Deck 13: Monetary Policy: Conventional and Unconventional

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/15

Play

Full screen (f)

Deck 13: Monetary Policy: Conventional and Unconventional

1

Explain what a $5 billion increase in bank reserves will do to real GDP under the following assumptions:

a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point.

b. Each 1 percentage point decline in interest rates stimulates $30 billion worth of new investment.

c. The expenditure multiplier is two.

d. The aggregate supply curve is so flat that prices do not rise noticeably when demand increases.

a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point.

b. Each 1 percentage point decline in interest rates stimulates $30 billion worth of new investment.

c. The expenditure multiplier is two.

d. The aggregate supply curve is so flat that prices do not rise noticeably when demand increases.

a. Increase in bank reserves by $1 billion reduces the interest rate by 0.5.

Assume that each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point. In such condition, $5 billion increase in bank reserves will reduce the interest rate by 2.5 percentage points.

The fall in rate of interest will lead to an increase in consumption and investment. As a result, the real GDP will increase. Hence, increase in bank reserves by $5 billion will positively affect the real GDP.

b. One percent decrease in interest rates stimulates investment by $30 billon

Assume that each 1 percentage point decline in rate of interest increases investment by $30 billion. The increase in bank reserves by $5 billion will reduce the supply of money into the market. This in turn increases the interest rate. Hence, one percent increase in interest rate will reduce the investment by $30 billion.

The decrease in investment will cause the real GDP to decrease. Hence, increase in bank reserve by $5 billion will negatively affect the real GDP.

c. Expenditure multiplier is two

Assume that expenditure multiplier is two. In such condition, increase in bank reserves by $5 billion will reduce the liquidity in the market. This in turn reduces the consumption. Hence, increase in bank reserves by $5 billion will reduce the real GDP.

d. Supply curve is flat

Assume that the supply curve is flat; it means prices do not respond to any change in demand.

The increase in bank reserves by $5 billion will reduce the demand for goods and services in the market. Since the supply curve is so flat, the reduction of demand will affect the output rather than price.

In a flat supply curve, increase in bank reserves by $5 billion will reduce the real GDP.

Assume that each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point. In such condition, $5 billion increase in bank reserves will reduce the interest rate by 2.5 percentage points.

The fall in rate of interest will lead to an increase in consumption and investment. As a result, the real GDP will increase. Hence, increase in bank reserves by $5 billion will positively affect the real GDP.

b. One percent decrease in interest rates stimulates investment by $30 billon

Assume that each 1 percentage point decline in rate of interest increases investment by $30 billion. The increase in bank reserves by $5 billion will reduce the supply of money into the market. This in turn increases the interest rate. Hence, one percent increase in interest rate will reduce the investment by $30 billion.

The decrease in investment will cause the real GDP to decrease. Hence, increase in bank reserve by $5 billion will negatively affect the real GDP.

c. Expenditure multiplier is two

Assume that expenditure multiplier is two. In such condition, increase in bank reserves by $5 billion will reduce the liquidity in the market. This in turn reduces the consumption. Hence, increase in bank reserves by $5 billion will reduce the real GDP.

d. Supply curve is flat

Assume that the supply curve is flat; it means prices do not respond to any change in demand.

The increase in bank reserves by $5 billion will reduce the demand for goods and services in the market. Since the supply curve is so flat, the reduction of demand will affect the output rather than price.

In a flat supply curve, increase in bank reserves by $5 billion will reduce the real GDP.

2

Explain why both business investments and purchases of new homes rise when interest rates decline.

Reasons for increasing investment and purchasing new homes at decreasing interest rates

When the interest rate decreases, the cost of borrowing becomes low, which makes the borrowing cheaper. Since the borrowing is cheaper, the investment gives more profit. Hence, when the interest rate decreases, it leads to an increase in investment.

The value of homes is expected to increase over a period of time. When the interest rate is lower than the expected returns from the home property, it is profitable to buy a home by borrowing money. Hence, at lower interest rates, people prefer to purchase more new homes.

When the interest rate decreases, the cost of borrowing becomes low, which makes the borrowing cheaper. Since the borrowing is cheaper, the investment gives more profit. Hence, when the interest rate decreases, it leads to an increase in investment.

The value of homes is expected to increase over a period of time. When the interest rate is lower than the expected returns from the home property, it is profitable to buy a home by borrowing money. Hence, at lower interest rates, people prefer to purchase more new homes.

3

Explain how your answers to Test Yourself Question 5 would differ if each of the assumptions changed. Specifically, what sorts of changes in the assumptions would weaken the effects of monetary policy

Reference Test Yourself Question 5

Explain what a $5 billion increase in bank reserves will do to real GDP under the following assumptions:

a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point.

b. Each 1 percentage point decline in interest rates stimulates $30 billion worth of new investment.

c. The expenditure multiplier is two.

d. The aggregate supply curve is so flat that prices do not rise noticeably when demand increases.

Reference Test Yourself Question 5

Explain what a $5 billion increase in bank reserves will do to real GDP under the following assumptions:

a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point.

b. Each 1 percentage point decline in interest rates stimulates $30 billion worth of new investment.

c. The expenditure multiplier is two.

d. The aggregate supply curve is so flat that prices do not rise noticeably when demand increases.

a. Each $1 billion increase in bank reserve increases the rate of interest by 0.1 percentage point

If each $1 billion increase in bank reserve increases the rate of interest by 0.1 percentage point, then $5 billion increase in bank reserve will increase the rate of interest by 0.5 percentage points.

The increase in rate of interest will reduce the real GDP, but the effect of monetary policy will be very weak.

b. 1 percentage point decline in interest rate would increase investment by $0.5 billion

If 1 percentage point decline in rate of interest would increase investment by $0.5 billion, then the effect of monetary policy will be weaker.

Under such a condition, $5 billion increase in bank reserve will increase the rate of interest; as a result, the investment will fall slightly. The fall in investment will cause the real GDP to fall.

c. Consumption multiplier is 0.2

Since the bank reserve has a negative influence on consumption, bank reserve increase by $5 billion will reduce the level of consumption. If expenditure multiplier is 0.2, then the change in bank reserve will have less effect on the real GDP growth.

d. Steeper aggregate supply curve

If aggregate supply curve is steeper, then increase in bank reserve by $5 billion will cause the price to rise more than the increase in real GDP. Hence, the monetary policy will be weaker.

If each $1 billion increase in bank reserve increases the rate of interest by 0.1 percentage point, then $5 billion increase in bank reserve will increase the rate of interest by 0.5 percentage points.

The increase in rate of interest will reduce the real GDP, but the effect of monetary policy will be very weak.

b. 1 percentage point decline in interest rate would increase investment by $0.5 billion

If 1 percentage point decline in rate of interest would increase investment by $0.5 billion, then the effect of monetary policy will be weaker.

Under such a condition, $5 billion increase in bank reserve will increase the rate of interest; as a result, the investment will fall slightly. The fall in investment will cause the real GDP to fall.

c. Consumption multiplier is 0.2

Since the bank reserve has a negative influence on consumption, bank reserve increase by $5 billion will reduce the level of consumption. If expenditure multiplier is 0.2, then the change in bank reserve will have less effect on the real GDP growth.

d. Steeper aggregate supply curve

If aggregate supply curve is steeper, then increase in bank reserve by $5 billion will cause the price to rise more than the increase in real GDP. Hence, the monetary policy will be weaker.

4

From 2003 to 2011, the federal government's budget deficit rose sharply because of tax cuts and increased spending. If the Federal Reserve wanted to maintain the same level of aggregate demand in the face of large increases in the budget deficit, what should it have done What would you expect to happen to interest rates

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

5

Explain how your answers to Test Yourself Question 5 would differ if banks decided to hold onto the $5 billion in new reserves as excess reserves.

Reference Test Yourself Question 5

Explain what a $5 billion increase in bank reserves will do to real GDP under the following assumptions:

a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point.

b. Each 1 percentage point decline in interest rates stimulates $30 billion worth of new investment.

c. The expenditure multiplier is two.

d. The aggregate supply curve is so flat that prices do not rise noticeably when demand increases.

Reference Test Yourself Question 5

Explain what a $5 billion increase in bank reserves will do to real GDP under the following assumptions:

a. Each $1 billion increase in bank reserves reduces the rate of interest by 0.5 percentage point.

b. Each 1 percentage point decline in interest rates stimulates $30 billion worth of new investment.

c. The expenditure multiplier is two.

d. The aggregate supply curve is so flat that prices do not rise noticeably when demand increases.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

6

(More difficult) Consider an economy in which government purchases, taxes, and net exports are all zero. The consumption function is

C = 300 + 0.75 Y

and investment spending ( I ) depends on the rate of interest ( r ) in the following way:

I = 1,000 - 100 r

Find the equilibrium GDP if the Fed makes the rate of interest (a) 2 percent ( r = 0.02), (b) 5 percent, and (c) 10 percent.

C = 300 + 0.75 Y

and investment spending ( I ) depends on the rate of interest ( r ) in the following way:

I = 1,000 - 100 r

Find the equilibrium GDP if the Fed makes the rate of interest (a) 2 percent ( r = 0.02), (b) 5 percent, and (c) 10 percent.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

7

Why does a modern industrial economy need a central bank

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose there is $120 billion of cash and that half of this cash is held in bank vaults as required reserves (that is, banks hold no excess reserves). How large will the money supply be if the required reserve ratio is 10 percent 12 1 2 percent 16 2 3 percent

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

9

What are some reasons behind the worldwide trend toward greater central bank independence Are there arguments on the other side

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

10

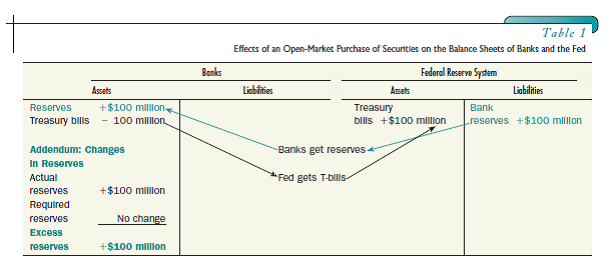

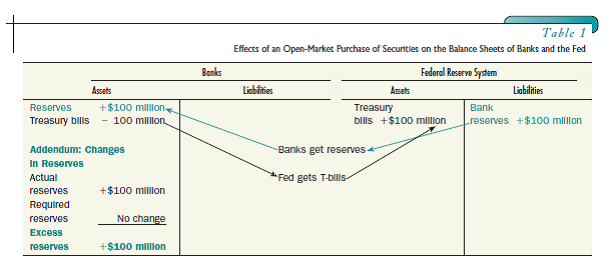

Show the balance sheet changes that would take place if the Federal Reserve Bank of New York purchased an office building from Citigroup for a price of $100 million. Compare this effect to the effect of an open-market purchase of securities shown in Table₁. What do you conclude

Table₁

Table₁

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

11

Explain why the quantity of bank reserves supplied normally is higher and the quantity of bank reserves demanded normally is lower at higher interest rates.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

12

Suppose the Fed purchases $5 billion worth of government bonds from Bill Gates, who banks at the Bank of America in San Francisco. Show the effects on the balance sheets of the Fed, the Bank of America, and Gates. (Hint: Where will the Fed get the $5 billion to pay Gates ) Does it make any difference if the Fed buys bonds from a bank or an individual

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

13

From September 2007 through December 2008, the Fed believed that interest rates needed to fall and took steps to reduce them, eventually cutting the federal funds rate from 5.25 percent to nearly zero. How did the Fed reduce the federal funds rate Illustrate your answer on a diagram.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

14

Treasury bills have a fixed face value (say, $1,000) and pay interest by selling at a discount. For example, if a one-year bill with a$1,000 face value sells today for $950, it will pay $1,000 - $950 = $50 in interest over its life. The interest rate on the bill is therefore $50/$950 = 0.0526, or 5.26 percent.

a. Suppose the price of the Treasury bill falls to $925. What happens to the interest rate

b. Suppose, instead, that the price rises to $975. What is the interest rate now

c. (More difficult) Now generalize this example. Let P be the price of the bill and r be the interest rate. Develop an algebraic formula expressing r in termsof P. ( Hint: The interest earned is $1,000 - P. What is the percentage interest rate ) Show that this formula illustrates the point made in the text: Higher bond prices mean lower interest rates.

a. Suppose the price of the Treasury bill falls to $925. What happens to the interest rate

b. Suppose, instead, that the price rises to $975. What is the interest rate now

c. (More difficult) Now generalize this example. Let P be the price of the bill and r be the interest rate. Develop an algebraic formula expressing r in termsof P. ( Hint: The interest earned is $1,000 - P. What is the percentage interest rate ) Show that this formula illustrates the point made in the text: Higher bond prices mean lower interest rates.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

15

Once the federal funds rate reached (approximately) zero, which happened in December 2008, what options were still open to the Fed. What did it actually do (Note: This may be a good question to discuss with your instructor.)

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck