Deck 6: Legal, Regulatory, and Professional Obligations of Auditors

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 6: Legal, Regulatory, and Professional Obligations of Auditors

1

Advanced Battery Technologies: Reverse Merger

![Advanced Battery Technologies: Reverse Merger Questions 1.Do you believe the legal standards of allegations with particularity sufficient facts and of no audit at all cited in ABAT under Section 10(b) of the Securities Exchange Act of 1934 are too strict, too lenient, or just about right with respect to auditors' legal liability in cases similar to ABAT ? Explain. 2. In ABAT , the plaintiffs alleged that the auditors falsely represented that they performed their audits in accordance with professional standards and that ABAT's financial statements were fairly presented. The amended complaint alleged that the audit firms were reckless and committed an extreme departure from the reasonable standards of care by failing to identify several purported red flags. Do you believe the failure to identify red flags should be sufficient in a court of law to successfully allege gross negligence? Include in your discussion the purpose of auditors looking to detect red flags as part of their audits in accordance with GAAS. 3. Do you believe that auditors should be held legally liable when their filings to the SEC are [overly] optimistic while filings with Chinese regulatory agencies are [unduly] pessimistic? Explain using ethical reasoning to craft your answer.](https://d2lvgg3v3hfg70.cloudfront.net/SM1615/11eb75b5_726e_daf9_adfc_69fb0babd137_SM1615_00.jpg)

![Advanced Battery Technologies: Reverse Merger Questions 1.Do you believe the legal standards of allegations with particularity sufficient facts and of no audit at all cited in ABAT under Section 10(b) of the Securities Exchange Act of 1934 are too strict, too lenient, or just about right with respect to auditors' legal liability in cases similar to ABAT ? Explain. 2. In ABAT , the plaintiffs alleged that the auditors falsely represented that they performed their audits in accordance with professional standards and that ABAT's financial statements were fairly presented. The amended complaint alleged that the audit firms were reckless and committed an extreme departure from the reasonable standards of care by failing to identify several purported red flags. Do you believe the failure to identify red flags should be sufficient in a court of law to successfully allege gross negligence? Include in your discussion the purpose of auditors looking to detect red flags as part of their audits in accordance with GAAS. 3. Do you believe that auditors should be held legally liable when their filings to the SEC are [overly] optimistic while filings with Chinese regulatory agencies are [unduly] pessimistic? Explain using ethical reasoning to craft your answer.](https://d2lvgg3v3hfg70.cloudfront.net/SM1615/11eb75b5_726f_020a_adfc_c7135eee58df_SM1615_00.jpg)

Questions

1.Do you believe the legal standards of allegations with "particularity sufficient facts" and of "no audit at all" cited in ABAT under Section 10(b) of the Securities Exchange Act of 1934 are too strict, too lenient, or just about right with respect to auditors' legal liability in cases similar to ABAT ? Explain.

2. In ABAT , the plaintiffs alleged that the auditors falsely represented that they performed their audits in accordance with professional standards and that ABAT's financial statements were fairly presented. The amended complaint alleged that the audit firms were reckless and committed an "extreme departure from the reasonable standards of care" by failing to identify several purported "red flags." Do you believe the failure to identify red flags should be sufficient in a court of law to successfully allege gross negligence? Include in your discussion the purpose of auditors looking to detect red flags as part of their audits in accordance with GAAS.

3. Do you believe that auditors should be held legally liable when their filings to the SEC are [overly] optimistic while filings with Chinese regulatory agencies are [unduly] pessimistic? Explain using ethical reasoning to craft your answer.

![Advanced Battery Technologies: Reverse Merger Questions 1.Do you believe the legal standards of allegations with particularity sufficient facts and of no audit at all cited in ABAT under Section 10(b) of the Securities Exchange Act of 1934 are too strict, too lenient, or just about right with respect to auditors' legal liability in cases similar to ABAT ? Explain. 2. In ABAT , the plaintiffs alleged that the auditors falsely represented that they performed their audits in accordance with professional standards and that ABAT's financial statements were fairly presented. The amended complaint alleged that the audit firms were reckless and committed an extreme departure from the reasonable standards of care by failing to identify several purported red flags. Do you believe the failure to identify red flags should be sufficient in a court of law to successfully allege gross negligence? Include in your discussion the purpose of auditors looking to detect red flags as part of their audits in accordance with GAAS. 3. Do you believe that auditors should be held legally liable when their filings to the SEC are [overly] optimistic while filings with Chinese regulatory agencies are [unduly] pessimistic? Explain using ethical reasoning to craft your answer.](https://d2lvgg3v3hfg70.cloudfront.net/SM1615/11eb75b5_726e_daf9_adfc_69fb0babd137_SM1615_00.jpg)

![Advanced Battery Technologies: Reverse Merger Questions 1.Do you believe the legal standards of allegations with particularity sufficient facts and of no audit at all cited in ABAT under Section 10(b) of the Securities Exchange Act of 1934 are too strict, too lenient, or just about right with respect to auditors' legal liability in cases similar to ABAT ? Explain. 2. In ABAT , the plaintiffs alleged that the auditors falsely represented that they performed their audits in accordance with professional standards and that ABAT's financial statements were fairly presented. The amended complaint alleged that the audit firms were reckless and committed an extreme departure from the reasonable standards of care by failing to identify several purported red flags. Do you believe the failure to identify red flags should be sufficient in a court of law to successfully allege gross negligence? Include in your discussion the purpose of auditors looking to detect red flags as part of their audits in accordance with GAAS. 3. Do you believe that auditors should be held legally liable when their filings to the SEC are [overly] optimistic while filings with Chinese regulatory agencies are [unduly] pessimistic? Explain using ethical reasoning to craft your answer.](https://d2lvgg3v3hfg70.cloudfront.net/SM1615/11eb75b5_726f_020a_adfc_c7135eee58df_SM1615_00.jpg)

Questions

1.Do you believe the legal standards of allegations with "particularity sufficient facts" and of "no audit at all" cited in ABAT under Section 10(b) of the Securities Exchange Act of 1934 are too strict, too lenient, or just about right with respect to auditors' legal liability in cases similar to ABAT ? Explain.

2. In ABAT , the plaintiffs alleged that the auditors falsely represented that they performed their audits in accordance with professional standards and that ABAT's financial statements were fairly presented. The amended complaint alleged that the audit firms were reckless and committed an "extreme departure from the reasonable standards of care" by failing to identify several purported "red flags." Do you believe the failure to identify red flags should be sufficient in a court of law to successfully allege gross negligence? Include in your discussion the purpose of auditors looking to detect red flags as part of their audits in accordance with GAAS.

3. Do you believe that auditors should be held legally liable when their filings to the SEC are [overly] optimistic while filings with Chinese regulatory agencies are [unduly] pessimistic? Explain using ethical reasoning to craft your answer.

Securities Exchange Act of 1934 (SEA): This act was created to oversee security transactions in secondary market, it make sure that there is transparency and accuracy. It also ensures that there is less fraud and manipulation in security transactions. This act approves the formation of securities exchange commission (SEC), which is the regulatory body of SEA. It helps in monitoring the financial reports that companies which are trading publicly are required to disclose

Company AB and its auditors were accused of negligence and fraud. Plaintiffs file complaint against the auditors for auditing the accounts of country 'C' reverse merger companies. The case was dismissed by the court as the plaintiff was not able to adequately plead scienter under the provisions of Private Securities Litigation Reform Act (PSLRA).

1.

Section 10 b and Rule 10-5 of Security Exchange Act:

The section 10b when read with Rule 10-5 prohibits use of any scheme, device or article to defraud and create liability for any misstatement or omission of material fact in any public statement of a company. Any investor who takes decision on the basis of such statement and suffer loss can claim for damages from the company.

Auditors cannot be always found guilty of the action taken by them. The ruling under the given case provides the plaintiffs to prove scienter against an auditor or an audit firm to make him liable under the provisions of section 10b and rule 10(b)(5) of securities exchange act.

The plaintiff has to prove that the auditor's practices were so poor that it amount to 'no audit at all' and the firm ignored the signs that were very obvious that the audit firm should have known them.

It can be said that the legal standards of alligations cited under this case are not lenient but also not very strict with respect to the legal liablity of the auditors. The standard requires a specific condition which can prove auditors legaly liable in this case.

2.

Gross negligence is committed when the auditor voluntarily and consciously disregards the need of using reasonable care while conducting an audit.

In the given case it was alleged that auditors failed to prepare the accounts of the company in accordance with professional and accounting standards. It was alleged that auditors failed in identifying the purported 'red flags' that shows that something was wrong in the business.

It can be said that failure in identifying the red flags in the business are sufficient to prove that gross negligence on the part of auditor. There should be sufficient evidence to prove that auditors failed to apply due diligence in conducting a audit.

Generally accepted accounting standards (GAAS) provides an auditor to perform an audit with high professional standards. It is important for auditors to identify or detect the red flags of the business to protect the business from the future loss and also protect the interest of various stake holders who rely on the financial statements audited by an auditor.

3.

It can be accurately said that the auditors should be held legally liable for filing an optimistic reports of the company with securities exchange commission and at the same time filing pessimistic report with country 'C' regulating agencies. This is because a company reports cannot be overly optimistic and pessimistic at the same time.

It is against the ethical code of conduct of an auditor to file different reports for the same company to different regulating authorities. This would led to misunderstanding and will jeopardize the interest of the investors and other stakeholders.

Company AB and its auditors were accused of negligence and fraud. Plaintiffs file complaint against the auditors for auditing the accounts of country 'C' reverse merger companies. The case was dismissed by the court as the plaintiff was not able to adequately plead scienter under the provisions of Private Securities Litigation Reform Act (PSLRA).

1.

Section 10 b and Rule 10-5 of Security Exchange Act:

The section 10b when read with Rule 10-5 prohibits use of any scheme, device or article to defraud and create liability for any misstatement or omission of material fact in any public statement of a company. Any investor who takes decision on the basis of such statement and suffer loss can claim for damages from the company.

Auditors cannot be always found guilty of the action taken by them. The ruling under the given case provides the plaintiffs to prove scienter against an auditor or an audit firm to make him liable under the provisions of section 10b and rule 10(b)(5) of securities exchange act.

The plaintiff has to prove that the auditor's practices were so poor that it amount to 'no audit at all' and the firm ignored the signs that were very obvious that the audit firm should have known them.

It can be said that the legal standards of alligations cited under this case are not lenient but also not very strict with respect to the legal liablity of the auditors. The standard requires a specific condition which can prove auditors legaly liable in this case.

2.

Gross negligence is committed when the auditor voluntarily and consciously disregards the need of using reasonable care while conducting an audit.

In the given case it was alleged that auditors failed to prepare the accounts of the company in accordance with professional and accounting standards. It was alleged that auditors failed in identifying the purported 'red flags' that shows that something was wrong in the business.

It can be said that failure in identifying the red flags in the business are sufficient to prove that gross negligence on the part of auditor. There should be sufficient evidence to prove that auditors failed to apply due diligence in conducting a audit.

Generally accepted accounting standards (GAAS) provides an auditor to perform an audit with high professional standards. It is important for auditors to identify or detect the red flags of the business to protect the business from the future loss and also protect the interest of various stake holders who rely on the financial statements audited by an auditor.

3.

It can be accurately said that the auditors should be held legally liable for filing an optimistic reports of the company with securities exchange commission and at the same time filing pessimistic report with country 'C' regulating agencies. This is because a company reports cannot be overly optimistic and pessimistic at the same time.

It is against the ethical code of conduct of an auditor to file different reports for the same company to different regulating authorities. This would led to misunderstanding and will jeopardize the interest of the investors and other stakeholders.

2

As discussed in the opening reflection, MF Global filed a complaint charging PwC with professional malpractice, breach of contract, and unjust enrichment in connection with its advice concerning, and approval of, the company's off-balance-sheet accounting for its investments. The court's decision points out that absent PwC's advice, MF Global Holdings would not have invested heavily in European sovereign debt to generate immediate revenues and would not have suffered the massive damages that befell the company in 2011. Do you believe that auditors should be held legally liable when they advise clients on matters related to the company's finances that turn out to be wrong? Explain with reference to legal and professional standards.

Professional who is appointed as an auditor is responsible for performing his duties by using his skills and persistence. If he fails in performing his responsibilities, then he may be held liable for it.

There are several liabilities which an auditor faces which are as follows:

Liability of negligence : It arises when the auditor fails to examine the book of accounts properly.

Criminal liability of auditor: It arises when an auditor commit any wrongdoings during the course of audit.

Liable liability of an auditor: It arises when an auditor in his audit report defame any personnel of the company. Hence, he is responsible in the ground of defamation.

Company M filed a complaint against its audit firm for giving an advice that leads to loss to company M. Company M contended that it was the advice of the audit firm that makes M invest in a project which in turn was not profitable.

The auditor should not be held liable for the advices given by him to corporates in the course of his profession. When the advice is given in his professional capacity and that advice causes damages to the corporate, then the auditor cannot be held liable.

The auditor is not responsible for the advice given by him to his clients in professional qualification. He is only responsible for the audit function he has performed for the company.

An auditor who works ethically and fulfills his legal obligation is not liable for the decisions taken by him on professional basis but if it is found that the wrong decisions are taken with deceitful intensions, then the auditor can be held legally liable.

The legal and professional standards of the auditor determine code of conduct that is to be followed by an auditor. Various statute and authorities form rules and standards that are to be followed by an auditor. Whenever an auditor fails to adhere to the standards, then, he can be held liable.

There are several liabilities which an auditor faces which are as follows:

Liability of negligence : It arises when the auditor fails to examine the book of accounts properly.

Criminal liability of auditor: It arises when an auditor commit any wrongdoings during the course of audit.

Liable liability of an auditor: It arises when an auditor in his audit report defame any personnel of the company. Hence, he is responsible in the ground of defamation.

Company M filed a complaint against its audit firm for giving an advice that leads to loss to company M. Company M contended that it was the advice of the audit firm that makes M invest in a project which in turn was not profitable.

The auditor should not be held liable for the advices given by him to corporates in the course of his profession. When the advice is given in his professional capacity and that advice causes damages to the corporate, then the auditor cannot be held liable.

The auditor is not responsible for the advice given by him to his clients in professional qualification. He is only responsible for the audit function he has performed for the company.

An auditor who works ethically and fulfills his legal obligation is not liable for the decisions taken by him on professional basis but if it is found that the wrong decisions are taken with deceitful intensions, then the auditor can be held legally liable.

The legal and professional standards of the auditor determine code of conduct that is to be followed by an auditor. Various statute and authorities form rules and standards that are to be followed by an auditor. Whenever an auditor fails to adhere to the standards, then, he can be held liable.

3

Heinrich M ü ller: Big Four Whistleblower? (a GVV case)

Questions

1. Evaluate Heinrich's actions from an ethical perspective.

2. Assume you are in Heinrich's position and trying to decide among the following alternatives: (1) meet the reporter without discussing it with the firm; (2) meet with the reporter after first discussing it with the firm;(3) skipping a follow-up meeting altogether. What would you do and why?

3. Assume you have decided to meet with the firm first. Consider the following in developing a game plan on what you are going to say, who you are going to say it to, and why.

• What are the key values that inform your intended actions?

• What are the main arguments you are trying to counter? That is, what are the reasons and rationalizations you need to address?

• What is at stake for the key parties, including those who disagree with you?

• What levers can you use to influence those who disagree with you?

• What is your most powerful and persuasive response to the reasons and rationalizations you need to address? To whom should the argument be made? When and in what context?

4. In an ideal world, what do you hope the outcome of this situation will be after you meet with the firm? Explain.

Questions

1. Evaluate Heinrich's actions from an ethical perspective.

2. Assume you are in Heinrich's position and trying to decide among the following alternatives: (1) meet the reporter without discussing it with the firm; (2) meet with the reporter after first discussing it with the firm;(3) skipping a follow-up meeting altogether. What would you do and why?

3. Assume you have decided to meet with the firm first. Consider the following in developing a game plan on what you are going to say, who you are going to say it to, and why.

• What are the key values that inform your intended actions?

• What are the main arguments you are trying to counter? That is, what are the reasons and rationalizations you need to address?

• What is at stake for the key parties, including those who disagree with you?

• What levers can you use to influence those who disagree with you?

• What is your most powerful and persuasive response to the reasons and rationalizations you need to address? To whom should the argument be made? When and in what context?

4. In an ideal world, what do you hope the outcome of this situation will be after you meet with the firm? Explain.

Whistleblower: It refers to a person (employee) who blows a whistle regarding the unethical and illegal activities that are going on in his company in his presence.

When an employee discovers any illegal or unethical activity of any officer or other employee of the company and decides to disclose these activities to public or appropriate authority, this action is termed as whistle blowing.

Person H discovers few confidential information about the tax avoidance strategies of his company. He went to his supervisor and found that she too was involved in the whole arrangement. At last he decided to blow the whistle regarding these actions and with the help of a reporter who called H regarding the information that was received by him related to unethical tax transactions of company in which H was working.

1.

If H's actions are evaluated on ethical perspective it can be said that H is the person of high morals and ethical conduct.

The facts of the case state that H was an ethical person and professional too. As soon as he discovered the matters related to tax avoidance he made an attempt to report it. However later he discovered that his supervisor were also involved in the whole arrangement of tax avoidance. Even then he was determined to make sure that the arrangement was exposed by one way or another.

Thus it can be concluded that H was an ethical person and professional.

2.

If a person discovers the conventional information in place of person H and is given following three alternative:

a. Meet the reporter before discussing with the firm.

b. Meet the reporter after first discussing it with the firm

c. Skipping a Follow up meeting

He should choose the alternative number second. This is because before going directly to the reporter the person should discuss the matter with his firm he should try to find a solution out with his company. If he is unable to find any solution or way out after the discussion with the company then he should take help of the third person that is the reporter.

Thus it can be said that the alterative number second is an appropriate alternative for any individual who sees himself in place of H.

3.

As an individual takes the second alternative and decides to meet with the firm first then the following game plan will be developed:

a. The key factors that determine the actions of an individual are honesty, morals and professional code of conduct.

b. Some of the arguments that are to be countered by the individual are, that the acts of tax avoidance should not be done within the organization as the organization is not only for a single or a group of person but for the whole community, that the actions of the executives are criminal offence and can leads to severe consequences, that the fraud will not only affect the people involved but the organization as a whole and other members of the organizations.

c. The parties involved and their stakes in this argument are:

(i) The company: The Company's part which is at stake is its reputation, goodwill, profit and long term survival.

(ii) The person H : H's code of conduct, morals and ethical values are at stake.

(iii) The executive: all the executive's personal benefit, his job and reputation in the company are at stake.

d. If an individual faces any such situation of dilemma he should uses following levers to convince the people who are against him:

(i) Positive persuasion - the person can persuade the people against him in a positive way, like he can make them realize that the act done by them is not ethical and legal and the consequences of this will adversely affect the lives of many people.

(ii) Negative persuasion- the person can persuade the people against him in a negative way, like he can threaten them of disclosing their name to the higher authorities and media if the refuse to stop such illegal action.

e. It is the basic human nature that most of the people respond to negative persuasion. Thus in this case the most powerful response an individual can give to pursue the other party is negative persuasion. The person should make such response to the executives that are involved in such engagement while the meeting with such executives.

4.

In the practical world there can be two outcomes of the given situation that are given below:

a. The executives of the firm would realize their mistake and stop doing such acts.

b. The executive of the firm would refuse to stop such acts and they would be disclosed by employees like H.

When an employee discovers any illegal or unethical activity of any officer or other employee of the company and decides to disclose these activities to public or appropriate authority, this action is termed as whistle blowing.

Person H discovers few confidential information about the tax avoidance strategies of his company. He went to his supervisor and found that she too was involved in the whole arrangement. At last he decided to blow the whistle regarding these actions and with the help of a reporter who called H regarding the information that was received by him related to unethical tax transactions of company in which H was working.

1.

If H's actions are evaluated on ethical perspective it can be said that H is the person of high morals and ethical conduct.

The facts of the case state that H was an ethical person and professional too. As soon as he discovered the matters related to tax avoidance he made an attempt to report it. However later he discovered that his supervisor were also involved in the whole arrangement of tax avoidance. Even then he was determined to make sure that the arrangement was exposed by one way or another.

Thus it can be concluded that H was an ethical person and professional.

2.

If a person discovers the conventional information in place of person H and is given following three alternative:

a. Meet the reporter before discussing with the firm.

b. Meet the reporter after first discussing it with the firm

c. Skipping a Follow up meeting

He should choose the alternative number second. This is because before going directly to the reporter the person should discuss the matter with his firm he should try to find a solution out with his company. If he is unable to find any solution or way out after the discussion with the company then he should take help of the third person that is the reporter.

Thus it can be said that the alterative number second is an appropriate alternative for any individual who sees himself in place of H.

3.

As an individual takes the second alternative and decides to meet with the firm first then the following game plan will be developed:

a. The key factors that determine the actions of an individual are honesty, morals and professional code of conduct.

b. Some of the arguments that are to be countered by the individual are, that the acts of tax avoidance should not be done within the organization as the organization is not only for a single or a group of person but for the whole community, that the actions of the executives are criminal offence and can leads to severe consequences, that the fraud will not only affect the people involved but the organization as a whole and other members of the organizations.

c. The parties involved and their stakes in this argument are:

(i) The company: The Company's part which is at stake is its reputation, goodwill, profit and long term survival.

(ii) The person H : H's code of conduct, morals and ethical values are at stake.

(iii) The executive: all the executive's personal benefit, his job and reputation in the company are at stake.

d. If an individual faces any such situation of dilemma he should uses following levers to convince the people who are against him:

(i) Positive persuasion - the person can persuade the people against him in a positive way, like he can make them realize that the act done by them is not ethical and legal and the consequences of this will adversely affect the lives of many people.

(ii) Negative persuasion- the person can persuade the people against him in a negative way, like he can threaten them of disclosing their name to the higher authorities and media if the refuse to stop such illegal action.

e. It is the basic human nature that most of the people respond to negative persuasion. Thus in this case the most powerful response an individual can give to pursue the other party is negative persuasion. The person should make such response to the executives that are involved in such engagement while the meeting with such executives.

4.

In the practical world there can be two outcomes of the given situation that are given below:

a. The executives of the firm would realize their mistake and stop doing such acts.

b. The executive of the firm would refuse to stop such acts and they would be disclosed by employees like H.

4

Distinguish between common-law liability and statutory liability for auditors. What is the basis for the difference in liability?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

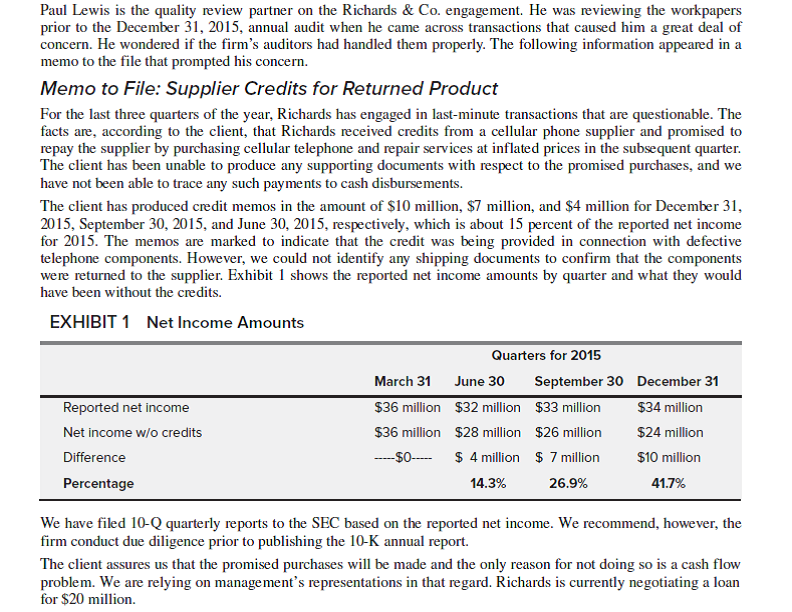

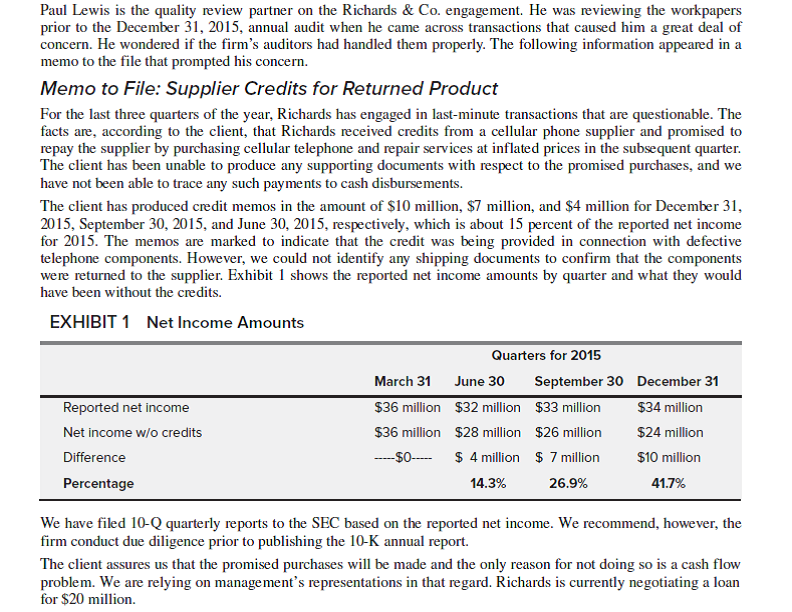

Richards Co: Year-end Audit Engagement

Questions

1. Does it seem from the limited data that the credit memo transactions can be justified as adjustments to reported net income amounts? Explain.

2. From an audit perspective, do you think the firm followed generally accepted auditing standards? Explain.

3. Based on the limited facts presented, do you think the firm violated any provisions of the Securities Exchange Act of 1934? Explain with reference to the auditors' legal liability.

Questions

1. Does it seem from the limited data that the credit memo transactions can be justified as adjustments to reported net income amounts? Explain.

2. From an audit perspective, do you think the firm followed generally accepted auditing standards? Explain.

3. Based on the limited facts presented, do you think the firm violated any provisions of the Securities Exchange Act of 1934? Explain with reference to the auditors' legal liability.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

Is there a conceptual difference between an error and negligence from a reasonable care perspective? Give examples of each in your response.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

Anjoorian et al.: Third-Party Liability

Questions

1. The court found that the addressing of audit reports to the shareholders, while not conclusive, is a strong indication that P T intended the shareholders to rely upon them. Do you agree, in general, that addressing the reports to a class of owners should be sufficient to hold an auditor legally liable to any shareholder who can demonstrate a lack of reasonable care? What about in applying the facts of this case? Would your conclusion change? Explain.

2. Judge Silverstein relied on the Restatement (Second) of the Law of Torts for his ruling. Assume he had relied on the "near-privity relationship" ruling in Credit Alliance, and evaluate the legal liability of the auditors using that standard.

3. The court decision refers to the importance of the auditors' knowing about third-party usage of the audited financial statements. What role does such knowledge play in enabling auditors to meet their professional and ethical responsibilities?

Questions

1. The court found that the addressing of audit reports to the shareholders, while not conclusive, is a strong indication that P T intended the shareholders to rely upon them. Do you agree, in general, that addressing the reports to a class of owners should be sufficient to hold an auditor legally liable to any shareholder who can demonstrate a lack of reasonable care? What about in applying the facts of this case? Would your conclusion change? Explain.

2. Judge Silverstein relied on the Restatement (Second) of the Law of Torts for his ruling. Assume he had relied on the "near-privity relationship" ruling in Credit Alliance, and evaluate the legal liability of the auditors using that standard.

3. The court decision refers to the importance of the auditors' knowing about third-party usage of the audited financial statements. What role does such knowledge play in enabling auditors to meet their professional and ethical responsibilities?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

Distinguish between the legal concepts of actually foreseen third-party users and reasonably foreseeable third-party users. How does each concept establish a basis for an auditor's legal liability to third parties?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

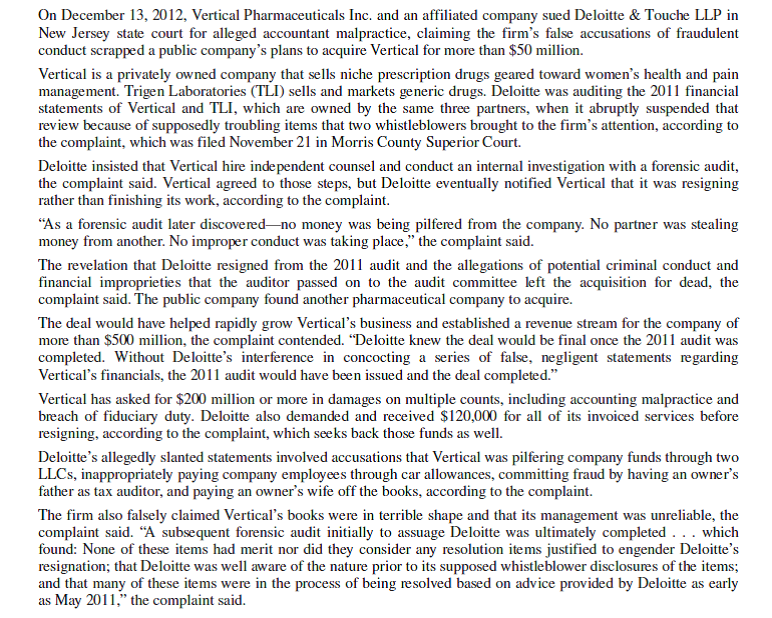

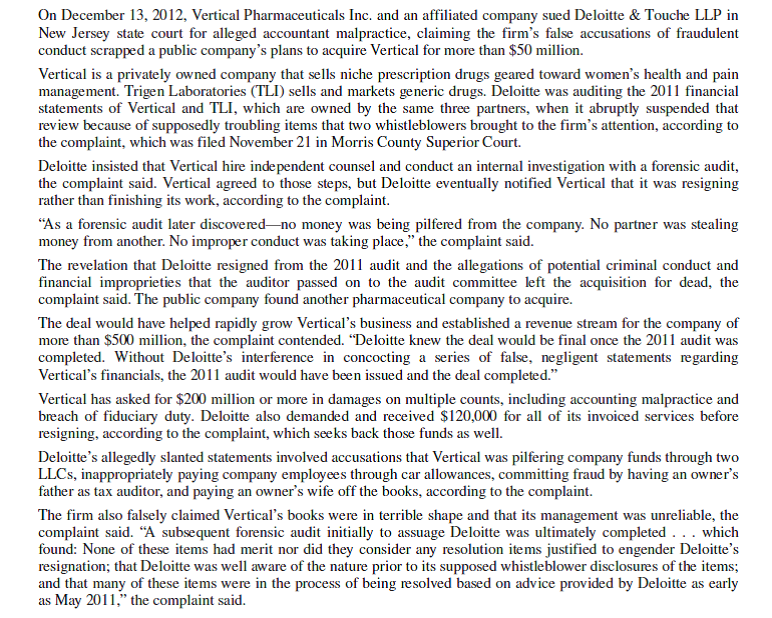

Vertical Pharmaceuticals Inc. et al. v. Deloitte Touche LLP

Questions

1. Do you believe Deloitte Touche breached its fiduciary duty to Vertical Pharmaceuticals in this case? Explain.

2. Do you believe Deloitte was guilty of malpractice as alleged by Vertical? Use the discussion in this chapter to answer the question.

3. Do you think it was ethical for Deloitte to resign from the engagement without waiting for the results of the investigation and forensic audit that was conducted at Deloitte's insistence? Use ethical reasoning to support your belief.

Questions

1. Do you believe Deloitte Touche breached its fiduciary duty to Vertical Pharmaceuticals in this case? Explain.

2. Do you believe Deloitte was guilty of malpractice as alleged by Vertical? Use the discussion in this chapter to answer the question.

3. Do you think it was ethical for Deloitte to resign from the engagement without waiting for the results of the investigation and forensic audit that was conducted at Deloitte's insistence? Use ethical reasoning to support your belief.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

Do you think that the provision of nonaudit services for a client with a failed audit is evidence of negligence? Explain.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

Kay Lee, LLP

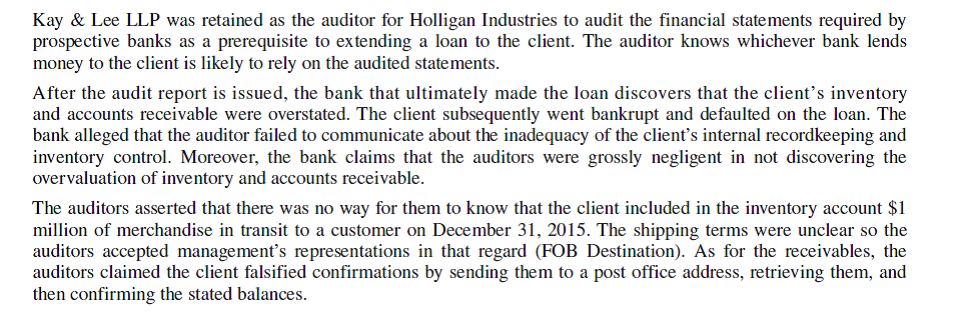

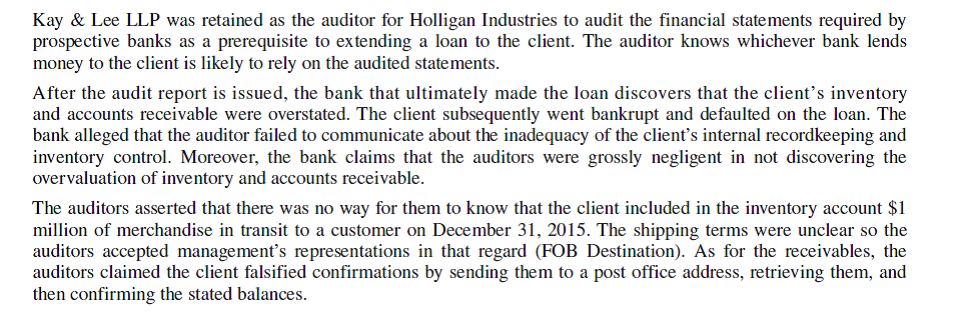

Questions

1. What would the bank have to prove to successfully bring a lawsuit against Kay Lee?

2. What defenses might the auditors use to rebut any charges made about their (deficient) audit?

3. Critically evaluate the auditors' statements about the inventory and receivables with respect to generally accepted auditing standards and the firm's ethical responsibilities.

Questions

1. What would the bank have to prove to successfully bring a lawsuit against Kay Lee?

2. What defenses might the auditors use to rebut any charges made about their (deficient) audit?

3. Critically evaluate the auditors' statements about the inventory and receivables with respect to generally accepted auditing standards and the firm's ethical responsibilities.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

Explain the legal basis for a cause of action against an auditor. What are the defenses available to the auditor to rebut such charges? How does adherence to the ethical standards of the accounting profession relate to these defenses?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

Getaway Cruise Lines: Questionable Payments to do Business Overseas (a GVV case)

Questions

1. Do you think the two payments are facilitation payments or bribes? Explain.

2. How might Kristen best explain her point of view to Matt while being true to her values?

3. What are the likely reasons and rationalizations Matt will give for making the payments discussed in the case?

4. Are there any levers that Kirsten can use to counteract the reason and rationalizations and persuade Matt about the right thing to do?

Questions

1. Do you think the two payments are facilitation payments or bribes? Explain.

2. How might Kristen best explain her point of view to Matt while being true to her values?

3. What are the likely reasons and rationalizations Matt will give for making the payments discussed in the case?

4. Are there any levers that Kirsten can use to counteract the reason and rationalizations and persuade Matt about the right thing to do?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

Assume a third party such as a successor audit firm quickly discovers a fraud that the predecessor external auditor has overlooked for years. Do you think this provides evidence supporting scienter? Explain.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

Con-way Inc.

Summary of Findings

Questions

1. The FCPA distinguishes between so-called facilitating payments and more serious activities. Do you think such a distinction and the related penalties for violations under the Act make sense from an ethical perspective? Use the utilitarian analysis to support your position.

2. Assume the auditors of Con-way knew about the accounting for FCPA payments in the books and records of the company. Do you think the auditors would be guilty of: (1) ordinary negligence; (2) gross negligence; or (3) fraud? Explain.

3. Given that the FCPA permits facilitating payments, do you believe it is ethically appropriate for companies to deduct such payments from their income taxes? Why or why not? What about outright bribery payments? What does the law require in each instance with respect to tax deductibility?

Summary of Findings

Questions

1. The FCPA distinguishes between so-called facilitating payments and more serious activities. Do you think such a distinction and the related penalties for violations under the Act make sense from an ethical perspective? Use the utilitarian analysis to support your position.

2. Assume the auditors of Con-way knew about the accounting for FCPA payments in the books and records of the company. Do you think the auditors would be guilty of: (1) ordinary negligence; (2) gross negligence; or (3) fraud? Explain.

3. Given that the FCPA permits facilitating payments, do you believe it is ethically appropriate for companies to deduct such payments from their income taxes? Why or why not? What about outright bribery payments? What does the law require in each instance with respect to tax deductibility?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

What are the legal requirements for a third party to sue an auditor under Section 10 and Rule 10b-5 of the Securities Exchange Act of 1934? How do these requirements relate to the Hochfelder decision?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

Satyam: India's Enron

Questions

1. Madan Bahsin concludes in her research paper that examined the fraud at Satyam that "the scandal brought to light the importance of ethics and its relevance to corporate culture." Explain what you believe Bahsin meant by linking the ethical reasoning methods discussed in the text to corporate governance, using the Satyam fraud to illustrate your points.

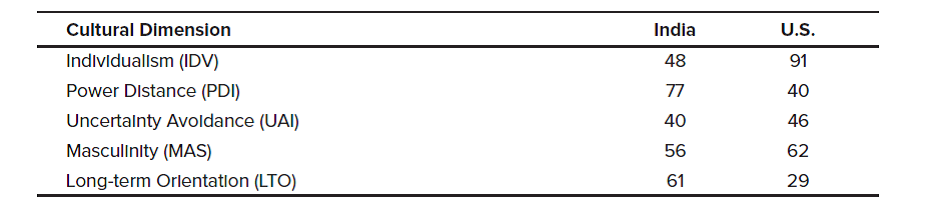

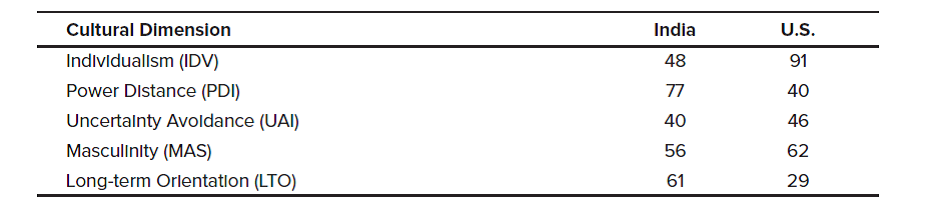

2. Hofstede's cultural values that were discussed in Chapter 1 reflect the following scores with respect to India and the United States.

Do you believe these differences in cultural values and the discussion in this chapter about corporate governance in India can be used to explain the nature and scope of the fraud at Satyam including the involvement of Raju in the acquisition of two companies owned by his sons? What checks and balances might have existed in the United States to deal with the fraud in a more effective manner?

3. Briefly discuss the audit failures of PwC and its affiliates with respect to the accounting issues raised in the case including fraud risk assessment. What rules of professional conduct in the AICPA Code that was discussed in Chapter 4 were violated?

Questions

1. Madan Bahsin concludes in her research paper that examined the fraud at Satyam that "the scandal brought to light the importance of ethics and its relevance to corporate culture." Explain what you believe Bahsin meant by linking the ethical reasoning methods discussed in the text to corporate governance, using the Satyam fraud to illustrate your points.

2. Hofstede's cultural values that were discussed in Chapter 1 reflect the following scores with respect to India and the United States.

Do you believe these differences in cultural values and the discussion in this chapter about corporate governance in India can be used to explain the nature and scope of the fraud at Satyam including the involvement of Raju in the acquisition of two companies owned by his sons? What checks and balances might have existed in the United States to deal with the fraud in a more effective manner?

3. Briefly discuss the audit failures of PwC and its affiliates with respect to the accounting issues raised in the case including fraud risk assessment. What rules of professional conduct in the AICPA Code that was discussed in Chapter 4 were violated?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

Valley View Manufacturing Inc. sought a $500,000 loan from First National Bank. First National insisted that audited financial statements be submitted before it would extend credit. Valley View agreed to do so, and an audit was performed by an independent CPA who submitted her report to Valley View. First National, upon reviewing the audited statements, decided to extend the credit desired. Certain ratios used by First National in reaching its decision were extremely positive indicating a strong cash flow. It was subsequently learned that the CPA, despite the exercise of reasonable care, had failed to discover a sophisticated embezzlement scheme by Valley View's chief accountant. Under these circumstances, what liability might the CPA have?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

Autonomy

Background

Questions

1. In an analysis by the Association of Certified Financial Crime Specialists (ACFCS) about the Autonomy merger with HP, the following statement is made: "The scandal is prompting questions about who is to blame for the soured merger. As details emerge, the case is spotlighting the difficulties that accountants and lawyers face in complex mergers and acquisitions and business deals. The case also raises the issue of what responsibility these professionals have for detecting potentially fraudulent business records where the line between accounting discrepancies and financial crime is blurred." Given the facts of the case, do you believe Deloitte met its obligations with regard to due care and professional judgment? Explain.

2. Meg Whitman is quoted in the case as saying that the board, which approved the Autonomy transaction, relied on audited information from Deloitte Touche and additional auditing from KPMG. Given that auditing standards and legal requirements dictate that auditors are responsible for detecting material fraud in the financial statements of audit clients, would you blame the auditors for failing to uncover the improper accounting for revenue at Autonomy? Which audit and ethical standards are critical in making that determination?

3. Do you believe a conflict of interest exists when audit firms earn about as much money from nonaudit services as audit services, given they are expected to make independent judgments on the financial transactions and financial reporting of their audit clients? Explain by using the Autonomy case as one such example of a possible conflict.

Background

Questions

1. In an analysis by the Association of Certified Financial Crime Specialists (ACFCS) about the Autonomy merger with HP, the following statement is made: "The scandal is prompting questions about who is to blame for the soured merger. As details emerge, the case is spotlighting the difficulties that accountants and lawyers face in complex mergers and acquisitions and business deals. The case also raises the issue of what responsibility these professionals have for detecting potentially fraudulent business records where the line between accounting discrepancies and financial crime is blurred." Given the facts of the case, do you believe Deloitte met its obligations with regard to due care and professional judgment? Explain.

2. Meg Whitman is quoted in the case as saying that the board, which approved the Autonomy transaction, relied on audited information from Deloitte Touche and additional auditing from KPMG. Given that auditing standards and legal requirements dictate that auditors are responsible for detecting material fraud in the financial statements of audit clients, would you blame the auditors for failing to uncover the improper accounting for revenue at Autonomy? Which audit and ethical standards are critical in making that determination?

3. Do you believe a conflict of interest exists when audit firms earn about as much money from nonaudit services as audit services, given they are expected to make independent judgments on the financial transactions and financial reporting of their audit clients? Explain by using the Autonomy case as one such example of a possible conflict.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Nixon Co., CPAs, issued an unmodified opinion on the 2015 financial statements of Madison Corp. These financial statements were included in Madison's annual report and Form 10-K filed with the SEC. Nixon did not detect material misstatements in the financial statements as a result of negligence in the performance of the audit. Based upon the financial statements, Harry Corp. purchased stock in Madison. Shortly thereafter, Madison became insolvent, causing the price of the stock to decline drastically. Harry has commenced legal action against Nixon for damages based upon Section 10(b) and Rule 10b-5 of the Securities Exchange Act of 1934. What would be Nixon's best defense to such an action? Explain.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

The following pertains to auditor legal liability standards under the PSLRA:

a. The Reform Act requires that, in any private securities fraud action in which the plaintiff is alleging a misleading statement or omission on the part of the defendant, "the complaint shall specify each statement alleged to have been misleading, the reason or reasons why the statement is misleading, and, if an allegation regarding the statement or omission is made on information and belief, the complaint shall state with particularity all facts on which that belief is formed." 90

Do you believe this standard better protects auditors from legal liability than the standards which existed before the PSLRA? Explain.

b. Do you believe the change in standards for auditors' liability under the PSLRA from joint and-several to proportional liability was a good thing? Explain.

a. The Reform Act requires that, in any private securities fraud action in which the plaintiff is alleging a misleading statement or omission on the part of the defendant, "the complaint shall specify each statement alleged to have been misleading, the reason or reasons why the statement is misleading, and, if an allegation regarding the statement or omission is made on information and belief, the complaint shall state with particularity all facts on which that belief is formed." 90

Do you believe this standard better protects auditors from legal liability than the standards which existed before the PSLRA? Explain.

b. Do you believe the change in standards for auditors' liability under the PSLRA from joint and-several to proportional liability was a good thing? Explain.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

Some auditors claim that increased exposure under Section 404 of SOX creates a litigation environment that is unfairly risky for auditors. Do you think that the inability of auditors to detect a financial statement misstatement due to gross deficiencies in internal controls over financial reporting should expose auditors to litigation? Why or why not? Include reference to appropriate ethical standards in your response.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Assume a U.S. company operates overseas and is approached by foreign governments officials with a request to provide family members with student internships with the company. The company does business in that country with foreign customers and is negotiating for a contract with one such customer to provide services. Under what circumstances might such a request violate the FCPA?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Has the accounting profession created a situation in which auditors' ethical behavior is impaired by their professional obligations? How does the profession's view of such obligations relate to how courts tend to view the legal liability of auditors?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

Consider the following statement and explain the relationship between legal compliance on a global level and ethical responsibilities of accountants and auditors: "Ethical values and legal principles are usually closely related, but ethical obligations typically exceed legal duties."

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

Business ethics is about managing ethics in an organizational context and involves applying principles and standards that guide behavior in business conduct. According to IFAC, "The decisions and behaviors of accountants should reinforce good governance and ethical practices, develop and promote an ethical culture, foster trust and transparency, bring credibility and value to decision making, and present a faithful picture of organizational health to stakeholders." Explain how accountants and auditors can meet these expectations in a global environment and protect the public interest.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

How do Gray's accounting values establish a basis for financial reporting in countries with different cultural systems?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

What are the costs and benefits of establishing one set of accounting standards (i.e., IFRS) around the world? How do cultural factors, legal systems, and ethics influence your answer? Apply a utilitarian approach in making the analysis.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

The Institute of Chartered Accountants in England and Wales (ICAEW) has adopted a code of ethics based on the IFAC Code. In commenting on the principles-based approach used in these codes, the ICAEW states that a principles approach "focuses on the spirit of the guidance and encourage responsibility and the exercise of professional judgment, which are key elements of professions." Explain how factors underlying professional judgment that were discussed in Chapter 4 come into play in the global environment.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

Consider the practice of making "facilitating payments" to foreign officials and others as part of doing business abroad in the context of the following statement: International companies are confronted with a variety of decisions that create ethical dilemmas for the decision makers. "Right wrong" and "just-unjust" derive their meaning and true value from the attitudes of a given culture. Some ethical standards are culture-specific, and we should not be surprised to find that an act that is considered quite ethical in one culture may be looked upon with disregard in another. Explain how culture interacts with the acceptability of making facilitating payments in a country. Use rights theory and justice reasoning to analyze the ethics of allowing facilitating payments such as under the FCPA in the United States and prohibiting them as under the U.K. Bribery Act.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

One provision of the U.K. Bribery Act is that it applies to bribes that occur anywhere in the world by non-U.K. companies that conduct any part of their business in the United Kingdom. For example, the Bribery Act would cover a company that has a few employees working in the United Kingdom or that simply sells its goods or services in the United Kingdom. Evaluate this policy from an ethical perspective using ethical reasoning. In particular, do you think the policy is fair? Is it right?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

What is the purpose of having a two-tier system of boards of directors in countries such as Germany? How does the dual-board approach ameliorate the potential conflicts in the principal-agent relationship between investor and manager?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

In discussing the benefits of the Global Code of Ethics, Richard George, chairperson of the International Ethics Standards Board for Accountants, said, "Strong and clear independence standards are vital to investor trust in financial reporting. The increase in trust and certainty that flow from familiarity with standards, including a common understanding of what it means to be independent when providing assurance services, will contribute immeasurably to a reduction in barriers to international capital flows." Explain the link between auditor independence and facilitating international capital flows from the public interest perspective.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

What are the unique challenges to the global internal audit function?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

In this chapter, we discuss problems encountered by the PCAOB in gaining access to inspect work papers of auditors in U.S. international accounting firms that have Chinese company clients that list their stock in the United States. Explain why these problems exist from a cultural and legal perspective. How might shareholder interests be compromised by the arrangement between the PCAOB and CSRC that was struck in the Long top Financial case discussed in this chapter?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck