Deck 17: Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 17: Capital Budgeting

1

Decision Rule Criteria. The net present value (NPV), profitability index (PI), and internal rate of return (IRR) methods are often employed in project valuation. Identify each of the following statements as true or false, and explain your answers.

A. The IRR method can tend to understate the relative attractiveness of superior investment projects when the opportunity cost of cash flows is below the IRR.

B. A PI = 1 describes a project with an NPV = 0.

C. Selection solely according to the NPV criterion will tend to favor larger rather than smaller investment projects.

D. When NPV = 0, the IRR exceeds the cost of capital.

E. Use of the PI criterion is especially appropriate for larger firms with easy access to capital markets.

A. The IRR method can tend to understate the relative attractiveness of superior investment projects when the opportunity cost of cash flows is below the IRR.

B. A PI = 1 describes a project with an NPV = 0.

C. Selection solely according to the NPV criterion will tend to favor larger rather than smaller investment projects.

D. When NPV = 0, the IRR exceeds the cost of capital.

E. Use of the PI criterion is especially appropriate for larger firms with easy access to capital markets.

A)

We know that information costs will increase MCC and it will in turn reduce the IRR too. Hence the sentence is correct. And the assertion is true.

B)

In case of depreciation although it may not involve direct cash outlay but always it is not possible to safely ignore it in investment project evaluation. This is because sometimes depending on the condition of plant and equipment depreciation may be very high and in that case ignoring depreciation will be a mistake. Hence the statement is false.

C)

The MCC will be less elastic for larger firms, as initially elasticity remain high for smaller firms or lesser level of investment but when investment become larger and firm size rises then the cost of a new project will be less elastic. Hence the statement is true.

D)

Although theoretically we can determine the cost of debt and equity independently but in practice these are determined jointly for the sake of accounting convenience. Hence the statement is true.

E)

Investment like depreciation or in damaged equipment usually has low level of risk. Hence the statement is true.

We know that information costs will increase MCC and it will in turn reduce the IRR too. Hence the sentence is correct. And the assertion is true.

B)

In case of depreciation although it may not involve direct cash outlay but always it is not possible to safely ignore it in investment project evaluation. This is because sometimes depending on the condition of plant and equipment depreciation may be very high and in that case ignoring depreciation will be a mistake. Hence the statement is false.

C)

The MCC will be less elastic for larger firms, as initially elasticity remain high for smaller firms or lesser level of investment but when investment become larger and firm size rises then the cost of a new project will be less elastic. Hence the statement is true.

D)

Although theoretically we can determine the cost of debt and equity independently but in practice these are determined jointly for the sake of accounting convenience. Hence the statement is true.

E)

Investment like depreciation or in damaged equipment usually has low level of risk. Hence the statement is true.

2

"The decision to start your own firm and go into business can be thought of as a capital budgeting decision. You only go ahead if projected returns look attractive on a personal and financial basis." Discuss this statement.

Capital budgeting refers to the process of planning expenditures which generate cash flows expected to extend beyond one year. Hence the first part of the given sentence can be thought of as a rough definition of capital budgeting.

Regarding the second part it can be said that it is talking about the analysis and comparing different projects. In a very general term it can be said that the project must look attractive in order to invest in. Now a project is chosen after comparing the present value of its future cash inflow and outflow. That is how the attractiveness of a project can be said if the present value of its cash inflows is much higher than the present value of its cash outflow.

Regarding the second part it can be said that it is talking about the analysis and comparing different projects. In a very general term it can be said that the project must look attractive in order to invest in. Now a project is chosen after comparing the present value of its future cash inflow and outflow. That is how the attractiveness of a project can be said if the present value of its cash inflows is much higher than the present value of its cash outflow.

3

Decision Rule Criteria. The net present value (NPV), profitability index (PI), and internal rate of return (IRR) methods are often employed in project valuation. Identify each of the following statements as true or false, and explain your answers.

A. The IRR method can tend to understate the relative attractiveness of superior investment projects when the opportunity cost of cash flows is below the IRR.

B. A PI = 1 describes a project with an NPV = 0.

C. Selection solely according to the NPV criterion will tend to favor larger rather than smaller investment projects.

D. When NPV = 0, the IRR exceeds the cost of capital.

E. Use of the PI criterion is especially appropriate for larger firms with easy access to capital markets.

A. The IRR method can tend to understate the relative attractiveness of superior investment projects when the opportunity cost of cash flows is below the IRR.

B. A PI = 1 describes a project with an NPV = 0.

C. Selection solely according to the NPV criterion will tend to favor larger rather than smaller investment projects.

D. When NPV = 0, the IRR exceeds the cost of capital.

E. Use of the PI criterion is especially appropriate for larger firms with easy access to capital markets.

A)

Here actually the statement is false. This is because IRR usually overstates in case of project with higher return since in case of reinvestment return decreases.

B)

Since PI is the ratio of present value of cash inflow to present value of cash outflow hence in case of equal pv of cash inflow and outflow PI will be one. And since NPV is pv of cash inflow minus pv of cash outflow in case both of them equal NPV will be zero. Hence this statement is true.

C)

NPV signify the absolute attractiveness and PI method signify relative attractiveness of a project. Hence NPV is going to prefer larger projects. Hence the statement is true.

D)

When NPV is equal to zero then IRR is equal to cost of capital. Hence the statement is false.

E)

Here the statement is false. This is because Pi criterion is particularly useful when there is scarcity of funds. This is because PI method signifies return per unit of dollar outflow. So it is useful for smaller projects.

Here actually the statement is false. This is because IRR usually overstates in case of project with higher return since in case of reinvestment return decreases.

B)

Since PI is the ratio of present value of cash inflow to present value of cash outflow hence in case of equal pv of cash inflow and outflow PI will be one. And since NPV is pv of cash inflow minus pv of cash outflow in case both of them equal NPV will be zero. Hence this statement is true.

C)

NPV signify the absolute attractiveness and PI method signify relative attractiveness of a project. Hence NPV is going to prefer larger projects. Hence the statement is true.

D)

When NPV is equal to zero then IRR is equal to cost of capital. Hence the statement is false.

E)

Here the statement is false. This is because Pi criterion is particularly useful when there is scarcity of funds. This is because PI method signifies return per unit of dollar outflow. So it is useful for smaller projects.

4

What major steps are involved in the capital budgeting process?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Cost of Capital. Indicate whether each of the following would increase or decrease the cost of capital that should be used by the firm in investment project evaluation. Explain.

A. Interest rates rise because the Federal Reserve System tightens the money supply.

B. The stock market suffers a sharp decline, as does the company's stock price, without (in management's opinion) any decline in the company's earnings potential.

C. The company's home state eliminates the corporate income tax in an effort to keep or attract valued employers.

D. In an effort to reduce the federal deficit, Congress raises corporate income tax rates.

E. A merger with a leading competitor increases the company's stock price substantially.

A. Interest rates rise because the Federal Reserve System tightens the money supply.

B. The stock market suffers a sharp decline, as does the company's stock price, without (in management's opinion) any decline in the company's earnings potential.

C. The company's home state eliminates the corporate income tax in an effort to keep or attract valued employers.

D. In an effort to reduce the federal deficit, Congress raises corporate income tax rates.

E. A merger with a leading competitor increases the company's stock price substantially.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

OIBDA is an abbreviation for "operating income before depreciation and amortization." Like its predecessor EBITDA ("earnings before interest, taxes, depreciation, and amortization"), OIBDA is used to analyze profitability before noncash charges tied to plant and equipment investments. Can you see any advantages or disadvantages stemming from the use of OIBDA instead of net income as a measure of investment project attractiveness?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Present Value. New York City licenses taxicabs in two classes: (1) for operation by companies with fleets and (2) for operation by independent driver-owners having only one cab. Strict limits are imposed on the number of taxicabs by restricting the number of licenses, or medallions, that are issued to provide service on the streets of New York City. This medallion system dates from a Depression-era city law designed to address an overabundance of taxis that depressed driver earnings and congested city streets. In 1937, the city slapped a moratorium on the issuance of new taxicab licenses. The number of cabs, which peaked at 21,000 in 1931, fell from 13,500 in 1937 to 11,787 in May 1996, when the city broke a 59-year cap and issued an additional 400 licenses. However, because the city has failed to allow sufficient expansion, taxicab medallions have developed a trading value in the open market. After decades of often-explosive medallion price increases, fleet license prices rose to $600,000 in 2007.

A. Discuss the factors determining the value of a license. To make your answer concrete, estimate numerical values for the various components that together can be summarized in a medallion price of $600,000.

B. What factors would determine whether a change in the fare fixed by the city would raise or lower the value of a medallion?

C. Cab drivers, whether hired by companies or as owners of their own cabs, seem unanimous in opposing any increase in the number of cabs licensed. They argue that an increase in the number of cabs would increase competition for customers and drive down what they regard as an already unduly low return to drivers. Is their economic analysis correct? Who would gain and who would lose from an expansion in the number of licenses issued at a nominal fee?

A. Discuss the factors determining the value of a license. To make your answer concrete, estimate numerical values for the various components that together can be summarized in a medallion price of $600,000.

B. What factors would determine whether a change in the fare fixed by the city would raise or lower the value of a medallion?

C. Cab drivers, whether hired by companies or as owners of their own cabs, seem unanimous in opposing any increase in the number of cabs licensed. They argue that an increase in the number of cabs would increase competition for customers and drive down what they regard as an already unduly low return to drivers. Is their economic analysis correct? Who would gain and who would lose from an expansion in the number of licenses issued at a nominal fee?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Toyota Motor Corp., like most major multinational corporations, enjoys easy access to world financial markets. Explain why the NPV approach is the most appropriate tool for Toyota's investment project selection process.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

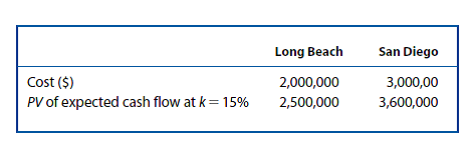

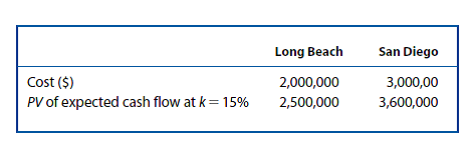

NPV and PI. Suppose the Pacific Princess luxury cruise line is contemplating leasing an additional cruise ship to expand service from the Hawaiian Islands to Long Beach or San Diego. A financial analysis by staff personnel resulted in the following projections for a five-year planning horizon:

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Level 3 Communications, Inc., like many emerging telecom carriers, has only limited and infrequent access to domestic debt and equity markets. Explain the attractiveness of a "benefit/cost ratio" approach in capital budgeting for Level 3, and illustrate why the NPV, PI, and IRR capital budgeting decision rules sometimes provide different rank orderings of investment project alternatives.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

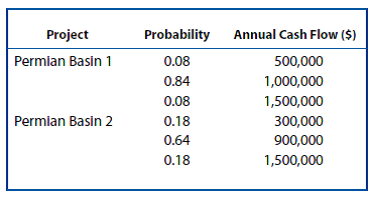

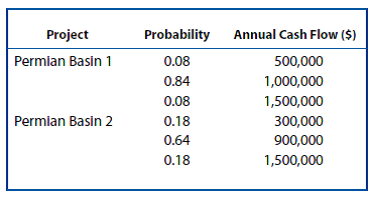

NPV and PI. Louisiana Drilling and Exploration, Inc., (LD E) has the funds necessary to complete one of two risky oil and gas drilling projects. The first, Permian Basin 1, involves the recovery of a well that was plugged and abandoned five years ago but that may now be profitable, given improved recovery techniques. The second, Permian Basin 2, is a new onshore exploratory well that appears to be especially promising. Based on a detailed analysis by its technical staff, LD E projects a 10-year life for each well with annual net cash flows as follows:

In the recovery project valuation, LD E uses an 8 percent risk-fee rate and a standard 12 percent risk premium. For exploratory drilling projects, the company uses larger risk premiums proportionate to project risks as measured by the project coefficient of variation. For example, an exploratory project with a coefficient of variation 1½ times that for recovery projects would require a risk premium of 18 percent ( 1.5 × 12%). Both projects involve land acquisition as well as surface preparation and subsurface drilling costs of $3 million each.

A. Calculate the expected value, standard deviation, and coefficient of variation for annual net operating revenues from each well.

B. Calculate and evaluate the NPV for each project using the risk-adjusted discount rate method.

C. Calculate and evaluate the PI for each project.

In the recovery project valuation, LD E uses an 8 percent risk-fee rate and a standard 12 percent risk premium. For exploratory drilling projects, the company uses larger risk premiums proportionate to project risks as measured by the project coefficient of variation. For example, an exploratory project with a coefficient of variation 1½ times that for recovery projects would require a risk premium of 18 percent ( 1.5 × 12%). Both projects involve land acquisition as well as surface preparation and subsurface drilling costs of $3 million each.

A. Calculate the expected value, standard deviation, and coefficient of variation for annual net operating revenues from each well.

B. Calculate and evaluate the NPV for each project using the risk-adjusted discount rate method.

C. Calculate and evaluate the PI for each project.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

How is a crossover discount rate calculated, and how does it affect capital budgeting decisions?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

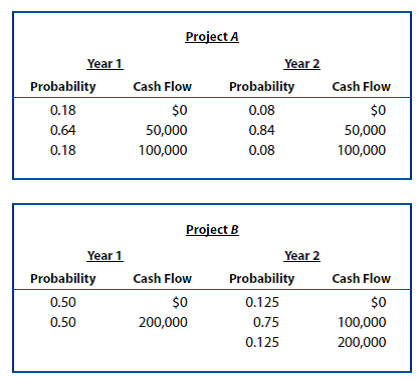

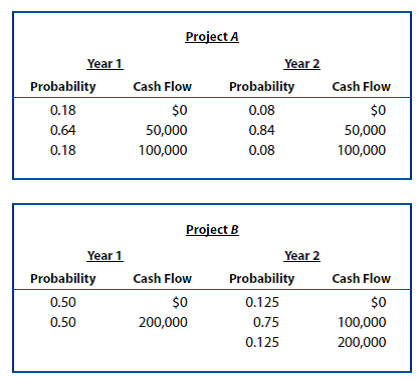

Investment Project Choice. Toby Amberville's Manhattan Café, Inc., is considering investment in two alternative capital budgeting projects. Project A is an investment of $75,000 to replace working but obsolete refrigeration equipment. Project B is an investment of $150,000 to expand dining room facilities. Relevant cash flow data for the two projects over their expected two-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation for cash flows from each project.

B. Calculate the risk-adjusted NPV for each project using a 15 percent cost of capital for the riskier project and a 12 percent cost of capital for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank the projects according to the PI criterion.

D. Calculate the IRR for each project, and rank the projects according to the IRR criterion.

E. Compare your answers to parts B, C, and D, and discuss any differences.

A. Calculate the expected value, standard deviation, and coefficient of variation for cash flows from each project.

B. Calculate the risk-adjusted NPV for each project using a 15 percent cost of capital for the riskier project and a 12 percent cost of capital for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank the projects according to the PI criterion.

D. Calculate the IRR for each project, and rank the projects according to the IRR criterion.

E. Compare your answers to parts B, C, and D, and discuss any differences.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

An efficient firm employs inputs in such proportions that the marginal product/price ratios for all inputs are equal. In terms of capital budgeting, this implies that the marginal cost of debt should equal the marginal cost of equity in the optimal capital structure. In practice, firms often issue debt at interest rates substantially below the yield that investors require on the firm's equity shares. Does this mean that many firms are not operating with optimal capital structures? Explain.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

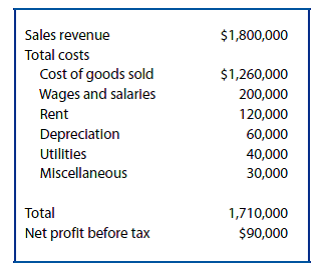

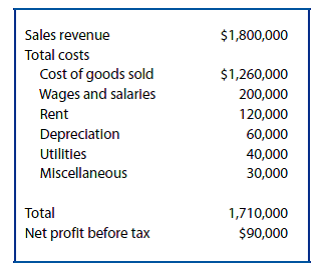

Cash Flow Estimation. Cunningham's Drug Store, a medium-size drugstore located in Milwaukee, Wisconsin, is owned and operated by Richard Cunningham. Cunningham's sells pharmaceuticals, cosmetics, toiletries, magazines, and various novelties. Cunningham's most recent annual net income statement is as follows:

Cunningham's sales and expenses have remained relatively constant over the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial 3-year period and then would reevaluate its profitability. The soda fountain would require an incremental investment of $20,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the 3-year period. At the end of that time, additional capital would be required to continue operating the soda fountain, and no capital would be recovered if it were shut down. The soda fountain is expected to have annual sales of $100,000 and food and materials expenses of $20,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8 percent and utility expenses by 5 percent. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of other fountain items are expected to decline by 10 percent.

A. Calculate net incremental cash flows for the soda fountain.

B. Assume that Cunningham has the capital necessary to install the soda fountain and that he places a 12 percent opportunity cost on those funds. Should the soda fountain be installed? Why or why not?

Cunningham's sales and expenses have remained relatively constant over the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial 3-year period and then would reevaluate its profitability. The soda fountain would require an incremental investment of $20,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the 3-year period. At the end of that time, additional capital would be required to continue operating the soda fountain, and no capital would be recovered if it were shut down. The soda fountain is expected to have annual sales of $100,000 and food and materials expenses of $20,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8 percent and utility expenses by 5 percent. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of other fountain items are expected to decline by 10 percent.

A. Calculate net incremental cash flows for the soda fountain.

B. Assume that Cunningham has the capital necessary to install the soda fountain and that he places a 12 percent opportunity cost on those funds. Should the soda fountain be installed? Why or why not?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose that Black Decker's interest rate on newly issued debt is 7.5 percent and the firm's marginal federal-plus-state income tax rate is 40 percent. This implies a 4.5 percent after-tax component cost of debt. Also assume that the firm has decided to finance next year's projects by selling debt. Does this mean that next year's investment projects have a 4.5 percent cost of capital?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

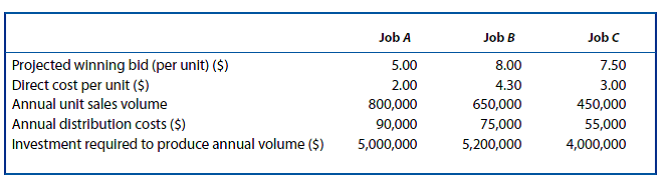

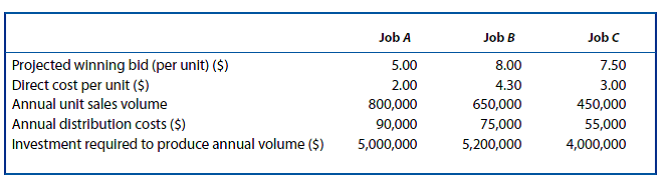

Cash Flow Analysis. Dunder-Mifflin, Inc., is analyzing the potential profitability of three printing jobs put up for bid by the State Department of Revenue:

Assume that (1) the company's marginal city-plus-state-plus-federal tax rate is 50 percent; (2) each job is expected to have a 6-year life; (3) the firm uses straight-line depreciation; (4) the average cost of capital is 14 percent; (5) the jobs have the same risk as the firm's other business; and (6) the company has already spent $60,000 on developing the preceding data. This $60,000 has been capitalized and will be amortized over the life of the project.

A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each project? On which project, if any, should the company bid?

C. Suppose that Dunder-Mifflin's primary business is quite cyclical, improving, and declining with the economy, but that job A is expected to be countercyclical. Might this have any bearing on your decision?

Assume that (1) the company's marginal city-plus-state-plus-federal tax rate is 50 percent; (2) each job is expected to have a 6-year life; (3) the firm uses straight-line depreciation; (4) the average cost of capital is 14 percent; (5) the jobs have the same risk as the firm's other business; and (6) the company has already spent $60,000 on developing the preceding data. This $60,000 has been capitalized and will be amortized over the life of the project.

A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each project? On which project, if any, should the company bid?

C. Suppose that Dunder-Mifflin's primary business is quite cyclical, improving, and declining with the economy, but that job A is expected to be countercyclical. Might this have any bearing on your decision?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

Research in financial economics concludes that stockholders of target firms in takeover battles "win" (earn abnormal returns) and that stockholders of successful bidders do not lose subsequent to takeovers, even though takeovers usually occur at substantial premiums over pre-bid market prices. Is this observation consistent with capital market efficiency?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

Cost of Capital. Eureka Membership Warehouse, Inc., is a rapidly growing chain of retail outlets offering brand-name merchandise at discount prices. A security analyst's report issued by a national brokerage firm indicates that debt yielding 13 percent composes 25 percent of Eureka's overall capital structure. Furthermore, both earnings and dividends are expected to grow at a rate of 15 percent per year.

Currently, common stock in the company is priced at $30, and it should pay $1.50 per share in dividends during the coming year. This yield compares favorably with the 8 percent return currently available on risk-free securities and the 14 percent average for all common stocks, given the company's estimated beta of 2.

A. Calculate Eureka's component cost of equity using both the CAPM and the dividend yield plus expected growth model.

B. Assuming a 40 percent marginal federal-plus-state income tax rate, calculate Eureka's weighted-average cost of capital.

Currently, common stock in the company is priced at $30, and it should pay $1.50 per share in dividends during the coming year. This yield compares favorably with the 8 percent return currently available on risk-free securities and the 14 percent average for all common stocks, given the company's estimated beta of 2.

A. Calculate Eureka's component cost of equity using both the CAPM and the dividend yield plus expected growth model.

B. Assuming a 40 percent marginal federal-plus-state income tax rate, calculate Eureka's weighted-average cost of capital.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

"Risky projects are accepted for investment on the basis of favorable expectations concerning profitability. In the postaudit process, they must not be unfairly criticized for failing to meet those expectations." Discuss this statement.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck