Deck 8: Master Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 8: Master Budgeting

1

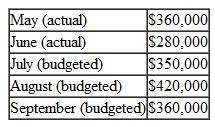

Midwest Products is a wholesale distributor of leaf rakes. Thus, peak sales occur in August of each year as shown in the company's sales budget for the third quarter, given below:

From past experience, the company has learned that 20% of a month's sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. May sales totaled $430,000. and June sales totaled $540,000.

From past experience, the company has learned that 20% of a month's sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. May sales totaled $430,000. and June sales totaled $540,000.

Required:

1. Prepare a schedule of expected cash collections from sales, by month and in total, for the third quarter.

2. Assume that the company will prepare a budgeted balance sheet as of September 30. Compute the accounts receivable as of that date.

From past experience, the company has learned that 20% of a month's sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. May sales totaled $430,000. and June sales totaled $540,000.

From past experience, the company has learned that 20% of a month's sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. May sales totaled $430,000. and June sales totaled $540,000.Required:

1. Prepare a schedule of expected cash collections from sales, by month and in total, for the third quarter.

2. Assume that the company will prepare a budgeted balance sheet as of September 30. Compute the accounts receivable as of that date.

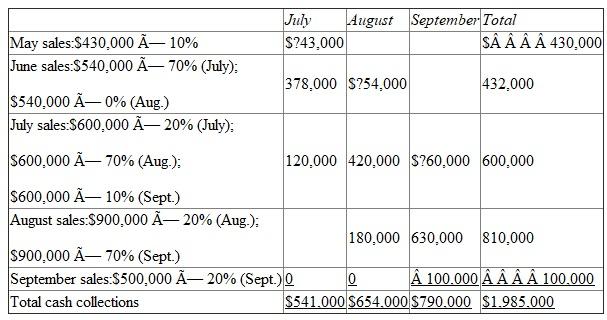

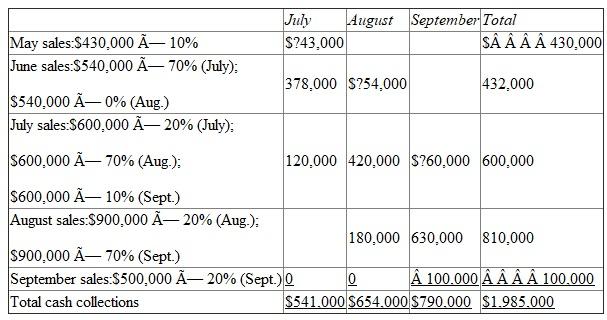

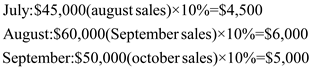

1)The first step to creating a schedule of expected cash collections is determining how sales each month affect sales in subsequent months. The third quarter of the year includes July, August and September. Since we know that 20% of sales are collected in the same month of sale, 70% of sales are recovered in the month following a sale and 10% is recovered two months following a sale, we can determine the amount of expected cash receipts for each month by back dating.

For example, to first determine expected cash collection for July, we simply need to follow the collection schedule. Work backwards.

1. Two months before July is May (for August, it is June; for September, it is July). Therefore, we will need to collect 10% of the sales made in May during July (as well as 10% of June sales in August and 10% of July sales in September).

2. One month before July is June (For August, it is July; for September, it is August). Therefore, we will need to collect 70% of the sales made in June for July (as well as 70% of July sales in August and 70% of August sales in September).

3. Finally, we also know that 20% of July sales will be collected in July (20% of August sales will also be collected in August and the same for September).

4. Sum the results of collections for each month

This is best represented in a schedule:

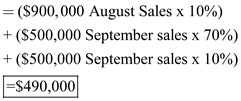

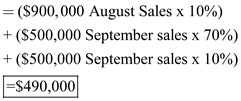

2)Follow the collection schedule. Keep in mind that to find the accounts receivable as of September 30, you are really using the cost schedule for the months of October and November (September sales won't be fully collected until two months after the sale which includes 10% in November), as that is what you will have to collect for in the next period:

2)Follow the collection schedule. Keep in mind that to find the accounts receivable as of September 30, you are really using the cost schedule for the months of October and November (September sales won't be fully collected until two months after the sale which includes 10% in November), as that is what you will have to collect for in the next period:

1. Two months before October is August. Therefore, we will need to collect 10% of the sales made in August during October.

2. One month before October is September. Therefore, we will need to collect 70% of the sales made in September for October.

3. Finally, we also know that 10% of September sales will be collected in November, and therefore remain uncollected as of September 30.

4. Sum the results of collections for the month.

Accounts receivable at September 30:

For example, to first determine expected cash collection for July, we simply need to follow the collection schedule. Work backwards.

1. Two months before July is May (for August, it is June; for September, it is July). Therefore, we will need to collect 10% of the sales made in May during July (as well as 10% of June sales in August and 10% of July sales in September).

2. One month before July is June (For August, it is July; for September, it is August). Therefore, we will need to collect 70% of the sales made in June for July (as well as 70% of July sales in August and 70% of August sales in September).

3. Finally, we also know that 20% of July sales will be collected in July (20% of August sales will also be collected in August and the same for September).

4. Sum the results of collections for each month

This is best represented in a schedule:

2)Follow the collection schedule. Keep in mind that to find the accounts receivable as of September 30, you are really using the cost schedule for the months of October and November (September sales won't be fully collected until two months after the sale which includes 10% in November), as that is what you will have to collect for in the next period:

2)Follow the collection schedule. Keep in mind that to find the accounts receivable as of September 30, you are really using the cost schedule for the months of October and November (September sales won't be fully collected until two months after the sale which includes 10% in November), as that is what you will have to collect for in the next period:1. Two months before October is August. Therefore, we will need to collect 10% of the sales made in August during October.

2. One month before October is September. Therefore, we will need to collect 70% of the sales made in September for October.

3. Finally, we also know that 10% of September sales will be collected in November, and therefore remain uncollected as of September 30.

4. Sum the results of collections for the month.

Accounts receivable at September 30:

2

What is a budget What is budgetary control

A Budget is a quantitative expression of a plan of action prepared in advance of the period to which it relates.

It may be prepared for the entire organisation or for various departments or for various functions involved in the organisation.

Budget is a means of translating the overall objectives of the business into detailed feasible plan of action.

A Budget is a pre-determined statement of management policy during a given period which provides a standard comparison with the results actually achieved.

The budget is an estimate prepared in advance of the period to which it applies.

Budgetary control is a system of controlling costs through budgets budgeting is thus only a part of the budgetary control.

Budgetary control is the establishment of budgets relating to the responsibilities of executives of a policy and the continuous comparison of the actual with the budgeted results, either to secure by individual action the objectives of the policy or to provide a basis for its revision.

It may be prepared for the entire organisation or for various departments or for various functions involved in the organisation.

Budget is a means of translating the overall objectives of the business into detailed feasible plan of action.

A Budget is a pre-determined statement of management policy during a given period which provides a standard comparison with the results actually achieved.

The budget is an estimate prepared in advance of the period to which it applies.

Budgetary control is a system of controlling costs through budgets budgeting is thus only a part of the budgetary control.

Budgetary control is the establishment of budgets relating to the responsibilities of executives of a policy and the continuous comparison of the actual with the budgeted results, either to secure by individual action the objectives of the policy or to provide a basis for its revision.

3

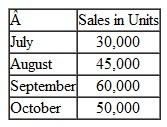

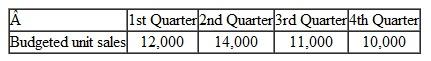

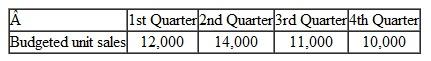

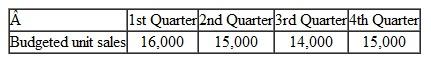

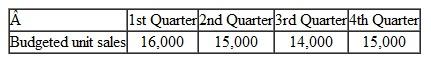

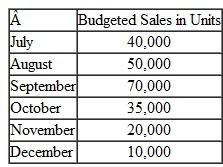

Crystal Telecom has budgeted the sales of its innovative mobile phone over the next four months as follows:

The company is now in the process of preparing a production budget for the third quarter. Past experience has shown that end-of-month finished goods inventories must equal 10% of the next month's sales. The inventory at the end of June was 3.000 units.

The company is now in the process of preparing a production budget for the third quarter. Past experience has shown that end-of-month finished goods inventories must equal 10% of the next month's sales. The inventory at the end of June was 3.000 units.

Required:

Prepare a production budget for the third quarter showing the number of units to be produced each month and for the quarter in total.

The company is now in the process of preparing a production budget for the third quarter. Past experience has shown that end-of-month finished goods inventories must equal 10% of the next month's sales. The inventory at the end of June was 3.000 units.

The company is now in the process of preparing a production budget for the third quarter. Past experience has shown that end-of-month finished goods inventories must equal 10% of the next month's sales. The inventory at the end of June was 3.000 units.Required:

Prepare a production budget for the third quarter showing the number of units to be produced each month and for the quarter in total.

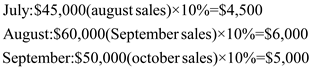

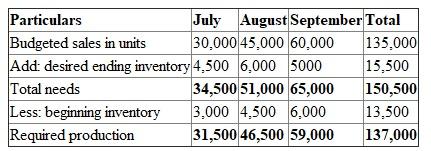

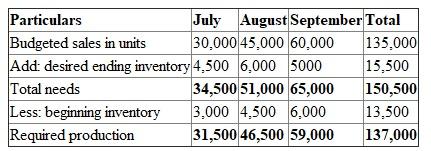

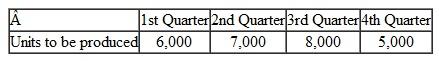

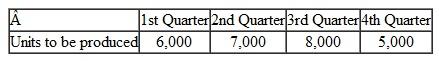

Production budget:

To meet the desired level of inventory and budgeted sales for the year, the budget, which estimates the number of units to be manufactured, is called production budget.

The budget should be prepared based on the estimated sales of the year to ensure that production and sales are kept balanced during the year.

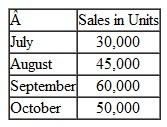

The first step in creation of a production budget is to determine the ending inventory for each month. In the given case, it is three months. Accordingly, there is a need to determine the amounts for the month of July, August and September (October falls in the fourth quarter of the year and not the third).

Since estimated ending inventory is equal to 10% of the next month's sales, the calculation is as follows:

Ending inventories:

It is also important to note that the ending inventory for one month is equal to the beginning inventory of the next month. Accordingly, the beginning inventory for July is 3,000, 4,500 for August, and 6,000 for September.

It is also important to note that the ending inventory for one month is equal to the beginning inventory of the next month. Accordingly, the beginning inventory for July is 3,000, 4,500 for August, and 6,000 for September.

The production budget:

To meet the desired level of inventory and budgeted sales for the year, the budget, which estimates the number of units to be manufactured, is called production budget.

The budget should be prepared based on the estimated sales of the year to ensure that production and sales are kept balanced during the year.

The first step in creation of a production budget is to determine the ending inventory for each month. In the given case, it is three months. Accordingly, there is a need to determine the amounts for the month of July, August and September (October falls in the fourth quarter of the year and not the third).

Since estimated ending inventory is equal to 10% of the next month's sales, the calculation is as follows:

Ending inventories:

It is also important to note that the ending inventory for one month is equal to the beginning inventory of the next month. Accordingly, the beginning inventory for July is 3,000, 4,500 for August, and 6,000 for September.

It is also important to note that the ending inventory for one month is equal to the beginning inventory of the next month. Accordingly, the beginning inventory for July is 3,000, 4,500 for August, and 6,000 for September.The production budget:

4

Discuss some of the major benefits to be gained from budgeting.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

Micro Products. Inc.. has developed a very powerful electronic calculator. Each calculator requires three small "chips" that cost $2 each and are purchased from an overseas supplier. Micro Products has prepared a production budget for the calculator by quarters for Year 2 and for the first quarter of Year 3, as shown below:

The chip used in production of the calculator is sometimes hard to get, so it is necessary to carry large inventories as a precaution against stockouts. For this reason, the inventory of chips at the end of a quarter must equal 20% of the following quarter's production needs. A total of 36.000 chips will be on hand to start the first quarter of Year 2,

The chip used in production of the calculator is sometimes hard to get, so it is necessary to carry large inventories as a precaution against stockouts. For this reason, the inventory of chips at the end of a quarter must equal 20% of the following quarter's production needs. A total of 36.000 chips will be on hand to start the first quarter of Year 2,

Required:

Prepare a direct materials budget for chips, by quarter and in total, for Year 2. At the bottom of your budget, show the dollar amount of purchases for each quarter and for the year in total.

The chip used in production of the calculator is sometimes hard to get, so it is necessary to carry large inventories as a precaution against stockouts. For this reason, the inventory of chips at the end of a quarter must equal 20% of the following quarter's production needs. A total of 36.000 chips will be on hand to start the first quarter of Year 2,

The chip used in production of the calculator is sometimes hard to get, so it is necessary to carry large inventories as a precaution against stockouts. For this reason, the inventory of chips at the end of a quarter must equal 20% of the following quarter's production needs. A total of 36.000 chips will be on hand to start the first quarter of Year 2,Required:

Prepare a direct materials budget for chips, by quarter and in total, for Year 2. At the bottom of your budget, show the dollar amount of purchases for each quarter and for the year in total.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

What is meant by the term responsibility accounting

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

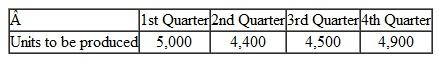

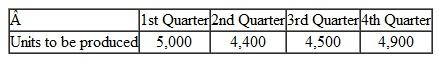

The production manager of Junnen Corporation has submitted the following forecast of units to be produced for each quarter of the upcoming fiscal year.

Each unit requires 0.40 direct labor-hours and direct labor-hour workers are paid $11 per hour.

Each unit requires 0.40 direct labor-hours and direct labor-hour workers are paid $11 per hour.

Required:

1. Construct the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced.

2. Construct the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. Instead, assume that the company's direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 1,800 hours of work each quarter. If the number of required direct labor-hours is less than this number, the workers are paid for 1,800 hours anyway. Any hours worked in excess of 1,800 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

Each unit requires 0.40 direct labor-hours and direct labor-hour workers are paid $11 per hour.

Each unit requires 0.40 direct labor-hours and direct labor-hour workers are paid $11 per hour.Required:

1. Construct the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced.

2. Construct the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. Instead, assume that the company's direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 1,800 hours of work each quarter. If the number of required direct labor-hours is less than this number, the workers are paid for 1,800 hours anyway. Any hours worked in excess of 1,800 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

What is a master budget Briefly describe its contents.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

The direct labor budget of Krispin Corporation for the upcoming fiscal year includes the following budgeted direct labor-hours.

The company's variable manufacturing overhead rate is $1.75 per direct labor-hour and the company's fixed manufacturing overhead is $35,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $15,000 per quarter.

The company's variable manufacturing overhead rate is $1.75 per direct labor-hour and the company's fixed manufacturing overhead is $35,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $15,000 per quarter.

Required:

1. Construct the company's manufacturing overhead budget for the upcoming fiscal year.

2. Compute the company's manufacturing overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. Round off to the nearest whole cent.

The company's variable manufacturing overhead rate is $1.75 per direct labor-hour and the company's fixed manufacturing overhead is $35,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $15,000 per quarter.

The company's variable manufacturing overhead rate is $1.75 per direct labor-hour and the company's fixed manufacturing overhead is $35,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $15,000 per quarter.Required:

1. Construct the company's manufacturing overhead budget for the upcoming fiscal year.

2. Compute the company's manufacturing overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. Round off to the nearest whole cent.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

Why is the sales forecast the starting point in budgeting

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

The budgeted unit sales of Haerve Company for the upcoming fiscal year are provided below:

The company's variable selling and administrative expenses per unit are $2.75. Fixed selling and administrative expenses include advertising expenses of $12,000 per quarter, executive salaries of $40,000 per quarter, and depreciation of $16,000 per quarter. In addition, the company will make insurance payments of $6,000 in the 2nd Quarter and $6,000 in the 4th Quarter. Finally, property taxes of $6,000 will be paid in the 3rd Quarter.

The company's variable selling and administrative expenses per unit are $2.75. Fixed selling and administrative expenses include advertising expenses of $12,000 per quarter, executive salaries of $40,000 per quarter, and depreciation of $16,000 per quarter. In addition, the company will make insurance payments of $6,000 in the 2nd Quarter and $6,000 in the 4th Quarter. Finally, property taxes of $6,000 will be paid in the 3rd Quarter.

Required:

Prepare the company's selling and administrative expense budget for the upcoming fiscal year.

The company's variable selling and administrative expenses per unit are $2.75. Fixed selling and administrative expenses include advertising expenses of $12,000 per quarter, executive salaries of $40,000 per quarter, and depreciation of $16,000 per quarter. In addition, the company will make insurance payments of $6,000 in the 2nd Quarter and $6,000 in the 4th Quarter. Finally, property taxes of $6,000 will be paid in the 3rd Quarter.

The company's variable selling and administrative expenses per unit are $2.75. Fixed selling and administrative expenses include advertising expenses of $12,000 per quarter, executive salaries of $40,000 per quarter, and depreciation of $16,000 per quarter. In addition, the company will make insurance payments of $6,000 in the 2nd Quarter and $6,000 in the 4th Quarter. Finally, property taxes of $6,000 will be paid in the 3rd Quarter.Required:

Prepare the company's selling and administrative expense budget for the upcoming fiscal year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

"As a practical matter, planning and control mean exactly the same thing." Do you agree Explain.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

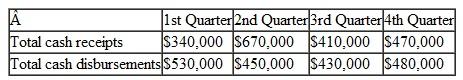

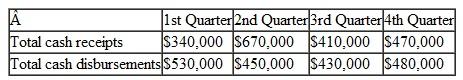

Forest Outfitters is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows:

The company's beginning cash balance for the upcoming fiscal year will be $50,000. The company requires a minimum cash balance of $30,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid.

The company's beginning cash balance for the upcoming fiscal year will be $50,000. The company requires a minimum cash balance of $30,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid.

Required:

Prepare the company's cash budget for the upcoming fiscal year.

The company's beginning cash balance for the upcoming fiscal year will be $50,000. The company requires a minimum cash balance of $30,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid.

The company's beginning cash balance for the upcoming fiscal year will be $50,000. The company requires a minimum cash balance of $30,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid.Required:

Prepare the company's cash budget for the upcoming fiscal year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

Describe the flow of budget data in an organization. Who are the participants in the budgeting process, and how do they participate

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

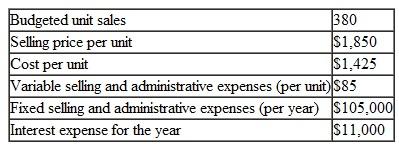

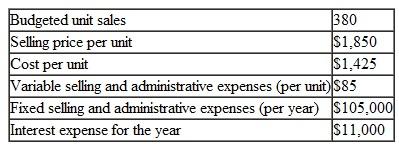

Seattle Cat is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process:

Required:

Required:

Prepare the company's budgeted income statement using an absorption income statement as shown in Schedule 9.

Required:

Required: Prepare the company's budgeted income statement using an absorption income statement as shown in Schedule 9.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

What is a self-imposed budget What are the major advantages of self-imposed budgets What caution must be exercised in their use

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

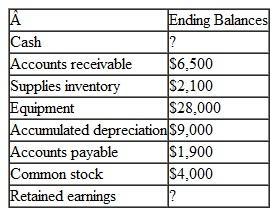

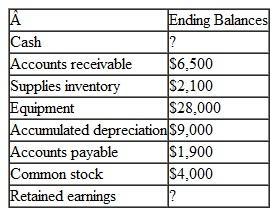

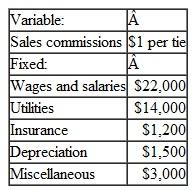

The management of Academic Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year:

The beginning balance of retained earnings was $21,000, net income is budgeted to be $8,600, and dividends are budgeted to be $3,500.

The beginning balance of retained earnings was $21,000, net income is budgeted to be $8,600, and dividends are budgeted to be $3,500.

Required:

Prepare the company's budgeted balance sheet.

The beginning balance of retained earnings was $21,000, net income is budgeted to be $8,600, and dividends are budgeted to be $3,500.

The beginning balance of retained earnings was $21,000, net income is budgeted to be $8,600, and dividends are budgeted to be $3,500.Required:

Prepare the company's budgeted balance sheet.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

How can budgeting assist a company in planning its workforce staffing levels

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

The marketing department of Graber Corporation has submitted the following sales forecast for the upcoming fiscal year.

The selling price of the company's product is $22.00 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made, 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $66,000.

The selling price of the company's product is $22.00 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made, 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $66,000.

The company expects to start the first quarter with 3,200 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 3,400 units.

Required:

1. Prepare the company's sales budget and schedule of expected cash collections.

2. Prepare the company's production budget for the upcoming fiscal year.

The selling price of the company's product is $22.00 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made, 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $66,000.

The selling price of the company's product is $22.00 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made, 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $66,000.The company expects to start the first quarter with 3,200 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 3,400 units.

Required:

1. Prepare the company's sales budget and schedule of expected cash collections.

2. Prepare the company's production budget for the upcoming fiscal year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

"The principal purpose of the cash budget is to see how much cash the company will have in the bank at the end of the year." Do you agree Explain.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

The production department of Priston Company has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year.

In addition, the beginning raw materials inventory for the 1st Quarter is budgeted to be 3,600 pounds and the beginning accounts payable for the 1st Quarter is budgeted to be $11.775.

In addition, the beginning raw materials inventory for the 1st Quarter is budgeted to be 3,600 pounds and the beginning accounts payable for the 1st Quarter is budgeted to be $11.775.

Each unit requires three pounds of raw material that costs $2.50 per pound. Management desires to end each quarter with a raw materials inventory equal to 20% of the following quarter's production needs. The desired ending inventory for the 4th Quarter is 3,700 pounds. Management plans to pay for 70% of raw material purchases in the quarter acquired and 30% in the following quarter. Each unit requires 0.50 direct labor-hours and direct labor-hour workers are paid $12 per hour.

Required:

1. Prepare the company's direct materials budget and schedule of expected cash disbursements for purchases of materials for the upcoming fiscal year.

2. Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced.

In addition, the beginning raw materials inventory for the 1st Quarter is budgeted to be 3,600 pounds and the beginning accounts payable for the 1st Quarter is budgeted to be $11.775.

In addition, the beginning raw materials inventory for the 1st Quarter is budgeted to be 3,600 pounds and the beginning accounts payable for the 1st Quarter is budgeted to be $11.775.Each unit requires three pounds of raw material that costs $2.50 per pound. Management desires to end each quarter with a raw materials inventory equal to 20% of the following quarter's production needs. The desired ending inventory for the 4th Quarter is 3,700 pounds. Management plans to pay for 70% of raw material purchases in the quarter acquired and 30% in the following quarter. Each unit requires 0.50 direct labor-hours and direct labor-hour workers are paid $12 per hour.

Required:

1. Prepare the company's direct materials budget and schedule of expected cash disbursements for purchases of materials for the upcoming fiscal year.

2. Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

The Production Department of Harveton Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year.

Each unit requires 0.80 direct labor-hours and direct labor-hour workers are paid $11.50 per hour.

Each unit requires 0.80 direct labor-hours and direct labor-hour workers are paid $11.50 per hour.

In addition, the variable manufacturing overhead rate is $2.50 per direct labor-hour. The fixed manufacturing overhead is $90,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $34,000 per quarter.

Required:

1. Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced.

2. Prepare the company's manufacturing overhead budget.

Each unit requires 0.80 direct labor-hours and direct labor-hour workers are paid $11.50 per hour.

Each unit requires 0.80 direct labor-hours and direct labor-hour workers are paid $11.50 per hour.In addition, the variable manufacturing overhead rate is $2.50 per direct labor-hour. The fixed manufacturing overhead is $90,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $34,000 per quarter.

Required:

1. Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced.

2. Prepare the company's manufacturing overhead budget.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

Tonga Toys manufactures and distributes a number of products to retailers. One of these products. Playclay, requires three pounds of material A135 in the manufacture of each unit. The company is now planning raw materials needs for the third quarter-July, August, and September. Peak sales of Playclay occur in the third quarter of each year. To keep production and shipments moving smoothly, the company has the following inventory requirements:

a. The finished goods inventory on hand at the end of each month must be equal to 5,000 units plus 30% of the next month's sales. The finished goods inventory on June 30 is budgeted to be 17,000 units.

b. The raw materials inventory on hand at the end of each month must be equal to one-half of the following month's production needs for raw materials. The raw materials inventory on June 30 for material A135 is budgeted to be 64,500 pounds.

c. The company maintains no work in process inventories.

A sales budget for Playclay for the last six months of the year follows.

Required:

Required:

1. Prepare a production budget for Playclay for the months July, August. September, and October.

2. Examine the production budget that you prepared. Why will the company produce more units than it sells in July and August and less units than it sells in September and October

3. Prepare a direct materials budget showing the quantity of material A135 to be purchased for July. August, and September and for the quarter in total.

a. The finished goods inventory on hand at the end of each month must be equal to 5,000 units plus 30% of the next month's sales. The finished goods inventory on June 30 is budgeted to be 17,000 units.

b. The raw materials inventory on hand at the end of each month must be equal to one-half of the following month's production needs for raw materials. The raw materials inventory on June 30 for material A135 is budgeted to be 64,500 pounds.

c. The company maintains no work in process inventories.

A sales budget for Playclay for the last six months of the year follows.

Required:

Required: 1. Prepare a production budget for Playclay for the months July, August. September, and October.

2. Examine the production budget that you prepared. Why will the company produce more units than it sells in July and August and less units than it sells in September and October

3. Prepare a direct materials budget showing the quantity of material A135 to be purchased for July. August, and September and for the quarter in total.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

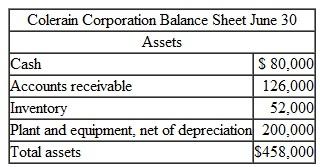

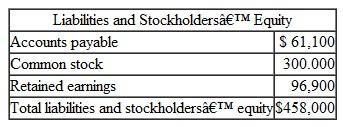

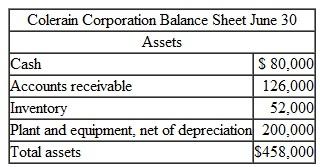

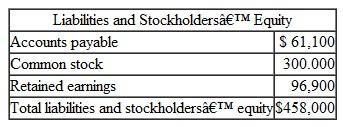

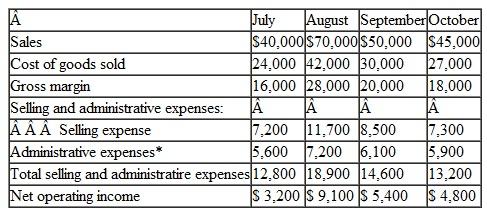

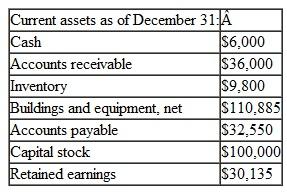

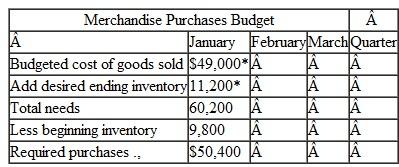

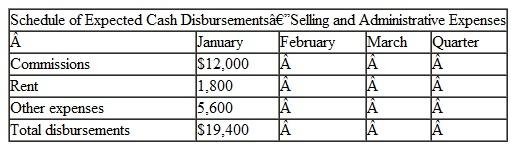

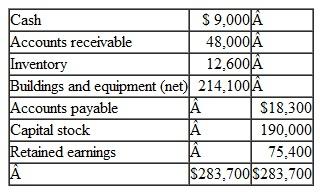

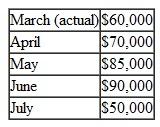

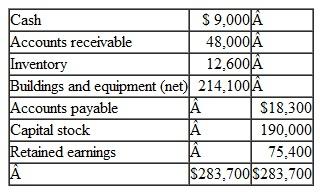

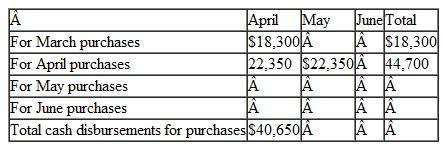

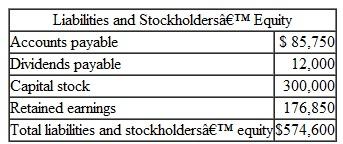

Colerain Corporation is a merchandising company that is preparing a profit plan for the third quarter of the calendar year. The company's balance sheet as of June 30 is shown below;

Colerain's managers have made the following additional assumptions and estimates:

Colerain's managers have made the following additional assumptions and estimates:

1. Estimated sales for July, August, September, and October will be $200,000. $220,000. 210.000. and $230,000, respectively.

2. All sales are on credit and all credit sales are collected. Each month's credit sales are collected 30% in the month of sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July.

3. Each month's ending inventory must equal 40% of the cost of next month's sales. The cost of goods sold is 65% of sales. The company pays for 50% of its merchandise purchases in the month of the purchase and the remaining 50% in the month following the purchase. All of the accounts payable at June 30 will be paid in July.

4. Monthly selling and administrative expenses are always $65,000. Each month $5,000 of this total amount is depreciation expense and the remaining $60,000 relates to expenses that are paid in the month they are incurred.

5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The company does not plan to issue any common stock or repurchase its own stock during the quarter ended September 30.

Required:

1. Prepare a schedule of expected cash collections for July, August, and September. Also compute total cash collections for the quarter ended September 30th.

2. a. Prepare a merchandise purchases budget for July, August, and September. Also compute total merchandise purchases for the quarter ended September 30th.

b. Prepare a schedule of expected cash disbursements for merchandise purchases for July, August, and September. Also compute total cash disbursements for merchandise purchases for the quarter ended September 30th.

3. Prepare an income statement for the quarter ended September 30th. Use the absorption format shown in Schedule 9.

4. Prepare a balance sheet as of September 30th.

Colerain's managers have made the following additional assumptions and estimates:

Colerain's managers have made the following additional assumptions and estimates:1. Estimated sales for July, August, September, and October will be $200,000. $220,000. 210.000. and $230,000, respectively.

2. All sales are on credit and all credit sales are collected. Each month's credit sales are collected 30% in the month of sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July.

3. Each month's ending inventory must equal 40% of the cost of next month's sales. The cost of goods sold is 65% of sales. The company pays for 50% of its merchandise purchases in the month of the purchase and the remaining 50% in the month following the purchase. All of the accounts payable at June 30 will be paid in July.

4. Monthly selling and administrative expenses are always $65,000. Each month $5,000 of this total amount is depreciation expense and the remaining $60,000 relates to expenses that are paid in the month they are incurred.

5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The company does not plan to issue any common stock or repurchase its own stock during the quarter ended September 30.

Required:

1. Prepare a schedule of expected cash collections for July, August, and September. Also compute total cash collections for the quarter ended September 30th.

2. a. Prepare a merchandise purchases budget for July, August, and September. Also compute total merchandise purchases for the quarter ended September 30th.

b. Prepare a schedule of expected cash disbursements for merchandise purchases for July, August, and September. Also compute total cash disbursements for merchandise purchases for the quarter ended September 30th.

3. Prepare an income statement for the quarter ended September 30th. Use the absorption format shown in Schedule 9.

4. Prepare a balance sheet as of September 30th.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

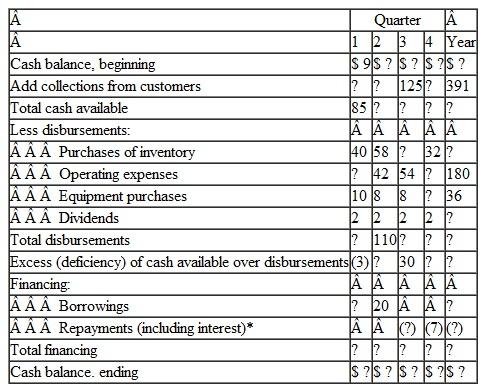

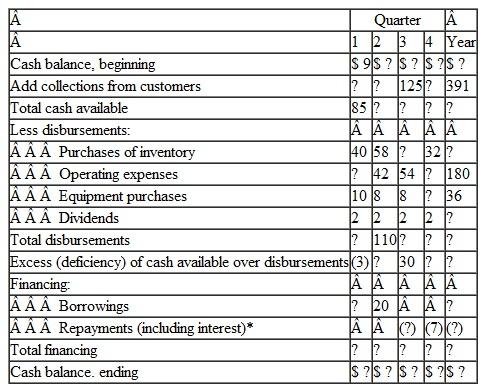

A cash budget, by quarters, is shown on the following page for a retail company (000 omitted). The company requires a minimum cash balance of $5,000 to start each quarter.

*Interest will total $4,000 for the year.

*Interest will total $4,000 for the year.

Required:

Fill in the missing amounts in the table above.

*Interest will total $4,000 for the year.

*Interest will total $4,000 for the year.Required:

Fill in the missing amounts in the table above.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

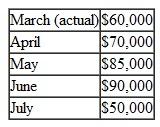

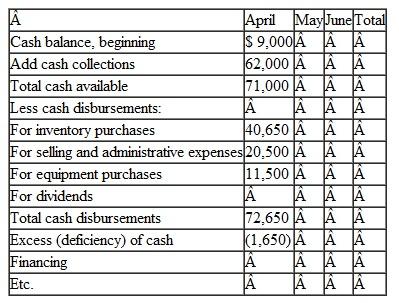

Calgon Products, a distributor of organic beverages, needs a cash budget for September. The following information is available:

a. The cash balance at the beginning of September is $9,000.

b. Actual sales for July and August and expected sales for September are as follows:

Sales on account are collected over a three-month period as follows: 10% collected in the month of sale, 70% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible.

Sales on account are collected over a three-month period as follows: 10% collected in the month of sale, 70% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible.

c. Purchases of inventory will total $25,000 for September. Twenty percent of a month's inventory purchases are paid for during the month of purchase. The accounts payable remaining from August's inventory purchases total $16,000, all of which will be paid in September.

d. Selling and administrative expenses are budgeted at $13,000 for September. Of this amount, $4,000 is for depreciation

e. Equipment costing $ 18,000 will be purchased for cash during September, and dividends totaling $3,000 will be paid during the month.

f. The company maintains a minimum cash balance of S5.000. An open line of credit is available from the company's bank to bolster the cash balance as needed.

Required:

1. Prepare a schedule of expected cash collections for September.

2. Prepare a schedule of expected cash disbursements for inventory purchases for September.

3. Prepare a cash budget for September. Indicate in the financing section any borrowing that will be needed during September. Assume that any interest will not be paid until the following month.

a. The cash balance at the beginning of September is $9,000.

b. Actual sales for July and August and expected sales for September are as follows:

Sales on account are collected over a three-month period as follows: 10% collected in the month of sale, 70% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible.

Sales on account are collected over a three-month period as follows: 10% collected in the month of sale, 70% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible.c. Purchases of inventory will total $25,000 for September. Twenty percent of a month's inventory purchases are paid for during the month of purchase. The accounts payable remaining from August's inventory purchases total $16,000, all of which will be paid in September.

d. Selling and administrative expenses are budgeted at $13,000 for September. Of this amount, $4,000 is for depreciation

e. Equipment costing $ 18,000 will be purchased for cash during September, and dividends totaling $3,000 will be paid during the month.

f. The company maintains a minimum cash balance of S5.000. An open line of credit is available from the company's bank to bolster the cash balance as needed.

Required:

1. Prepare a schedule of expected cash collections for September.

2. Prepare a schedule of expected cash disbursements for inventory purchases for September.

3. Prepare a cash budget for September. Indicate in the financing section any borrowing that will be needed during September. Assume that any interest will not be paid until the following month.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

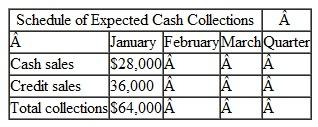

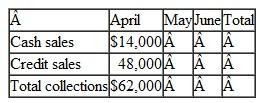

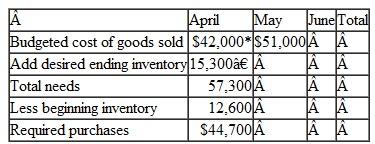

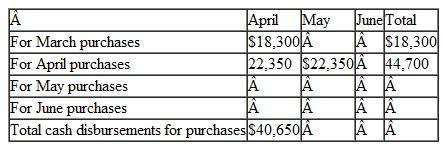

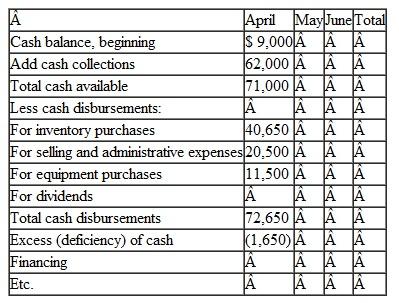

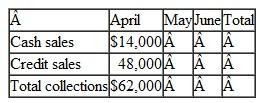

Janus Products, Inc., is a merchandising company that sells binders, paper, and other school supplies. The company is planning its cash needs for the third quarter. In the past, Janus Products has had to borrow money during the third quarter to support peak sales of back-to-school materials, which occur during August. The following information has been assembled to assist in preparing a cash budget for the quarter:

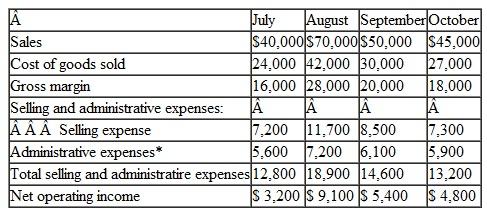

a. Budgeted monthly absorption costing income statements for July-October are as follows:

*Includes $2,000 depreciation each month.

*Includes $2,000 depreciation each month.

b. Sales are 20% for cash and 80% on credit.

c. Credit sales are collected over a three-month period with 10% collected in the month of sale, 70% in the month following sale, and 20% in the second month following sale. May sales totaled $30,000, and June sales totaled $36,000.

d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable for inventory purchases at June 30 total $11,700.

e. The company maintains its ending inventory levels at 75% of the cost of the merchandise to be sold in the following month. The merchandise inventory at June 30 is $18,000.

f. Land costing $4,500 will be purchased in July.

g. Dividends of $ 1,000 will be declared and paid in September.

h. The cash balance on June 30 is $8,000; the company must maintain a cash balance of at least this amount at the end of each month.

i. The company has an agreement with a local bank that allows it to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $40,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Required:

1. Prepare a schedule of expected cash collections for July, August, and September and for the quarter in total.

2. Prepare the following for merchandise inventory:

a. A merchandise purchases budget for July, August, and September.

b. A schedule of expected cash disbursements for merchandise purchases for July. August, and September and for the quarter in total.

3. Prepare a cash budget for July, August, and September and for the quarter in total.

a. Budgeted monthly absorption costing income statements for July-October are as follows:

*Includes $2,000 depreciation each month.

*Includes $2,000 depreciation each month.b. Sales are 20% for cash and 80% on credit.

c. Credit sales are collected over a three-month period with 10% collected in the month of sale, 70% in the month following sale, and 20% in the second month following sale. May sales totaled $30,000, and June sales totaled $36,000.

d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable for inventory purchases at June 30 total $11,700.

e. The company maintains its ending inventory levels at 75% of the cost of the merchandise to be sold in the following month. The merchandise inventory at June 30 is $18,000.

f. Land costing $4,500 will be purchased in July.

g. Dividends of $ 1,000 will be declared and paid in September.

h. The cash balance on June 30 is $8,000; the company must maintain a cash balance of at least this amount at the end of each month.

i. The company has an agreement with a local bank that allows it to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $40,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Required:

1. Prepare a schedule of expected cash collections for July, August, and September and for the quarter in total.

2. Prepare the following for merchandise inventory:

a. A merchandise purchases budget for July, August, and September.

b. A schedule of expected cash disbursements for merchandise purchases for July. August, and September and for the quarter in total.

3. Prepare a cash budget for July, August, and September and for the quarter in total.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Refer to the data for Janus Products, Inc., in Problem 8-17. The company's president is interested in knowing how reducing inventory levels and collecting accounts receivable sooner will impact the cash budget. He revises the cash collection and ending inventory assumptions as follows:

1. Sales continue to be 20% for cash and 80% on credit. However, credit sales from July, August, and September are collected over a three-month period with 25% collected in the month of sale, 60% collected in the month following sale, and 15%; in the second month following sale. Credit sales from May and June are collected during the third quarter using the collection percentages specified in Problem 8-17.

2. The company maintains its ending inventory levels for July, August, and September at 25% of the cost of merchandise to be sold in the following month. The merchandise inventory at June 30 remains $18,000 and accounts payable for inventory purchases at June 30 remains $11.700.

All other information from Problem 8-17 that is not referred to above remains the same.

Required:

1. Using the president's new assumptions in (1) above, prepare a schedule of expected cash collections for July, August, and September and for the quarter in total.

2. Using the president's new assumptions in (2) above, prepare the following for merchandise inventory:

a. A merchandise purchases budget for July. August, and September.

b. A schedule of expected cash disbursements for merchandise purchases for July, August, and September and for the quarter in total.

3. Using the president's new assumptions, prepare a cash budget for July, August, September, and for the quarter in total.

4. Prepare a brief memorandum for the president explaining how his revised assumptions affect the cash budget.

1. Sales continue to be 20% for cash and 80% on credit. However, credit sales from July, August, and September are collected over a three-month period with 25% collected in the month of sale, 60% collected in the month following sale, and 15%; in the second month following sale. Credit sales from May and June are collected during the third quarter using the collection percentages specified in Problem 8-17.

2. The company maintains its ending inventory levels for July, August, and September at 25% of the cost of merchandise to be sold in the following month. The merchandise inventory at June 30 remains $18,000 and accounts payable for inventory purchases at June 30 remains $11.700.

All other information from Problem 8-17 that is not referred to above remains the same.

Required:

1. Using the president's new assumptions in (1) above, prepare a schedule of expected cash collections for July, August, and September and for the quarter in total.

2. Using the president's new assumptions in (2) above, prepare the following for merchandise inventory:

a. A merchandise purchases budget for July. August, and September.

b. A schedule of expected cash disbursements for merchandise purchases for July, August, and September and for the quarter in total.

3. Using the president's new assumptions, prepare a cash budget for July, August, September, and for the quarter in total.

4. Prepare a brief memorandum for the president explaining how his revised assumptions affect the cash budget.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

Crydon, Inc.. manufactures an advanced swim fin for scuba divers. Management is now preparing detailed budgets for the third quarter, July through September, and has assembled the following information to assist in preparing the budget:

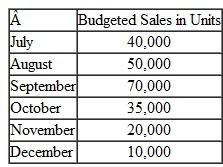

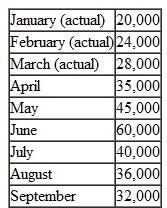

a. The Marketing Department has estimated sales as follows for the remainder of the year (in pairs of swim fins):

The selling price of the swim fins is $50 per pair.

b. All sales are on account. Based on past experience, sales are expected to be collected in the following pattern:

b. All sales are on account. Based on past experience, sales are expected to be collected in the following pattern:

40% in the month of sale

50% in the month following sale

10% uncollectible

The beginning accounts receivable balance (excluding uncollectible amounts) on July 1 will be $130,000.

c. The company maintains finished goods inventories equal to 10% of the following month's sales. The inventory of finished goods on July 1 will be 600 pairs.

d. Each pair of swim tins requires 2 pounds of geico compound. To prevent shortages, the company would like the inventory of geico compound on hand at the end of each month to be equal to 20% of the following month's production needs. The inventory of geico compound on hand on July 1 will be 2.440 pounds.

e. Geico compound costs $2.50 per pound. Crydon pays for 60% of its purchases in the month of purchase; the remainder is paid for in the following month. The accounts payable balance for geico compound purchases will be $11,400 on July 1.

Required:

1. Prepare a sales budget, by month and in total, for the third quarter. (Show your budget in both pairs of swim fins and dollars.) Also prepare a Schedule of expected cash collections, by month and in total, for the third quarter.

2. Prepare a production budget for each of the months July through October.

3. Prepare a direct materials budget for geico compound, by month and in total, for the third quarter. Also prepare a schedule of expected cash disbursements for geico compound, by month and in total, for the third quarter.

a. The Marketing Department has estimated sales as follows for the remainder of the year (in pairs of swim fins):

The selling price of the swim fins is $50 per pair.

b. All sales are on account. Based on past experience, sales are expected to be collected in the following pattern:

b. All sales are on account. Based on past experience, sales are expected to be collected in the following pattern:40% in the month of sale

50% in the month following sale

10% uncollectible

The beginning accounts receivable balance (excluding uncollectible amounts) on July 1 will be $130,000.

c. The company maintains finished goods inventories equal to 10% of the following month's sales. The inventory of finished goods on July 1 will be 600 pairs.

d. Each pair of swim tins requires 2 pounds of geico compound. To prevent shortages, the company would like the inventory of geico compound on hand at the end of each month to be equal to 20% of the following month's production needs. The inventory of geico compound on hand on July 1 will be 2.440 pounds.

e. Geico compound costs $2.50 per pound. Crydon pays for 60% of its purchases in the month of purchase; the remainder is paid for in the following month. The accounts payable balance for geico compound purchases will be $11,400 on July 1.

Required:

1. Prepare a sales budget, by month and in total, for the third quarter. (Show your budget in both pairs of swim fins and dollars.) Also prepare a Schedule of expected cash collections, by month and in total, for the third quarter.

2. Prepare a production budget for each of the months July through October.

3. Prepare a direct materials budget for geico compound, by month and in total, for the third quarter. Also prepare a schedule of expected cash disbursements for geico compound, by month and in total, for the third quarter.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

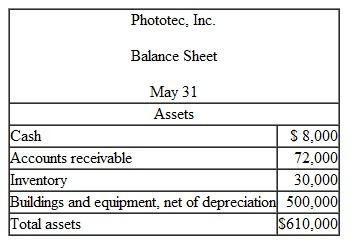

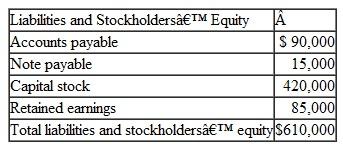

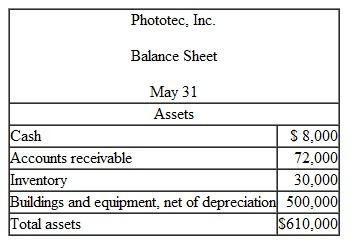

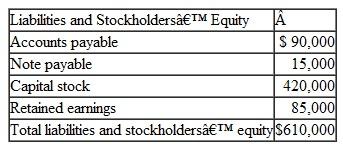

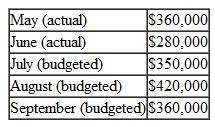

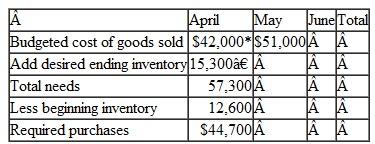

The balance sheet of Phototec. Inc.. a distributor of photographic supplies, as of May 31 is given below:

The company is in the process of preparing a budget for June and has assembled the following data:

The company is in the process of preparing a budget for June and has assembled the following data:

a. Sales are budgeted at $250,000 for June. Of these sales, $60,000 will be for cash: the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder is collected the following month. All of the May 31 accounts receivable will be collected in June.

b. Purchases of inventory are expected to total $200,000 during June. These purchases will all be on account. Forty percent of all inventory purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the May 31 accounts payable to suppliers will be paid during June.

c. The June 30 inventory balance is budgeted at $40,000.

d. Selling and administrative expenses for June are budgeted at $51,000, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $2,000 for the month.

e. The note payable on the May 31 balance sheet will be paid during June. The company's interest expense for June (on all borrowing) will be $500, which will be paid in cash.

f. New warehouse equipment costing $9,000 will be purchased for cash during June.

g. During June, the company will borrow $18,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year.

Required:

1. Prepare a cash budget for June. Support your budget with a schedule of expected cash collections from sales and a schedule of expected cash disbursements for inventory purchases.

2. Prepare a budgeted income statement for June. Use the absorption costing income statement format as shown in Schedule 9.

3. Prepare a budgeted balance sheet as of June 30.

The company is in the process of preparing a budget for June and has assembled the following data:

The company is in the process of preparing a budget for June and has assembled the following data:a. Sales are budgeted at $250,000 for June. Of these sales, $60,000 will be for cash: the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder is collected the following month. All of the May 31 accounts receivable will be collected in June.

b. Purchases of inventory are expected to total $200,000 during June. These purchases will all be on account. Forty percent of all inventory purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the May 31 accounts payable to suppliers will be paid during June.

c. The June 30 inventory balance is budgeted at $40,000.

d. Selling and administrative expenses for June are budgeted at $51,000, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $2,000 for the month.

e. The note payable on the May 31 balance sheet will be paid during June. The company's interest expense for June (on all borrowing) will be $500, which will be paid in cash.

f. New warehouse equipment costing $9,000 will be purchased for cash during June.

g. During June, the company will borrow $18,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year.

Required:

1. Prepare a cash budget for June. Support your budget with a schedule of expected cash collections from sales and a schedule of expected cash disbursements for inventory purchases.

2. Prepare a budgeted income statement for June. Use the absorption costing income statement format as shown in Schedule 9.

3. Prepare a budgeted balance sheet as of June 30.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

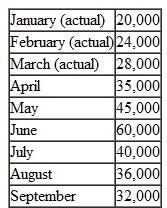

Natural Care Corp., a distributor of natural cosmetics, is ready to begin its third quarter, in which peak sales occur. The company has requested a $60,000. 90-day loan from its bank to help meet cash requirements during the quarter. Because Natural Care has experienced difficulty in paying off its loans in the past, the bank's loan officer has asked the company to prepare a cash budget for the quarter. In response to this request, the following data have been assembled:

a. On July 1, the beginning of the third quarter, the company will have a cash balance of $43,000.

b. Actual sales for the last two months and budgeted sales for the third quarter follow (all sales are on account):

Past experience shows that 25% of a month's sales are collected in the month of sale. 70% in the month following sale, and 2% in the second month following sale. The remainder is uncollectible.

Past experience shows that 25% of a month's sales are collected in the month of sale. 70% in the month following sale, and 2% in the second month following sale. The remainder is uncollectible.

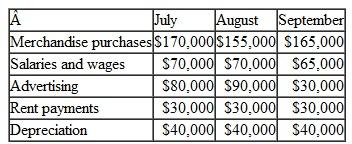

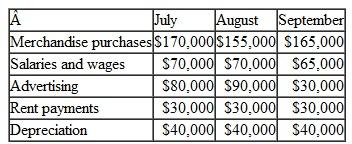

c. Budgeted merchandise purchases and budgeted expenses for the third quarter are given below:

Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on June 30, which will be paid during July, total $160,000.

Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on June 30, which will be paid during July, total $160,000.

d. Equipment costing $25,000 will be purchased for cash during July.

e. In preparing the cash budget, assume that the $60,000 loan will be made in July and repaid in September. Interest on the loan will total $2,000.

Required:

1. Prepare a schedule of expected cash collections for July. August, and September and for the quarter in total.

2. Prepare a cash budget, by month and in total, for the third quarter.

3. If the company needs a minimum cash balance of $20,000 to start each month, can the loan be repaid as planned Explain.

a. On July 1, the beginning of the third quarter, the company will have a cash balance of $43,000.

b. Actual sales for the last two months and budgeted sales for the third quarter follow (all sales are on account):

Past experience shows that 25% of a month's sales are collected in the month of sale. 70% in the month following sale, and 2% in the second month following sale. The remainder is uncollectible.

Past experience shows that 25% of a month's sales are collected in the month of sale. 70% in the month following sale, and 2% in the second month following sale. The remainder is uncollectible.c. Budgeted merchandise purchases and budgeted expenses for the third quarter are given below:

Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on June 30, which will be paid during July, total $160,000.

Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on June 30, which will be paid during July, total $160,000.d. Equipment costing $25,000 will be purchased for cash during July.

e. In preparing the cash budget, assume that the $60,000 loan will be made in July and repaid in September. Interest on the loan will total $2,000.

Required:

1. Prepare a schedule of expected cash collections for July. August, and September and for the quarter in total.

2. Prepare a cash budget, by month and in total, for the third quarter.

3. If the company needs a minimum cash balance of $20,000 to start each month, can the loan be repaid as planned Explain.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

Granger Stokes, managing partner of the venture capital firm of Halston and Stokes, was dissatisfied with the top management of PrimeDrive, a manufacturer of computer disk drives. Halston and Stokes had invested $20 million in PrimeDrive, and the return on their investment had been unsatisfactory for several years. In a tense meeting of the board of directors of PrimeDrive, Stokes exercised his firm's rights as the major equity investor in PrimeDrive and fired PrimeDrive's chief executive officer (CEO). He then quickly moved to have the board of directors of PrimeDrive appoint himself as the new CEO.

Stokes prided himself on his hard-driving management style. At the first management meeting, he asked two of the managers to stand and fired them on the spot, just to show everyone who was in control of the company. At the budget review meeting that followed, he ripped up the departmental budgets that had been submitted for his review and yelled at the managers for their "wimpy, do nothing targets." He then ordered everyone to submit new budgets calling for at least a 40% increase in sales volume and announced that he would not accept excuses for results that fell below budget.

Keri Kalani, an accountant working for the production manager at PrimeDrive, discovered toward the end of the year that her boss had not been scrapping defective disk drives that had been returned by customers. Instead, he had been shipping them in new cartons to other customers to avoid booking losses. Quality control had deteriorated during the year as a result of the push for increased volume, and returns of defective TRX drives were running as high as 15% of the new drives shipped. When she confronted her boss with her discovery, he told her to mind her own business. And then, to justify his actions, he said, "All of us managers are finding ways to hit Stokes's targets."

Required:

1. Is Granger Stokes using budgets as a planning and control tool

2. What are the behavioral consequences of the way budgets are being used at PrimeDrive

3. What, if anything, do you think Keri Kalani should do

Stokes prided himself on his hard-driving management style. At the first management meeting, he asked two of the managers to stand and fired them on the spot, just to show everyone who was in control of the company. At the budget review meeting that followed, he ripped up the departmental budgets that had been submitted for his review and yelled at the managers for their "wimpy, do nothing targets." He then ordered everyone to submit new budgets calling for at least a 40% increase in sales volume and announced that he would not accept excuses for results that fell below budget.

Keri Kalani, an accountant working for the production manager at PrimeDrive, discovered toward the end of the year that her boss had not been scrapping defective disk drives that had been returned by customers. Instead, he had been shipping them in new cartons to other customers to avoid booking losses. Quality control had deteriorated during the year as a result of the push for increased volume, and returns of defective TRX drives were running as high as 15% of the new drives shipped. When she confronted her boss with her discovery, he told her to mind her own business. And then, to justify his actions, he said, "All of us managers are finding ways to hit Stokes's targets."

Required:

1. Is Granger Stokes using budgets as a planning and control tool

2. What are the behavioral consequences of the way budgets are being used at PrimeDrive

3. What, if anything, do you think Keri Kalani should do

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

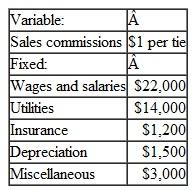

Jodi Horton, president of the retailer Crestline Products, has just approached the company's bank with a request for a $30,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories in support of peak April sales. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April-June, during which the loan will be used;

a. On April 1, the start of the loan period, the cash balance will be $26,000. Accounts receivable on April 1 will total $151.500. of which $141,000 will be collected during April and $7,200 will be collected during May. The remainder will be uncollectible.

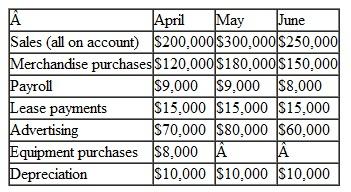

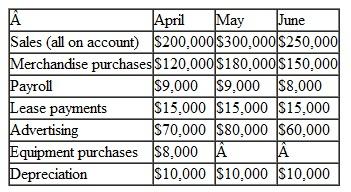

b. Past experience shows that 20% of a month's sales are collected in the month of sale, 75% in the month following sale, and 4% in the second month following sale. The other 1% represents bad debts that are never collected. Budgeted sales and expenses for the three-month period follow:

c. Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on March 31, which will be paid during April, total $108,000.

c. Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on March 31, which will be paid during April, total $108,000.

d. In preparing the cash budget, assume that the $30,000 loan will be made in April and repaid in June. Interest on the loan will total $1,200.

Required:

1. Prepare a schedule of expected cash collections for April, May, and June and for the three months in total.

2. Prepare a cash budget, by month and in total, for the three-month period.

3. If the company needs a minimum cash balance of $20,000 to start each month, can the loan be repaid as planned Explain.

a. On April 1, the start of the loan period, the cash balance will be $26,000. Accounts receivable on April 1 will total $151.500. of which $141,000 will be collected during April and $7,200 will be collected during May. The remainder will be uncollectible.

b. Past experience shows that 20% of a month's sales are collected in the month of sale, 75% in the month following sale, and 4% in the second month following sale. The other 1% represents bad debts that are never collected. Budgeted sales and expenses for the three-month period follow:

c. Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on March 31, which will be paid during April, total $108,000.

c. Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases on March 31, which will be paid during April, total $108,000.d. In preparing the cash budget, assume that the $30,000 loan will be made in April and repaid in June. Interest on the loan will total $1,200.

Required:

1. Prepare a schedule of expected cash collections for April, May, and June and for the three months in total.

2. Prepare a cash budget, by month and in total, for the three-month period.

3. If the company needs a minimum cash balance of $20,000 to start each month, can the loan be repaid as planned Explain.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

The president of Univax, Inc., has just approached the company's bank seeking short-term financing for the coming year, Year 2. Univax is a distributor of commercial vacuum cleaners. The bank has stated that the loan request must be accompanied by a detailed cash budget that shows the quarters in which financing will be needed, as well as the amounts that will be needed and the quarters in which repayments can be made.

To provide this information for the bank, the president has directed that the following data be gathered from which a cash budget can be prepared:

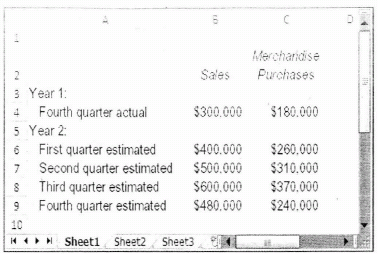

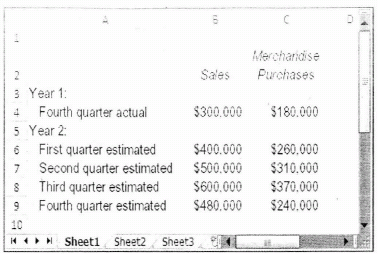

a. Budgeted sales and merchandise purchases for Year 2, as well as actual sales and purchases for the last quarter of Year 1. are as follows:

b. The company typically collects 33% of a quarter's sales before the quarter ends and another 65% in the following quarter. The remainder is uncollectible. This pattern of collections is now being experienced in the actual data for the Year 1 fourth quarter.

c. Some 20% of a quarter's merchandise purchases are paid for within the quarter. The remainder is paid in the following quarter.

d. Selling and administrative expenses for Year 2 are budgeted at $90,000 per quarter plus 12% of sales. Of the fixed amount. $20.000 each quarter is depreciation.

e. The company will pay SI0.000 in cash dividends each quarter.

f. Land purchases will be made as follows during the year: $80.000 in the second quarter and $48,500 in the third quarter.

g. The Cash account contained 520,000 at the end of Year 1. The company must maintain a minimum cash balance of at least $18,000.

h. The company has an agreement with a local bank that allows the company to borrow in increments of $10,000 at the beginning of each quarter, up to a total loan balance of $100,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the year.

i. At present, the company has no loans outstanding.

Required:

1. Prepare the following, by quarter and in total, for Year 2:

a. A schedule of expected cash collections on sales.

b. A schedule of expected cash disbursements for merchandise purchases.

3. Compute the expected cash disbursements for selling and administrative expenses, by quarter and in total, for Year 2.

4. Prepare a cash budget by quarter and in total for Year 2.

To provide this information for the bank, the president has directed that the following data be gathered from which a cash budget can be prepared:

a. Budgeted sales and merchandise purchases for Year 2, as well as actual sales and purchases for the last quarter of Year 1. are as follows:

b. The company typically collects 33% of a quarter's sales before the quarter ends and another 65% in the following quarter. The remainder is uncollectible. This pattern of collections is now being experienced in the actual data for the Year 1 fourth quarter.

c. Some 20% of a quarter's merchandise purchases are paid for within the quarter. The remainder is paid in the following quarter.

d. Selling and administrative expenses for Year 2 are budgeted at $90,000 per quarter plus 12% of sales. Of the fixed amount. $20.000 each quarter is depreciation.

e. The company will pay SI0.000 in cash dividends each quarter.

f. Land purchases will be made as follows during the year: $80.000 in the second quarter and $48,500 in the third quarter.

g. The Cash account contained 520,000 at the end of Year 1. The company must maintain a minimum cash balance of at least $18,000.

h. The company has an agreement with a local bank that allows the company to borrow in increments of $10,000 at the beginning of each quarter, up to a total loan balance of $100,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the year.

i. At present, the company has no loans outstanding.

Required:

1. Prepare the following, by quarter and in total, for Year 2:

a. A schedule of expected cash collections on sales.

b. A schedule of expected cash disbursements for merchandise purchases.

3. Compute the expected cash disbursements for selling and administrative expenses, by quarter and in total, for Year 2.

4. Prepare a cash budget by quarter and in total for Year 2.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

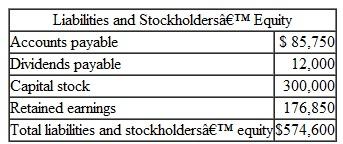

35