Deck 12: Managerial Decisions for Firms With Market Power

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 12: Managerial Decisions for Firms With Market Power

1

Higher unemployment caused by the recession and higher gasoline prices have contributed to a substantial reduction during 2008 in the number of vehicles on roads, bridges, and in tunnels. According to The Wall Street Journal (April 28, 2009), the reduction in demand for toll bridge and tunnel crossings created a serious revenue problem for many cities. In New York, the number of vehicles traveling across bridges and through tunnels fell from 23.6 million in January 2008 to 21.9 million in January 2009. "That drop presents a challenge, because road tolls subsidize MTA subways, which are more likely to be used as people get out of their cars." In an apparent attempt to raise toll revenue, the MTA increased tolls by 10 percent on the nine crossings it controls.

a. Is MTA a monopolist in New York City? Do you think MTA possesses a high degree of market power? Why or why not?

b. If the marginal cost of letting another vehicle cross a bridge or travel through a tunnel is nearly zero, how should the MTA set tolls in order to maximize profit? In order to maximize toll revenue? How are these two objectives related?

c. With the decrease in demand for bridge and tunnel crossings, what is the optimal way to adjust tolls: raise tolls, lower tolls, or leave tolls unchanged? Explain carefully?

a. Is MTA a monopolist in New York City? Do you think MTA possesses a high degree of market power? Why or why not?

b. If the marginal cost of letting another vehicle cross a bridge or travel through a tunnel is nearly zero, how should the MTA set tolls in order to maximize profit? In order to maximize toll revenue? How are these two objectives related?

c. With the decrease in demand for bridge and tunnel crossings, what is the optimal way to adjust tolls: raise tolls, lower tolls, or leave tolls unchanged? Explain carefully?

It is given that high unemployment rate because of recession created low turnover for toll bridges due to less vehicle utilization.

(A) Certainly MTA has a high degree of market power. This is because MTA is planning to increase the price of toll even when the demand has fallen. This can happen only in case of monopolistic completion or monopoly when demand is inelastic.

(B) If the marginal cost of letting another vehicle cross a bridge or travel through a tunnel is zero, the toll should charge price slightly higher than the average cost. It can even charge different prices according to the vehicle size and thus creating price differentiation. By price differentiation, MTA can earn major profits.

(C) The optimal way would be hike price till it makes a profit. This is because the demand is inelastic and hiking prices will not affect the demand to a great extent.

(A) Certainly MTA has a high degree of market power. This is because MTA is planning to increase the price of toll even when the demand has fallen. This can happen only in case of monopolistic completion or monopoly when demand is inelastic.

(B) If the marginal cost of letting another vehicle cross a bridge or travel through a tunnel is zero, the toll should charge price slightly higher than the average cost. It can even charge different prices according to the vehicle size and thus creating price differentiation. By price differentiation, MTA can earn major profits.

(C) The optimal way would be hike price till it makes a profit. This is because the demand is inelastic and hiking prices will not affect the demand to a great extent.

2

QuadPlex Cinema is the only movie theater in Idaho Falls. The nearest rival movie theater, the Cedar Bluff Twin, is 35 miles away in Pocatello. Thus QuadPlex Cinema possesses a degree of market power. Despite having market power, QuadPlex Cinema is currently suffering losses. In a conversation with the owners of QuadPlex, the manager of the movie theater made the following suggestions: "Since QuadPlex is a local monopoly, we should just increase ticket prices until we make enough profit."

a. Comment on this strategy.

b. How might the market power of QuadPlex Cinema be measured?

c. What options should QuadPlex consider in the long run?

a. Comment on this strategy.

b. How might the market power of QuadPlex Cinema be measured?

c. What options should QuadPlex consider in the long run?

It is given that Q. is a local cinema enjoying monopoly power.

(A) Q. cinema enjoys high inelastic demand. Though it has monopoly power, high prices result in lower demand. The monopolist enjoys high revenues till the cost has not increased, and if the cost increases, low demand at high prices pose difficult problems to single price monopolist.

(B) The market power of Q. cinemas can be measured by the elasticity of demand. If demand level does not decrease to a great extent by a price increase, then there is inelastic demand.

(C) Instead of just increasing the price, the cinema could adopt a price differentiation strategy. It could charge different prices according to the demand.

(A) Q. cinema enjoys high inelastic demand. Though it has monopoly power, high prices result in lower demand. The monopolist enjoys high revenues till the cost has not increased, and if the cost increases, low demand at high prices pose difficult problems to single price monopolist.

(B) The market power of Q. cinemas can be measured by the elasticity of demand. If demand level does not decrease to a great extent by a price increase, then there is inelastic demand.

(C) Instead of just increasing the price, the cinema could adopt a price differentiation strategy. It could charge different prices according to the demand.

3

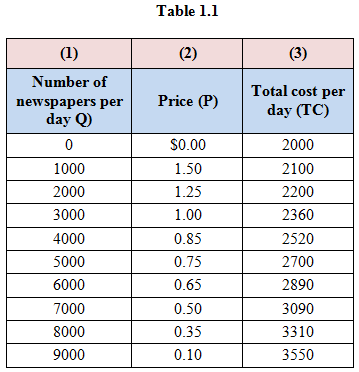

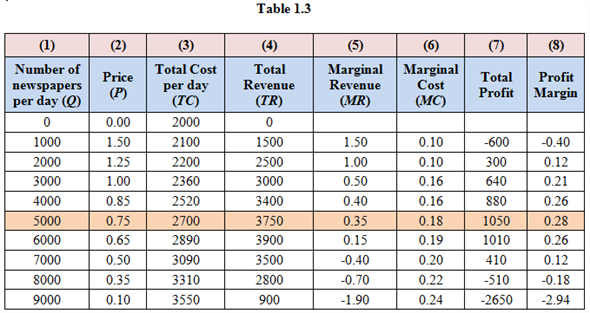

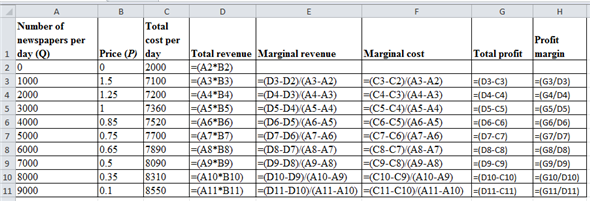

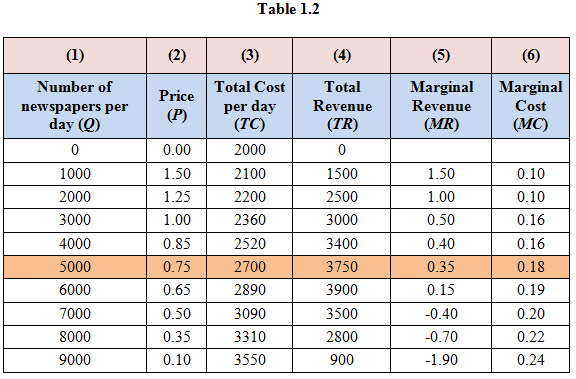

The El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the demand and cost schedules shown in the spreadsheet that follows:

![The El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the demand and cost schedules shown in the spreadsheet that follows: a. Create a spreadsheet using Microsoft Excel (or any other spreadsheet software) that matches the one above by entering the output, price, and cost data given. b. Use the appropriate formulas to create three new columns (4, 5, and 6) in your spreadsheet for total revenue, marginal revenue ( MR ), and marginal cost ( MC ), respectively. [Computation check: At Q = 3,000, MR = $0.50 and MC = $0.16]. What price should the manager of the El Dorado Star charge? How many papers should be sold daily to maximize profit? c. At the price and output level you answered in part b , is the El Dorado Star making the greatest possible amount of total revenue? Is this what you expected? Explain why or why not. d. Use the appropriate formulas to create two new columns (7 and 8) for total profit and profit margin, respectively. What is the maximum profit the El Dorado Star can earn? What is the maximum possible profit margin? Are profit and profit margin maximized at the same point on demand? e. What is the total fixed cost for the El Dorado Star ? Create a new spreadsheet in which total fixed cost increases to $5,000. What price should the manager charge? How many papers should be sold in the short run? What should the owners of the Star do in the long run?](https://d2lvgg3v3hfg70.cloudfront.net/SM2913/11eb7730_36aa_54f1_adfc_c115476a7cf6_SM2913_00.jpg)

a. Create a spreadsheet using Microsoft Excel (or any other spreadsheet software) that matches the one above by entering the output, price, and cost data given.

b. Use the appropriate formulas to create three new columns (4, 5, and 6) in your spreadsheet for total revenue, marginal revenue ( MR ), and marginal cost ( MC ), respectively. [Computation check: At Q = 3,000, MR = $0.50 and MC = $0.16]. What price should the manager of the El Dorado Star charge? How many papers should be sold daily to maximize profit?

c. At the price and output level you answered in part b , is the El Dorado Star making the greatest possible amount of total revenue? Is this what you expected? Explain why or why not.

d. Use the appropriate formulas to create two new columns (7 and 8) for total profit and profit margin, respectively. What is the maximum profit the El Dorado Star can earn? What is the maximum possible profit margin? Are profit and profit margin maximized at the same point on demand?

e. What is the total fixed cost for the El Dorado Star ? Create a new spreadsheet in which total fixed cost increases to $5,000. What price should the manager charge? How many papers should be sold in the short run? What should the owners of the Star do in the long run?

![The El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the demand and cost schedules shown in the spreadsheet that follows: a. Create a spreadsheet using Microsoft Excel (or any other spreadsheet software) that matches the one above by entering the output, price, and cost data given. b. Use the appropriate formulas to create three new columns (4, 5, and 6) in your spreadsheet for total revenue, marginal revenue ( MR ), and marginal cost ( MC ), respectively. [Computation check: At Q = 3,000, MR = $0.50 and MC = $0.16]. What price should the manager of the El Dorado Star charge? How many papers should be sold daily to maximize profit? c. At the price and output level you answered in part b , is the El Dorado Star making the greatest possible amount of total revenue? Is this what you expected? Explain why or why not. d. Use the appropriate formulas to create two new columns (7 and 8) for total profit and profit margin, respectively. What is the maximum profit the El Dorado Star can earn? What is the maximum possible profit margin? Are profit and profit margin maximized at the same point on demand? e. What is the total fixed cost for the El Dorado Star ? Create a new spreadsheet in which total fixed cost increases to $5,000. What price should the manager charge? How many papers should be sold in the short run? What should the owners of the Star do in the long run?](https://d2lvgg3v3hfg70.cloudfront.net/SM2913/11eb7730_36aa_54f1_adfc_c115476a7cf6_SM2913_00.jpg)

a. Create a spreadsheet using Microsoft Excel (or any other spreadsheet software) that matches the one above by entering the output, price, and cost data given.

b. Use the appropriate formulas to create three new columns (4, 5, and 6) in your spreadsheet for total revenue, marginal revenue ( MR ), and marginal cost ( MC ), respectively. [Computation check: At Q = 3,000, MR = $0.50 and MC = $0.16]. What price should the manager of the El Dorado Star charge? How many papers should be sold daily to maximize profit?

c. At the price and output level you answered in part b , is the El Dorado Star making the greatest possible amount of total revenue? Is this what you expected? Explain why or why not.

d. Use the appropriate formulas to create two new columns (7 and 8) for total profit and profit margin, respectively. What is the maximum profit the El Dorado Star can earn? What is the maximum possible profit margin? Are profit and profit margin maximized at the same point on demand?

e. What is the total fixed cost for the El Dorado Star ? Create a new spreadsheet in which total fixed cost increases to $5,000. What price should the manager charge? How many papers should be sold in the short run? What should the owners of the Star do in the long run?

The following is the information given about E. D. Star:

a )

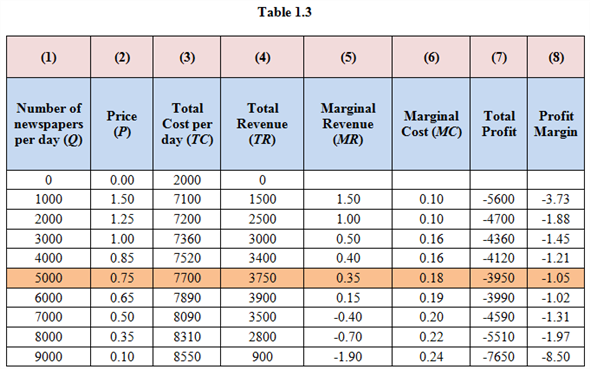

Table 1.1 shows the spreadsheet with the given inputs and cost structure:

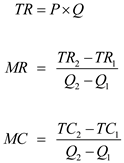

b )

b )

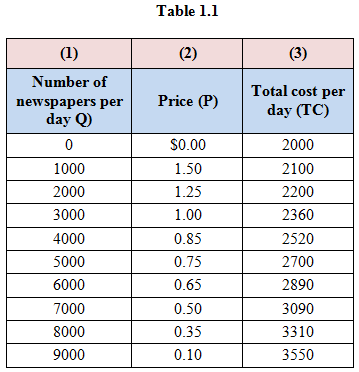

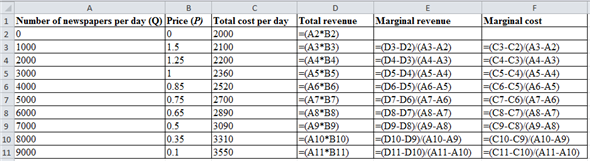

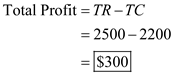

Write the formulae as follows:

Represent the values of Total Revenue ( TR ), Marginal Revenue ( MR ) and Marginal Cost ( MC ) of firm as follows:

Represent the values of Total Revenue ( TR ), Marginal Revenue ( MR ) and Marginal Cost ( MC ) of firm as follows:

Represent the table of the formulae excel sheet as follows:

Represent the table of the formulae excel sheet as follows:

The profit is maximized when

The profit is maximized when

. In the given case, MR and MC do not equal each other at any point, the nearest they can reach is when

. In the given case, MR and MC do not equal each other at any point, the nearest they can reach is when

and

and

. After this point, MC starts exceeding MR.

. After this point, MC starts exceeding MR.

This maximization of output happens when

and

and

.

.

c)

The firm is making highest revenue when

. This is because monopolist does not work like competitive sellers. They charge differential prices to attain maximum profits.

. This is because monopolist does not work like competitive sellers. They charge differential prices to attain maximum profits.

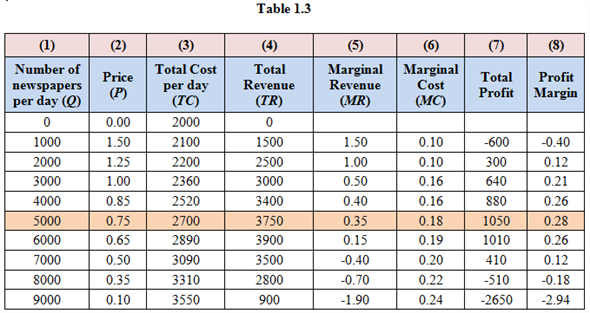

( d )

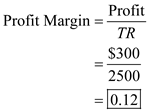

Table 1.3 shows the total profit and profit margin:

Used Formulas to calculate values of table 1.2 as follows:

Used Formulas to calculate values of table 1.2 as follows:

Calculation part:

Calculation part:

For example calculate total profit when quantity is 2000 and price is $1.25 as follows:

Similarly, remaining total profit values can be calculated.

Similarly, remaining total profit values can be calculated.

For example calculate profit margin when quantity is 2000 and price is $1.25 as follows:

Similarly, remaining profit margin values can be calculated.

Similarly, remaining profit margin values can be calculated.

Therefore, the profit and profit margin are maximized at quantity 5000.

( e )

The total fixed is $2,000 for the firm. This is because when output is zero, total cost is $2,000.

Represent the formulae excel sheet as follows;

Represent the table of the profit and profit margin when total fixed cost increases to 5,000 as follows:

Represent the table of the profit and profit margin when total fixed cost increases to 5,000 as follows:

Though the marginal cost and revenue intersect at

Though the marginal cost and revenue intersect at

, the profit margin is negative for all quantities.

, the profit margin is negative for all quantities.

- In short run, price is greater than average variable cost, so the firm should not shut down. Otherwise firm will incur losses equal to fixed cost, $5,000.

- The fixed cost will spread over quantities in the long run, the profits will increase.

a )

Table 1.1 shows the spreadsheet with the given inputs and cost structure:

b )

b )Write the formulae as follows:

Represent the values of Total Revenue ( TR ), Marginal Revenue ( MR ) and Marginal Cost ( MC ) of firm as follows:

Represent the values of Total Revenue ( TR ), Marginal Revenue ( MR ) and Marginal Cost ( MC ) of firm as follows: Represent the table of the formulae excel sheet as follows:

Represent the table of the formulae excel sheet as follows: The profit is maximized when

The profit is maximized when . In the given case, MR and MC do not equal each other at any point, the nearest they can reach is when

. In the given case, MR and MC do not equal each other at any point, the nearest they can reach is when  and

and . After this point, MC starts exceeding MR.

. After this point, MC starts exceeding MR.This maximization of output happens when

and

and .

.c)

The firm is making highest revenue when

. This is because monopolist does not work like competitive sellers. They charge differential prices to attain maximum profits.

. This is because monopolist does not work like competitive sellers. They charge differential prices to attain maximum profits.( d )

Table 1.3 shows the total profit and profit margin:

Used Formulas to calculate values of table 1.2 as follows:

Used Formulas to calculate values of table 1.2 as follows: Calculation part:

Calculation part: For example calculate total profit when quantity is 2000 and price is $1.25 as follows:

Similarly, remaining total profit values can be calculated.

Similarly, remaining total profit values can be calculated.For example calculate profit margin when quantity is 2000 and price is $1.25 as follows:

Similarly, remaining profit margin values can be calculated.

Similarly, remaining profit margin values can be calculated.Therefore, the profit and profit margin are maximized at quantity 5000.

( e )

The total fixed is $2,000 for the firm. This is because when output is zero, total cost is $2,000.

Represent the formulae excel sheet as follows;

Represent the table of the profit and profit margin when total fixed cost increases to 5,000 as follows:

Represent the table of the profit and profit margin when total fixed cost increases to 5,000 as follows:  Though the marginal cost and revenue intersect at

Though the marginal cost and revenue intersect at , the profit margin is negative for all quantities.

, the profit margin is negative for all quantities.- In short run, price is greater than average variable cost, so the firm should not shut down. Otherwise firm will incur losses equal to fixed cost, $5,000.

- The fixed cost will spread over quantities in the long run, the profits will increase.

4

Tots-R-Us operates the only day-care center in an exclusive neighborhood just outside of Washington, D.C. Tots-R-Us is making substantial economic profit, but the owners know that new day-care centers will soon learn of this highly profitable market and attempt to enter the market. The owners decide to begin spending immediately a rather large sum on advertising designed to decrease elasticity. Should they wait until new firms actually enter? Explain how advertising can be employed to allow Tots-R-Us to keep price above average cost without encouraging entry.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

Antitrust authorities at the Federal Trade Commission are reviewing your company's recent merger with a rival firm. The FTC is concerned that the merger of two rival firms in the same market will increase market power. A hearing is scheduled for your company to present arguments that your firm has not increased its market power through this merger. Can you do this? How? What evidence might you bring to the hearing?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

You own a small bank in a state that is now considering allowing interstate banking. You oppose interstate banking because it will be possible for the very large money center banks in New York, Chicago, and San Francisco to open branches in your bank's geographic market area. While proponents of interstate banking point to the benefits to consumers of increased competition, you worry that economies of scale might ultimately force your now profitable bank out of business. Explain how economies of scale (if significant economies of scale in fact do exist) could result in your bank being forced out of business in the long run.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

The Harley-Davidson motorcycle company, which had a copyright on the word "hog," applied for exclusive rights to its engine sound. Why would a company want copyrights on two such mundane things?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

The Wall Street Journal reported that businesses are aggressively pushing consumers to pay bills electronically. Numerous banks dropped their monthly fees for online bill paying, and many merchants are offering incentives for customers to sign up for online bill payment. Aside from the direct cost savings to businesses, such as lower postage and other administrative costs, what other reason might explain business's interest in online bill payment?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

Even if the firms in a monopolistically competitive market collude successfully and fix price, economic profit will still be competed away if there is unrestricted entry. Explain. Will price be higher or lower under such an agreement in long-run equilibrium than would be the case if firms didn't collude? Explain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

The Ali Baba Co. is the only supplier of a particular type of Oriental carpet. The estimated demand for its carpets is

Q = 112,000 ? 500 P + 5 M

where Q = number of carpets, P = price of carpets (dollars per unit), and M = consumers' income per capita. The estimated average variable cost function for Ali Baba's carpets is

AVC = 200 ? 0.012 Q + 0.000002 Q 2

Consumers' income per capita is expected to be $20,000 and total fixed cost is $100,000.

a. How many carpets should the firm produce in order to maximize profit?

b. What is the profit-maximizing price of carpets?

c. What is the maximum amount of profit that the firm can earn selling carpets?

d. Answer parts a through c if consumers' income per capita is expected to be $30,000 instead.

Q = 112,000 ? 500 P + 5 M

where Q = number of carpets, P = price of carpets (dollars per unit), and M = consumers' income per capita. The estimated average variable cost function for Ali Baba's carpets is

AVC = 200 ? 0.012 Q + 0.000002 Q 2

Consumers' income per capita is expected to be $20,000 and total fixed cost is $100,000.

a. How many carpets should the firm produce in order to maximize profit?

b. What is the profit-maximizing price of carpets?

c. What is the maximum amount of profit that the firm can earn selling carpets?

d. Answer parts a through c if consumers' income per capita is expected to be $30,000 instead.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

Dr. Leona Williams, a well-known plastic surgeon, has a reputation for being one of the best surgeons for reconstructive nose surgery. Dr. Williams enjoys a rather substantial degree of market power in this market. She has estimated demand for her work to be

Q = 480 ? 0.2 P

where Q is the number of nose operations performed monthly and P is the price of a nose operation.

a. What is the inverse demand function for Dr. Williams's services?

b. What is the marginal revenue function?

The average variable cost function for reconstructive nose surgery is estimated to be

AVC = 2 Q 2 ? 15 Q + 400

where AVC is average variable cost (measured in dollars), and Q is the number of operations per month. The doctor's fixed costs each month are $8,000.

c. If the doctor wishes to maximize her profit, how many nose operations should she perform each month?

d. What price should Dr. Williams charge to perform a nose operation?

e. How much profit does she earn each month?

Q = 480 ? 0.2 P

where Q is the number of nose operations performed monthly and P is the price of a nose operation.

a. What is the inverse demand function for Dr. Williams's services?

b. What is the marginal revenue function?

The average variable cost function for reconstructive nose surgery is estimated to be

AVC = 2 Q 2 ? 15 Q + 400

where AVC is average variable cost (measured in dollars), and Q is the number of operations per month. The doctor's fixed costs each month are $8,000.

c. If the doctor wishes to maximize her profit, how many nose operations should she perform each month?

d. What price should Dr. Williams charge to perform a nose operation?

e. How much profit does she earn each month?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

A firm with two factories, one in Michigan and one in Texas, has decided that it should produce a total of 500 units to maximize profit. The firm is currently producing 200 units in the Michigan factory and 300 units in the Texas factory. At this allocation between plants, the last unit of output produced in Michigan added $5 to total cost, while the last unit of output produced in Texas added $3 to total cost.

a. Is the firm maximizing profit? If so, why? If not, what should it do?

b. If the firm produces 201 units in Michigan and 299 in Texas, what will be the increase (decrease) in the firm's total cost?

a. Is the firm maximizing profit? If so, why? If not, what should it do?

b. If the firm produces 201 units in Michigan and 299 in Texas, what will be the increase (decrease) in the firm's total cost?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

In a recent "earnings call," a teleconference call to shareholders in which the CEO reports and discusses quarterly earnings per share, Coca-Cola's CEO Muhtar Kent bragged about "winning" market share from rival beverage company PepsiCo. However, rising sugar costs in 2011 are forcing Coke to raise soft drink prices by 3 to 4 percent, and this could undermine Coke's market share gains if Pepsi does not also raise its soft drink prices. The Wall Street Journal (April 27, 2011) reports that, in an effort to continue "winning the market share battle," Kent plans to maintain relatively low prices in soft drinks by raising prices disproportionately higher in other categories such as fruit juices and sport drinks. The WSJ raises the concern that "winning market share may come at too great a financial cost." Discuss some reasons why Coke's pricing tactics to win market share could in fact reduce Coke's profit and earnings per share.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

In a Wall Street Journal article titled "Sparing Fliers Even Higher Airfares," Scott McCartney claims that jet fuel hedging by Southwest Airlines resulted in lower airfares for passengers on all airlines: "Without (the fuel hedging) windfall, (Southwest) likely would have had to jack up fares well beyond last year's (fares)." Other airline industry analysts have also claimed that Southwest charges no fee for baggage ("Bags Fly Free") largely because of the airline's success in hedging its fuel costs. Evaluate these two claims. [ Hint : You should read Illustration 12.3 before you answer this question.]

Illustration 12.3 for Reference:

![In a Wall Street Journal article titled Sparing Fliers Even Higher Airfares, Scott McCartney claims that jet fuel hedging by Southwest Airlines resulted in lower airfares for passengers on all airlines: Without (the fuel hedging) windfall, (Southwest) likely would have had to jack up fares well beyond last year's (fares). Other airline industry analysts have also claimed that Southwest charges no fee for baggage (Bags Fly Free) largely because of the airline's success in hedging its fuel costs. Evaluate these two claims. [ Hint : You should read Illustration 12.3 before you answer this question.] Illustration 12.3 for Reference:](https://d2lvgg3v3hfg70.cloudfront.net/SM2913/11eb7730_36ad_1438_adfc_91ec10606e52_SM2913_00.jpg)

Illustration 12.3 for Reference:

![In a Wall Street Journal article titled Sparing Fliers Even Higher Airfares, Scott McCartney claims that jet fuel hedging by Southwest Airlines resulted in lower airfares for passengers on all airlines: Without (the fuel hedging) windfall, (Southwest) likely would have had to jack up fares well beyond last year's (fares). Other airline industry analysts have also claimed that Southwest charges no fee for baggage (Bags Fly Free) largely because of the airline's success in hedging its fuel costs. Evaluate these two claims. [ Hint : You should read Illustration 12.3 before you answer this question.] Illustration 12.3 for Reference:](https://d2lvgg3v3hfg70.cloudfront.net/SM2913/11eb7730_36ad_1438_adfc_91ec10606e52_SM2913_00.jpg)

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

Amtrak, a national passenger railroad heavily subsidized by taxpayers, operates at a huge loss every year. Recently, officials at Amtrak expressed confidence that they can turn things around by "running the railroad like a business." Specifically, Amtrak's managers plan to raise ticket prices to "trim costs and boost revenues." What must be true about Amtrak's demand elasticity for this plan to work? What effect will raising price have on Amtrak's costs?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

The owners of the Tampa Bay Buccaneers have seen demand for season tickets decline steadily, probably because the team's performance is ranked near the bottom of 32 teams in the National Football League. The team owners are now considering a decrease in season ticket prices. Using graphical analysis, show that when demand decreases for a monopolist, price must be cut to maximize profit.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck