Deck 13: The Multinational Corporation and Globalization

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 13: The Multinational Corporation and Globalization

1

The Great Computer Company, a U.S. corporation, has a subsidiary in the Netherlands. It is deciding whether to invest $2 million of its (the parent's) funds in a 3-year project in the Netherlands.

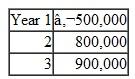

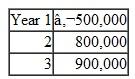

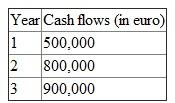

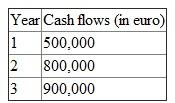

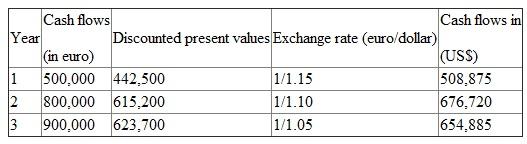

The aftertax cash flows to the subsidiary are estimated to be as follows (in euros):

The entire cash flows of the subsidiary are remitted to the parent annually. There is no additional tax (nor credit) in the parent country.

The entire cash flows of the subsidiary are remitted to the parent annually. There is no additional tax (nor credit) in the parent country.

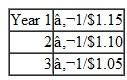

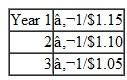

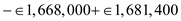

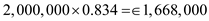

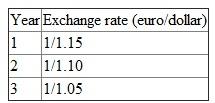

The exchange rate today is €1/$1.20. The exchange rate forecast for the next 3 years is the following:

The cost of capital for both the parent and the subsidiary is 13 percent.

The cost of capital for both the parent and the subsidiary is 13 percent.

a. What is the NPV of this project to the Netherlands' subsidiary

b. What is the NPV of this project to the U.S. parent

c. Should the project be accepted

The aftertax cash flows to the subsidiary are estimated to be as follows (in euros):

The entire cash flows of the subsidiary are remitted to the parent annually. There is no additional tax (nor credit) in the parent country.

The entire cash flows of the subsidiary are remitted to the parent annually. There is no additional tax (nor credit) in the parent country.The exchange rate today is €1/$1.20. The exchange rate forecast for the next 3 years is the following:

The cost of capital for both the parent and the subsidiary is 13 percent.

The cost of capital for both the parent and the subsidiary is 13 percent.a. What is the NPV of this project to the Netherlands' subsidiary

b. What is the NPV of this project to the U.S. parent

c. Should the project be accepted

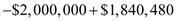

a) NPV of the project to the Netherland's subsidiary.

A U.S parent company is planning to invest $2 million in a 3 year project in its subsidiary in Netherland. The cost of the capital for both parent and subsidiary is 13 percent.

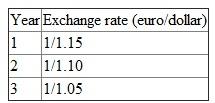

We are given the following estimated after tax cash flows to the subsidiary:

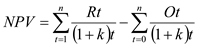

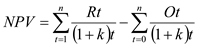

NPV is calculated with following formula:

NPV is calculated with following formula:

Where, t= time period (e.g., year)

Where, t= time period (e.g., year)

n=last period of project

=cash inflow in period t

=cash inflow in period t

=cash outflow in period t

=cash outflow in period t

k=discount rate (cost of capital)

Let's calculate the discounted present values of cash flows:

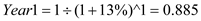

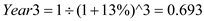

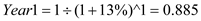

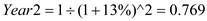

Present value (PV) factors at 13%.

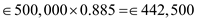

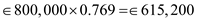

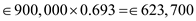

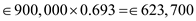

Present value of cash inflow of year1 =

Present value of cash inflow of year1 =

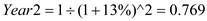

Present value of cash inflow of year2 =

Present value of cash inflow of year2 =

Present value of cash inflow of year3 =

Present value of cash inflow of year3 =

Total present value =

Total present value =

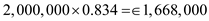

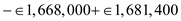

Now, the expected initial investment is $2,000,000. To calculate the NPV for Netherland, we need to convert it in euro. The exchange rate in year 0 is euro1/dollar1.20. If we express it in terms of euro: euro 0.834 per dollar

Now, the expected initial investment is $2,000,000. To calculate the NPV for Netherland, we need to convert it in euro. The exchange rate in year 0 is euro1/dollar1.20. If we express it in terms of euro: euro 0.834 per dollar

Therefore, the expected initial investment in euro:

Therefore, NPV = - expected initial investment + total present value

Therefore, NPV = - expected initial investment + total present value

NPV =

NPV =

NPV =

So, the NPV of the project to the Netherlands' subsidiary is euro 13,400.

So, the NPV of the project to the Netherlands' subsidiary is euro 13,400.

b) NPV of the project to the US parent.

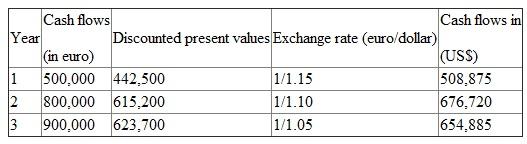

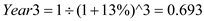

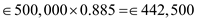

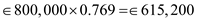

To calculate the NPV to the US parent, we will convert the discounted cash flows of the subsidiary in to dollar. We are given the following exchange rate forecast for the next 3 years:

Following table shows the cash flows in terms of US parent.

Following table shows the cash flows in terms of US parent.

Total cash flows =

Total cash flows =

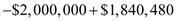

NPV = - expected initial investment + total present value

NPV = - expected initial investment + total present value

NPV =

NPV =

NPV =

The NPV of the project to the US parent is -$159,520.

The NPV of the project to the US parent is -$159,520.

c) The project should not be accepted, because the NPV of the project to the US parent is negative. Though the NPV of the project to the Netherland's subsidiary is positive, but still the project should not be accepted. A parent's perspective is appropriate when evaluating a project, since any project that can create a positive net present value for the parent should enhance the firm's value.

A U.S parent company is planning to invest $2 million in a 3 year project in its subsidiary in Netherland. The cost of the capital for both parent and subsidiary is 13 percent.

We are given the following estimated after tax cash flows to the subsidiary:

NPV is calculated with following formula:

NPV is calculated with following formula: Where, t= time period (e.g., year)

Where, t= time period (e.g., year)n=last period of project

=cash inflow in period t

=cash inflow in period t =cash outflow in period t

=cash outflow in period tk=discount rate (cost of capital)

Let's calculate the discounted present values of cash flows:

Present value (PV) factors at 13%.

Present value of cash inflow of year1 =

Present value of cash inflow of year1 =  Present value of cash inflow of year2 =

Present value of cash inflow of year2 =  Present value of cash inflow of year3 =

Present value of cash inflow of year3 =  Total present value =

Total present value =  Now, the expected initial investment is $2,000,000. To calculate the NPV for Netherland, we need to convert it in euro. The exchange rate in year 0 is euro1/dollar1.20. If we express it in terms of euro: euro 0.834 per dollar

Now, the expected initial investment is $2,000,000. To calculate the NPV for Netherland, we need to convert it in euro. The exchange rate in year 0 is euro1/dollar1.20. If we express it in terms of euro: euro 0.834 per dollarTherefore, the expected initial investment in euro:

Therefore, NPV = - expected initial investment + total present value

Therefore, NPV = - expected initial investment + total present valueNPV =

NPV =

NPV =  So, the NPV of the project to the Netherlands' subsidiary is euro 13,400.

So, the NPV of the project to the Netherlands' subsidiary is euro 13,400.b) NPV of the project to the US parent.

To calculate the NPV to the US parent, we will convert the discounted cash flows of the subsidiary in to dollar. We are given the following exchange rate forecast for the next 3 years:

Following table shows the cash flows in terms of US parent.

Following table shows the cash flows in terms of US parent. Total cash flows =

Total cash flows =  NPV = - expected initial investment + total present value

NPV = - expected initial investment + total present valueNPV =

NPV =

NPV =  The NPV of the project to the US parent is -$159,520.

The NPV of the project to the US parent is -$159,520.c) The project should not be accepted, because the NPV of the project to the US parent is negative. Though the NPV of the project to the Netherland's subsidiary is positive, but still the project should not be accepted. A parent's perspective is appropriate when evaluating a project, since any project that can create a positive net present value for the parent should enhance the firm's value.

2

What is the difference between a futures contract and a forward contract

Before elaborating the differences between futures contract and forward contract, it is important to define them first.

Futures Contract : Futures contract is a standardized derivative contract which takes place between two parties to buy or sell a particular asset or financial instrument at a pre determined price in the future. The seller of the contract agrees to deliver the asset at the specified time in the future, while the buyer agrees to pay a specific price and receive the asset at a future date. The agreement is made on the trading floor of a future exchange, which acts as an intermediary.

The price changes that occurs after the agreement, causes gains to one party and loss to other. If the price of the asset rises after the agreement, the buyer stands to gain at the expense of seller. On the other hand, if price of the underlying asset falls, the seller gains at the expense of buyer.

Forward Contract : Forward contract just like futures, is a derivative contract which specifies an agreement between two private parties to buy or sell an underlying asset on a specified date at a specified price. The agreed upon price is called the delivery price which is equal to the forward price at the time the contract is made. The forward contract is not standardized and it is not traded on exchange unlike futures contract.

Difference between futures contract and forward contract

Though both futures and forward contract are functionally very similar, still there are certain differences, which can be explained as follows:

1. A Futures contract is a standardized contract, while forward is a non-standardized contract.

2. Futures contract is quoted and traded on the floors of the exchange. On the other hand, forward contract is traded over the counter and it is a private agreement between buyer and seller.

3. In futures contract, futures exchange acts as counterparty to both parties in the contract. To reduce the risk, the exchange makes sure that both parties deposit an initial margin, and all future positions are marked to market with daily settlement of profits and losses. Therefore, the possibility of counterparty risk is almost zero in a future trade. On the other hand, there is no such mechanism in forward market. As the forward contracts are settled at the time of delivery, the profit or loss is only realized at the time of settlement, therefore the resulting loss from a default is much greater for both the parties.

4. Futures contracts have exchange institution's clearing houses that settles and guarantee the transaction between parties, which completely eliminates the risk. On the contrary, forward agreements are purely private agreements with no government regulations therefore it increases the chances of default by the parties.

5. Another point of difference between both the contracts is regarding the specific details about settlement and delivery. In futures market, daily changes are settled day by day until the end of the contract. However, in case of forward contracts, the settlement occurs at the end of the contract only. Moreover, futures contract settlement occurs over a range of dates, while there is one date settlement date in case of forward contracts.

6. Contract maturity is another factor where both the contracts differ. The future contract may not necessarily mature at the time of delivery of the asset, they are usually closed prior to maturity. There is a possibility that delivery do not happen at all. On the other hand, the forward contracts mature at the delivery of the asset or commodity.

7. The size of the contract is also a point of difference. In case of futures contract, the size of the contract is standardized. On the other hand, in case of forward contract, the size of the contract varies depending upon the requirement of contracting parties.

Futures Contract : Futures contract is a standardized derivative contract which takes place between two parties to buy or sell a particular asset or financial instrument at a pre determined price in the future. The seller of the contract agrees to deliver the asset at the specified time in the future, while the buyer agrees to pay a specific price and receive the asset at a future date. The agreement is made on the trading floor of a future exchange, which acts as an intermediary.

The price changes that occurs after the agreement, causes gains to one party and loss to other. If the price of the asset rises after the agreement, the buyer stands to gain at the expense of seller. On the other hand, if price of the underlying asset falls, the seller gains at the expense of buyer.

Forward Contract : Forward contract just like futures, is a derivative contract which specifies an agreement between two private parties to buy or sell an underlying asset on a specified date at a specified price. The agreed upon price is called the delivery price which is equal to the forward price at the time the contract is made. The forward contract is not standardized and it is not traded on exchange unlike futures contract.

Difference between futures contract and forward contract

Though both futures and forward contract are functionally very similar, still there are certain differences, which can be explained as follows:

1. A Futures contract is a standardized contract, while forward is a non-standardized contract.

2. Futures contract is quoted and traded on the floors of the exchange. On the other hand, forward contract is traded over the counter and it is a private agreement between buyer and seller.

3. In futures contract, futures exchange acts as counterparty to both parties in the contract. To reduce the risk, the exchange makes sure that both parties deposit an initial margin, and all future positions are marked to market with daily settlement of profits and losses. Therefore, the possibility of counterparty risk is almost zero in a future trade. On the other hand, there is no such mechanism in forward market. As the forward contracts are settled at the time of delivery, the profit or loss is only realized at the time of settlement, therefore the resulting loss from a default is much greater for both the parties.

4. Futures contracts have exchange institution's clearing houses that settles and guarantee the transaction between parties, which completely eliminates the risk. On the contrary, forward agreements are purely private agreements with no government regulations therefore it increases the chances of default by the parties.

5. Another point of difference between both the contracts is regarding the specific details about settlement and delivery. In futures market, daily changes are settled day by day until the end of the contract. However, in case of forward contracts, the settlement occurs at the end of the contract only. Moreover, futures contract settlement occurs over a range of dates, while there is one date settlement date in case of forward contracts.

6. Contract maturity is another factor where both the contracts differ. The future contract may not necessarily mature at the time of delivery of the asset, they are usually closed prior to maturity. There is a possibility that delivery do not happen at all. On the other hand, the forward contracts mature at the delivery of the asset or commodity.

7. The size of the contract is also a point of difference. In case of futures contract, the size of the contract is standardized. On the other hand, in case of forward contract, the size of the contract varies depending upon the requirement of contracting parties.

3

The XYZ Multinational Corporation has manufacturing facilities in country A and an assembly plant in country B. The company ships manufactured units from its plant in A to its assembly plant in B.

a. In April 2013, the company will ship 1,000 units with a production cost of 65 per unit to its plant in country B. Its operating expenses in A are 15,000 for the month. The income tax rate in A is 20 percent and in B 40 percent. The company plans to have a transfer price of 100 per unit. The final product can be sold in B for 140. B's operating expenses are 10,000 during the month. How much will the combined profits be of the two operations in April 2013

b. Could the company benefit by changing the transfer price to 120

c. Now, suppose the income tax rate in A is 40 percent, while in B it is 20 percent. What will the combined profit be if all other numbers are the same as in a

d. What would be the result in c if the company decreased its transfer price to 90

a. In April 2013, the company will ship 1,000 units with a production cost of 65 per unit to its plant in country B. Its operating expenses in A are 15,000 for the month. The income tax rate in A is 20 percent and in B 40 percent. The company plans to have a transfer price of 100 per unit. The final product can be sold in B for 140. B's operating expenses are 10,000 during the month. How much will the combined profits be of the two operations in April 2013

b. Could the company benefit by changing the transfer price to 120

c. Now, suppose the income tax rate in A is 40 percent, while in B it is 20 percent. What will the combined profit be if all other numbers are the same as in a

d. What would be the result in c if the company decreased its transfer price to 90

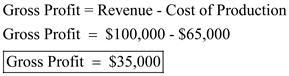

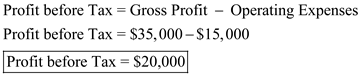

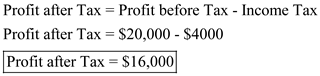

a)

A corporation has a manufacturing unit in country A and an assembly plant in country B. The company ships manufactured units from its plant in A to its assembly plant in B.

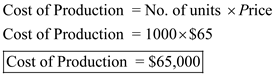

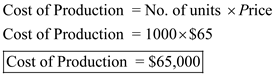

COST OF PRODUCTION:

The company ships 1,000 units with production cost of $65 per unit.

So, the cost of production in country A is as follows:

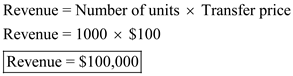

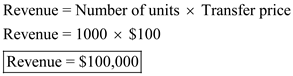

REVENUE GENERATED:

REVENUE GENERATED:

Company has the transfer price of $100 per unit.

So the revenue generated in country A is as follows:

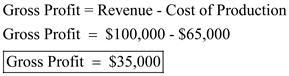

GROSS PROFIT:

GROSS PROFIT:

Calculate gross profit as follows:

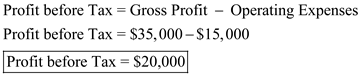

PROFIT BEFORE TAX:

PROFIT BEFORE TAX:

The operating expenses in country A are $15,000. Calculation of profit before tax is given below:

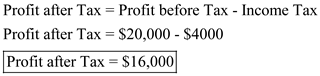

PROFIT AFTER TAX:

PROFIT AFTER TAX:

Lastly, calculation for profit after tax is as follows:

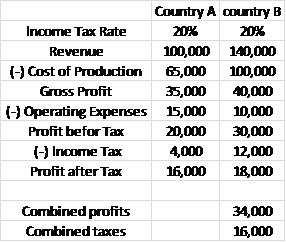

TABLE:

TABLE:

The following table shows the combined profits and taxes:

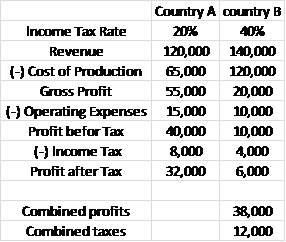

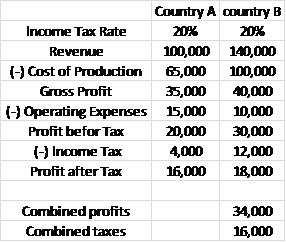

Table-1

CONCLUSION:

CONCLUSION:

Since the tax rate is 20% in country A and 40% in country B, the profit in country A is $16,000 and in country B is $18,000. The combined profits of the two operations are $34,000 and the combined tax liabilities are $16,000.

b)

As the transfer price changes from $100 to $120, means that the revenue generation in country A increases and at the same time, the cost of production in country B increases because the revenue generated in country A is the cost of production for country B.

The tax rate and operating expenses remain the same.

The following table shows the profit after tax by using the same steps as used in part (a).

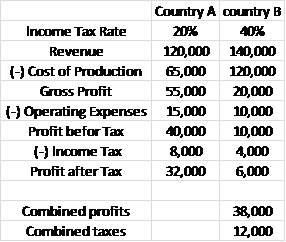

Table-2

CONCLUSION:

CONCLUSION:

Yes, the company benefits by changing the transfer price from $100 to $120.

When the transfer price is $100, the combined profits are $34,000.

And a transfer price of $120, the combined profits is $38,000.

The main reason behind this answer is the non-changing or constant income tax rate and operating expenses.

c)

Now, the income tax rate in country A is 40% while in country B it is 20%. All other things remain the same that is the revenue generated, the cost of production, and the operating expenses. Using the same procedure and formulae used in part (a), obtain the combined profit as follows:

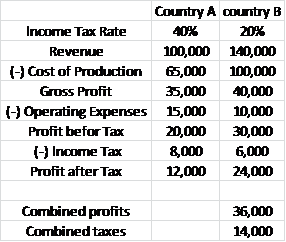

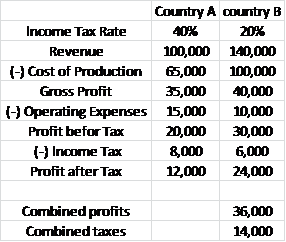

Table-3

CONCLUSION:

CONCLUSION:

The company benefits by the change in rate of income tax because in part (a) when the income tax rate is 20% in country A and 40% in country B, then the combined profits are $34,000 and combined tax liability is $16,000.

But as the income tax rate changed to 40% in country A and 20% in country B, then the combined profits are increased to $36,000 and the tax liability decreased to $14,000

d)

Now, the company decreases its transfer price from $100 to $90.

This leads to a change in revenue generation in country A and a change in the cost of production in country B, because the revenue generated in country A is the cost of production for country B.

The income tax rate is 40% in country A and 20% in country B.

The operating expenses are $15,000 for country A and $10,000 for country B

By using the same formulae which was used in part (a), draw a table to show whether it is beneficial for the corporation to decrease its transfer price or not:

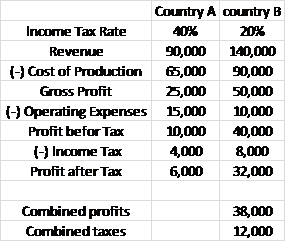

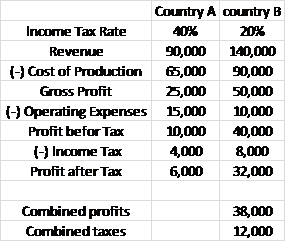

Table-4

CONCLUSION:

CONCLUSION:

As the transfer price decreases from $100 to $90 and the income tax rate is 40% in country A and 20% in country B, the combined profits increases from $36,000 to $38,000 and the combined tax liability decreases from $14,000 to $12,000.

A corporation has a manufacturing unit in country A and an assembly plant in country B. The company ships manufactured units from its plant in A to its assembly plant in B.

COST OF PRODUCTION:

The company ships 1,000 units with production cost of $65 per unit.

So, the cost of production in country A is as follows:

REVENUE GENERATED:

REVENUE GENERATED: Company has the transfer price of $100 per unit.

So the revenue generated in country A is as follows:

GROSS PROFIT:

GROSS PROFIT: Calculate gross profit as follows:

PROFIT BEFORE TAX:

PROFIT BEFORE TAX: The operating expenses in country A are $15,000. Calculation of profit before tax is given below:

PROFIT AFTER TAX:

PROFIT AFTER TAX: Lastly, calculation for profit after tax is as follows:

TABLE:

TABLE: The following table shows the combined profits and taxes:

Table-1

CONCLUSION:

CONCLUSION: Since the tax rate is 20% in country A and 40% in country B, the profit in country A is $16,000 and in country B is $18,000. The combined profits of the two operations are $34,000 and the combined tax liabilities are $16,000.

b)

As the transfer price changes from $100 to $120, means that the revenue generation in country A increases and at the same time, the cost of production in country B increases because the revenue generated in country A is the cost of production for country B.

The tax rate and operating expenses remain the same.

The following table shows the profit after tax by using the same steps as used in part (a).

Table-2

CONCLUSION:

CONCLUSION: Yes, the company benefits by changing the transfer price from $100 to $120.

When the transfer price is $100, the combined profits are $34,000.

And a transfer price of $120, the combined profits is $38,000.

The main reason behind this answer is the non-changing or constant income tax rate and operating expenses.

c)

Now, the income tax rate in country A is 40% while in country B it is 20%. All other things remain the same that is the revenue generated, the cost of production, and the operating expenses. Using the same procedure and formulae used in part (a), obtain the combined profit as follows:

Table-3

CONCLUSION:

CONCLUSION: The company benefits by the change in rate of income tax because in part (a) when the income tax rate is 20% in country A and 40% in country B, then the combined profits are $34,000 and combined tax liability is $16,000.

But as the income tax rate changed to 40% in country A and 20% in country B, then the combined profits are increased to $36,000 and the tax liability decreased to $14,000

d)

Now, the company decreases its transfer price from $100 to $90.

This leads to a change in revenue generation in country A and a change in the cost of production in country B, because the revenue generated in country A is the cost of production for country B.

The income tax rate is 40% in country A and 20% in country B.

The operating expenses are $15,000 for country A and $10,000 for country B

By using the same formulae which was used in part (a), draw a table to show whether it is beneficial for the corporation to decrease its transfer price or not:

Table-4

CONCLUSION:

CONCLUSION: As the transfer price decreases from $100 to $90 and the income tax rate is 40% in country A and 20% in country B, the combined profits increases from $36,000 to $38,000 and the combined tax liability decreases from $14,000 to $12,000.

4

S. importer who owes a Belgian company €500,000 payable 30 days from today expects that the US$ will weaken during this period. What would you advise the importer to do What would happen if the US$ were to strengthen during this period

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

Today the XYZ Corporation shipped goods valued at €1 million to a customer in Belgium. Payment is due in 90 days, and the Belgian firm will make the payment in euros. Today's spot rate is €1/$1.40. The 90-day forward rate is €1/$1.38.

a. How many dollars would XYZ receive if payment were made today

b. If XYZ sells €1 million forward for 90 days, how much is it assured to receive 90 days from now

c. If XYZ had not hedged in the forward market and the spot rate 90 days from now is €1/$1.39, how much would XYZ receive (in U.S. dollars)

d. If the U.S. dollar were to weaken in the 90 days and XYZ did not hedge, would it benefit or lose

a. How many dollars would XYZ receive if payment were made today

b. If XYZ sells €1 million forward for 90 days, how much is it assured to receive 90 days from now

c. If XYZ had not hedged in the forward market and the spot rate 90 days from now is €1/$1.39, how much would XYZ receive (in U.S. dollars)

d. If the U.S. dollar were to weaken in the 90 days and XYZ did not hedge, would it benefit or lose

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

S. importer purchases a currency option. If the foreign currency does not rise to the strike price, what should the importer do

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

The ABC Company expects to receive payment in euros from a German company in 60 days. To protect itself from a decline in the value of the euro, it purchases a put option with a strike price of $1.42/€ at a premium of $0.015 (1.5 cents) per option.

a. If the exchange rate 60 days from now is $1.40/€, should ABC exercise the option How much will it gain or lose on the transaction

b. If the exchange rate is $1.41/€, what should the company do and why

c. At what exchange rate will the company break even

a. If the exchange rate 60 days from now is $1.40/€, should ABC exercise the option How much will it gain or lose on the transaction

b. If the exchange rate is $1.41/€, what should the company do and why

c. At what exchange rate will the company break even

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

Describe the additional complications facing an MNC compared with a domestic corporation when it is evaluating a capital budgeting project.

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

Why should an MNC's capital budgeting decision be based on the parent's results rather than those of the subsidiary

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

Is an MNC generally faced with incurring double taxation on its profits in the subsidiary's country Why or why not

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

Why should a government be concerned with the pricing of products that a company transfers to an affiliate in another country

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck