Deck 12: Investing in Stocks and Bonds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 12: Investing in Stocks and Bonds

1

A couple in their early 30s, Charles and Sherry Ashcroft recently inherited $90,000 from a relative. Charles earns a comfortable income as a sales manager for Transportation Logistics, Inc., and Sherry does equally well as an attorney with a major law firm. Because they have no children and don't need the money, they've decided to invest all of the inheritance in stocks, bonds, and perhaps even some money market instruments. However, because they're not very familiar with the market, they turn to you for help.

Critical Thinking Questions

1. What kind of investment approach do you think the Ashcrofts should adopt-that is, should they be conservative with their money or aggressive Explain.

2. What kind of stocks do you think the Ashcrofts should invest in How important is current income (i.e., dividends or interest income) to them Should they be putting any of their money into bonds Explain.

3. Construct an investment portfolio that you feel would be right for the Ashcrofts and invest the full $90,000. Put actual stocks, bonds, and/or convertible securities in the portfolio; you may also put up to one-third of the money into short-term securities such as CDs, Treasury bills, money funds, or MMDAs. Select any securities you want, so long as you feel they'd be suitable for the Ashcrofts. Make sure that the portfolio consists of six or more different securities, and use the latest issue of The Wall Street Journal or an online source such as http://finance.yahoo.com to determine the market prices of the securities you select. Show the amount invested in each security along with the amount of current income (from dividends and/or interest) that will be generated from the investments. Briefly explain why you selected these particular securities for the Ashcrofts' portfolio.

Critical Thinking Questions

1. What kind of investment approach do you think the Ashcrofts should adopt-that is, should they be conservative with their money or aggressive Explain.

2. What kind of stocks do you think the Ashcrofts should invest in How important is current income (i.e., dividends or interest income) to them Should they be putting any of their money into bonds Explain.

3. Construct an investment portfolio that you feel would be right for the Ashcrofts and invest the full $90,000. Put actual stocks, bonds, and/or convertible securities in the portfolio; you may also put up to one-third of the money into short-term securities such as CDs, Treasury bills, money funds, or MMDAs. Select any securities you want, so long as you feel they'd be suitable for the Ashcrofts. Make sure that the portfolio consists of six or more different securities, and use the latest issue of The Wall Street Journal or an online source such as http://finance.yahoo.com to determine the market prices of the securities you select. Show the amount invested in each security along with the amount of current income (from dividends and/or interest) that will be generated from the investments. Briefly explain why you selected these particular securities for the Ashcrofts' portfolio.

1)Since Persons C and SA are both quite young, have no children, and have good, stable incomes, they should adopt an aggressive investment approach.

Since, they are young they have time on their side, and can ride out the ups and downs of the stock market. They will be able to invest more of their money as they have no children. Without children, they have fewer financial obligations and will not require a constant income stream from their investments. Since they have good stable jobs, they will not need income from their investments. They could still fulfill all their financial obligations even if their investments do not pan out.

2)They should invest in Blue Chip stocks, Growth stocks, Tech stocks, Large-cap, Mid-cap and Small cap stocks. Investing in these stocks is suitable to a more aggressive than investing in bonds or Treasuries. This is because the prices of these stocks fluctuate more than those of bonds and Treasuries. Since they can afford to be more aggressive at investing, they should take the opportunity to do so.

By selecting many different types of stocks, they will be able to diversify their portfolio. Current income investments are not important to them since they have good, stable jobs that bring in the income they need for their expenses.

They could put some of their money into bonds to achieve a more diversified portfolio, but that is not necessary since they are quite young and have plenty of time to wait out any stock market downturns. In addition, interest rates are expected to rise, and this will lead bond rates to fall.

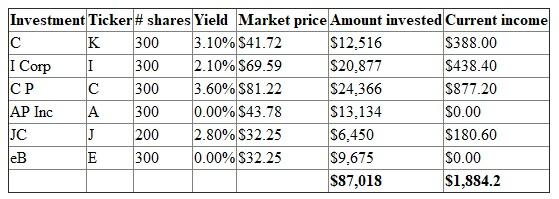

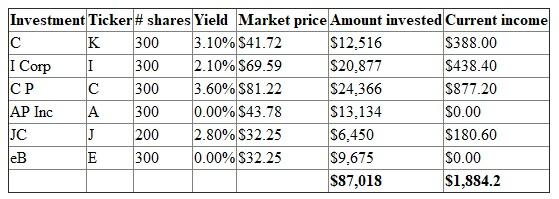

3)Organize the securities in a table as shown below:

Invest the remaining $2,982 in a CD. These stocks were selected so that Persons C and SA could have a diversified portfolio, with some Growth stocks; some Large caps stocks, some mid cap stocks, some small cap stocks, some energy stocks and some Tech stocks. These stocks were selected based on their financial health.

Invest the remaining $2,982 in a CD. These stocks were selected so that Persons C and SA could have a diversified portfolio, with some Growth stocks; some Large caps stocks, some mid cap stocks, some small cap stocks, some energy stocks and some Tech stocks. These stocks were selected based on their financial health.

C is a soft drink company that has been around for a long time. It has low debt, and is financial healthy. As it is a growth stock, it is a good, stable investment to balance out some of the riskier investments.

I Corp is a media and internet company, which fits with the Tech stock recommendations for the couple. It is a mid cap stock, which will offer some diversification from large cap stocks.

C P is the world's largest independent exploration and Production Company, and specializes in exploring for, producing, transporting, and marketing oil and natural gas. This is a good addition to their portfolio as it diversifies into the energy segment.

AP Inc. is a biopharmaceutical company that focuses on the development and commercialization of therapeutics in the field of cancer metabolism and inborn errors of metabolism. It is a small cap stock, which will offer some diversification from large cap stocks. In addition, it diversifies into the medical segment.

JC is a financial hold company that provides various financial services worldwide. It is a good addition to their portfolio as it diversifies into the financial services segment.

eB Inc. provides online platforms, tools and services to help individuals and merchants in online and mobile commerce and payments internationally. It is a tech stock that aids in commerce, which is not the same kind of tech segment as I Corp. It is a good addition to their portfolio as it offers diversity within the tech segment itself.

Since, they are young they have time on their side, and can ride out the ups and downs of the stock market. They will be able to invest more of their money as they have no children. Without children, they have fewer financial obligations and will not require a constant income stream from their investments. Since they have good stable jobs, they will not need income from their investments. They could still fulfill all their financial obligations even if their investments do not pan out.

2)They should invest in Blue Chip stocks, Growth stocks, Tech stocks, Large-cap, Mid-cap and Small cap stocks. Investing in these stocks is suitable to a more aggressive than investing in bonds or Treasuries. This is because the prices of these stocks fluctuate more than those of bonds and Treasuries. Since they can afford to be more aggressive at investing, they should take the opportunity to do so.

By selecting many different types of stocks, they will be able to diversify their portfolio. Current income investments are not important to them since they have good, stable jobs that bring in the income they need for their expenses.

They could put some of their money into bonds to achieve a more diversified portfolio, but that is not necessary since they are quite young and have plenty of time to wait out any stock market downturns. In addition, interest rates are expected to rise, and this will lead bond rates to fall.

3)Organize the securities in a table as shown below:

Invest the remaining $2,982 in a CD. These stocks were selected so that Persons C and SA could have a diversified portfolio, with some Growth stocks; some Large caps stocks, some mid cap stocks, some small cap stocks, some energy stocks and some Tech stocks. These stocks were selected based on their financial health.

Invest the remaining $2,982 in a CD. These stocks were selected so that Persons C and SA could have a diversified portfolio, with some Growth stocks; some Large caps stocks, some mid cap stocks, some small cap stocks, some energy stocks and some Tech stocks. These stocks were selected based on their financial health. C is a soft drink company that has been around for a long time. It has low debt, and is financial healthy. As it is a growth stock, it is a good, stable investment to balance out some of the riskier investments.

I Corp is a media and internet company, which fits with the Tech stock recommendations for the couple. It is a mid cap stock, which will offer some diversification from large cap stocks.

C P is the world's largest independent exploration and Production Company, and specializes in exploring for, producing, transporting, and marketing oil and natural gas. This is a good addition to their portfolio as it diversifies into the energy segment.

AP Inc. is a biopharmaceutical company that focuses on the development and commercialization of therapeutics in the field of cancer metabolism and inborn errors of metabolism. It is a small cap stock, which will offer some diversification from large cap stocks. In addition, it diversifies into the medical segment.

JC is a financial hold company that provides various financial services worldwide. It is a good addition to their portfolio as it diversifies into the financial services segment.

eB Inc. provides online platforms, tools and services to help individuals and merchants in online and mobile commerce and payments internationally. It is a tech stock that aids in commerce, which is not the same kind of tech segment as I Corp. It is a good addition to their portfolio as it offers diversity within the tech segment itself.

2

The price of Garden Designs, Inc. is now $85. The company pays no dividends. Sean Perth expects the price four years from now to be $125 a share. Should Sean buy Garden Designs if he wants a 15 percent rate of return Explain.

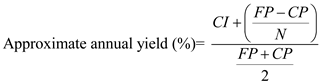

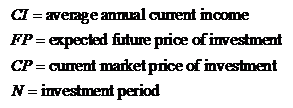

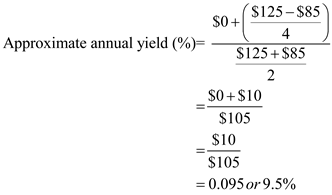

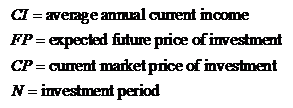

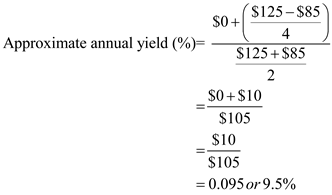

a) Compute the approximate yield:

Approximate yield is computed to know the exact value of the return that an investment offers.

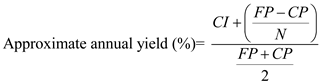

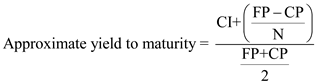

The formula to compute the approximate yield of an investment is as below:

Here,

Here,

Substitute:

Substitute:

The average annual current income is $0 per share, the future price is $125 per share and $85 is the current market price and the number of holding years is 4.

Therefore, the approximate yield of the investment is

Therefore, the approximate yield of the investment is

The approximate yield (or percent rate of return) is 9.5%. If he requires a 15% rate of return, he should not buy this stock as it gives only 9.5% rate of return.

The approximate yield (or percent rate of return) is 9.5%. If he requires a 15% rate of return, he should not buy this stock as it gives only 9.5% rate of return.

Approximate yield is computed to know the exact value of the return that an investment offers.

The formula to compute the approximate yield of an investment is as below:

Here,

Here,  Substitute:

Substitute: The average annual current income is $0 per share, the future price is $125 per share and $85 is the current market price and the number of holding years is 4.

Therefore, the approximate yield of the investment is

Therefore, the approximate yield of the investment is  The approximate yield (or percent rate of return) is 9.5%. If he requires a 15% rate of return, he should not buy this stock as it gives only 9.5% rate of return.

The approximate yield (or percent rate of return) is 9.5%. If he requires a 15% rate of return, he should not buy this stock as it gives only 9.5% rate of return. 3

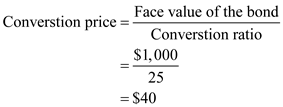

A 6 percent convertible bond (maturing in 20 years) is convertible into 25 shares of the company's common stock. The bond has a par value of $1,000 and is currently trading at $800; the stock (which pays a dividend of 95 cents a share) is currently trading in the market at $35 a share. Use this information to answer the following questions:

a. What is the current yield on the convertible bond What is the dividend yield on the company's common stock Which provides more current income: the convertible bond or the common stock Explain.

b. What is the bond's conversion ratio Its conversion price

c. What is the conversion value of this issue Is there any conversion premium in this issue If so, how much

d. What is the (approximate) yield to maturity on the convertible bond

a. What is the current yield on the convertible bond What is the dividend yield on the company's common stock Which provides more current income: the convertible bond or the common stock Explain.

b. What is the bond's conversion ratio Its conversion price

c. What is the conversion value of this issue Is there any conversion premium in this issue If so, how much

d. What is the (approximate) yield to maturity on the convertible bond

A convertible bond has 20 years to mature. Par value of the bond is $1,000. Current price of the bond is $800.

This bond can be converted into 25 shares. Stock pays the amount of 95 cents i.e. $0.95. The current price of the stock is $35.

a)

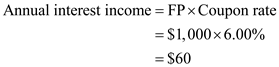

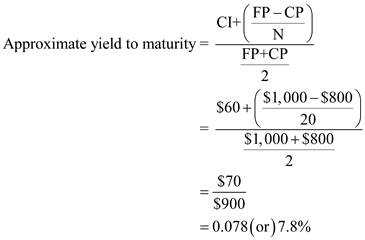

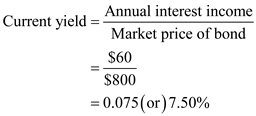

Determine the current yield on the bond:

Current yield can be calculated by dividing annual interest income:

Step 1: Calculate the annual interest income (assume face value of the bond/expected future price of the investment is $1,000):

Step 1: Calculate the annual interest income (assume face value of the bond/expected future price of the investment is $1,000):

Step 2: Calculate the current yield of the bond:

Step 2: Calculate the current yield of the bond:

Therefore, current yield on convertible bond is

Therefore, current yield on convertible bond is

.

.

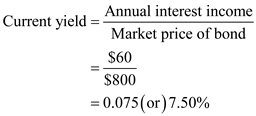

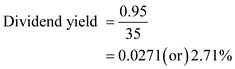

Determine the dividend yield on the common stock:

Dividend yield can be calculated by dividing dividend amount with market price per share (current price of the stock):

Substitute $0.95 for annual dividend received per share and $35 for market price per share in the equation:

Substitute $0.95 for annual dividend received per share and $35 for market price per share in the equation:

Therefore, dividend yield on the common stock is

Therefore, dividend yield on the common stock is

.

.

Therefore, it can be concluded that the convertible bond offers more current income since it has a higher yield than the common stock.

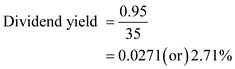

b)

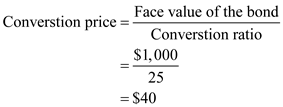

Determine the conversion ratio:

Since the bond is convertible into 25 shares of the company's common stock, the bond's conversion ratio is

.

.

Calculate the conversion price by dividing the face value of the bond with conversion ratio:

The conversion price is

The conversion price is

.

.

c)

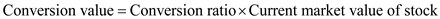

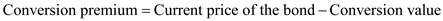

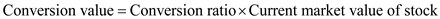

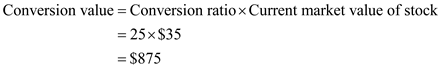

Determine the conversion value using the following formula:

Substitute 25 for conversion ratio and $35 for current market value of the stock in the formula of conversion value:

Substitute 25 for conversion ratio and $35 for current market value of the stock in the formula of conversion value:

Therefore, conversion value of the issue is

Therefore, conversion value of the issue is

.

.

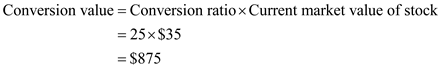

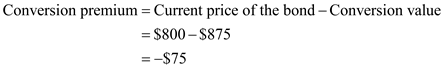

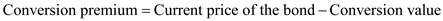

Determine the conversion premium:

Conversion premium is the difference between current price of the bond and conversion value:

Substitute the values in the formula:

Substitute the values in the formula:

The convertible bond traded at $800, and has a conversion value of $875. Since $800 is less than $875 and $800 is also less than $1,000 (the straight bond value), there is no conversion premium in this issue.

The convertible bond traded at $800, and has a conversion value of $875. Since $800 is less than $875 and $800 is also less than $1,000 (the straight bond value), there is no conversion premium in this issue.

d)

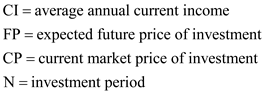

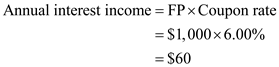

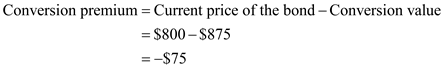

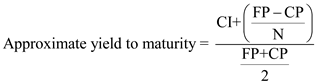

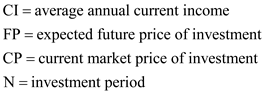

The approximate yield to maturity can be calculated by using the following formula:

Here,

Here,

Substitute 60 for CI, 1,800 for FP, 1,000 for CP, and 20 for N:

Substitute 60 for CI, 1,800 for FP, 1,000 for CP, and 20 for N:

Therefore, approximate yield to maturity is

Therefore, approximate yield to maturity is

.

.

This bond can be converted into 25 shares. Stock pays the amount of 95 cents i.e. $0.95. The current price of the stock is $35.

a)

Determine the current yield on the bond:

Current yield can be calculated by dividing annual interest income:

Step 1: Calculate the annual interest income (assume face value of the bond/expected future price of the investment is $1,000):

Step 1: Calculate the annual interest income (assume face value of the bond/expected future price of the investment is $1,000):  Step 2: Calculate the current yield of the bond:

Step 2: Calculate the current yield of the bond:  Therefore, current yield on convertible bond is

Therefore, current yield on convertible bond is  .

. Determine the dividend yield on the common stock:

Dividend yield can be calculated by dividing dividend amount with market price per share (current price of the stock):

Substitute $0.95 for annual dividend received per share and $35 for market price per share in the equation:

Substitute $0.95 for annual dividend received per share and $35 for market price per share in the equation:  Therefore, dividend yield on the common stock is

Therefore, dividend yield on the common stock is  .

. Therefore, it can be concluded that the convertible bond offers more current income since it has a higher yield than the common stock.

b)

Determine the conversion ratio:

Since the bond is convertible into 25 shares of the company's common stock, the bond's conversion ratio is

.

.Calculate the conversion price by dividing the face value of the bond with conversion ratio:

The conversion price is

The conversion price is  .

. c)

Determine the conversion value using the following formula:

Substitute 25 for conversion ratio and $35 for current market value of the stock in the formula of conversion value:

Substitute 25 for conversion ratio and $35 for current market value of the stock in the formula of conversion value:  Therefore, conversion value of the issue is

Therefore, conversion value of the issue is  .

. Determine the conversion premium:

Conversion premium is the difference between current price of the bond and conversion value:

Substitute the values in the formula:

Substitute the values in the formula:  The convertible bond traded at $800, and has a conversion value of $875. Since $800 is less than $875 and $800 is also less than $1,000 (the straight bond value), there is no conversion premium in this issue.

The convertible bond traded at $800, and has a conversion value of $875. Since $800 is less than $875 and $800 is also less than $1,000 (the straight bond value), there is no conversion premium in this issue.d)

The approximate yield to maturity can be calculated by using the following formula:

Here,

Here, Substitute 60 for CI, 1,800 for FP, 1,000 for CP, and 20 for N:

Substitute 60 for CI, 1,800 for FP, 1,000 for CP, and 20 for N:  Therefore, approximate yield to maturity is

Therefore, approximate yield to maturity is  .

. 4

What makes for a good investment Use the approximate yield formula or a financial calculator to rank the following investments according to their expected returns.

a. Buy a stock for $30 a share, hold it for three years, and then sell it for $60 a share (the stock pays annual dividends of $2 a share).

b. Buy a security for $40, hold it for two years, and then sell it for $100 (current income on this security is zero).

c. Buy a one-year, 5 percent note for $1,000 (assume that the note has a $1,000 par value and that it will be held to maturity).

a. Buy a stock for $30 a share, hold it for three years, and then sell it for $60 a share (the stock pays annual dividends of $2 a share).

b. Buy a security for $40, hold it for two years, and then sell it for $100 (current income on this security is zero).

c. Buy a one-year, 5 percent note for $1,000 (assume that the note has a $1,000 par value and that it will be held to maturity).

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Briefly discuss some of the different types of common stock. Which types would be most appealing to you, and why

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Explain the system of bond ratings used by Moody's and Standard Poor's. Why would it make sense to ever buy junk bonds

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

What is meant by the risk-return trade-off What is the risk-free rate of return

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

An investor in the 28 percent tax bracket is trying to decide which of two bonds to select: one is a 5.5 percent U.S. Treasury bond selling at par; the other is a municipal bond with a 4.25 percent coupon, which is also selling at par. Which of these two bonds should the investor select Why

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Using the resources available at your campus or public library, work the following problems. ( Note: Show your work for all your calculations.)a. Select any two common stocks and then determine the dividend yield, EPS, and P/E ratio for each.

b. Select any two bonds and then determine the current yield and yield to maturity of each.

c. Select any two convertible debentures and then determine the conversion ratio, conversion value, and conversion premium for each.

b. Select any two bonds and then determine the current yield and yield to maturity of each.

c. Select any two convertible debentures and then determine the conversion ratio, conversion value, and conversion premium for each.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Elaine Tolbert is a 28-year-old management trainee at a large chemical company. She is single and has no plans for marriage. Her annual salary is $34,000 (placing her in the 15 percent tax bracket), and her monthly expenditures come to approximately $1,500. During the past year or so, Elaine has managed to save around $8,000, and she expects to continue saving at least that amount each year for the foreseeable future. Her company pays the premium on her $35,000 life insurance policy. Because Elaine's entire education was financed by scholarships, she was able to save money from the summer and part-time jobs she held as a student. Altogether, she has a nest egg of nearly $18,000, out of which she'd like to invest about $15,000. She'll keep the remaining $3,000 in a bank CD that pays 3 percent interest and will use this money only in an emergency. Elaine can afford to take more risks than someone with family obligations can, but she doesn't wish to be a speculator; she simply wants to earn an attractive rate of return on her investments.

Critical Thinking Questions

1. What investment options are open to Elaine

2. What chance does she have of earning a satisfactory return if she invests her $15,000 in (a) bluechip stocks, (b) growth stocks, (c) speculative stocks, (d) corporate bonds, or (e) municipal bonds

3. Discuss the factors you would consider when analyzing these alternate investment vehicles.

4. What recommendation would you make to Elaine regarding her available investment alternatives Explain.

Critical Thinking Questions

1. What investment options are open to Elaine

2. What chance does she have of earning a satisfactory return if she invests her $15,000 in (a) bluechip stocks, (b) growth stocks, (c) speculative stocks, (d) corporate bonds, or (e) municipal bonds

3. Discuss the factors you would consider when analyzing these alternate investment vehicles.

4. What recommendation would you make to Elaine regarding her available investment alternatives Explain.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Summarize the evidence on the potential cost of being out of the stock market during its best months.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Explain the difference between dirty (full) and clean bond prices What is the significance of the difference in the prices for a bond buyer

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

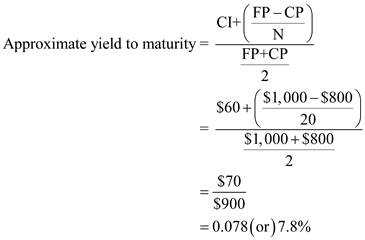

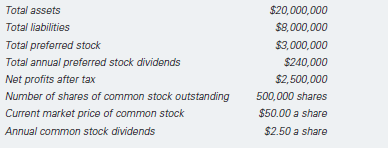

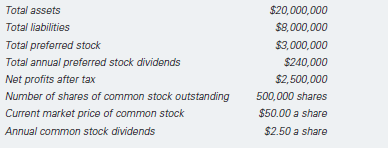

Selected financial information about Upper End Clothing, Inc., is as follows:

Using the company's financial information, compute the following:

a. The stock's dividend yield

b. Book value per share

c. EPS

d. P/E ratio

Using the company's financial information, compute the following:

a. The stock's dividend yield

b. Book value per share

c. EPS

d. P/E ratio

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Describe and differentiate between a bond's (a) current yield and (b) yield to maturity. Why are these yield measures important to the bond investor Find the yield to maturity of a 20-year, 9 percent, $1,000 par value bond trading at a price of $850. What's the current yield on this bond

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

You have decided to sell a 5 percent semiannual coupon bond two months after the last coupon payment. The bond is currently selling for $951.25. Answer the following questions about the bond:

a. What is the clean price of the bond

b. What is the dirty (full) price of the bond

c. Explain how the clean and dirty prices of the bond are relevant to the buyer of the bond.

a. What is the clean price of the bond

b. What is the dirty (full) price of the bond

c. Explain how the clean and dirty prices of the bond are relevant to the buyer of the bond.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Briefly describe the two basic sources of return to investors.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

What are DRPs , and how do they fit into a stock investment program

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

What effects do market interest rates have on the price behavior of outstanding bonds

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Assume that you've just inherited $500,000 and have decided to invest a big chunk of it ($350,000, to be exact) in common stocks. Your objective is to build up as much capital as you can over the next 15 to 20 years, and you're willing to tolerate a "good deal'' of risk.

a. What types of stocks (blue chips, income stocks, and so on) do you think you'd be most interested in, and why Select at least three types of stocks and briefly explain the rationale for selecting each.

b. Would your selections change if you were dealing with a smaller amount of money-say, only $50,000 What if you were a more risk-averse investor

a. What types of stocks (blue chips, income stocks, and so on) do you think you'd be most interested in, and why Select at least three types of stocks and briefly explain the rationale for selecting each.

b. Would your selections change if you were dealing with a smaller amount of money-say, only $50,000 What if you were a more risk-averse investor

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Which of these two bonds offers the highest current yield Which one has the highest yield to maturity

a. A 6.55 percent, 22-year bond quoted at 52.000

b. A 10.25 percent, 27-year bond quoted at 103.625

a. A 6.55 percent, 22-year bond quoted at 52.000

b. A 10.25 percent, 27-year bond quoted at 103.625

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

What is interest on interest , and why is it such an important element of return

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Go to the asset allocation tool noted in the chapter's Cool Apps feature. Enter assumptions that fit your current and anticipated situation and produce an asset allocation recommendation. Then add 20 years to your age and redo the calculations. Finally, redo the calculations assuming minimal risk tolerance. Explain the results of changing these key assumptions.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

Discuss the evidence regarding the ability of most investors to effectively time getting in and out of the stock market. How sensitive are returns to being out of the market for just a few months of good stock market performance

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Find the current yield of a 5.65 percent, 8-year bond that's currently priced in the market at $853.75. Now, use a financial calculator to find the yield to maturity on this bond (use annual compounding). What's the current yield and yield to maturity on this bond if it trades at $1,000 If it's priced at $750 Comment on your findings.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

What is the desired rate of return, and how would it be used to make an investment decision

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

What's the difference between a secured bond and an unsecured bond

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

An investor is thinking about buying some shares of Razortronics, Inc., at $75 a share. She expects the price of the stock to rise to $115 a share over the next three years. During that time, she also expects to receive annual dividends of $4 per share. Given that the investor's expectations (about the future price of the stock and the dividends it pays) hold up, what rate of return can the investor expect to earn on this investment ( Hint: Use either the approximate yield formula or a financial calculator to solve this problem.)

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

A 25-year, zero coupon bond was recently quoted at 6.500. Find the current yield and yield to maturity of this issue, given the bond has a par value of $1,000. (Assume annual compounding for the yield to maturity measure.)

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

From a tax perspective, would it make any difference to an investor whether the return on a stock took the form of dividends or capital gains Explain.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

Are junk bonds and zero coupon bonds the same Explain. What are the basic tax features of a tax-exempt municipal bond

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

A company has total assets of $2.5 million, total liabilities of $1.8 million, and $200,000 worth of 8 percent preferred stock outstanding. What is the firm's total book value What would its book value per share be if the firm had 50,000 shares of common stock outstanding

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

Assume that an investor pays $850 for a long-term bond that carries a 7.5 percent coupon. During the next 12 months, interest rates drop sharply, and the investor sells the bond at a price of $962.50.

a. Find the current yield that existed on this bond at the beginning of the year. What was it by the end of the one-year holding period

b. Compute the return on this investment using the approximate yield formula and a one-year investment period.

a. Find the current yield that existed on this bond at the beginning of the year. What was it by the end of the one-year holding period

b. Compute the return on this investment using the approximate yield formula and a one-year investment period.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

What's the difference between a cash dividend and a stock dividend Which would you rather receive

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

What is a convertible bond, and why do investors buy convertible securities

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

In this chapter, we learned that common stock is often placed into various categories-blue-chip, growth, income, and so forth-and referred to by its size, such as large-, mid-, or small-cap. In this project, you'll examine and compare the returns on various types of common stock.

Common comparisons include:

• Large-cap versus mid- or small-cap

• Blue-chip versus speculative

• Growth versus income

• Cyclical versus defensive

Pick any two combinations from the foregoing list, and then select a stock to represent each of the categories included in your choices. For all four of your stocks, obtain information on:

• The company's EPS

• Growth in dividends per share

• Dividend yield

• P/E ratio

• The stock's beta

In addition, use the formula given in this chapter to compute each stock's approximate yield for the past year, based on what the stock is trading for today versus the price it sold for a year ago. Be sure to include any dividends paid over the past 12 months. You can obtain this information from financial newspapers or from online sources, such as http://finance.yahoo.com.

Compare and contrast the performance and characteristics of the stocks you've chosen. Based on your findings, does the type of stock you own make a difference Which type or types are the most suitable for your investment purposes

Common comparisons include:

• Large-cap versus mid- or small-cap

• Blue-chip versus speculative

• Growth versus income

• Cyclical versus defensive

Pick any two combinations from the foregoing list, and then select a stock to represent each of the categories included in your choices. For all four of your stocks, obtain information on:

• The company's EPS

• Growth in dividends per share

• Dividend yield

• P/E ratio

• The stock's beta

In addition, use the formula given in this chapter to compute each stock's approximate yield for the past year, based on what the stock is trading for today versus the price it sold for a year ago. Be sure to include any dividends paid over the past 12 months. You can obtain this information from financial newspapers or from online sources, such as http://finance.yahoo.com.

Compare and contrast the performance and characteristics of the stocks you've chosen. Based on your findings, does the type of stock you own make a difference Which type or types are the most suitable for your investment purposes

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

The Clarkson Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company's stock currently trades at $60 per share.

a. Compute the stock's EPS.

b. What is the stock's P/E ratio

c. Determine what the stock's dividend yield would be if it paid $1.75 per share to common stockholders.

a. Compute the stock's EPS.

b. What is the stock's P/E ratio

c. Determine what the stock's dividend yield would be if it paid $1.75 per share to common stockholders.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Find the conversion value of a convertible bond that carries a conversion ratio of 24, given that the market price of the underlying common stock is $55 a share. Would there be any conversion premium if the convertible bond had a market price of $1,500 If so, how much

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Describe the various types of risk to which investors are exposed.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Define and briefly discuss each of these common stock measures: (a) book value, (b) ROE, (c) EPS, (d) P/E ratio, and (e) beta.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Describe the conversion privilege on a convertible security. Explain how the market price of the underlying common stock affects the market price of a convertible bond.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck