and lowered interest rates.

A) 30.59 months faster

B) 24.51 months faster

C) 21.61 months faster

D) 18.81 months faster

E) 15.51 months faster

A) 30.59 months faster

B) 24.51 months faster

C) 21.61 months faster

D) 18.81 months faster

E) 15.51 months faster

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

Crystal is considering purchasing a condo that will have monthly payments of $1,950 per month. Property taxes along with heating costs will total $400 per month. Her monthly credit card bills total $75 per month and car payments are $450 per month. If Crystal's gross monthly income is $7,500 per month, determine his Total Debt Service Ratio.

A) 37.33%

B) 38.33%

C) 39.33%

D) 40.33%

E) 41.33%

A) 37.33%

B) 38.33%

C) 39.33%

D) 40.33%

E) 41.33%

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

Semi-annual payments of $5,000 are to be made on a $70,000 loan at 14% compounded semi-annually. A smaller, final payment will be made at the end of the amortization period. What will be the size of the final payment?

A) $2,977

B) $4,125

C) $3,130

D) $4,990

E) $3,855

A) $2,977

B) $4,125

C) $3,130

D) $4,990

E) $3,855

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

Equipment valued at $94,000 was purchased and paid for through the dealership's financing option. Repayments were over 5 years with monthly payment of $1,900. Interest on the loan was compounded monthly. Determine the principal portion and interest portion of the 15th loan payment.

A) Principal = $1,406.74; Interest = $493.26

B) Principal = $493.26; Interest = $1,406.74

C) Principal = $1,400.00; Interest = $500.00

D) Principal = $500.00; Interest = $1,400.00

E) Principal = $1,206.74; Interest = $693.26

A) Principal = $1,406.74; Interest = $493.26

B) Principal = $493.26; Interest = $1,406.74

C) Principal = $1,400.00; Interest = $500.00

D) Principal = $500.00; Interest = $1,400.00

E) Principal = $1,206.74; Interest = $693.26

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

A home improvement loan is to be repaid by equal monthly payments for six years. The interest rate is 5.4% compounded monthly and the amount borrowed is $33,500. How much interest will the borrower pay during the 4th year?

A) $1,022

B) $521

C) $837

D) $145

E) $686

A) $1,022

B) $521

C) $837

D) $145

E) $686

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

The Zhao family purchased a $670,000 home 7 years ago. The mortgage was based on 25-year amortization and the term of the mortgage was for 7 years at 6.3% interest compounded semi-annually. At the start of year 8, the Zhao family have refinanced their mortgage at 6.1% compounded semi-annually, and have decided to increase their payments by 10% of the original payment amount. Determine how much faster the family will be able to pay off the mortgage by increasing payments and lowered interest rates.

A) 33 months faster

B) 35 months faster

C) 37 months faster

D) 39 months faster

E) 41 months faster

A) 33 months faster

B) 35 months faster

C) 37 months faster

D) 39 months faster

E) 41 months faster

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

A mortgage contract for $145,000 written 10 years ago is just at the end of its second five-year term. The interest rates were 8% compounded semi-annually for the first term and 7% compounded semi-annually for the second term. If monthly payments throughout have been based on a 25-year amortization, calculate the principal balance at the end of the second term.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

$10,000 is to be repaid quarterly monthly over two years at 7.85% compounded semi-annually. Construct an amortization schedule for the loan. How much interest is paid in total?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

The Melnyks are nearing the end of the first three-year term of a $200,000 mortgage loan with a 20-year amortization. The interest rate has been 7.7% compounded semi-annually for the initial term. How much will their monthly payments decrease if the interest rate upon renewal is 6.7% compounded semi-annually?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

Jakob borrowed $27,000 for a car. He is making monthly payments of $494.81 at 3.8% compounded monthly. Construct a partial amortization schedule showing details of the first two payments, payments 33 and 34, and the last two payments.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

The Bingham family had a Loan to Value Ratio of 75%. If they had saved $95,000 as a down payment for a home, determine the value of the property, they were to purchase.

A) $280,000

B) $380,000

C) $480,000

D) $580,000

E) $680,000

A) $280,000

B) $380,000

C) $480,000

D) $580,000

E) $680,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

A $350,000 mortgage is amortized over 25 years. What is the monthly payment if interest is 5.8% compounded quarterly?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

The Switzers are nearing the end of the first five-year term of a $200,000 mortgage loan with a 25-year amortization. The interest rate has been 4.5% compounded semi-annually for the initial term. How much will their monthly payments increase if the interest rate upon renewal is 7.5% compounded semi-annually?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

A $25,000 home improvement (mortgage) loan charges interest at 6.6% compounded monthly for a three-year term. Monthly payments are based on a 10-year amortization and rounded up to the next $10. What will be the principal balance at the end of the first term?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

Larissa bought a stereo for $5,000. She made a down payment of $1,000, and financed the balance with monthly payments over four years at 8.5% compounded quarterly. Construct a partial amortization schedule showing details of the first two payments, payments 22 and 23, and the last two payments. How much interest did Larissa pay in total?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

Jessica bought an $1,150 television set for 25% down and the balance to be paid with interest at 11.25% compounded monthly in six equal monthly payments. Construct the full amortization schedule for the debt. Calculate the total interest paid.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

A loan of $20,000 is to be repaid by equal semi-annual payments over three years at 7.5% compounded semi-annually. Construct an amortization schedule for the loan. How much interest is paid in total?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

Grace calculated her Gross Debt Service Ratio as 24%. If her monthly mortgage payments are $980 per month, while monthly property taxes and hydro total another $180 per month, determine her gross monthly income.

A) $6.833.33

B) $6,133.33

C) $5,833.33

D) $5,133.33

E) $4,833.33

A) $6.833.33

B) $6,133.33

C) $5,833.33

D) $5,133.33

E) $4,833.33

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

A $200,000 mortgage at 5.5% compounded monthly is amortized over 20 years. What is the amount of the monthly payment?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

If the loan payments and interest rate remain unchanged, will it take longer to reduce the balance from $20,000 to $10,000 than to reduce the balance from $10,000 to $0? Explain briefly.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

A mortgage of $300,000 is amortized over 20 years at 5.25% compounded quarterly. What is the outstanding balance after 10 years?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

Metro Construction received $60,000 in vendor financing at 10.5% compounded semi-annually for the purchase of a loader. The contract requires semi-annual payments of $10,000 until the debt is paid off. Suppose that the loan permits an additional prepayment of principal on any scheduled payment date. Prepare another amortization schedule that reflects a prepayment of $5,000 with the third scheduled payment. How much interest is saved as a result of the prepayment?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

Lucille borrowed $21,500 for office equipment. The loan requires quarterly payments over two years at 6.5% compounded semi-annually. Construct a full amortization schedule for the loan. Show the total interest paid.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

Mona calculated her Total Debt Service Ratio to be 35%, given a gross monthly income of $5,800 per month. If her other debt amounted to $250 and her utilities and condo fees were another $300, then determine how much her monthly mortgage payments are.

A) 1,240

B) $1,380

C) $1,420

D) $1,480

E) $1,550

A) 1,240

B) $1,380

C) $1,420

D) $1,480

E) $1,550

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

A $200,000 mortgage at 6.2% compounded semi-annually with a 25-year amortization requires monthly payments. The mortgage allows the borrower to "double up" on a payment once each year. How much will the amortization period be shortened if the mortgagor doubles the tenth payment?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

Metro Construction received $60,000 in vendor financing at 6.5% compounded semi-annually for the purchase of a loader. The contract requires semi-annual payments of $7,500 until the debt is paid off. Construct the complete amortization schedule for the debt. How much total interest will be paid over the life of the loan?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck