Deck 10: Prices, Output, and Strategy: Pure and Monopolistic Competition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 10: Prices, Output, and Strategy: Pure and Monopolistic Competition

1

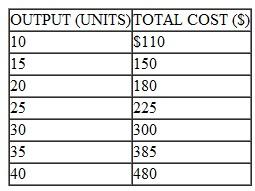

Assume that a firm in a perfectly competitive industry has the following total cost schedule:

a. Calculate a marginal cost and an average cost schedule for the firm.

a. Calculate a marginal cost and an average cost schedule for the firm.

b. If the prevailing market price is $17 per unit, how many units will be produced and sold What are profits per unit What are total profits

c. Is the industry in long-run equilibrium at this price

a. Calculate a marginal cost and an average cost schedule for the firm.

a. Calculate a marginal cost and an average cost schedule for the firm.b. If the prevailing market price is $17 per unit, how many units will be produced and sold What are profits per unit What are total profits

c. Is the industry in long-run equilibrium at this price

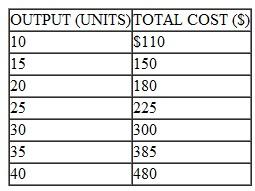

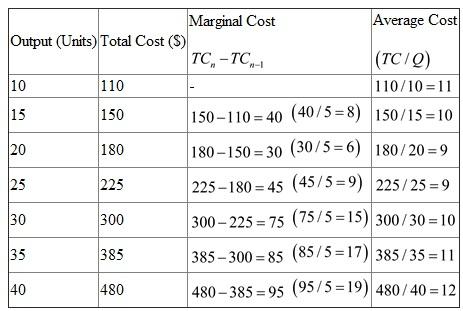

a) Marginal cost and average cost schedule

Marginal cost refers to the addition to the total cost due to increase in one unit of output. Average cost is per unit cost. Total cost is divided by the output to know the average cost. The following is the marginal and average cost schedule:-

Above schedule depicts the output, total cost, marginal cost, and average cost. Marginal cost and average costs schedule have been derived from the output and total cost schedule.

Above schedule depicts the output, total cost, marginal cost, and average cost. Marginal cost and average costs schedule have been derived from the output and total cost schedule.

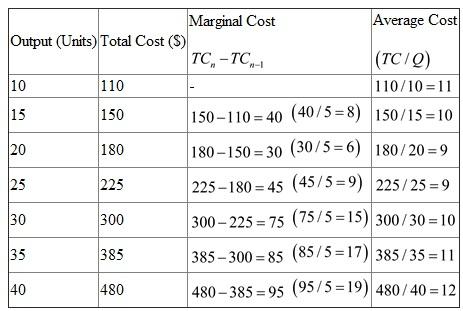

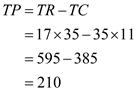

b) Production and profit at the price of $17

Purely competitive market is characterized by the large number of buyers and sellers. Price is decided by the demand and supply forces. Price is equal to the marginal cost

. Thus, price and marginal costs are equal at the 35 units of output. A total of 35 units of output will be produced and sold.

. Thus, price and marginal costs are equal at the 35 units of output. A total of 35 units of output will be produced and sold.

Cost per unit is $11 and price per unit is $17, thus profit per unit is

. The following is the total profit

. The following is the total profit

:-

:-

The total profit is

The total profit is

.

.

c) Long run equilibrium at this price

Purely competitive market is characterized by the large number of buyers and sellers in the market. Price is decided by the demand and supply forces in the market. Firm earns the abnormal profit at this price and more firms would be attracted toward the market. Abnormal profit would be withered away. Now each firm would be earning normal profit. Hence, firm is not in long run equilibrium. Firm gets only normal in long run in purely competitive market.

Marginal cost refers to the addition to the total cost due to increase in one unit of output. Average cost is per unit cost. Total cost is divided by the output to know the average cost. The following is the marginal and average cost schedule:-

Above schedule depicts the output, total cost, marginal cost, and average cost. Marginal cost and average costs schedule have been derived from the output and total cost schedule.

Above schedule depicts the output, total cost, marginal cost, and average cost. Marginal cost and average costs schedule have been derived from the output and total cost schedule. b) Production and profit at the price of $17

Purely competitive market is characterized by the large number of buyers and sellers. Price is decided by the demand and supply forces. Price is equal to the marginal cost

. Thus, price and marginal costs are equal at the 35 units of output. A total of 35 units of output will be produced and sold.

. Thus, price and marginal costs are equal at the 35 units of output. A total of 35 units of output will be produced and sold.Cost per unit is $11 and price per unit is $17, thus profit per unit is

. The following is the total profit

. The following is the total profit  :-

:- The total profit is

The total profit is  .

.c) Long run equilibrium at this price

Purely competitive market is characterized by the large number of buyers and sellers in the market. Price is decided by the demand and supply forces in the market. Firm earns the abnormal profit at this price and more firms would be attracted toward the market. Abnormal profit would be withered away. Now each firm would be earning normal profit. Hence, firm is not in long run equilibrium. Firm gets only normal in long run in purely competitive market.

2

Royersford Knitting Mills, Ltd., sells a line of women's knit underwear. The firm now sells about 20,000 pairs a year at an average price of $10 each. Fixed costs amount to $60,000, and total variable costs equal $120,000. The production department has estimated that a 10 percent increase in output would not affect fixed costs but would reduce average variable cost by 40 cents.

The marketing department advocates a price reduction of 5 percent to increase sales, total revenues, and profits. The arc elasticity of demand with respect to prices is estimated at -2.

a. Evaluate the impact of the proposal to cut prices on (i) total revenue, (ii) total cost, and (iii) total profits.

b. If average variable costs are assumed to remain constant over a 10 percent increase in output, evaluate the effects of the proposed price cut on total profits.

The marketing department advocates a price reduction of 5 percent to increase sales, total revenues, and profits. The arc elasticity of demand with respect to prices is estimated at -2.

a. Evaluate the impact of the proposal to cut prices on (i) total revenue, (ii) total cost, and (iii) total profits.

b. If average variable costs are assumed to remain constant over a 10 percent increase in output, evaluate the effects of the proposed price cut on total profits.

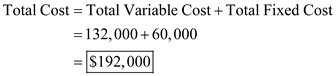

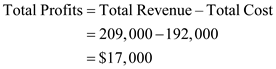

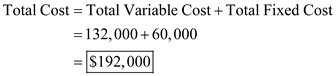

a) Impacts of prices cut on Total Revenue, Total Cost and Total Profits

Following is the information about the firm:-

• Firm sells about 20,000 pairs

• Average price is $10

• Fixed cost is $60,000

• Total variable cost is $120,000

• It is expected that 10 % increase in the output would not affect fixed costs but reduce the average variable cost by 40 cents

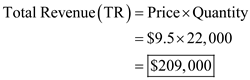

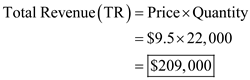

(i) Total Revenue

The 5 % cut in the price means now price is $9.5 per pair (95% of 10). Elasticity of demand is -2 that imply that there would be 10% increase in the quantity demanded by customers. There would be addition of 2,000 (10% of 20,000)

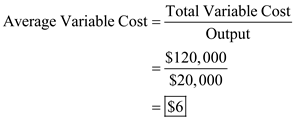

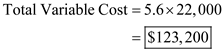

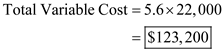

(ii) Total Cost

(ii) Total Cost

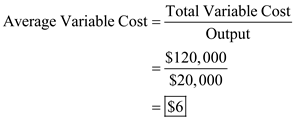

A firm sells the 20,000 pairs and total variable cost is $120,000

There will be 40 cents reduction in the average variable cost. Hence now average variable cost is

There will be 40 cents reduction in the average variable cost. Hence now average variable cost is

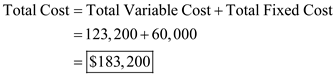

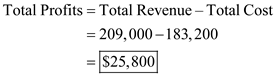

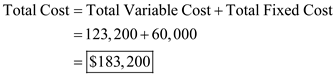

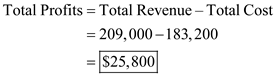

(iii) Total Profits

(iii) Total Profits

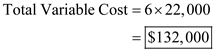

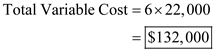

b) Total profit when the average variable cost remains constant over 10 % increase in output

b) Total profit when the average variable cost remains constant over 10 % increase in output

Total profit if average cost remains constant over the 10% increase in the output is

Total profit if average cost remains constant over the 10% increase in the output is

Following is the information about the firm:-

• Firm sells about 20,000 pairs

• Average price is $10

• Fixed cost is $60,000

• Total variable cost is $120,000

• It is expected that 10 % increase in the output would not affect fixed costs but reduce the average variable cost by 40 cents

(i) Total Revenue

The 5 % cut in the price means now price is $9.5 per pair (95% of 10). Elasticity of demand is -2 that imply that there would be 10% increase in the quantity demanded by customers. There would be addition of 2,000 (10% of 20,000)

(ii) Total Cost

(ii) Total Cost A firm sells the 20,000 pairs and total variable cost is $120,000

There will be 40 cents reduction in the average variable cost. Hence now average variable cost is

There will be 40 cents reduction in the average variable cost. Hence now average variable cost is

(iii) Total Profits

(iii) Total Profits  b) Total profit when the average variable cost remains constant over 10 % increase in output

b) Total profit when the average variable cost remains constant over 10 % increase in output

Total profit if average cost remains constant over the 10% increase in the output is

Total profit if average cost remains constant over the 10% increase in the output is

3

Netflix and Redbox Compete for Movie Rentals 30

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

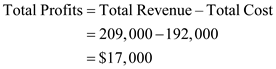

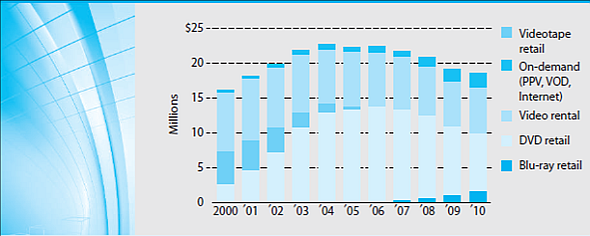

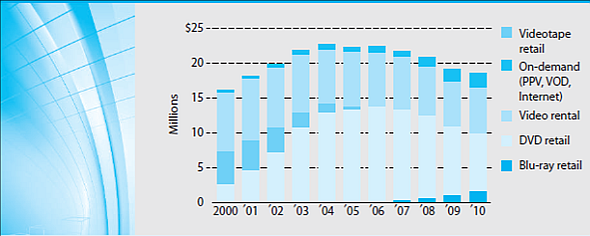

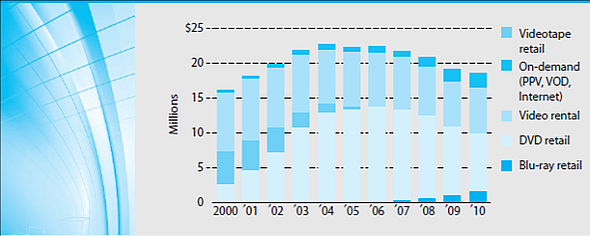

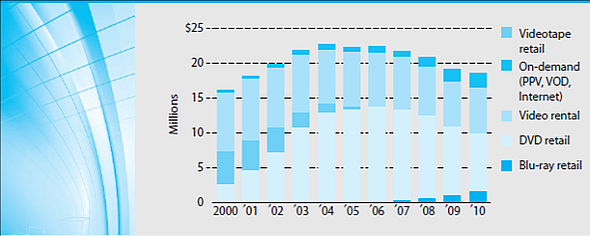

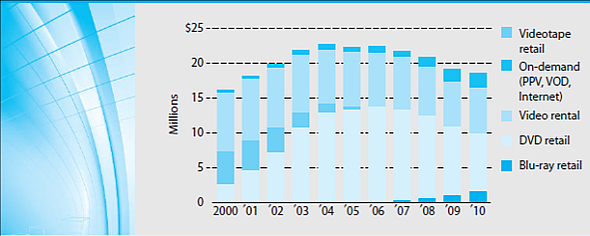

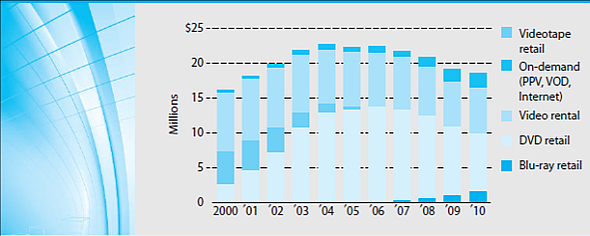

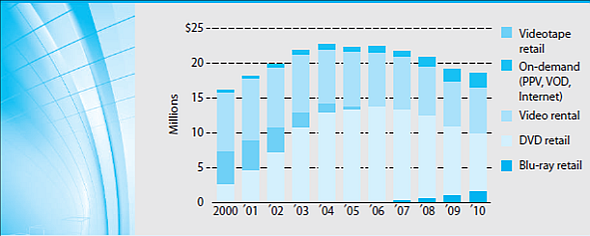

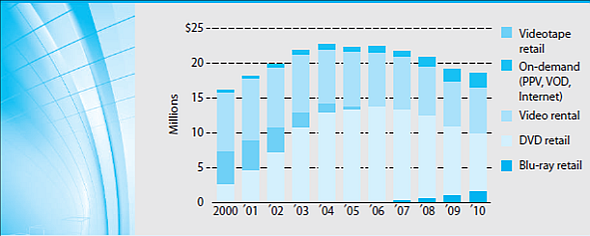

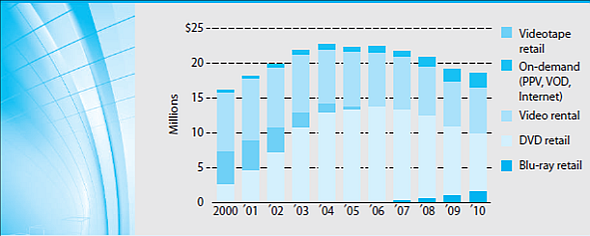

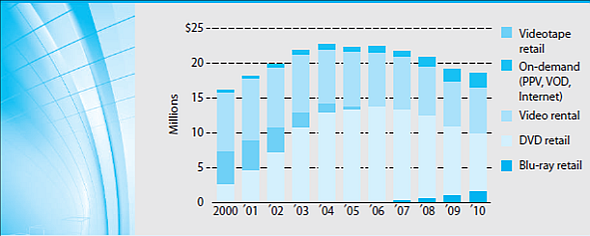

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

What disruptive technology has threatened the bricks-and-mortar and mail-in movie rental business

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

What disruptive technology has threatened the bricks-and-mortar and mail-in movie rental business

According to the porter's strategic framework, there are five forces of competition to be identified in the market for threats to profits. Those five forces are threat of new entrant, threat of substitute, power of supplier, power of buyers and intensity of the rivalry. There is a sixth force added to this framework called Disruptive technology. The term disruptive technology innovation creates a value to the new market by disrupting the existing markets.

The bricks-and-motor was worth of a $5.5 billion who made money from the business of movie rental. The decision of entering in the mail-in-delivery and online DVD rental business brought a revolution around. Netflix received a high price competition from a well-established company in the market. The Blockbuster decreased the price to $14.99 which forced Netflix to decrease price to $9.99 per month.

However, the brick-and-motor and mail-in movie rental business received a threat from the disruptive technology in the video rental industry by the streaming video on demand. This has become a threat of new entry along with new technology, which has disrupted the bricks and mortar and mail-in the movie rental business. This technology has made viewers an easy access to the videos.

The bricks-and-motor was worth of a $5.5 billion who made money from the business of movie rental. The decision of entering in the mail-in-delivery and online DVD rental business brought a revolution around. Netflix received a high price competition from a well-established company in the market. The Blockbuster decreased the price to $14.99 which forced Netflix to decrease price to $9.99 per month.

However, the brick-and-motor and mail-in movie rental business received a threat from the disruptive technology in the video rental industry by the streaming video on demand. This has become a threat of new entry along with new technology, which has disrupted the bricks and mortar and mail-in the movie rental business. This technology has made viewers an easy access to the videos.

4

The Poster Bed Company believes that its industry can best be classified as monopolistically competitive. An analysis of the demand for its canopy bed has resulted in the following estimated demand function for the bed:

P = 1760 - 12Q

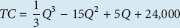

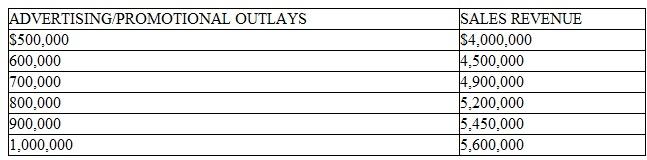

The cost analysis department has estimated the total cost function for the poster bed as

a. Calculate the level of output that should be produced to maximize short-run profits.

b. What price should be charged

c. Compute total profits at this price-output level.

d. Compute the point price elasticity of demand at the profit-maximizing level of output.

e. What level of fixed costs is the firm experiencing on its bed production

f. What is the impact of a $5,000 increase in the level of fixed costs on the price charged, output produced, and profit generated

P = 1760 - 12Q

The cost analysis department has estimated the total cost function for the poster bed as

a. Calculate the level of output that should be produced to maximize short-run profits.

b. What price should be charged

c. Compute total profits at this price-output level.

d. Compute the point price elasticity of demand at the profit-maximizing level of output.

e. What level of fixed costs is the firm experiencing on its bed production

f. What is the impact of a $5,000 increase in the level of fixed costs on the price charged, output produced, and profit generated

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Saving Sony Music

Explore the crisis that Internet file sharing of copyrighted music recordings has caused for Vivendi Universal, Sony Music, EMI, and AOL Time Warner Music, which together formerly supplied 70 percent of the global music industry.

How would the Internet firms Napster and Kazaa be reflected in a Porter Five Forces industry analysis

Explore the crisis that Internet file sharing of copyrighted music recordings has caused for Vivendi Universal, Sony Music, EMI, and AOL Time Warner Music, which together formerly supplied 70 percent of the global music industry.

How would the Internet firms Napster and Kazaa be reflected in a Porter Five Forces industry analysis

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

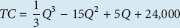

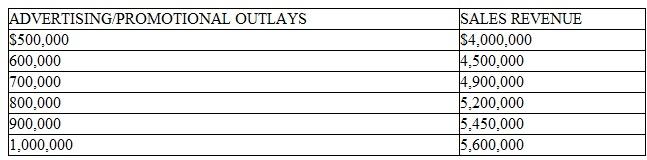

Jordan Enterprises has estimated the contribution margin (P - MC)/P for its Air Express model of basketball shoes to be 40 percent. Based on market research and past experience, Jordan estimates the following relationship between the sales for Air Express and advertising/promotional outlays:

a. What is the marginal revenue from an additional dollar spent on advertising if the firm is currently spending $1,000,000 on advertising

a. What is the marginal revenue from an additional dollar spent on advertising if the firm is currently spending $1,000,000 on advertising

b. What level of advertising would you recommend to Jordan's management

a. What is the marginal revenue from an additional dollar spent on advertising if the firm is currently spending $1,000,000 on advertising

a. What is the marginal revenue from an additional dollar spent on advertising if the firm is currently spending $1,000,000 on advertising b. What level of advertising would you recommend to Jordan's management

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

The profitability of the leading cola syrup manufacturers PepsiCo and Coca-Cola and of the bottlers in the cola business is very different. PepsiCo and Coca-Cola enjoy an 81 percent operating profit as a percentage of sales; bottlers experience only a 15 percent operating profit as a percentage of sales. Perform a Porter's Five Forces analysis that explains why one type of business is potentially so profitable relative to the other.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following products and services are likely to encounter adverse selection problems: golf shirts at traveling pro tournaments, certified gemstones from Tiffany's, graduation gift travel packages, or mail-order auto parts Why or why not

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Netflix and Redbox Compete for Movie Rentals 30

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Does easy access to distribution channels at grocery stores for Redbox's 22,000 vending machines indicate a high- or low-entry threat in the movie rental business Why Why might McDonald's be an even better distribution channel than grocery stores

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Does easy access to distribution channels at grocery stores for Redbox's 22,000 vending machines indicate a high- or low-entry threat in the movie rental business Why Why might McDonald's be an even better distribution channel than grocery stores

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

If notorious firm behavior (i.e., defrauding a buyer of high-priced experience goods by delivering low quality) becomes known throughout the marketplace only with a lag of three periods, profits on high-quality transactions remain the same, and interest rates rise slightly, are customers more likely or less likely to agree to pay high prices for an experience good Explain.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

Saving Sony Music

Explore the crisis that Internet file sharing of copyrighted music recordings has caused for Vivendi Universal, Sony Music, EMI, and AOL Time Warner Music, which together formerly supplied 70 percent of the global music industry.

Why was the Internet a disruptive technology for Sony Music Did the new digital file transfer technology favor album-size transactions which Sony Music understood very well Or did the new technology favor Steve Jobs's vision of an Apple iTunes Music Store focused on easily accessible 99-cent singles What aspect of the iTunes Music Store made it more desirable that simply transferring stolen digital music files one by one

Explore the crisis that Internet file sharing of copyrighted music recordings has caused for Vivendi Universal, Sony Music, EMI, and AOL Time Warner Music, which together formerly supplied 70 percent of the global music industry.

Why was the Internet a disruptive technology for Sony Music Did the new digital file transfer technology favor album-size transactions which Sony Music understood very well Or did the new technology favor Steve Jobs's vision of an Apple iTunes Music Store focused on easily accessible 99-cent singles What aspect of the iTunes Music Store made it more desirable that simply transferring stolen digital music files one by one

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

Television channel operating profits vary from as high as 45 to 55 percent at MTV and Nickelodeon down to 12 to 18 percent at NBC and ABC. Provide a Porter Five Forces analysis of each type of network. Why is MTV so profitable relative to the major networks

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Netflix and Redbox Compete for Movie Rentals 30

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Are there any economies of scale in the on-demand video rental business to serve as a barrier to the entry of Amazon

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Are there any economies of scale in the on-demand video rental business to serve as a barrier to the entry of Amazon

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

What should be Sony Music's competitive strategy in response to this crisis Include a discussion of resource-based capabilities, business opportunities, and a road map of future innovation.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

The costs of producing steel have declined substantially from building a conventional hot-rolled steel mill down to the new minimill technology that requires only scrap metal, an electric furnace, and 300 workers rather than iron ore raw materials, enormous blast furnaces, rolling mills, reheating furnaces, and thousands of workers. What effect on the potential industry profitability would Porter's Five Forces framework suggest this new technology had Why

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Netflix and Redbox Compete for Movie Rentals 30

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Who are Netflix's and Redbox's suppliers Are they in a position to appropriate much of the value in the value chain Why or why not

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

Who are Netflix's and Redbox's suppliers Are they in a position to appropriate much of the value in the value chain Why or why not

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Is your competitive strategy for Sony Music a product differentiation strategy, a low-cost strategy, or an information technology strategy What is your strategic focus

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

Ethanol is again viewed as one part of a solution to the problem of shortages of petroleum products. Ethanol is made from a blend of gasoline and alcohol derived from corn or sugar cane. What would you expect the impact of this program to be on the price of corn, soybeans, and wheat

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

Netflix and Redbox Compete for Movie Rentals 30

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

What factors determine the intensity of rivalry in any industry Is the intensity of rivalry in the video rental industry high or low Why

Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business.

Movie studios like Viacom and Time Warner also entered the market with directto- the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies and 10 times Netflix's or Redbox's $1.99 or $1 fees for overnight rentals. At such exorbitant prices, the studios earn a 70 percent margin, but studies of price elasticity in home entertainment experiments suggest an eight-fold increase in volume for half-price promotions. On-demand movie rentals and Blu-ray retail sales are the only two growing segments of consumer demand for video (see Figure).

FIGURE Consumer Spending on Video

Use Porter's Five Forces model to answer the following questions:

What factors determine the intensity of rivalry in any industry Is the intensity of rivalry in the video rental industry high or low Why

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Why invest capital in purely competitive industries with equilibrium margins that are razor thin and entrants that erode quasi profits Suppose volume is not exceptionally large, why then

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck