Deck 15: Preserving Your Estate

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 15: Preserving Your Estate

1

Describe the basic clauses normally included in a will and the requirements regarding who may make a valid will.

The basic clauses normally included in a will are:

• Introductory clause : In introductory clause testator's name and address is included to find out the country for tax and legal purposes.

• Direction of payments : With the help of this clause, the testator can direct the estate to make a certain payments of expenses to creditors.

• Disposition of property : This clause includes the identification and distribution of property.

• Appointment clause : Appointment clause appoints the decedent's personal representative who administers the estate, guardians for minor children, and trustees and their successors.

• Tax clause : This clause states how much tax is charged from each beneficiary based on his or her share of the taxable estate.

• Simultaneous death clause : This clause describes what happens in case of simultaneous death.

• Execution and attestation clause : Every will should be in writing and signed by the testator as its end as a precaution against fraud.

• Witness clause : The final clause helps to affirm that the will in question is really that of deceased. All states require two witnesses to the testator's signing of the will.

To make a valid will, it must be made by a person with sound mind, with no undue influence, the will itself must have been properly executed, and its execution must be free from fraud.

• Introductory clause : In introductory clause testator's name and address is included to find out the country for tax and legal purposes.

• Direction of payments : With the help of this clause, the testator can direct the estate to make a certain payments of expenses to creditors.

• Disposition of property : This clause includes the identification and distribution of property.

• Appointment clause : Appointment clause appoints the decedent's personal representative who administers the estate, guardians for minor children, and trustees and their successors.

• Tax clause : This clause states how much tax is charged from each beneficiary based on his or her share of the taxable estate.

• Simultaneous death clause : This clause describes what happens in case of simultaneous death.

• Execution and attestation clause : Every will should be in writing and signed by the testator as its end as a precaution against fraud.

• Witness clause : The final clause helps to affirm that the will in question is really that of deceased. All states require two witnesses to the testator's signing of the will.

To make a valid will, it must be made by a person with sound mind, with no undue influence, the will itself must have been properly executed, and its execution must be free from fraud.

2

Discuss the reasons estate planners cite for making lifetime gifts. How can gift giving be used to reduce estate shrinkage

Estate planners recommend lifetime gift giving for the following tax-related reasons:

• Gift tax annual exclusion : Under the federal gift tax law certain amount of money can be given as gift without being subject to gift tax. This exemption is known as annual exclusion. For the calendar year 2009, 2010 and 2011 it was $13,000 per person up to 30 individuals and it was increased to $14,000 for 2012 and 2013.

• Gift tax exclusion escapes estate tax : Property that qualifies for the annual exclusion is not taxable and thus is free from gift and estate taxes. Estate tax savings from this exclusion can be significant.

• Appreciation in value : Because of inflation, generally a gift's increase in value after it was given. But this appreciation is excluded from the donor's estate. None of the appreciation is subject to gift or estate tax.

• Credit limit : Gift taxes don't have to be paid on cumulative lifetime gifts up to the applicable gift exclusion amount of $1,000,000. To the extent that the credit is used against lifetime gift taxes, it is not available to offset estate taxes.

• Impact of marital deduction : The transfer tax marital deduction allows one spouse to give the other spouse an unlimited amount of property entirely transfer tax free without reducing the donor spouse's AEA.

From the above discussion, it is clear that gift giving can be used to reduce estate shrinkage by saving taxes on it.

• Gift tax annual exclusion : Under the federal gift tax law certain amount of money can be given as gift without being subject to gift tax. This exemption is known as annual exclusion. For the calendar year 2009, 2010 and 2011 it was $13,000 per person up to 30 individuals and it was increased to $14,000 for 2012 and 2013.

• Gift tax exclusion escapes estate tax : Property that qualifies for the annual exclusion is not taxable and thus is free from gift and estate taxes. Estate tax savings from this exclusion can be significant.

• Appreciation in value : Because of inflation, generally a gift's increase in value after it was given. But this appreciation is excluded from the donor's estate. None of the appreciation is subject to gift or estate tax.

• Credit limit : Gift taxes don't have to be paid on cumulative lifetime gifts up to the applicable gift exclusion amount of $1,000,000. To the extent that the credit is used against lifetime gift taxes, it is not available to offset estate taxes.

• Impact of marital deduction : The transfer tax marital deduction allows one spouse to give the other spouse an unlimited amount of property entirely transfer tax free without reducing the donor spouse's AEA.

From the above discussion, it is clear that gift giving can be used to reduce estate shrinkage by saving taxes on it.

3

State the topics you would cover in your ethical will. Would you consider recording it digitally

Ethical Will

To my dear husband Mathew, Children Michael and Joy, Grandchildren Robert and Peter:

Family stories and history:

I met your dad at college and we fall in love with each other. With the blessings of god and family, we got married. God blessed us with two cute little babies like you. The two most important roles in my life were being a good wife to your father and good mother to you. My parents and in-laws were wonderful and they helped me a lot to bring you up. We always wanted the best for each of you as much as we possibly could. I have always been proud to have children like you and thankful to god for giving me such a great husband.

Life experiences:

The things that I am proud of in my life are:

Getting my college degree

Being chosen 'student of the year' in 1980

Having you and your dad in my life

Serving society for almost 20 years

Owning a big estate

Having built a strong financial background for the future

Being friendly to all we come in contact with

Our two grandchildren

Learning to play piano

Morals:

We want you to respect life and other people. The 'golden rule' of the life is, treat other people in the manner in which you want to be treated.

Mistakes:

They are the part of life and we learn from them. It builds character and success as we learn to appreciate the lessons.

Future:

We want that you also get a loving soul mate, someone who shares your life even in difficult time. Let your gratitude shine by helping others.

Yes, I will consider recording it digitally. As ethical, Will can take various forms, such as handwritten letters or journals, personal essays written on a computer, or even a digitally recorded discourse to be shared by DVD or audiotape.

To my dear husband Mathew, Children Michael and Joy, Grandchildren Robert and Peter:

Family stories and history:

I met your dad at college and we fall in love with each other. With the blessings of god and family, we got married. God blessed us with two cute little babies like you. The two most important roles in my life were being a good wife to your father and good mother to you. My parents and in-laws were wonderful and they helped me a lot to bring you up. We always wanted the best for each of you as much as we possibly could. I have always been proud to have children like you and thankful to god for giving me such a great husband.

Life experiences:

The things that I am proud of in my life are:

Getting my college degree

Being chosen 'student of the year' in 1980

Having you and your dad in my life

Serving society for almost 20 years

Owning a big estate

Having built a strong financial background for the future

Being friendly to all we come in contact with

Our two grandchildren

Learning to play piano

Morals:

We want you to respect life and other people. The 'golden rule' of the life is, treat other people in the manner in which you want to be treated.

Mistakes:

They are the part of life and we learn from them. It builds character and success as we learn to appreciate the lessons.

Future:

We want that you also get a loving soul mate, someone who shares your life even in difficult time. Let your gratitude shine by helping others.

Yes, I will consider recording it digitally. As ethical, Will can take various forms, such as handwritten letters or journals, personal essays written on a computer, or even a digitally recorded discourse to be shared by DVD or audiotape.

4

Explain the general nature of the federal estate tax. How does the unified tax credit affect the amount of estate tax owed What is the portability concept

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

How can changes in the provisions of a will be made legally In what four ways can a will be revoked

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

Explain the general procedure used to calculate the federal estate tax due.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

Your best friend has asked you to be executor of his estate. What qualifications do you need, and would you accept the responsibility

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

The two basic techniques of estate planning are (1) dividing your estate and (2) deferring income to minimize taxes. Describe and discuss each of these techniques.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Explain these terms: (a) intestacy , (b) testator , (c) codicil , (d) letter of last instructions.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

George Reed, 48 and a widower, and Debbie Moore, 44 and previously divorced, were married five years ago. There are children from their prior marriages, two children for George and one child for Debbie. The couple's estate is valued at $1.4 million, including a house valued at $475,000, a vacation home at the beach, investments, antique furniture that has been in Debbie's family for many years, and jewelry belonging to George's first wife. Discuss how they could use trusts as part of their estate planning, and suggest some other ideas for them to consider when preparing their wills and related documents.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

What is meant by the probate process Who is an executor , and what is the executor's role in estate settlement

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

If you die without a valid will, the laws of your state will determine what happens to your property. That may be fine with people who have few assets, but it's not fine for people who care what happens to their property, and it's certainly not fine for people with dependents. In this project, you'll consider what your current will should contain and what changes you should make to your will based on your future circumstances.

Look back through this chapter and review the common features of a will. Then write your own will, based on the sample clauses and examples of a representative will given in the text. List the property that you currently have, or expect to have in the near future, and name a beneficiary for each. Be sure to name your personal representative, and charge him or her with disposing of your estate according to your wishes. If you have children or expect to have children, or if you have other dependents such as an elderly parent or a disabled sibling, be sure to name a guardian and a backup guardian for them. Also prepare a letter of last instructions to convey any personal thoughts or instructions that you feel cannot be properly included in your will. Remember, this exercise should help you think about the orderly disposition of your estate, which is the final act in implementing your personal financial plans.

Look back through this chapter and review the common features of a will. Then write your own will, based on the sample clauses and examples of a representative will given in the text. List the property that you currently have, or expect to have in the near future, and name a beneficiary for each. Be sure to name your personal representative, and charge him or her with disposing of your estate according to your wishes. If you have children or expect to have children, or if you have other dependents such as an elderly parent or a disabled sibling, be sure to name a guardian and a backup guardian for them. Also prepare a letter of last instructions to convey any personal thoughts or instructions that you feel cannot be properly included in your will. Remember, this exercise should help you think about the orderly disposition of your estate, which is the final act in implementing your personal financial plans.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

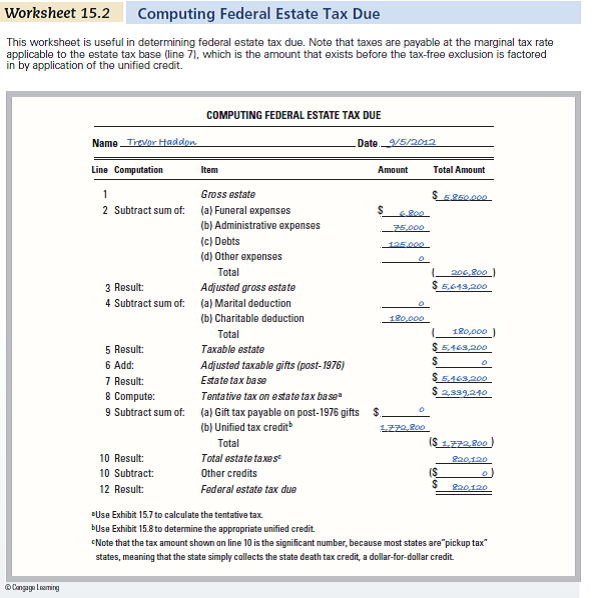

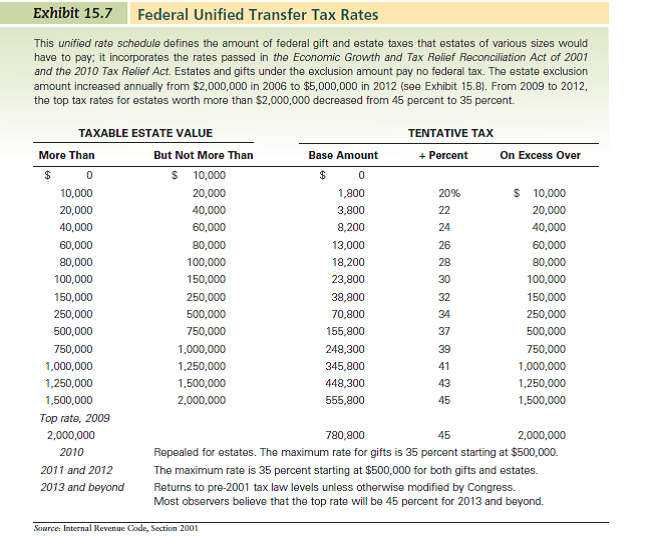

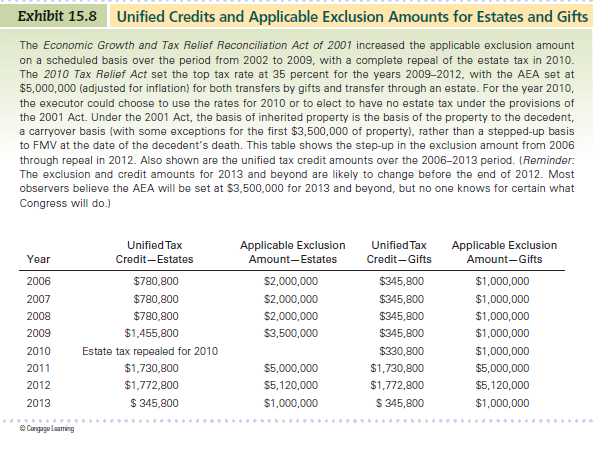

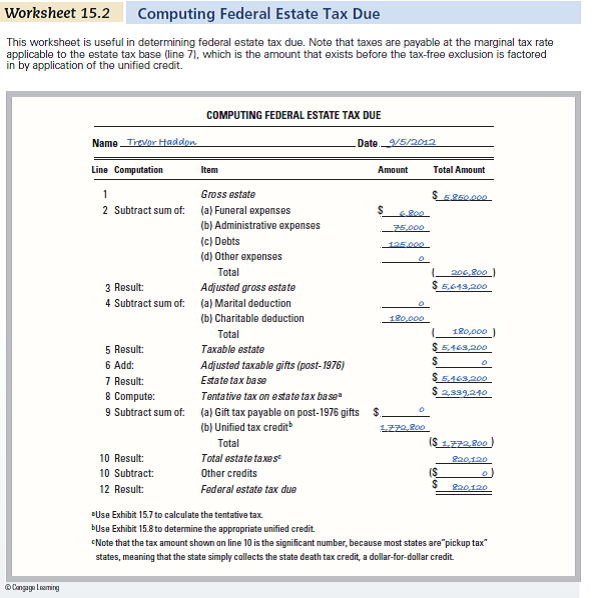

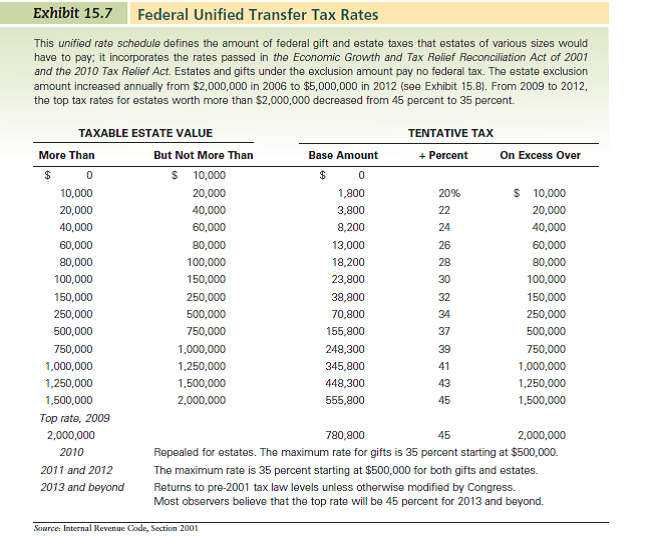

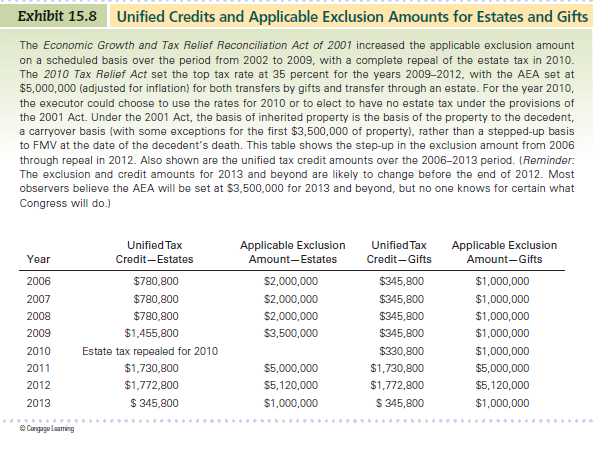

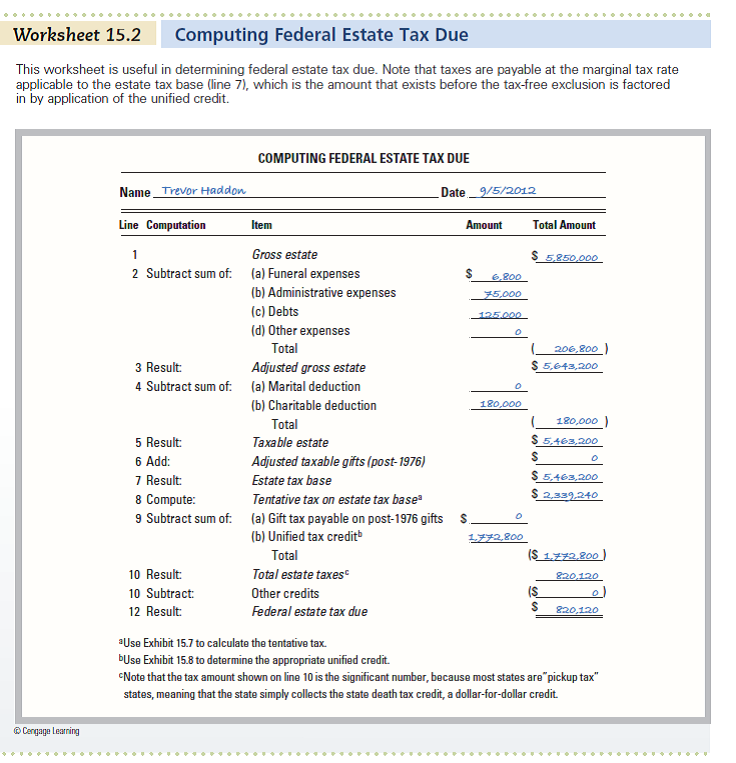

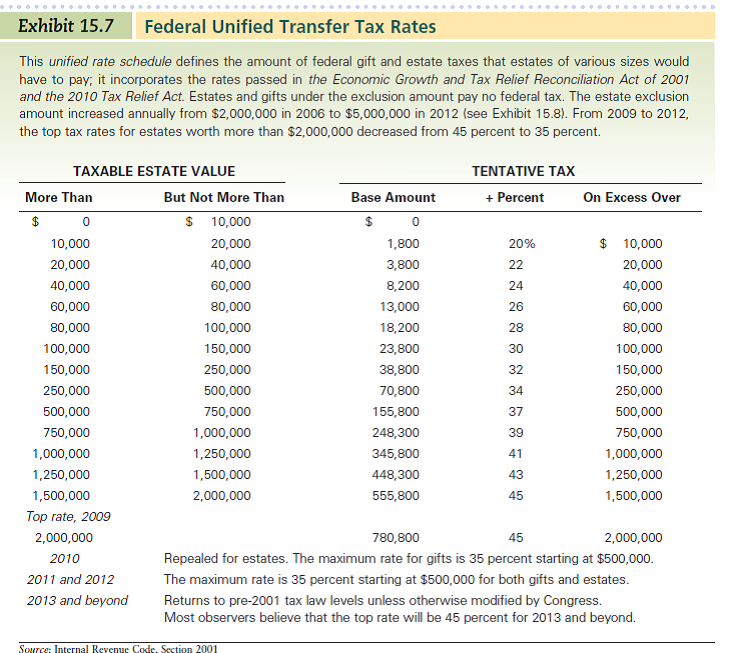

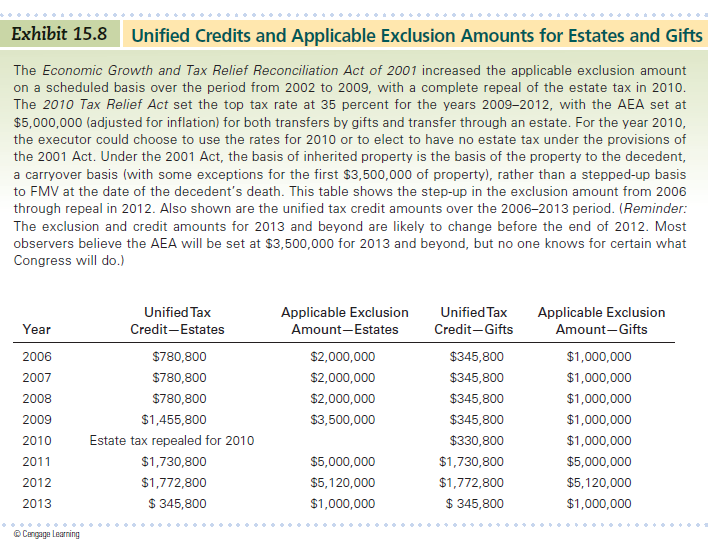

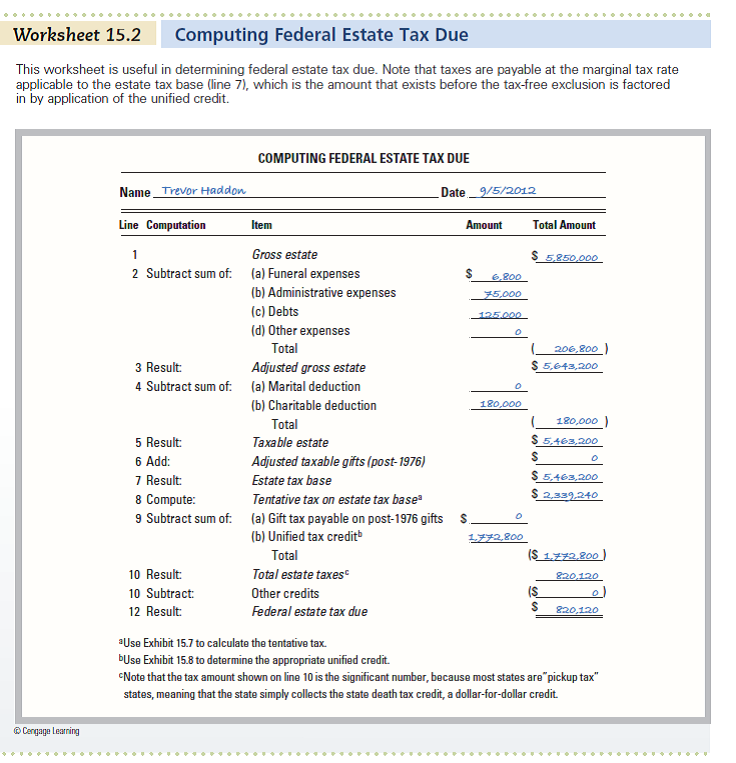

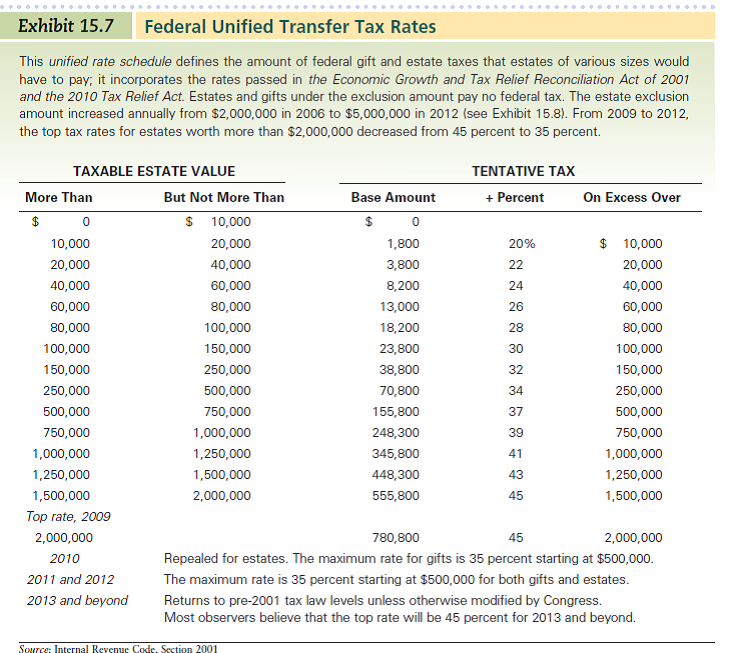

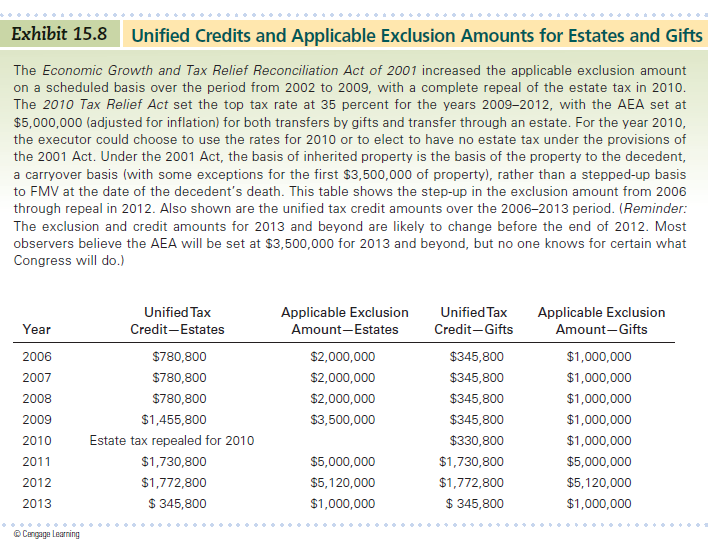

Use Worksheet 15.2. When Russell Hypes died unmarried in 2012, he left an estate valued at $7,850,000. His trust directed distribution as follows: $20,000 to the local hospital, $160,000 to his alma mater, and the remainder to his three adult children. Death-related costs and expenses were $16,800 for funeral expenses, $40,000 paid to attorneys, $5,000 paid to accountants, and $30,000 paid to the trustee of his living trust. In addition, there were debts of $125,000. Use Worksheet 15.2 and Exhibits 15.7 and 15.8 to calculate the federal estate tax due on his estate.

(Reference Worksheet 15.2 and Exhibits 15.7 and 15.8 )

(Reference Worksheet 15.2 and Exhibits 15.7 and 15.8 )

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

Discuss the importance and goals of estate planning. Explain why estates often break up. Distinguish between the probate estate and the gross estate.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

Describe briefly the importance of these documents in estate planning: (a) power of attorney, (b) living will, (c) durable power of attorney for health care, and (d) ethical will.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

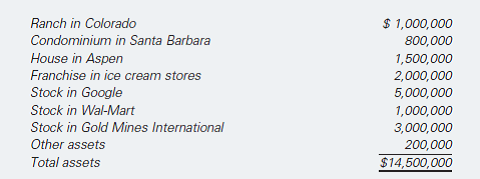

In the late 1970s, Latafat Tilki, from Turkey, migrated to the United States, where he is now a citizen. A man of many talents and deep foresight, he has built a large fleet of oceangoing oil tankers during his stay in the United States. Now a wealthy man in his 60s, he resides in Aspen, Colorado, with his second wife, Karen, age 50. They have two sons, one in junior high and one a high-school freshman. For some time, Latafat has considered preparing a will to ensure that his estate will be properly distributed when he dies. A survey of his estate reveals the following:

The house and the Gold Mines International shares are held in joint tenancy with his wife, but all other property is in his name alone. He desires that there be a separate fund of $1 million for his sons' education and that the balance of his estate be divided as follows: 40 percent to his sons, 40 percent to his wife, and 20 percent given to other relatives, friends, and charitable institutions. He has scheduled an appointment for drafting his will with his attorney and close friend, Gary Ingram. Latafat would like to appoint Gary, who is 70 years old, and Latafat's 40-year-old cousin, Ceylan Sadik (a CPA), as coexecutors. If one of them predeceases Latafat, he'd like Second National Bank to serve as co-executor.

Critical Thinking Questions

1. Does Latafat really need a will Explain why or why not. What would happen to his estate if he were to die without a will

2. Explain to Latafat the common features that need to be incorporated into a will.

3. Might the manner in which title is held thwart his estate planning desires What should be done to avoid problems

4. Is a living trust an appropriate part of his estate plan How would a living trust change the nature of Latafat's will

5. How does the age of his children complicate the estate plan What special provisions should he consider

6. What options are available to Latafat if he decides later to change or revoke the will Is it more difficult to change a living trust

7. What duties will Gary Ingram and Ceylan Sadik have to perform as co-executors of Latafat's estate If a trust is created, what should Latafat consider in his selection of a trustee or co-trustees Might Gary and Ceylan, serving together, be a good choice

The house and the Gold Mines International shares are held in joint tenancy with his wife, but all other property is in his name alone. He desires that there be a separate fund of $1 million for his sons' education and that the balance of his estate be divided as follows: 40 percent to his sons, 40 percent to his wife, and 20 percent given to other relatives, friends, and charitable institutions. He has scheduled an appointment for drafting his will with his attorney and close friend, Gary Ingram. Latafat would like to appoint Gary, who is 70 years old, and Latafat's 40-year-old cousin, Ceylan Sadik (a CPA), as coexecutors. If one of them predeceases Latafat, he'd like Second National Bank to serve as co-executor.

Critical Thinking Questions

1. Does Latafat really need a will Explain why or why not. What would happen to his estate if he were to die without a will

2. Explain to Latafat the common features that need to be incorporated into a will.

3. Might the manner in which title is held thwart his estate planning desires What should be done to avoid problems

4. Is a living trust an appropriate part of his estate plan How would a living trust change the nature of Latafat's will

5. How does the age of his children complicate the estate plan What special provisions should he consider

6. What options are available to Latafat if he decides later to change or revoke the will Is it more difficult to change a living trust

7. What duties will Gary Ingram and Ceylan Sadik have to perform as co-executors of Latafat's estate If a trust is created, what should Latafat consider in his selection of a trustee or co-trustees Might Gary and Ceylan, serving together, be a good choice

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Summarize important legislation affecting estate taxes, and briefly describe the impact on estate planning. Explain why getting rid of the estate tax doesn't eliminate the need for estate planning.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Generate a list of estate planning objectives that apply to your personal family situation. Be sure to consider the size of your potential estate as well as people planning and asset planning. Estate planning is not just about taxes.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

Define and differentiate between joint tenancy and tenancy by the entirety. Discuss the advantages and disadvantages of joint ownership. How does tenancy in common differ from joint tenancy

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

Briefly describe the steps involved in the estate planning process.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

What is the right of survivorship What is community property, and how does it differ from joint tenancy with regard to the right of survivorship

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

Robert Hancock, of Charlotte, North Carolina, was 65 when he retired in 2005. Alyssa, his wife of 40 years, passed away the next year. Her will left everything to Robert. Although Alyssa's estate was valued at $2,250,000, there was no estate tax due because of the 100 percent marital deduction. Their only child, Nathan, is married to Mary; they have four children, two in college and two in high school. In 2007, Robert made a gift of Apple stock worth $260,000 jointly to Nathan and Mary. Because of the two $13,000 annual exclusions and the unified credit, no gift taxes were due. When Robert died in 2012, his home was valued at $850,000, his vacation cabin on a lake was valued at $485,000, his investments in stocks and bonds at $1,890,000, and his pension funds at $645,000 (Nathan was named beneficiary). Robert also owned a life insurance policy that paid proceeds of $700,000 to Nathan. He left $60,000 to his church and $25,000 to his high school to start a scholarship fund in his wife's name. The rest of the estate was left to Nathan. Funeral costs were $15,000. Debts were $90,000 and miscellaneous expenses were $25,000. Attorney and accounting fees came to $36,000. Use Worksheet 15.2 to guide your calculations as you complete these exercises.

Critical Thinking Questions

1. Compute the value of Robert's probate estate.

2. Compute the value of Robert's gross estate.

3. Determine the total allowable deductions.

4. Calculate the estate tax base , taking into account the gifts given to Nathan and Mary (remember that the annual exclusions "adjust" the taxable gifts).

5. Use Exhibit 15.7 to determine the tentative tax on estate tax base.

6. Subtract the appropriate unified tax credit (Exhibit 15.8) for 2012 from the tentative tax on estate tax base to arrive at the federal estate tax due.

REFERENCES:

Critical Thinking Questions

1. Compute the value of Robert's probate estate.

2. Compute the value of Robert's gross estate.

3. Determine the total allowable deductions.

4. Calculate the estate tax base , taking into account the gifts given to Nathan and Mary (remember that the annual exclusions "adjust" the taxable gifts).

5. Use Exhibit 15.7 to determine the tentative tax on estate tax base.

6. Subtract the appropriate unified tax credit (Exhibit 15.8) for 2012 from the tentative tax on estate tax base to arrive at the federal estate tax due.

REFERENCES:

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

Describe the basic trust arrangement, and discuss typical reasons for establishing trusts. What essential qualities should a trustee possess

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

David and Cheryl Allen are in their mid-30s and have two children, ages 8 and 5. They have combined annual income of $95,000 and own a house in joint tenancy with a market value of $310,000, on which they have a mortgage of $250,000. David has $100,000 in group term life insurance and an individual universal life policy for $150,000. However, the Allens haven't prepared their wills. David plans to draw one up soon, but the couple thinks that Cheryl doesn't need one because the house is jointly owned. As their financial planner, explain why it's important for both David and Cheryl to draft wills as soon as possible.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

What is a living (inter vivos) trust Distinguish between a revocable living trust and an irrevocable living trust.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

What is a will Why is it important Describe the consequences of dying intestate.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

Explain each of these terms: (a) grantor , (b) trustee , (c) beneficiary , (d) pour-over will , (e) testamentary trust , and (f) irrevocable life insurance trust.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

Prepare a basic will for yourself, using the guidelines presented in the text; also prepare your brief letter of last instructions.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

What is a gift, and when is a gift made Describe the following terms as they relate to federal gift taxes: (a) annual exclusion , (b) gift splitting , (c) charitable deduction , and (d) marital deduction.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck